KSA Foodservice Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD8232

December 2024

91

About the Report

KSA Foodservice Market Overview

- The KSA Foodservice market is currently valued at USD 27 billion, driven by rising consumer demand for diverse dining experiences, influenced by a young population and increasing disposable income. Government initiatives under Vision 2030, which aim to boost tourism and expand urban centers, play a critical role in fostering growth within the sector. Factors such as convenience-driven lifestyles and the popularity of fast-food options further contribute to the steady expansion of the foodservice industry.

- Major demand centers for foodservice in KSA include Riyadh, Jeddah, and the Eastern Province. These regions dominate due to high population density, economic significance, and substantial investment in entertainment and hospitality projects. Riyadh, as the capital and an economic hub, has a large concentration of dining establishments catering to both locals and expatriates, making it a leading market for foodservice expansion and innovation.

- The Saudi Food and Drug Authority (SFDA) enforces stringent food safety standards, impacting all foodservice operators in the Kingdom. In 2023, the SFDA increased the frequency of inspections to maintain high food quality standards, leading to the closure of hundreds of establishments that failed to comply. Such regulations ensure consumer safety, but compliance demands continuous quality control investments, especially for new entrants in the market.

KSA Foodservice Market Segmentation

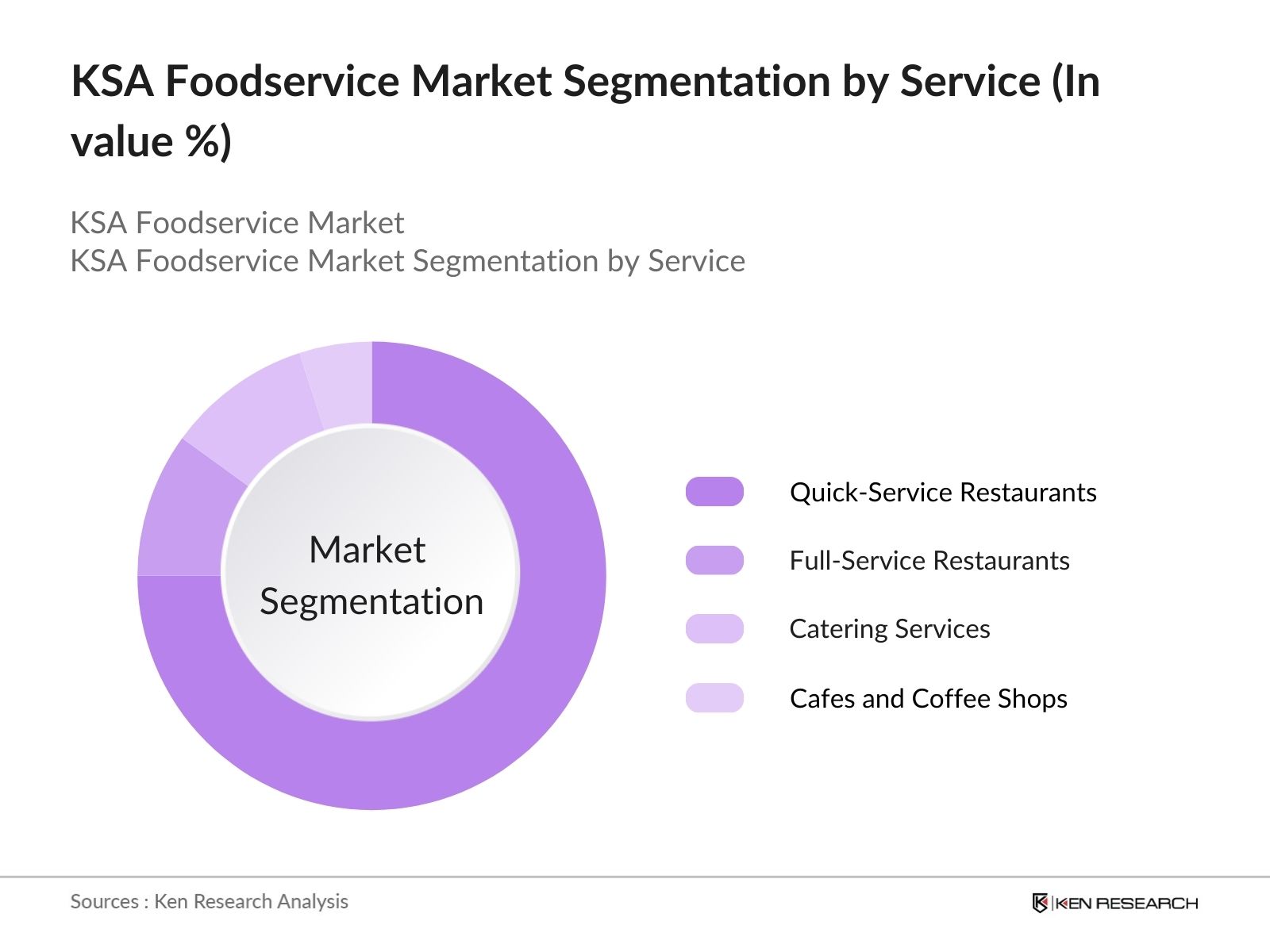

- By Service Type: The market is segmented by service type into Full-Service Restaurants, Quick-Service Restaurants, Catering Services, and Cafes. Quick-Service Restaurants hold a dominant market share due to their widespread appeal among the younger demographic and working population who prioritize convenience. Established chains like Al Baik and McDonald's have established strong brand loyalty, contributing to this segment's dominance, especially in urban areas where dining out and delivery options are highly popular.

