KSA Kitchen Hood Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi Bisht

Product Code:KROD4639

December 2024

94

About the Report

KSA Kitchen Hood Market Overview

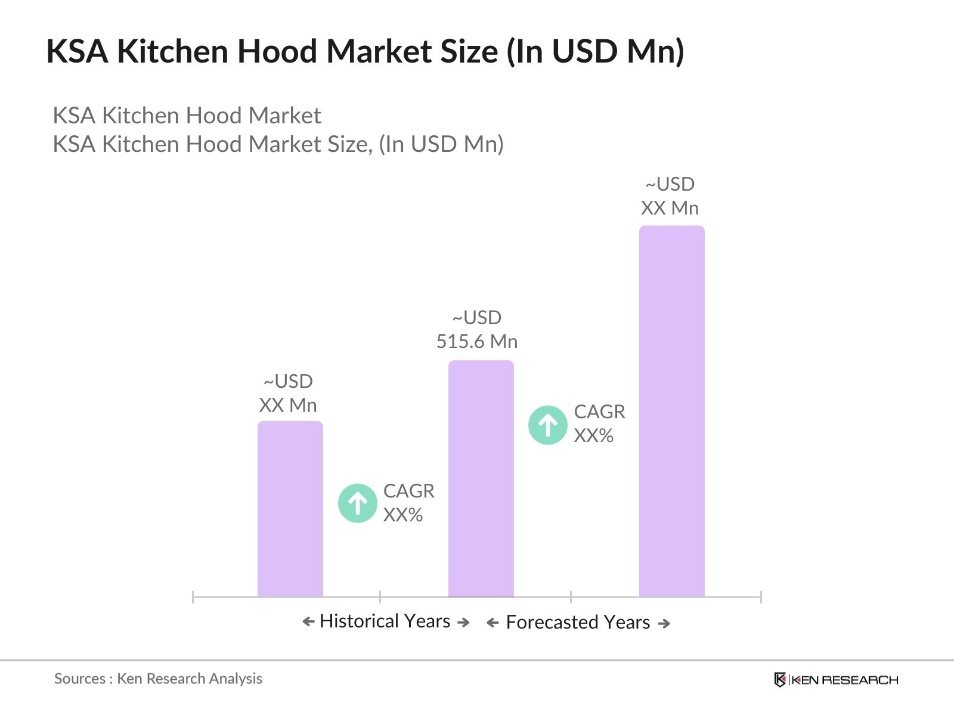

- The KSA Kitchen Hood Market is valued at USD 515.6 million, driven by the rapid growth in urbanization and a booming real estate sector. The demand for kitchen hoods is propelled by the rise in residential and commercial construction projects, supported by government initiatives such as Vision 2030. The increased awareness of air quality and hygiene standards is also contributing to the steady growth of the market, with consumers becoming more conscious of indoor air pollution and health impacts. This market is further sustained by increasing disposable incomes and a shift toward more luxurious and functional kitchen appliances.

- In the KSA kitchen hood market, major cities like Riyadh, Jeddah, and Dammam lead in market demand due to the concentration of urban developments and the rapid growth of commercial establishments. Riyadh, as the capital and largest city, benefits from significant government infrastructure spending and high demand from upscale residential projects. Jeddah, a major commercial hub, and Dammam, a vital industrial city, also see strong demand for kitchen appliances due to their large hospitality sectors and rising consumer sophistication.

- In 2022, Saudi Arabia increased customs duty rates on 99 products, including foodstuffs, beverages, industrial, and agricultural goods. The new duty rates, ranging from 5.5% to 25%, are part of the government's effort to protect local industries and agricultural production. This update affects a wide range of products, such as air conditioners, vehicle parts, and various food items like tomatoes and juices. Businesses are encouraged to review their supply chains and customs compliance to mitigate the financial impact of these changes.

