KSA Machinery & Equipment Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD2225

December 2024

86

About the Report

KSA Machinery & Equipment Market Overview

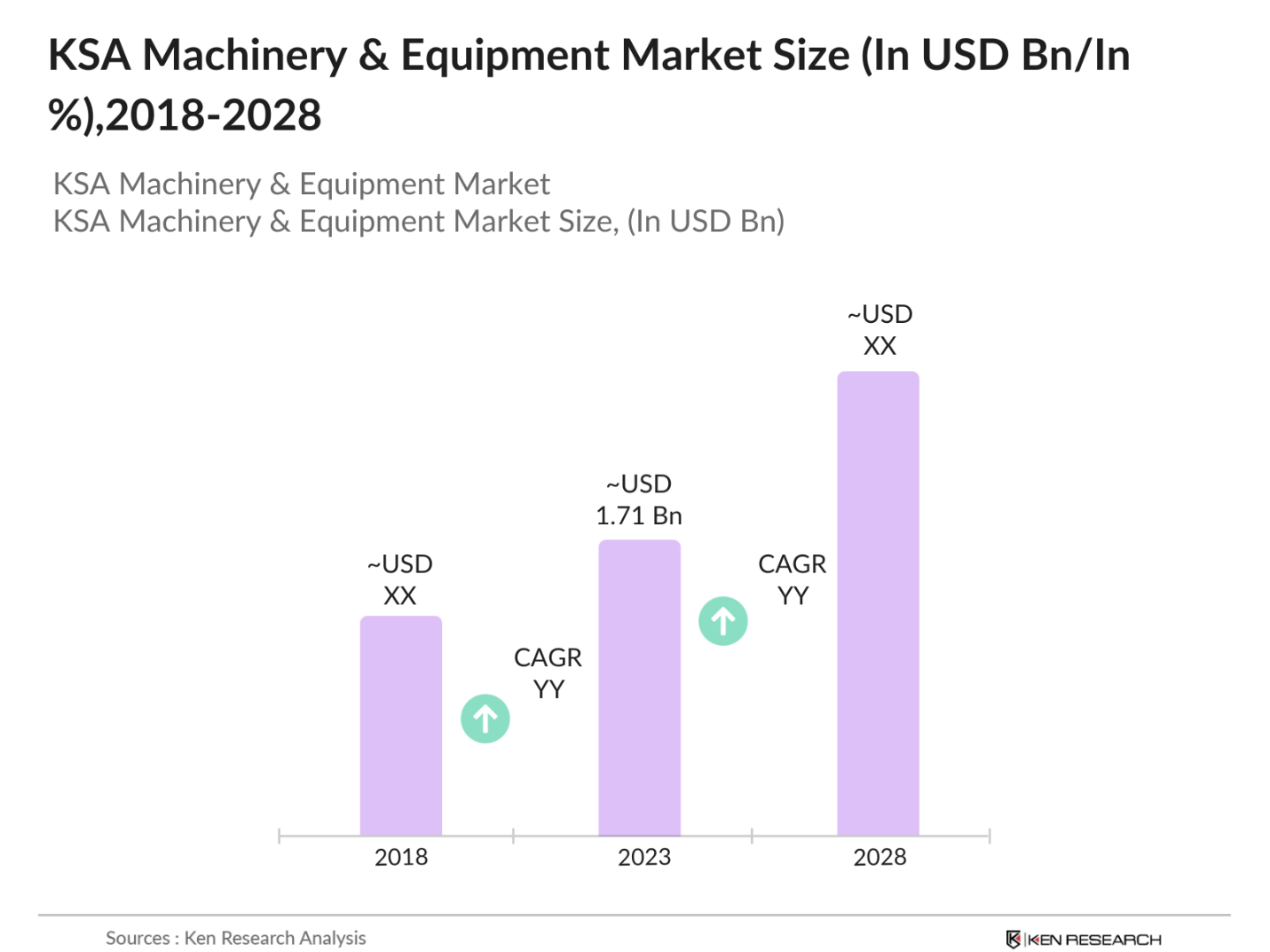

- The KSA (Kingdom of Saudi Arabia) machinery and equipment market is valued at USD 1.71 billion, driven by the countrys rapid industrialization, growing infrastructure projects, and the governments Vision 2030 initiative. This market has experienced consistent growth due to an increase in construction projects, manufacturing sectors, and investments in various industries, including oil and gas, mining, and agriculture.