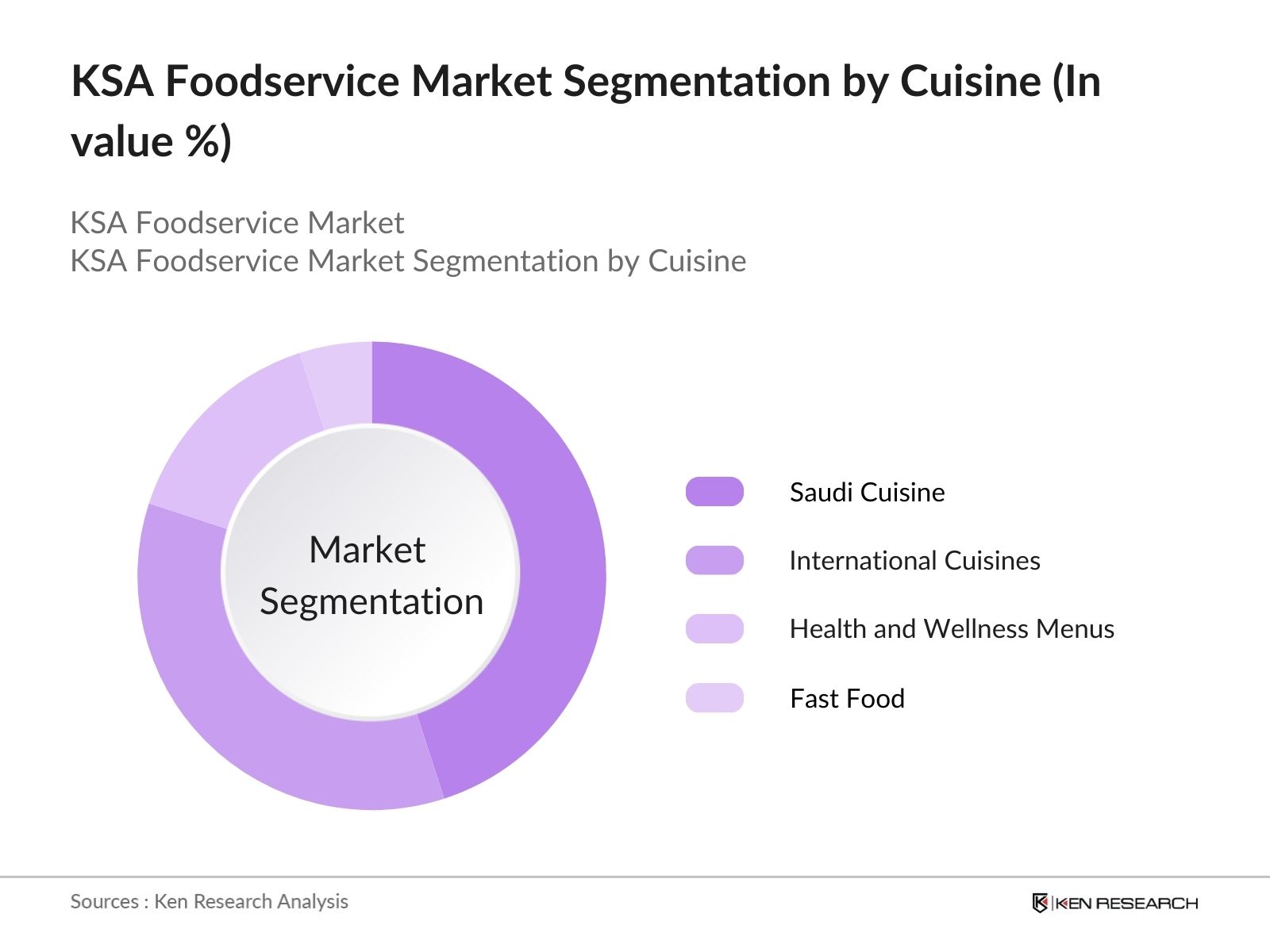

- By Cuisine Type: The market is further segmented by cuisine type into Saudi Cuisine, International Cuisines (Asian, Western), Health and Wellness-Oriented Menus, and Fast Food. Saudi Cuisine maintains a significant share of the market, fueled by demand for local dishes among residents and tourists. The cultural significance of traditional cuisine, combined with seasonal demand spikes during national celebrations, bolsters this segment. Many foodservice providers integrate Saudi dishes to cater to both locals and tourists seeking authentic culinary experiences.

KSA Foodservice Market Competitive Landscape

The KSA Foodservice market is highly competitive, with both local and international players striving to meet growing demand through extensive distribution networks, innovative menu offerings, and customer loyalty programs.

KSA Foodservice Market Analysis

Growth Drivers

- Food Consumption Rates and Population Growth The foodservice industry in Saudi Arabia is being driven by a rapid increase in food consumption, fueled by a growing population. As of 2023, Saudi Arabia's population stands at 37 million, with projections suggesting a consistent annual increase due to both birth rates and economic immigration. Coupled with this growth, urbanization trends are pushing food demand across Saudi cities, especially in Riyadh, Jeddah, and Dammam. This expanding population base is creating substantial demand for various dining options, benefiting both traditional and international foodservice operators in the country.

