KSA Lending Market Outlook to 2029

Capitalizing on the boom driven by Saudi Vision 2030

Region:Middle East

Author(s):Navya and Anurag

Product Code:KR1456

October 2024

72

About the Report

KSA Lending Market Overview:

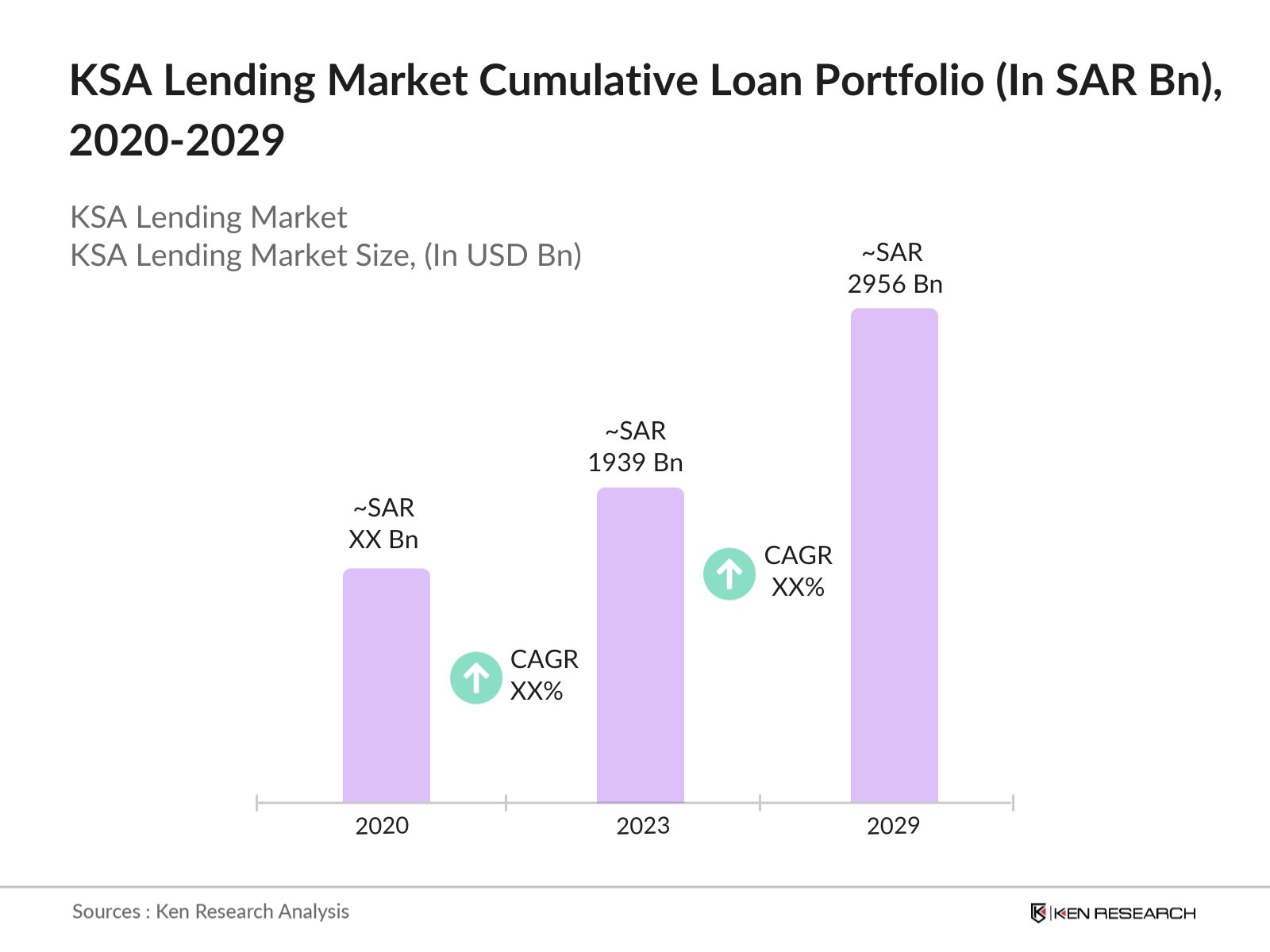

- The cumulative loan portfolio of KSA Lending Market reached SAR 1939 Bn in 2023, driven primarily by the governments Vision 2030 initiative, which aims to diversify the economy and reduce dependence on oil revenue. The expansion of the private sector and the increasing demand for credit, particularly in real estate and consumer lending, have been significant growth drivers.