- Dominant regions within Saudi Arabia include Riyadh, Makkah, and the Eastern Province, primarily due to the concentration of large-scale construction projects, industrial hubs, and strategic infrastructure initiatives. Riyadh is the center of government-led projects, while Makkah benefits from religious tourism and construction, and the Eastern Province dominates due to its oil and gas facilities.

- The Saudi governments Vision 2030, aimed at diversifying the economy, has prioritized the development of industrial and infrastructure projects, directly benefiting the machinery and equipment market. The National Industrial Development and Logistics Program (NIDLP) has allocated $300 billion towards the creation of advanced industrial zones and logistics hubs, leading to increased machinery imports.

KSA Machinery & Equipment Market Segmentation

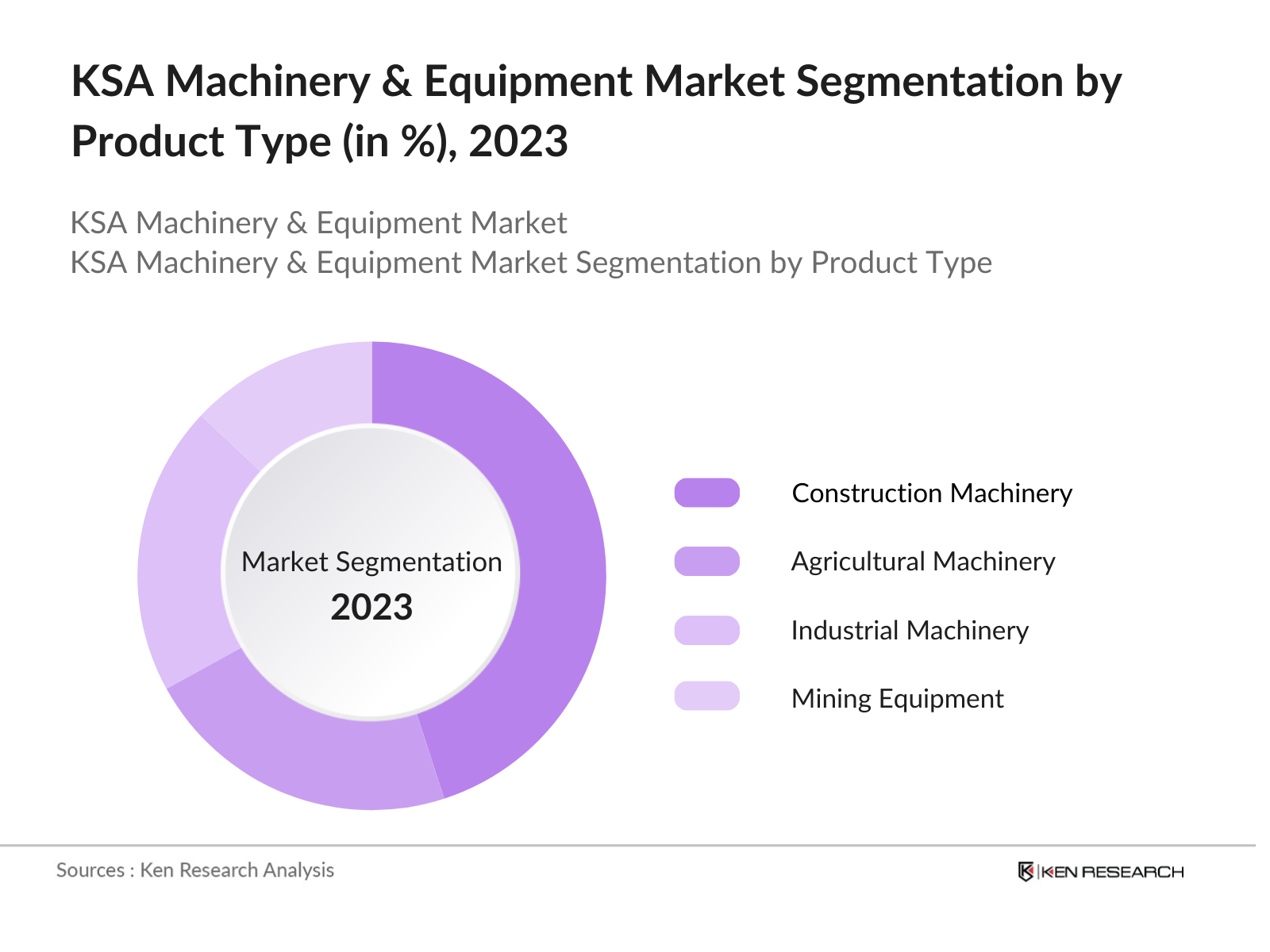

By Product Type: The KSA machinery and equipment market is segmented by product type into construction machinery, agricultural machinery, industrial machinery, mining equipment, and energy equipment. Construction machinery, including excavators, loaders, and cranes, has recently dominated the market share under the product type segmentation. This is due to the extensive infrastructure and urban development projects ongoing in the kingdom, such as the NEOM city, Red Sea Project, and the Riyadh Metro, which require substantial heavy machinery investments. Construction machinery accounts for over 45% of the market share due to its crucial role in these high-profile projects.

