KSA Herbal Medicine Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD7698

November 2024

80

About the Report

KSA Herbal Medicine Market Overview

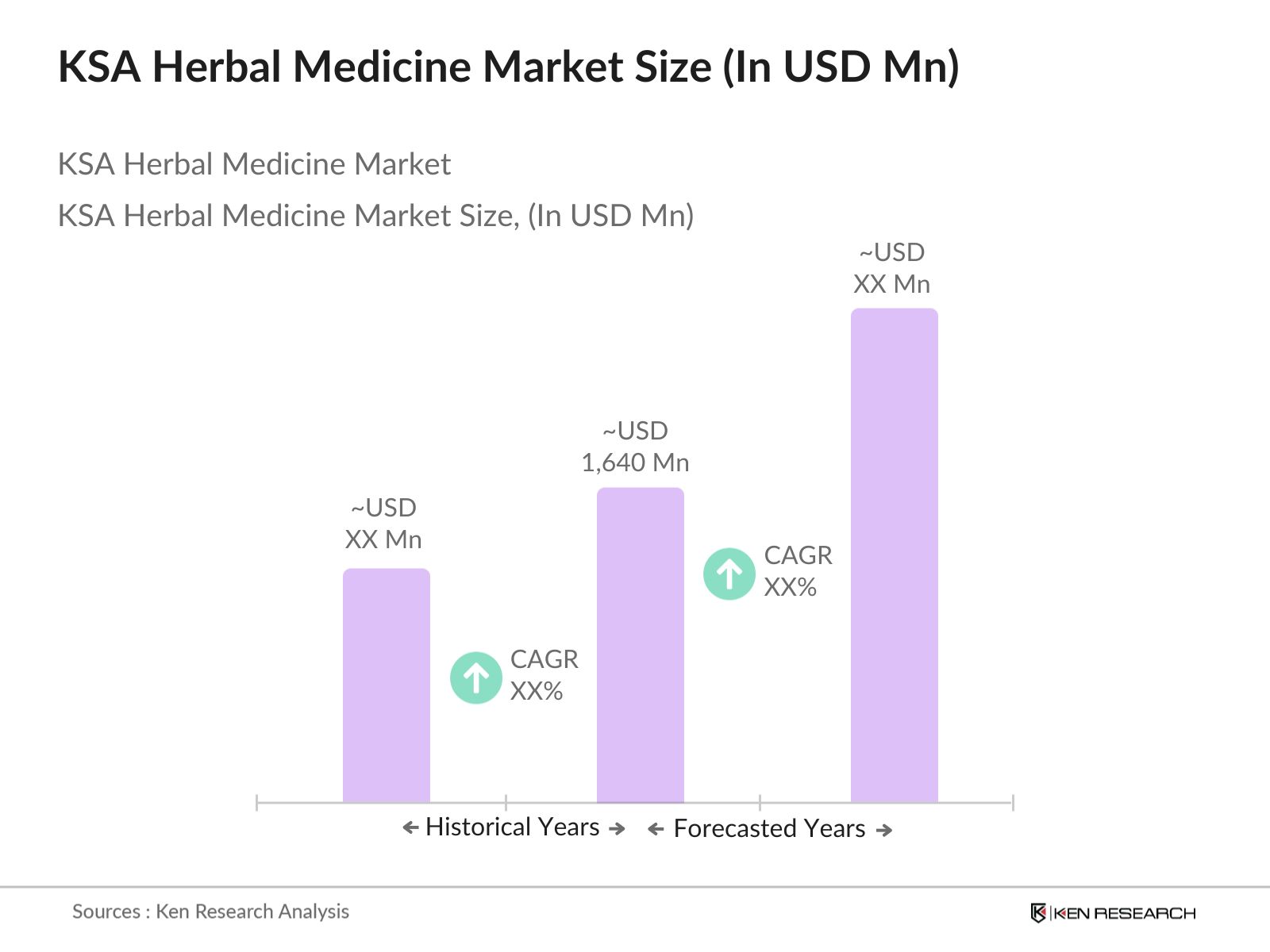

- The KSA Herbal Medicine Market is valued at USD 1,640 million based on a five-year historical analysis. This market is driven by several key factors, including the rising preference for natural and alternative remedies, largely driven by public awareness of the side effects of synthetic medications. Moreover, the Saudi governments Vision 2030 initiatives supporting traditional medicine have fueled the growth, along with the increasing demand for herbal products in treating chronic ailments like diabetes and hypertension.

