KSA Luxury Car Market Outlook to 2030

Region:Middle East

Author(s):Manan

Product Code:KR1518

July 2025

100

About the Report

KSA Luxury Car Market Overview

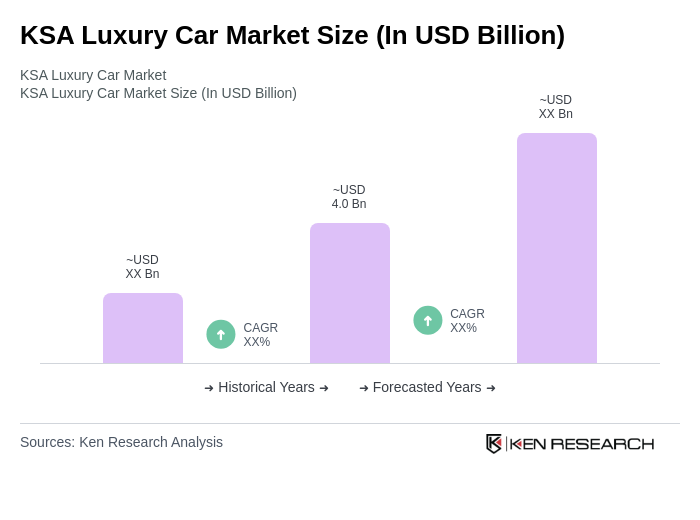

- The KSA Luxury Car Market is valued at USD 4.0 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, a growing affluent population, and an increasing preference for high-end vehicles among consumers. The luxury car segment has seen a surge in demand due to the expanding urban landscape, the influence of global luxury brands, and the increasing adoption of advanced technology and safety features in vehicles[.

- Key cities dominating the KSA Luxury Car Market include Riyadh, Jeddah, and Dammam. Riyadh, as the capital, serves as a central hub for luxury car dealerships and affluent consumers. Jeddah, with its coastal lifestyle and affluent expatriate community, also plays a significant role, while Dammam benefits from its proximity to industrial areas and a growing middle class.

- In recent years, the Saudi government has introduced initiatives aimed at enhancing the luxury car market, including incentives for electric luxury vehicles and policies supporting sustainable transportation. These efforts align with broader national strategies to promote eco-friendly mobility and encourage consumers to consider electric and hybrid luxury options.

KSA Luxury Car Market Segmentation

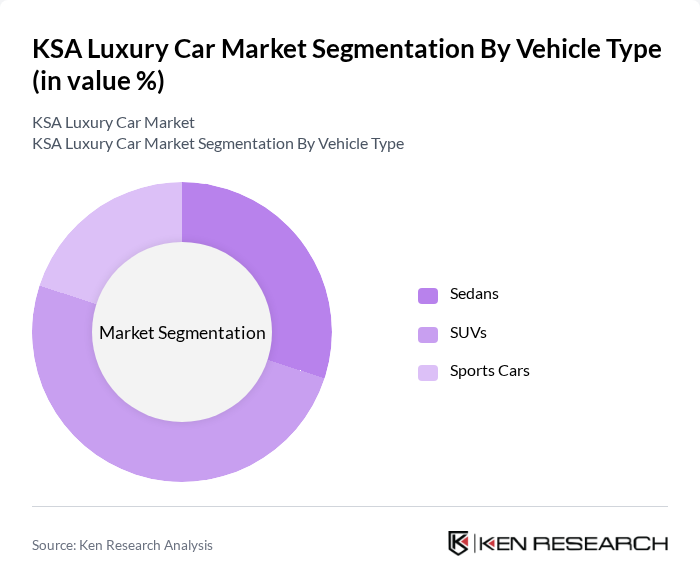

By Vehicle Type: The luxury car market is primarily segmented into sedans, SUVs, and sports cars. Among these, SUVs dominate the market due to their versatility, spaciousness, and suitability for both urban and off-road driving. The growing trend of family-oriented luxury vehicles has led to an increased preference for SUVs, as they offer a blend of luxury and practicality. Additionally, the rising popularity of luxury SUVs is fueled by their advanced technology features, enhanced safety measures, and the demand for vehicles that cater to both comfort and performance among affluent consumers.

