KSA Home Furniture Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD8302

December 2024

88

About the Report

KSA Home Furniture Market Overview

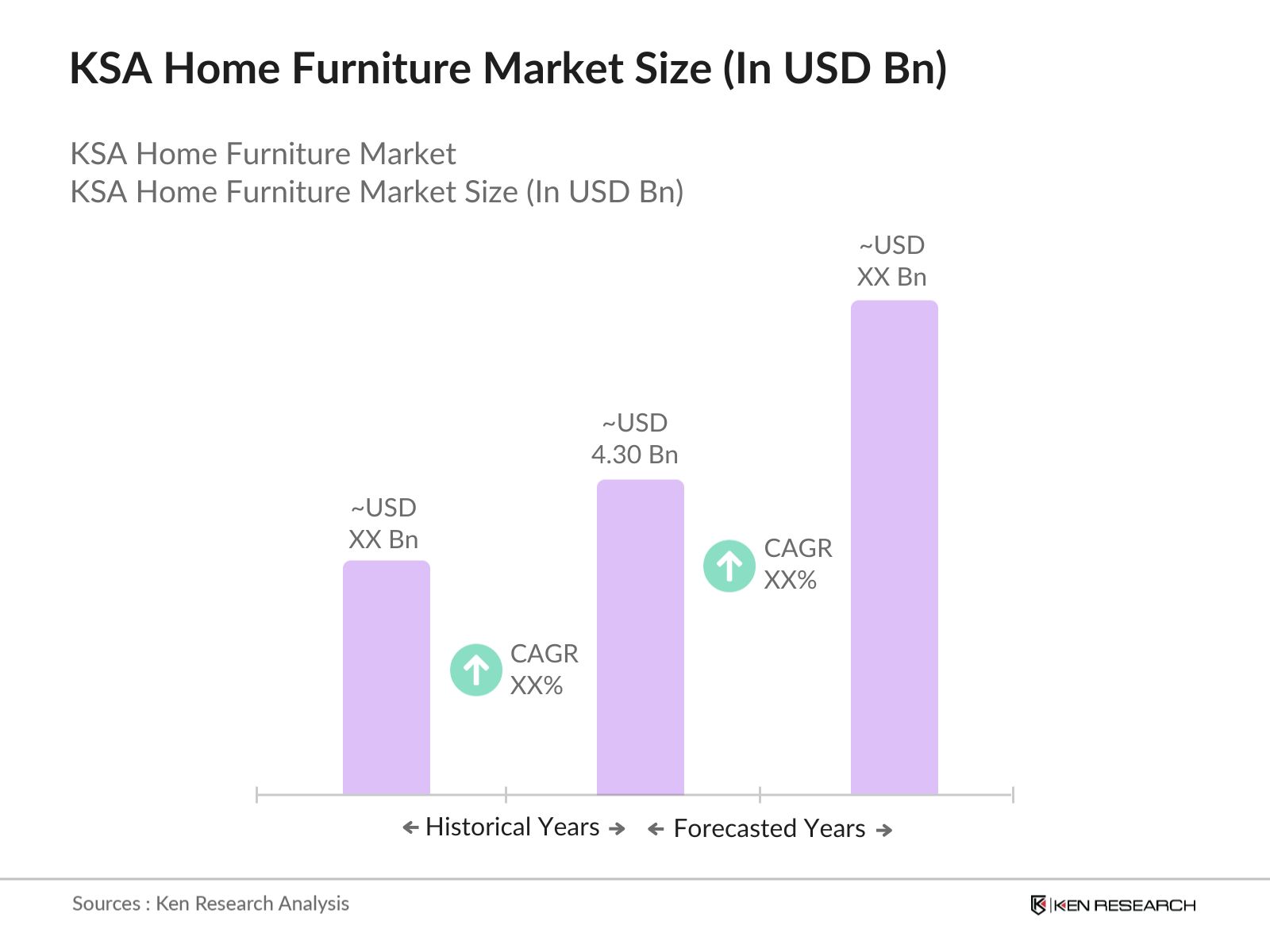

- The KSA home furniture market is valued at USD 4.30 billion, driven primarily by the country's rapid urbanization, economic growth, and the ongoing infrastructure projects under Saudi Vision 2030. The push for modern, high-quality, and functional furniture has led to increased consumer demand across both residential and commercial spaces. Factors such as increased disposable income, expansion of e-commerce, and the growing popularity of sustainable furniture choices also contribute to the markets steady expansion, solidifying KSA as a significant player in the Middle Eastern furniture industry.

