KSA Industrial Gases Market Outlook to 2030

Region:Middle East

Author(s):Sanjna

Product Code:KROD3831

November 2024

81

About the Report

KSA Industrial Gases Market Overview

- The KSA industrial gases market is valued at USD 1.5 billion, primarily driven by the booming oil & gas, chemical, and manufacturing sectors. The growing demand for gases like hydrogen, oxygen, nitrogen, and carbon dioxide for various industrial applications, including petroleum refining and chemical production, is a key factor. The government's infrastructure projects such as NEOM and Vision 2030 also significantly contribute to the market expansion as these initiatives demand high volumes of industrial gases for construction and industrial applications.

- The dominance of cities like Riyadh, Jeddah, and Dammam in the industrial gases market can be attributed to their well-developed industrial base and close proximity to major oil and gas fields. These cities serve as hubs for petrochemical and manufacturing industries, which require a substantial amount of industrial gases for operations. Additionally, these regions are key points of distribution for large industrial projects linked to Vision 2030.

- Saudi Arabia's Vision 2030 aims to transform the Kingdoms economy, with over $1 trillion invested in various infrastructure projects. These initiatives are fueling the demand for industrial gases in sectors like construction, energy, and healthcare. NEOM, a $500 billion smart city, and the Red Sea Project are key drivers of this demand, as they require substantial volumes of gases like oxygen and nitrogen for construction and development activities. These projects are pivotal to the Kingdom's long-term economic diversification strategy.