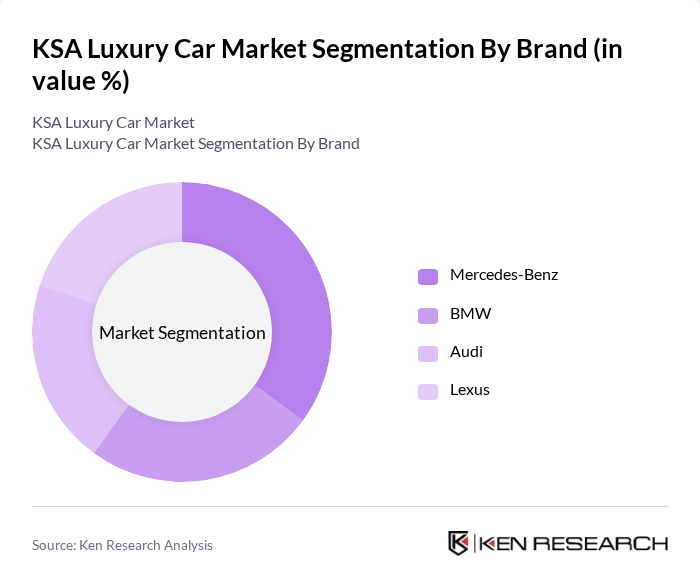

By Brand: The luxury car market is segmented by brand, including high-end manufacturers such as Mercedes-Benz, BMW, Audi, and Lexus. Among these, Mercedes-Benz holds a significant position due to its strong brand recognition and diverse product offerings that cater to various consumer preferences. The brand's commitment to innovation and luxury features has made it a favorite among affluent buyers. Additionally, the growing trend of customization and personalization in luxury vehicles has further solidified the brand's appeal, as consumers seek unique options that reflect their individual tastes.