- Riyadh, Jeddah, and Dammam are the major demand centers for home furniture in KSA. Riyadh leads due to its role as the administrative and financial hub of the country, attracting significant investments in housing and commercial real estate. Jeddahs position as a coastal city enhances its appeal for tourism-related projects, while Dammam benefits from large industrial and residential developments. These cities also have well-established retail networks and showrooms, enabling easy access to furniture products, making them the primary markets for home furnishings in the region.

- The Saber certification program enforces product safety standards for imported goods, including furniture, to ensure compliance with Saudi regulations. Implemented by the Saudi Standards, Metrology and Quality Organization, the program requires all imported furniture to meet specific safety and quality criteria before entering the market. This regulatory framework ensures that consumers are protected from substandard products, and furniture importers must complete Saber certification to operate legally.

KSA Home Furniture Market Segmentation

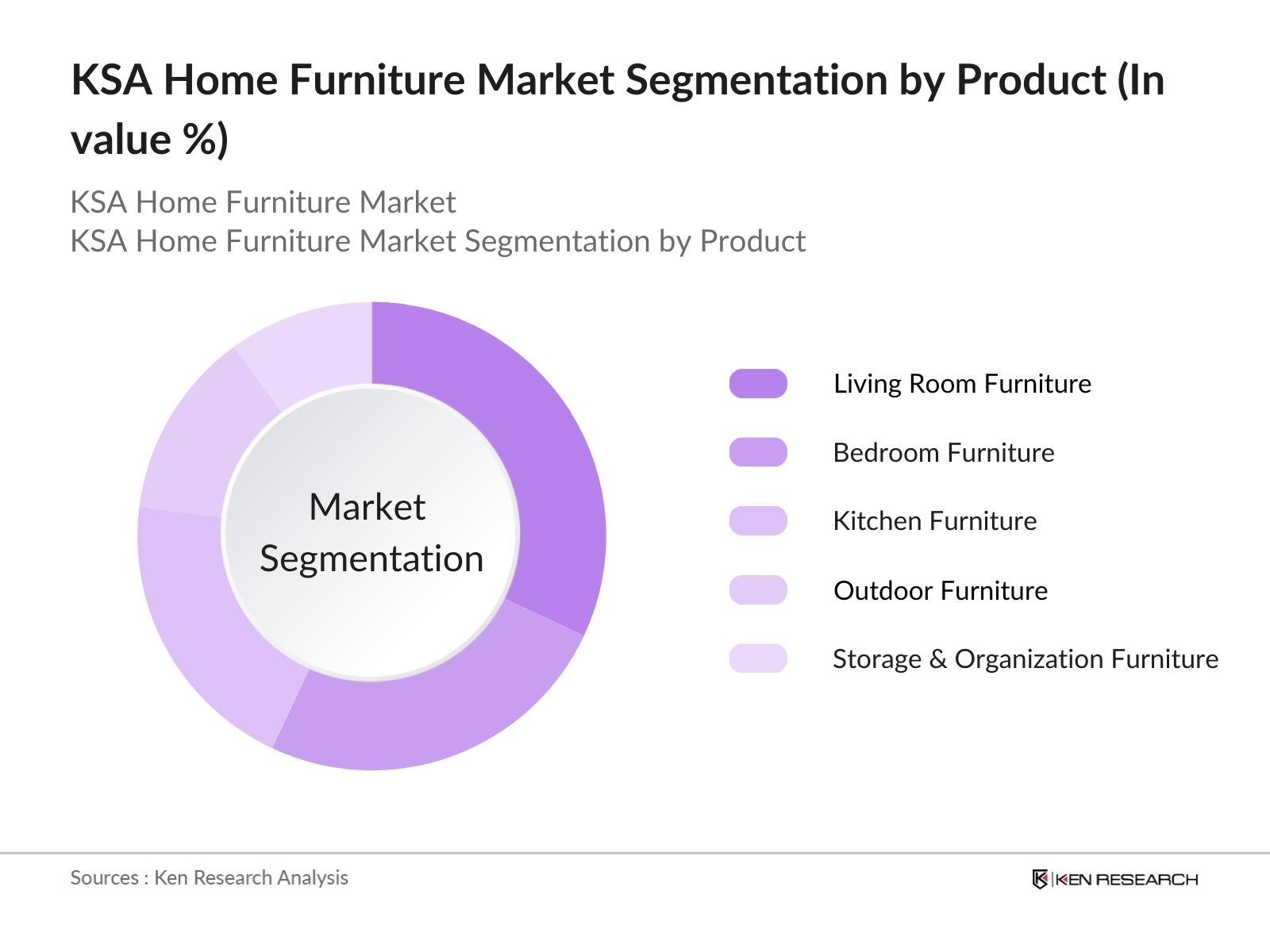

- By Product Type: The market is segmented by product type into living room furniture, bedroom furniture, kitchen furniture, outdoor furniture, and storage & organization furniture. Recently, living room furniture holds a dominant market share within this segmentation. This trend can be attributed to the role of the living room as the central area for social gatherings and family interactions, leading consumers to invest in stylish, comfortable, and functional pieces that reflect their personal taste and meet high aesthetic standards. Brands in KSA are increasingly offering a range of contemporary and modular designs to cater to this demand.