- Tourism Growth and Cultural Events: Saudi Arabia's strategic focus on tourism as part of Vision 2030 has made the Kingdom a significant regional tourist destination. In 2023 alone, the country received 27 million visitors, up from 16 million in 2022, largely due to cultural events like the Riyadh Season and Jeddah Season, supported by the Saudi Ministry of Tourism. These events increase foodservice demand, particularly in metropolitan and tourist-frequented areas, as international tourists bring varied culinary preferences, boosting both high-end and quick-service dining establishments.

- Urbanization and Lifestyle Shifts: The urbanization rate in Saudi Arabia has exceeded 84% as of 2024, with major cities seeing higher rates of population consolidation. This urban migration is driving a shift toward a dining-out culture, especially among the younger demographic, who account for over majority of the total population. Such trends are leading to increased demand for convenient dining options like fast food and quick-service restaurants, which are rapidly expanding to cater to urban consumers' preferences and busy lifestyles.

Challenges

- Rising Raw Material Costs: In 2024, the foodservice industry in Saudi Arabia is grappling with increased operational costs due to the rising prices of imported raw materials. With a significant portion of food products sourced internationally, global supply chain disruptions have escalated costs for essential ingredients like meat, dairy, and vegetables. This price surge directly impacts the profit margins of foodservice businesses, creating challenges for maintaining competitive pricing without compromising on quality. As a result, local foodservice operators are under pressure to balance cost efficiencies with customer expectations.