KSA Kitchen Hood Market Segmentation

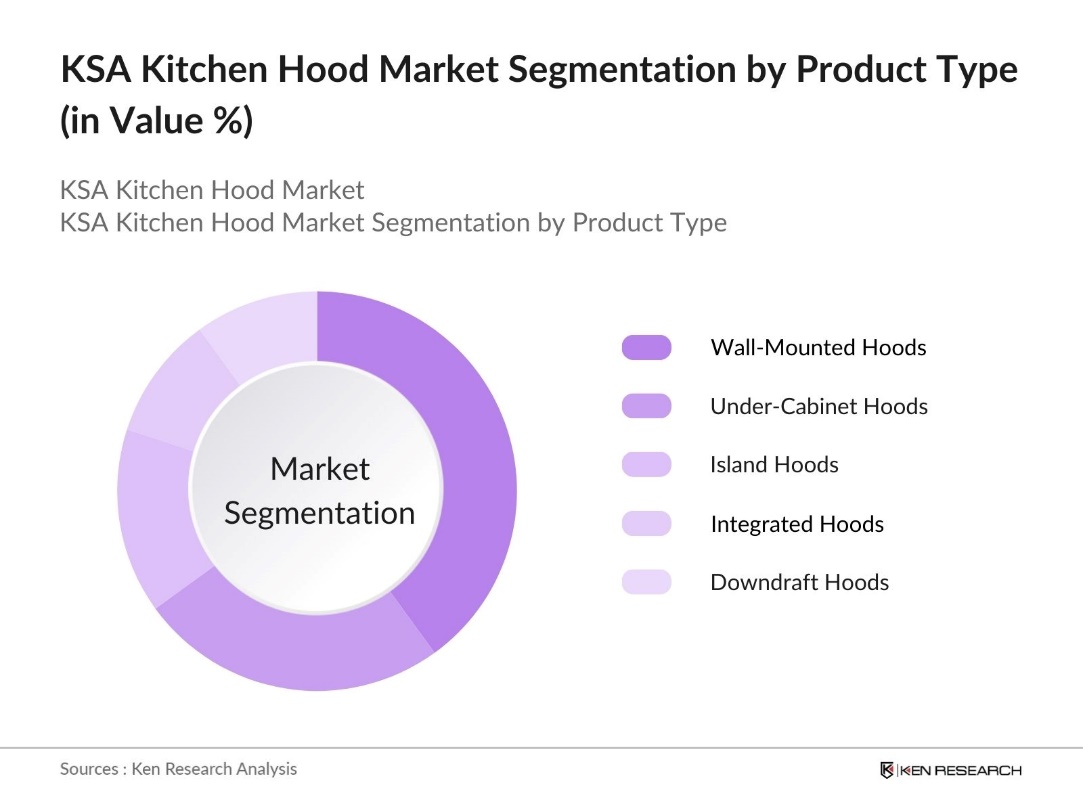

By Product Type: The KSA kitchen hood market is segmented by product type into wall-mounted hoods, under-cabinet hoods, island hoods, integrated hoods, and downdraft hoods. Recently, wall-mounted hoods have gained a dominant market share due to their increasing popularity in modern and urban residential kitchens. These products are valued for their aesthetic appeal and space-saving design, making them ideal for contemporary homes. Additionally, the growing trend toward open kitchen designs in luxury housing projects has increased the demand for wall-mounted hoods.