- Market is dominated by major banks including the National Commercial Bank (NCB), Al Rajhi Bank, Riyad Bank, and Samba Financial Group. These institutions have a stronghold due to their vast networks and comprehensive financial product offerings.

- In 2024, Al Rajhi Bank has successfully issued $1 billion in Additional Tier 1 (AT1) sustainable sukuk, with a final yield set at 6.375%. This yield is an improvement from the initial guidance of 6.875% provided earlier in the issuance process. The sukuk is characterized as perpetual, meaning it does not have a fixed maturity date, although it can be redeemed starting in May 2029.

- Riyadh, Jeddah, and Dammam dominate the KSA Lending Market due to their large populations, higher levels of economic activity, and concentration of major businesses. Riyadh, as the capital city, has the highest concentration of financial institutions and corporate headquarters, making it a focal point for commercial lending.

KSA Lending Market Segmentation:

By Retail Lending: KSA lending market is segmented by retail lending into personal loan-big ticket, personal loan-microlending, home loan, auto loan, credit card loan, education loan & BNPL. In 2023, Personal Loan-Big Ticket dominated this segment driven by increased demand for larger credit lines among high-income individuals and expanding consumer confidence in the economic landscape.

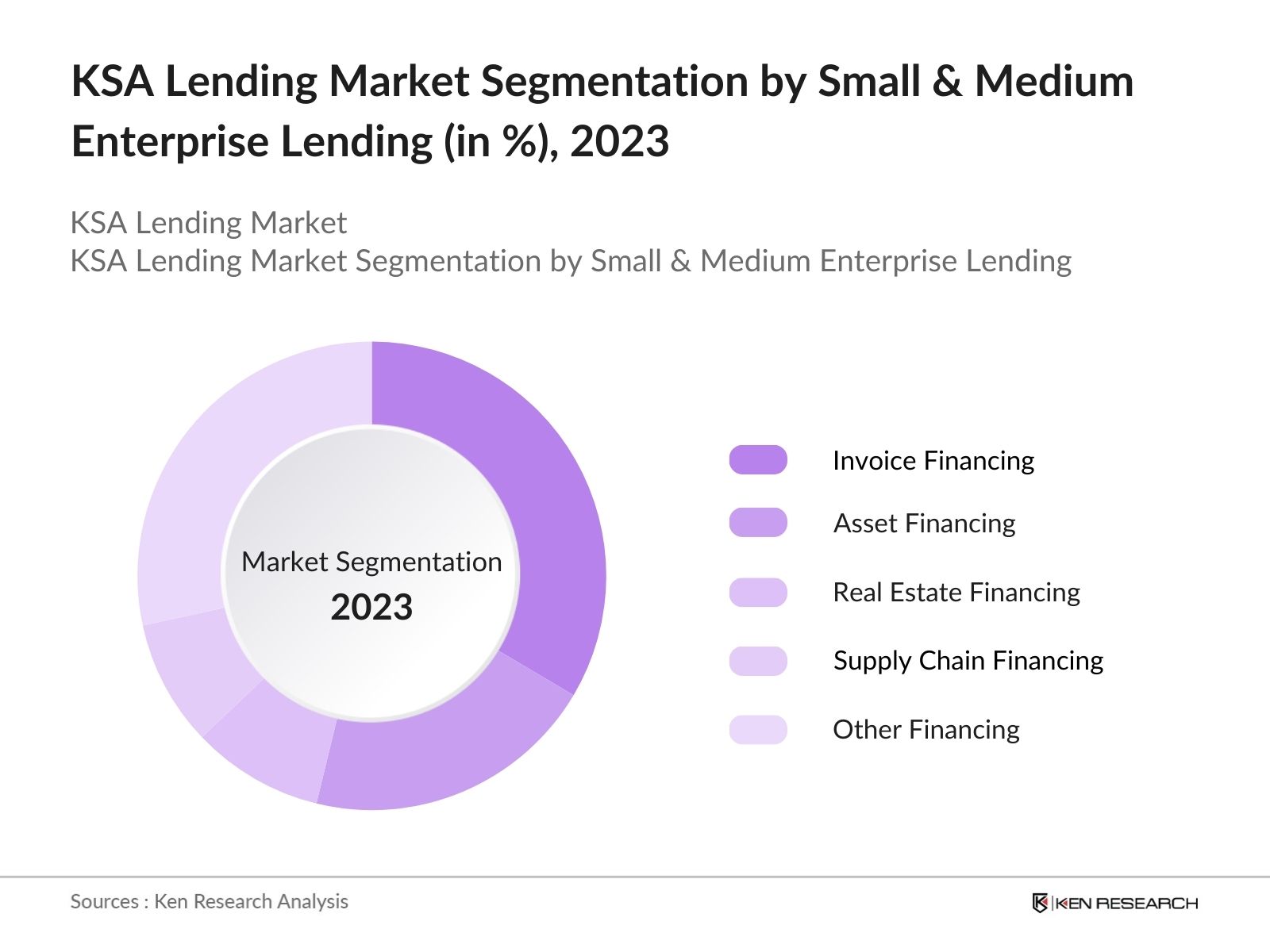

By Small & Medium Enterprise Lending: KSA lending market is segmented by small & medium enterprise lending by invoice financing, asset financing, real estate financing, supply chain financing & others. In 2023, Invoice Financing dominated this segment due to the increasing need for businesses to manage cash flow and bridge payment gaps. The dominance of Invoice Financing was fueled by the growing awareness among SMEs about its benefits, such as quick access to working capital without the need for additional collateral.

By Other Loans: KSA lending market is segmented by other loans into corporate loans & micro enterprise loans. In 2023, Corporate Loans was the dominant segment. This was largely due to the growing demand for large-scale financing by corporations seeking to expand operations, invest in new projects, and enhance their competitive edge. The segment's dominance was further reinforced by favorable government policies aimed at boosting the private sector.

KSA Lending Industry Analysis:

KSA Lending Market Growth Drivers

- Vision 2030's Economic Diversification and Financial Inclusion Initiatives: The Saudi Vision 2030 has been a pivotal growth driver for the KSA Lending Market. The Saudi government allocated SAR 1.25 trillion in its 2024 budget towards infrastructure, healthcare, and education sectors, creating significant opportunities for financial institutions to provide loans.