- Compliance with Food Safety Standards: Saudi Arabia upholds rigorous food safety standards under the Saudi Food and Drug Authority (SFDA), requiring regular inspections and certifications for foodservice operators. The SFDAs extensive inspections ensure compliance across the sector, resulting in penalties for non-compliant establishments. While these standards are essential for consumer protection, compliance requires ongoing investment in quality control, employee training, and updated infrastructure. These efforts, though necessary, add to the operational costs faced by the foodservice industry, underscoring the importance of maintaining consistent standards in a competitive market.

KSA Foodservice Market Future Outlook

Over the next five years, the KSA Foodservice Market is expected to experience continued growth due to urbanization, tourism expansion, and increasing consumer spending on dining experiences. The adoption of digital ordering and delivery services will further enhance market reach, meeting the demands of a tech-savvy, convenience-oriented population.

Future Market Opportunities

- Digital Innovation and E-commerce Integration in Food Services Saudi Arabias rapidly evolving digital infrastructure supports e-commerce integration within the foodservice sector, driven by high smartphone penetration (95% as of 2023) and increasing internet connectivity. Online food delivery platforms have seen substantial growth, with a substantial rise in online orders compared to the previous year, paving the way for digital-only restaurants and app-based food delivery services, presenting a significant opportunity for expansion and customer reach.

- Expansion into New Saudi Regions With government initiatives promoting regional development, demand for food services in cities outside major hubs like Riyadh and Jeddah is rising. As infrastructure projects continue to unfold in Al-Ula, NEOM, and Qiddiya, population inflows are expected to increase, creating untapped demand for dining options in these growing cities. The Saudi governments National Industrial Development and Logistics Program aims to enhance infrastructure and connectivity in these regions, providing a foundation for foodservice growth.

Scope of the Report

|

By Service Type |

Full-Service Restaurants Quick-Service Restaurants Catering and Event Services Cafes and Coffee Shops |

|

By Cuisine Type |

Saudi Cuisine International Cuisines Health and Wellness-Oriented Menus Fast Food |

|

By Distribution Channel |

Dine-In Takeout and Delivery Drive-Thru Services |

|

By Customer Type |

Individual Consumers Corporate Clients Tourist Segment |

|

By Region |

Riyadh Jeddah Eastern Province Makkah Region Other Cities |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Tourism)

Franchise Owners

Foodservice Equipment Suppliers

Real Estate Developers

Restaurant Chains and Independent Operators

Food and Beverage Manufacturers

Companies

Players Mentioned in the Report

Al Baik

Herfy Food Services Co.

KUDU Co.

Saudi Catering and Contracting Co.

Dominos Pizza

Americana Group

McDonalds Saudi Arabia

Pizza Hut Saudi Arabia

Fuddruckers

Starbucks

Dunkin Donuts

Chilis KSA

Applebees Saudi Arabia

Texas Roadhouse KSA

Tim Hortons Saudi Arabia

Table of Contents

01 KSA Foodservice Market Overview

Definition and Scope

Market Taxonomy

Industry Growth Rate

Market Segmentation Overview

02 KSA Foodservice Market Size (in USD Mn)

Historical Market Size

Key Market Milestones and Developments

Year-On-Year Growth Analysis

03 KSA Foodservice Market Analysis

Growth Drivers (Food Consumption Rates, Tourism Growth, Cultural Events, Urbanization)

Increasing Demand for Local Cuisine

Expansion of Quick Service Restaurants

Government Support for the Hospitality Sector

Growth in Mall-Based Dining

Market Challenges (Operational Costs, Regulatory Compliance, Consumer Preferences, Workforce Requirements)

Rising Raw Material Costs

Compliance with Food Safety Standards

Shift to Health-Conscious Eating

Workforce Localization Challenges

Opportunities (Digital Innovation, Customizable Menus, Sustainable Practices)

E-commerce Integration in Food Services

Expansion into New Saudi Regions

Promotion of Sustainable and Organic Food Options

Trends (Increased Demand for Health Foods, Delivery App Integration, Food Tech Adoption)

Rising Preference for Plant-Based Diets

Adoption of Contactless Dining Solutions

Popularity of Cloud Kitchens

Government Regulation (Food Safety Laws, Employment Quotas, Health Standards)

