KSA Games Market Outlook to 2030

Region:Middle East

Author(s):Yogita Sahu

Product Code:KROD6225

December 2024

92

About the Report

KSA Games Market Overview

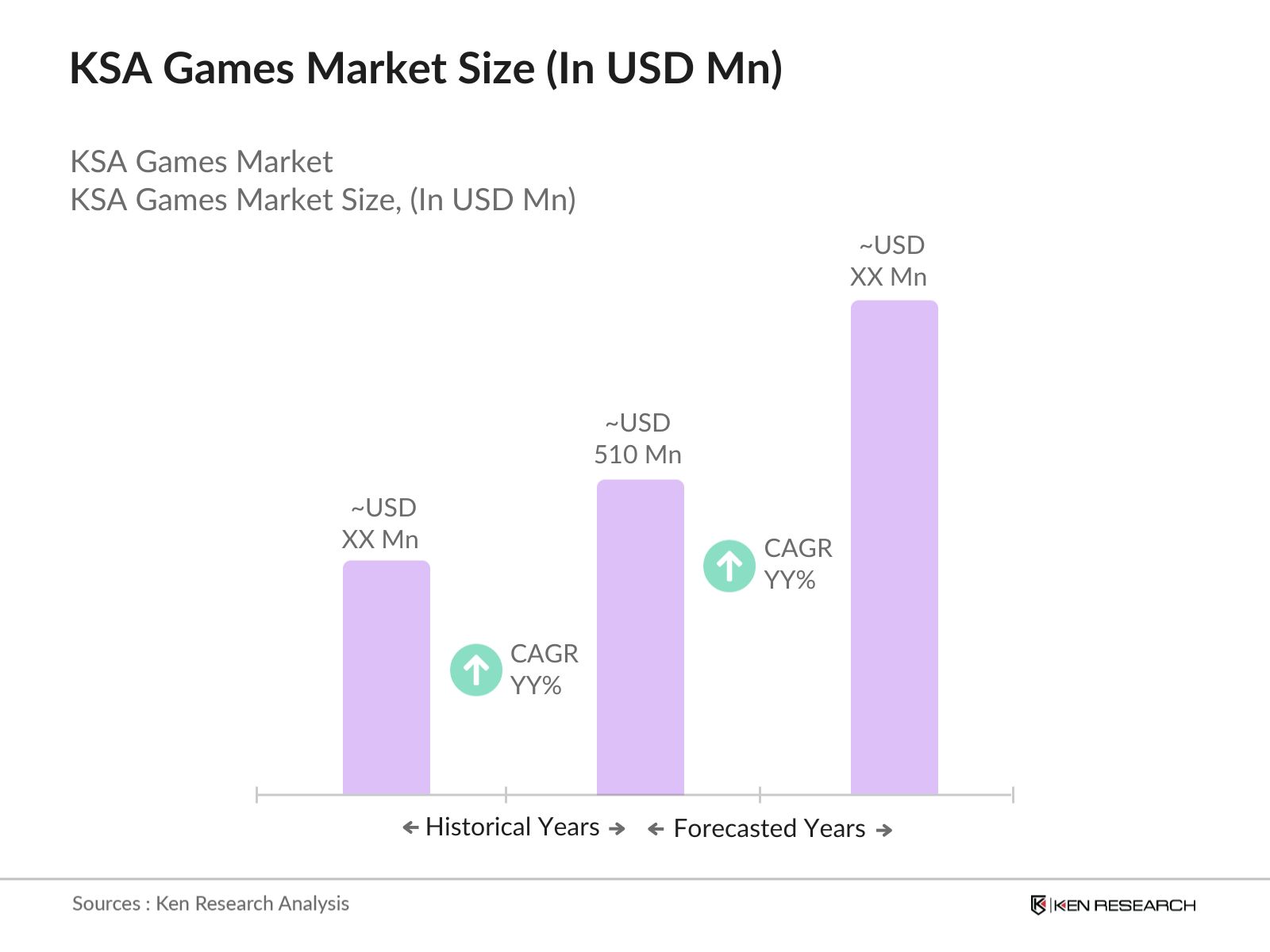

- The KSA Games Market is valued at USD 510 million, supported by the Kingdoms digitalization efforts and the burgeoning youth population's interest in gaming. With a compound annual growth rate (CAGR) of 18.5% between 2018 and 2023, the market benefits from initiatives under Saudi Vision 2030, promoting esports, local game development, and digital entertainment. Government support, increased internet penetration, and investments in infrastructure further boost the market's expansion.

