KSA HR Tech Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD5851

November 2024

90

About the Report

KSA HR Tech Market Overview

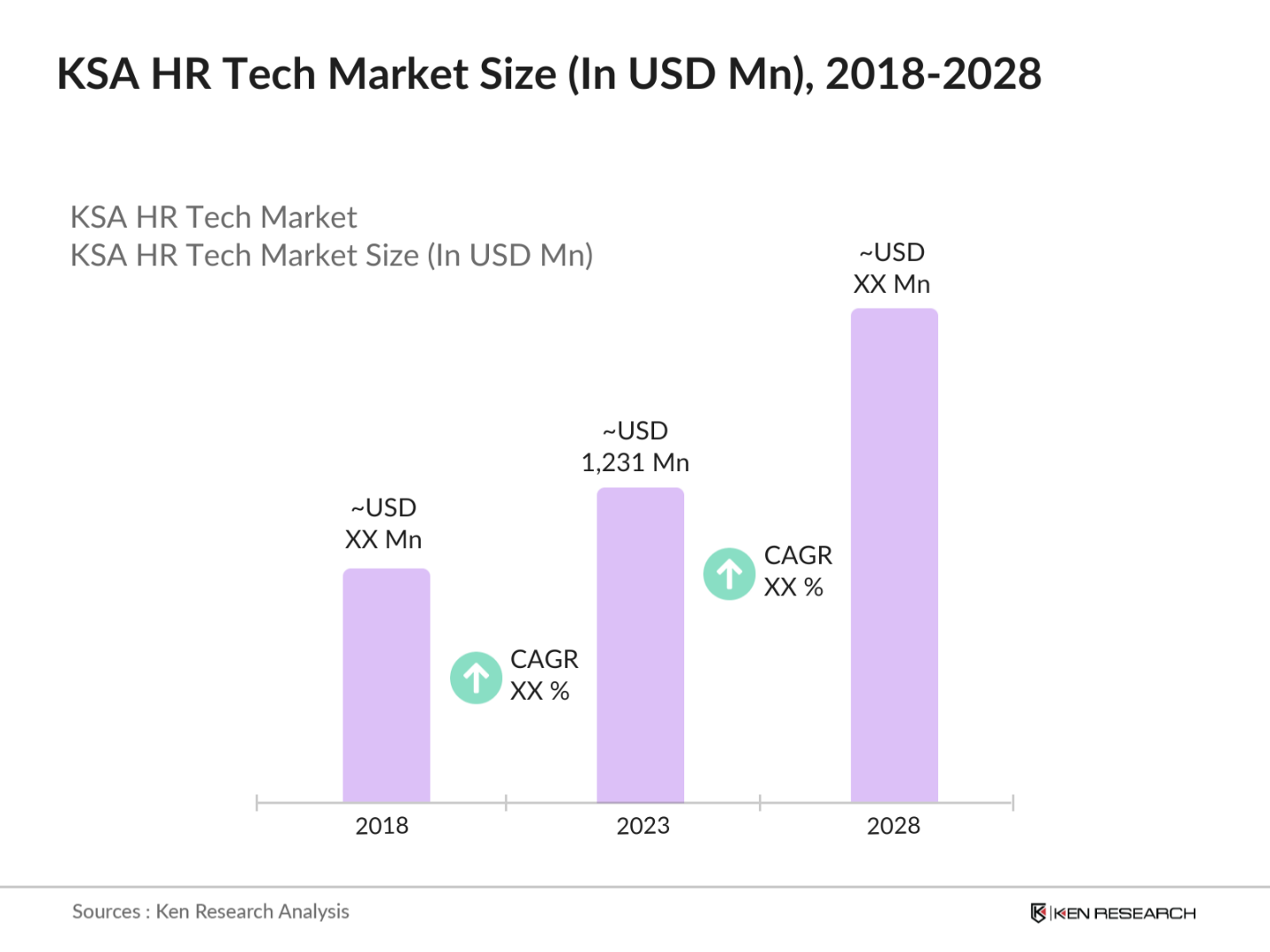

- The KSA HR Tech market is valued at USD 1,231 million, based on a five-year historical analysis. This market is primarily driven by the Kingdom's push for digital transformation under Vision 2030, which aims to enhance productivity and workforce management across industries. The rising demand for cloud-based HR solutions, AI integration, and automation of HR processes is leading to the rapid adoption of advanced HR technologies by enterprises of all sizes, fostering market growth.