KSA Industrial Gases Market Segmentation

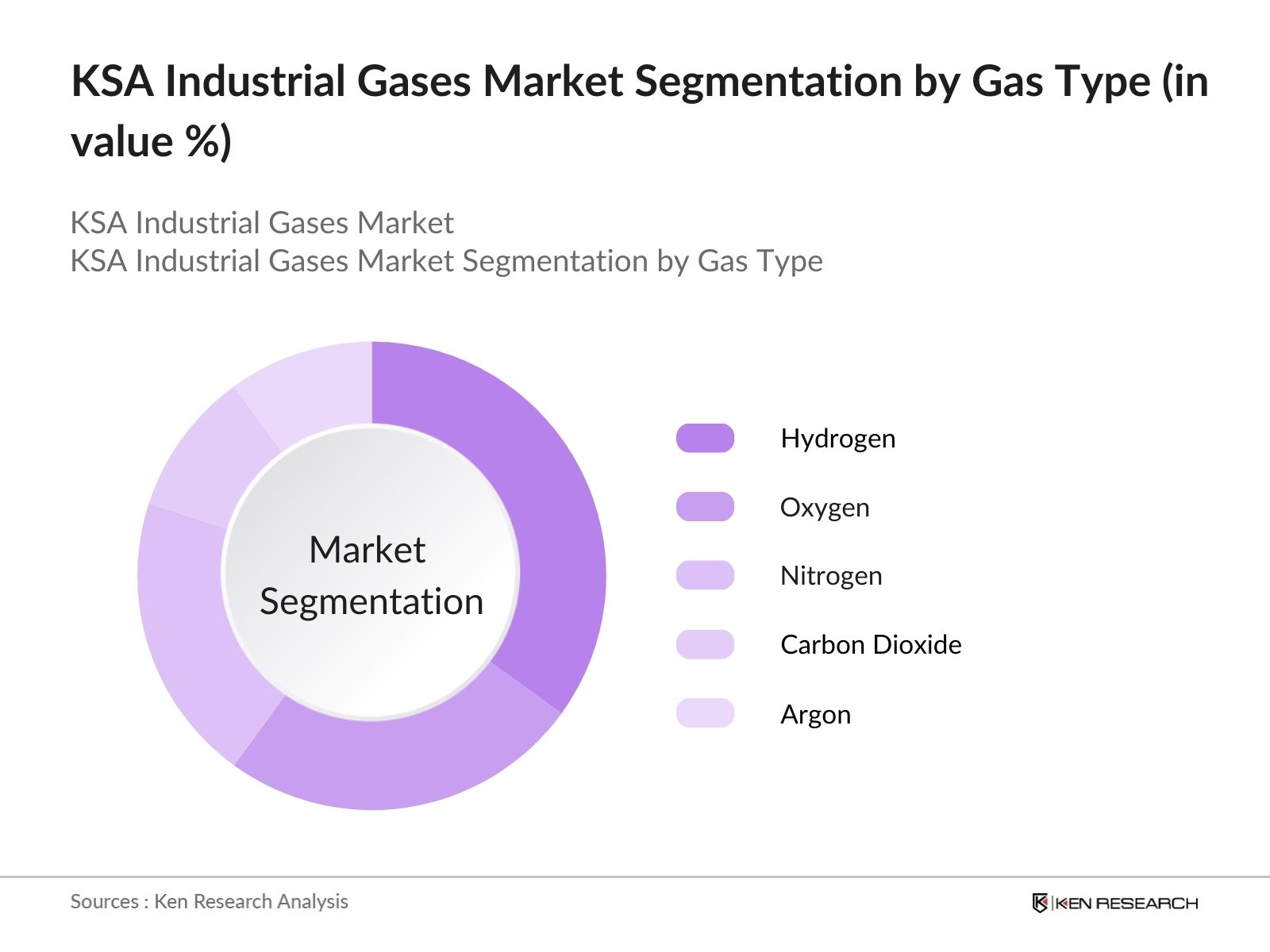

By Gas Type: The KSA industrial gases market is segmented by gas type into oxygen, nitrogen, hydrogen, carbon dioxide, and argon. Hydrogen is the dominant segment, largely due to its increasing usage in petroleum refining and chemical manufacturing. As hydrogen plays a crucial role in desulfurization and is central to the emerging clean energy initiatives in the country, the demand for this gas has surged.

