KSA Gaming PC Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi Bisht

Product Code:KROD5931

December 2024

95

About the Report

KSA Gaming PC Market Overview

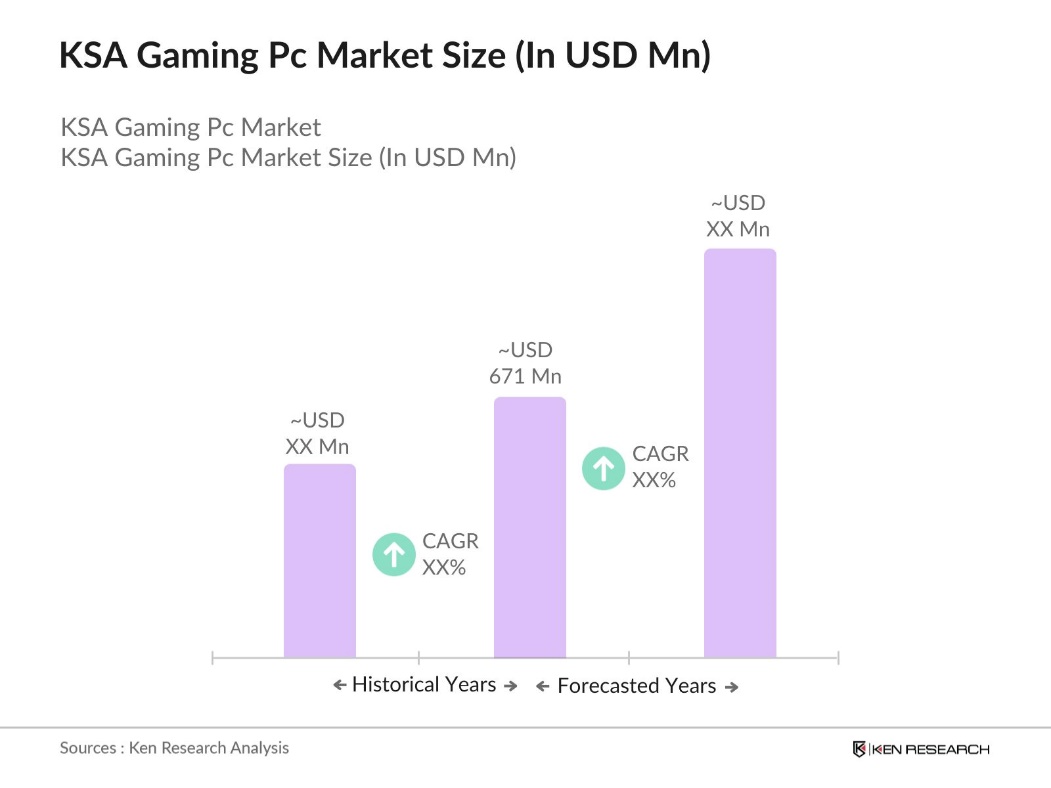

- The KSA Gaming PC market, valued at USD 671 million, has shown substantial growth driven by the surge in digital entertainment, particularly gaming, as a dominant form of leisure. This growth is bolstered by government initiatives promoting the digital economy and supporting the development of e-sports infrastructure. A combination of rising disposable income and technological advancements in high-performance gaming PCs has contributed to this markets expansion.

- Riyadh and Jeddah are the primary cities leading the KSA Gaming PC market, attributed to their higher concentrations of affluent consumers and access to premium retail channels. Riyadh, being the countrys business hub, has a significant customer base with high spending capabilities, which drives demand for advanced gaming setups. Jeddah follows closely, supported by a robust tech culture and increasing popularity of gaming among the younger population.

- The Saudi government offers tax incentives for technology startups, encouraging local innovation. The expected to apply to a small percentage of registered startups in India, with experts noting that less than 1% of the approximately 84,000 registered startups may benefit from these tax incentives. These incentives foster a thriving tech ecosystem, indirectly boosting demand for gaming PCs among new businesses and developers.

