KSA Food Packaging Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD6539

December 2024

83

About the Report

KSA Food Packaging Market Overview

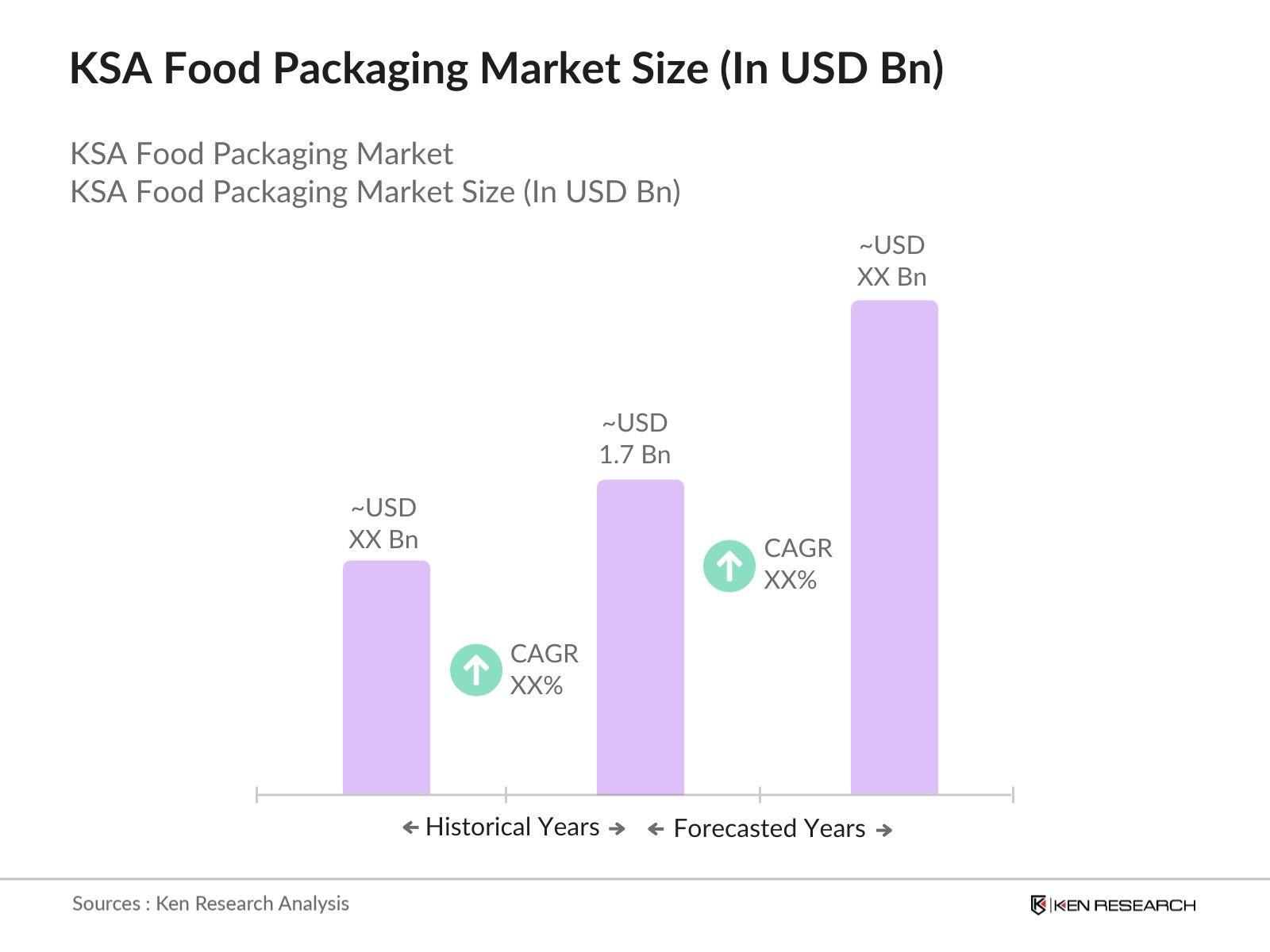

- The KSA food packaging market is valued at USD 1.7 billion, propelled by a surge in demand for convenience foods, coupled with evolving consumer preferences towards sustainable packaging solutions. This growth trajectory is significantly influenced by a burgeoning urban population that favors ready-to-eat meals, thereby driving the adoption of innovative packaging technologies. With the rise of e-commerce and food delivery services, the need for efficient and environmentally friendly packaging continues to gain momentum across various market segments.