- Riyadh and Jeddah dominate the market, driven by a higher concentration of young tech-savvy populations, ample disposable incomes, and extensive infrastructure for digital connectivity. These cities host large esports events and gaming conventions, positioning them as hubs for both domestic and regional gaming communities. The Eastern Province also shows strong growth, benefiting from proximity to the Gulf region and an emerging interest in digital entertainment.

- In 2024, the Saudi government unveiled the National Gaming and E-Sports Strategy, aiming to generate SAR 20 billion in revenue from the gaming sector by 2030. This initiative includes incentives for foreign gaming companies, fostering a supportive business environment that facilitates knowledge transfer and encourages collaboration with local developers.

KSA Games Market Segmentation

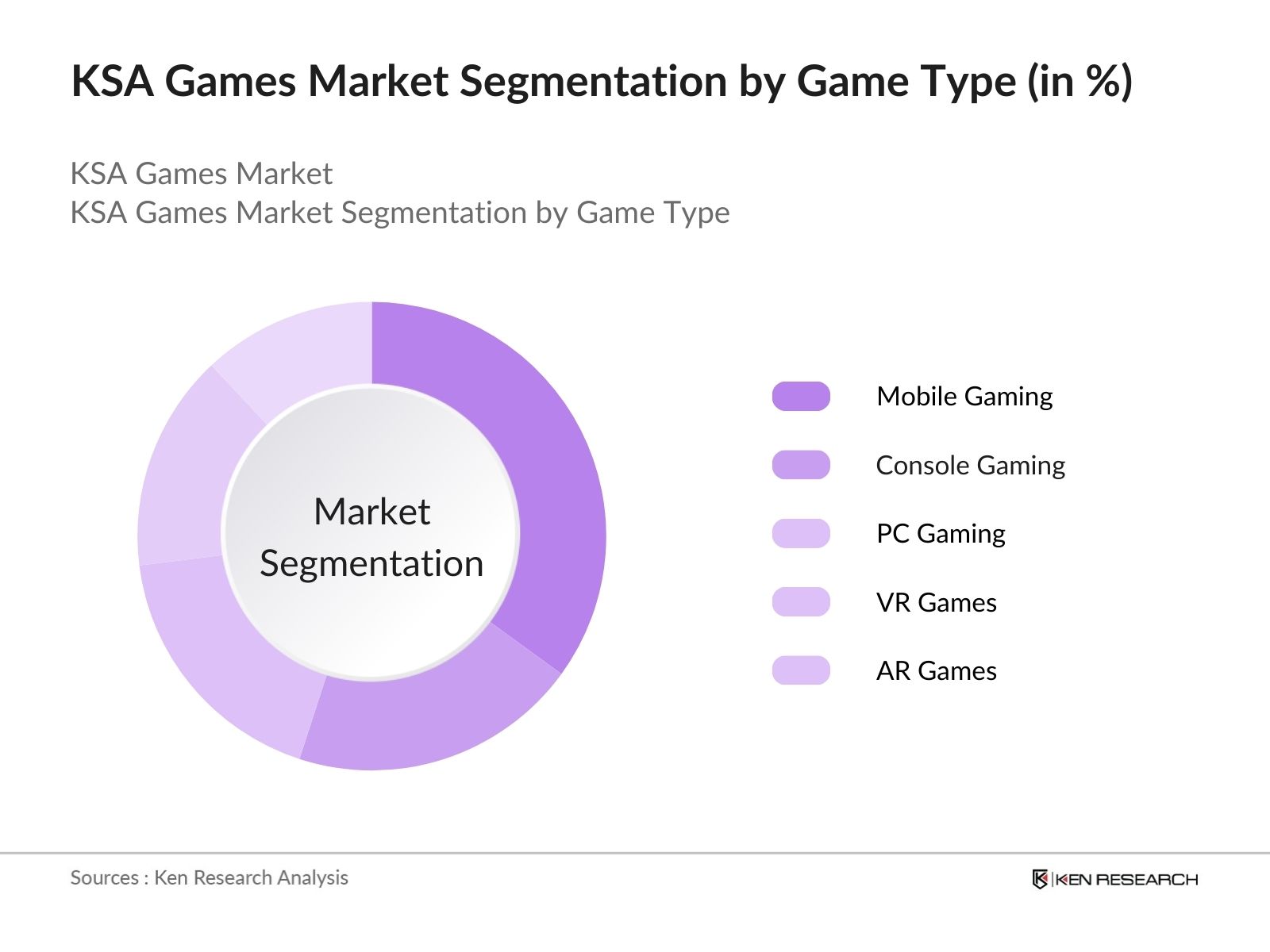

By Game Type: The market is segmented by game type into console gaming, mobile gaming, PC gaming, VR games, and AR games. Among these, mobile gaming holds the dominant share due to the high penetration of smartphones, relatively lower barriers to entry, and the popularity of mobile-based gaming platforms among the young population. The market is further driven by continuous improvements in mobile internet speed, especially with the adoption of 5G, which has enhanced gameplay quality.

