KSA Food Delivery Market Outlook to 2029

Region:Middle East

Author(s):Nishika, Kartika

Product Code:KR1466

January 2025

91

About the Report

KSA Food Delivery market Overview

- The Saudi Arabia food delivery market is valued at SAR 32 bn, driven by a five-year historical analysis of increasing internet penetration and smartphone adoption. This growth is fueled by evolving consumer lifestyles, the rising popularity of online platforms, and the strategic investments of major players in digital infrastructure.

- The market is dominated by Riyadh and Jeddah due to their high population density, rapid urbanization, and a tech-savvy demographic. These cities host a significant number of restaurants, cloud kitchens, and logistics providers, making them hubs for food delivery services. Their advanced infrastructure and consumer inclination towards convenience further bolster their leadership in the market.

- The acquisition of HungerStation by Delivery Hero SE for USD 297 million was executed on July 21, 2023. This strategic move allowed Delivery Hero to take full ownership of HungerStation, which is the leading food delivery service in Saudi Arabia, connecting over 10,000 partners with customers. The acquisition is significant as it enhances Delivery Hero's position in the Middle Eastern food delivery market and facilitates greater integration and knowledge sharing within its ecosystem.

KSA Food Delivery market Segmentation

KSA Food Delivery market is divided into further segments:

