KSA Landscaping Market Outlook to 2029

Region:Middle East

Author(s):Namita and Aishwarya

Product Code:KR1494

April 2025

80-100

About the Report

KSA Landscaping Market Overview

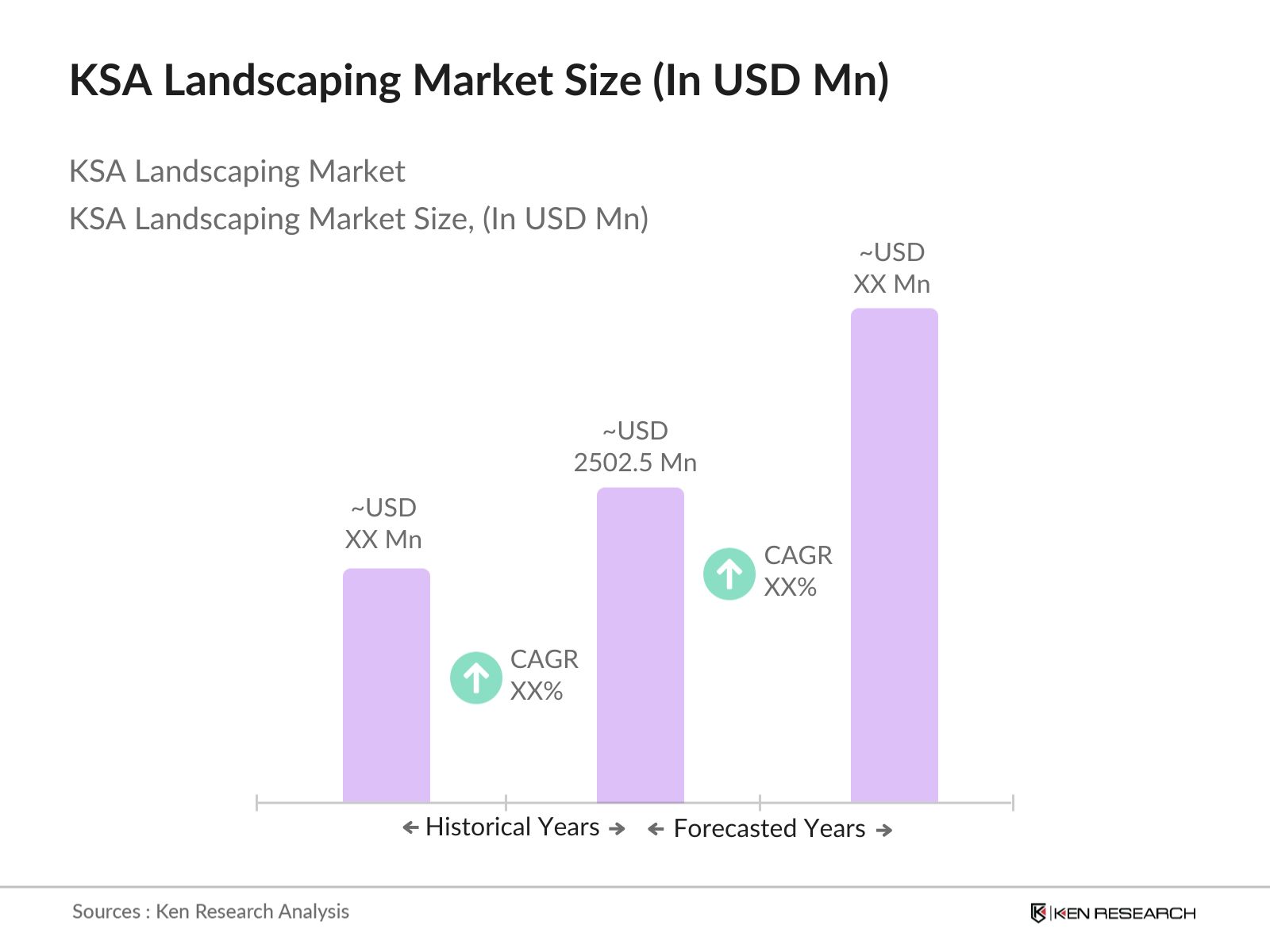

The KSA Landscaping Market is valued at USD 2502.5 million, based on a five-year historical analysis, reflecting a steady increase in public infrastructure investments and private residential projects. The market rose from USD 2387.2 million to USD 2502.5 million within one year, backed by large-scale developments such as the Red Sea Project, NEOM, and King Abdullah Financial District. Additional demand stems from mixed-use developments and an expanding pipeline of giga projects, contributing to consistent growth in landscaping demand across the kingdom.