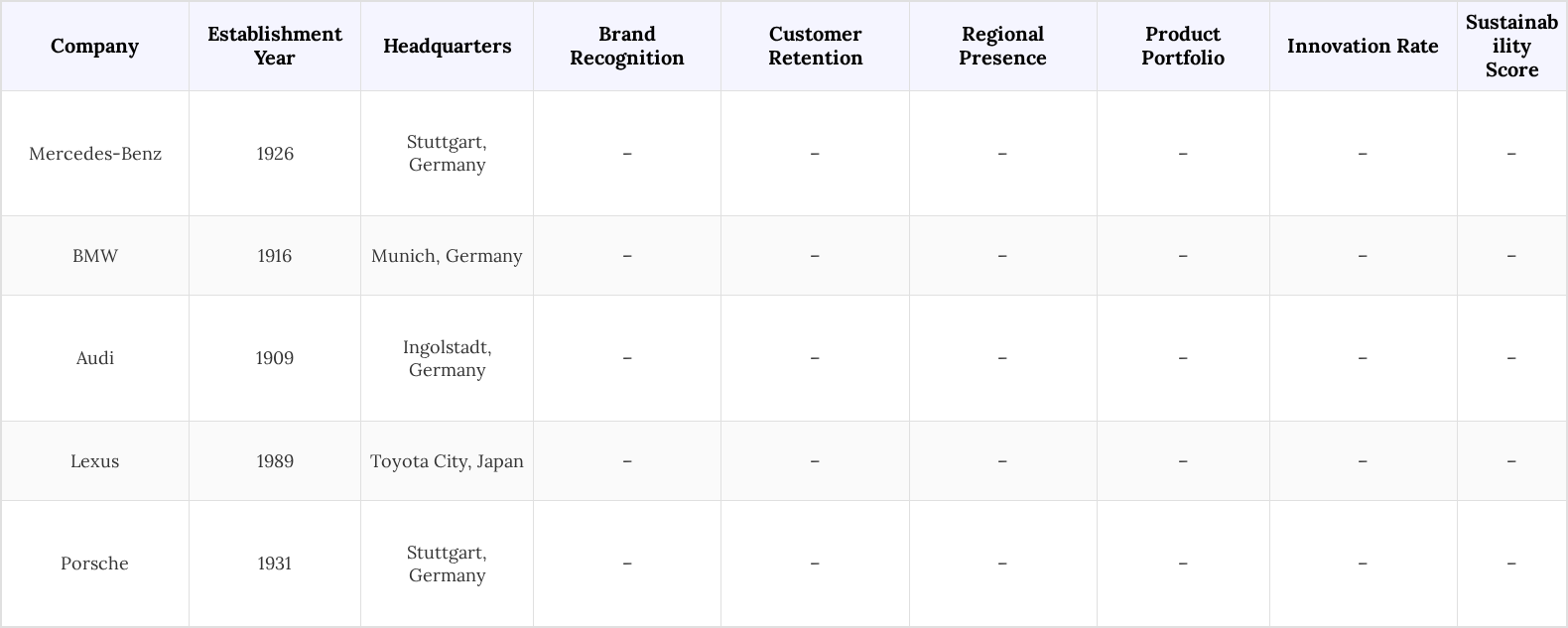

KSA Luxury Car Market Competitive Landscape

The KSA Luxury Car Market is characterized by a competitive landscape featuring both local and international players. Prominent companies such as Mercedes-Benz, BMW, Audi, and Lexus are key competitors, each vying for market share through innovative offerings and strong brand loyalty. The market is marked by a high level of brand recognition and customer retention, with companies focusing on enhancing their product portfolios to meet the evolving preferences of affluent consumers[1][3].

KSA Luxury Car Market Industry Analysis

Growth Drivers

- Rising Disposable Income: In 2023, the average per capita income in Saudi Arabia is SAR 3195, reflecting a 6% increase from previous year. This rise in income enables consumers to allocate more funds towards luxury purchases, including high-end vehicles. As the economy diversifies and employment opportunities expand, the affluent class is expected to grow, further driving demand for luxury cars. This trend is supported by the Kingdom's Vision 2030 initiative, which aims to enhance the quality of life and economic prosperity.

- Increasing Demand for Luxury Vehicles: In future, the demand for luxury vehicles in Saudi Arabia is anticipated to increase substantially. In 2024, KSA sold approximately 1700 units, driven by a growing middle class and a shift in consumer preferences towards premium brands. The luxury vehicle segment is expected to account for 14% of total car sales, reflecting a significant market shift. This demand is fueled by the desire for status symbols and advanced automotive technology, aligning with global trends in luxury consumption.

- Expansion of Luxury Car Dealerships: The number of luxury car dealerships in Saudi Arabia is projected to grow by 25% by 2030, with over 50 new showrooms opening across major cities. This expansion is driven by increased investment from international luxury brands seeking to tap into the affluent consumer base. Enhanced accessibility to luxury vehicles through these dealerships is expected to boost sales, as consumers benefit from improved service offerings and a wider selection of models, thereby enhancing the overall market landscape.

Market Challenges

- High Import Tariffs on Luxury Vehicles: Saudi Arabia imposes significant import tariffs on luxury vehicles, which directly impact pricing and affordability. This tariff structure poses a barrier to entry for new luxury brands and limits consumer choices in the market. The high costs associated with these tariffs can deter potential buyers, leading to a slower growth rate in the luxury car segment compared to other automotive sectors, thereby influencing overall market dynamics.

- Limited Availability of Financing Options: Limited access to financing remains a key challenge for the luxury car market in Saudi Arabia. Stringent lending criteria and high-interest rates restrict the purchasing power of many consumers, particularly younger buyers who may prefer flexible payment options. As a result, the market may experience slower growth due to financial constraints faced by prospective customers.

KSA Luxury Car Market Future Outlook

The KSA luxury car market is poised for significant transformation as consumer preferences evolve towards sustainability and technology. In future, the market is expected to witness a notable increase in electric luxury vehicle sales, driven by government incentives and a growing environmental consciousness among consumers. Additionally, the rise of digital marketing strategies will enhance brand engagement, allowing luxury car manufacturers to reach a broader audience. These trends indicate a dynamic shift in the market landscape, fostering innovation and new consumer experiences.

