KSA Hydroponic Market Outlook 2030

Region:Middle East

Author(s):Shivani Mehra

Product Code:KROD4122

November 2024

87

About the Report

KSA Hydroponic Market Overview

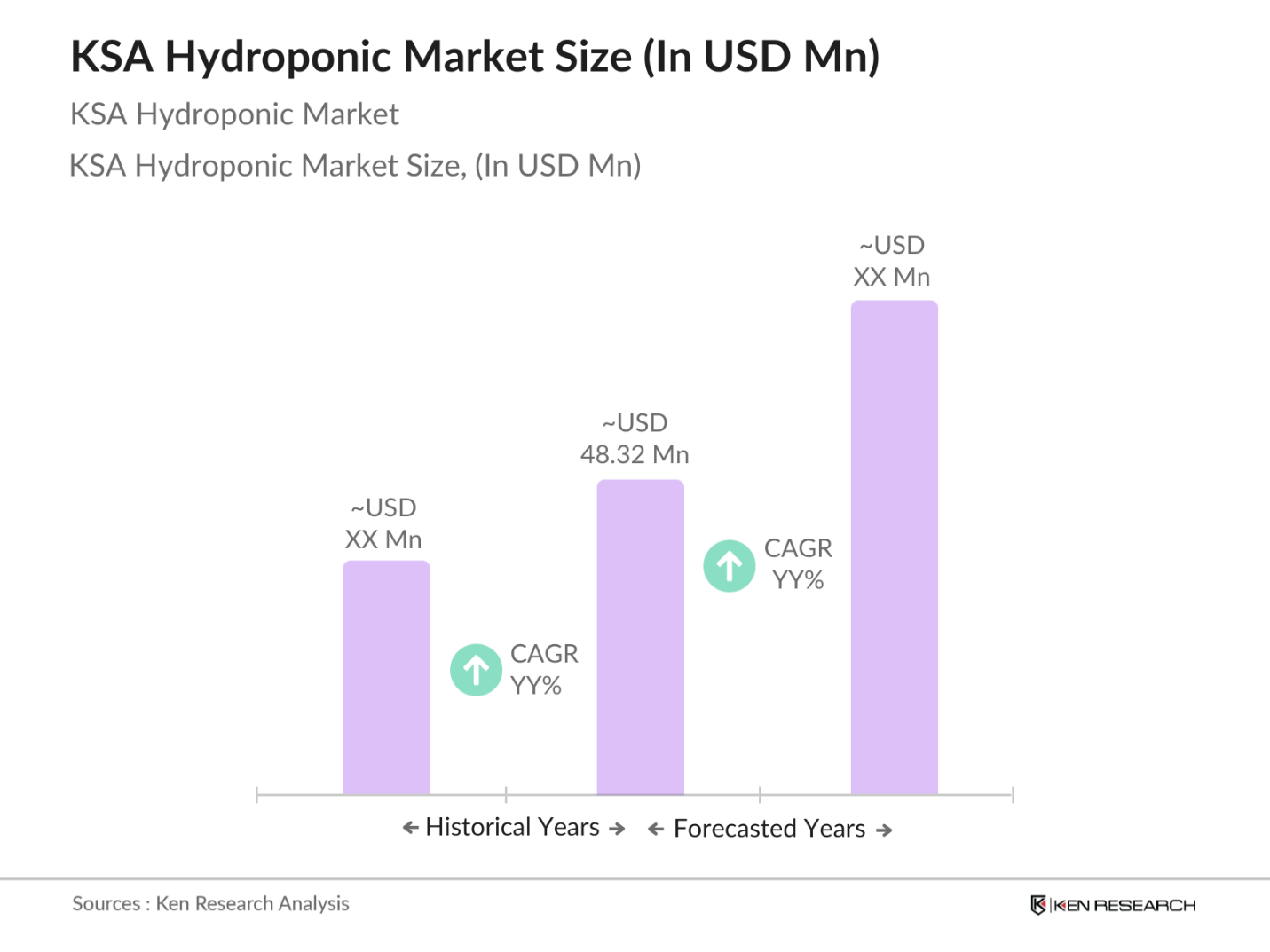

- The hydroponic market in the Kingdom of Saudi Arabia (KSA) is valued at approximately USD 48.32 million based on historical analysis. This growth is driven by the increasing adoption of hydroponic systems to address water scarcity in the region, supported by government-backed initiatives. The water-efficient nature of hydroponic farming plays a crucial role in its widespread implementation, particularly in a country where water conservation is vital for sustainable agricultural development.