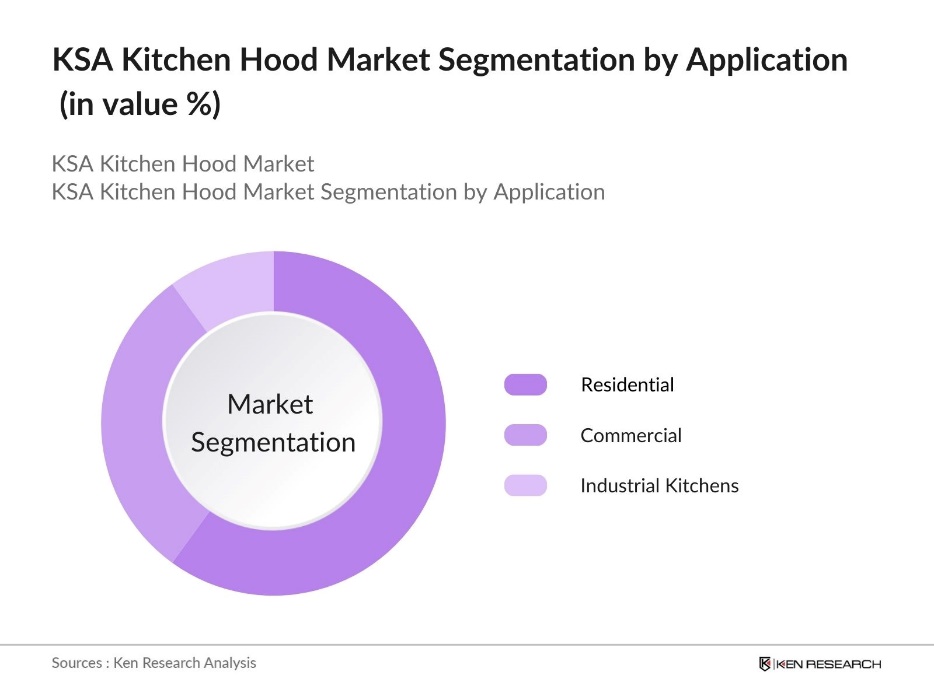

By Application: The KSA kitchen hood market is also segmented by application into residential, commercial (restaurants, cafes, hotels), and industrial kitchens. The residential segment holds the highest market share, primarily due to the rapid growth in real estate development, particularly high-end and luxury housing projects. As homeownership rates rise in the Kingdom, the demand for kitchen appliances, including hoods, has increased significantly. Additionally, kitchen hoods are now seen as an essential item in modern homes, due to heightened health awareness about air quality.

KSA Kitchen Hood Market Competitive Landscape

The market is dominated by a few major international players, as well as some regional brands. Key international brands like Bosch and Electrolux have maintained their market leadership due to their long-established presence, trusted reputation, and innovative product offerings tailored to high-end consumers. These global companies, along with a few domestic players, control a significant share of the market. The competition in the market is largely driven by product innovation, energy efficiency, and design aesthetics, which play a crucial role in attracting consumers in the Kingdom's growing luxury segment.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Annual Revenue |

Product Innovation |

Sustainability Focus |

Regional Distribution |

Brand Loyalty |

Market Penetration |

|

Bosch Home Appliances |

1886 |

Stuttgart, Germany |

|||||||

|

Electrolux |

1919 |

Stockholm, Sweden |

|||||||

|

Whirlpool Corporation |

1911 |

Benton Harbor, USA |

|||||||

|

Siemens Home Appliances |

1847 |

Munich, Germany |

|||||||

|

Miele |

1899 |

Gtersloh, Germany |

KSA Kitchen Hood Industry Analysis

Growth Drivers

- Rising Urbanization and Residential Construction: The increasing pace of urbanization in Saudi Arabia has driven substantial growth in the residential and commercial real estate sectors. The population in urban areas, continues to grow due to migration and housing demand, particularly in major cities like Riyadh, Jeddah, and Mecca. The Housing Program Annual Report 2023 indicates that over 96,000 families benefited from housing support, and there were more than 26,000 contracts signed for land products aimed at improving housing affordability. This growth in urbanization supports the need for air-quality management in confined spaces.

- Increased Consumer Awareness of Air Quality: Consumer awareness about air quality and its impact on health has risen significantly, driven by increasing concerns over pollution and the rise in respiratory diseases. Saudi Arabia reported a rise in indoor air pollution-related health issues, with over 49% of rural households population in 2023 being conscious of the air quality inside homes. The trend toward cleaner air and improved hygiene standards has pushed consumers to invest in kitchen hoods to remove pollutants and maintain healthier indoor environments. The Saudi Ministry of Health reports that indoor air quality improvements are a critical public health goal for residential and commercial areas.

- Energy Efficiency Mandates: The Saudi government's focus on sustainability and energy conservation has led to the implementation of stringent regulations for household appliances, including kitchen hoods. The Saudi Energy Efficiency Program (SEEP) requires that all kitchen hoods sold within the Kingdom adhere to specific energy efficiency standards. This move is part of a broader national strategy aimed at reducing carbon emissions and promoting environmental sustainability. By ensuring that kitchen hoods meet these standards, the government is working toward creating a more energy-efficient and environmentally friendly residential sector

Market Challenges

- High Initial Costs and Installation Complexity: While kitchen hoods provide long-term energy savings and health benefits, their upfront costs can be a barrier, particularly for residential consumers. The complexity of installation, which often requires professional assistance, further adds to the overall expense. This factor can limit adoption, especially among lower-income households, where the initial investment and the need for technical expertise may deter potential buyers. Additionally, the installation process can be more challenging in certain environments, adding to the overall cost burden for consumers.

