KSA Gas Sensors Market Outlook to 2030

Region:Middle East

Author(s):Abhinav

Product Code:KROD5786

November 2024

90

About the Report

KSA Gas Sensors Market Overview

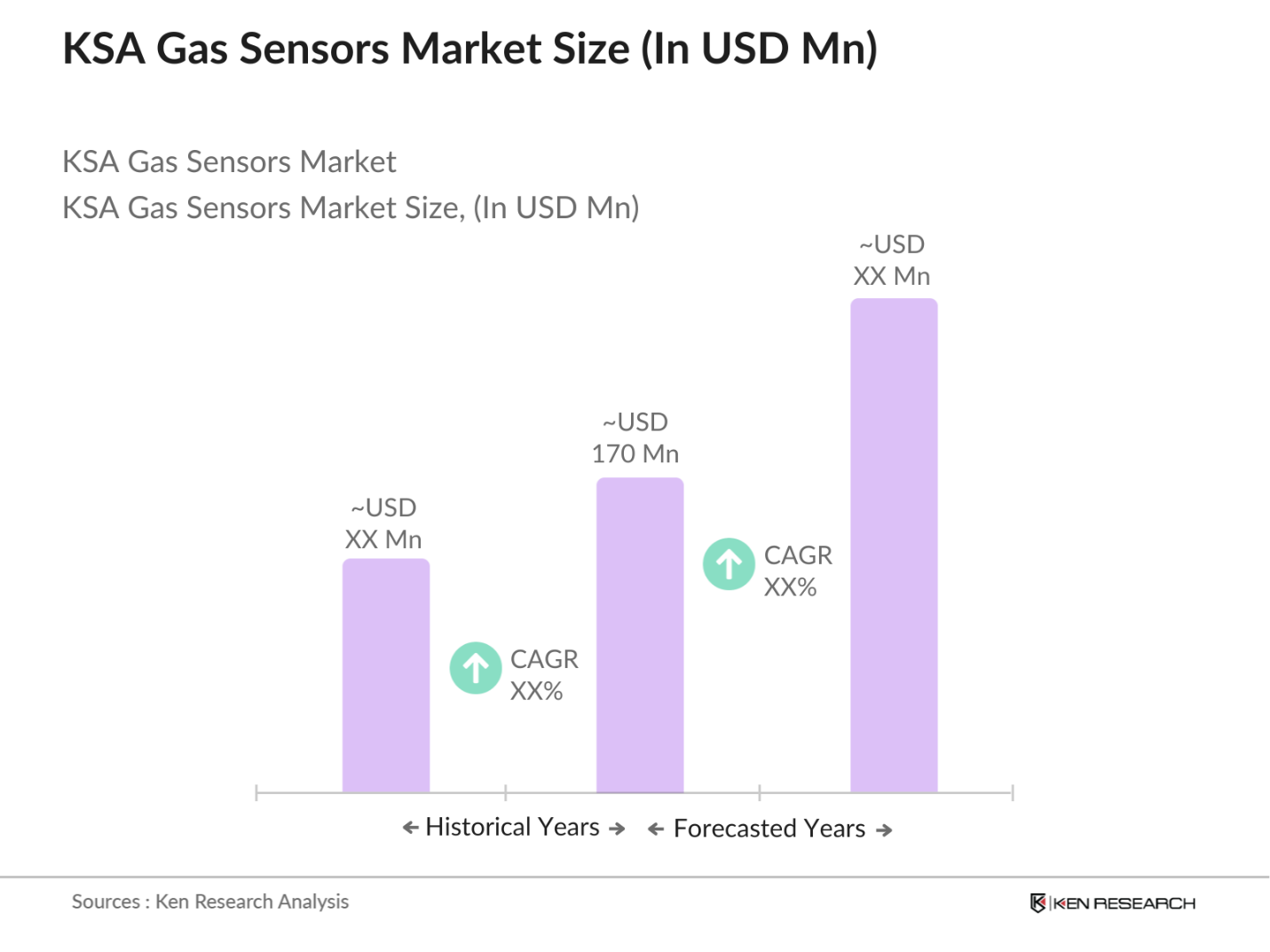

- The Kingdom of Saudi Arabia (KSA) gas sensors market is valued at approximately USD 170 million, based on a five-year historical analysis. The market is driven primarily by the expansion of the oil and gas industry, a significant contributor to the Saudi economy. With heightened environmental concerns and the need for continuous monitoring of gas emissions in petrochemical and refining industries, there has been a substantial increase in demand for high-precision gas sensors across the region.