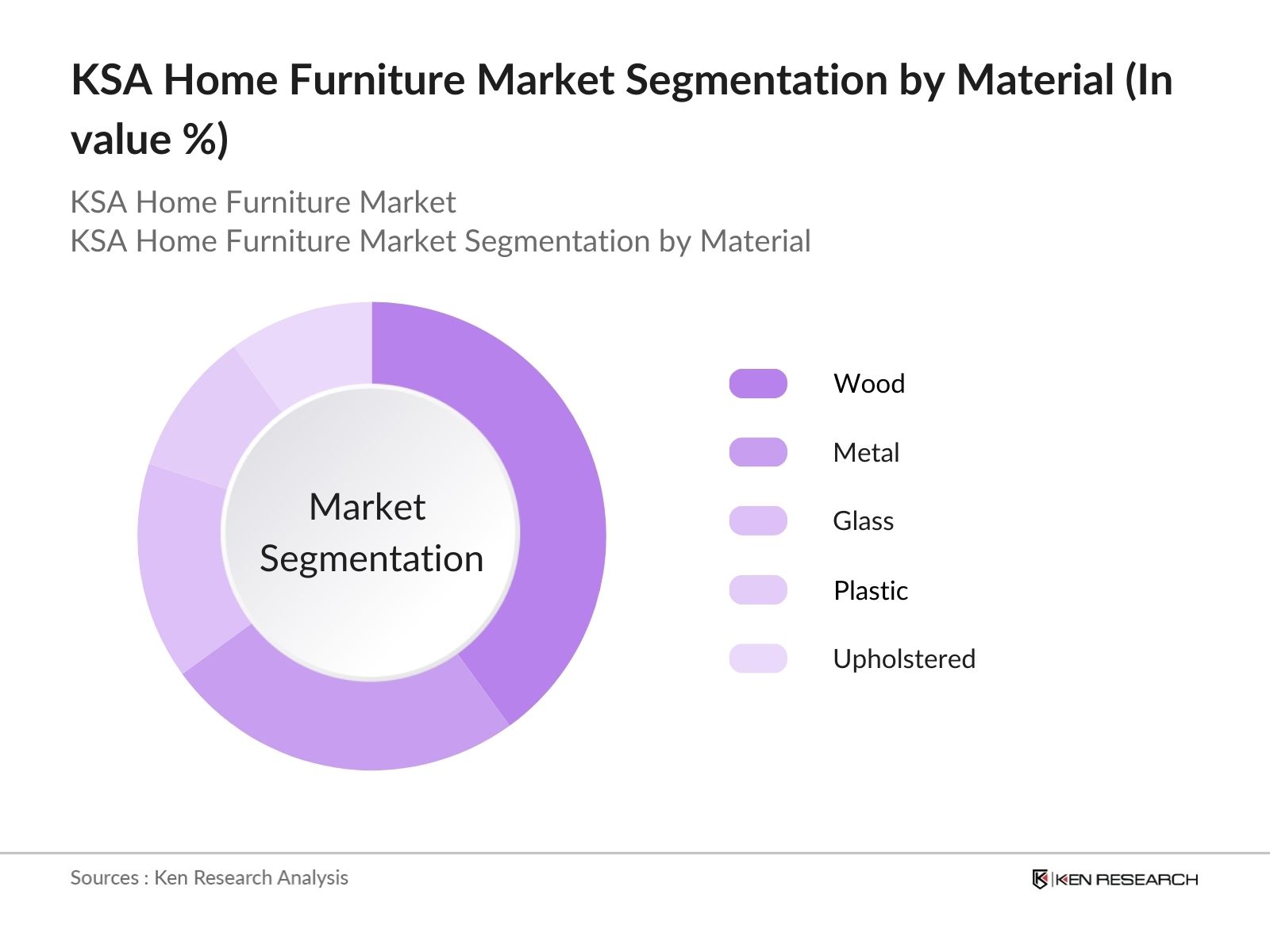

- By Material Type: The market is further segmented by material type, including wood, metal, glass, plastic, and upholstered furniture. Wood dominates this segment due to its long-lasting appeal and versatility in design, making it a popular choice for consumers seeking durability and a high-end look. In addition, wood offers adaptability to various design themes, such as traditional or modern aesthetics, which aligns with the premium segments demand for quality and customizable options. Woods favorable properties, including easy maintenance and environmental benefits, also reinforce its strong position in the market.

