KSA In Vitro Fertilization (IVF) Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD8678

November 2024

82

About the Report

KSA In Vitro Fertilization (IVF) Market Overview

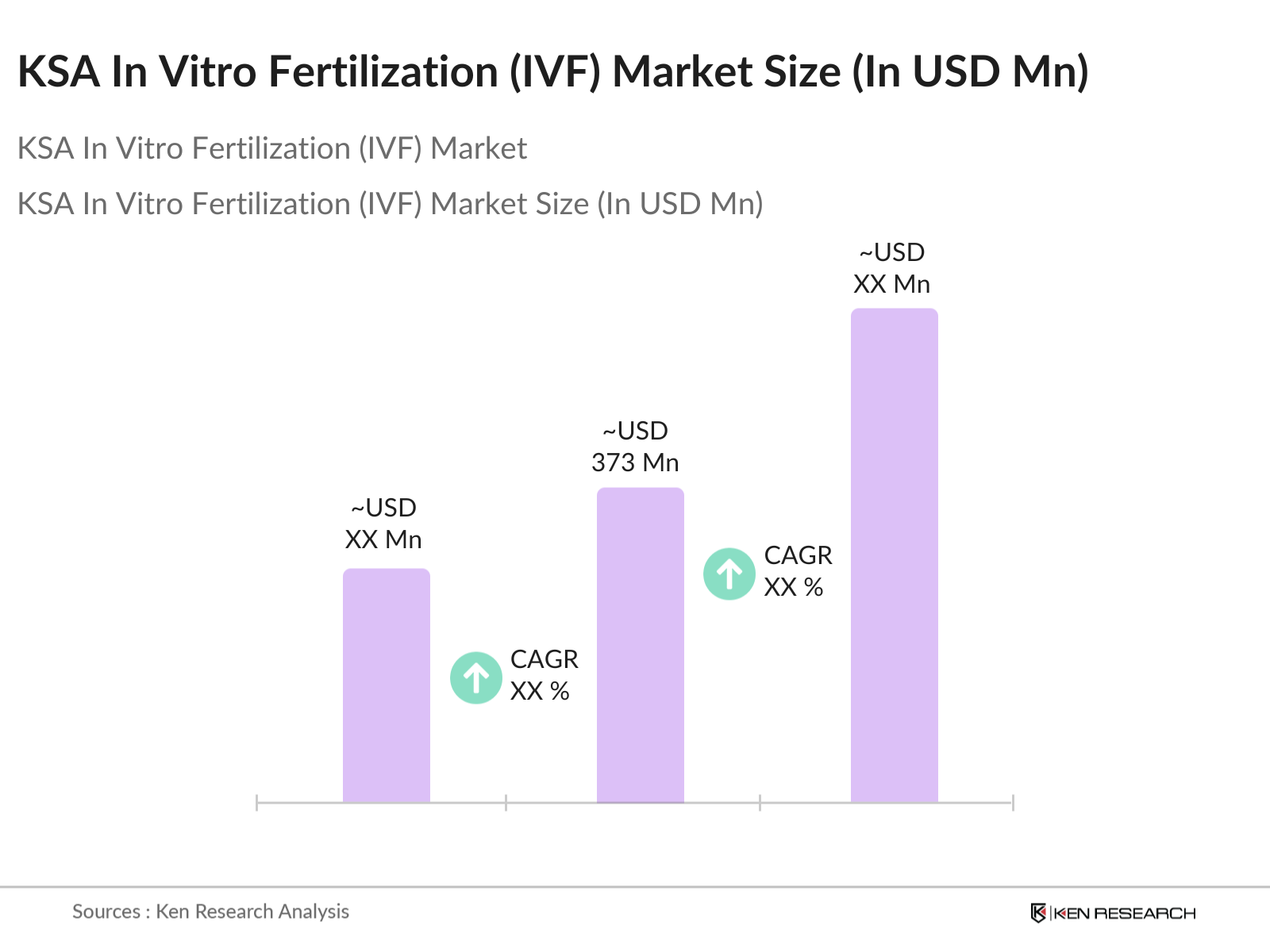

- The Saudi Arabia In Vitro Fertilization (IVF) market is valued at USD 373 million, based on a five-year historical analysis. This growth is primarily driven by the rising incidence of infertility among couples, advancements in reproductive technologies, and increased societal acceptance of assisted reproductive techniques. The government's supportive policies and investments in healthcare infrastructure further bolster the market's expansion.