- Dominant cities in the KSA Herbal Medicine Market include Riyadh, Jeddah, and Dammam, with their dominance attributed to their large, affluent populations and established healthcare infrastructures. These cities have strong demand for herbal medicine due to increased health consciousness among their populations, easy access to herbal products, and a growing number of herbal clinics and stores catering to these preferences.

- The SFDA has implemented stringent guidelines to regulate the herbal medicine market in Saudi Arabia. As of 2023, the SFDA requires herbal products to undergo rigorous safety and efficacy testing before they can be marketed. Only 60% of submitted products received approval in 2023, reflecting the high standards in place. These regulations ensure that consumers have access to safe and effective herbal remedies while promoting market transparency.

KSA Herbal Medicine Market Segmentation

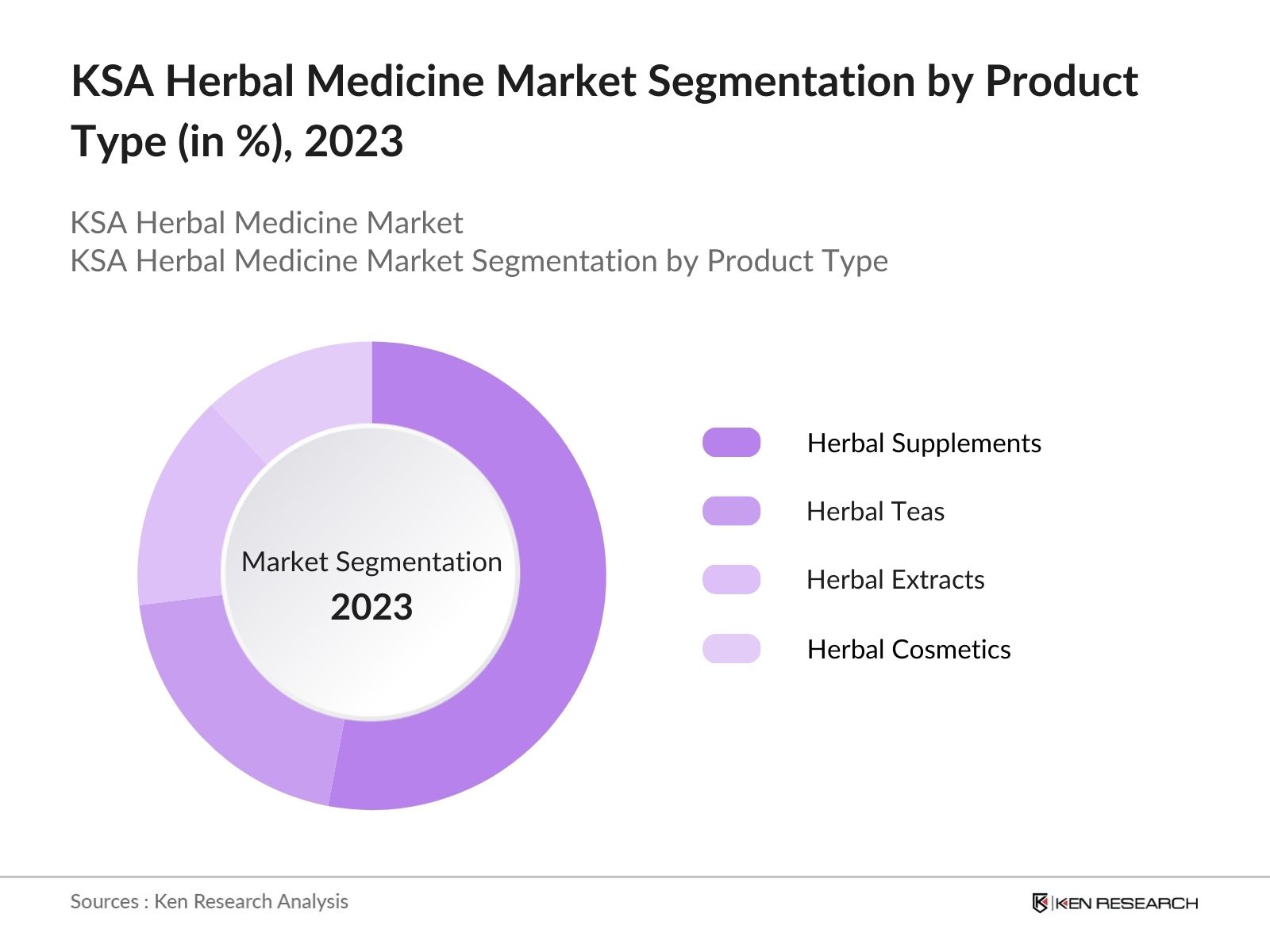

By Product Type: The KSA Herbal Medicine market is segmented by product type into herbal supplements, herbal teas, herbal extracts, herbal cosmetics, and herbal oils. Recently, herbal supplements have a dominant market share in KSA under the product type segmentation, driven by their broad acceptance as dietary aids and the increasing focus on preventive healthcare.