- Riyadh and Jeddah dominate the KSA hydroponic market due to their strong agricultural infrastructure and government incentives that encourage the adoption of advanced farming technologies. Riyadh, in particular, benefits from proximity to research institutions and agribusinesses that have embraced hydroponic techniques as part of the regions food security strategy. Jeddah, on the other hand, has capitalized on commercial hydroponic farms that cater to a growing urban population, further solidifying its leadership in the market.

- In 2022, the Saudi government launched the National Food Security Strategy to boost domestic agricultural production. This policy includes SAR 3.5 billion in subsidies for hydroponic farming systems that enhance food security by producing locally grown crops. The policy aims to reduce the nations reliance on food imports, which currently exceed SAR 100 billion annually. By the end of 2023, approximately 1,000 hectares of farmland had transitioned to hydroponic methods under this initiative.

KSA Hydroponic Market Segmentation

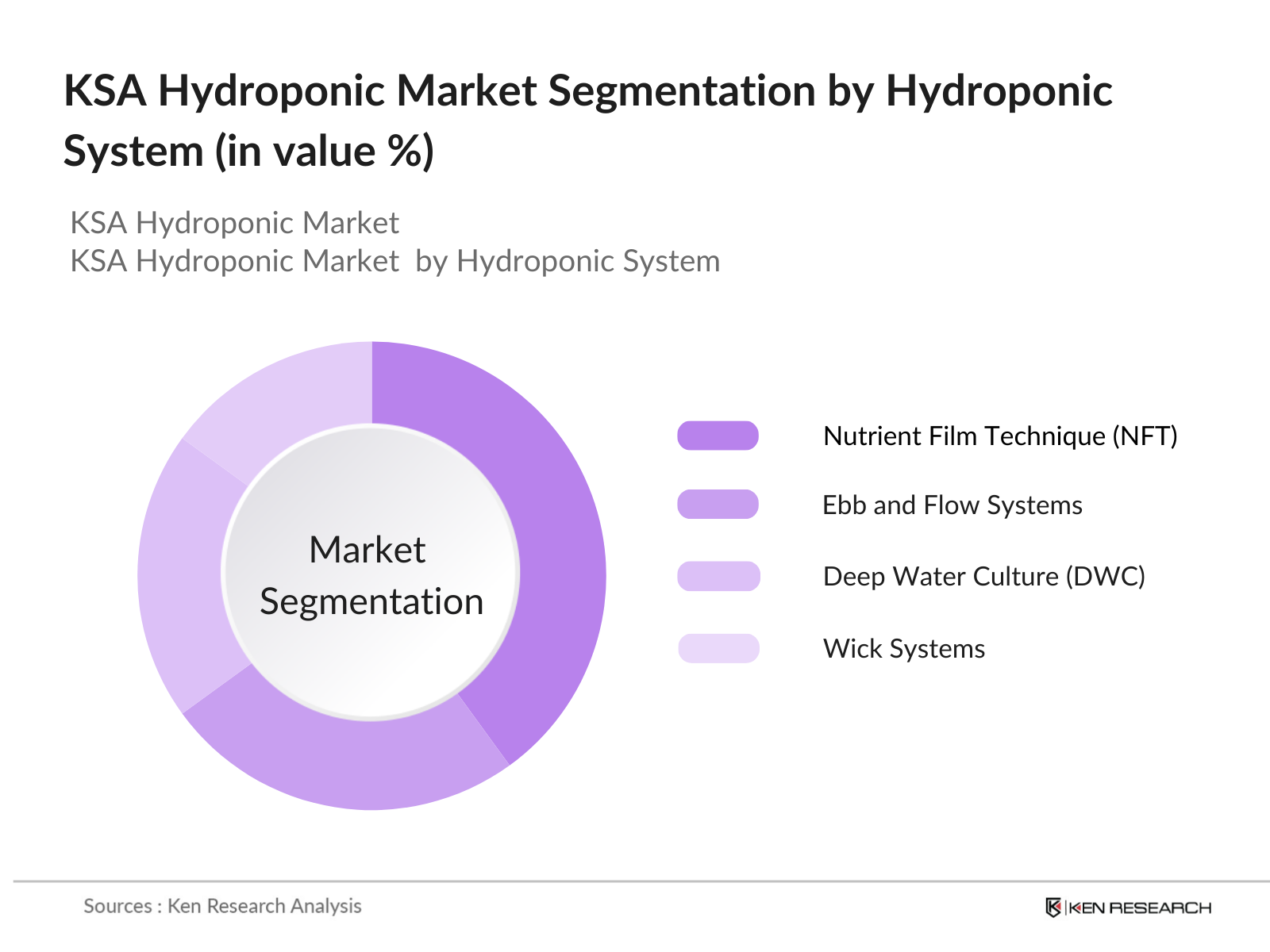

- By Hydroponic System: The KSA's hydroponic market is segmented by hydroponic systems into Wick Systems, Deep Water Culture (DWC), Nutrient Film Technique (NFT), and Ebb and Flow Systems. Among these, Nutrient Film Technique (NFT) dominates the market share due to its efficient nutrient usage and lower water consumption, which are particularly relevant in a region like Saudi Arabia where water conservation is paramount. The scalability and adaptability of NFT systems make them the preferred choice for commercial farming operations, further contributing to their prominence in the market.