- In terms of regional dominance, Riyadh and Jeddah stand out as key contributors to the HR Tech market. Riyadh, being the capital, houses the majority of large corporations and governmental institutions that require advanced HR solutions to manage a growing workforce. Additionally, Jeddahs industrial sector, including the retail and manufacturing industries, has rapidly adopted digital HR platforms to streamline operations and maintain compliance with regulatory changes, including Saudization and Nitaqat requirements.

- Saudi Arabia's labor law reforms, part of Vision 2030, are designed to support workforce localization and improve labor market efficiency. These reforms, particularly around Saudization (Nitaqat program), require companies to implement advanced HR systems to track compliance with nationalization quotas and manage employee rights. In 2024, over 60% of firms reported investing in HR Tech tools to meet these regulatory requirements, especially in sectors like construction and retail.

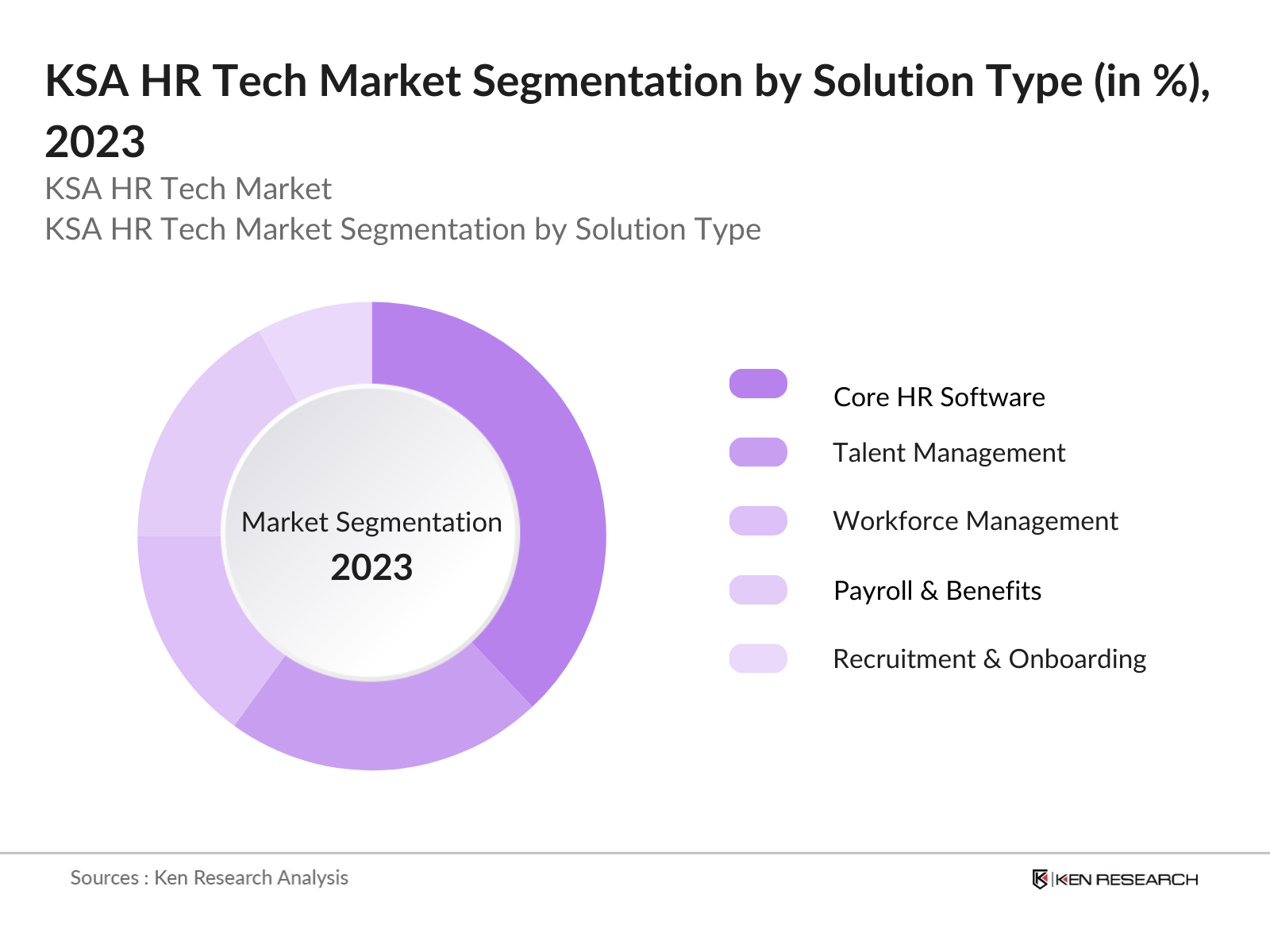

KSA HR Tech Market Segmentation

By Solution Type: The market is segmented by solution type into core HR software, talent management, workforce management, payroll & benefits management, and recruitment & onboarding solutions. Among these, core HR software holds a dominant share due to the fundamental need for organizations to manage essential HR operations like employee data, attendance tracking, and payroll processing.