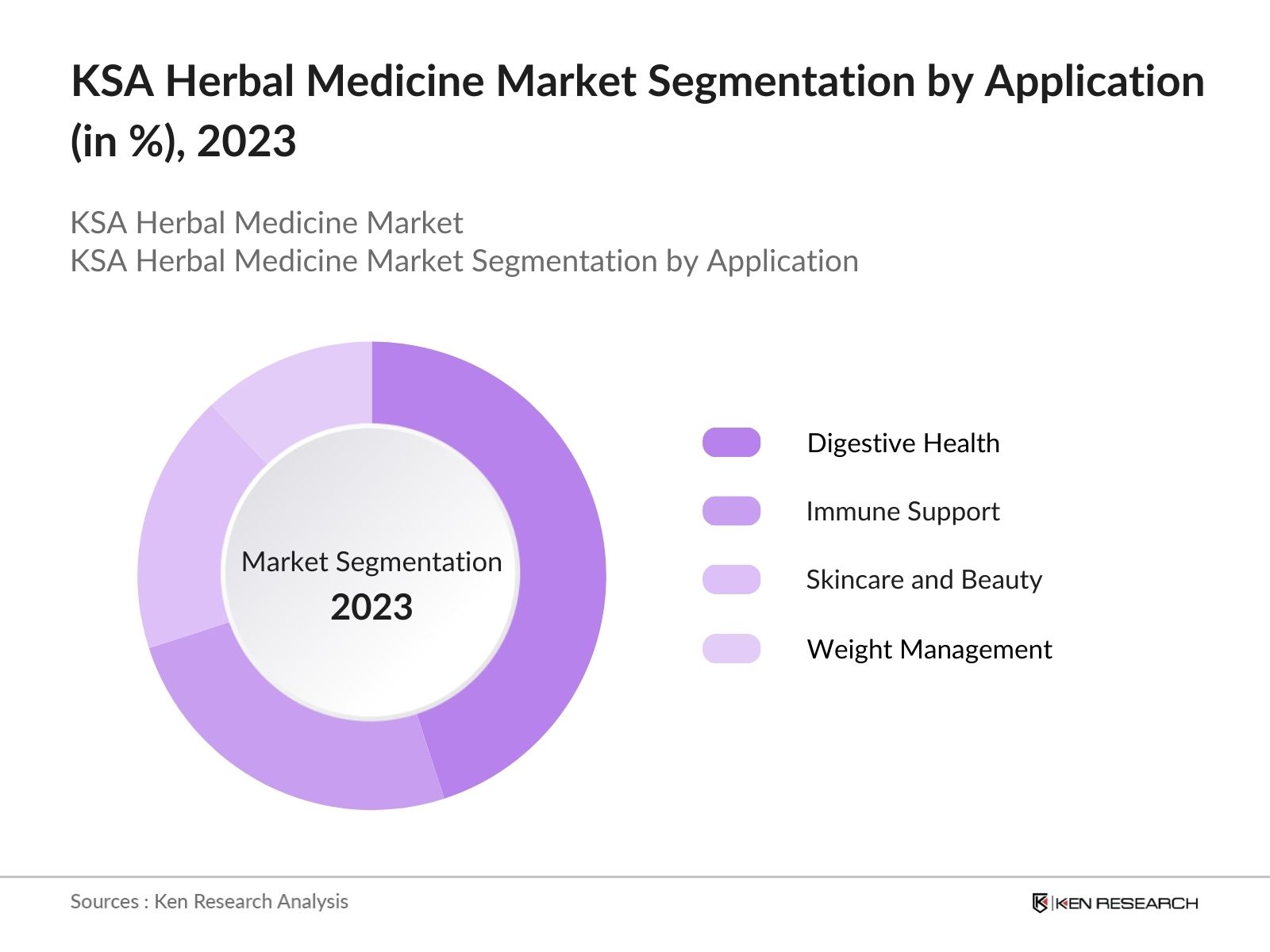

By Application: The market is further segmented by application into digestive health, immune support, skincare and beauty, weight management, and stress relief. Digestive health products hold a dominant market share under this segmentation. This is due to the high prevalence of gastrointestinal issues in Saudi Arabia, with herbal remedies seen as a safer, more natural alternative to pharmaceutical solutions.