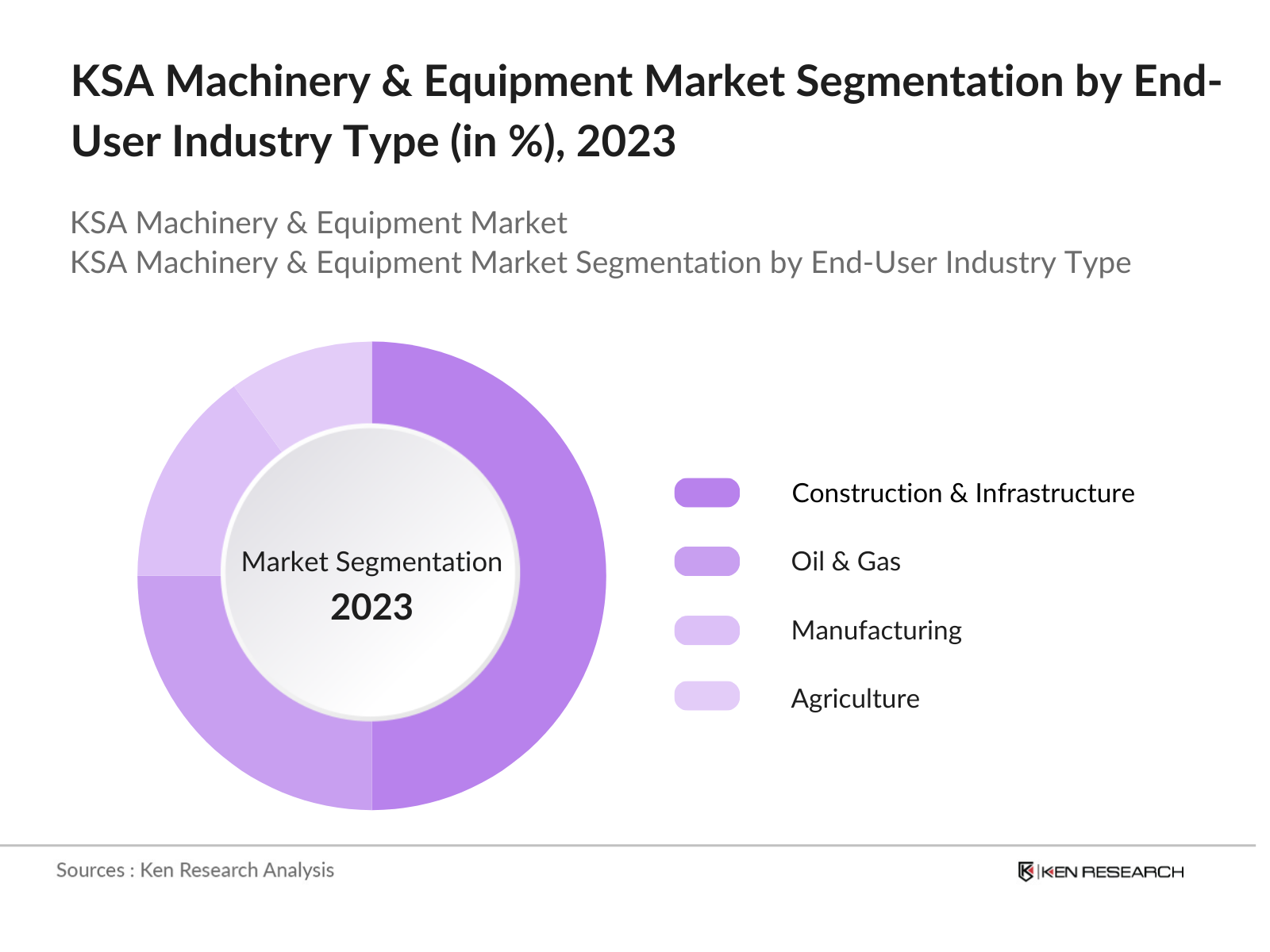

By End-User Industry: The KSA machinery and equipment market is also segmented by end-user industry into construction & infrastructure, oil & gas, manufacturing, agriculture, and mining. The construction and infrastructure segment is the dominant player in this market with over 50% of the market share. This is due to the governments ongoing investments in mega projects aimed at diversifying the economy away from oil reliance, such as the Saudi Vision 2030. The large-scale demand for machinery in the construction sector is fueled by these transformative initiatives, making it the most significant contributor to the markets growth.

KSA Machinery and Equipment Market Competitive Landscape

The KSA machinery and equipment market is dominated by several major international and regional players. Companies such as Caterpillar, Komatsu, and JCB are well-established due to their advanced technological products and strong global presence. Local distributors and companies like Saudi Liebherr and Zahid Tractor also play a significant role, offering tailored solutions to the unique needs of the Saudi market.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Product Categories |

Market Presence |

Key Clients |

|

Caterpillar Inc. |

1925 |

Illinois, USA |

|||||

|

Komatsu Ltd. |

1921 |

Tokyo, Japan |

|||||

|

JCB |

1945 |

Staffordshire, UK |

|||||

|

Saudi Liebherr |

1983 |

Riyadh, KSA |

|||||

|

Zahid Tractor |

1950 |

Jeddah, KSA |

KSA Machinery and Equipment Industry Analysis

KSA Machinery and Equipment Market Growth Drivers

- Industrialization and Infrastructure Expansion: Saudi Arabia's ongoing industrialization, driven by Vision 2030, has led to a sharp increase in the demand for machinery and equipment. As of 2023, Saudi Arabia's industrial sector contributed nearly $70 billion to the GDP, supported by robust investments in infrastructure. The nation has allocated $500 billion to projects like NEOM and Qiddiya, significantly increasing machinery demand for construction and logistics purposes. These developments create a robust market for construction machinery, heavy equipment, and industrial machines, essential for meeting deadlines and building large-scale urban centers.