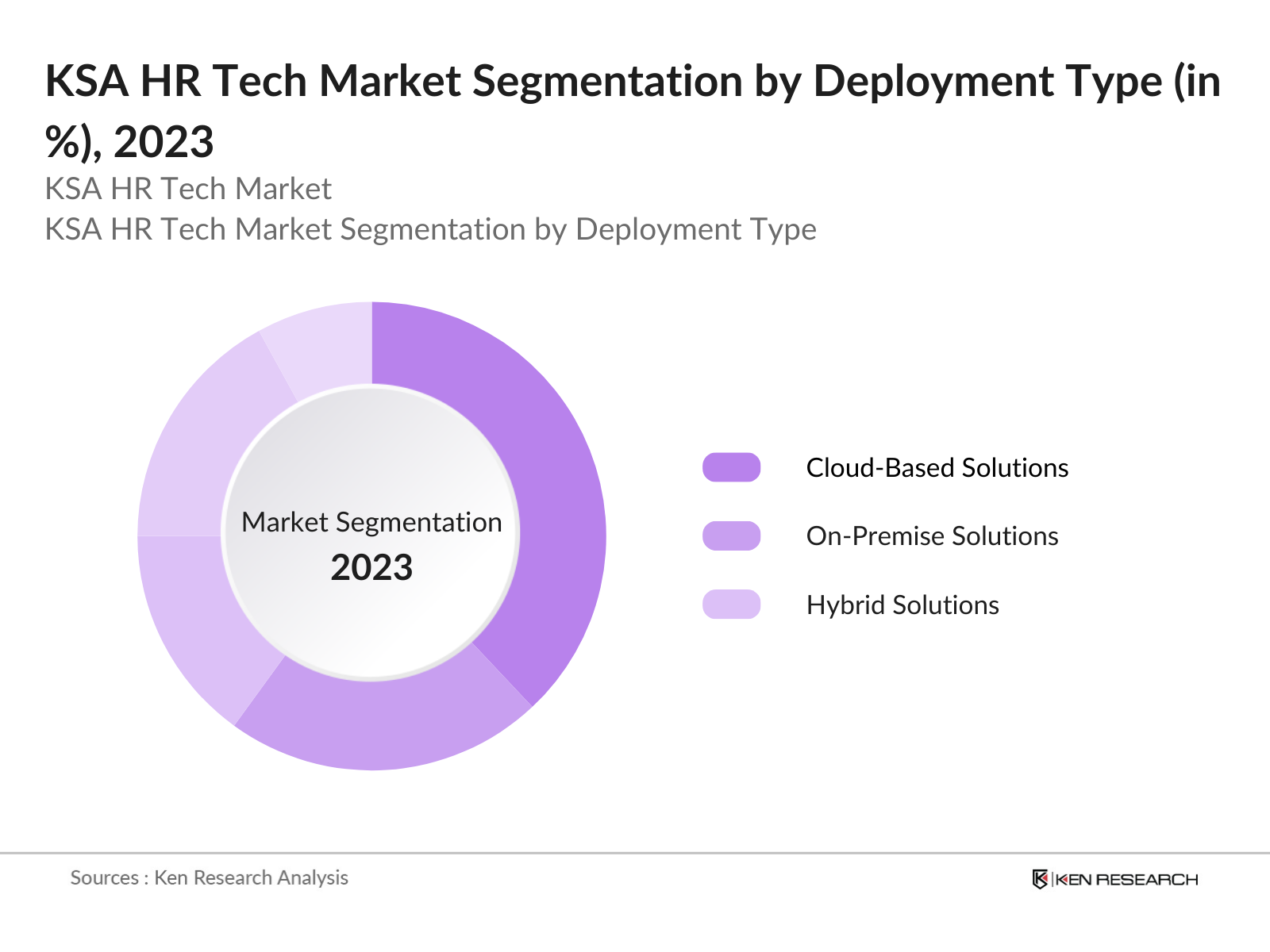

By Deployment Type: The market is segmented by deployment type into cloud-based solutions, on-premise solutions, and hybrid solutions. Cloud-based solutions dominate this category with a significant market share as companies in KSA increasingly opt for scalable and flexible software that does not require large upfront capital investments. The cloud's cost-effectiveness, seamless updates, and ease of integration with other enterprise systems are driving its popularity.