The Riyadh Province, Western Saudi Arabia, and cities like Makkah and Jeddah continue to dominate the landscaping market due to high urbanization, massive hotel pipeline development, and commercial expansion. Makkah alone accounts for 85,000 hotel room keys under development, significantly boosting demand for green space, softscaping, and water-efficient outdoor amenities. The Riyadh Green Initiative, with a goal of planting 7.5 million trees, further accelerates project activity, making these regions focal points for both public and private sector landscaping contracts.

Landscaping companies operating in Saudi Arabia must comply with regulatory frameworks set by the Ministry of Municipal, Rural Affairs, and Housing (MOMRAH), including mandatory registration with the Saudi Contractors Authority (SCA) to qualify for tenders. To incentivize urban expansion, the government has implemented a 2.5% white land tax on undeveloped land to encourage landowners to develop or sell idle plots. Furthermore, Saudi Arabia has introduced initiatives to allocate 46 sq. m of green space per person, supporting the nations environmental sustainability goals under Vision 2030. Contractual guidelines also mandate performance bonds (1%2%), insurance guarantees, and limitations on subcontracting to below 30% without special approval.

KSA Landscaping Market Segmentation

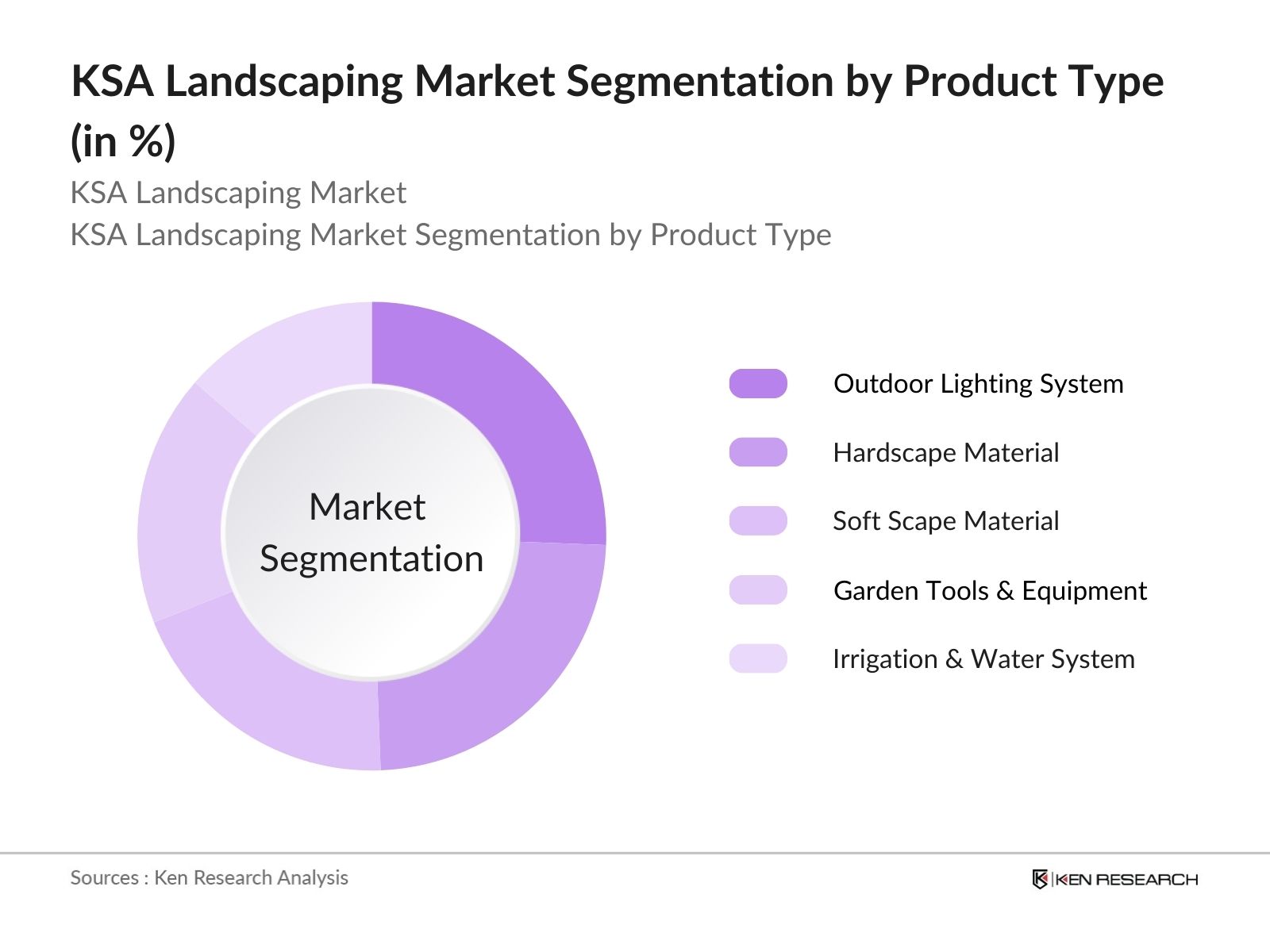

By Product Type: The KSA landscaping market is segmented by product type into Hardscaping, Softscaping, Lighting and Water Features, and Green Infrastructure. Among these, hardscaping holds prominence due to large-scale infrastructure projects emphasizing pathways, plazas, and durable surfaces. High-budget projects like NEOM and Diriyah Gate increasingly incorporate paving, fountains, and walls to define space, enhance usability, and achieve a modern visual identity.