- Increase in Small and Medium Enterprises: Government initiatives to support SMEs through funding and financing programs have increased borrowing, with SMEs accounting for 14% of total bank loans in 2023. These efforts include subsidized interest rates and credit guarantee schemes, making loans more accessible for small businesses.

- Regulatory Reforms and Supportive Policies: SAMA's reforms, including easing lending restrictions and the 2022 "Open Banking Framework," aim to boost financial sector stability, competition, and innovation. These measures are designed to improve access to financial services for underserved populations and foster greater transparency in banking operations.

KSA Lending Market Challenges

- Stringent Regulatory Environment: The KSA Lending Market faces challenges due to the increasingly stringent regulatory environment. These regulations include stricter capital adequacy requirements and enhanced oversight of lending practices, particularly in the mortgage sector. While these are necessary for financial stability, they can also slow down the growth of the lending market.

- Limited Credit Information: Credit information coverage in Saudi Arabia is lower compared to global averages, limiting lenders' ability to make informed lending decisions. This gap in data creates challenges in accurately assessing borrowers' creditworthiness, potentially leading to higher default risks.

KSA Lending Market Government Initiatives

- Financial Sector Development Program: Launched in 2017, this initiative aims to cultivate a diversified and efficient financial sector supporting national economic development. It includes measures to increase SME loans as a percentage of total bank loans to 11% by 2025 and to restructure the Kafalah Program to ensure its sustainability in supporting SMEs. It has provided direct lending initiatives exceeding SAR 2 billion to over 2,300 companies, facilitating access to finance for businesses.

- Annual Borrowing Plan for 2024: The Minister of Finance approved a plan that includes public debt developments and initiatives for the debt markets. The plan estimates financing needs of approximately SAR 86 billion to cover debt maturities and the expected deficit in the state budget for 2024, indicating a structured approach to managing government financing activities.

KSA Lending Market Competitive Landscape:

|

Company |

Year of Establishment |

Head Office |

|

Saudi National Bank |

1953 |

Riyadh |

|

Al Rajhi Bank |

1957 |

Riyadh |

|

Riyadh Bank |

1957 |

Riyadh |

|

Arab National Bank |

1979 |

Riyadh |

|

Saudi British Bank |

1978 |

Riyadh |

|

The Saudi Investment Bank |

1976 |

Riyadh |

|

Bank Aljazira |

1975 |

Jeddah |

|

Alinma Bank |

2006 |

Riyadh |

- Arab National Banks Agreement with Saudi EXIM Bank: In 2023, Saudi EXIM Bank signed an agreement with Arab National Bank (ANB) to enhance export financing for small and medium-sized enterprises (SMEs) in Saudi Arabia. This collaboration aims to provide guarantees from Saudi EXIM Bank, facilitating better access to financing for SMEs engaged in export activities.