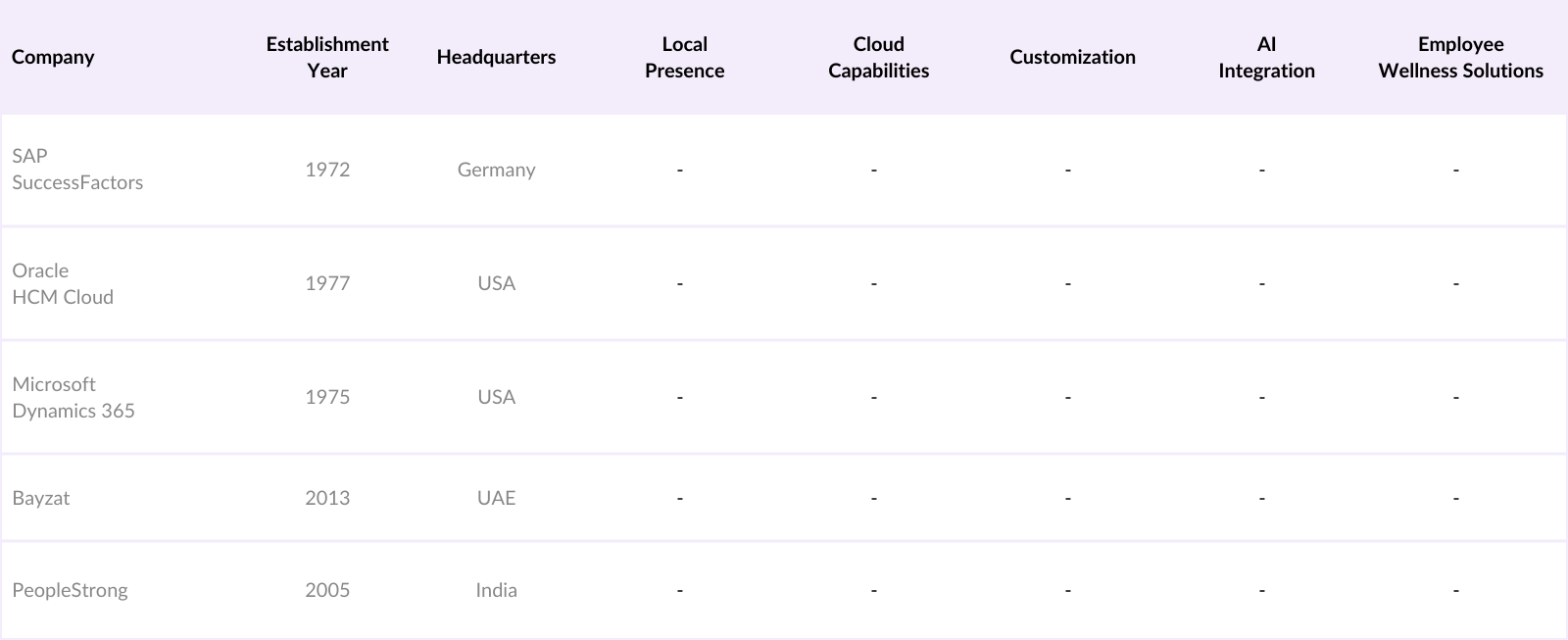

KSA HR Tech Market Competitive Landscape

The KSA HR Tech market is dominated by a mixture of local and global players, with a focus on providing customized solutions to meet the specific needs of businesses within the Kingdom. Companies like Oracle, SAP, and Microsoft hold significant market shares, driven by their robust product portfolios and cloud infrastructure. Meanwhile, local players are gaining traction by offering solutions that cater specifically to the regulations and requirements unique to KSA, such as Nitaqat compliance.

KSA HR Tech Industry Analysis

Growth Drivers

- Increasing Demand for Cloud-Based HR Solutions: Cloud-based HR solutions are gaining traction in the Kingdom, driven by the need for scalable, efficient workforce management tools. By 2024, it is estimated that over 55% of Saudi enterprises will be leveraging cloud technologies to enhance HR functions. Government initiatives, like the Saudi Cloud First Policy, are encouraging both public and private sectors to adopt cloud solutions.

- Talent Management and Workforce Optimization: Saudi Arabias growing focus on talent management and optimization is a direct result of its evolving labor market. With over 5 million employees expected in the private sector by 2024, there is a rising demand for advanced HR Tech solutions that can support performance management, talent acquisition, and employee retention.