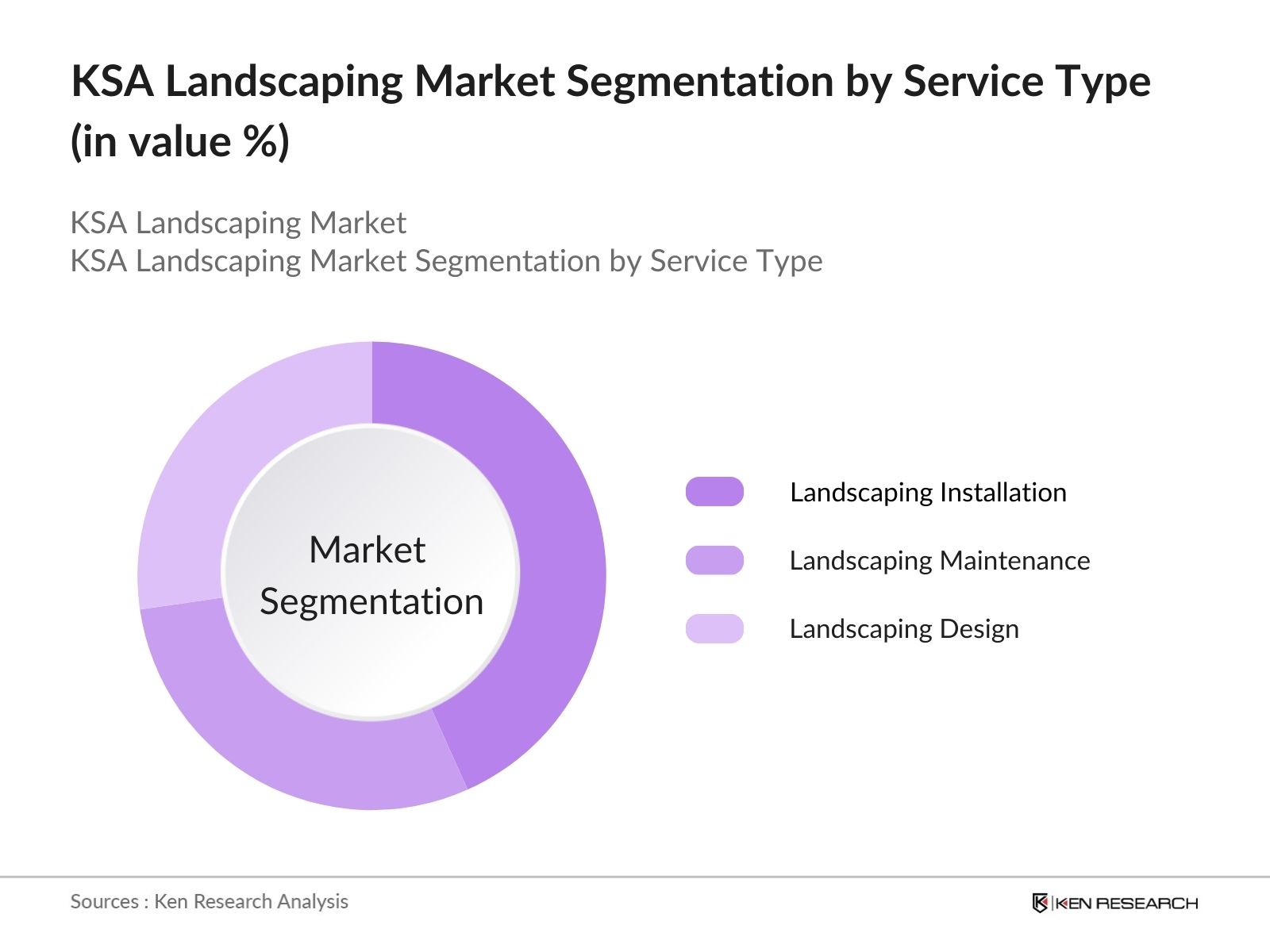

By Service Type: The KSA landscaping market is segmented by service type into Design & Planning, Installation & Construction, and Maintenance & Irrigation Management. Maintenance and irrigation services dominate due to the regions climatic constraints and the need for continual water management. With over 8,500 hotel keys planned in Makkah alone, service continuity becomes a critical element across residential and commercial developments.

By Service Type: The KSA landscaping market is segmented by service type into Design & Planning, Installation & Construction, and Maintenance & Irrigation Management. Maintenance and irrigation services dominate due to the regions climatic constraints and the need for continual water management. With over 8,500 hotel keys planned in Makkah alone, service continuity becomes a critical element across residential and commercial developments.

KSA Landscaping Market Competitive Landscape

The KSA Landscaping Market is moderately fragmented with a mix of local contractors and established engineering firms. Key players operate across installation, irrigation, softscape, and maintenance. Companies with strong public sector ties and capabilities in smart irrigation, drought-tolerant design, and giga-project execution are gaining competitive advantage as sustainability becomes a key bid criterion.

KSA Landscaping Market Analysis

Growth Drivers

Vision 2030 Urban Greening Mandate: Saudi Arabias Vision 2030 includes large-scale green infrastructure projects such as Green Riyadh and King Salman Park. These initiatives aim to increase urban green cover, reduce carbon emissions, and enhance liveability generating consistent landscaping demand across public parks, road medians, cultural zones, and tourism corridors in major cities like Riyadh and Makkah.

Tourism-Driven Outdoor Aesthetic Enhancement: Tourism-focused giga projects like NEOM, Red Sea Global, and Diriyah Gate are integrating functional and aesthetic landscaping in resorts, coastal boardwalks, and urban plazas. These developments require comprehensive design-build services including hardscape, smart irrigation, and plant-based climate moderation fueling year-round demand for landscape architecture, lighting systems, and outdoor experience design.

Commercial and Residential Real Estate Growth: The Kingdoms expanding real estate sector driven by mixed-use compounds, gated communities, and shopping boulevards is increasingly embedding landscaping as a value enhancer. Developers are prioritizing greenery, vertical gardens, and interactive spaces to improve property appeal and compliance with energy and water efficiency goals, especially in Riyadh and Jeddah.