- Alinma Bank: In 2023, Alinma Bank secured three awards at the Global SME Banking Innovation Awards: Best SME Business Loan Product, Outstanding Staff Training, Learning & Development Program & Outstanding SME Cash Management Solution. These awards highlight Alinma Bank's commitment to enhancing services for small and medium-sized enterprises (SMEs) and investing in staff development.

KSA Lending Future Market Outlook:

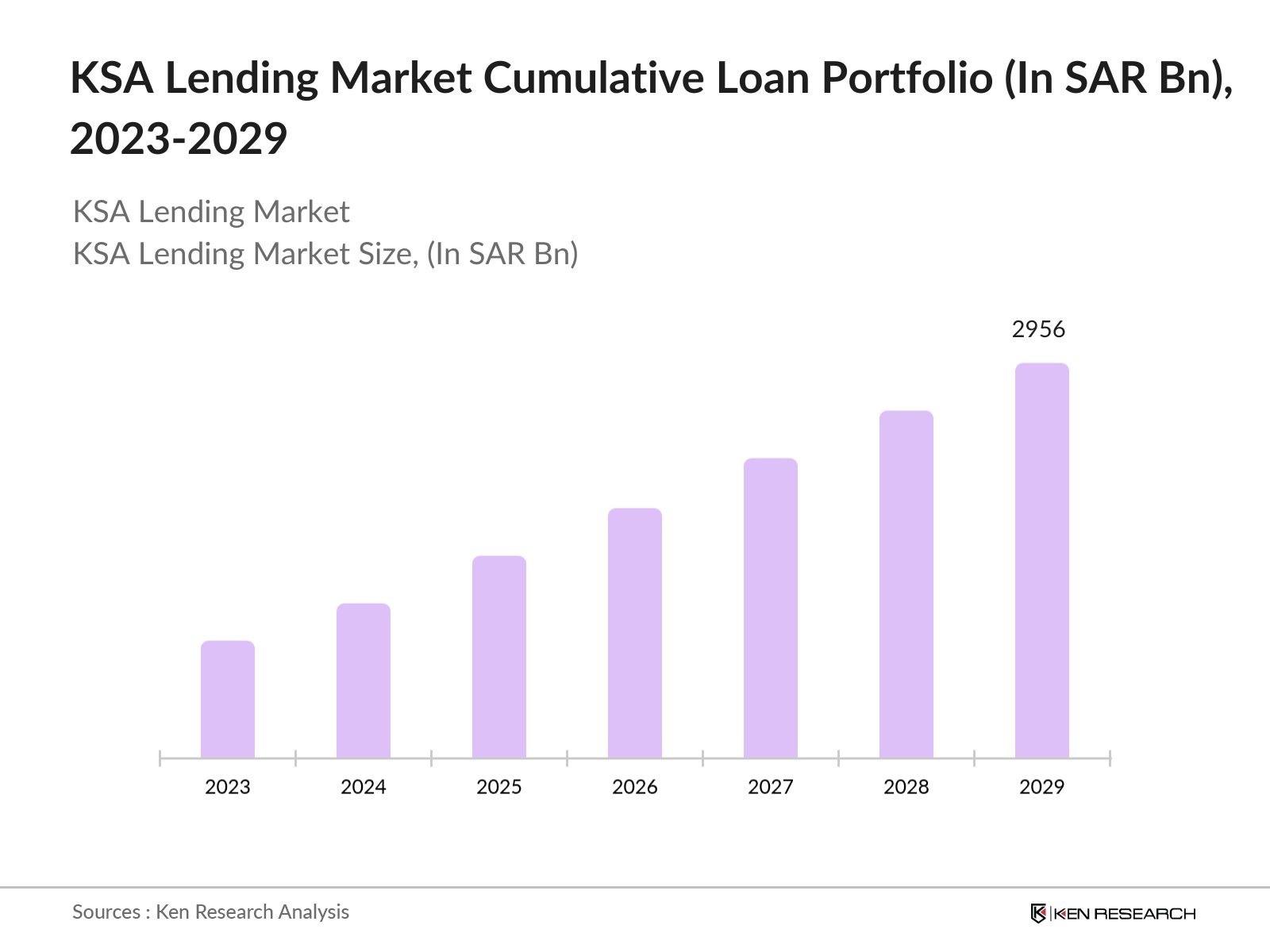

The cumulative loan portfolio of KSA lending market is expected to reach SAR 2956 Bn by 2029, driven by government initiatives such as Vision 2030 and the Financial Sector Development Program (FSDP). These programs aim to diversify the economy, promote financial inclusion, and foster innovation in the financial sector.