KSA Gaming Pc Market Segmentation

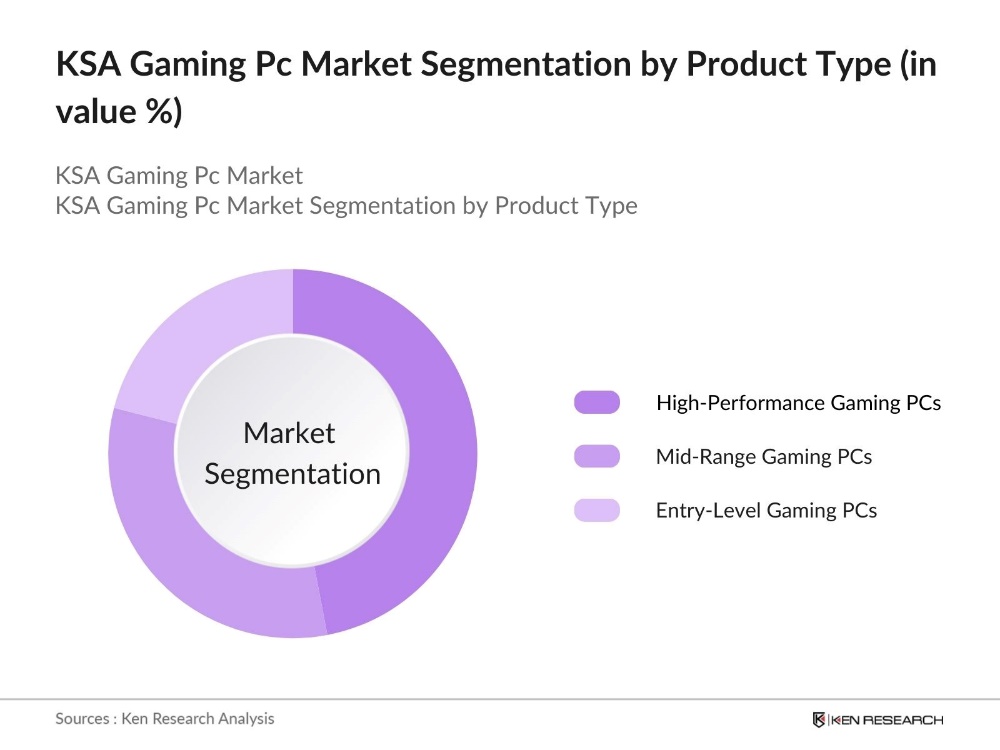

By Product Type: The market is segmented by product type into high-performance gaming PCs, mid-range gaming PCs, and entry-level gaming PCs. High-performance gaming PCs have captured the dominant market share within this segment, driven by the increasing popularity of e-sports and virtual reality gaming, which demand powerful hardware. Brands like Alienware and ROG by ASUS have capitalized on this demand by offering specialized, high-spec models that cater to professional and hardcore gamers. Their advanced graphics, superior processing power, and enhanced cooling systems make them the preferred choice among consumers seeking premium gaming experiences.

