KSA Food Market Outlook to 2030

Region:Middle East

Author(s):Yogita Sahu

Product Code:KROD4468

October 2024

85

About the Report

KSA Food Market Overview

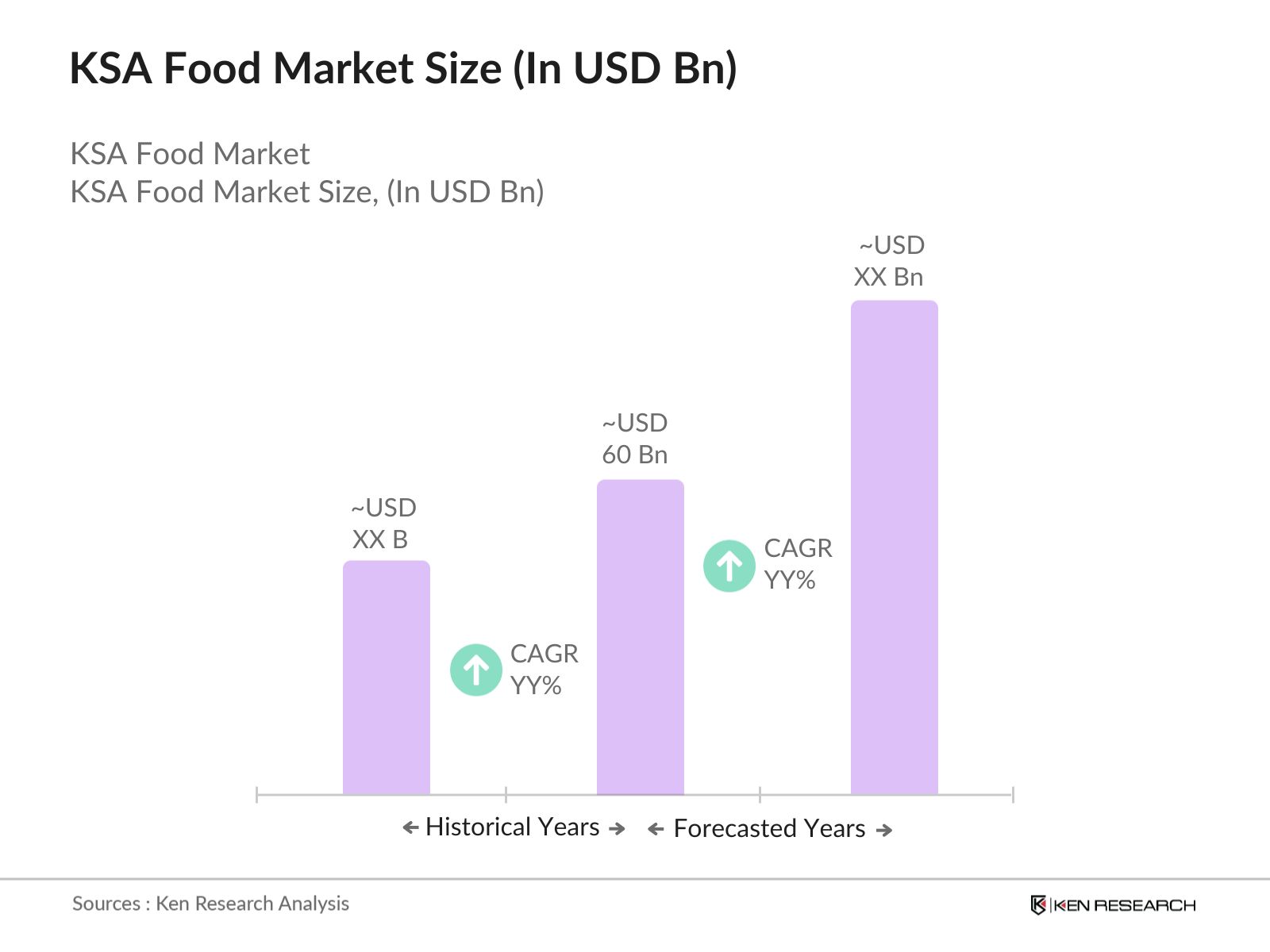

- The KSA food market was valued at USD 60 billion, reflecting its significant growth over the past five years. The market's expansion is primarily driven by increased urbanization, rising disposable incomes, and shifting dietary preferences among Saudi consumers. The government's Vision 2030, which emphasizes food security and self-sufficiency, has also played a critical role in fostering market growth. As more international food brands and chains enter the Saudi market, competition has intensified, particularly in categories like processed foods and beverages.