Future Market Trends:

- Digital Banking and Fintech Growth: The KSA Lending Market is expected to see significant growth in digital banking and fintech services. With the Saudi Fintech Strategy in place, more digital-only banks and fintech companies will enter the market, offering innovative lending solutions that cater to the needs of a tech-savvy population.

- Increased Focus on Sustainable Financing: Over the next five years, there will be a growing emphasis on sustainable financing within the KSA Lending Market. Financial institutions are expected to introduce more green loans and environmentally-friendly financing products in response to global and local environmental concerns.

Scope of the Report

|

By Retail Lending |

Personal Loan-Big Ticket Personal Loan-Microlending Home Loan Auto Loan Credit Card Loan Education Loan BNPL |

|

By Small & Medium Enterprise Lending |

Small & Medium Enterprise Lending by Invoice Financing Asset Financing Real Estate Financing Supply Chain Financing Other Financing |

|

By Other Loans |

Corporate Loans Micro Enterprise Loans |

|

By Source of Financing |

Personal Loan - Big Ticket Personal Loan - Micro Lending Home Loan Auto Loan Credit Card Loan Education Loan Buy Now Pay Later (BNPL) Invoice Financing for SMEs Supply Chain Financing for SMEs |

|

By Supplier |

Home Loans Credit Card Loans Personal Loans Big Ticket Personal Loans Micro Lending Education Loans Auto Loans Buy Now Pay Later (BNPL) Invoice Financing for SMEs Supply Chain Financing for SMEs |

|

By Customer Acquisition |

Personal Loan - Big Ticket Personal Loan - Micro Lending Home Loan Auto Loan Credit Card Loan Education Loan Buy Now Pay Later (BNPL) Invoice Financing for SMEs Supply Chain Financing for SMEs |

Products

Key Target Audience:

Fintech Companies

Microfinance Companies

Small and Medium Enterprises (SMEs)

Construction and Infrastructure Companies

Telecommunications Companies

Insurance Companies

Investment & Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Finance, Saudi Arabia)

Time Period Captured in the Report:

Historical Period: 2020-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Major Players Mentioned in the Report:

