KSA HVAC Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD10885

November 2024

86

About the Report

KSA HVAC Market Overview

- The KSA HVAC market is valued at USD 2.9 billion, based on a comprehensive five-year historical analysis. This substantial market size is driven by the rapid urbanization, significant investments in infrastructure projects, and a climate necessitating year-round cooling solutions. Increased government emphasis on energy-efficient systems, coupled with a robust growth in residential and commercial construction projects, also contribute significantly to market expansion.

- Dominant regions within the Saudi HVAC market include Riyadh, Jeddah, and the Eastern Province. Riyadh leads due to its position as the capital with extensive construction activities, both residential and commercial. The Eastern Province is a significant player as well, owing to its concentration of industrial zones and oil facilities, where high-performance HVAC systems are essential for operational efficiency and safety.

- Saudi Arabias strict energy efficiency standards require HVAC systems to meet specific performance metrics. The Saudi Standards, Metrology, and Quality Organization (SASO) mandates that all HVAC units achieve specified efficiency levels to reduce national electricity consumption. Recent standards have led to a 10% reduction in energy consumption for new installations, per SASO reports.

KSA HVAC Market Segmentation

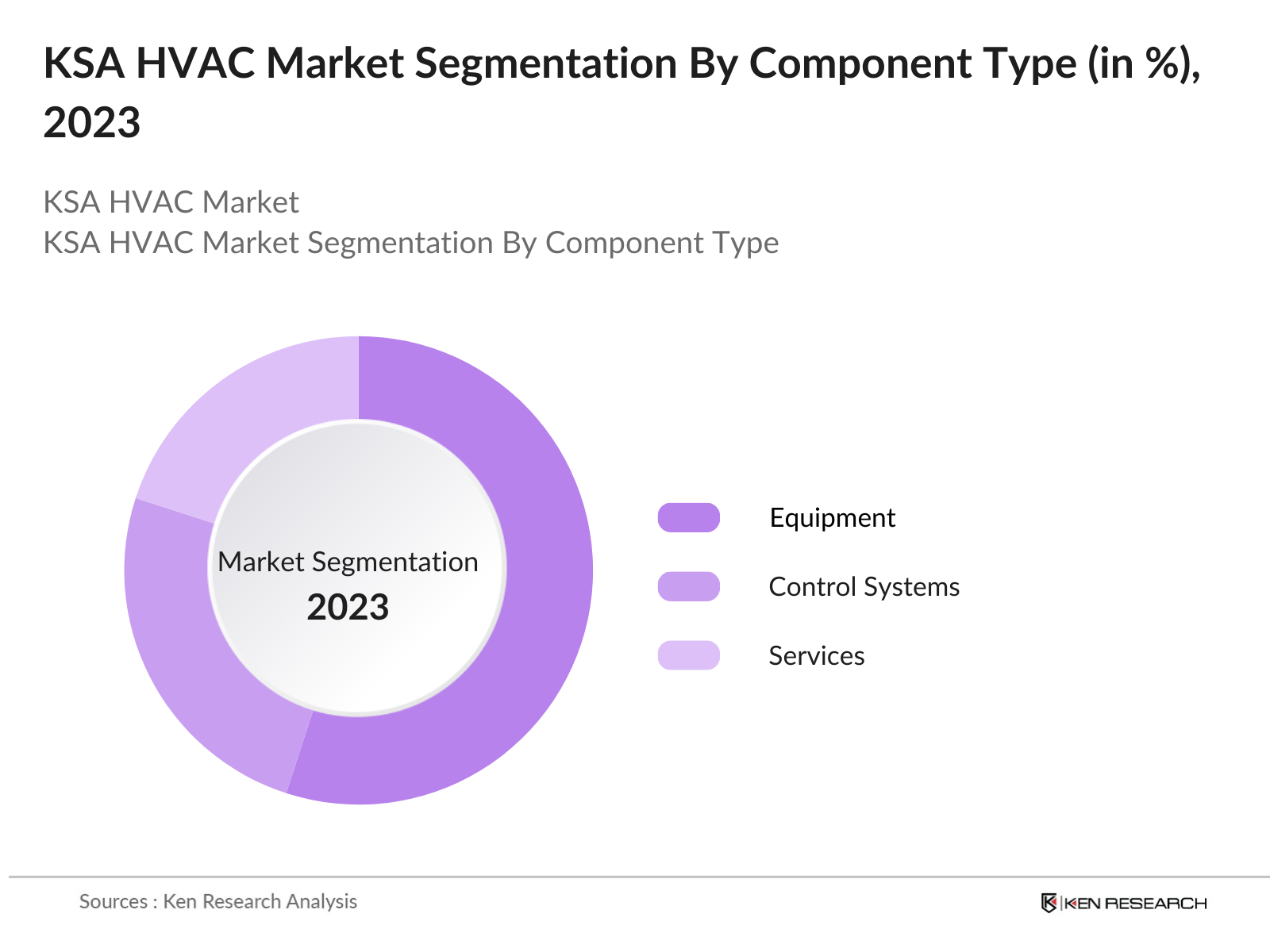

By Component: The Saudi HVAC market is segmented by component into equipment, control systems, and services. Equipment has a dominant market share in the component segmentation, largely due to the high demand for air conditioning systems in the region. The prevalence of centralized and ductless systems in various infrastructure projects ensures equipment remains at the forefront, with control systems gaining traction as buildings adopt smart technology.

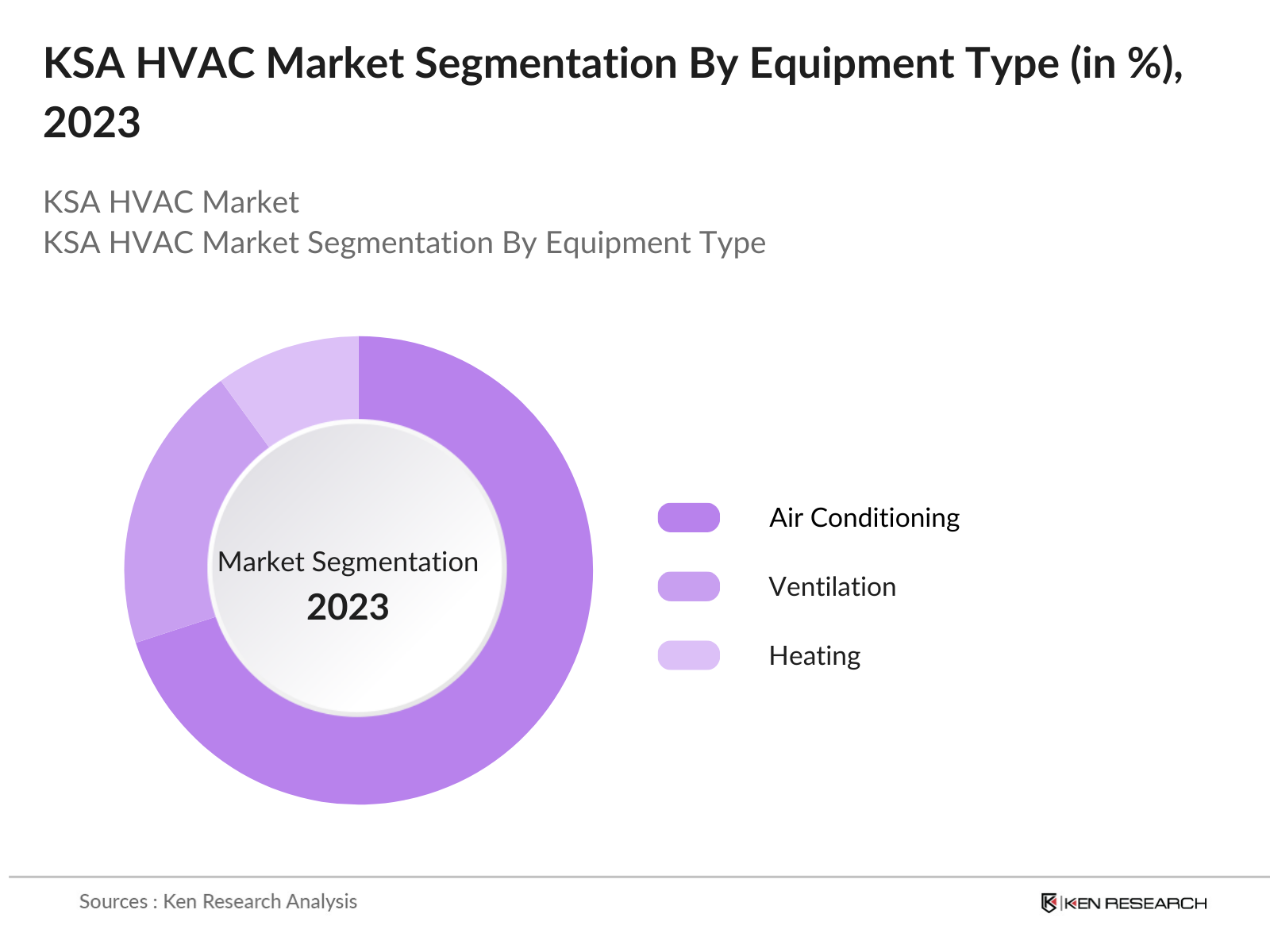

By Equipment Type: The Saudi HVAC market is segmented by equipment type into heating, ventilation, and air conditioning. Air conditioning dominates the market, reflecting KSAs high temperatures, which drive continuous demand for effective cooling solutions. In urban centers, commercial and residential buildings are extensively outfitted with advanced cooling systems, bolstered by government regulations that encourage energy efficiency in air conditioning.