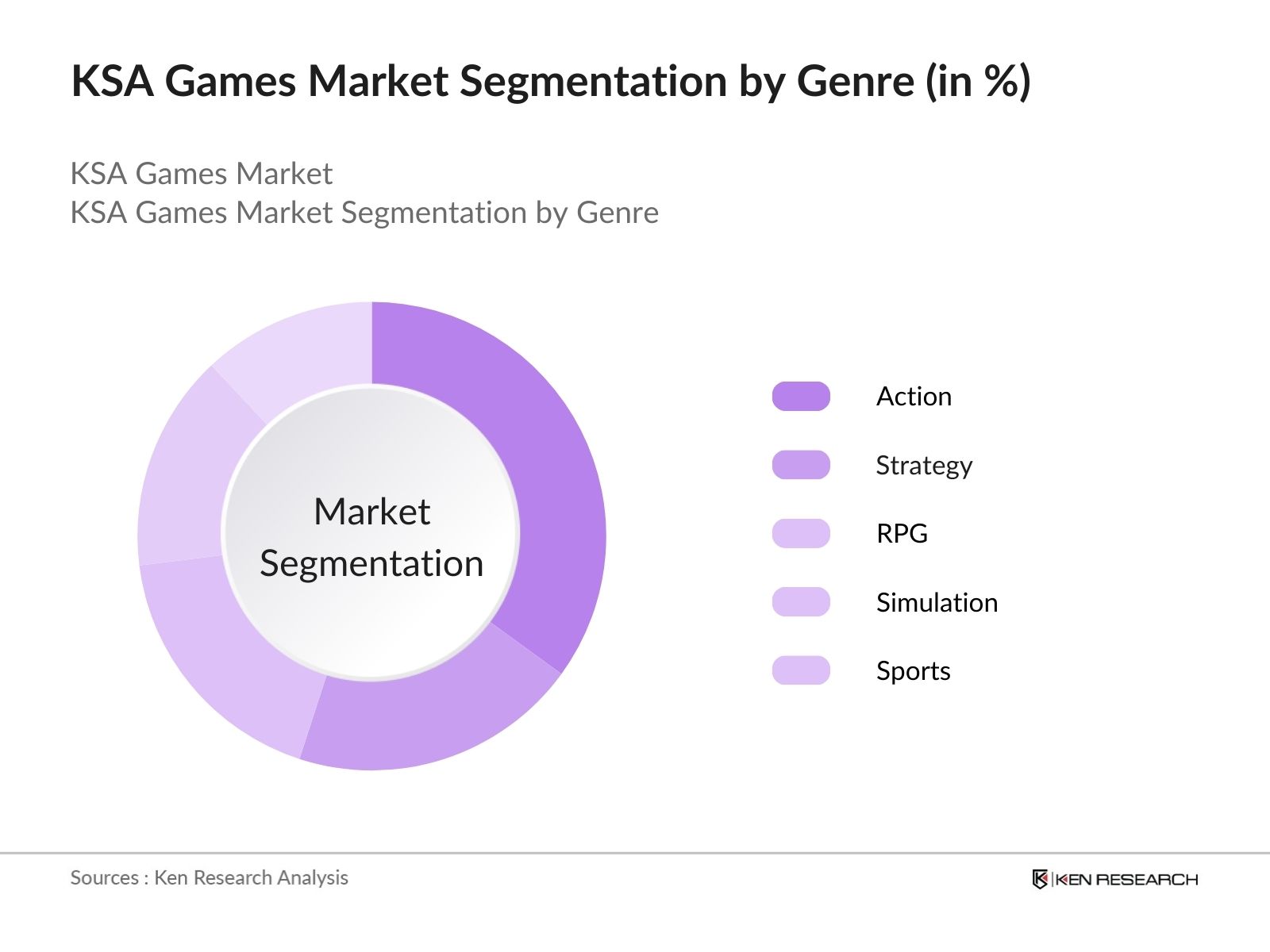

By Genre: The market is also segmented by genre into action, strategy, RPG (role-playing games), simulation, and sports. Action games lead this segment due to high demand for fast-paced games that offer immersive experiences. The rise of popular franchises and localized content has further driven the dominance of action games, appealing to the preferences of the KSA's gaming audience for engaging and visually stimulating experiences.