KSA Home Furniture Market Competitive Landscape

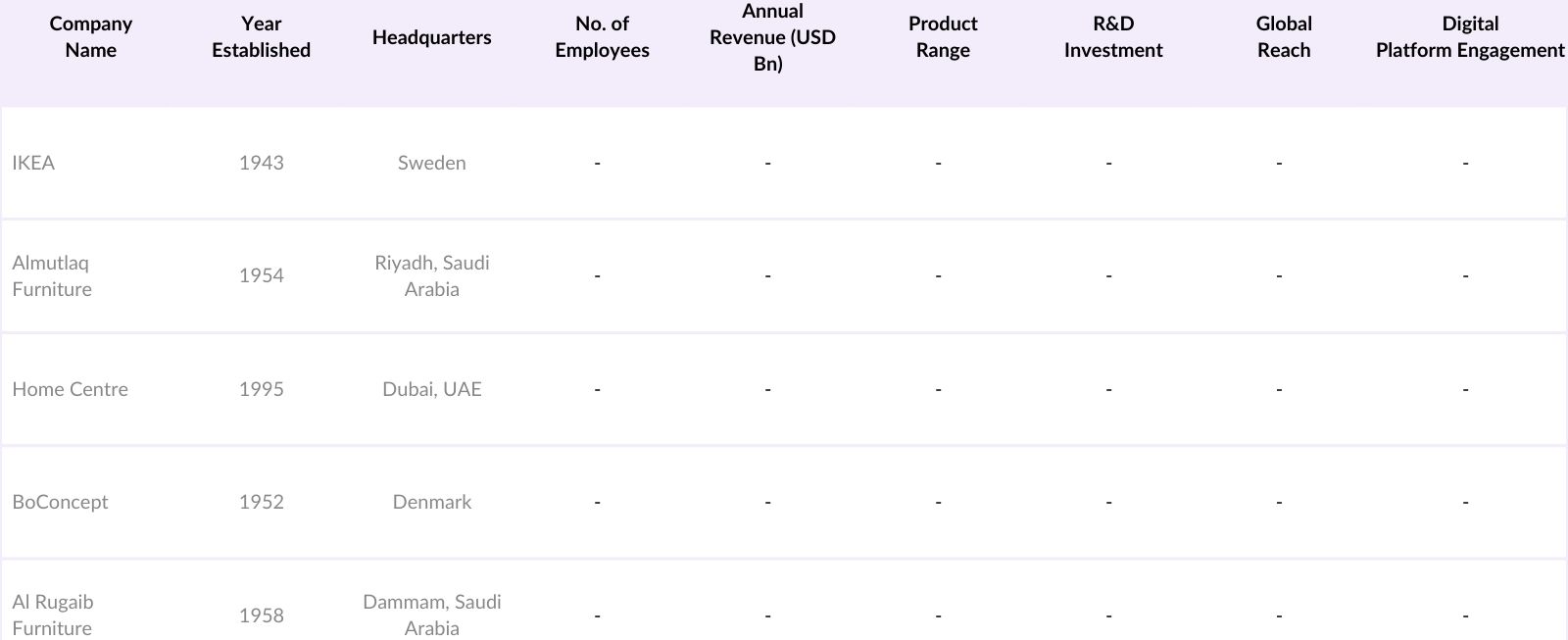

The KSA home furniture market is highly competitive, with both international brands and local manufacturers striving to capture market share through innovative designs, extensive distribution networks, and sustainable product offerings. Key players are actively enhancing their digital retail capabilities to cater to the growing demand for online shopping.

KSA Home Furniture Market Analysis

Growth Drivers

- Increasing Urbanization (Urban Household Demand): Saudi Arabia's urban population has grown significantly, now comprising over majority of the total population, influenced by the country's rapid economic development and urban migration. This urban shift has increased the demand for modern home furniture as urban households seek efficient, space-saving solutions. With an estimated 10 million households in urban areas, this segment has seen a sharp rise in demand for durable and stylish furniture that complements apartment living. As of 2024, the trend towards urban living continues to drive furniture market demand, creating an opportunity for brands to tailor products to urban household needs.

- Rising Disposable Income: Saudi households have seen a substantial increase in disposable income, with average monthly incomes reaching SAR 10,000 in 2024. This rise in purchasing power has led to increased household expenditure on home furnishings, as consumers now prioritize comfort, aesthetics, and quality. As disposable income continues to grow, there is a noticeable shift toward luxury and premium furniture segments, particularly in urban areas. This trend is supported by data from the General Authority for Statistics, showing that furniture and household maintenance accounted for a notable portion of household expenditure in recent years.

- Rapid E-commerce Penetration (Digital Retailing): The rapid growth of e-commerce in Saudi Arabia has transformed the furniture purchasing experience. With over 38 million internet users, online furniture sales have grown as consumers seek convenience and variety. Major e-commerce players report a surge in home furniture sales, reflecting changing consumer habits. The Ministry of Communications and Information Technology estimates that by 2024, the value of online retail will reach all-time high, with a significant portion of this directed towards furniture purchases, highlighting the markets potential for digital retailing

Challenges

- High Production and Raw Material Costs: Saudi Arabia's dependence on imported raw materials for furniture production exposes the industry to global supply chain challenges and fluctuations in material costs. Recent increases in the cost of essential materials like wood, metal, and upholstery have created added pressure on local manufacturers and retailers. These rising costs often lead to higher prices for consumers, as companies pass on expenses to maintain viable profit margins. The reliance on global suppliers makes the industry particularly susceptible to disruptions, impacting the consistency and affordability of finished products.