- Rising Adoption of AI & Automation in HR Processes: Automation and AI are revolutionizing HR practices in Saudi Arabia, where more than 30% of enterprises are integrating AI-powered solutions by 2024 to automate routine HR functions like recruitment, employee monitoring, and payroll management. AI-based platforms allow HR departments to focus on strategic initiatives such as talent development and workforce planning.

Market Challenges

- Data Security and Privacy Concerns (GDPR-like Regulations): Data security remains a significant challenge for the HR Tech sector in Saudi Arabia, especially with stringent regulations akin to GDPR being developed. Saudi Arabia's National Data Governance Policies demand secure handling of employee data across all sectors. In 2024, over 60% of companies express concerns about data breaches and privacy, as these issues can hinder the adoption of cloud-based HR solutions.

- Integration with Legacy Systems: Many businesses in Saudi Arabia still rely on legacy HR systems, creating challenges in integrating newer, cloud-based HR Tech platforms. According to a 2024 industry report, over 40% of Saudi companies are struggling with integrating modern HR solutions with their existing IT infrastructure. This compatibility issue results in delays in deployment and increased costs for businesses seeking to modernize their HR departments.

KSA HR Tech Market Future Outlook

Over the next five years, the KSA HR Tech market is expected to experience rapid growth, driven by the increasing adoption of AI-driven HR solutions, cloud-based infrastructure, and government support for digital transformation. Companies are likely to invest in more sophisticated HR platforms that enhance employee experience, improve decision-making through data analytics, and ensure compliance with evolving labor laws.

