KSA Home Appliances Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD9000

December 2024

82

About the Report

KSA Home Appliances Market Overview

- The KSA Home Appliances Market is valued at USD 3.8 billion, reflecting substantial demand driven by a combination of urbanization, rising household income, and an increasing inclination toward energy-efficient and smart appliances. Growth in urban households and government initiatives promoting energy efficiency contribute significantly to the market size, with major companies expanding their energy-efficient product lines in response to these trends. Sources such as Saudi Arabias General Authority for Statistics provide insight into the socioeconomic factors boosting household appliance demand.

- Dominant cities within the KSA home appliance market include Riyadh, Jeddah, and Dammam, where high-income levels, rapid urban expansion, and extensive infrastructure development stimulate appliance demand. Riyadh and Jeddah are focal points for the market due to their extensive real estate and construction projects, which drive household consumption patterns toward energy-efficient and smart home appliances.

- Saudi Arabia mandates efficiency standards for home appliances, enforced by the Saudi Standards, Metrology, and Quality Organization (SASO). In 2024, SASO strengthened these regulations, requiring specific energy efficiency certifications for imported and domestically manufactured appliances. This regulatory framework ensures that only appliances meeting national energy standards are sold, thus promoting a market shift towards efficient appliances.

KSA Home Appliances Market Segmentation

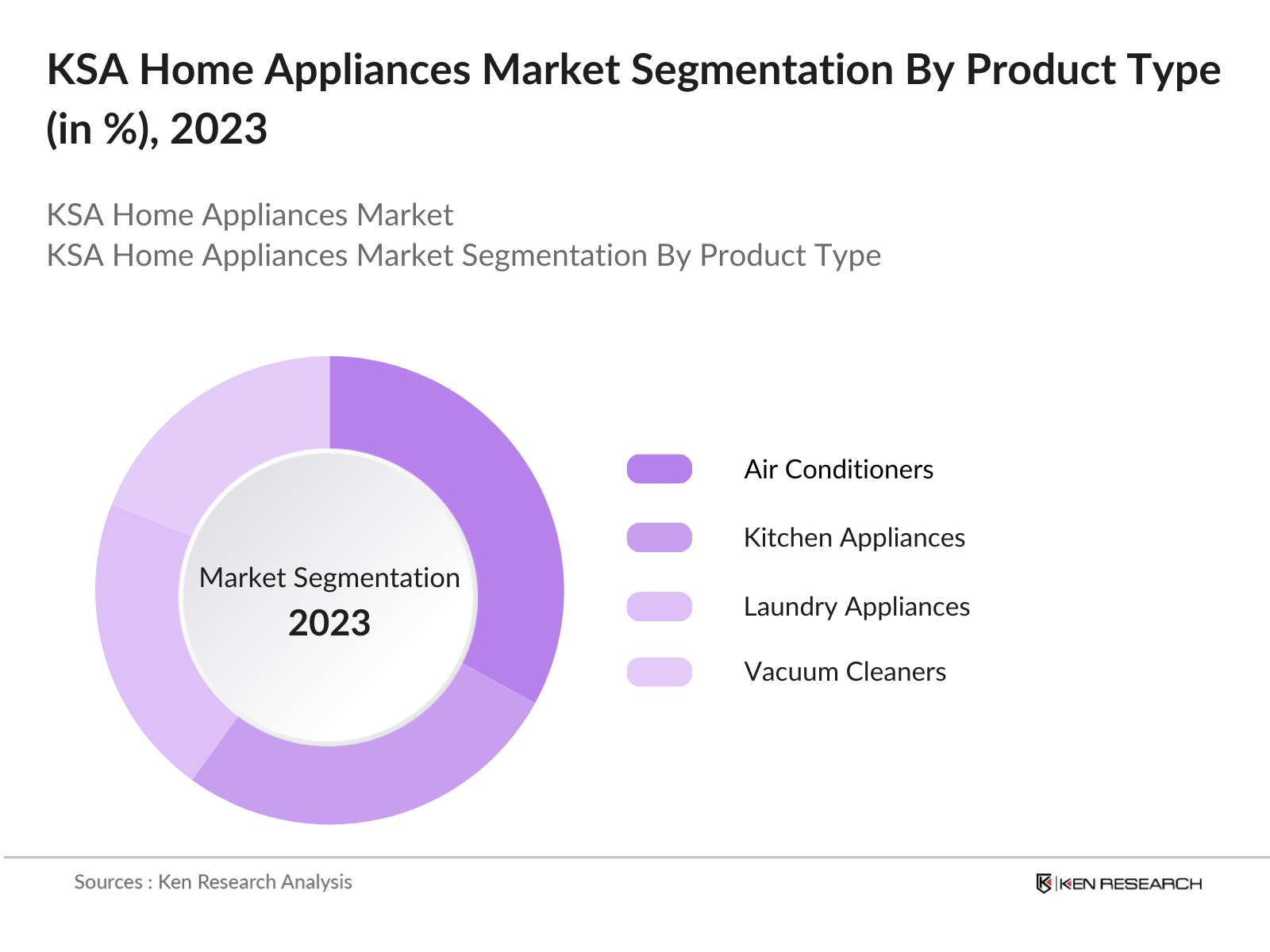

By Product Type: The KSA Home Appliances market is segmented by product type into kitchen appliances, laundry appliances, air conditioners, vacuum cleaners, and water heaters. Recently, air conditioners have emerged as the dominant product type due to the regions high temperatures, with both residential and commercial sectors driving demand. Brands like LG and Daikin lead in this category, benefiting from advancements in energy-efficient cooling technologies that align with government standards.

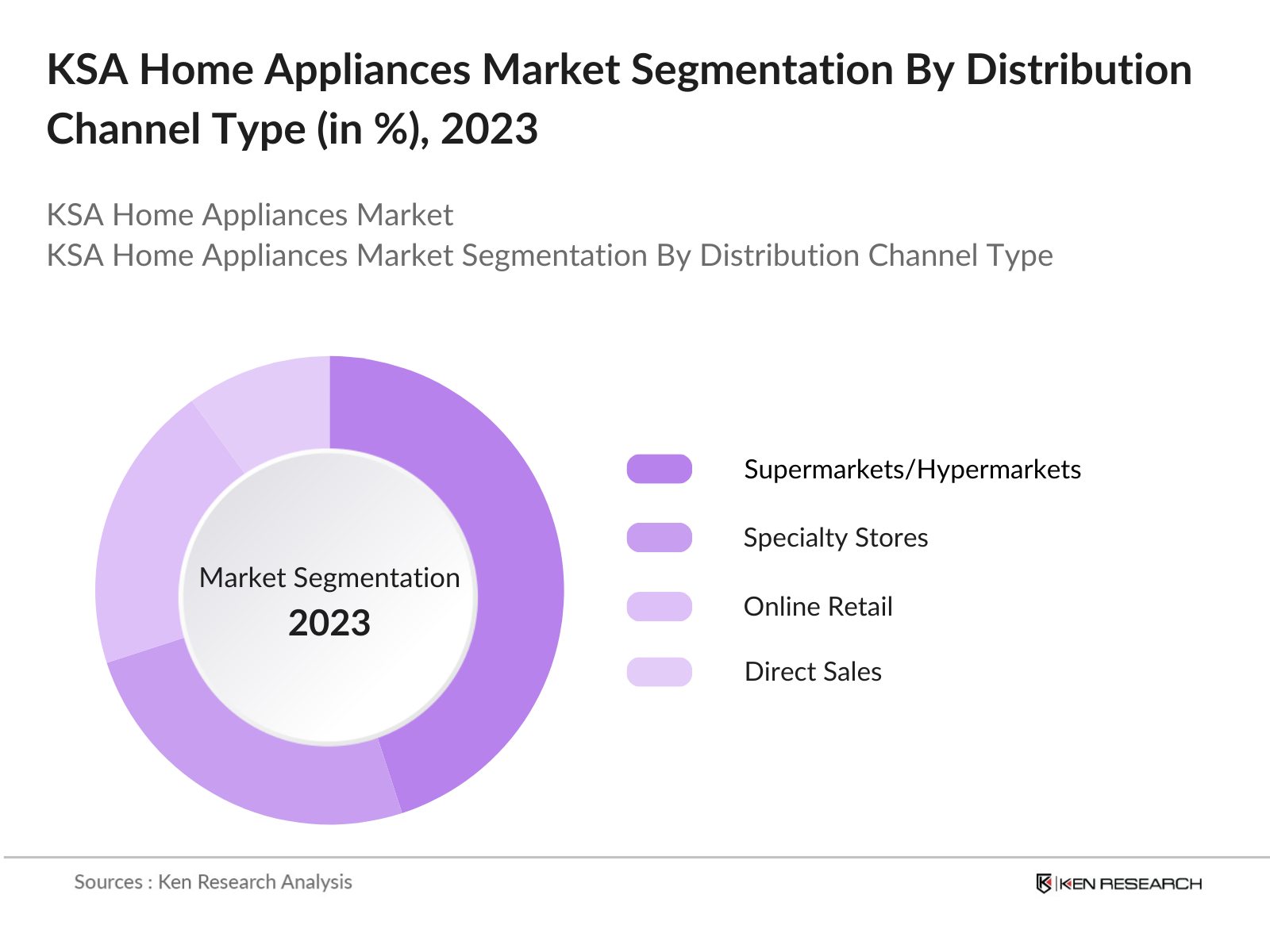

By Distribution Channel: The market segmentation by distribution channel includes online retail, supermarkets/hypermarkets, specialty stores, and direct sales. Supermarkets and hypermarkets have a dominant market share under this segmentation due to their extensive networks and convenience. These channels benefit from high foot traffic, accessibility, and the ability for consumers to compare products in person, driving purchase decisions in major cities across the Kingdom.