- Major cities such as Riyadh, Jeddah, and Dammam dominate the IVF market in Saudi Arabia. This dominance is attributed to the concentration of specialized fertility clinics, advanced medical facilities, and a higher awareness of reproductive health services in these urban centers. Additionally, the affluent population in these cities is more inclined to seek advanced fertility treatments, contributing to the market's growth.

- Governments globally are emphasizing stricter licensing and accreditation standards for fertility clinics to ensure safety and quality. For instance, in the UK, the Human Fertilisation and Embryology Authority (HFEA) inspects and licenses clinics, leading to safer, more regulated operations. Similar regulatory frameworks are in place across Europe, with the EU ensuring consistent standards to protect patient health.

KSA In Vitro Fertilization (IVF) Market Segmentation

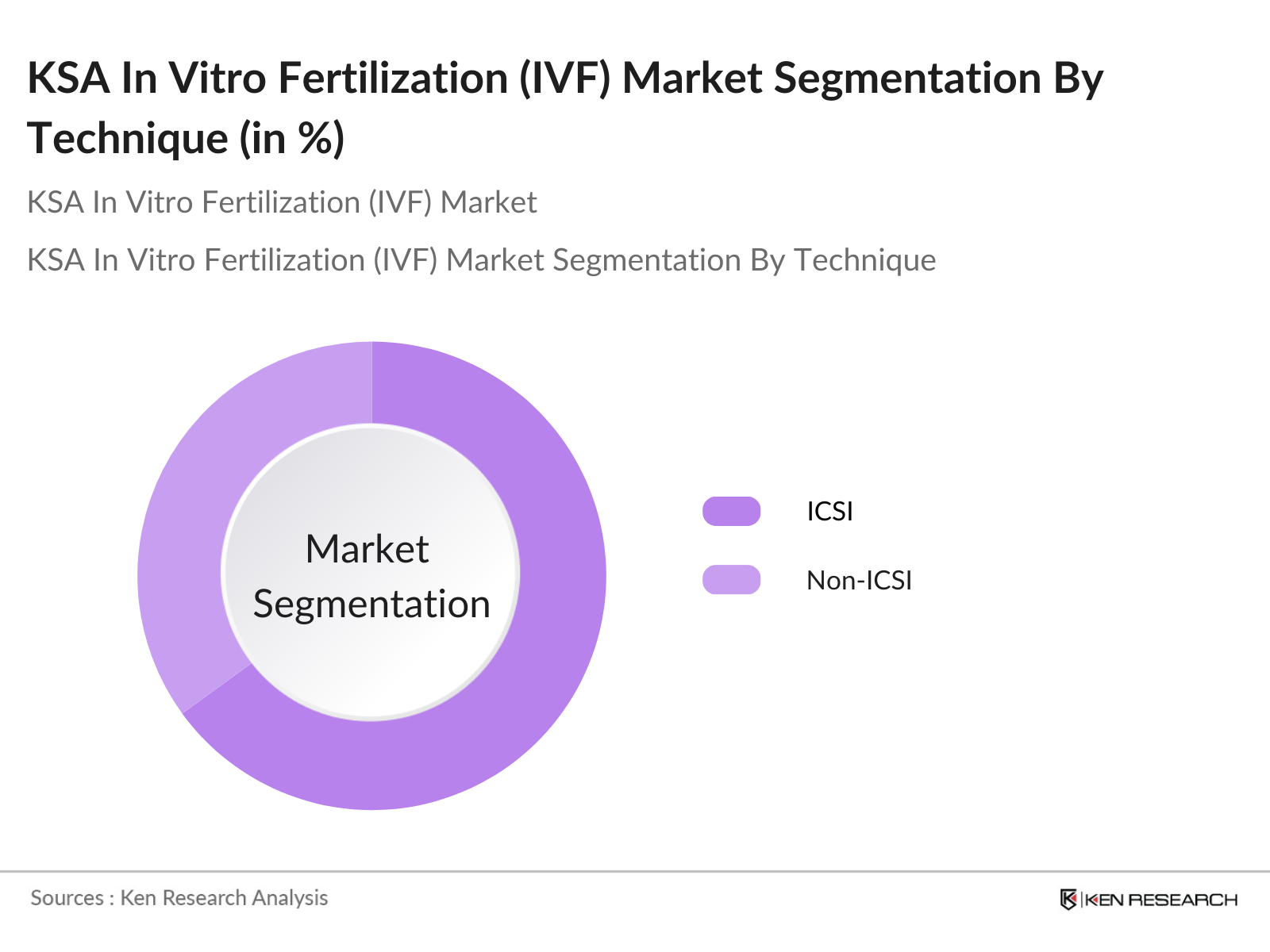

By Technique: The market is segmented by technique into Intracytoplasmic Sperm Injection (ICSI) and Non-ICSI IVF. ICSI has a dominant market share in Saudi Arabia under the technique segmentation. This is due to its higher success rates, especially in cases of male infertility, and its widespread adoption in fertility clinics across the country. The precision and effectiveness of ICSI make it a preferred choice among couples seeking assisted reproductive treatments.