- Riyadh and the Eastern Province, including Dammam and Jubail, dominate the KSA gas sensors market due to their industrial infrastructure. The presence of large oil refineries, petrochemical complexes, and industrial zones in these cities makes them hubs for gas sensors deployment. Riyadh's rapid urbanization and adoption of smart city initiatives also contribute to its dominance, while the Eastern Province's prominence in the oil and gas sector makes it a key region for gas sensor applications.

- KSA has implemented rigorous environmental and industrial safety standards that influence the gas sensors market. The country established the General Authority for Meteorology and Environmental Protection (GAMEP), which oversees compliance with air quality standards. In 2022, over 100 new regulations were introduced to enhance industrial safety, requiring the installation of gas detection systems in high-risk facilities. This regulatory framework underscores the necessity for advanced gas sensors to ensure adherence to safety protocols and environmental sustainability.

KSA Gas Sensors Market Segmentation

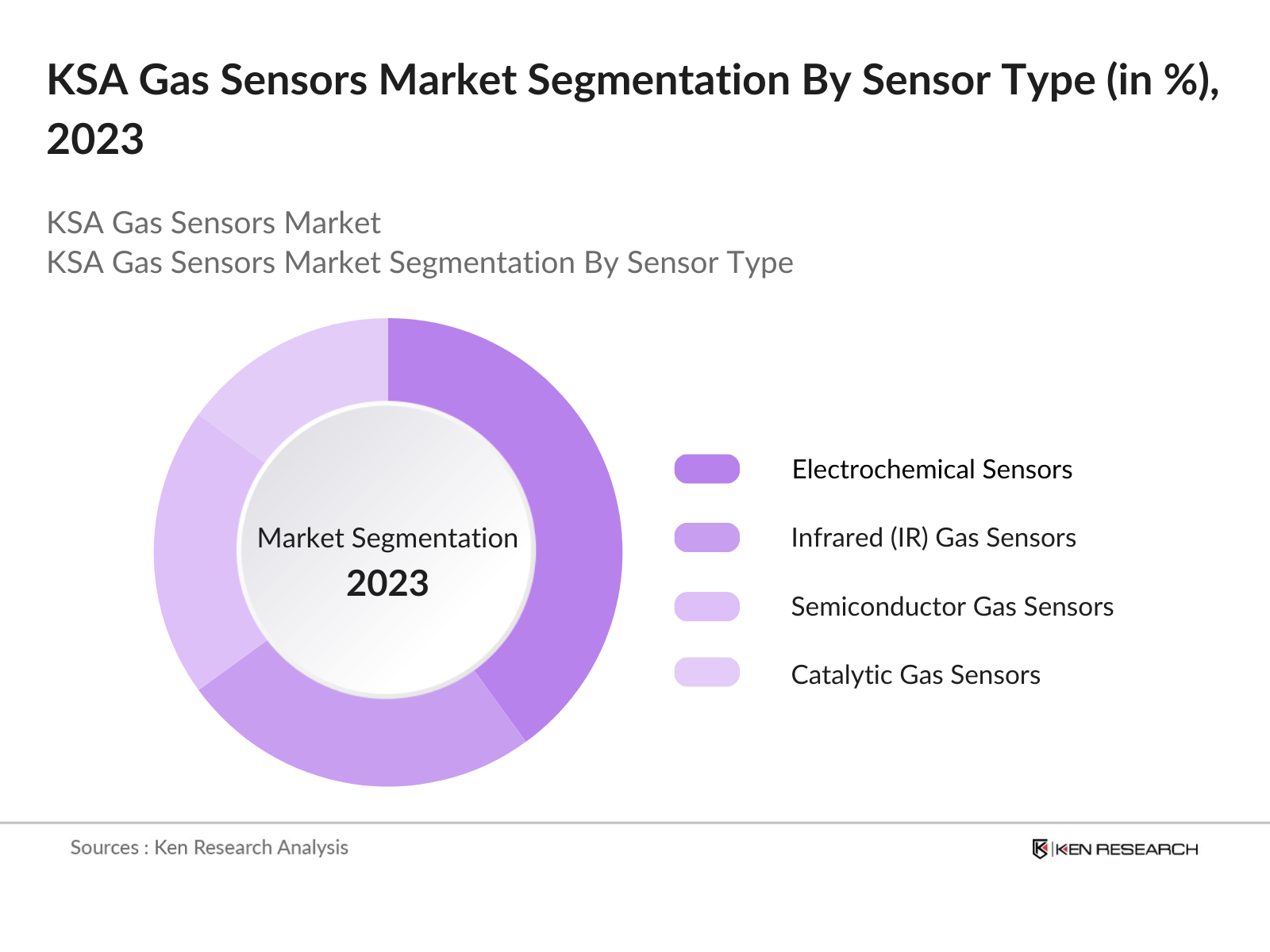

By Sensor Type: The KSA gas sensors market is segmented by sensor type into electrochemical sensors, infrared (IR) gas sensors, semiconductor gas sensors, catalytic gas sensors, and photoionization detectors (PID). Electrochemical sensors hold the dominant market share due to their widespread use in industrial safety and emission monitoring. These sensors are highly sensitive to gases such as carbon monoxide (CO) and nitrogen dioxide (NO), making them essential in oil refineries and petrochemical plants. Furthermore, their cost-effectiveness and reliability contribute to their strong position in the market.