KSA Home Appliances Market Competitive Landscape

The KSA Home Appliances market is consolidated, with major players including Samsung, LG Electronics, and Panasonic leading the industry. These companies leverage their strong distribution networks and advanced technology to gain market presence.

KSA Home Appliances Industry Analysis

Growth Drivers

- Government Subsidies on Energy-Efficient Appliances: The Saudi government actively encourages the use of energy-efficient appliances to reduce domestic energy consumption. Through the Saudi Energy Efficiency Center (SEEC), significant subsidies are provided to incentivize consumers to purchase appliances that meet high efficiency standards. In 2024, the SEEC reported that energy-efficient appliances could reduce energy usage by up to 30% in households, aligning with Vision 2030s goals to reduce energy waste. These subsidies lower upfront costs for consumers, making energy-efficient models more accessible and boosting demand in the home appliance sector.

- Rising Disposable Income Levels: Saudi Arabias disposable income levels have shown consistent growth, with the General Authority for Statistics reporting average household income increases across urban areas in 2024. With this increase, more consumers are likely to upgrade to modern and high-quality home appliances, especially in urban centers. According to the Saudi Central Bank, the improved income levels correlate with increased consumer expenditure on home improvement and technology-based appliances, thus driving the overall demand in the market.

- Shift Towards Smart Home Technologies: The trend of smart homes is accelerating in KSA, supported by the Saudi governments investment in digital infrastructure as part of Vision 2030. In 2024, the Communications and Information Technology Commission (CITC) documented a significant increase in connected devices per household, driven by rising consumer interest in home automation and energy management solutions. This shift towards smart technologies is encouraging consumers to invest in smart appliances, supporting the growth of the home appliances market.

Market Challenges

- High Import Dependence for Raw Materials: Saudi Arabias home appliance market relies heavily on imported raw materials for manufacturing, primarily due to limited domestic production capacity. The Saudi Customs Authority noted a dependency on imports from countries such as China, which leads to potential vulnerabilities, especially when facing global supply chain disruptions. These import requirements impact the cost and availability of home appliances, posing a challenge for manufacturers aiming to maintain stable production levels.

- Fluctuating Currency Rates: The fluctuating value of the Saudi riyal against foreign currencies directly affects the cost of imported appliances and raw materials. In 2024, the Saudi Central Bank highlighted increased currency rate fluctuations due to shifting oil prices and global economic uncertainties. These fluctuations impact pricing strategies for home appliance manufacturers and retailers, potentially leading to higher consumer prices and reduced market competitiveness.

KSA Home Appliances Market Future Outlook

Over the next five years, the KSA Home Appliances market is anticipated to experience robust growth, driven by urban expansion, increasing investment in energy-efficient technology, and the shift toward smart home solutions. Regulatory initiatives to reduce energy consumption in household appliances, coupled with an expanding consumer base, are expected to further boost the demand for advanced home appliances. Expansion into digital and omnichannel sales models is also likely to play a key role in shaping the market landscape.

Opportunities

- Expansion in Sustainable Appliances Segment

The sustainable appliance segment is growing as consumers show increased awareness of energy conservation. The SEEC has introduced guidelines promoting the use of sustainable, energy-efficient appliances, and more consumers are aligning with these recommendations. In 2024, the SEEC recorded that around 60% of new appliance purchases were energy-efficient models, reflecting an opportunity for manufacturers to expand sustainable product lines. - Partnerships with Real Estate Developers

Home appliance manufacturers are increasingly partnering with real estate developers to supply appliances for new housing projects. The Ministry of Housing has encouraged such collaborations to equip new developments with modern amenities, including energy-efficient and smart appliances. In 2024, several leading appliance brands reported that up to 20% of their sales came from bulk purchases linked to new housing projects, providing a strategic growth avenue.