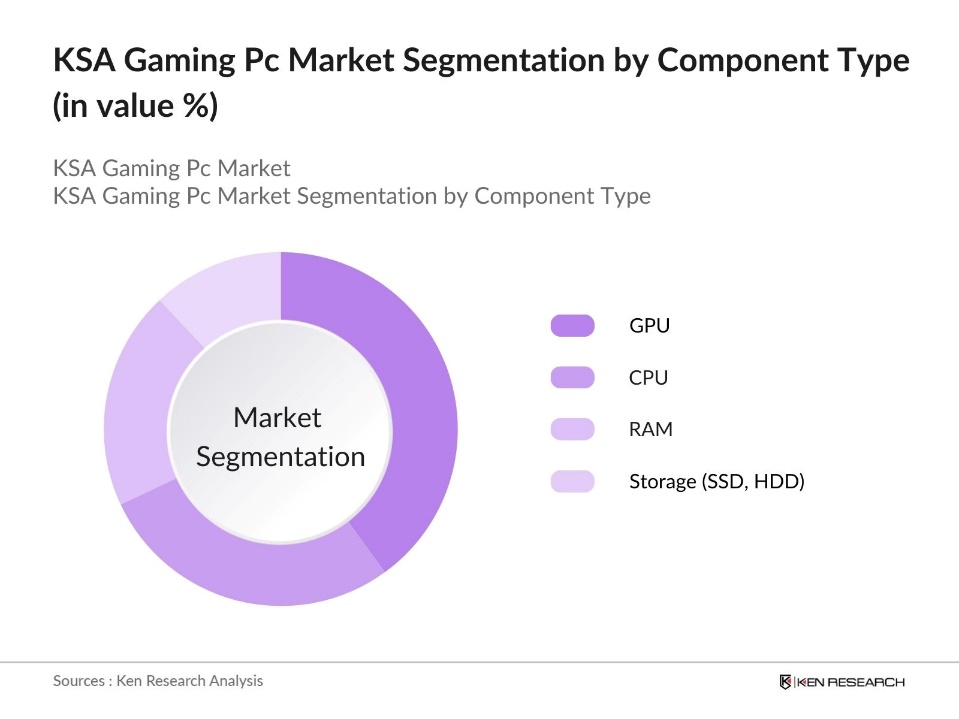

By Component Type: The market is segmented by component type, including CPU, GPU, RAM, and storage solutions (SSD, HDD). Within this segment, GPUs hold a dominant share due to their critical role in delivering high-quality graphics essential for gaming. The demand for GPUs has surged as gamers prioritize smoother and more realistic gameplay, which relies heavily on powerful graphics cards. Brands like NVIDIA and AMD lead the market in providing GPUs with top-tier performance that meets the requirements of modern, graphics-intensive games, solidifying their position in the gaming ecosystem.

KSA Gaming Pc Market Competitive Landscape

The KSA Gaming PC market is dominated by several key players, with both international and local companies establishing strong positions. This market consolidation underscores the significant influence of these companies, each competing on product innovation, brand loyalty, and customer service.

KSA Gaming Pc Industry Analysis

Growth Drivers

- Rise in Gaming Culture: Gaming has increasingly become a mainstream activity in KSA, driven by a youthful population and urbanization. Saudi Arabias General Authority for Statistics reports that 70% of its population is under 35, with a large segment identifying as active gamers. This shift has led to a notable increase in gaming PC demand, especially among younger demographics with strong purchasing power. The national eSports Federation supports tournaments like Gamers8, attracting over million visitors in 2023, highlighting the significant role of gaming culture in the Kingdom.

- Increased Disposable Income: The KSAs disposable income per capita was recorded at SAR 118,216 in 2023, a growth from the previous years due to economic diversification under Vision 2030. This increase has contributed to higher discretionary spending, facilitating the purchase of gaming PCs and accessories. The average household spending on entertainment has doubled in the last five years, with gaming being a prominent category. This economic trend is expected to sustain gaming PC demand.

- Technological Advancements in Gaming Hardware: Gaming hardware in KSA has rapidly advanced, with high-performance GPUs and CPUs now widely available. These components cater to consumer demand for smoother gameplay, faster load times, and enhanced graphics, aligning with local expectations for top-tier gaming experiences. This progression in technology fuels interest in high-performance gaming PCs, supporting the market's growth by meeting the needs of dedicated gamers seeking cutting-edge setups.

Market Challenges

- High Cost of High-Performance Gaming PCs: High-performance gaming PCs are often costly, making them less accessible to a broader audience, particularly students and young adults. This high expense stems from advanced components like GPUs and CPUs, which are subject to frequent pricing shifts due to fluctuating supply and demand. As a result, premium gaming setups remain a luxury, limiting widespread adoption in the market.