- Rise in Manufacturing Sector: The Saudi manufacturing sector has seen notable growth, contributing nearly $90 billion to the national economy in 2023. This has directly increased demand for machinery, such as packaging machines, metalworking tools, and assembly-line robots. The establishment of industrial cities like Jubail and Yanbu, with investments surpassing $150 billion, indicates the growing machinery market in the region. This growth is also driven by governmental initiatives encouraging local production, reducing dependence on imports, and stimulating machinery purchases for manufacturing.

- Construction and Real Estate Boom: With over 5,000 active construction projects, worth more than $1 trillion in total, the demand for construction machinery in Saudi Arabia is accelerating. High-profile projects, such as the Red Sea Project and Riyadh Metro, necessitate the use of advanced machinery like cranes, bulldozers, and excavators. In 2024, the value of ongoing real estate projects in the Kingdom is expected to surpass $1.2 trillion, further driving the demand for construction-related machinery. This has created a lucrative opportunity for both local and international machinery suppliers.

KSA Machinery and Equipment Market Challenges

- High Costs of Advanced Machinery: Acquiring advanced machinery remains a significant challenge due to the steep costs involved. For instance, modern CNC machines and industrial robots, widely used in the Saudi manufacturing sector, cost upwards of $500,000 per unit. This has put a financial strain on smaller businesses unable to afford such machinery, limiting their ability to compete with larger players who can make substantial capital investments. Financing options remain limited, particularly for SMEs, slowing their adoption of cutting-edge technologies in production.

Source - Fluctuating Raw Material Prices (Steel, Aluminum): The price volatility of essential raw materials like steel and aluminum, which are fundamental in manufacturing machinery, has posed a significant challenge to the industry. For instance, steel prices surged to over $900 per ton in 2023, while aluminum prices touched $2,500 per ton, disrupting the cost of production for machinery manufacturers. These fluctuations have led to unpredictability in machine pricing, making it difficult for businesses to manage costs and leading to delays in procurement and construction projects.