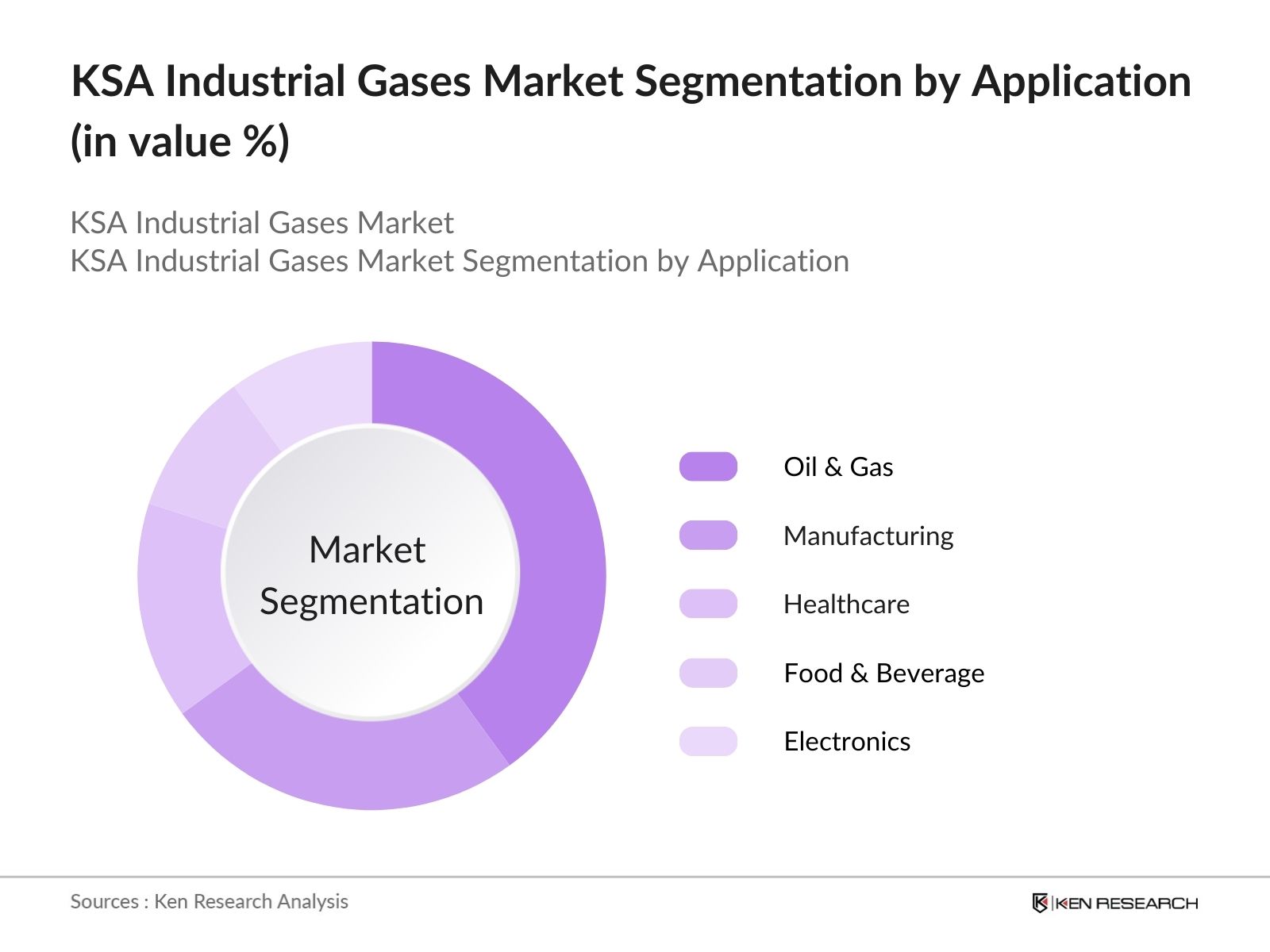

By Application: The market is segmented by application into healthcare, manufacturing, oil & gas, food & beverage, and electronics. Oil & gas applications dominate the market, primarily due to the continuous demand for industrial gases such as nitrogen for enhanced oil recovery and hydrogen for refinery operations. KSA, being one of the world's largest oil producers, has an extensive network of refineries and petrochemical plants that require a steady supply of industrial gases, making this segment the largest consumer of industrial gases in the country.

KSA Industrial Gases Market Competitive Landscape

The KSA industrial gases market is dominated by several major players who have established strong operational bases in the region. The competitive landscape is shaped by both local companies and global giants in the industrial gases sector. Companies like Air Liquide Saudi Arabia and National Industrial Gases Company (GASCO) have significant market share due to their extensive distribution networks and long-standing relationships with local industries. Foreign companies like Air Products and Linde have gained a foothold through strategic partnerships and by providing cutting-edge technology for gas production.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Employees |

Geographic Reach |

Product Portfolio |

R&D Initiatives |

Strategic Initiatives |

|

Air Liquide Saudi Arabia |

1902 |

Riyadh |

- |

- |

- |

- |

- |

- |

|

National Industrial Gases Company |

1983 |

Jubail |

- |

- |

- |

- |

- |

- |

|

Linde Saudi Arabia |

1879 |

Jeddah |

- |

- |

- |

- |

- |

- |

|

Air Products |

1940 |

Dammam |

- |

- |

- |

- |

- |

- |

|

Gulf Cryo |

1953 |

Khobar |

- |

- |

- |

- |

- |

- |

KSA Industrial Gases Market Analysis

Growth Drivers

- Expanding Petrochemical Industry: The Kingdom of Saudi Arabia (KSA) is one of the world's largest producers of petrochemicals, driven by a robust industrial infrastructure. In 2023, KSAs petrochemical production reached 118 million metric tons, supported by abundant raw material availability such as natural gas. This surge in production has increased the demand for industrial gases like oxygen and nitrogen for various processes, including cracking and polymerization.

- Increasing Demand for Healthcare Applications: In 2023, Saudi Arabia's healthcare sector saw significant growth, with over 520 hospitals across the Kingdom, increasing the demand for medical gases like oxygen, nitrous oxide, and helium. The Saudi government allocated$50.4 billionto healthcare and social development in 2023, constituting about16.96%of its total budget.With the growing population, projected to surpass 35 million in 2024, and increasing incidences of respiratory diseases, the demand for medical gases is on a sharp rise in both public and private hospitals.

- Rising Investments in Industrial Infrastructure: The Saudi government's ambitious NEOM city project and Vision 2030 plan have triggered massive investments in industrial infrastructure. In 2023, the Kingdom allocated over $300 billion to industrial development, which has directly boosted the demand for industrial gases used in construction, welding, and fabrication processes. Projects such as the Red Sea Development and the King Salman Energy Park (SPARK) are expected to significantly enhance the requirement for gases like argon, acetylene, and helium for cutting, welding, and energy production. These investments are a cornerstone in KSAs industrial sector expansion.

Challenges

- Stringent Environmental Regulations: Saudi Arabias commitment to the Paris Agreement has led to more stringent environmental regulations regarding CO2 emissions. In 2023, the Saudi government enforced new limits on industrial carbon emissions, impacting the production of industrial gases like nitrogen and hydrogen, which involve high levels of CO2 generation. Many companies are investing in carbon capture technologies, but the high capital expenditure required remains a significant hurdle.