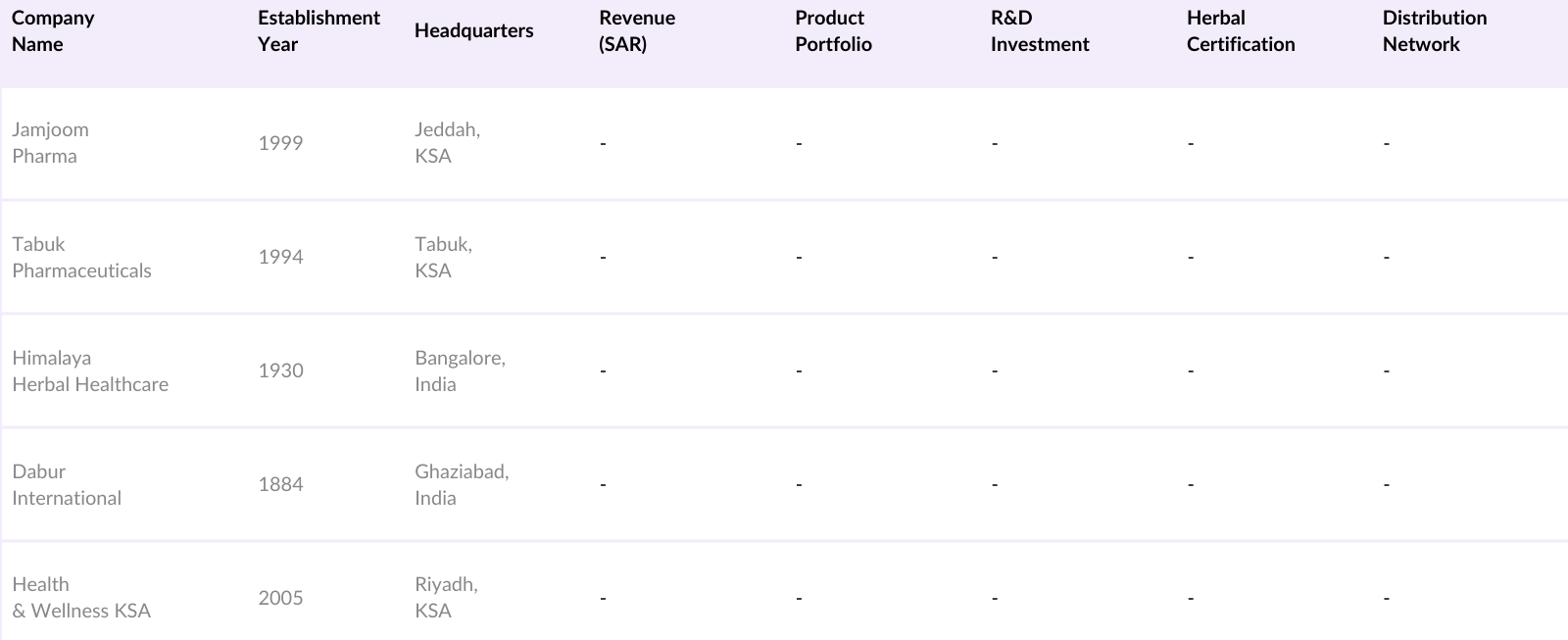

KSA Herbal Medicine Market Competitive Landscape

The KSA Herbal Medicine Market is dominated by a few major players, both local and international. Local manufacturers, such as Jamjoom Pharma and Tabuk Pharmaceuticals, maintain a strong foothold due to their deep understanding of consumer preferences and regulatory frameworks. Meanwhile, international brands like Himalaya Herbal Healthcare and Dabur International have successfully penetrated the market with their global product lines and extensive R&D efforts.

KSA Herbal Medicine Industry Analysis

Growth Drivers

- Increasing Preference for Natural Remedies: In 2024, Saudi Arabias shift toward natural remedies reflects a global trend emphasizing holistic health. The World Health Organization (WHO) estimates that 80% of the global population uses herbal medicine in some capacity. In Saudi Arabia, with a population of approximately 36 million, a significant portion of the population has started to prioritize plant-based therapies over conventional medicines. Rising awareness of natural treatments is supported by cultural practices deeply rooted in herbal remedies such as black seed, fenugreek, and licorice, used for centuries in the region.

- Rising Awareness of Health Benefits: As of 2024, the rising awareness of herbal medicines' health benefits, particularly for chronic diseases like diabetes, is gaining momentum. Saudi Arabia has a high diabetes prevalence, with over 4.2 million cases in 2023, making natural remedies such as cinnamon and fenugreek increasingly popular for managing blood sugar levels. The Saudi Ministry of Health has been conducting campaigns to educate the public on the health benefits of natural remedies, driving growth in the sector.

- Influence of Islamic Traditions on Herbal Use: Islamic traditions heavily influence Saudi Arabian culture, which significantly impacts the use of herbal medicines. Herbs like black seed, mentioned in Islamic texts, are integral to the country's cultural and religious practices. The market for black seed-based products, in particular, saw substantial growth in 2023, with millions of people turning to this herb for its purported health benefits. This cultural alignment drives demand for herbal products, as they resonate with local values and religious beliefs.

Market Challenges

- Regulatory Constraints: The herbal medicine market in Saudi Arabia faces stringent regulations from the SFDA, aimed at ensuring product safety and efficacy. In 2023, only 40% of herbal product submissions were approved for market entry, reflecting the challenges companies face in meeting regulatory standards. The strict requirements include rigorous testing and compliance with safety guidelines, which can be a significant barrier for local and international companies.

- Lack of Standardization in Product Quality: Despite the popularity of herbal medicine, a lack of standardization in product quality remains a challenge. The SFDA reported in 2022 that around 30% of herbal products failed to meet the required quality standards. This variability in product efficacy and purity makes consumers wary, affecting overall market trust. The government is working to address this by introducing stricter regulations and better testing protocols to ensure consistency and safety in herbal products.