KSA Machinery and Equipment Market Future Market Outlook

Over the next five years, the KSA machinery and equipment market is expected to experience robust growth, driven by continued government investments in Vision 2030 projects, expansion in non-oil industries, and increased automation in industrial sectors. The construction and manufacturing sectors will remain primary contributors to market demand as the kingdom focuses on large-scale urban development, including smart cities, green energy, and infrastructure projects.

- Adoption of Automation & AI in Machinery: The adoption of automation and AI in the machinery sector presents significant growth opportunities. Saudi Arabia is investing in smart manufacturing, and by 2023, over 30% of new machinery installations in factories involved automated or AI-driven technology. This has been encouraged by government policies that aim to increase productivity and reduce operational costs. The push towards AI-integrated machinery, especially in logistics and manufacturing, offers vast potential for both domestic and international suppliers of advanced technological equipment.

Source - Growing Demand for Green and Sustainable Equipment: The push for sustainability in line with Vision 2030 has increased the demand for eco-friendly machinery. In 2023, Saudi Arabia saw a rise in demand for energy-efficient equipment, with government-backed projects requiring contractors to use machinery with low emissions. Electric-powered construction machinery and renewable energy-driven equipment have become increasingly prominent, particularly in the context of large infrastructure projects like the NEOM city, where sustainable development is a priority. This trend represents a substantial opportunity for machinery providers specializing in green technology.

Scope of the Report

|

By Product Type |

Construction Machinery Agricultural Machinery Industrial Machinery Mining Equipment Energy Equipment |

|

By End-User Industry |

Construction & Infrastructure Oil & Gas Manufacturing Agriculture Mining |

|

By Technology |

Manual Operation Semi-Automatic Machinery Fully Automatic Machinery IoT-Enabled Machines |

|

By Material Used |

Steel-Based Machinery Aluminum-Based Machinery Composite Material Machinery |

|

By Region |

Riyadh Makkah Eastern Province Northern Borders Asir |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Machinery Industry

Construction and Infrastructure Companies

Oil & Gas Companies

Mining Corporations

Agricultural Enterprises

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Ministry of Industry and Mineral Resources, Saudi General Authority for Investment)

Industrial Equipment Companies

Companies

Players Mentioned in the Report:

Caterpillar Inc.

Komatsu Ltd.

JCB

Volvo Construction Equipment

Liebherr Group

Hyundai Heavy Industries

Doosan Infracore

CNH Industrial

XCMG

Sany Group

Zoomlion Heavy Industry

Hitachi Construction Machinery

Sandvik AB

John Deere

Manitou Group

Table of Contents

1. KSA Machinery & Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Market Maturity)

1.4. Market Segmentation Overview

2. KSA Machinery & Equipment Market Size (In USD Bn)

2.1. Historical Market Size (Volume, Value, Units Sold)

2.2. Year-On-Year Growth Analysis (Production Output, Import-Export Metrics)

2.3. Key Market Developments and Milestones (Investment Trends, Government Initiatives)

3. KSA Machinery & Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Industrialization and Infrastructure Expansion

3.1.2. Rise in Manufacturing Sector

3.1.3. Construction and Real Estate Boom

3.1.4. Government Vision 2030 and Related Policies

3.2. Market Challenges

3.2.1. High Costs of Advanced Machinery

3.2.2. Fluctuating Raw Material Prices (Steel, Aluminum)

3.2.3. Shortage of Skilled Labor for Machinery Operations

3.3. Opportunities

3.3.1. Adoption of Automation & AI in Machinery

3.3.2. Growing Demand for Green and Sustainable Equipment

3.3.3. Expansion of Local Manufacturing Capabilities

3.4. Trends

3.4.1. Integration of IoT in Industrial Machinery

3.4.2. Development of Smart Factories

3.4.3. Increasing Shift Towards Rental Machinery

3.5. Government Regulation

3.5.1. Import Tariff Policies (Machinery Components, Finished Products)

3.5.2. Compliance with Environmental Standards (Energy-Efficient Machinery)

3.5.3. Public-Private Partnerships for Infrastructure Projects

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Dealers)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Substitution Risk)

3.9. Competition Ecosystem (Foreign vs. Domestic Players, Dealer Networks)

4. KSA Machinery & Equipment Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Construction Machinery (Excavators, Loaders, Cranes)