- Supply Chain Disruptions: Global supply chain disruptions caused by geopolitical tensions and the COVID-19 pandemic have impacted the availability of raw materials required for industrial gas production, including oxygen and nitrogen. In 2022, delays in shipments of critical materials led to production slowdowns in KSAs gas sector, with some suppliers reporting delays of up to 45 days. While the situation improved slightly in 2023, the ongoing instability in international logistics poses a risk to the steady supply of essential inputs, potentially affecting the operational capabilities of local gas manufacturers.

KSA Industrial Gases Market Future Outlook

Over the next five years, the KSA industrial gases market is expected to witness substantial growth. This growth will be driven by continuous investments in large-scale industrial projects under Vision 2030, particularly in hydrogen production and green energy initiatives. The government's focus on sustainable industrial practices and carbon capture technologies is likely to create new opportunities for companies involved in the industrial gases sector. Moreover, the rising demand for medical gases in healthcare and increasing applications in food processing will contribute to market expansion.

Market Opportunities

- Green Hydrogen Initiatives: Saudi Arabia's green hydrogen initiatives are creating significant opportunities in the industrial gases market. The UK government has set an ambitious target to achieve up to 10 GW of low-carbon hydrogen production capacity by 2030, with at least half of this capacity expected to come from green hydrogen. These initiatives are focused on establishing a hydrogen economy in KSA, with the NEOM project playing a central role in hydrogen production.

- Expansion in Untapped Industrial Sectors: Saudi Arabia's industrial gases market is set to expand into new sectors, including chemical manufacturing and oil & gas processing. These sectors require large volumes of gases like nitrogen for blanketing and oxygen for chemical oxidation. The expansion of these industries presents significant growth opportunities for gas suppliers, who are increasingly focusing on tailored solutions for these high-demand sectors.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Gas Type |

Oxygen |

|

Nitrogen |

|

|

Hydrogen |

|

|

Carbon Dioxide |

|

|

Argon |

|

|

By Application |

Healthcare |

|

Manufacturing |

|

|

Oil & Gas |

|

|

Food & Beverage |

|

|

Electronics |

|

|

By End-User Industry |

Oil Refining |

|

Chemical Manufacturing |

|

|

Power Generation |

|

|

Metallurgy |

|

|

Automotive |

|

|

By Distribution Mode |

Pipeline Supply |

|

Bulk Supply |

|

|

Cylinder Supply |

|

|

By Region |

Riyadh |

|

Jeddah |

|

|

Dammam |

|

|

Eastern Province |

|

|

Other Regions |

Products

Key Target Audience

Petrochemical Companies

Oil Refining Industries

Power Generation Companies

Food & Beverage Processing Firms

Healthcare Providers

Electronics Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Ministry of Industry and Mineral Resources)

Companies

Major Players

Air Liquide Saudi Arabia

Linde Saudi Arabia

National Industrial Gases Company (GASCO)

Air Products

Gulf Cryo

Messer Group

Buzwair Gases

Saudi Basic Industries Corporation (SABIC)

Emirates Industrial Gases Co.

Praxair Saudi Arabia

Abdullah Hashim Industrial Gases & Equipment Co.

Advanced Petrochemical Company

Arabian Industrial Gases Company

Dubai Industrial Gases

Matheson Tri-Gas

Table of Contents

1. KSA Industrial Gases Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Industrial Gases Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Industrial Gases Market Analysis