Market Opportunities

- Adoption of Cloud HR Solutions by SMEs: Small and Medium Enterprises (SMEs) in Saudi Arabia, which make up 99% of registered businesses, are increasingly adopting cloud-based HR solutions to streamline their operations. In 2024, over 65% of SMEs are expected to utilize cloud platforms to manage payroll, recruitment, and compliance. The government's focus on promoting digital entrepreneurship through initiatives such as the Monsha'at program is driving this trend, providing incentives and support for SMEs to digitize their HR functions.

- AI and Predictive Analytics in Recruitment: AI-powered recruitment tools are becoming a significant opportunity in Saudi Arabias HR Tech landscape. By 2024, more than 35% of large enterprises are implementing AI-driven recruitment systems to improve candidate screening and enhance hiring accuracy. Predictive analytics are particularly useful in large-scale recruitment drives, helping organizations sift through massive amounts of applicant data to identify the best candidates.

Scope of the Report

|

By Solution Type |

Core HR Software Talent Management Workforce Management Payroll & Benefits Management Recruitment & Onboarding Solutions |

|

By Deployment Type |

Cloud-Based Solutions On-Premise Solutions Hybrid Solutions |

|

By Organization Size |

Small & Medium Enterprises (SMEs) Large Enterprises |

|

By End-User Industry |

Banking, Financial Services & Insurance (BFSI) Retail & E-Commerce Healthcare & Life Sciences IT & Telecom Manufacturing |

|

By Region |

Central Region Eastern Region Western Region Northern Region |

Products

Key Target Audience

HR Software Vendors

Large Enterprises

Small and Medium Enterprises (SMEs)

Venture Capital and Private Equity Firms

Government and Regulatory Bodies (Ministry of Human Resources and Social Development)

Labor Law Compliance Organizations

Cloud Service Providers

Talent Management Consultants

Companies

Players Mentioned in the Report

SAP SuccessFactors

Oracle HCM Cloud

Microsoft Dynamics 365

ADP Workforce Now

BambooHR

Zenefits

Ramco Systems

Cezanne HR

Bayzat

Al-Bashiq HR Software

Table of Contents

1. KSA HR Tech Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Industry Adoption Rate, Workforce Digitalization)

1.4. Market Segmentation Overview

2. KSA HR Tech Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Digital Transformation in KSA, Vision 2030 Initiatives)

3. KSA HR Tech Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives for Digitalization (Vision 2030, National Transformation Program)