Market Challenges

Water Scarcity and Irrigation Limitations: With average annual rainfall under 100 mm and increasing urban water demand, KSA faces serious irrigation challenges. Landscaping projects heavily rely on treated sewage effluent (TSE), which is not uniformly available across regions. Without efficient irrigation systems and drought-resistant plant planning, landscape upkeep becomes unsustainable, especially for municipalities and large commercial projects.

Shortage of Skilled Landscaping Professionals: There is a significant skills gap in Saudi Arabias landscaping workforce, particularly in irrigation engineering, plant care, and sustainable design. Most labor is expatriate and trained on-site, limiting innovation and long-term planning. The absence of certified horticulture institutes and landscape architecture programs constrains sectoral scalability, especially in technically demanding giga projects.

KSA Landscaping Market Future Outlook

Over the next five years, the KSA Landscaping Market is expected to witness sustained growth. Key drivers include rapid urbanization, tourism-led beautification mandates, and the rollout of green infrastructure across public spaces. With giga projects entering execution phases, the demand for advanced landscaping solutions will rise. Companies specializing in native plant systems, smart irrigation, and integrated design-build services are well positioned to secure long-term, multi-phase contracts.

Market Opportunities

Climate-Responsive and Native Landscaping Solutions: As sustainability becomes central to urban planning, there is rising demand for native, drought-tolerant plant species and xeriscaping models. Developers and public bodies are seeking suppliers who can offer locally adapted, low-maintenance greenery opening space for nurseries, irrigation designers, and contractors offering climate-resilient landscaping tailored to the Kingdoms extreme environmental conditions.

Integration of Smart Irrigation and Green Tech: Landscaping projects are rapidly integrating digital technologies such as IoT-based drip systems, soil moisture sensors, and app-based irrigation controls. These solutions reduce water consumption, cut maintenance costs, and improve plant health. Green tech firms that offer end-to-end smart irrigation tools are gaining traction across municipal tenders and luxury real estate developments.Scope Of the Report

Scope of the Report

|

By Revenue Type |

Landscaping Products |

|

By Product Type |

Outdoor Lighting Systems |

|

By Service Type |

Landscaping Installation |

|

By Application |

Public Landscaping |

|

By Region |

Riyadh |

Products

Key Target Audience

- Government Urban Development Authorities

- Real Estate and Mixed-Use Developers

- Hospitality and Tourism Project Owners

- Landscaping Design and Engineering Firms

- Irrigation and Outdoor Equipment Manufacturers

- Municipal Parks and Public Space Managers

- Smart City and Infrastructure Consultants

Companies

Players Mentioned in the Report

Nesma & Partners

Rashid Trading & Contracting Company

SALCO (Saudi Landscape Company)