- Riyadh and Jeddah dominate the market due to their large populations, urban infrastructure, and status as key commercial hubs. Riyadh, being the capital and economic center, attracts substantial investment in food services and retail. Jeddah, with its historical role as a gateway for trade, has also become a market for international food brands.

- The Saudi governments Vision 2030 plan emphasizes food security as a critical priority. In 2024, the government committed to enhance local food production through investments in modern agriculture technologies like hydroponics, aquaponics, and vertical farming. These programs aim to reduce the countrys reliance on imports and increase domestic production of essential food items like dairy, poultry, and vegetables.

KSA Food Market Segmentation

- By Product Type: The market is segmented by product type into fresh produce, processed foods, dairy products, meat and poultry, and beverages (non-alcoholic). Processed foods currently hold a dominant market share, driven by their convenience and longer shelf life, making them popular among busy urban consumers. Major players like Almarai and Savola have established a robust presence in this segment, leveraging strong distribution networks and brand recognition.

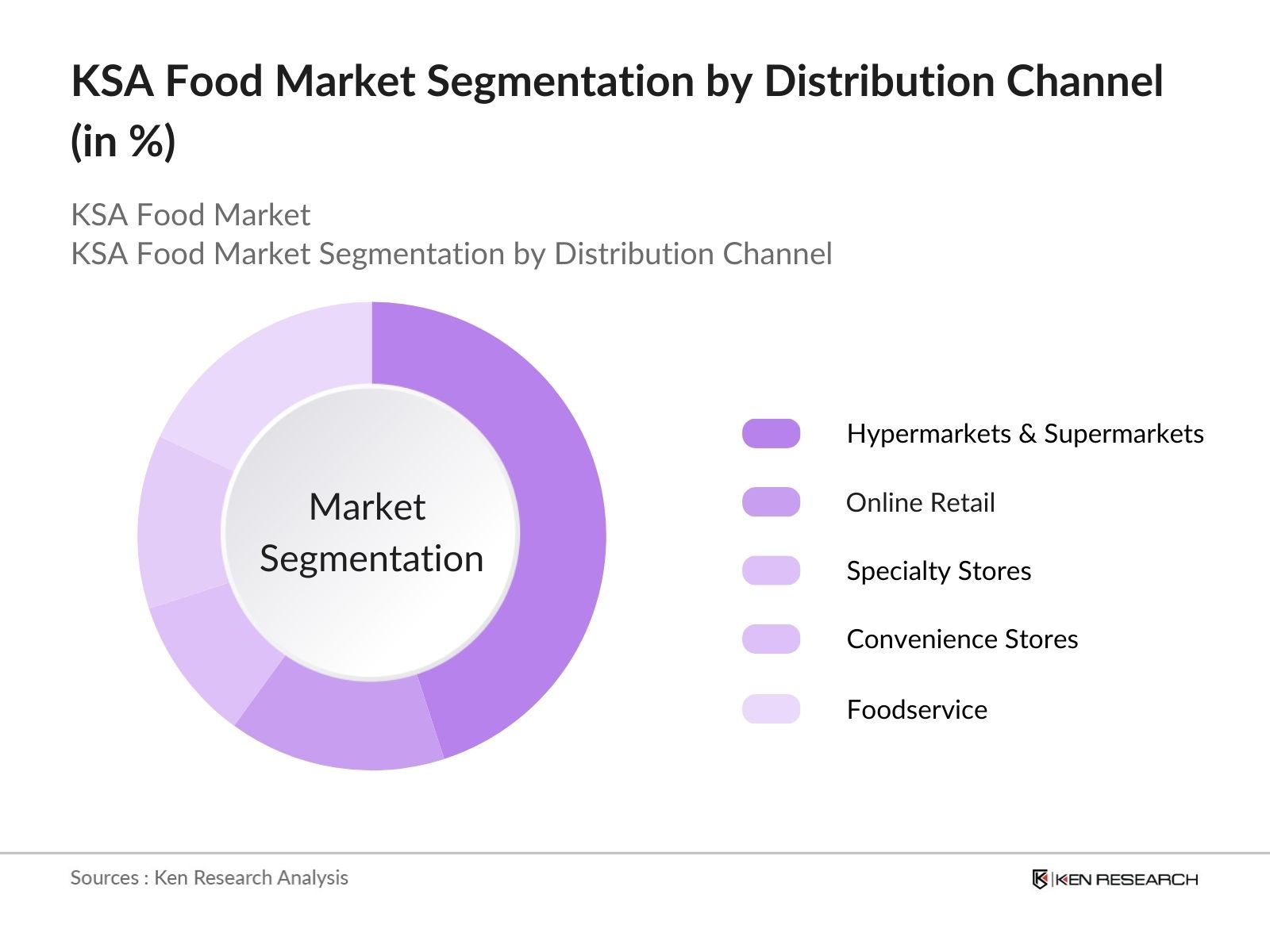

- By Distribution Channel: The market is also segmented by distribution channels into hypermarkets & supermarkets, online retail, specialty stores, convenience stores, and foodservice. Hypermarkets and supermarkets dominate the distribution landscape due to their extensive footprint, offering consumers a wide variety of food products under one roof. Chains like Panda and Carrefour have been expanding aggressively, ensuring they capture the largest share of foot traffic in major urban centers.

KSA Food Market Competitive Landscape

The market is led by several key players, both local and international, who have established a strong presence due to their investment in product innovation and extensive distribution networks. Almarai, for instance, leads in dairy and beverage products, while Savola Group dominates the edible oils and processed foods category.

|

Company Name |

Established Year |

Headquarters |

Products |

Revenue (USD) |

Market Segment |

Global Presence |

Innovations |

Employees |

|

Almarai Co. |

1977 |

Riyadh |