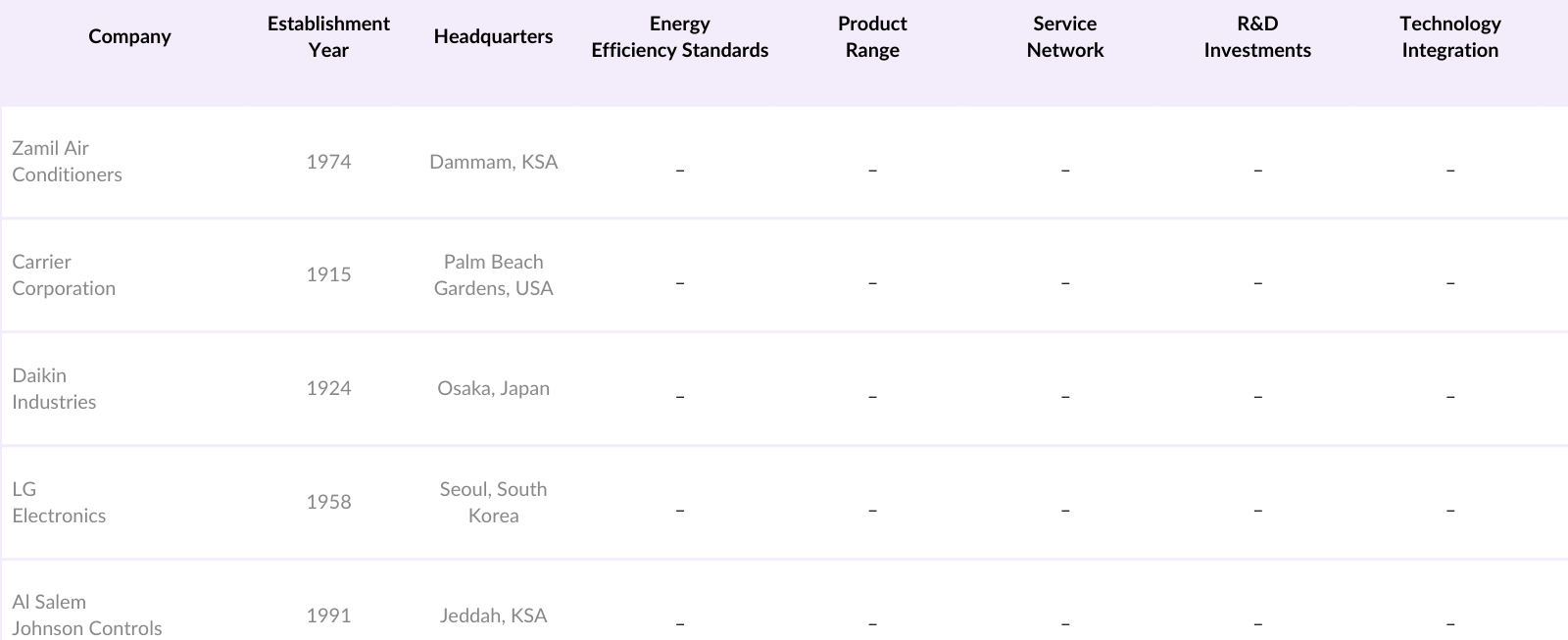

KSA HVAC Market Competitive Landscape

The KSA HVAC market is dominated by a few key players, combining local expertise and global brands. Major players include Zamil Air Conditioners, Carrier Corporation, and Daikin Industries. This competitive landscape indicates a strong presence of both domestic companies with localized insights and international firms offering technologically advanced products.

KSA HVAC Industry Analysis

Growth Drivers

- Rapid Urban Development: Saudi Arabia is experiencing unprecedented urban growth, with over 84% of the population now residing in urban areas, as per the latest World Bank data. Cities like Riyadh and Jeddah are expanding rapidly due to Vision 2030 initiatives, which aim to increase urbanization and reduce dependency on oil by fostering new economic hubs. This growth has catalyzed demand for HVAC systems, especially in residential and commercial developments. The government allocated $20 billion to urban infrastructure in 2024, with projects requiring large-scale HVAC installations.