- Low Penetration in Rural Areas: Rural areas in Saudi Arabia face significant challenges in accessing high-quality kitchen appliances like kitchen hoods. In these regions, households often prioritize essential needs over appliances, limiting the penetration of products such as kitchen hoods. The lack of infrastructure and distribution networks also complicates access to these products in rural markets, where logistics and installation services are harder to come by. This creates a gap in availability and adoption between urban and rural areas, where the use of traditional cooking methods is still more common.

KSA Kitchen Hood Market Future Outlook

Over the next few years, the KSA kitchen hood market is expected to experience substantial growth, driven by increasing urbanization, a growing focus on modern home aesthetics, and rising disposable incomes. The governments ambitious Vision 2030 initiative, which aims to diversify the Kingdom's economy, is likely to boost construction activities, especially in the residential and hospitality sectors. The demand for energy-efficient and technologically advanced kitchen hoods will rise as consumers increasingly prioritize sustainability and smart-home integration.

Market Opportunities

- Integration of Smart Technologies: The increasing adoption of smart home technologies offers significant opportunities for kitchen hood manufacturers in Saudi Arabia. IoT-enabled kitchen hoods can seamlessly integrate with home automation systems, offering features such as remote control, air quality monitoring, and energy optimization. This appeals to tech-savvy consumers seeking to enhance the convenience and efficiency of their living spaces. As more households embrace smart home systems, the demand for advanced kitchen hoods with these capabilities is expected to grow, aligning with the trend toward connected, modern living environments.

- Increasing Adoption of Ductless Hoods: Ductless kitchen hoods are becoming increasingly popular in urban areas, particularly in cities where space is a premium. These hoods are compact, easy to install, and require no external venting, making them ideal for smaller homes and apartments. The trend towards compact living spaces, especially in densely populated urban centers, has spurred demand for ductless hoods. Their ease of installation and suitability for modern, smaller kitchen designs make them an attractive option for a wide range of consumers, particularly in urban settings.

Scope of the Report

|

By Product Type |

Wall Mounted Hoods Under-Cabinet Hoods Island Hoods Integrated Hoods Downdraft Hoods |

|

By Application |

Residential Commercial (Restaurants, Cafes, Hotels) Industrial Kitchens |

|

By Technology |

Ducted Hoods Ductless Hoods |

|

By Power |

Low Power (<400 CFM) Medium Power (400-800 CFM) High Power (>800 CFM) |

|

By Region |

West East North South |

Products

Key Target Audience

Kitchen Appliance Manufacturers

Architectural and Design Firms

Kitchen Renovation and Remodeling Companies

Property Management Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (SASO Saudi Standards, Metrology, and Quality Organization)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Bosch Home Appliances

Electrolux

Whirlpool Corporation

Siemens Home Appliances

Miele

Elica

Smeg

Ariston

Panasonic

Hafele

Thermador

Kitchenaid

Beko

Fujioh

Faber

Table of Contents

1. KSA Kitchen Hood Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Kitchen Hood Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Kitchen Hood Market Analysis