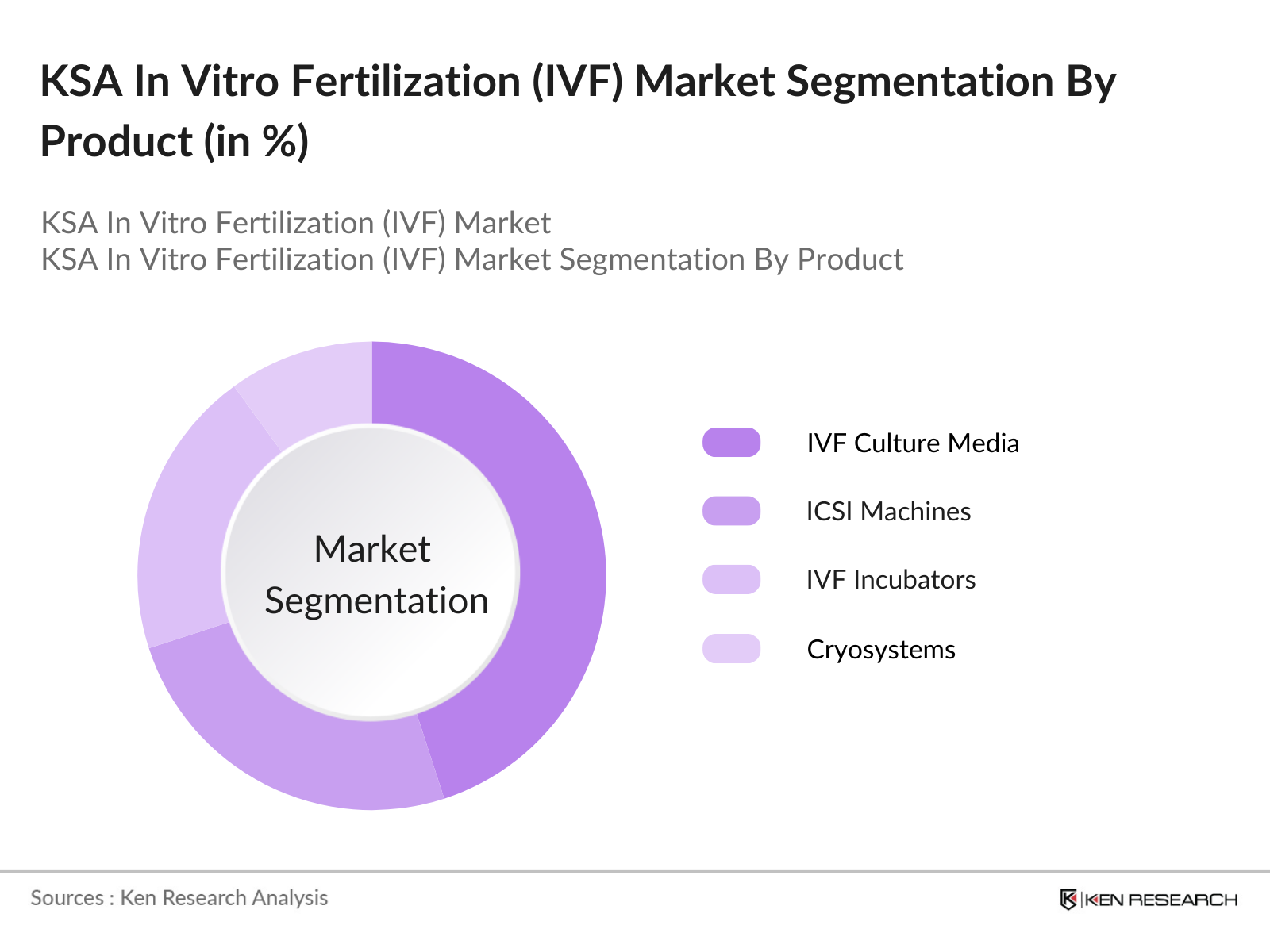

By Product: The market is further segmented by product into IVF Culture Media, ICSI Machines, IVF Incubators, Cryosystems, and Others. IVF Culture Media holds the largest market share in this segment. This is because culture media are essential for embryo development and significantly influence the success rates of IVF procedures. Continuous advancements and innovations in culture media formulations have enhanced embryo viability, leading to their predominant use in fertility clinics.