- Component Supply Chain Constraints: The gaming PC market in KSA faces supply chain issues, particularly in sourcing critical components like graphics cards. Ongoing global disruptions have led to delays in shipments, affecting product availability and price stability. These challenges hinder the timely release of new models cand impact the affordability and accessibility of high-performance gaming PCs for consumers.

KSA Gaming Pc Market Future Outlook

Over the next five years, the KSA Gaming PC market is expected to continue its upward trajectory, driven by the steady growth of e-sports, advancements in gaming technology, and the increasing popularity of streaming platforms. The ongoing expansion of digital infrastructure across the kingdom will further support this growth, making high-speed internet more accessible for online gaming. Moreover, government initiatives aimed at boosting the tech sector are likely to introduce more players into the market, enhancing competition and product availability for consumers.

Market Opportunities

- Expansion in Online Gaming and E-Sports: The eSports and online gaming sectors in Saudi Arabia are experiencing rapid growth, driven by a rising number of young, engaged gamers. This trend creates a robust demand for gaming PCs that can support high-speed internet and advanced processing power, catering to the needs of competitive online gaming and large-scale eSports tournaments that draw significant participation.

- Potential for Local Assembly and Customization: Local assembly of gaming PCs offers promising opportunities by reducing reliance on imports and allowing for tailored configurations. By establishing assembly facilities within the country, manufacturers can enhance market accessibility, offer customization options, and contribute to the Kingdoms broader localization initiatives, aligning with the goals of Vision 2030 to foster domestic production and innovation.

Scope of the Report

|

Product Type |

High-Performance Gaming PCs Mid-Range Gaming PCs Entry-Level Gaming PCs |

|

Component Type |

CPU GPU RAM Storage Solutions (SSD, HDD) |

|

Distribution Channel |

Online Retailers Offline Retailers Gaming Specialty Stores |

|

End-User |

Individual Gamers Professional E-Sports Players Gaming Cafs |

|

Region |

Riyadh Jeddah Dammam Makkah |

Products

Key Target Audience

Gaming Enthusiasts

Professional E-Sports Players

Gaming Caf Owners

High-Income Individuals

Tech Retailers

Component Suppliers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi General Authority for Competition)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

HP Inc.

Dell Technologies (Alienware)

ASUS

MSI

Acer (Predator Series)

Lenovo (Legion)

Razer Inc.