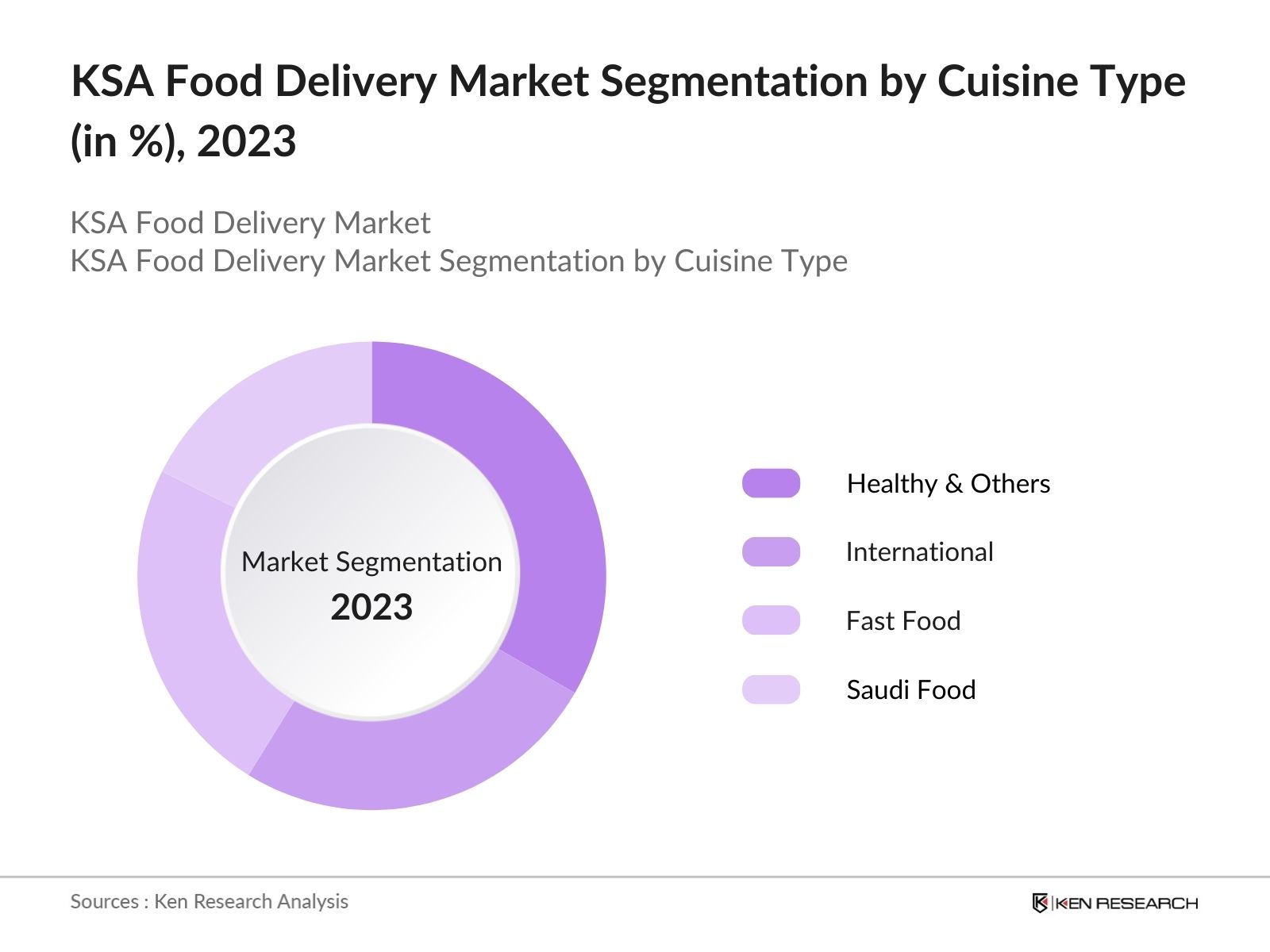

- By Cuisine Type: The food delivery market in Saudi Arabia is segmented into four categories under Cuisine Type: Fast Food, International, Saudi Food, and Healthy & Others. The Healthy & Others segment dominates due growing awareness of health-conscious eating, combined with the availability of familiar brands and affordable options, contributes significantly to its high market share in the Saudi food delivery market.