KSA In Vitro Fertilization (IVF) Market Competitive Landscape

The Saudi Arabia IVF market is characterized by the presence of several key players who contribute significantly to the industry's growth. These companies offer a range of services and products, leveraging advanced technologies to enhance treatment outcomes.

KSA In Vitro Fertilization (IVF) Industry Analysis

Growth Drivers

- Rising Infertility Rates: Infertility is an escalating issue worldwide, significantly impacting demand for assisted reproductive technologies. According to the World Health Organization (WHO), over 48 million couples worldwide experience infertility, driven by lifestyle changes, environmental factors, and delayed parenthood trends. Countries with high industrial growth, such as India and China, report an increase in infertility rates, particularly among urban populations. In India, studies by the Indian Council of Medical Research indicate approximately 10 million couples suffer from infertility annually.

- Technological Advancements in Reproductive Medicine: Reproductive technology has seen transformative advancements in embryo culturing, gene editing, and laboratory automation. The integration of CRISPR gene-editing technology, for instance, promises safer genetic interventions, minimizing hereditary disease transmission. According to NIH reports, advanced procedures like cryopreservation have contributed to a 15-20% increase in successful IVF treatments.

- Increasing Awareness and Acceptance of IVF: Awareness campaigns and normalization of fertility treatments have contributed to a growing acceptance of IVF globally. Social and online media campaigns in countries such as the United States have led to a 30% rise in IVF-related inquiries, as per the CDCs latest survey data. Cultural shifts in regions with previously low acceptance, like Southeast Asia and the Middle East, are also on the rise, encouraging more couples to consider these treatments as viable family planning options.

Market Challenges

- High Treatment Costs: Despite advancements, IVF remains a costly procedure, with limited affordability in regions lacking government insurance coverage. For example, the United States reports IVF cycle costs exceeding $12,000 per cycle, according to the CDC, creating a financial barrier for many. In Europe, costs vary widely, but high expenses remain a significant deterrent, particularly in countries with limited public healthcare support. These price barriers hinder market growth by limiting access to a select population segment.

- Cultural and Religious Considerations: Cultural and religious beliefs in certain regions affect the adoption of IVF and other assisted reproductive technologies. According to a report by the Pew Research Center, over 25% of surveyed populations in Middle Eastern countries express ethical concerns over IVF, limiting its adoption. Cultural sensitivity around infertility treatments is also seen in parts of Africa and South Asia, restricting market expansion due to socio-religious opposition.

KSA In Vitro Fertilization (IVF) Market Future Outlook

Over the next five years, the Saudi Arabia IVF market is expected to show significant growth driven by continuous government support, advancements in reproductive technologies, and increasing societal acceptance of assisted reproductive techniques. The expansion of specialized fertility clinics and the integration of cutting-edge technologies are anticipated to enhance treatment outcomes and accessibility.

Market Opportunities

- Expansion of Fertility Clinics: With increasing demand for IVF, the expansion of fertility clinics in underserved areas presents substantial growth opportunities. Countries like China plan to build over 100 fertility centers in the next few years, addressing their national fertility decline. Similarly, emerging economies in Southeast Asia are investing in medical infrastructure to support fertility care, catering to rising infertility rates. Expanding access in untapped regions is likely to enhance service reach and market penetration.

- Medical Tourism: Medical tourism is a booming opportunity in the fertility market, with countries like Thailand, Turkey, and Mexico becoming hubs for affordable IVF treatments. According to the World Bank, Thailand has witnessed a 25% rise in foreign patients seeking IVF services due to its competitive pricing and advanced facilities. This trend has made fertility tourism an appealing option for patients from high-cost countries, such as the US, where local treatment costs are prohibitive.

Scope of the Report

|

Technique |

Intracytoplasmic Sperm Injection (ICSI) |

|

Product |

IVF Culture Media |

|

End-User |

Fertility Clinics |

|

Infertility Type |

Male Infertility |

|

Region |

Central Region Western Region Eastern Region Southern Region |

Products

Key Target Audience

Fertility Clinics and Hospitals

Medical Device Manufacturers

Pharmaceutical Companies

Healthcare Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority)