Market Opportunities

- Growth in Online Luxury Car Sales: The online luxury car sales segment is witnessing significant growth, driven by increased digital engagement and consumer preference for convenience. Enhanced online platforms are enabling seamless transactions, allowing consumers to explore and purchase luxury vehicles from the comfort of their homes. This shift is expanding market reach and improving accessibility for both buyers and brands.

- Increasing Interest in Electric Luxury Vehicles: The electric luxury vehicle market is experiencing a surge in interest, fueled by rising environmental awareness and supportive government policies. As consumers increasingly seek sustainable transportation options, luxury car brands that invest in electric models are well-positioned to gain a competitive edge. This shift aligns with global trends toward eco-friendly and innovative mobility solutions.

Scope of the Report

| By Type |

Sedans SUVs Sports Cars Others |

| By Brand |

Mercedes-Benz BMW Audi Lexus |

| By End-User |

Individual Consumers Corporate Clients Government Agencies Rental Services Others |

| By Region |

Riyadh Jeddah Dammam Khobar |

| By Engine Type |

Petrol Diesel Hybrid Electric Others |

| By Price |

Below SAR 200,000 SAR 200,000 - SAR 500,000 SAR 500,000 - SAR 1,000,000 Above SAR 1,000,000 |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Arabian General Investment Authority, Ministry of Commerce)

Luxury Car Manufacturers

Automobile Distributors and Retailers

Automotive Technology Providers

Luxury Lifestyle Brands

Financial Institutions and Banks

Automotive Industry Associations

Companies

Players Mentioned in the Report:

Mercedes-Benz

BMW

Audi

Lexus

Porsche

Aston Martin

Bentley

Rolls-Royce

Maserati

Ferrari

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. KSA Luxury Car Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 KSA Luxury Car Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. KSA Luxury Car Market Analysis

3.1 Growth Drivers

3.1.1 Rising disposable income

3.1.2 Increasing demand for luxury vehicles

3.1.3 Expansion of luxury car dealerships

3.1.4 Government initiatives promoting luxury tourism

3.2 Market Challenges

3.2.1 High import tariffs on luxury vehicles

3.2.2 Limited availability of financing options

3.2.3 Intense competition from established brands

3.2.4 Economic fluctuations affecting consumer spending

3.3 Market Opportunities

3.3.1 Growth in online luxury car sales

3.3.2 Increasing interest in electric luxury vehicles

3.3.3 Expansion of luxury car rental services

3.3.4 Collaborations with luxury lifestyle brands

3.4 Market Trends

3.4.1 Shift towards sustainable luxury vehicles

3.4.2 Rise of digital marketing strategies

3.4.3 Customization and personalization of vehicles

3.4.4 Growth of luxury car clubs and communities

3.5 Government Regulation

3.5.1 Emission standards for luxury vehicles

3.5.2 Safety regulations for imported cars

3.5.3 Tax incentives for electric vehicles

3.5.4 Regulations on luxury vehicle financing

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. KSA Luxury Car Market Market Size

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. KSA Luxury Car Market Segmentation