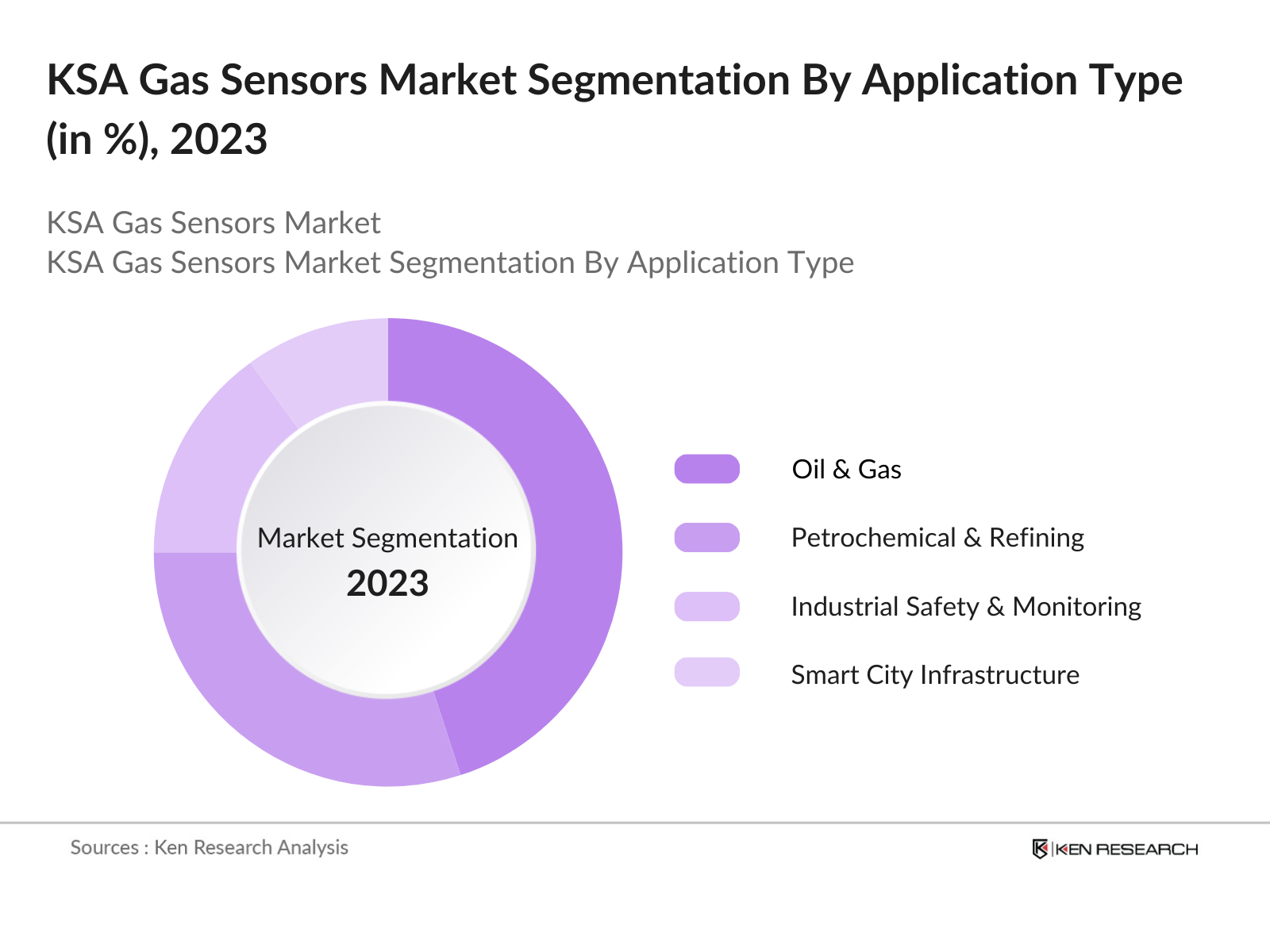

By Application: The market is segmented by application into oil & gas, petrochemical & refining, industrial safety & monitoring, smart city infrastructure, and automotive. The oil & gas segment dominates the market, driven by the high concentration of gas production and processing facilities in the region. Gas sensors are indispensable in detecting hazardous gases and ensuring compliance with stringent safety regulations in this sector. The demand for reliable and precise monitoring systems in the petrochemical industry also contributes to the segment's dominance.

KSA Gas Sensors Market Competitive Landscape

The KSA gas sensors market is characterized by the presence of both global and regional players. Major international companies have established a strong foothold in the region due to their advanced technological offerings and comprehensive product portfolios. Local manufacturers, while fewer in number, are increasingly entering the market to cater to region-specific needs. The market is dominated by key players such as Honeywell International Inc. and Siemens AG, both of which have extensive experience in producing high-quality gas sensors for industrial applications. Their strong distribution networks and longstanding relationships with local industries contribute to their dominance. New entrants face significant challenges in competing with these established players, particularly in terms of technological expertise and brand recognition.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Mn) |

Product Portfolio |

Regional Presence |

R&D Investments |

Technology Focus |

|

Honeywell International Inc. |

1906 |

Charlotte, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Siemens AG |

1847 |

Munich, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

|

Amphenol Advanced Sensors |

1932 |

Wallingford, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Figaro Engineering Inc. |

1968 |

Osaka, Japan |

_ |

_ |

_ |

_ |

_ |

_ |

|

AlphaSense Inc. |

1996 |

Essex, UK |

_ |

_ |

_ |

_ |

_ |

_ |

KSA Gas Sensors Industry Analysis

Growth Drivers