KSA Games Market Competitive Landscape

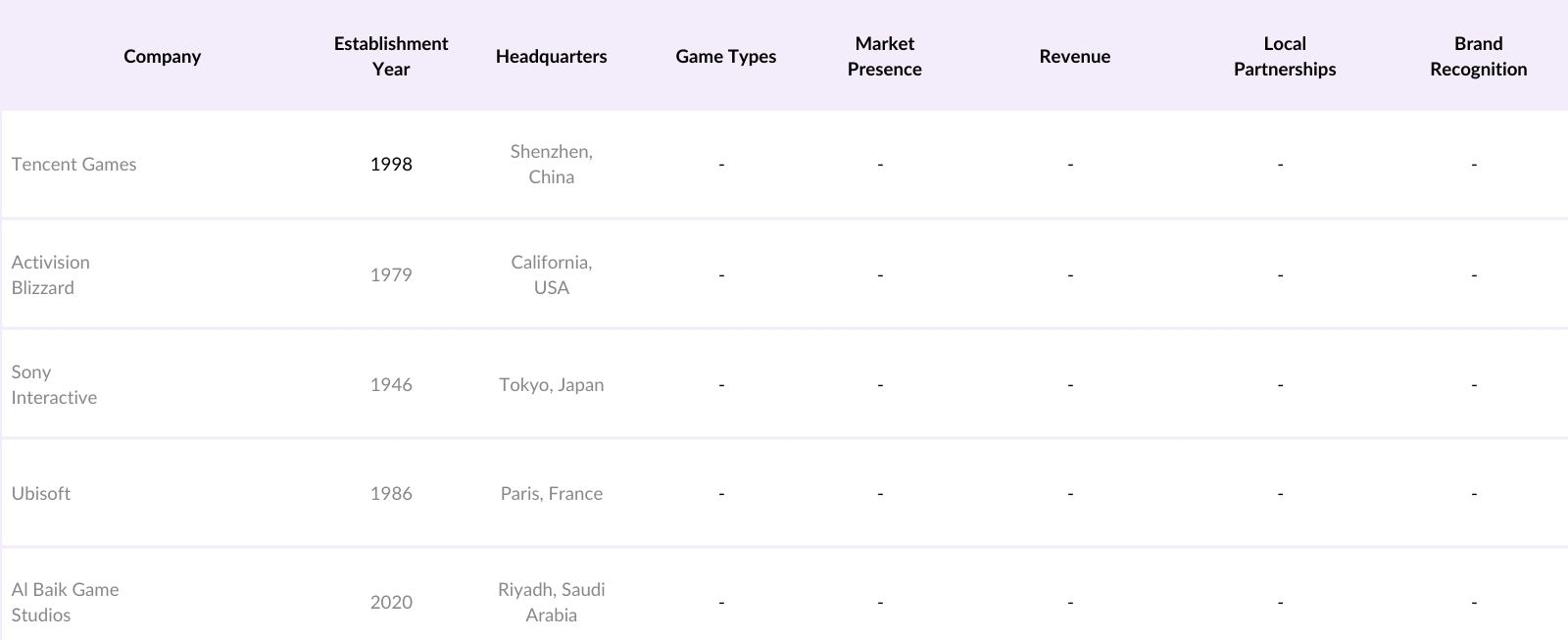

The market is characterized by a few dominant players, both global and regional, leveraging brand reputation, partnerships, and game localization strategies. International companies like Tencent and Activision Blizzard are highly competitive due to their well-established gaming franchises and substantial investments in local partnerships.