||||||

|

Savola Group |

1979 |

Jeddah |

||||||

|

National Aquaculture Group |

1985 |

Jazan |

||||||

|

Tanmiah Food Co. |

1962 |

Riyadh |

||||||

|

Al Rabie Saudi Foods |

1980 |

Riyadh |

KSA Food Market Analysis

Market Growth Drivers

- Increased Demand for Imported Food Products: As of 2024, Saudi Arabia remains heavily reliant on imported food to meet its domestic demand. In 2022, the Kingdom imported over 20 million metric tons of food products due to the scarcity of arable land and water resources. The demand for high-quality international food products is rising, particularly in urban areas such as Riyadh and Jeddah. Growing expatriate populations, are also fueling the demand for international food brands and specialized products like halal meat, contributing to the growth of the food import market.

- Government Investment in Agriculture and Food Security: The Saudi government is investing heavily in domestic agriculture through Vision 2030 initiatives, aiming to reduce food import dependency. By 2024, SAR 90 billion has been allocated to develop advanced agricultural technologies and increase local food production, particularly in water-efficient crops. The government is also encouraging private investment in agriculture through public-private partnerships (PPPs), aiming to ensure food security for the growing population.

- Rising Tourism and Foodservice Industry: The influx of international tourists, driven by the Kingdoms efforts to diversify its economy beyond oil, is another growth driver. In 2024, Saudi Arabia is expected to attract over 25 million international visitors, many of whom are participating in religious pilgrimages or attending international events. This rise in tourism is fueling the demand for food services, ranging from quick-service restaurants to luxury dining experiences.

Market Challenges

- Limited Water Resources: Saudi Arabia is one of the most water-scarce nations in the world, with per capita renewable water resources falling below 100 cubic meters annually. This scarcity is a challenge for the agriculture sector, which heavily relies on imported water-intensive crops like wheat. Despite government efforts to promote efficient water use, local food production faces ongoing challenges due to limited freshwater supplies and the high cost of desalination processes.