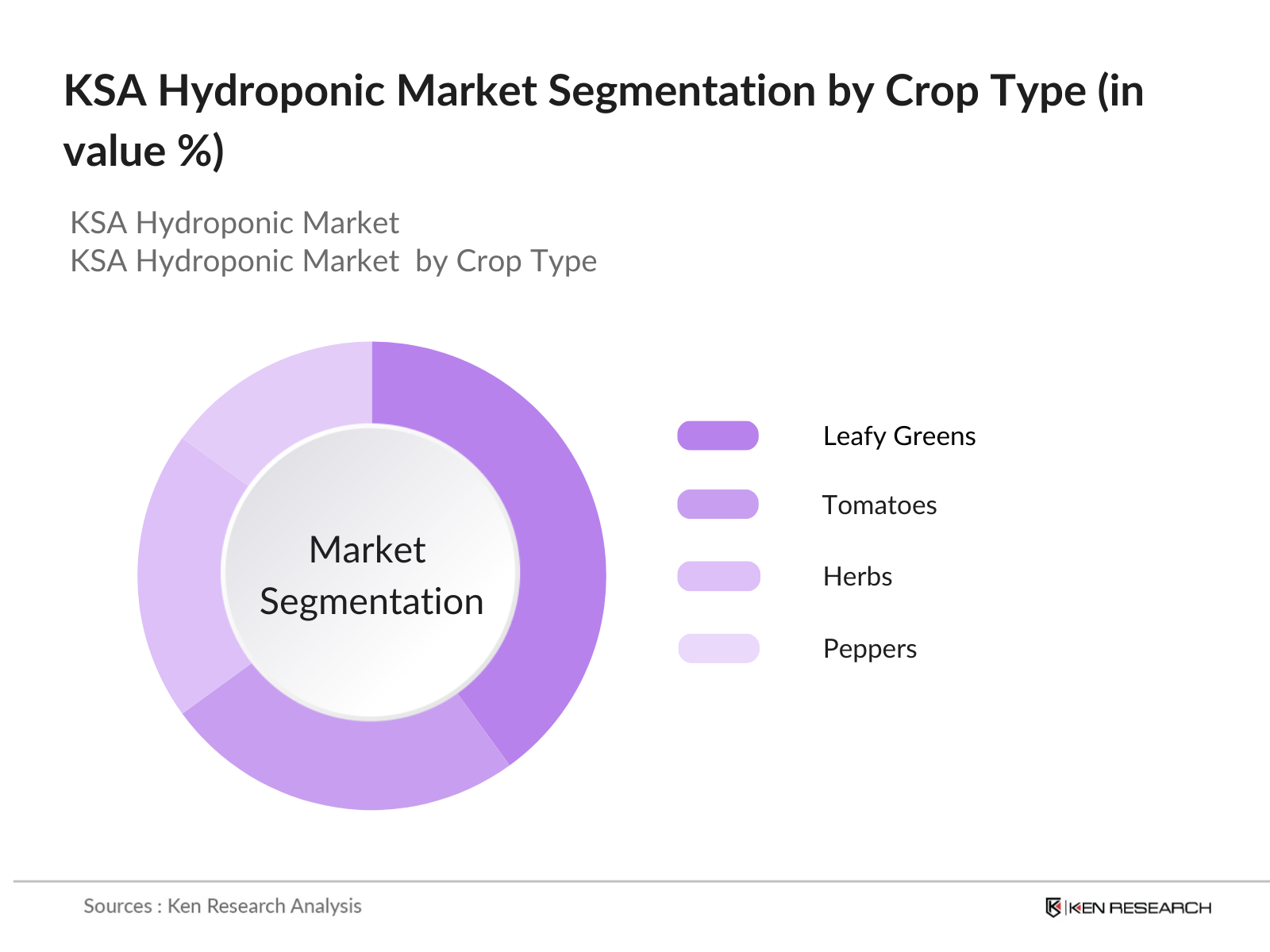

- By Crop Type: The hydroponic market in KSA is also segmented by crop types, which include Leafy Greens, Herbs, Tomatoes, and Peppers. Leafy Greens hold a dominant share in the market, primarily due to their shorter growth cycle and high demand from urban consumers seeking fresh, locally produced vegetables. The increasing consumer preference for healthier diets, combined with the suitability of hydroponics for leafy green production, has propelled this segment to the forefront of KSAs agricultural output.

KSA Hydroponic Market Competitive Landscape

KSA Hydroponic Market Competitive Landscape

The KSA hydroponic market is dominated by both local and international players who have established a strong presence through strategic investments and partnerships with the government. Companies such as Green Planet Farms and Saudi Agricultural Development Company have spearheaded the development of large-scale hydroponic systems across the region, contributing to the growth and consolidation of the market.

|

Company Name |

Established Year |

Headquarters |

Hydroponic Acreage |

No. of Hydroponic Units |

Energy Efficiency (kWh) |

Water Usage (m3) |

Technological Adoption |

Government Collaborations |

Yield Output (Kg/m2) |

|

Saudi Agricultural Development Co. |

1978 |

Riyadh |

- | - | - | - | - | - | - |

|

Green Planet Farms |

2005 |

Jeddah |

- | - | - | - | - | - | - |

|

Oasis Hydroponic Technologies |

2010 |

Mecca |

- | - | - | - | - | - | - |

|

Desert Hydroponics |

2013 |

Al-Khobar |

- | - | - | - | - | - | - |

|

Arabian Agri-Tech Solutions |

2009 |

Riyadh |

- | - | - | - | - | - | - |

KSA Hydroponic IndustryAnalysis

Market Growth Drivers

- Rising Food Security Concerns: Saudi Arabia currently imports a large portion of its food, creating a significant dependence on global markets. In 2023, disruptions in supply chains underscored the nations vulnerability to food shortages. Hydroponic farming has become a key strategic solution, offering substantially higher yields per square meter compared to traditional farming. The government is focusing on increasing domestic food production, with hydroponics playing a critical role in meeting this goal, helping to ensure a stable and reliable food supply while reducing reliance on imports.