- Major demand centers for food packaging in KSA include Riyadh, Jeddah, and Dammam. These cities dominate the market due to their high population density and robust economic activities, which stimulate consumer spending on food products. Riyadh stands out as the economic powerhouse, where a growing middle class increasingly invests in quality packaged foods. Meanwhile, Jeddah serves as a vital commercial hub, benefiting from its strategic coastal location that facilitates imports and exports of food products, thereby bolstering packaging requirements in the region.

- Government regulations significantly influence the food packaging market in Saudi Arabia. Under the Saudi Vision 2030 initiative, the government is implementing policies aimed at enhancing waste management and promoting sustainable practices. As part of this, new regulations regarding the use of recyclable materials have been introduced, with majority of food packaging companies reporting compliance with these standards by 2023. The implementation of the National Waste Management Strategy aims to reduce landfill waste substantially by 2025, encouraging businesses to adopt more sustainable packaging solutions.

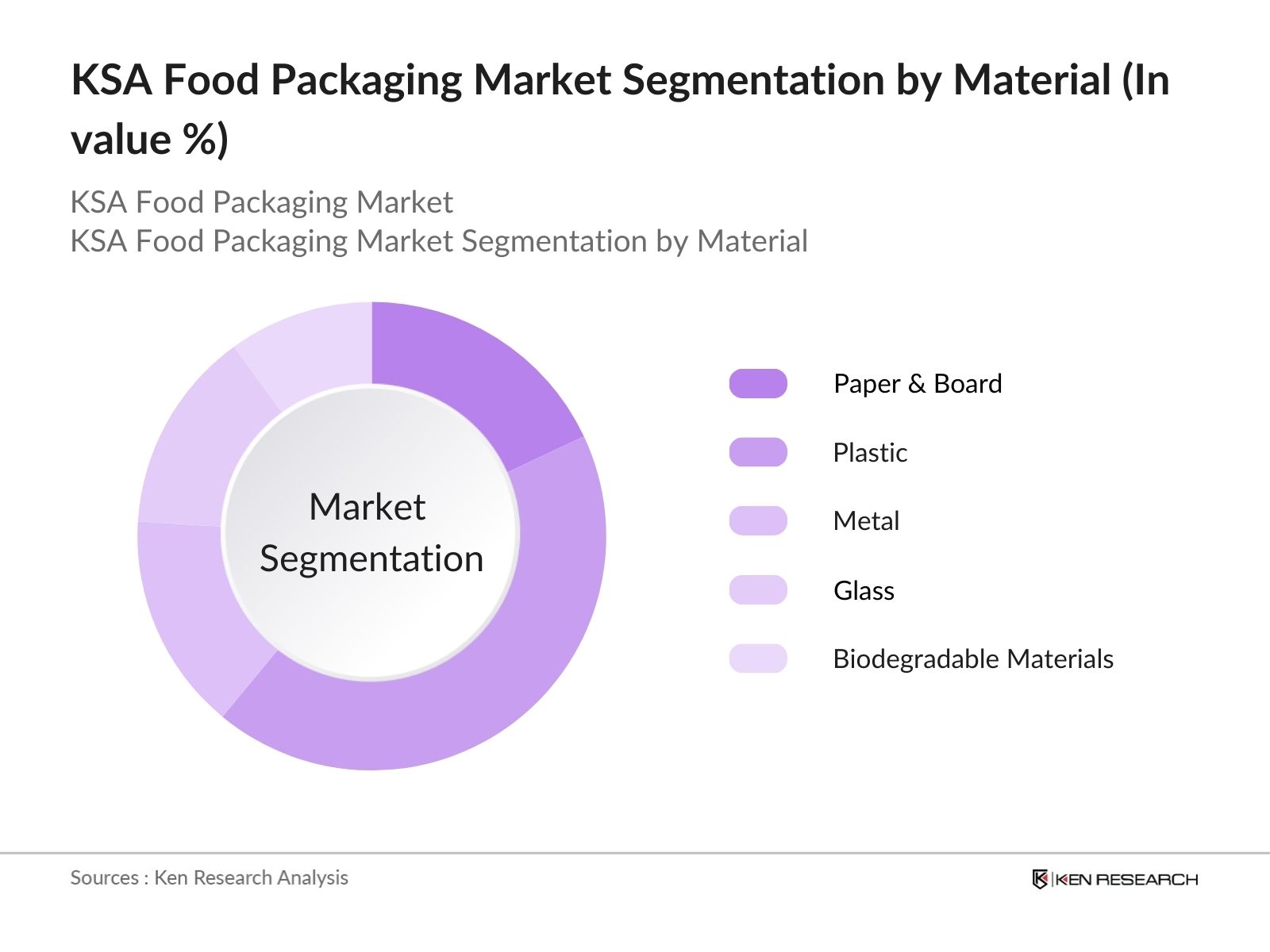

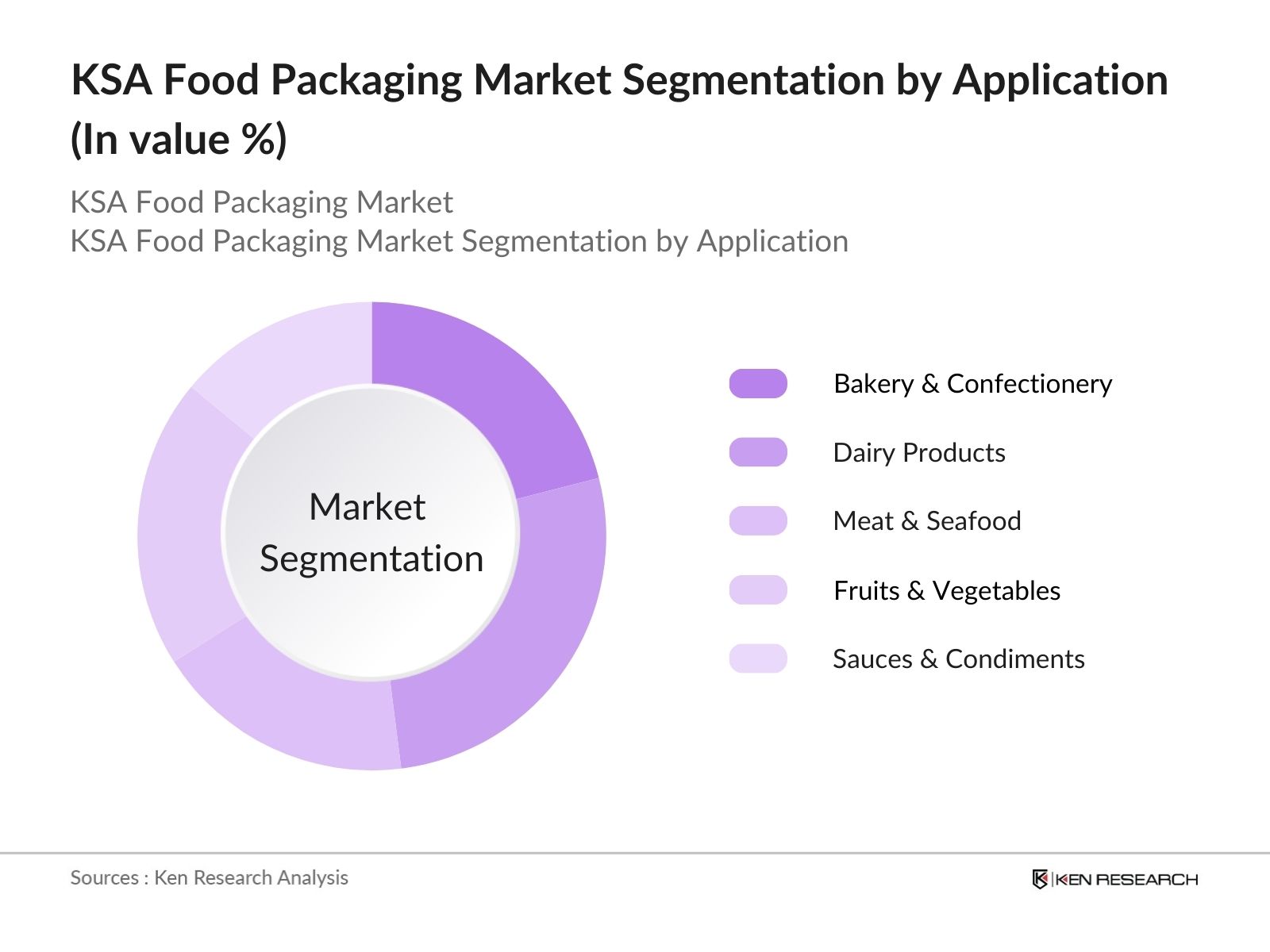

KSA Food Packaging Market Segmentation