- Industrial Growth: The Kingdom of Saudi Arabia (KSA) continues to experience significant industrial growth, particularly in the petrochemical and oil and gas sectors. In 2022, the manufacturing sector contributed approximately 12.5% to the nations GDP, amounting to around $55 billion. With the government's Vision 2030 plan promoting diversification, investments in petrochemical projects are expected to exceed $40 billion by 2025. Additionally, KSA's oil production reached an average of 10.4 million barrels per day in 2022, driving demand for gas sensors that monitor emissions and ensure safety in these industries.

- Rising Air Quality Concerns: Air quality has become a significant concern in KSA, particularly due to rapid urbanization and industrial activity. The country has experienced a rise in particulate matter (PM10) levels, with cities like Riyadh recording annual averages of 73 g/m in 2022, well above the World Health Organizations recommended levels of 50 g/m. This has prompted the government to implement stricter air quality monitoring regulations. Occupational safety regulations have also tightened, with a reported increase in workplace inspections, reaching over 100,000 inspections in 2022, emphasizing the need for reliable gas sensors in workplaces.

- Government Regulations: The Saudi government has established stringent environmental regulations to support its Vision 2030 initiative. The National Environmental Strategy, launched in 2021, aims to reduce greenhouse gas emissions by 278 million tons by 2030. Additionally, regulations requiring industries to adopt monitoring technologies have been enforced, with over 200 facilities mandated to report emissions data by 2025. These initiatives create a conducive environment for the gas sensors market, driving demand for advanced detection technologies that can comply with these regulatory frameworks.

Market Challenges

- Cost Sensitivity: Cost sensitivity remains a significant challenge in the KSA gas sensors market, primarily due to high initial installation costs and ongoing calibration and maintenance expenses. In 2022, the average cost of installing a gas detection system in industrial facilities ranged from $5,000 to $20,000, depending on the technology. Moreover, annual calibration and maintenance can add an additional 20% to 30% of the initial installation cost. This price sensitivity can deter smaller enterprises from adopting necessary safety measures, thereby slowing market growth.