- Favorable Government Policies (Subsidies, Infrastructure Investments): In 2022, the Saudi government established a $1.6 billion agricultural fund to provide subsidies and low-interest loans to support hydroponic farm operators. Significant infrastructure investments in desalination and smart irrigation systems have facilitated the expansion of hydroponic farming. By 2024, more than 500 hydroponic projects had been approved under government schemes, underscoring the Kingdom's commitment to modernizing its agricultural sector.

- Investment in Agri-Tech (Hydroponic Tech Partnerships): Private investments in agri-tech rose by $700 million between 2022, with a significant portion allocated to hydroponic technologies. Notably, partnerships between Saudi institutions and international tech firms have focused on improving hydroponic efficiency through automation, IoT integration, and AI-driven solutions. In 2023, a Saudi-Israeli collaboration aimed to enhance precision farming techniques, further establishing hydroponics as a technological leader in Saudi agriculture. These investments are critical in driving advancements in agri-tech and sustainable farming.

Market Challenges

- High Initial Setup Costs: The cost of establishing a 1-hectare hydroponic farm in Saudi Arabia can reach up to SAR 1.2 million, which remains a significant barrier to entry for many small-scale farmers. Despite government subsidies, high capital expenditure (CAPEX) for infrastructure, energy, and imported equipment pose challenges to wider adoption. Additionally, operational costs such as water desalination add to the financial burden, slowing down the expansion rate of hydroponics across the Kingdom.

- Limited Local Expertise in Hydroponics: By 2024, Saudi Arabia continues to rely heavily on foreign expertise for hydroponic farming operations. The lack of localized knowledge and trained personnel means that many operations depend on expensive foreign consultants, which increases the cost of running hydroponic farms. The government is actively addressing this challenge by funding vocational programs aimed at training locals, with over 10,000 participants enrolled in specialized agri-tech courses by 2024.