Saudi Food and Drug Authority (SFDA) Guidelines

Labor Regulations for Foodservice Industry

Tax Incentives for Small and Medium Enterprises (SMEs)

SWOT Analysis

Stakeholder Ecosystem (Suppliers, Distributors, Consumers, Regulatory Bodies)

Porter's Five Forces Analysis

Competition Ecosystem

04 KSA Foodservice Market Segmentation

By Service Type (in Value %)

Full-Service Restaurants

Quick-Service Restaurants

Catering and Event Services

Cafes and Coffee Shops

By Cuisine Type (in Value %)

Saudi Cuisine

International Cuisines (Asian, Western, Mediterranean)

Health and Wellness-Oriented Menus

Fast Food

By Distribution Channel (in Value %)

Dine-In

Takeout and Delivery

Drive-Thru Services

By Customer Type (in Value %)

Individual Consumers

Corporate Clients

Tourist Segment

By Region (in Value %)

Riyadh

Jeddah

Eastern Province

Makkah Region

Other Cities

05 KSA Foodservice Market Competitive Analysis

Detailed Profiles of Major Companies

Albaik

Herfy Food Services Co.

KUDU Co.

Saudi Catering and Contracting Co.

Domino's Pizza

Americana Group

McDonald's Saudi Arabia

Pizza Hut Saudi Arabia

Fuddruckers

Starbucks

Dunkin' Donuts

Chilis KSA

Applebee's Saudi Arabia

Texas Roadhouse KSA

Tim Hortons Saudi Arabia

Cross Comparison Parameters (Revenue, No. of Outlets, Menu Diversity, Regional Coverage, Customer Ratings, Delivery Partnerships, Brand Loyalty Programs, Workforce Size)

Market Share Analysis

Strategic Initiatives

Partnerships and Alliances

Investment and Expansion Plans

06 KSA Foodservice Market Regulatory Framework

Food and Safety Standards

Employment Regulations

Licensing and Certifications

07 KSA Foodservice Future Market Size (in USD Mn)

Future Market Size Projections

Key Drivers of Future Market Growth

08 KSA Foodservice Future Market Segmentation

By Service Type (in Value %)

By Cuisine Type (in Value %)

By Distribution Channel (in Value %)

By Customer Type (in Value %)

By Region (in Value %)

09 KSA Foodservice Market Analysts Recommendations

Customer Behavior Analysis

Growth and Penetration Strategies

Targeted Marketing Insights

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase maps the KSA Foodservice Market's stakeholder ecosystem. We utilized both proprietary and secondary data sources to pinpoint critical factors impacting market dynamics, such as urbanization rates, consumer spending on dining, and foodservice regulations.

Step 2: Market Analysis and Construction

In this stage, historical data was compiled and analyzed to examine foodservice market growth and structure. This includes measuring outlet penetration and consumer preferences, ensuring that revenue estimates reflect market demand.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were validated via in-depth interviews with sector experts, including prominent restaurant chain executives. Their insights helped refine our market assumptions and projections.

Step 4: Research Synthesis and Final Output

A comprehensive synthesis of the data collected was conducted, with input from local foodservice operators to verify segmentation insights, consumer trends, and competitive dynamics.

Frequently Asked Questions

01 How big is the KSA Foodservice Market?

The KSA Foodservice Market is valued at USD 27 billion, driven by increased urbanization and a young population with rising disposable income.

02 What are the challenges in the KSA Foodservice Market?

Key challenges in the KSA Foodservice Market include high operational costs, strict regulatory requirements, and the need for localized hiring, which can raise workforce costs and impact profitability.

03 Who are the major players in the KSA Foodservice Market?

Major players in the KSA Foodservice Market include Al Baik, Herfy Food Services Co., Americana Group, McDonald's Saudi Arabia, and Starbucks, each leveraging brand loyalty and strong consumer connections.

04 What are the growth drivers of the KSA Foodservice Market?

The KSA Foodservice Market growth is fueled by the expanding tourism sector, young consumer demand, and government initiatives like Vision 2030, which supports foodservice development.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.