- Technological Limitations: Technological limitations, such as sensor accuracy and detection range, pose significant challenges for the gas sensors market in KSA. Current electrochemical sensors typically have a detection range of 0-500 ppm, which may not be sufficient for all industrial applications. Reports indicate that inaccuracies in sensor readings can lead to unsafe conditions, with up to 25% of gas sensors in industrial settings failing to meet necessary detection thresholds. These limitations hinder the market's ability to provide reliable solutions for safety and compliance, leading to potential hazards. International Journal of Environmental Research and Public Health

KSA Gas Sensors Market Future Outlook

Over the next five years, the KSA gas sensors market is expected to experience steady growth driven by the continued development of the oil and gas sector, increased environmental regulation, and the expansion of smart city projects. The government's commitment to reducing emissions and improving industrial safety under its Vision 2030 initiative will create significant demand for advanced gas sensor technologies. Furthermore, advancements in wireless sensor technology and IoT integration are expected to improve the accuracy and efficiency of gas monitoring systems, thereby enhancing their adoption in various sectors. Technological advancements in the miniaturization of gas sensors, coupled with increased R&D investments by global players, will play a key role in shaping the market's future. Additionally, the adoption of gas sensors in the automotive and healthcare sectors presents new growth opportunities for market players.

Opportunities

- Technological Advancements: The KSA gas sensors market is poised for growth due to ongoing technological advancements such as nano sensors and wireless integration. Nano sensors, which provide higher sensitivity and faster response times, are gaining traction; for instance, the production of nano sensors is projected to reach over 2 million units by 2025. Moreover, the integration of wireless technologies facilitates remote monitoring capabilities, with smart device connections in the industrial sector expected to exceed 20 million by 2025. These advancements can enhance the accuracy and reliability of gas detection systems, driving further adoption across various sectors.

- Expansion in New Sectors: New sectors such as healthcare, automotive, and smart homes present significant opportunities for gas sensor adoption in KSA. The healthcare sector, projected to grow by 9% annually, requires gas sensors for monitoring gases in surgical and diagnostic applications. In automotive, with KSA's automotive industry valued at $7 billion in 2022, the integration of gas sensors for emissions monitoring and safety systems is crucial. Smart home technologies are also on the rise, with an estimated 1.5 million smart homes expected by 2025, further propelling the demand for gas detection solutions.

Scope of the Report

|

Sensor Type |

Electrochemical Sensors Infrared (IR) Semiconductor Catalytic PID |

|

Technology |

Wired Sensors Wireless Sensors MEMS-based Optical |

|

Application |

Oil & Gas, Petrochemical Industrial Safety Smart Cities Automotive |

|

Gas Type |

Oxygen (O) Carbon Monoxide (CO) Nitrogen Dioxide (NO) Sulfur Dioxide (SO) VOCs |

|

Region |

Riyadh Jeddah Eastern Provinc Makkah Tabuk |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Oil & Gas Companies

Petrochemical Refinery Industries

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization, Ministry of Energy)

Environmental Monitoring Industries

Industrial Safety Departments

Automotive Manufacturing Industries

Smart City Infrastructure Development Industries

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Honeywell International Inc.

Siemens AG

Amphenol Advanced Sensors

Figaro Engineering Inc.

AlphaSense Inc.

MSA Safety Inc.

City Technology Ltd. (Honeywell)

Dynament Ltd.

Aeroqual Ltd.

SGX Sensortech Ltd.

Table of Contents

1. KSA Gas Sensors Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Gas Sensors Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Gas Sensors Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Growth

3.1.2. Rising Air Quality Concerns

3.1.3. Government Regulations

3.1.4. Increased Adoption in Smart Cities

3.2. Market Challenges

3.2.1. Cost Sensitivity

3.2.2. Technological Limitations

3.2.3. Dependency on Imports

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Expansion in New Sectors

3.3.3. Public-Private Partnerships

3.4. Trends

3.4.1. Integration with IoT

3.4.2. Miniaturization of Sensors

3.4.3. Advanced Analytics for Predictive Maintenance

3.5. Government Regulation

3.5.1. Environmental and Industrial Safety Standards

3.5.2. National Industrial Development Program (NIDP)

3.5.3. Public-Private Partnerships (PPP) Initiatives

3.5.4. Emission Reduction Targets under Vision 2030

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA Gas Sensors Market Segmentation