- By Material Type: The market is segmented by material type into paper and board, plastic, metal, glass, and biodegradable materials. The flexible plastic segment currently leads the market, accounting for majority of the share. This dominance is attributed to the versatility and cost-effectiveness of flexible plastic packaging, which caters to a wide array of food products, including snacks, beverages, and ready-to-eat meals. The lightweight and moisture-resistant properties of flexible plastics enhance product shelf life and reduce transportation costs, making it a preferred choice among manufacturers and consumers alike.

- By Application: The market is also categorized by application into bakery and confectionery, dairy products, meat and seafood, fruits and vegetables, and sauces, dressings, and condiments. The dairy products segment holds the largest market share, driven by the increasing consumer demand for packaged milk, cheese, and yogurt. This demand is underpinned by a heightened focus on food safety and hygiene, prompting consumers to prefer packaged options that ensure freshness and quality. Innovations in packaging technology that extend shelf life further contribute to the segment's growth.

KSA Food Packaging Market Competitive Landscape

The KSA food packaging market is characterized by a diverse array of players, including both international giants and local manufacturers. Companies like Amcor, Ball Corporation, and Saudi Modern Packaging Co. have established significant market presence through innovation, extensive distribution networks, and a focus on sustainable practices.

KSA Food Packaging Market Analysis

Growth Drivers

- Rise in Consumer Demand for Convenience Foods: The demand for convenience foods in Saudi Arabia has surged, driven by changing lifestyles and consumer preferences. As of 2022, the food processing sector contributed USD 26 billion to the country's GDP, indicating a growing trend towards ready-to-eat meals and packaged food products. This shift is bolstered by a substantial increase in the population, which reached around 35.5 million, further fueling the demand for convenient food options. Moreover, in 2023, the food service sector witnessed remarkable growth, highlighting the increasing reliance on packaged food.

- Sustainable Packaging Adoption: Sustainable packaging is becoming increasingly important in Saudi Arabia's food sector, aligning with global environmental goals. The country's commitment to reducing plastic waste has led to a reported substantial decrease in single-use plastics in the food industry from 2020 to 2023. Additionally, the Saudi government aims for one-third of its plastic packaging to be recyclable or compostable by 2025. This focus on sustainability is reflected in a 2022 report stating that majority of consumers prefer brands that use eco-friendly packaging, emphasizing a significant market shift towards sustainable practices.