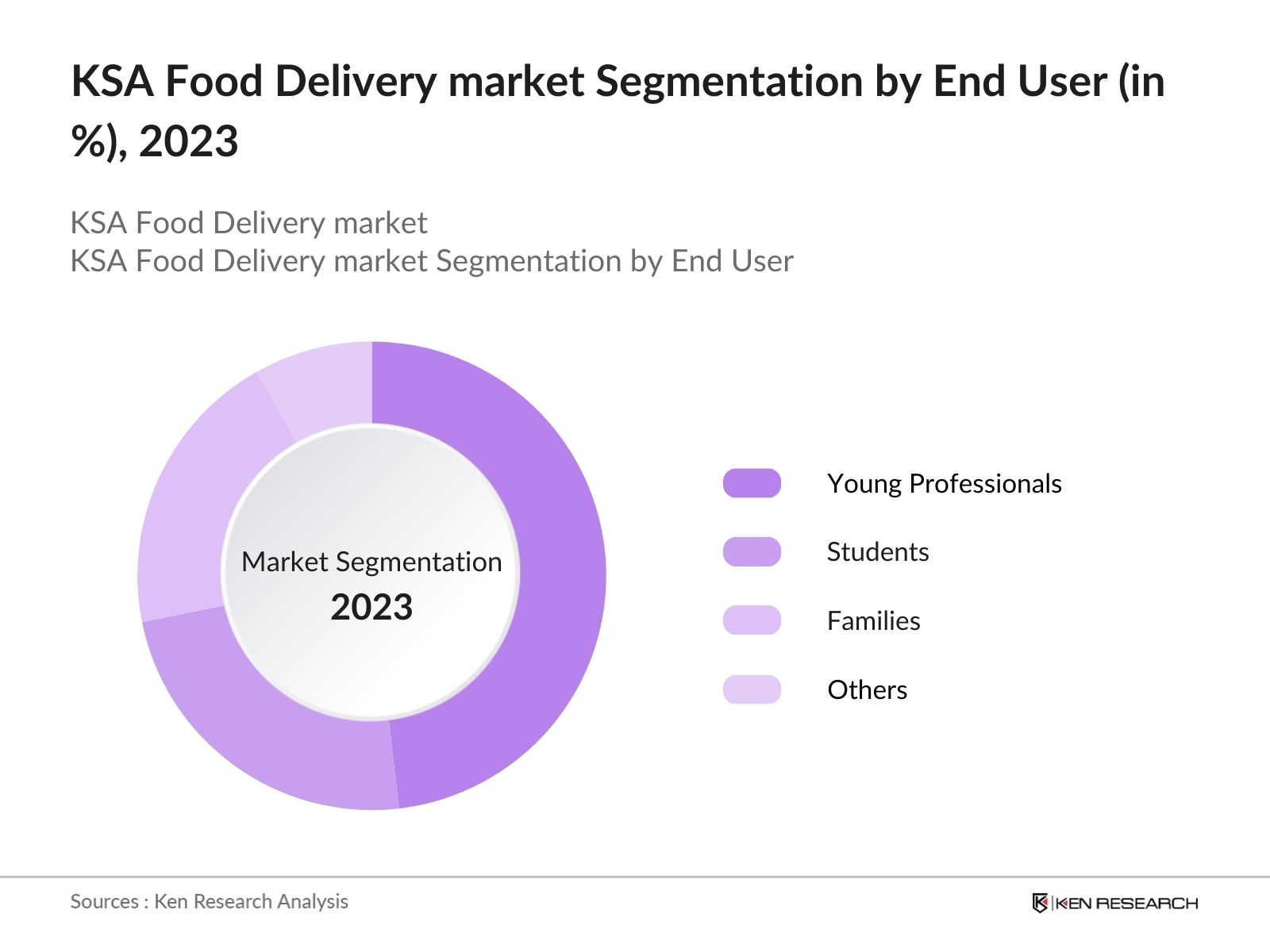

- By End User: The market is segmented into Young Professionals, Students, Families, and Others (including Expats and Short-term Residents). Young Professionals segment is the largest due to their preference for convenience and time-saving options. Their busy schedules and disposable incomes make them frequent users of food delivery services.

KSA Food Delivery market Competitive Landscape

The Saudi Arabia food aggregator market is highly competitive, with prominent players such as HungerStation, Jahez, Mrsool, and others actively shaping the landscape. HungerStation leads the market, leveraging its strong logistics network and user-friendly platform, while Jahez has steadily gained market share by offering high-quality service and appealing to local preferences.

KSA Food Delivery Industry Analysis

Market Growth Drivers

- Rising Digital Adoption: Over 90% smartphone penetration and growing internet usage are driving significant growth in digital food ordering. This digital shift not only facilitates quick and convenient ordering but also enhances user experiences through features such as real-time tracking and personalized recommendations.

- Shift to Digital Food Ordering: The 40% rise in dual-income households in KSA is driving demand for convenience, making digital food ordering a key market growth driver. As time-pressed consumers seek quick solutions, food delivery businesses can capitalize on this trend by offering diverse menus and flexible ordering options, catering to the needs of busy households.

- Collaborations with Cloud Kitchens and Grocery Platforms: Partnerships with cloud kitchens and hyperlocal grocery platforms enable faster scaling and diverse menu offerings. Strategic partnerships with cloud kitchens and hyperlocal grocery platforms are emerging as a powerful avenue for growth in the digital food ordering market. Collaborations with cloud kitchens allow food brands to scale operations quickly without the overhead costs associated with traditional restaurant setups.

Market Challenges

- Low Average Order Value (AOV): A low AOV poses a considerable challenge for businesses, as it means that each transaction generates limited revenue. This sensitivity to minor leakages and operational inefficiencies can severely affect profitability. Even small costs associated with delivery, packaging, or payment processing can disproportionately impact the bottom line when the average order value is low.

- High Attrition Rates: High turnover among delivery personnel is another critical issue that affects service quality and customer satisfaction. When delivery staff frequently change, it leads to inconsistency in service, which can frustrate customers and result in negative experiences.

KSA Food Delivery Future Market Outlook

Over the next five years, the Saudi Arabia food delivery market is expected to grow significantly, driven by rising urbanization, technological advancements, and increased disposable incomes. Factors such as government initiatives supporting digital transformation, expanding cloud kitchens, and a growing preference for convenience will play pivotal roles in this growth.

Market Opportunities

- Non-Metro Expansion: Rising demand in Tier 2 and Tier 3 cities presents a substantial opportunity for the food delivery market in KSA. As internet penetration and smartphone usage continue to grow, these regions are becoming increasingly receptive to digital services, including food delivery.

- Subscription Models: The development of subscription models within the KSA food delivery market can significantly enhance customer retention and profitability. By offering loyalty programs that include benefits such as free delivery, exclusive discounts, or access to special promotions, companies can encourage repeat usage among consumers. These subscription services create a sense of value for customers, making them more likely to choose the same platform for their food orders consistently.