KSA Hydroponic Market Future Outlook

The KSA hydroponic market is poised for significant growth driven by advancements in hydroponic technology, government incentives, and the rising demand for sustainable food production. With increasing urbanization and limited arable land, hydroponic systems provide a viable solution for meeting food security goals in the kingdom.

Market Opportunities:

- Urban Hydroponic Farming Initiatives: Urban farming is on the rise in Saudi Arabia, particularly in major cities like Riyadh, where rooftop hydroponic farms have been installed on over 100 buildings by 2024. This initiative aims to promote sustainable food production in urban centers and reduce reliance on imported produce.

- Sustainable Agriculture Practices (Use of Solar Energy in Hydroponics): With Saudi Arabia producing 50 gigawatts of solar power annually as of 2024, integrating solar energy into hydroponic systems has become a key trend. Farms are increasingly using solar panels to power their operations, reducing dependency on fossil fuels. The government has allocated SAR 2 billion towards renewable energy in agriculture, which includes support for solar-powered hydroponic farms.

Scope of the Report

|

By Hydroponic System |

Wick Systems Deep Water Culture (DWC) Nutrient Film Technique (NFT) Ebb and Flow Systems |

|

By Crop Type |

Leafy Greens Herbs Tomatoes Peppers |

|

By Equipment Type |

Hydroponic Tanks Pumps & Irrigation Systems Grow Lights Control Systems |

|

By End-User |

Commercial Farms Research and Educational Institutions Urban Farming Projects Residential/Backyard Users |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Agricultural Investment Firms

Hydroponic Equipment Manufacturers

Large Commercial Farms

Urban Farming Initiatives

Government and Regulatory Bodies (Ministry of Environment, Water, and Agriculture, KSA)

Water Management Agencies

Private Equity Investors

Venture Capitalist Firms

Companies

Players Mentioned in the Market

Saudi Agricultural Development Company

Green Planet Farms

Oasis Hydroponic Technologies

Desert Hydroponics

Arabian Agri-Tech Solutions

National Aquaponics Company

Greentech Arabia

Saudi Greenhouse Co.

Global Hydroponic Supplies

King Saud Agricultural Ventures

Agrisera

Middle East Hydroponic Innovations

SmartGrow KSA

Saudi Green Farming Initiative

AgroTech Global KSA

Table of Contents

1. KSA Hydroponic Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Nutrient Delivery Systems, Growth Media, Hydroponic Setup Types)

1.3. Market Growth Rate (Adoption in Arid Climates, Water Conservation Needs)

1.4. Market Segmentation Overview

2. KSA Hydroponic Market Size (In SAR Bn)

2.1. Historical Market Size (Focus on Hydroponic Adoption by Major Agribusinesses)

2.2. Year-On-Year Growth Analysis (Government Subsidies, Technological Innovation)

2.3. Key Market Developments and Milestones (Saudi Vision 2030, Agri-Tech Investment Programs)

3. KSA Hydroponic Market Analysis

3.1. Growth Drivers

3.1.1. Water Efficiency Requirements

3.1.2. Rising Food Security Concerns

3.1.3. Favorable Government Policies (Subsidies, Infrastructure Investments)

3.1.4. Investment in Agri-Tech (Hydroponic Tech Partnerships)

3.2. Market Challenges

3.2.1. High Initial Setup Costs

3.2.2. Limited Local Expertise in Hydroponics

3.2.3. Supply Chain Dependencies (Nutrient and Growth Media Imports)

3.3. Opportunities

3.3.1. Expansion of Commercial Greenhouses

3.3.2. Vertical Farming Initiatives

3.3.3. Private Sector Participation in Food Production

3.4. Trends

3.4.1. IoT Integration in Hydroponic Systems

3.4.2. Urban Hydroponic Farming Initiatives

3.4.3. Sustainable Agriculture Practices (Use of Solar Energy in Hydroponics)

3.5. Government Regulations

3.5.1. Saudi Vision 2030 Initiatives

3.5.2. Food Security Policies

3.5.3. Water Conservation Mandates

3.5.4. Public-Private Partnerships (Hydroponic Farming Projects)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA Hydroponic Market Segmentation