- Rising E-Commerce in Food Retail: The rise of e-commerce in Saudi Arabia's food retail sector has transformed consumer purchasing behaviour. In 2023, online food sales accounted for USD 2.48 billion, a notable increase from 2021. This growth is driven by the convenience and speed of online shopping, particularly among younger demographics. The Saudi Arabian General Authority for Statistics reported that e-commerce transactions in the retail sector rose remarkably in 2022, indicating a robust and expanding market for packaged food products.

Challenges

- Competition from Imported Products: The Saudi food packaging market faces stiff competition from imported products, especially those that offer lower prices. Local manufacturers are challenged to maintain quality while competing with cost-effective solutions from international suppliers. This competition can limit market share for domestic players and may necessitate strategic partnerships or innovations to enhance product appeal. As a result, domestic manufacturers are struggling to compete, leading to a potential decline in local production capacity unless innovation and cost reduction strategies are implemented.

- Regulatory Compliance and Standards: Navigating the regulatory landscape poses challenges for food packaging companies, as compliance with stringent health and safety standards is mandatory. Companies must continuously adapt their packaging processes to meet evolving regulations regarding materials, labeling, and sustainability, which can incur additional costs and operational complexities. Additionally, the introduction of the new packaging guidelines in 2023 further complicates the regulatory landscape, demanding more investment and adaptation from businesses

KSA Food Packaging Market Future Outlook

The KSA food packaging market is poised for significant growth, driven by advancements in packaging technologies, a growing focus on sustainability, and the increasing demand for convenience foods. As manufacturers invest in research and development to innovate packaging solutions that enhance product shelf life and reduce environmental impact, the market is expected to experience steady expansion. Furthermore, government support for local production and sustainable practices will likely reinforce market dynamics, positioning the sector for long-term success.

Future Market Opportunities

- Expansion of E-Commerce: The rise of e-commerce is transforming the food packaging landscape, with increasing demand for secure and protective packaging solutions that ensure product integrity during transit. Companies that leverage e-commerce channels will be well-positioned to capitalize on this trend, catering to the evolving needs of consumers seeking convenience and efficiency in their shopping experiences.

- Focus on Smart Packaging Technologies: The integration of smart packaging technologies, such as QR codes and RFID tags, is gaining traction within the food packaging sector. These innovations enhance consumer engagement by providing information on product freshness, nutritional value, and usage instructions. As consumers become more tech-savvy, the adoption of smart packaging is likely to rise, offering companies new avenues for differentiation and value creation.

Scope of the Report

|

By Material |

Paper & Board Plastic (Flexible, Rigid) Metal Glass Biodegradable |

|

By Packaging Type |

Rigid Packaging Semi-rigid Packaging Flexible Packaging |

|

By Application |

Bakery & Confectionery Dairy Products Meat & Seafood Fruits & Vegetables Sauces Dressings Condiments |

|

By Food Type |

Ready-to-Eat Foods Fresh Produce Processed Foods Frozen Foods |

|

By Region |

Central Eastern Western Northern Southern |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Environment, Water, and Agriculture)

Retailers and Wholesalers

Food and Beverage Manufacturers

Packaging Suppliers

Sustainability Advocates

Importers and Exporters

Companies

Players Mentioned in the Report

Saudi Modern Packaging Co.

Packaging Products Company

Napco National

SAPIN

LAMINA

Al Sharq Flexible Packaging Factory

National Packaging Products

Amcor

Ball Corporation

Graham Packaging Company

ProAmpac

Crown Holdings

Sealed Air Corporation

Mondi Group

DS Smith PLC

Table of Contents

01 KSA Food Packaging Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

02 KSA Food Packaging Market Size (In USD Bn)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

03 KSA Food Packaging Market Analysis

Growth Drivers

Increasing Demand for Convenience Foods

Sustainable Packaging Adoption

Rising E-Commerce in Food Retail

Market Challenges

Regulatory Compliance

Competition with Low-Cost Imports

Supply Chain Disruptions

Opportunities

Expansion in Eco-friendly Packaging

Digital Innovations in Packaging

Trends

Adoption of Smart Packaging

Biodegradable Material Usage

Customized Packaging Solutions

Government Regulations

Saudi Vision 2030 Packaging Initiatives

Waste Management Policies

Regulatory Standards

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competitive Ecosystem

04 KSA Food Packaging Market Segmentation

By Material (In Value %)