Scope of the Report

|

Product Type |

Kitchen Appliances Laundry Appliances Air Conditioners Vacuum Cleaners Water Heaters |

|

Distribution Channel |

Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales |

|

Technology |

Smart Appliances Conventional Appliances |

|

Energy Efficiency |

High Efficiency (A++ and above) Standard Efficiency |

|

Region |

Riyadh Jeddah Dammam Mecca Other Cities |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization - SASO)

Appliance Manufacturing Industries

Retail Chains and Supermarket Companies

E-commerce Platform Companies

Real Estate Development Companies

Energy Efficiency Industries

HVAC and Energy Management Companies

Companies

Players Mentioned in the Report

Samsung Electronics

LG Electronics

Panasonic Corporation

Midea Group

Bosch Home Appliances

Daikin Industries

Electrolux AB

Haier Group

General Electric

Fujitsu General

Table of Contents

1. KSA Home Appliances Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. KSA Home Appliances Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Home Appliances Market Analysis

3.1 Growth Drivers

3.1.1 Government Subsidies on Energy-Efficient Appliances

3.1.2 Rising Disposable Income Levels

3.1.3 Shift Towards Smart Home Technologies

3.1.4 Expanding Real Estate and Housing Market

3.2 Market Challenges

3.2.1 High Import Dependence for Raw Materials

3.2.2 Fluctuating Currency Rates

3.2.3 Lack of Skilled Labor for Installation and Maintenance

3.3 Opportunities

3.3.1 Expansion in Sustainable Appliances Segment

3.3.2 Partnerships with Real Estate Developers

3.3.3 E-commerce Channel Growth

3.4 Trends

3.4.1 Adoption of Smart Home Technologies

3.4.2 Increasing Popularity of Compact Appliances

3.4.3 Rising Demand for Energy-Efficient Models

3.5 Government Regulation

3.5.1 Efficiency Standards and Certifications

3.5.2 Import Regulations and Tariffs

3.5.3 Environmental Compliance for Disposal

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. KSA Home Appliances Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Kitchen Appliances

4.1.2 Laundry Appliances

4.1.3 Air Conditioners

4.1.4 Vacuum Cleaners

4.1.5 Water Heaters

4.2 By Distribution Channel (In Value %)

4.2.1 Online Retail

4.2.2 Supermarkets/Hypermarkets

4.2.3 Specialty Stores

4.2.4 Direct Sales

4.3 By Technology (In Value %)

4.3.1 Smart Appliances

4.3.2 Conventional Appliances

4.4 By Energy Efficiency Rating (In Value %)

4.4.1 High Efficiency (A++ and above)

4.4.2 Standard Efficiency

4.5 By Region (In Value %)

4.5.1 Riyadh

4.5.2 Jeddah

4.5.3 Dammam

4.5.4 Mecca

4.5.5 Other Cities

5. KSA Home Appliances Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Samsung Electronics

5.1.2 LG Electronics

5.1.3 Panasonic Corporation

5.1.4 Whirlpool Corporation

5.1.5 Midea Group

5.1.6 Bosch Home Appliances

5.1.7 Haier Group

5.1.8 Daikin Industries

5.1.9 Hitachi Appliances

5.1.10 Electrolux AB

5.1.11 Beko (Arelik)

5.1.12 Hisense

5.1.13 General Electric

5.1.14 Fujitsu General

5.1.15 Carrier Corporation

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Technology Adoption, Regional Presence, R&D Investments, Customer Service Network, After-Sales Support)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures and Partnerships

5.8 Government Grants and Support

5.9 Private Equity Investments

6. KSA Home Appliances Market Regulatory Framework

6.1 Environmental Standards and Compliance

6.2 Import and Export Regulations

6.3 Certification Requirements

7. KSA Home Appliances Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Home Appliances Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Technology (In Value %)

8.4 By Energy Efficiency Rating (In Value %)

8.5 By Region (In Value %)

9. KSA Home Appliances Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Market Positioning Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a market ecosystem map, including all major stakeholders in the KSA Home Appliances Market. This stage includes extensive desk research using secondary databases to gather comprehensive industry-level information, identifying critical variables that impact market trends.

Step 2: Market Analysis and Construction

We compile and analyze historical data, examining factors like market penetration and the ratio of distribution channels. Service quality statistics and consumer purchase behavior are evaluated to ensure accuracy and reliability in revenue and market share estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts. This approach provides valuable insights into industry operations and trends, helping refine and confirm the market data.

Step 4: Research Synthesis and Final Output

The final phase includes engaging with multiple appliance manufacturers to gain insights into product segments and sales performance. These interactions supplement the data, verifying and complementing the findings through a bottom-up approach.

Frequently Asked Questions

01. How big is the KSA Home Appliances Market?

The KSA Home Appliances market is valued at USD 3.8 billion, driven by rapid urban expansion, rising disposable income, and government initiatives focused on energy-efficient appliances.

02. What are the challenges in the KSA Home Appliances Market?

Challenges in the market include high import dependency for raw materials, fluctuating currency rates, and a shortage of skilled labor for installation and maintenance services.

03. Who are the major players in the KSA Home Appliances Market?

Key players include Samsung Electronics, LG Electronics, Panasonic Corporation, Midea Group, and Bosch Home Appliances, which dominate through extensive distribution networks and technological advancements.

04. What drives growth in the KSA Home Appliances Market?

Growth drivers include increased urbanization, rising household incomes, and government support for energy-efficient appliances, which stimulate demand for advanced home solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.