- High Dependence on Food Imports: Saudi Arabia imports approximately 80% of its food, which exposes the country to fluctuations in global food prices and supply chain disruptions. As of 2024, the Kingdom imported over 20 million metric tons of food. Global food supply shocks, such as those caused by geopolitical tensions or natural disasters, significantly affect domestic food prices and availability. This dependency on imports presents a vulnerability to the Saudi food market, as any disruption in international trade could impact food security and the cost of living.

KSA Food Market Future Outlook

The KSA food industry is expected to continue its upward trajectory over the next five years, driven by growing consumer demand for convenience foods, premium products, and health-conscious alternatives. With the Vision 2030 initiative's focus on food security and local food production, the market is likely to see more investments in domestic agriculture and food processing industries.

Future Market Opportunities

- Expansion of Vertical Farming: Over the next five years, vertical farming is expected to expand significantly across urban areas in Saudi Arabia, particularly in smart cities like NEOM. By 2029, vertical farms will contribute to producing a substantial portion of the country's vegetable supply. This farming technique is projected to reduce the Kingdoms dependency on imported produce while minimizing water use, aligning with the countrys environmental goals under Vision 2030.

- Growth of Plant-Based Food Products: The market for plant-based food products is expected to grow rapidly in Saudi Arabia in the coming years. By 2028, it is estimated that the Kingdom will witness a sharp increase in demand for plant-based dairy and meat alternatives, driven by rising consumer awareness of health and sustainability issues. Local food manufacturers are likely to expand their product lines to include plant-based options, leveraging advancements in food technology to cater to this growing demand.

Scope of the Report

|

Product Type |

Fresh Produce Processed Foods Dairy Products Meat and Poultry Beverages (Non-Alcoholic) |

|

Distribution Channel |

Hypermarkets & Supermarkets Online Retail Specialty Stores Convenience Stores Foodservice |

|

Consumer Segment |

Retail Consumers Commercial Consumers Institutional Consumers E-commerce Buyers Industrial Consumers |

|

Region |

North East West South |

|

Cuisine Preference |

Local Cuisine International Cuisine Fast Food |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Environment, Water and Agriculture)

Food and Beverage Manufacturers

Foodservice Providers

Packaging and Labeling Companies

Banks and Financial Institutions

Companies

Players Mentioned in the Report:

Almarai Co.

Savola Group

National Aquaculture Group

Tanmiah Food Company

Al Rabie Saudi Foods

Sunbulah Group

Saudia Dairy & Foodstuff Co. (SADAFCO)

NADEC

Al Watania Agriculture

Almunajem Foods

Halwani Bros Co.

Al Kabeer Group

Afia International Company

Americana Group

Binzagr Company

Table of Contents

1. KSA Food Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. KSA Food Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Food Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Disposable Income

3.1.2 Changing Dietary Preferences

3.1.3 Government Initiatives for Food Security

3.1.4 Expanding Urbanization

3.2 Market Challenges

3.2.1 Stringent Import Regulations

3.2.2 High Dependence on Food Imports

3.2.3 Climate Change and Water Scarcity

3.3 Opportunities

3.3.1 Rising Demand for Organic and Healthy Foods

3.3.2 Halal Food Exports Expansion

3.3.3 Technological Advancements in Agriculture and Food Processing

3.3.4 Growth of E-commerce in the Food Sector

3.4 Trends

3.4.1 Shift Towards Plant-based Diets

3.4.2 Increasing Popularity of Functional Foods

3.4.3 Growth of Ready-to-Eat Meals

3.4.4 Sustainable and Environment-friendly Packaging

3.5 Government Regulation

3.5.1 Saudi Vision 2030 and Food Security Policies

3.5.2 Tariff and Non-Tariff Barriers on Food Imports

3.5.3 Support for Local Food Production

3.5.4 Food Safety Regulations and Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. KSA Food Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Fresh Produce