- Government Energy Efficiency Policies: In line with Vision 2030, Saudi Arabia's government mandates energy-efficient systems, including HVAC, to reduce domestic energy consumption, which comprises 38% of total energy use, as per the Kingdoms energy ministry. The newly adopted Saudi Building Code specifies stringent energy efficiency requirements, making it compulsory for new buildings to include high-performance HVAC systems. The National Energy Efficiency Program (NEEP) offers incentives to install energy-efficient HVAC units, influencing residential and commercial.

- Extreme Climatic Conditions: Saudi Arabias harsh climate, with summer temperatures averaging 45C, drives continuous demand for HVAC systems. The General Authority for Statistics reports an increase in temperature extremes, causing HVAC use in households to surge, especially in urban areas. Demand is particularly high in regions like the Eastern Province, where over 90% of households have air conditioning systems to combat extreme temperatures, further supported by rising electricity generation.

Market Challenges

- High Installation and Maintenance Costs: High initial installation and ongoing maintenance costs for HVAC systems are a notable challenge, as HVAC components are often imported, raising prices significantly. According to the Saudi Customs Authority, HVAC-related import tariffs range from 5-15%, leading to higher costs for consumers and commercial entities. These expenses are compounded by high labor costs for specialized HVAC technicians, with average installation costs for commercial units ranging around SAR 50,000.

- Regulatory Compliance Issues: Compliance with evolving HVAC standards in Saudi Arabia, particularly those related to energy efficiency, is complex. For instance, the Saudi Building Code mandates rigorous energy standards for HVAC systems, and non-compliance can result in penalties. Small to medium HVAC providers struggle to adhere to these standards due to limited resources, impacting market participation.

KSA HVAC Market Future Outlook

Over the next five years, the Saudi HVAC market is expected to experience notable growth, driven by continued investments in infrastructure, technological advancements in HVAC systems, and government incentives promoting energy efficiency. These factors, coupled with a shift toward smart and sustainable solutions, are likely to create ample growth opportunities for both local and international players within the market.

Opportunities

- Demand for Smart HVAC Solutions: The growing trend of smart cities and buildings has increased demand for smart HVAC systems in Saudi Arabia. The adoption of IoT-enabled HVAC systems is on the rise, with 32% of new commercial constructions incorporating smart systems to reduce energy use, according to the Ministry of Communications and Information Technology. Smart HVAC systems enable predictive maintenance, energy optimization, and remote monitoring, supporting both commercial and residential sectors.

- Integration with Renewable Energy Sources: Saudi Arabias commitment to renewable energy, aiming to achieve 50% power from renewables by 2030, presents an opportunity for HVAC systems integrated with solar energy. As reported by the Saudi Energy Ministry, there are over 500 solar-powered HVAC units installed in various pilot projects in NEOM and Riyadh, paving the way for more installations. Integrating HVAC systems with renewable sources like solar reduces dependency on grid electricity and aligns with the Kingdom's sustainability goals.

Scope of the Report

|

Component |

Equipment Control Systems Services |

|

Equipment Type |

Heating Ventilation Air Conditioning |

|

Application |

Residential Commercial Industrial Institutional |

|

Technology |

Centralized Decentralized Ducted Ductless |

|

Region |

Riyadh Jeddah Eastern Province Makkah Al-Madinah |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization)

HVAC Equipment Manufacturing Industries

Residential and Commercial Building Companies

Industrial Facilities Companies

Real Estate Development Companies

Retail Distributor Companies

Investor and Venture Capitalist Firms

Energy and Sustainability Industries

Companies

Players Mentioned in the Report

Zamil Air Conditioners

Carrier Corporation

Daikin Industries

LG Electronics

Al Salem Johnson Controls

Mitsubishi Electric Corporation

Samsung HVAC

Toshiba Carrier Corporation

Fujitsu General Limited

Trane Technologies

Table of Contents

1. Saudi Arabia HVAC Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia HVAC Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia HVAC Market Analysis