KSA Herbal Medicine Market Future Outlook

Over the next five years, the KSA Herbal Medicine Market is expected to experience significant growth, driven by increased consumer interest in natural health solutions and ongoing support from government programs such as Vision 2030. Advancements in herbal product research, coupled with increased investments in distribution networks, are likely to boost market expansion.

Market Opportunities

- Expansion into Retail and E-Commerce Channels: Retail and e-commerce offer significant growth opportunities for the herbal medicine market in Saudi Arabia. In 2024, e-commerce in Saudi Arabia is expected to generate over $12 billion, with health products being one of the fastest-growing segments. As consumers increasingly turn to online platforms for health-related products, herbal medicine brands have the opportunity to expand their reach.

- Investment in R&D for New Herbal Products: Investment in research and development is crucial for the herbal medicine markets future growth. In 2023, Saudi Arabia invested $75 million in healthcare-related R&D, with a focus on traditional medicine. Companies that prioritize the development of new herbal products, backed by scientific research, are expected to benefit from increased consumer trust and regulatory approval. R&D initiatives in collaboration with local universities are also being promoted by the government to foster innovation in this sector.

Scope of the Report

|

Product Type |

Herbal Supplements Herbal Teas Herbal Extracts Herbal Cosmetics Herbal Oils |

|

Application |

Digestive Health Immune Support Skincare and Beauty Weight Management Stress Relief |

|

Form |

Capsules Tablets Liquids Powders Ointments |

|

Distribution Channel |

Pharmacies Health Stores Online Retail Supermarkets and Hypermarkets Specialty Stores |

|

Region |

Riyadh Jeddah Dammam Makkah Medina |

Products

Key Target Audience

Pharmaceutical Companies

Herbal Product Manufacturers

Retailers and Distributors

Healthcare Providers

Government and Regulatory Bodies (SFDA, Ministry of Health)

Investment and Venture Capital Firms

Organic Certification Agencies

Traditional Medicine Practitioners

Companies

Players Mentioned in the Report

Jamjoom Pharma

Tabuk Pharmaceuticals

Herbawi Pharmaceuticals

Nahdi Medical Co.

Saudi Modern Food Factory

Alpha Pharma

Health & Wellness KSA

KSA Herbal Trading Co.

Herbal Kingdom Trading Co.

Global Pharma KSA

Table of Contents

1. KSA Herbal Medicine Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Herbal Medicine Market Size (in SAR Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Herbal Medicine Market Dynamics