- Import Dependency due to Local Manufacturing Gaps: The Saudi furniture market depends significantly on imported goods, with a large portion of both finished products and raw materials sourced internationally. This reliance creates challenges when economic or logistical disruptions arise, affecting the availability and pricing of furniture. Efforts to bolster local manufacturing are ongoing, but the sector has yet to scale up to meet national demand fully. This dependency on imports continues to influence the industry, as domestic production capabilities lag behind the requirements of a rapidly growing market

KSA Home Furniture Market Future Outlook

The KSA home furniture market is set to experience robust growth, fueled by government initiatives in residential and commercial real estate. The trend toward smart and sustainable furniture aligns well with Saudi Vision 2030s goals, which emphasizes improving quality of life and adopting eco-friendly practices. The increasing adoption of modular furniture, water-resistant materials, and energy-efficient designs is anticipated to drive market innovation and expansion.

Future Market Opportunities

- Growing Demand for Smart Furniture: With smart home adoption increasing, there is a rising demand for smart furniture in Saudi Arabia, as consumers look for integrated solutions that enhance convenience and connectivity. A notable portion of Saudi households use smart devices, creating an emerging market for smart furniture products like automated seating, modular workstations, and connected storage. As of 2024, this trend aligns with the Kingdoms vision to be at the forefront of digital transformation, supported by policies promoting smart home adoption.

- Rise in Home Renovations: Post-COVID, Saudi households have focused more on home improvement and redesign, with data from the Ministry of Municipal, Rural Affairs and Housing indicating a substantial increase in residential renovation permits in 2023. With this, the demand for stylish and functional furniture has grown as consumers seek to refresh living spaces. This trend is particularly strong among young families and middle-income households, driving interest in contemporary and customizable furniture solutions for renovations.

Scope of the Report

|

By Product Type |

Living Room Furniture |

|

By Material Type |

Wood |

|

By Distribution Channel |

Retail Stores |

|

By End-User |

Residential |

|

By Region |

Riyadh |

Products

Key Target Audience

Furniture Retailers

Real Estate Developers

Interior Designers and Architects

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization (SASO), Ministry of Housing)

E-commerce Platforms

Sustainable Furniture Manufacturers

Companies

Players Mentioned in the Report

IKEA

Almutlaq Furniture

Al Rugaib Furniture

Home Centre

Pan Emirates

BoConcept

Saudi Modern Factory Company

Al Abdul Karim

Danube Home

Pottery Barn

Ashleys Furniture HomeStore

Home Box

Q House of Basics

Al Huzaifa Furniture

Crate & Barrel

Table of Contents

1. KSA Home Furniture Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. KSA Home Furniture Market Size (In SAR Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Home Furniture Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Urbanization (Urban Household Demand)

3.1.2 Government Support for Real Estate (Vision 2030 Impact)

3.1.3 Rising Disposable Income (Household Expenditure Trends)

3.1.4 Rapid E-commerce Penetration (Digital Retailing)

3.2 Market Challenges

3.2.1 High Production and Raw Material Costs (Supply Chain Disruptions)

3.2.2 Import Dependency (Local Manufacturing Gaps)

3.2.3 Increasing Competition from International Brands (Market Share Pressure)

3.3 Opportunities

3.3.1 Growing Demand for Smart Furniture (Integration with Smart Homes)

3.3.2 Rise in Home Renovations (Post-COVID Redesign Trends)

3.3.3 Focus on Sustainable Materials (Eco-Friendly Products)

3.4 Trends

3.4.1 Modular and Space-Saving Designs (Apartments & Smaller Homes)

3.4.2 Adoption of Premium & Customizable Furniture (Luxury Segment)

3.4.3 Rise of Online Furniture Marketplaces (E-commerce Adaptation)

3.5 Government Regulations

3.5.1 Saudi Product Safety Program (Saber Certification)

3.5.2 Import Regulations (Custom Duty Impacts)

3.5.3 Furniture Manufacturing Standards (Quality & Compliance)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. KSA Home Furniture Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Living Room Furniture