Paper & Board

Plastic (Flexible, Rigid)

Metal

Glass

Biodegradable Materials

By Packaging Type (In Value %)

Rigid Packaging

Semi-rigid Packaging

Flexible Packaging

By Application (In Value %)

Bakery & Confectionery

Dairy Products

Meat & Seafood

Fruits & Vegetables

Sauces, Dressings, and Condiments

By Food Type (In Value %)

Ready-to-Eat Foods

Fresh Produce

Processed Foods

Frozen Foods

By Region (In Value %)

Central

Eastern

Western

Northern

Southern

05 KSA Food Packaging Market Competitive Analysis

Detailed Profiles of Major Companies

Saudi Modern Packaging Co. Ltd.

Packaging Products Company

Napco National

SAPIN

LAMINA

Al Sharq Flexible Packaging Factory

National Packaging Products

Amcor

Ball Corporation

Graham Packaging Company

ProAmpac

Crown Holdings

Sealed Air Corporation

Mondi Group

DS Smith PLC

Cross Comparison Parameters (Market Share, Product Offerings, Sustainability Initiatives, Financial Performance, Regional Presence, Technological Capabilities, Customer Base, Innovation Index)

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants and Subsidies

Private Equity Investments

06 KSA Food Packaging Market Regulatory Framework

Environmental Standards

Compliance and Certification Requirements

Packaging Material Regulations

Recyclability and Disposal Guidelines

07 KSA Food Packaging Future Market Size (In USD Bn)

Future Market Size Projections

Key Factors Driving Future Market Growth

08 KSA Food Packaging Future Market Segmentation

By Material (In Value %)

By Packaging Type (In Value %)

By Application (In Value %)

By Food Type (In Value %)

By Region (In Value %)

09 KSA Food Packaging Market Analysts Recommendations

TAM/SAM/SOM Analysis

Customer Cohort Analysis

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins by mapping out the KSA food packaging ecosystem, identifying the most influential stakeholders and industry players. Through desk research and verified secondary sources, key variables such as material trends and consumer preferences are outlined.

Step 2: Market Analysis and Data Compilation

In this phase, historical data is analyzed to determine market growth patterns and identify dominant segments. This step includes a detailed analysis of segment-wise revenue generation, supported by qualitative data on consumer behavior and purchasing patterns.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses are validated through consultations with industry experts and packaging specialists. Interviews provide insights into industry challenges and opportunities, refining the data with real-world expertise on market trends and operational dynamics.

Step 4: Research Synthesis and Final Output

The research is synthesized into a comprehensive report format, ensuring alignment with market needs and client expectations. This includes cross-referencing quantitative findings with qualitative insights to present a well-rounded view of the market.

Frequently Asked Questions

01 How big is the KSA Food Packaging Market?

The KSA food packaging market is valued at USD 1.7 billion, largely driven by the rise in demand for convenient, ready-to-eat food products and sustainable packaging solutions.

02 What are the major challenges in the KSA Food Packaging Market?

Key challenges in the KSA food packaging market include regulatory compliance with sustainability standards, competition with low-cost imports, and fluctuating raw material prices affecting profitability for local manufacturers.

03 Who are the leading players in the KSA Food Packaging Market?

Major players in the KSA food packaging market include Saudi Modern Packaging Co., Napco National, SAPIN, Amcor, and Ball Corporation, with extensive distribution networks and a focus on innovative packaging solutions.

04 What drives growth in the KSA Food Packaging Market?

KSA food packaging market growth is primarily driven by urbanization, increasing consumer preference for packaged foods, and the governments push towards sustainable and eco-friendly packaging.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.