3.1. Growth Drivers (Urbanization, Energy Efficiency Mandates, Climate Conditions, Increasing Construction Projects)

3.1.1. Rapid Urban Development

3.1.2. Government Energy Efficiency Policies

3.1.3. Extreme Climatic Conditions

3.1.4. Rise in Construction of Commercial Buildings

3.2. Market Challenges (High Initial Costs, Limited Local Manufacturing, Energy Dependency, Regulatory Barriers)

3.2.1. High Installation and Maintenance Costs

3.2.2. Regulatory Compliance Issues

3.2.3. High Dependency on Imported Components

3.2.4. Skilled Workforce Shortage

3.3. Opportunities (Green Building Initiatives, Integration with Smart Systems, Technological Advancements)

3.3.1. Demand for Smart HVAC Solutions

3.3.2. Integration with Renewable Energy Sources

3.3.3. Growing Investments in Sustainable Infrastructure

3.4. Trends (Adoption of Energy-Efficient HVAC Systems, Automation, Digital Monitoring)

3.4.1. Increased Adoption of IoT in HVAC

3.4.2. Use of AI for Predictive Maintenance

3.4.3. Integration with Building Management Systems

3.5. Government Regulations (Saudi Vision 2030, Efficiency Standards, Renewable Energy Targets)

3.5.1. Energy Efficiency Standards

3.5.2. Regulations for Green Buildings

3.5.3. Incentives for Renewable Energy Integration

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Saudi Arabia HVAC Market Segmentation

4.1. By Component (In Value %)

4.1.1. Equipment

4.1.2. Control Systems

4.1.3. Services

4.2. By Equipment Type (In Value %)

4.2.1. Heating

4.2.2. Ventilation

4.2.3. Air Conditioning

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Institutional

4.4. By Technology (In Value %)

4.4.1. Centralized

4.4.2. Decentralized

4.4.3. Ducted

4.4.4. Ductless

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

4.5.4. Makkah

4.5.5. Al-Madinah

5. Saudi Arabia HVAC Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Daikin Industries

5.1.2. Zamil Air Conditioners

5.1.3. Al Salem Johnson Controls

5.1.4. Carrier Corporation

5.1.5. LG Electronics

5.1.6. Samsung HVAC

5.1.7. Gree Electric Appliances

5.1.8. Mitsubishi Electric Corporation

5.1.9. Toshiba Carrier Corporation

5.1.10. Trane Technologies

5.1.11. S.K.M Air Conditioning

5.1.12. Panasonic Corporation

5.1.13. Alessa Industries

5.1.14. York (Johnson Controls)

5.1.15. Fujitsu General Limited

5.2. Cross Comparison Parameters (Product Portfolio, Energy Efficiency Standards, After-Sales Services, Technological Integration, R&D Investments, Market Penetration, Customization Capabilities, Key Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

5.8. Government Incentives and Subsidies

6. Saudi Arabia HVAC Market Regulatory Framework

6.1. National Standards and Certifications

6.2. Compliance Requirements for HVAC Systems

6.3. Environmental and Safety Regulations

7. Saudi Arabia HVAC Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia HVAC Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Equipment Type (In Value %)

8.3. By Application (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia HVAC Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Demographics and Preferences

9.3. Effective Marketing Strategies

9.4. Identification of White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping the entire ecosystem of stakeholders within the KSA HVAC Market. This process incorporates extensive desk research, utilizing secondary and proprietary databases to obtain comprehensive insights. The primary goal is to identify and define key variables that shape market trends.

Step 2: Market Analysis and Construction

This phase involves collecting and analyzing historical data pertinent to the Saudi HVAC Market, including HVAC unit adoption rates and HVAC-related energy consumption. An evaluation of service quality statistics ensures the reliability and accuracy of these data points.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts from a diverse array of HVAC companies. These consultations yield valuable operational and financial insights that are instrumental in refining market data.

Step 4: Research Synthesis and Final Output

The final step involves a comprehensive synthesis, including direct engagement with major HVAC equipment manufacturers. These interactions enable an in-depth understanding of product segments, customer preferences, and emerging trends, ensuring a validated analysis of the KSA HVAC Market.

Frequently Asked Questions

01. How big is the KSA HVAC Market?

The KSA HVAC market is valued at USD 2.9 billion, driven by growing infrastructure investments and climate demands for year-round cooling solutions.

02. What are the major challenges in the KSA HVAC Market?

Challenges include high initial costs, dependency on imported components, and compliance with evolving energy efficiency standards.

03. Who are the major players in the KSA HVAC Market?

Key players include Zamil Air Conditioners, Carrier Corporation, Daikin Industries, and LG Electronics, known for their extensive product ranges and technological innovations.

04. What are the growth drivers of the KSA HVAC Market?

The market is propelled by urbanization, energy efficiency regulations, and increased adoption of smart HVAC systems in residential and commercial projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.