3.1. Growth Drivers

3.1.1. Increasing Preference for Natural Remedies

3.1.2. Government Initiatives Supporting Herbal Medicine

3.1.3. Rising Awareness of Health Benefits

3.1.4. Influence of Islamic Traditions on Herbal Use

3.2. Market Challenges

3.2.1. Regulatory Constraints

3.2.2. Lack of Standardization in Product Quality

3.2.3. Competition from Conventional Pharmaceuticals

3.3. Opportunities

3.3.1. Expansion into Retail and E-Commerce Channels

3.3.2. Investment in R&D for New Herbal Products

3.3.3. Rising Demand for Organic and Certified Products

3.4. Trends

3.4.1. Increased Use of Traditional Arab Remedies

3.4.2. Growing Popularity of Herbal Teas and Supplements

3.4.3. Cross-Sector Collaborations with Cosmetics and Food

3.5. Regulatory Environment

3.5.1. Saudi Food and Drug Authority (SFDA) Guidelines

3.5.2. Import Regulations on Herbal Ingredients

3.5.3. Labelling and Certification Requirements for Herbal Products

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competitive Landscape

4. KSA Herbal Medicine Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Herbal Supplements

4.1.2. Herbal Teas

4.1.3. Herbal Extracts

4.1.4. Herbal Cosmetics

4.1.5. Herbal Oils

4.2. By Application (in Value %)

4.2.1. Digestive Health

4.2.2. Immune Support

4.2.3. Skincare and Beauty

4.2.4. Weight Management

4.2.5. Stress Relief

4.3. By Form (in Value %)

4.3.1. Capsules

4.3.2. Tablets

4.3.3. Liquids

4.3.4. Powders

4.3.5. Ointments

4.4. By Distribution Channel (in Value %)

4.4.1. Pharmacies

4.4.2. Health Stores

4.4.3. Online Retail

4.4.4. Supermarkets and Hypermarkets

4.4.5. Specialty Stores

4.5. By Region (in Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Makkah

4.5.5. Medina

5. KSA Herbal Medicine Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Jamjoom Pharma

5.1.2. Tabuk Pharmaceuticals

5.1.3. Herbawi Pharmaceuticals

5.1.4. Nahdi Medical Co.

5.1.5. Saudi Modern Food Factory

5.1.6. Alpha Pharma

5.1.7. Health & Wellness KSA

5.1.8. KSA Herbal Trading Co.

5.1.9. Herbal Kingdom Trading Co.

5.1.10. Global Pharma KSA

5.1.11. Himalaya Herbal Healthcare

5.1.12. Dabur International

5.1.13. Hamdard Laboratories

5.1.14. Al Manar Herbals

5.1.15. Al-Jazeera Pharmaceutical Industries

5.2. Cross Comparison Parameters

Revenue, Market Share, R&D Investment, Product Portfolio, Geographical Presence, Distribution Network, Brand Value, Partnerships/Collaborations

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Herbal Medicine Market Regulatory Framework

6.1. SFDA Compliance

6.2. Herbal Product Certification Standards

6.3. Health and Safety Regulations

6.4. Sustainability and Organic Certifications

7. KSA Herbal Medicine Market Future Size (in SAR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Herbal Medicine Market Future Segmentation

8.1. By Product Type (in Value %)

8.2. By Application (in Value %)

8.3. By Form (in Value %)

8.4. By Distribution Channel (in Value %)

8.5. By Region (in Value %)

9. KSA Herbal Medicine Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase of this research involves creating an ecosystem map that identifies all major stakeholders in the KSA Herbal Medicine Market. This step is based on extensive desk research and involves gathering data from proprietary and secondary sources to identify critical factors influencing the market.

Step 2: Market Analysis and Construction

In this stage, historical data for the market is compiled and analyzed, covering various metrics such as market penetration, sales channels, and revenue generation. This analysis helps in constructing an accurate representation of the market dynamics, ensuring the reliability of market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on the data collected, and these are further validated through consultations with industry experts. Interviews with key stakeholders in the KSA herbal medicine industry provide invaluable insights into operational and market-specific trends.

Step 4: Research Synthesis and Final Output

The final phase of the research process involves synthesizing all gathered data and insights into a comprehensive report. Direct engagement with herbal medicine manufacturers and distributors helps verify and refine the market estimates, ensuring the most accurate and credible analysis.

Frequently Asked Questions

01. How big is the KSA Herbal Medicine Market?

The KSA Herbal Medicine Market is valued at USD 1,640 million based on a five-year historical analysis. This market is driven by several key factors, including the rising preference for natural and alternative remedies, largely driven by public awareness of the side effects of synthetic medications.

02. What are the challenges in the KSA Herbal Medicine Market?

Challenges in this market include stringent regulatory hurdles, the lack of standardization in product quality, and competition from conventional pharmaceuticals.

03. Who are the major players in the KSA Herbal Medicine Market?

Key players include Jamjoom Pharma, Tabuk Pharmaceuticals, Himalaya Herbal Healthcare, Dabur International, and Herbawi Pharmaceuticals, all dominating due to their strong product lines and market strategies.

04. What are the growth drivers of the KSA Herbal Medicine Market?

The market is propelled by factors like the increasing popularity of natural remedies, government support for herbal products, and rising consumer health awareness.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.