Origin PC

CyberPowerPC

iBUYPOWER

Table of Contents

1. KSA Gaming PC Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Metrics and Dynamics

1.4. Value Chain Analysis

1.5. Market Segmentation Overview

2. KSA Gaming PC Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Developments and Market Milestones

3. KSA Gaming PC Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Gaming Culture

3.1.2. Increased Disposable Income

3.1.3. Technological Advancements in Gaming Hardware

3.1.4. Government Support for E-Sports and Digital Media

3.2. Market Challenges

3.2.1. High Cost of High-Performance Gaming PCs

3.2.2. Component Supply Chain Constraints

3.2.3. Cybersecurity Concerns

3.3. Opportunities

3.3.1. Expansion in Online Gaming and E-Sports

3.3.2. Potential for Local Assembly and Customization

3.3.3. Increased Demand for VR-Compatible Systems

3.4. Trends

3.4.1. Rise in Demand for Gaming Accessories (e.g., headsets, controllers)

3.4.2. Subscription Gaming Services

3.4.3. Customization and Modding Trends

3.5. Government Regulation

3.5.1. Import Regulations for Electronics

3.5.2. E-Sports Initiatives and Sponsorships

3.5.3. Tax Incentives for Technology Startups

3.6. SWOT Analysis

3.7. Competitive Ecosystem and Market Mapping

3.8. Porters Five Forces Analysis

4. KSA Gaming PC Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. High-Performance Gaming PCs

4.1.2. Mid-Range Gaming PCs

4.1.3. Entry-Level Gaming PCs

4.2. By Component Type (In Value %)

4.2.1. CPU

4.2.2. GPU

4.2.3. RAM

4.2.4. Storage Solutions (SSD, HDD)

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retailers

4.3.2. Offline Retailers

4.3.3. Gaming Specialty Stores

4.4. By End-User (In Value %)

4.4.1. Individual Gamers

4.4.2. Professional E-Sports Players

4.4.3. Gaming Cafs

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Makkah

5. KSA Gaming PC Market Competitive Analysis

5.1. Profiles of Major Companies

5.1.1. HP Inc.

5.1.2. Dell Technologies (Alienware)

5.1.3. ASUS

5.1.4. MSI

5.1.5. Acer (Predator Series)

5.1.6. Lenovo (Legion)

5.1.7. Razer Inc.

5.1.8. Origin PC

5.1.9. CyberPowerPC

5.1.10. iBUYPOWER

5.1.11. Maingear

5.1.12. Corsair

5.1.13. Zotac

5.1.14. Skytech Gaming

5.1.15. Samsung Electronics (Gaming Monitors)

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Distribution Reach, Market Position, R&D Investment, Technology Partnerships, Customer Reviews, and Brand Perception)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Funding

6. KSA Gaming PC Market Regulatory Framework

6.1. Import Tariffs and Duties on Gaming PCs

6.2. Compliance and Certification Requirements

6.3. Data Protection Laws (Impact on Online Gaming)

6.4. Standards for Energy-Efficient Electronics

7. KSA Gaming PC Future Market Size (In USD Mn)

7.1. Projections for Future Market Size

7.2. Factors Influencing Future Market Growth

8. KSA Gaming PC Future Market Segmentation

8.1. By Product Type (Projected Value %)

8.2. By Component Type (Projected Value %)

8.3. By Distribution Channel (Projected Value %)

8.4. By End-User (Projected Value %)

8.5. By Region (Projected Value %)

9. KSA Gaming PC Market Analysts Recommendations

9.1. Market Entry and Expansion Strategies

9.2. Customer Segment Prioritization

9.3. Innovation and R&D Initiatives

9.4. Identification of White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involved creating a comprehensive overview of the KSA Gaming PC market ecosystem. Through secondary research and proprietary databases, major variables such as market drivers, product preferences, and consumer demographics were identified to outline market dynamics accurately.

Step 2: Market Analysis and Construction

In this phase, historical data for the KSA Gaming PC market was collected and analyzed to estimate market trends and key growth factors. This also involved assessing various distribution channels, revenue generation from gaming products, and user engagement statistics to confirm data reliability.

Step 3: Hypothesis Validation and Expert Consultation

Based on initial findings, a set of market hypotheses was developed and validated through in-depth interviews with industry professionals, including representatives from leading gaming PC brands and component manufacturers. These insights contributed to refining our market estimates and verifying industry insights.

Step 4: Research Synthesis and Final Output

The final stage incorporated direct inputs from multiple stakeholders, including gaming PC manufacturers and retail distributors, to confirm the segmentation and growth trends. This validated data was then used to compile a comprehensive analysis, ensuring accurate and insightful market representation for KSA Gaming PCs.

Frequently Asked Questions

01 How big is the KSA Gaming PC Market?

The KSA Gaming PC market was valued at USD 671 million, driven by a growing interest in gaming and supportive digital infrastructure in the country.

02 What are the challenges in the KSA Gaming P C Market?

Major challenges in KSA Gaming PC market include the high costs associated with high-performance gaming setups, limited local assembly options, and supply chain issues impacting component availability.

03 Who are the major players in the KSA Gaming PC Market?

Key players in KSA Gaming PC market include HP Inc., Dell Technologies, ASUS, MSI, and Acer, known for their advanced gaming hardware, diverse product lines, and strong market presence.

04 What factors are driving growth in the KSA Gaming PC Market?

The KSA Gaming PC market is primarily driven by the increasing popularity of e-sports, advancements in gaming technology, and government initiatives promoting digital entertainment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.