Zaid Alhussain Group

Safari Group

Table of Contents

1. Executive Summary

1.1. Market Overview of KSA Landscaping Market

1.2. Ecosystem of Players in the Market

2. KSA Landscaping Market Overview

2.1. Growth in Commercial, Residential, and Public Projects

2.2. Vision 2030 and Giga Project Landscaping Demand

2.3. Tourism-Driven Outdoor Aesthetic Development

2.4. Urban Greening and Government Spending Initiatives

2.5. Smart Irrigation and Sustainability Trends

3. KSA Landscaping Market Sizing

3.1. Market Value 2024 and Forecast to 2030

3.2. CAGR Analysis by Revenue Type (Products & Services)

3.3. Regional Demand Breakdown – Riyadh, Makkah, Tabuk

3.4. Application-Wise Landscape Demand (Public, Commercial, Residential)

4. KSA Landscaping Market Segmentations

4.1. By Revenue Type

4.2. By Product Type

4.3. By Service Type

4.4. By Application

4.5. By Region

5. Competitive Landscape

5.1. Competitive Overview

5.2. Cross-Comparison of Key Players

6. Market Growth Drivers

6.1. Vision 2030 Urban Greening Mandates

6.2. Tourism and Giga Project Development

6.3. Real Estate and Mixed-Use Landscaping Demand

7. Market Challenges

7.1. Water Scarcity and Irrigation Dependency

7.2. Workforce Skill Gap in Design and Execution

8. Future Outlook

8.1. Market Evolution to 2030

8.2. Role of Sustainability and Green Technologies

9. Market Opportunities

9.1. Demand for Native and Xeriscape Landscaping

9.2. Integration of Smart Irrigation Systems

10. Scope of the Report

10.1 By Revenue Type

10.2 By Product Type

10.3 By Service Type

10.4 By Application

10.5 By Region

11. Key Target Audience

11.1 Listed Audience Segments

12. Research Methodology

12.1 Identification of Key Variables

12.2 Market Analysis and Construction

12.3 Hypothesis Validation and Expert Consultation

12.5 Research Synthesis and Final Output

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The study began with mapping the KSA landscaping ecosystem, including design firms, contractors, equipment providers, public authorities, and real estate developers. Secondary research involved reviewing government tenders, real estate investment reports, Vision 2030 plans, and project data from NEOM, Qiddiya, and Red Sea Global. Key variables identified included product mix, service types, application areas, and region-wise demand.

Step 2: Market Analysis and Construction

Market sizing was conducted using a triangulated approach combining project-level landscaping budgets, average material/service costs, and regional construction activity. Demand was split into product and service categories using project procurement estimates. Application-based segmentation was derived from publicly awarded contracts, while regional demand was calibrated using city-level development project data, particularly from Riyadh, Makkah, and Tabuk.

Step 3: Hypothesis Validation and Expert Consultation

Primary research included 40+ CATI interviews with landscape architects, project managers, irrigation solution providers, and urban developers. Respondents represented firms such as Nesma, SALCO, Safari Group, and Zaid Alhussain Group. Insights gathered covered project timelines, pricing benchmarks, tech adoption (e.g., smart irrigation), and future landscaping trends. Feedback was also collected from municipal authorities and giga-project stakeholders.

Step 4: Research Synthesis and Final Output

Findings from primary and secondary sources were consolidated to deliver segment-wise projections through 2030. Market splits by region, product, service, and application were derived using city-level project databases and infrastructure investment trends. Final estimates accounted for smart landscaping adoption, sustainability mandates, and the pace of project execution within Vision 2030 frameworks.

Frequently Asked Questions

01. How big is the KSA Landscaping Market?

The KSA Landscaping Market is valued at USD 2,502.5 million, based on a five-year historical analysis. Growth in the market is primarily driven by large-scale urban transformation efforts, increasing demand for real estate projects, and the widespread integration of sustainable and green infrastructure in both public and private sector developments.

02. What are the challenges in the KSA Landscaping Market?

Key challenges include in KSA Landscaping Market are water scarcity, which complicates irrigation planning, and a shortage of skilled professionals in landscape architecture and horticulture. Additionally, fragmented execution capabilities and regional climate variability increase project complexity, especially in areas like Tabuk and Makkah that require adaptive landscaping design and maintenance frameworks.

03. Who are the major players in the KSA Landscaping Market?

KSA Landscaping Market Leading players include Nesma & Partners, Rashid Trading & Contracting Company, SALCO (Saudi Landscape Company), Zaid Alhussain Group, and Safari Group. These companies are active across public infrastructure, real estate compounds, and giga-project landscaping, offering services in softscaping, irrigation, hardscaping, and long-term urban maintenance.

04. What are the growth drivers of the KSA Landscaping Market?

KSA Landscaping Market Growth is fueled by Vision 2030 mandates, giga-projects like NEOM and Qiddiya, and increasing investments in tourism and retail beautification. The rising demand for green public spaces, energy-efficient buildings, and climate-resilient landscapes is also accelerating the adoption of smart irrigation systems and native, low-maintenance plant species.

05. Which segment dominates the KSA Landscaping Market?

In KSA Landscaping Market Landscaping products hold a dominant position in the market, driven by rising demand for outdoor lighting, hardscaping materials, and advanced irrigation systems. On the application front, public landscaping leads the segment, supported by government-led beautification projects, development of green corridors, and sustainable park infrastructure initiatives across major cities such as Riyadh, Makkah, and Tabuk.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.