3.1.2. Increasing Demand for Cloud-Based HR Solutions

3.1.3. Talent Management and Workforce Optimization

3.1.4. Rising Adoption of AI & Automation in HR Processes

3.2. Market Challenges

3.2.1. Data Security and Privacy Concerns (GDPR-like Regulations)

3.2.2. Integration with Legacy Systems

3.2.3. Shortage of Skilled Professionals in HR Tech

3.3. Opportunities

3.3.1. Adoption of Cloud HR Solutions by SMEs

3.3.2. AI and Predictive Analytics in Recruitment

3.3.3. Employee Experience Platforms (EX)

3.4. Trends

3.4.1. Rise of Remote Work and HR Automation Tools

3.4.2. Integration of HR Tech with Payroll and Financial Systems

3.4.3. Growth in Employee Wellness and Engagement Platforms

3.5. Government Regulation

3.5.1. National Data Privacy Laws

3.5.2. Labor Law Reforms Impacting HR Tech

3.5.3. Compliance with Saudization and Nitaqat Programs

3.6. SWOT Analysis

3.7. Stake Ecosystem (HR Tech Providers, Consulting Firms, End-Users)

3.8. Porters Five Forces

3.9. Competition Ecosystem (HR Tech Platforms, Local and International Players)

4. KSA HR Tech Market Segmentation

4.1. By Solution Type (In Value %)

4.1.1. Core HR Software

4.1.2. Talent Management

4.1.3. Workforce Management

4.1.4. Payroll & Benefits Management

4.1.5. Recruitment & Onboarding Solutions

4.2. By Deployment Type (In Value %)

4.2.1. Cloud-Based Solutions

4.2.2. On-Premise Solutions

4.2.3. Hybrid Solutions

4.3. By Organization Size (In Value %)

4.3.1. Small & Medium Enterprises (SMEs)

4.3.2. Large Enterprises

4.4. By End-User Industry (In Value %)

4.4.1. Banking, Financial Services & Insurance (BFSI)

4.4.2. Retail & E-Commerce

4.4.3. Healthcare & Life Sciences

4.4.4. IT & Telecom

4.4.5. Manufacturing

4.5. By Region (In Value %)

4.5.1. Central Region

4.5.2. Eastern Region

4.5.3. Western Region

4.5.4. Northern Region

5. KSA HR Tech Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. SAP SuccessFactors

5.1.2. Oracle HCM Cloud

5.1.3. Workday

5.1.4. ADP Workforce Now

5.1.5. BambooHR

5.1.6. Zenefits

5.1.7. Microsoft Dynamics 365

5.1.8. Ramco Systems

5.1.9. Cezanne HR

5.1.10. Bayzat

5.1.11. Al-Bashiq HR Software

5.1.12. Odoo HR

5.1.13. SAGE HR

5.1.14. Beehive HRMS

5.1.15. PeopleStrong

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Local Presence, SaaS Capabilities, Customization, AI & Analytics Integration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA HR Tech Market Regulatory Framework

6.1. Data Security Regulations (National Cybersecurity Authority)

6.2. Compliance Requirements (Labor Law, Nitaqat)

6.3. Certification Processes (ISO 27001 for HR Tech Solutions)

7. KSA HR Tech Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (AI Adoption, Workforce Optimization Tools)

8. KSA HR Tech Market Future Segmentation

8.1. By Solution Type (In Value %)

8.2. By Deployment Type (In Value %)

8.3. By Organization Size (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. KSA HR Tech Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (HR Departments, Decision-Makers)

9.3. Marketing Initiatives (Local Customization, SaaS Offerings)

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved creating a comprehensive ecosystem map that includes all stakeholders within the KSA HR Tech market. This phase was supported by thorough desk research, leveraging secondary and proprietary databases to gather industry data. The focus was on identifying key variables such as adoption rates, regulatory requirements, and technological advancements.

Step 2: Market Analysis and Construction

The second phase involved collecting historical data on the KSA HR Tech market. This included assessing the market penetration of various HR solutions, the ratio of cloud-based versus on-premise solutions, and the revenue generated by these segments. The quality of these services was also evaluated to ensure accurate estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through CATI interviews with industry experts. These discussions provided valuable insights from companies operating in the HR tech space, adding depth to the research findings and helping to verify the data collected.

Step 4: Research Synthesis and Final Output

In the final phase, we engaged with multiple HR software vendors to gather detailed insights into product segments, sales performance, and end-user preferences. This helped verify and complement the statistics derived from the research, ensuring an accurate and validated analysis of the KSA HR Tech market.

Frequently Asked Questions

01 How big is the KSA HR Tech Market?

The KSA HR Tech market is valued at USD 1,231 million, based on a five-year historical analysis. This market is primarily driven by the Kingdom's push for digital transformation under Vision 2030, which aims to enhance productivity and workforce management across industries.

02 What are the challenges in the KSA HR Tech Market?

Key challenges include data security concerns, regulatory compliance with local labor laws, and the integration of new HR solutions with legacy systems, particularly in more traditional industries.

03 Who are the major players in the KSA HR Tech Market?

Key players include SAP SuccessFactors, Oracle HCM Cloud, Microsoft Dynamics 365, Bayzat, and PeopleStrong, which dominate due to their strong cloud capabilities and local market presence.

04 What are the growth drivers of the KSA HR Tech Market?

The market is driven by the governments Vision 2030 initiatives, increasing adoption of AI and cloud-based solutions, and the need for companies to streamline workforce management and improve employee engagement.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.