3.1. Growth Drivers

3.1.1. Rising Urbanization and Residential Construction (Residential, Hospitality, Commercial Sectors)

3.1.2. Increased Consumer Awareness of Air Quality (Health, Hygiene Trends)

3.1.3. Government Initiatives Supporting Real Estate and Infrastructure Development (Vision 2030, Housing Programs)

3.1.4. Energy Efficiency Mandates (Sustainability, Energy Conservation Regulations)

3.2. Market Challenges

3.2.1. High Initial Costs and Installation Complexity (Cost Factors)

3.2.2. Low Penetration in Rural Areas (Distribution, Accessibility Challenges)

3.2.3. Lack of Consumer Education and Product Awareness (Knowledge Gaps)

3.3. Opportunities

3.3.1. Integration of Smart Technologies (IoT-Enabled Hoods, Smart Home Systems)

3.3.2. Increasing Adoption of Ductless Hoods (Compact and Easy Installation for Urban Dwellings)

3.3.3. Collaboration Between Developers and Appliance Manufacturers (Real Estate Partnerships)

3.4. Trends

3.4.1. Increasing Preference for Premium, Designer Kitchen Hoods (Luxury and Design-Focused Consumers)

3.4.2. Rising Popularity of Energy Star Rated Appliances (Energy-Efficient Products)

3.4.3. Growth of Online Sales Channels and E-commerce (Retail Distribution Trends)

3.5. Government Regulations

3.5.1. KSA Energy Efficiency Labeling and Standards (Government Programs for Energy Efficiency)

3.5.2. Building Code Regulations Impacting Kitchen Appliance Installations (Construction Codes)

3.5.3. Import Tariffs and Trade Policies for Kitchen Appliances (Tariff Structures)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Kitchen Hood Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Wall Mounted Hoods

4.1.2. Under-Cabinet Hoods

4.1.3. Island Hoods

4.1.4. Integrated Hoods

4.1.5. Downdraft Hoods

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial (Restaurants, Cafes, Hotels)

4.2.3. Industrial Kitchens

4.3. By Technology (In Value %)

4.3.1. Ducted Hoods

4.3.2. Ductless Hoods

4.4. By Power (In Value %)

4.4.1. Low Power (< 400 CFM)

4.4.2. Medium Power (400-800 CFM)

4.4.3. High Power (> 800 CFM)

4.5. By Region (In Value %)

4.5.1. West

4.5.2. East

4.5.3. North

4.5.4. South

5. KSA Kitchen Hood Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bosch Home Appliances

5.1.2. Whirlpool Corporation

5.1.3. Electrolux

5.1.4. Miele

5.1.5. Elica

5.1.6. Siemens Home Appliances

5.1.7. Smeg

5.1.8. Beko

5.1.9. Fujioh

5.1.10. Faber

5.1.11. Ariston

5.1.12. Hafele

5.1.13. Kitchenaid

5.1.14. Thermador

5.1.15. Panasonic

5.2. Cross Comparison Parameters

(No. of Employees, Headquarters, Inception Year, Revenue, Brand Presence in KSA, Product Portfolio, Distribution Network, Technological Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Kitchen Hood Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Kitchen Hood Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Kitchen Hood Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Power (In Value %)

8.5. By Region (In Value %)

9. KSA Kitchen Hood Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins by mapping out the key stakeholders in the KSA kitchen hood market, including manufacturers, distributors, and consumers. Using secondary research methods, this phase involves gathering data on market trends, product types, and major competitors.

Step 2: Market Analysis and Construction

We analyze historical data from the past five years, focusing on product penetration and consumer preferences. This step helps us build a robust understanding of market dynamics and key growth drivers. Revenue estimates are calculated based on verified sales data.

Step 3: Hypothesis Validation and Expert Consultation

The third phase involves validating our hypotheses through interviews with industry experts, including manufacturers and distributors in the KSA. These discussions provide deeper insights into market challenges and opportunities, ensuring the accuracy of our market forecast.

Step 4: Research Synthesis and Final Output

The final step integrates all data collected from the bottom-up approach and expert consultations. We provide a comprehensive market report, offering detailed insights into consumer behavior, market segmentation, and competitive dynamics.

Frequently Asked Questions

01. How big is the KSA Kitchen Hood Market?

The KSA Kitchen Hood Market is valued at USD 515.6 million, driven by an expanding residential sector and government infrastructure initiatives.

02. What are the challenges in the KSA Kitchen Hood Market?

Challenges in KSA Kitchen Hood Market include the high initial cost of premium kitchen hoods and low consumer awareness in rural areas, which impacts overall market penetration.

03. Who are the major players in the KSA Kitchen Hood Market?

Key players in KSA Kitchen Hood Market include Bosch, Electrolux, Whirlpool, Siemens, and Miele, who dominate due to their strong distribution networks and product innovation.

04. What are the growth drivers of the KSA Kitchen Hood Market?

The KSA Kitchen Hood Market growth is driven by increasing urbanization, rising disposable incomes, and the growing trend of modern, open-plan kitchens in luxury residential projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.