Scope of the Report

|

Segment |

Sub-segments |

|---|---|

|

Cuisine Type |

Fast Food International Saudi Food Healthy & Others |

|

End User |

Young Professionals Students Families Others |

|

Region |

Central |

Products

Key Target Audience

Food Delivery Aggregators

Restaurants and Cloud Kitchen Operators

Logistics and Last-Mile Delivery Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Commerce and Investment)

Technology and AI Solution Providers

Payment Gateway Service Providers

Local and Regional Food Chains

Companies

Players Mentioned in the market:

HungerStation

Jahez

Mrsool

Noon Food

ToYou

Table of Contents

1. Executive Summary

1.1. KSA Food & Grocery Retail Market Overview

1.2. Key Insights

2. Present Market Scenario

2.1. Overview of KSA Online Food Delivery Market

2.2. KSA Online Food Delivery Market by Business Model

2.3. KSA Food Aggregator Market Sizing

2.4. KSA Food Aggregator Market Segmentation

2.4.1. By Cuisine Type

2.4.2. By End User Demographics

2.4.3. By Region

3. Competition Landscape

3.1. Timeline & Offerings of Major Players in KSA Food Delivery Market

3.2. Saudi Arabia's Delivery Apps Raises/Exits in Order of Funds Raised

3.3. Mergers & Acquisitions Reshaping Food Delivery Apps Landscape in Saudi Arabia

3.4. PEAK Matrix Assessment of Saudi Arabia Food Delivery Market

3.5. Market Share of Major Players in the Food Delivery App Market of Saudi Arabia

3.6. Cross Comparison of Key Players Offering Food Delivery Services in KSA

4. Market Dynamics

4.1. Key Market Drivers and Restraints of KSA Food Delivery Market

4.2. Technological Advancements in Food Delivery Application Market

4.3. Government Regulations and Policies

5. Consumer Insights

5.1. Consumer Behavior Analysis

5.1.1. Demographic Breakdown

5.1.2. Order Frequency, Spending Patterns & Cuisine

5.1.3. Consumer Preferences by Time & Promotions

6. KSA Grocery Delivery Market

6.1. Overview of KSA Online Grocery Delivery Market

6.2. KSA Online Grocery Delivery Market Sizing

6.3. KSA Online Grocery Delivery by Business Model

7. Analyst Recommendations

7.1. Key Offerings of Food Delivery Applications: What to Sell?

7.2. Adjacent Offerings in KSA Food Delivery Market: What to Sell?

7.3. Target Focus Region for Market Entry: Where to Sell?

7.4. Winning Strategies: How to Sell?

8. Industry Speaks

8.1. Interview with an Industry Expert at Careem

8.2. Interview with an Industry Expert at Keeta

9. Research Methodology

9.1. Market Sizing Approach

9.2. Industry Experts Interviewed

9.3. Market Definitions

Disclaimer

Contact Us

Research Methodology

Step 1: Hypothesis Creation

The research team first framed a hypothesis about the KSA food delivery market by analyzing existing industry factors. This process involved reviewing data from company reports, trade publications, online articles, government associations, and industry reports. Both public and proprietary databases were utilized to define the market and collect relevant data points, ensuring a comprehensive understanding of the sector.

Step 2: Hypothesis Testing

To validate the initial hypothesis, interviews were conducted with key stakeholders, including C-level executives, directors, regional managers, heads of operations, logistics supervisors, and consultants. Computer-assisted telephonic interviews (CATIs) were used to gain deeper insights into the KSA food delivery market, verify assumptions, and refine market estimations.

Step 3: Market Sizing Approach

The market size was determined using a bottom-up approach, identifying major players in the sector and analyzing their service offerings. This included examining revenue data, order volumes, delivery fees, and partnerships. The revenue estimates were cross-verified through secondary sources such as industry reports and government data, ensuring the accuracy and reliability of the findings.

Step 4: Interpretation and Future Forecasting

Future market trends were projected by analyzing key macroeconomic and industry-level factors, including smartphone penetration, evolving consumer preferences, advancements in delivery technology, and economic conditions in KSA. Additional considerations included changes in regulatory frameworks, expansion of cloud kitchens, and logistical infrastructure improvements. The final analysis was synthesized by industry experts to provide actionable insights and forecasts for stakeholders in the KSA food delivery market.

Frequently Asked Questions

01. How big is the KSA food delivery market?

The KSA food delivery market is valued at SAR 32 bn, driven by increasing smartphone adoption, evolving consumer habits, and expanding restaurant partnerships.

02. What are the challenges in KSA food delivery market?

Challenges in the KSA food delivery market include regulatory compliance, logistical inefficiencies in last-mile delivery, and intense competition among players.

03. Who are the major players in KSA food delivery market?

Major players in the KSA food delivery market include HungerStation, Jahez, Careem, Uber Eats, and The Chefz, all of which have invested heavily in technology and logistics.

04. What are the growth drivers of KSA food delivery market?

Growth drivers in the KSA food delivery market include technological advancements, increasing disposable incomes, and a preference for convenience among consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.