KSA Games Market Analysis

Market Growth Drivers

- Surging Demand for Online Gaming in Saudi Arabia: In 2024, the Saudi gaming sector saw a dramatic increase in the number of players in the online gaming space, with around 18 million active gamers nationwide, a result of higher internet penetration and a tech-savvy population. The governments efforts to expand 5G networks have further fueled demand for online multiplayer games, reaching nearly 90% of urban areas.

- Increased Local Content Production Supported by Government Initiatives: The Saudi government has invested heavily in gaming and e-sports content development, with over SAR 1 billion allocated in 2024 to support local gaming studios. This effort is part of a broader vision to position Saudi Arabia as a global gaming hub, and it has led to an increase in localized games catering specifically to the cultural nuances of the Kingdom.

- Youth Population Dominance: With nearly 40% of the Saudi population under the age of 25, there is a substantial target audience fueling the gaming market's growth. This demographic has shown a strong preference for digital entertainment, spending an average of SAR 3,000 annually on gaming. Additionally, the prevalence of gaming among Saudi youth is driving interest in e-sports and creating a sustainable demand for gaming products and services.

Market Challenges

- High Production Costs for Local Game Development: Despite government support, game development costs in Saudi Arabia remain high, with the average development cost for a standard game reaching around SAR 10 million. These high costs discourage smaller studios and independent developers, posing a significant challenge to market diversification and the growth of unique local content.

- Regulatory Challenges Surrounding Game Content: Game developers in Saudi Arabia face stringent content regulations, with over 20% of global games released in 2024 experiencing delays or modifications before being approved for the Saudi market. These regulatory hurdles slow down market access for international games and may hinder foreign investment in the Saudi gaming industry.

KSA Games Market Future Outlook

Over the next five years, the KSA Games industry is expected to grow, bolstered by favorable government policies, expanding esports infrastructure, and investments in game development. The focus on game localization, combined with increasing demand for immersive experiences like VR and AR, positions the market for sustained growth.

Future Market Opportunities

- Rise in Subscription-Based Gaming Services: Over the next five years, Saudi Arabia will likely witness substantial growth in subscription-based gaming services, with local gamers expected to embrace bundled gaming content offerings by 2029. This trend aligns with the increasing preference for high-quality, uninterrupted gaming experiences.

- Growth of the E-Sports Economy: Saudi Arabias e-sports sector is anticipated to grow significantly, with projected revenues potentially doubling by 2029 as the country hosts more international tournaments. Government incentives and state-of-the-art e-sports facilities will support this growth, making Saudi Arabia a global center for competitive gaming.

Scope of the Report

|

Game Type |

Console Gaming Mobile Gaming PC Gaming Virtual Reality (VR) Games Augmented Reality (AR) Games |

|

Genre |

Action Strategy Role-Playing Games (RPG) Simulation Sports |

|

Device Type |

Smartphones Gaming Consoles PCs/Laptops VR Headsets |

|

Distribution Channel |

Online Stores App Stores Offline Retail |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (e.g., Saudi Esports Federation, Ministry of Culture)

Game Developers and Publishers

Investors and Venture Capitalist Firms

Gaming Hardware Manufacturers

Esports Organizers and Associations

Telecommunication Service Providers

Retailers and Distributors of Gaming Consoles and Accessories

Digital Marketing Agencies Specializing in Gaming

Companies

Players Mentioned in the Report:

Tencent Games

Activision Blizzard

Sony Interactive Entertainment

Ubisoft

Epic Games

Electronic Arts (EA)

Square Enix

Bandai Namco

Sega Sammy Holdings

Nintendo

Table of Contents

1. KSA Games Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics (Growth Rate, Factors Influencing Demand, Seasonal Trends)

1.4. Market Segmentation Overview

2. KSA Games Market Size (In SAR Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Games Market Analysis

3.1. Growth Drivers

Increasing Digitalization (Internet Penetration, 5G Expansion)