Medical Research Institutes

Health Insurance Providers

Medical Tourism Agencies

Companies

Players Mentioned in the Report

Dr. Sulaiman Al Habib Medical Group

HealthPlus Fertility Center

Dr. Samir Abbas Medical Centers

Saad Specialist Hospital

King Faisal Specialist Hospital

Dr. Khalid Idriss Hospital

Al Manaa General Hospital

Thuriah Medical Center

Bnoon Medical Center

Al Hada Military Hospital

Table of Contents

1. Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Market Analysis

3.1. Growth Drivers

3.1.1. Rising Infertility Rates

3.1.2. Technological Advancements in Reproductive Medicine

3.1.3. Government Initiatives and Support

3.1.4. Increasing Awareness and Acceptance of IVF

3.2. Market Challenges

3.2.1. High Treatment Costs

3.2.2. Cultural and Religious Considerations

3.2.3. Limited Access in Rural Areas

3.3. Opportunities

3.3.1. Expansion of Fertility Clinics

3.3.2. Medical Tourism

3.3.3. Research and Development in Assisted Reproductive Technologies

3.4. Trends

3.4.1. Adoption of Preimplantation Genetic Testing (PGT)

3.4.2. Integration of Artificial Intelligence in IVF Procedures

3.4.3. Growth of Egg and Sperm Freezing Services

3.5. Government Regulations

3.5.1. Licensing and Accreditation of Fertility Clinics

3.5.2. Ethical Guidelines for Assisted Reproductive Technologies

3.5.3. Insurance Coverage Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Market Segmentation

4.1. By Technique (In Value %)

4.1.1. Intracytoplasmic Sperm Injection (ICSI)

4.1.2. Non-ICSI IVF

4.2. By Product (In Value %)

4.2.1. IVF Culture Media

4.2.2. ICSI Machines

4.2.3. IVF Incubators

4.2.4. Cryosystems

4.2.5. Others

4.3. By End-User (In Value %)

4.3.1. Fertility Clinics

4.3.2. Hospitals

4.3.3. Others

4.4. By Infertility Type (In Value %)

4.4.1. Male Infertility

4.4.2. Female Infertility

4.4.3. Combined Infertility

4.5. By Region (In Value %)

4.5.1. Central Region

4.5.2. Western Region

4.5.3. Eastern Region

4.5.4. Southern Region

5. Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dr. Sulaiman Alhabib Medical Group

5.1.2. HealthPlus Fertility & Women's Health Center

5.1.3. Dr. Samir Abbas Medical Centers

5.1.4. Dr. Khalid Idriss Hospital

5.1.5. KKUH-Assisted Conception Unit

5.1.6. King Faisal Specialist Hospital

5.1.7. Saad Hospital IVF Center

5.1.8. Al Manaa General Hospital

5.1.9. Thuriah Medical Center

5.1.10. Bnoon Medical Center

5.1.11. Al Hada Military Hospital

5.1.12. Al Hammadi Hospital

5.1.13. Al Noor Specialist Hospital

5.1.14. Al Safa Hospital

5.1.15. Al Yamamah Hospital

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Number of IVF Cycles Performed Annually, Success Rates, Range of Services Offered, Technological Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Regulatory Framework

6.1. National Health Regulations

6.2. Compliance Requirements

6.3. Certification Processes

7. Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1. By Technique (In Value %)

8.2. By Product (In Value %)

8.3. By End-User (In Value %)

8.4. By Infertility Type (In Value %)

8.5. By Region (In Value %)

9. Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabia IVF Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Saudi Arabia IVF Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple IVF clinics and industry experts to acquire detailed insights into product segments, clinical outcomes, and patient preferences. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabia IVF market.

Frequently Asked Questions

01 How big is the Saudi Arabia IVF Market?

The Saudi Arabia In Vitro Fertilization (IVF) market is valued at USD 373 million, based on a five-year historical analysis. This growth is primarily driven by the rising incidence of infertility among couples, advancements in reproductive technologies, and increased societal acceptance of assisted reproductive techniques.

02 What are the challenges in the Saudi Arabia IVF Market?

Challenges include high treatment costs, limited access to advanced fertility treatments in rural areas, and cultural and religious considerations that can affect the perception and acceptance of assisted reproductive methods.

03 Who are the major players in the Saudi Arabia IVF Market?

Key players in the market include Dr. Sulaiman Al Habib Medical Group, HealthPlus Fertility Center, Dr. Samir Abbas Medical Centers, Saad Specialist Hospital, and King Faisal Specialist Hospital, all known for their advanced IVF facilities and high success rates.

04 What drives growth in the Saudi Arabia IVF Market?

The market is propelled by factors such as rising infertility rates, government initiatives supporting fertility treatments, advancements in IVF technologies, and increasing societal acceptance of assisted reproductive techniques.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.