4.1.2 Bedroom Furniture

4.1.3 Kitchen Furniture

4.1.4 Outdoor Furniture

4.1.5 Storage & Organization Furniture

4.2 By Material Type (In Value %)

4.2.1 Wood

4.2.2 Metal

4.2.3 Glass

4.2.4 Plastic

4.2.5 Upholstered

4.3 By Distribution Channel (In Value %)

4.3.1 Retail Stores

4.3.2 Specialty Furniture Stores

4.3.3 Online Channels

4.3.4 Home Improvement Stores

4.4 By End-User (In Value %)

4.4.1 Residential

4.4.2 Commercial

4.5 By Region (In Value %)

4.5.1 Riyadh

4.5.2 Jeddah

4.5.3 Dammam

4.5.4 Makkah

4.5.5 Eastern Province

5. KSA Home Furniture Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 IKEA

5.1.2 Almutlaq Furniture

5.1.3 Al Rugaib Furniture

5.1.4 Home Centre

5.1.5 Pan Emirates

5.1.6 BoConcept

5.1.7 Saudi Modern Factory Company

5.1.8 Al Abdul Karim

5.1.9 Danube Home

5.1.10 Pottery Barn

5.1.11 Ashleys Furniture HomeStore

5.1.12 Home Box

5.1.13 Q House of Basics

5.1.14 Al Huzaifa Furniture

5.1.15 Crate & Barrel

5.2 Cross-Comparison Parameters (Headquarters Location, Revenue, Number of Stores, Local Partnerships, Product Range, Pricing Strategy, E-commerce Presence, Marketing Reach)

5.3 Market Share Analysis (By Product Type and Region)

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Funding Support

5.8 Private Equity Investments and Venture Capital

6. KSA Home Furniture Market Regulatory Framework

6.1 Product Compliance Standards

6.2 Import and Export Regulations

6.3 Quality Certification Processes (SASO Standards)

7. KSA Home Furniture Future Market Size (In SAR Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. KSA Home Furniture Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Material Type (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. KSA Home Furniture Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Cohort Analysis

9.3 Marketing Strategy Insights

9.4 Potential Growth Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this phase, an ecosystem map of the KSA Home Furniture Market is created to outline all primary stakeholders. Desk research is conducted to define core variables influencing market dynamics.

Step 2: Market Analysis and Data Compilation

Historical and current data related to the KSA Home Furniture Market are collected, analyzing market penetration, demand-supply ratios, and consumer preferences to support revenue projections.

Step 3: Hypothesis Testing and Validation

Industry experts are engaged through interviews to validate data and hypotheses. Insights gained through consultations provide operational and financial perspectives to enhance the analysis.

Step 4: Final Data Synthesis and Report Generation

All insights are synthesized to form a comprehensive report, verified with stakeholders, to ensure accuracy and relevance to market trends, providing a validated analysis of the KSA Home Furniture Market.

Frequently Asked Questions

01. How big is the KSA Home Furniture Market?

The KSA home furniture market is valued at USD 4.30 billion, driven by factors such as urbanization, economic growth, and a shift toward high-quality furnishings.

02. What are the primary challenges in the KSA Home Furniture Market?

Challenges in the KSA home furniture market include high dependency on imported raw materials and a shortage of skilled labor for installation, both of which impact cost and scalability.

03. Who are the major players in the KSA Home Furniture Market?

Key players in the KSA home furniture market include IKEA, Almutlaq Furniture, Al Rugaib Furniture, Home Centre, and BoConcept, recognized for their diverse product offerings and extensive market reach.

04. What are the growth drivers of the KSA Home Furniture Market?

KSA home furniture market growth is primarily driven by the Vision 2030 initiative, a young population with increasing disposable income, and the rise of e-commerce which makes furniture accessible to a broader audience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.