E-sports Popularity

Youth Population Engagement

Government Initiatives (Vision 2030, Misk Gaming Initiatives)

3.2. Market Challenges

Cultural Sensitivities

Regulatory Hurdles

Competitive International Presence

3.3. Opportunities

Localization of Game Content

Partnership with Global Game Developers

Expansion into Virtual Reality (VR) and Augmented Reality (AR)

3.4. Trends

Growth in Mobile Gaming

Rise of Cloud Gaming Services

Influencer Marketing Impact

3.5. Government Policies and Regulation

Saudi Esports Federation Regulations

Content Approval Processes

Tax Incentives for Gaming Investments

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Game Developers, Publishers, Distributors)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA Games Market Segmentation

4.1. By Game Type (In Value % and Volume %)

Console Gaming

Mobile Gaming

PC Gaming

Virtual Reality (VR) Games

Augmented Reality (AR) Games

4.2. By Genre (In Value % and Volume %)

Action

Strategy

Role-Playing Games (RPG)

Simulation

Sports

4.3. By Device Type (In Value % and Volume %)

Smartphones

Gaming Consoles

PCs/Laptops

VR Headsets

4.4. By Distribution Channel (In Value % and Volume %)

Online Stores

App Stores

Offline Retail

4.5. By Region (In Value % and Volume %)

North

West

East

South

5. KSA Games Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

Activision Blizzard

Sony Interactive Entertainment

Tencent Games

Electronic Arts (EA)

Epic Games

Ubisoft

Nintendo

NetEase

Square Enix

Riot Games

Bandai Namco

Sega Sammy Holdings

Zynga

Gameloft

Al Baik Games Studios

5.2. Cross Comparison Parameters (Revenue, Market Share, Active Player Base, Digital Ad Spend, Localization Efforts, Number of Game Titles)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Games Market Regulatory Framework

6.1. Digital Content Regulations

6.2. Age Rating Standards

6.3. Data Privacy and Security Laws

6.4. Compliance Requirements for Foreign Publishers

6.5. Certification Processes

7. KSA Games Future Market Size (In SAR Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Games Future Market Segmentation

8.1. By Game Type (In Value % and Volume %)

8.2. By Genre (In Value % and Volume %)

8.3. By Device Type (In Value % and Volume %)

8.4. By Distribution Channel (In Value % and Volume %)

8.5. By Region (In Value % and Volume %)

9. KSA Games Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Key Marketing Strategies

9.3. White Space Opportunity Analysis

9.4. Audience Engagement Tactics

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We began by mapping the ecosystem of the KSA Games Market, identifying key stakeholders such as game developers, publishers, and distributors. Extensive desk research utilizing proprietary databases allowed us to define and quantify market drivers, trends, and potential challenges.

Step 2: Market Analysis and Construction

We collected and analyzed historical data, assessing market penetration and the distribution of gaming devices across key regions. This analysis included determining the popularity of various game types, enabling precise estimations of the market size and growth rate.

Step 3: Hypothesis Validation and Expert Consultation

Our research hypotheses were validated through interviews with industry experts, including representatives from local gaming studios, telecommunication companies, and esports organizers. These insights were essential in refining our market projections.

Step 4: Research Synthesis and Final Output

We conducted further consultations with hardware manufacturers and service providers to gather additional insights on consumer preferences, pricing strategies, and localization efforts. These discussions ensured a comprehensive and verified analysis of the KSA Games Market.

Frequently Asked Questions

01. How big is the KSA Games Market?

The KSA Games Market is valued at USD 510 million, supported by digital infrastructure development and a youth-driven demand for gaming experiences.

02. What are the growth drivers of the KSA Games Market?

Key drivers in the KSA Games Market include increased internet penetration, government initiatives supporting digital entertainment, and the expansion of 5G, which enhances gaming experiences.

03. Who are the major players in the KSA Games Market?

Prominent players in the KSA Games Market include Tencent Games, Activision Blizzard, Sony Interactive Entertainment, and local companies like Al Baik Game Studios.

04. What challenges does the KSA Games Market face?

Challenges in the KSA Games Market include content localization to meet cultural standards, regulatory requirements, and competition from international gaming platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.