4.1.2. Agricultural Machinery (Tractors, Irrigation Equipment)

4.1.3. Industrial Machinery (CNC Machines, Automation Equipment)

4.1.4. Mining Equipment (Drills, Earth Movers)

4.1.5. Energy Equipment (Oil & Gas Machinery, Power Generation Equipment)

4.2. By End-User Industry (In Value %)

4.2.1. Construction & Infrastructure

4.2.2. Oil & Gas

4.2.3. Manufacturing

4.2.4. Agriculture

4.2.5. Mining

4.3. By Technology (In Value %)

4.3.1. Manual Operation

4.3.2. Semi-Automatic Machinery

4.3.3. Fully Automatic & AI-Driven Machinery

4.3.4. IoT-Enabled Smart Machines

4.4. By Material Used (In Value %)

4.4.1. Steel-Based Machinery

4.4.2. Aluminum-Based Machinery

4.4.3. Composite Material Machinery

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Makkah

4.5.3. Eastern Province

4.5.4. Northern Borders

4.5.5. Asir

5. KSA Machinery & Equipment Market Competitive Analysis

5.1.1. Caterpillar Inc.

5.1.2. Komatsu Ltd.

5.1.3. JCB

5.1.4. Volvo Construction Equipment

5.1.5. Liebherr Group

5.1.6. Hyundai Heavy Industries

5.1.7. Doosan Infracore

5.1.8. CNH Industrial

5.1.9. XCMG

5.1.10. Sany Group

5.1.11. Zoomlion Heavy Industry

5.1.12. Hitachi Construction Machinery

5.1.13. Sandvik AB

5.1.14. John Deere

5.1.15. Manitou Group

5.2 Cross Comparison Parameters (Revenue, No. of Employees, Market Presence, Machinery Categories)

5.3. Market Share Analysis (By Company, By Product Category)

5.4. Strategic Initiatives (Product Launches, Regional Expansions, Dealer Networks)

5.5. Mergers And Acquisitions

5.6. Investment Analysis (Capital Expenditures, Infrastructure Investments)

5.7. Venture Capital Funding

5.8. Government Grants & Incentives

5.9. Private Equity Investments

6. KSA Machinery & Equipment Market Regulatory Framework

6.1. Machinery Safety Standards

6.2. Import & Export Regulations

6.3. Certification Processes (ISO, CE Marking)

7. KSA Machinery & Equipment Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Technological Adoption, Government Policies)

8. KSA Machinery & Equipment Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Technology (In Value %)

8.4. By Material Used (In Value %)

8.5. By Region (In Value %)

9. KSA Machinery & Equipment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involved mapping the ecosystem of the KSA machinery and equipment market, which included key stakeholders, manufacturers, and industry drivers. This was done through comprehensive desk research and the integration of proprietary databases to understand market variables influencing growth, demand, and supply.

Step 2: Market Analysis and Construction

A detailed historical market analysis was conducted, assessing factors such as industry growth, import-export metrics, and sectoral demand. Additionally, production capacity and government policy impacts were evaluated to create accurate revenue forecasts and growth trajectories.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, industry experts from both international and local machinery manufacturers were consulted. This involved direct interviews and surveys to validate market trends, customer preferences, and operational insights, providing a ground-level understanding of the market.

Step 4: Research Synthesis and Final Output

The final output stage synthesized data collected from various sources, verified through consultations, and provided insights into future projections. The analysis was cross-referenced with government data, industry reports, and expert insights, ensuring a reliable, comprehensive overview of the KSA machinery and equipment market.

Frequently Asked Questions

01. How big is the KSA Machinery & Equipment Market?

The KSA machinery and equipment market is valued at USD 1.71 billion, driven by government-led infrastructure projects, industrial growth, and the Vision 2030 initiative aimed at economic diversification.

02. What are the challenges in the KSA Machinery & Equipment Market?

Challenges in this market include the high cost of advanced machinery, fluctuating raw material prices, and a shortage of skilled labor for operating high-tech machinery. Additionally, reliance on imports for specific equipment poses logistical challenges.

03. Who are the major players in the KSA Machinery & Equipment Market?

Key players in the KSA machinery market include Caterpillar Inc., Komatsu Ltd., JCB, Saudi Liebherr, and Zahid Tractor. These companies dominate due to their strong distribution networks and longstanding relationships with key Saudi industries.

04. What are the growth drivers of the KSA Machinery & Equipment Market?

The market is propelled by massive infrastructure projects under Vision 2030, the expansion of manufacturing and industrial capabilities, and increasing demand for automation and smart machinery across multiple sectors, including construction, oil and gas, and mining.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.