3.1. Growth Drivers

3.1.1. Expanding Petrochemical Industry (petrochemical production demand)

3.1.2. Increasing Demand for Healthcare Applications (medical gases usage in hospitals and healthcare facilities)

3.1.3. Rising Investments in Industrial Infrastructure (project-specific demand such as NEOM and Vision 2030)

3.1.4. Increasing Demand for Clean Energy (hydrogen production and CO2 capture)

3.2. Market Challenges

3.2.1. High Production Costs (energy-intensive production processes)

3.2.2. Stringent Environmental Regulations (compliance with CO2 emissions and green technologies)

3.2.3. Supply Chain Disruptions (fluctuations in raw material availability)

3.3. Opportunities

3.3.1. Technological Advancements (cryogenic technologies, energy-efficient production)

3.3.2. Green Hydrogen Initiatives (development of hydrogen economy in KSA)

3.3.3. Expansion in Untapped Industrial Sectors (oil & gas, chemical manufacturing)

3.4. Trends

3.4.1. Increasing Use of Industrial Gases in Oil Refining (CO2 for enhanced oil recovery, nitrogen blanketing)

3.4.2. Growth in Food & Beverage Processing (nitrogen and carbon dioxide for preservation)

3.4.3. Adoption of On-Site Gas Generation (cost savings for manufacturers)

3.5. Government Regulations

3.5.1. Vision 2030 Infrastructure Projects (increased gas demand)

3.5.2. National Environmental Protection Standards (low-carbon industrial gas production)

3.5.3. Public-Private Partnerships in Industrial Sectors

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Industrial Gases Market Segmentation

4.1. By Gas Type (In Value %)

4.1.1. Oxygen

4.1.2. Nitrogen

4.1.3. Hydrogen

4.1.4. Carbon Dioxide

4.1.5. Argon

4.2. By Application (In Value %)

4.2.1. Healthcare

4.2.2. Manufacturing

4.2.3. Oil & Gas

4.2.4. Food & Beverage

4.2.5. Electronics

4.3. By End-User Industry (In Value %)

4.3.1. Oil Refining

4.3.2. Chemical Manufacturing

4.3.3. Power Generation

4.3.4. Metallurgy

4.3.5. Automotive

4.4. By Distribution Mode (In Value %)

4.4.1. Pipeline Supply

4.4.2. Bulk Supply

4.4.3. Cylinder Supply

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Eastern Province

4.5.5. Other Regions

5. KSA Industrial Gases Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Air Liquide Saudi Arabia

5.1.2. Linde Saudi Arabia

5.1.3. National Industrial Gases Company (GASCO)

5.1.4. Air Products

5.1.5. Gulf Cryo

5.1.6. Messer Group

5.1.7. Buzwair Gases

5.1.8. Saudi Basic Industries Corporation (SABIC)

5.1.9. Emirates Industrial Gases Co.

5.1.10. Praxair Saudi Arabia

5.1.11. Abdullah Hashim Industrial Gases & Equipment Co.

5.1.12. Advanced Petrochemical Company

5.1.13. Arabian Industrial Gases Company

5.1.14. Dubai Industrial Gases

5.1.15. Matheson Tri-Gas

5.2. Cross Comparison Parameters (Revenue, Market Share, Distribution Network, Industrial Gas Type, R&D Initiatives, Geographic Presence, Technological Edge, End-User Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Industrial Gases Market Regulatory Framework

6.1. National Emission Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Industrial Gases Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Industrial Gases Future Market Segmentation

8.1. By Gas Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Distribution Mode (In Value %)

8.5. By Region (In Value %)

9. KSA Industrial Gases Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key stakeholders in the KSA industrial gases market. This step includes comprehensive desk research using secondary and proprietary databases to gather industry-level information. The goal is to identify critical market dynamics like demand drivers, industrial applications, and consumption trends.

Step 2: Market Analysis and Construction

We analyze historical data of the KSA industrial gases market, covering penetration, market growth trends, and revenue generation. Special emphasis is placed on gas consumption patterns in sectors like oil & gas and manufacturing to establish an accurate representation of market performance.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through consultations with industry experts via computer-assisted telephone interviews (CATIs). This step ensures that data regarding production capacity, distribution modes, and technological innovations is aligned with real-world industrial practices.

Step 4: Research Synthesis and Final Output

The final step involves integrating insights from various stakeholders, including gas producers, distributors, and end-users, to deliver a comprehensive and verified analysis. The results provide actionable recommendations to the industry's key players.

Frequently Asked Questions

1. How big is the KSA industrial gases market?

The KSA industrial gases market is valued at USD 1.5 billion, with significant growth driven by the petrochemical, oil refining, and manufacturing industries.

2. What are the challenges in the KSA industrial gases market?

Key challenges include high production costs, strict environmental regulations, and fluctuations in raw material availability, which can impact gas production.

3. Who are the major players in the KSA industrial gases market?

Major players in the KSA market include Air Liquide Saudi Arabia, National Industrial Gases Company, Linde Saudi Arabia, Air Products, and Gulf Cryo, which dominate due to their extensive distribution networks and technological edge.

4. What are the growth drivers of the KSA industrial gases market?

The market is driven by increasing demand in petrochemical industries, large-scale infrastructure projects under Vision 2030, and the growing need for green hydrogen and carbon capture technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.