4.1. By Type of Hydroponic System (In Value %)

4.1.1. Wick Systems

4.1.2. Deep Water Culture (DWC)

4.1.3. Nutrient Film Technique (NFT)

4.1.4. Ebb and Flow Systems

4.2. By Crop Type (In Value %)

4.2.1. Leafy Greens

4.2.2. Herbs

4.2.3. Tomatoes

4.2.4. Peppers

4.3. By Equipment Type (In Value %)

4.3.1. Hydroponic Tanks

4.3.2. Pumps & Irrigation Systems

4.3.3. Grow Lights

4.3.4. Control Systems (Automation, Monitoring)

4.4. By End-User (In Value %)

4.4.1. Commercial Farms

4.4.2. Research and Educational Institutions

4.4.3. Urban Farming Projects

4.4.4. Residential/Backyard Users

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Al-Khobar

4.5.4. Mecca

5. KSA Hydroponic Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Saudi Agricultural Development Company

5.1.2. Green Planet Farms

5.1.3. Desert Hydroponics

5.1.4. Arabian Agri-Tech Solutions

5.1.5. National Aquaponics Company

5.1.6. Oasis Hydroponic Technologies

5.1.7. Greentech Arabia

5.1.8. Saudi Greenhouse Co.

5.1.9. Agrisera

5.1.10. Global Hydroponic Supplies

5.1.11. King Saud Agricultural Ventures

5.1.12. AgroTech Global KSA

5.1.13. Middle East Hydroponic Innovations

5.1.14. SmartGrow KSA

5.1.15. Saudi Green Farming Initiative

5.2 Cross Comparison Parameters (Hydroponic Acreage, No. of Hydroponic Units, Energy Efficiency, Water Usage, Technological Adoption, Government Collaborations, Yield Output, Export Volume)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Hydroponic Market Regulatory Framework

6.1. Agricultural Regulations for Water Usage

6.2. Compliance with Sustainable Farming Standards

6.3. Nutrient and Growth Media Regulations

6.4. Certification for Organic Produce (KSA Standards)

7. KSA Hydroponic Future Market Size (In SAR Bn)

7.1. Future Market Size Projections (Driven by Government Investments)

7.2. Key Factors Driving Future Market Growth (Technological Innovations, Consumer Demand for Organic Produce)

8. KSA Hydroponic Future Market Segmentation

8.1. By Type of Hydroponic System (In Value %)

8.2. By Crop Type (In Value %)

8.3. By Equipment Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. KSA Hydroponic Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives (Targeting Arid Regions, Sustainability-Focused Marketing)

9.4. White Space Opportunity Analysis (Advanced Nutrient Systems, Vertical Farming)

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, we mapped the ecosystem of the KSA hydroponic market by identifying all major stakeholders, including equipment manufacturers, commercial farms, and regulatory bodies. Through extensive secondary research, proprietary databases were leveraged to extract comprehensive industry insights, allowing us to identify key variables driving the market.

Step 2: Market Analysis and Construction

This step involved compiling historical data on hydroponic system adoption, evaluating market penetration rates, and determining the financial health of key market players. We analyzed data on the number of hydroponic farms in KSA, irrigation techniques, and the corresponding revenue to construct a reliable market model.

Step 3: Hypothesis Validation and Expert Consultation

To validate the hypotheses formed during desk research, consultations were conducted with industry experts, including representatives from major hydroponic farms and agribusinesses. These interviews provided invaluable insights into operational and strategic challenges, refining our market data.

Step 4: Research Synthesis and Final Output

The final phase synthesized data from hydroponic suppliers and farmers to corroborate market estimates and trends. This allowed us to produce a comprehensive, data-backed report that accurately represents the dynamics of the KSA hydroponic market.

Frequently Asked Questions

01. How big is the KSA Hydroponic Market?

The KSA hydroponic market is valued at USD 48.32 million, driven by the need for sustainable agriculture and water-efficient farming techniques, especially in arid regions of the kingdom.

02. What are the challenges in the KSA Hydroponic Market?

Challenges include the high initial setup costs for hydroponic systems, limited local expertise in hydroponic farming, and dependence on imported nutrients and growth media.

03. Who are the major players in the KSA Hydroponic Market?

Key players in the market include Saudi Agricultural Development Company, Green Planet Farms, and Oasis Hydroponic Technologies, which have established themselves through strong partnerships and technological innovation.

04. What are the growth drivers of the KSA Hydroponic Market?

The market is driven by factors such as government support, the growing demand for food security, and the efficiency of hydroponic systems in conserving water.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.