8.1 By Type

8.1.1 Sedans

8.1.2 SUVs

8.1.3 Coupes

8.1.4 Convertibles

8.1.5 Others

8.2 By End-User

8.2.1 Individual Consumers

8.2.2 Corporate Clients

8.2.3 Government Agencies

8.2.4 Rental Services

8.2.5 Others

8.3 By Region

8.3.1 Riyadh

8.3.2 Jeddah

8.3.3 Dammam

8.3.4 Khobar

8.4 By Engine Type

8.4.1 Petrol

8.4.2 Diesel

8.4.3 Hybrid

8.4.4 Electric

8.4.5 Others

8.5 By Price Range

8.5.1 Below SAR 200,000

8.5.2 SAR 200,000 - SAR 500,000

8.5.3 SAR 500,000 - SAR 1,000,000

8.5.4 Above SAR 1,000,000

8.6 By Brand

8.6.1 Mercedes-Benz

8.6.2 BMW

8.6.3 Audi

8.6.4 Lexus

8.7 By Fuel Efficiency

8.7.1 Low Efficiency

8.7.2 Moderate Efficiency

8.7.3 High Efficiency

8.7.4 Others

8.8 By Customization Options

8.8.1 Standard Packages

8.8.2 Premium Packages

8.8.3 Bespoke Options

8.8.4 Others

9. KSA Luxury Car Market Competitive Analysis

9.1 Market Share of Key Players

9.2 Cross Comparison of Key Players

9.2.1 Sales Growth Rate

9.2.2 Market Penetration Rate

9.2.3 Customer Satisfaction Index

9.2.4 Brand Loyalty Metrics

9.2.5 Average Dealership Rating

9.2.6 Product Range Diversity

9.2.7 Marketing Spend as a Percentage of Sales

9.2.8 Online Presence and Engagement

9.2.9 After-Sales Service Quality

9.2.10 Innovation Index

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 Detailed Profile of Major Companies

9.5.1 BMW Group

9.5.2 Mercedes-Benz

9.5.3 Audi AG

9.5.4 Lexus

9.5.5 Porsche AG

9.5.6 Land Rover

9.5.7 Maserati

9.5.8 Bentley Motors

9.5.9 Rolls-Royce Motor Cars

9.5.10 Ferrari

9.5.11 Aston Martin

9.5.12 Bugatti

9.5.13 Lamborghini

9.5.14 McLaren Automotive

9.5.15 Tesla, Inc.

10. KSA Luxury Car Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Budget Allocation Trends

10.1.2 Preferred Brands and Models

10.1.3 Procurement Processes

10.1.4 Decision-Making Criteria

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Investment in Fleet Management

10.2.2 Trends in Corporate Leasing

10.2.3 Budgeting for Luxury Vehicles

10.2.4 Impact of Economic Conditions

10.3 Pain Point Analysis by End-User Category

10.3.1 Maintenance and Service Issues

10.3.2 Availability of Spare Parts

10.3.3 Financing Challenges

10.3.4 Customer Support Experiences

10.4 User Readiness for Adoption

10.4.1 Awareness of Luxury Brands

10.4.2 Attitudes Towards Electric Vehicles

10.4.3 Preferences for Customization

10.4.4 Readiness for Online Purchases

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Performance Metrics

10.5.2 Customer Feedback Mechanisms

10.5.3 Expansion into New Segments

10.5.4 Long-term Value Assessment

11. KSA Luxury Car Market Future Size

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market Gaps Identification

1.2 Business Model Framework

2. Marketing and Positioning Recommendations

2.1 Branding Strategies

2.2 Product USPs

3. Distribution Plan

3.1 Urban Retail Strategies

3.2 Rural NGO Tie-ups

4. Channel & Pricing Gaps

4.1 Underserved Routes

4.2 Pricing Bands Analysis

5. Unmet Demand & Latent Needs

5.1 Category Gaps

5.2 Consumer Segments

6. Customer Relationship

6.1 Loyalty Programs

6.2 After-sales Service

7. Value Proposition

7.1 Sustainability Initiatives

7.2 Integrated Supply Chains

8. Key Activities

8.1 Regulatory Compliance

8.2 Branding Efforts

8.3 Distribution Setup

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product Mix Considerations

9.1.2 Pricing Band Strategies

9.1.3 Packaging Options

9.2 Export Entry Strategy

9.2.1 Target Countries

9.2.2 Compliance Roadmap

10. Entry Mode Assessment

10.1 Joint Ventures

10.2 Greenfield Investments

10.3 Mergers & Acquisitions

10.4 Distributor Model

11. Capital and Timeline Estimation

11.1 Capital Requirements

11.2 Timelines for Implementation

12. Control vs Risk Trade-Off

12.1 Ownership vs Partnerships

13. Profitability Outlook

13.1 Breakeven Analysis

13.2 Long-term Sustainability

14. Potential Partner List

14.1 Distributors

14.2 Joint Ventures

14.3 Acquisition Targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Luxury Car Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the KSA Luxury Car Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA Luxury Car Market.