Saudi National Bank

Al Rajhi Bank

Riyadh Bank

Arab National Bank

Saudi British Bank

The Saudi Investment Bank

Bank Aljazira

Alinma Bank

Table of Contents

1. Executive Summary

1.1 Executive Summary: KSA Lending Market

2. KSA Lending Market Overview and Genesis

2.1 Overview of Banking Sector in KSA

2.2 Emerging Business Model in KSA Lending Market

2.3 Ecosystem of Major Entities in KSA Lending Market

2.4 Business Cycle and Genesis of KSA Lending Market

2.5 Timeline of Major Banks in KSA Lending Market

3. KSA Lending Market Size and Segmentation

3.1 Market Size of KSA Lending Market, 2020 - 2023

3.2 Segmentation – Retail Lending Market Size, 2020 - 2023

3.2.1 Sub Segmentation – Personal Loan Market Size, 2020 - 2023

3.2.2 Sub Segmentation – Home Loan Market Size, 2020 - 2023

3.2.3 Sub Segmentation – Auto Loan Market Size, 2020 - 2023

3.2.4 Sub Segmentation – Education Loan Market Size, 2020 - 2023

3.2.5 Sub Segmentation – Credit Card Loan Market Size, 2020 - 2023

3.2.6 Sub Segmentation – BNPL Market Size, 2020 - 2023

3.3 Segmentation – Small and Medium Enterprises Lending Market Size, 2020 - 2023

3.3.1 Sub Segmentation – Invoice Financing Market Size, 2020 - 2023

3.3.2 Sub Segmentation – Asset Financing Market Size, 2020 - 2023

3.3.3 Sub Segmentation – Real Estate Financing Market Size, 2020 - 2023

3.3.4 Sub Segmentation – Supply Chain Financing Market Size, 2020 - 2023

3.3.5 Sub Segmentation – Other SME Financing Market Size, 2020 - 2023

3.4 Segmentation – Other Loans Market Size. 2020 - 2023

3.4.1 Sub Segmentation – Micro Enterprises Loan Market Size, 2020 - 2023

3.4.2 Sub Segmentation –Corporate Loans Market Size, 2020 - 2023

3.5 Segmentation – By Source of Financing, 2023

3.6 Segmentation – By Suppliers, 2023

3.7 Segmentation – By Customer Acquisition Channels, 2023

4. Industry Analysis

4.1 PORTER 5 Forces Analysis of KSA Lending Market

4.2 Trends & Developments in KSA Lending Market

4.3 Growth Drivers of KSA Lending Market

4.4 Bottlenecks & Challenges in KSA Lending Market

4.5 Decision Making Parameters for Selecting Lenders in KSA

4.6 Major Government Regulations in KSA Lending Market

5. Competition Analysis

5.1 Cross Comparison of Major Banks in KSA Lending Market

6. KSA Lending Market Future Outlook

6.1 Market Size of KSA Lending Market, 2024 – 2029

6.2 Segmentation – Retail Lending Market Size, 2024 – 2029

6.2.1 Sub Segmentation – Personal Loan Market Size, 2024 – 2029

6.2.2 Sub Segmentation – Home Loan Market Size, 2024– 2029

6.2.3 Sub Segmentation – Auto Loan Market Size, 2024 – 2029

6.2.4 Sub Segmentation – Education Loan Market Size, 2024 – 2029

6.2.5 Sub Segmentation – Credit Card Loan Market Size, 2024– 2029

6.2.6 Sub Segmentation – BNPL Market Size, 2024 – 2029

6.3 Segmentation – Small and Medium Enterprises Lending Market Size, 2024– 2029

6.3.1 Sub Segmentation – Invoice Financing Market Size, 2024 – 2029

6.3.2 Sub Segmentation – Asset Financing Market Size, 2024 – 2029

6.3.3 Sub Segmentation – Real Estate Financing Market Size, 2024 – 2029

6.3.4 Sub Segmentation – Supply Chain Financing Market Size, 2024 – 2029

6.3.5 Sub Segmentation – Other SME Financing Market Size, 2024 – 2029

6.4 Segmentation – Other Loans Market Size. 2024 – 2029

6.4.1 Sub Segmentation – Micro Enterprises Loan Market Size, 2024 – 2029

6.4.2 Sub Segmentation –Corporate Loans Market Size, 2024 – 2029

6.5 Segmentation – By Suppliers, 2029

6.6 Segmentation – By Customer Acquisition Channels, 2029

7. Research Methodology

7.1 Market Taxonomy

7.2 Market Definitions

7.3 Abbreviations

7.4 Market Sizing Approach

7.5 Consolidated Research Approach

7.6 Sample Size Inclusion

7.7 Limitation and Future Conclusions

Disclaimer

Contact Us

Research Methodology

Step 1: Overview of the Saudi Arabia Lending Industry Ecosystem

Understanding the ecosystem of the lending industry in Saudi Arabia, identification of lending entities in Saudi Arabia under various business models such as banks, NBFCs and fintech companies, distributing them in different broad segments and identifying the major players in each of the segments.

Step 2: Data Collection & Analysis Methodology

CATIs with company and industry professionals to understand the revenue of the company, services offered, pricing/revenue streams, USP, geographical presence, number of loans offered, type of loans offered, tie ups with financial institutions, etc.

Step 3: Validation & Sanity Checking

Bottom-to-Top Approach in order to evaluate the overall credit disbursed and AUM. Overall value computed based on interviews with industry experts & estimates. Sanity Checking from Industry Veterans, Professionals & various Proxy Models

Frequently Asked Questions

01 How big is KSA Lending Market?

The cumulative loan portfolio of KSA lending market reached SAR 1939 Bn in 2023, driven primarily by the governments Vision 2030 initiative, which aims to diversify the economy and reduce dependence on oil revenue.

02 What are the Key Factors Driving KSA Lending Market?

KSA Lending Market is driven by increase in small & medium enterprises, regulatory reforms and digital transformation. These measures are designed to improve access to financial services for underserved populations and foster greater transparency in banking operations.

03 Who are the Major Players in KSA Lending Market?

KSA Lending Market is dominated by major banks including the National Commercial Bank (NCB), Al Rajhi Bank, Riyad Bank, and Samba Financial Group. These institutions have a stronghold due to their vast networks and comprehensive financial product offerings.

04 What is the Future of KSA Lending Market?

The cumulative loan portfolio of KSA lending market is expected to reach SAR 2956 Bn by 2029, driven by government initiatives such as Vision 2030 and the Financial Sector Development Program (FSDP). These programs aim to diversify the economy, promote financial inclusion, and foster innovation in the financial sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.