4.1.2 Processed Foods

4.1.3 Dairy Products

4.1.4 Meat and Poultry

4.1.5 Beverages (Non-Alcoholic)

4.2 By Distribution Channel (In Value %)

4.2.1 Hypermarkets & Supermarkets

4.2.2 Online Retail

4.2.3 Specialty Stores

4.2.4 Convenience Stores

4.2.5 Foodservice

4.3 By Consumer Segment (In Value %)

4.3.1 Retail Consumers

4.3.2 Commercial Consumers

4.3.3 Institutional Consumers

4.3.4 E-commerce Buyers

4.3.5 Industrial Consumers

4.4 By Region (In Value %)

4.4.1 North

4.4.2 East

4.4.3 West

4.4.4 South

4.5 By Cuisine Preference (In Value %)

4.5.1 Local Cuisine

4.5.2 International Cuisine (Indian, Italian, American)

4.5.3 Fast Food

5. KSA Food Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Almarai Co.

5.1.2. Savola Group

5.1.3. National Aquaculture Group

5.1.4. Tanmiah Food Company

5.1.5. NADEC

5.1.6. Al Rabie Saudi Foods

5.1.7. Sunbulah Group

5.1.8. Saudia Dairy & Foodstuff Co. (SADAFCO)

5.1.9. Al Watania Agriculture

5.1.10. Almunajem Foods

5.1.11. Halwani Bros Co.

5.1.12. Al Kabeer Group

5.1.13. Afia International Company

5.1.14. Americana Group

5.1.15. Binzagr Company

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Key Products, Global Presence, Innovation Capabilities)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. KSA Food Market Regulatory Framework

6.1 Food Import Regulations

6.2 Quality Standards and Certification

6.3 Compliance with Halal Standards

6.4 Packaging and Labeling Regulations

7. KSA Food Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Food Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Consumer Segment (In Value %)

8.4 By Region (In Value %)

8.5 By Cuisine Preference (In Value %)

9. KSA Food Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all major stakeholders within the KSA Food Market ecosystem, including manufacturers, distributors, retailers, and regulatory bodies. This step uses a combination of secondary and proprietary research databases to gather industry-specific information. The goal is to pinpoint key market dynamics and variables such as consumer behavior and regulatory shifts that will impact market growth.

Step 2: Market Analysis and Construction

This phase entails the collection and analysis of historical data on the KSA Food Market. We examine market penetration levels, food production volumes, and sales revenue from various sub-segments, while also assessing competition intensity and pricing trends.

Step 3: Hypothesis Validation and Expert Consultation

We develop market hypotheses and validate them through in-depth interviews with industry experts. These consultations provide firsthand insights into supply chain dynamics, distribution strategies, and the operational challenges faced by manufacturers and retailers.

Step 4: Research Synthesis and Final Output

In the final phase, data collected from bottom-up and top-down approaches is synthesized. This data is further cross-referenced with interviews conducted across key market stakeholders. The resulting analysis provides a comprehensive view of the market, highlighting trends, opportunities, and potential risks.

Frequently Asked Questions

01. How big is the KSA Food Market?

The KSA food market is valued at USD 60 billion, driven by increasing urbanization, rising disposable incomes, and government initiatives to enhance food security.

02. What are the challenges in the KSA Food Market?

Challenges in the KSA food market include dependency on food imports, stringent import regulations, and the impact of climate change on agricultural productivity. Additionally, water scarcity poses a significant challenge for local food production.

03. Who are the major players in the KSA Food Market?

Major players in the KSA food market include Almarai, Savola Group, Tanmiah Food Company, National Aquaculture Group, and Al Rabie Saudi Foods, each contributing significantly to various segments of the market.

04. What are the growth drivers of the KSA Food Market?

Key growth drivers in the KSA food market include increasing demand for processed foods, rising popularity of healthy and organic foods, and government support for local food production under the Vision 2030 initiative.

05. What are the trends in the KSA Food Market?

Emerging trends in the KSA food market include the rise of plant-based diets, growing demand for halal-certified products, and the increasing importance of e-commerce platforms in food distribution.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.