Frequently Asked Questions

What is the current value of the KSA Luxury Car Market?

The KSA Luxury Car Market is valued at approximately USD 4.0 billion, driven by rising disposable incomes and a growing affluent population. This market has experienced significant growth due to increased demand for high-end vehicles and advanced automotive technology.

Which cities are the main hubs for luxury car sales in Saudi Arabia?

The primary cities dominating the KSA Luxury Car Market include Riyadh, Jeddah, and Dammam. Riyadh serves as the capital and central hub, while Jeddah attracts affluent expatriates, and Dammam benefits from its proximity to industrial areas and a growing middle class.

What factors are driving the growth of the KSA Luxury Car Market?

Key growth drivers include rising disposable incomes, increasing demand for luxury vehicles, and the expansion of luxury car dealerships. Additionally, government initiatives promoting sustainable transportation and electric vehicles are contributing to the market's growth.

What types of vehicles dominate the KSA Luxury Car Market?

The luxury car market in Saudi Arabia is primarily segmented into sedans, SUVs, and sports cars. SUVs dominate due to their versatility and spaciousness, catering to family-oriented consumers who seek a blend of luxury and practicality.

Which luxury car brands are most popular in Saudi Arabia?

Popular luxury car brands in Saudi Arabia include Mercedes-Benz, BMW, Audi, and Lexus. Mercedes-Benz holds a significant market position due to its strong brand recognition, diverse product offerings, and commitment to innovation and luxury features.

What challenges does the KSA Luxury Car Market face?

Challenges include high import tariffs on luxury vehicles, which can reach up to 15%, limiting affordability. Additionally, limited financing options and intense competition from established brands pose barriers to market growth and consumer purchasing power.

How is the Saudi government supporting the luxury car market?

The Saudi government supports the luxury car market through initiatives that promote electric vehicles and sustainable transportation. These efforts align with the Kingdom's Vision 2030 initiative, which aims to enhance the quality of life and economic prosperity.

What is the expected trend for electric luxury vehicles in Saudi Arabia?

The electric luxury vehicle market in Saudi Arabia is expected to grow significantly, with sales projected to reach 6,000 units in the future. This growth is driven by rising environmental awareness and government incentives for electric vehicle purchases.

What is the impact of online sales on the KSA Luxury Car Market?

The online luxury car sales segment is projected to grow by 30%, driven by increased digital engagement and consumer preference for convenience. Enhanced online platforms will facilitate seamless transactions, expanding market reach and accessibility for consumers.

What are the financing options available for luxury car buyers in Saudi Arabia?

Currently, only 35% of luxury car buyers in Saudi Arabia are expected to utilize financing options due to stringent lending criteria and high-interest rates. This limited access to financing can restrict purchasing power, particularly among younger buyers.

How does the KSA Luxury Car Market compare to other automotive sectors?

The luxury car segment is expected to account for 14% of total car sales in Saudi Arabia, reflecting a significant market shift. This growth is driven by a growing middle class and a shift in consumer preferences towards premium brands.

What role do luxury car dealerships play in the KSA market?

Luxury car dealerships are crucial in the KSA market, with a projected 25% growth in their numbers. This expansion enhances accessibility to luxury vehicles, improves service offerings, and provides a wider selection of models to affluent consumers.

What are the customization options available for luxury vehicles in Saudi Arabia?

Luxury vehicles in Saudi Arabia offer various customization options, including standard packages, premium packages, and bespoke options. This trend reflects consumer preferences for unique vehicles that cater to individual tastes and enhance the luxury experience.

What is the future outlook for the KSA Luxury Car Market?

The KSA Luxury Car Market is poised for transformation, with a notable increase in electric vehicle sales and a shift towards sustainability. Digital marketing strategies will enhance brand engagement, allowing manufacturers to reach a broader audience and adapt to evolving consumer preferences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.