4.1. By Sensor Type (In Value %)

4.1.1. Electrochemical Sensors

4.1.2. Infrared (IR) Gas Sensors

4.1.3. Semiconductor Gas Sensors

4.1.4. Catalytic Gas Sensors

4.1.5. Photoionization Detectors (PID)

4.2. By Technology (In Value %)

4.2.1. Wired Sensors

4.2.2. Wireless Sensors

4.2.3. MEMS-based Sensors

4.2.4. Optical Sensors

4.3. By Application (In Value %)

4.3.1. Oil & Gas

4.3.2. Petrochemical & Refining

4.3.3. Industrial Safety & Monitoring

4.3.4. Smart City Infrastructure

4.3.5. Automotive

4.4. By Gas Type (In Value %)

4.4.1. Oxygen (O) Sensors

4.4.2. Carbon Monoxide (CO) Sensors

4.4.3. Nitrogen Dioxide (NO) Sensors

4.4.4. Sulfur Dioxide (SO) Sensors

4.4.5. Volatile Organic Compounds (VOC)

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province (Dammam, Jubail)

4.5.4. Makkah

4.5.5. Tabuk

5. KSA Gas Sensors Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Honeywell International Inc.

5.1.2. Siemens AG

5.1.3. Amphenol Advanced Sensors

5.1.4. Figaro Engineering Inc.

5.1.5. SGX Sensortech Ltd.

5.1.6. Ametek Inc.

5.1.7. AlphaSense Inc.

5.1.8. Membrapor AG

5.1.9. SenseAir AB

5.1.10. Dynament Ltd.

5.2 Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2 Headquarters

5.2.3 Revenue (In USD)

5.2.4 Market Share (In %)

5.2.5 R&D Investments (In % of Revenue)

5.2.6 Product Portfolio Breadth

5.2.7 Regional Presence

5.2.8 Technological Capabilities

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. KSA Gas Sensors Market Regulatory Framework

6.1 Industry Standards Compliance

6.2 Certification Requirements (ISO, ATEX, etc.)

6.3 Environmental Regulations

6.4 Health & Safety Regulations

7. KSA Gas Sensors Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Gas Sensors Future Market Segmentation

8.1 By Sensor Type (In Value %)

8.2 By Technology (In Value %)

8.3 By Application (In Value %)

8.4 By Gas Type (In Value %)

8.5 By Region (In Value %)

9. KSA Gas Sensors Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step in our research process involved mapping the entire KSA gas sensors ecosystem, identifying key market players and stakeholders. Extensive desk research was carried out using proprietary databases to define the critical variables that influence market growth.

Step 2: Market Analysis and Construction

Historical data on the KSA gas sensors market was compiled to analyze market trends, sensor penetration across different industries, and their respective revenue contributions. We also examined key industry developments to ensure a robust market forecast.

Step 3: Hypothesis Validation and Expert Consultation

We validated our market hypotheses through detailed consultations with industry experts, including manufacturers, distributors, and government representatives. These consultations provided us with essential insights into market dynamics and operational challenges.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the collected data and expert insights into a comprehensive report, ensuring accuracy and validation through cross-verification with industry standards. The report presents a well-rounded analysis of the KSA gas sensors market.

Frequently Asked Questions

How big is the KSA Gas Sensors Market?

The KSA gas sensors market is valued at approximately USD 170 million, driven by the oil and gas industry's significant demand for advanced gas monitoring systems and stringent environmental regulations.

What are the challenges in the KSA Gas Sensors Market?

Challenges include high initial costs for sensor installations, maintenance issues due to harsh environmental conditions, and a dependency on imported technology, which affects the cost-efficiency of local industries.

Who are the major players in the KSA Gas Sensors Market?

Key players include Honeywell International Inc., Siemens AG, Amphenol Advanced Sensors, Figaro Engineering Inc., and AlphaSense Inc., who lead the market due to their technological expertise and extensive distribution networks.

What are the growth drivers of the KSA Gas Sensors Market?

Growth drivers include increasing demand from the oil & gas and petrochemical sectors, stricter environmental regulations under Vision 2030, and the adoption of gas sensors in smart city initiatives for enhanced air quality monitoring.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.