KSA Marble and Granite Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD3060

November 2024

96

About the Report

KSA Marble and Granite Market Overview

- The KSA marble and granite market is valued at USD 1.80 billion, driven by a strong focus on infrastructural development, government-backed initiatives under Vision 2030, and rising demand from the commercial real estate and residential sectors. The Kingdom's ambition to develop urban centers such as Neom, The Red Sea Project, and Qiddiya has significantly propelled the demand for high-quality building materials, including marble and granite.

- Major urban centers like Riyadh, Jeddah, and Dammam are leading the market due to rapid urbanization, a booming construction sector, and growing investments in luxury residential complexes. These cities host a concentration of large-scale construction projects where marble and granite are extensively used for aesthetic and functional purposes. On the other hand, smaller cities are gradually adopting premium materials to meet the increasing demand for high-end architectural designs in private and public projects.

- The Ministry of Industry and Mineral Resources (MIMR) has prioritized the domestic production of marble and granite to reduce dependency on imports and stimulate local industries. In 2024, over 60 quarries are operational across the Kingdom, producing a variety of marble and granite types for both domestic consumption and export markets. This focus on local production is also part of broader efforts to diversify the economy, decrease unemployment, and contribute to non-oil revenues.

KSA Marble and Granite Market Segmentation

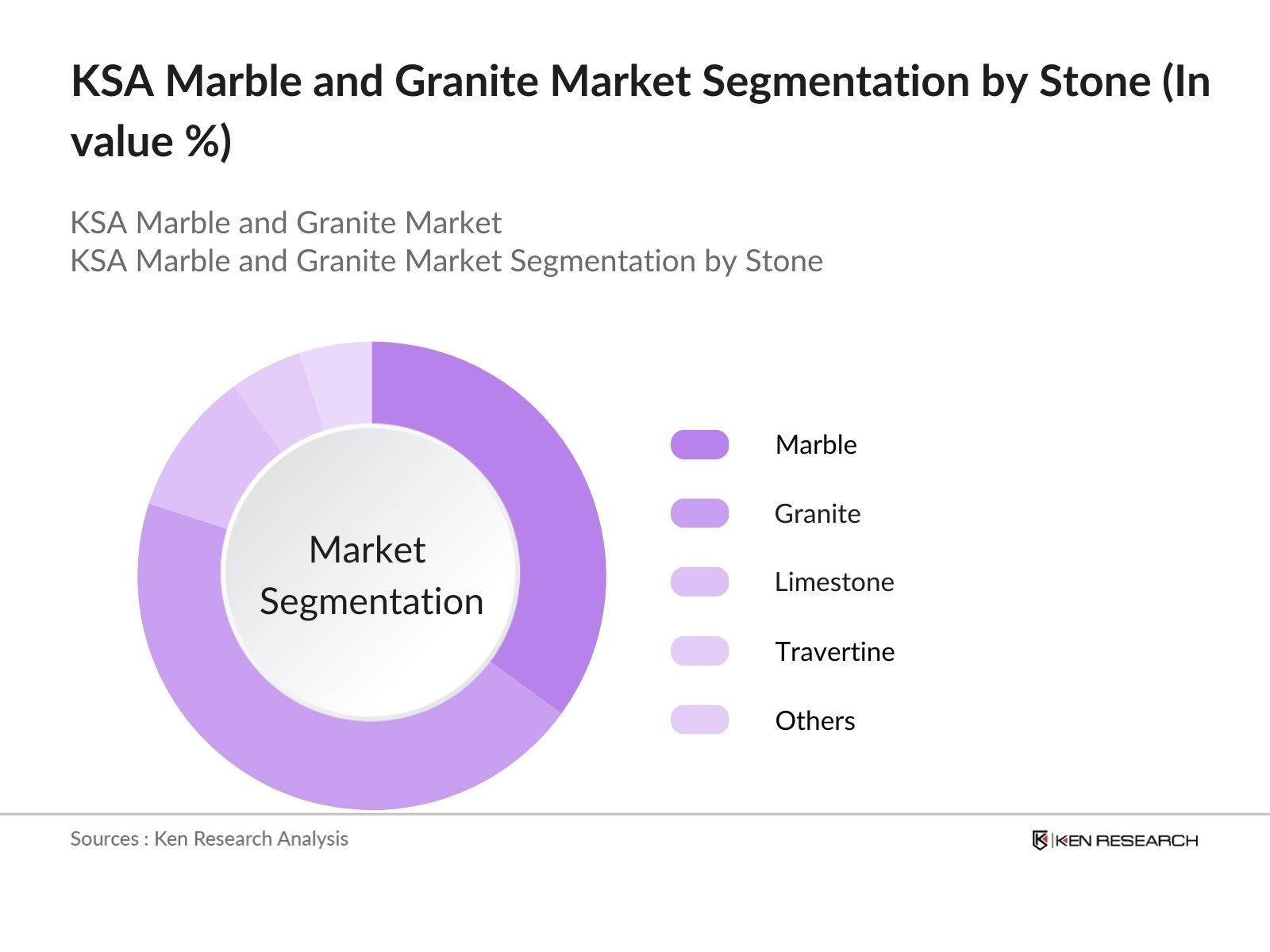

- By Type of Stone: The market is segmented by type of stone into marble, granite, limestone, travertine, and others. Marble dominates the market due to its high demand in luxury real estate and commercial building projects, particularly in large cities like Riyadh and Jeddah. Granite, known for its durability and wide range of applications in both interior and exterior constructions, is also growing rapidly. Limestone and travertine, while smaller segments, are seeing increased use in heritage and cultural projects driven by the government's focus on tourism and historical site development.

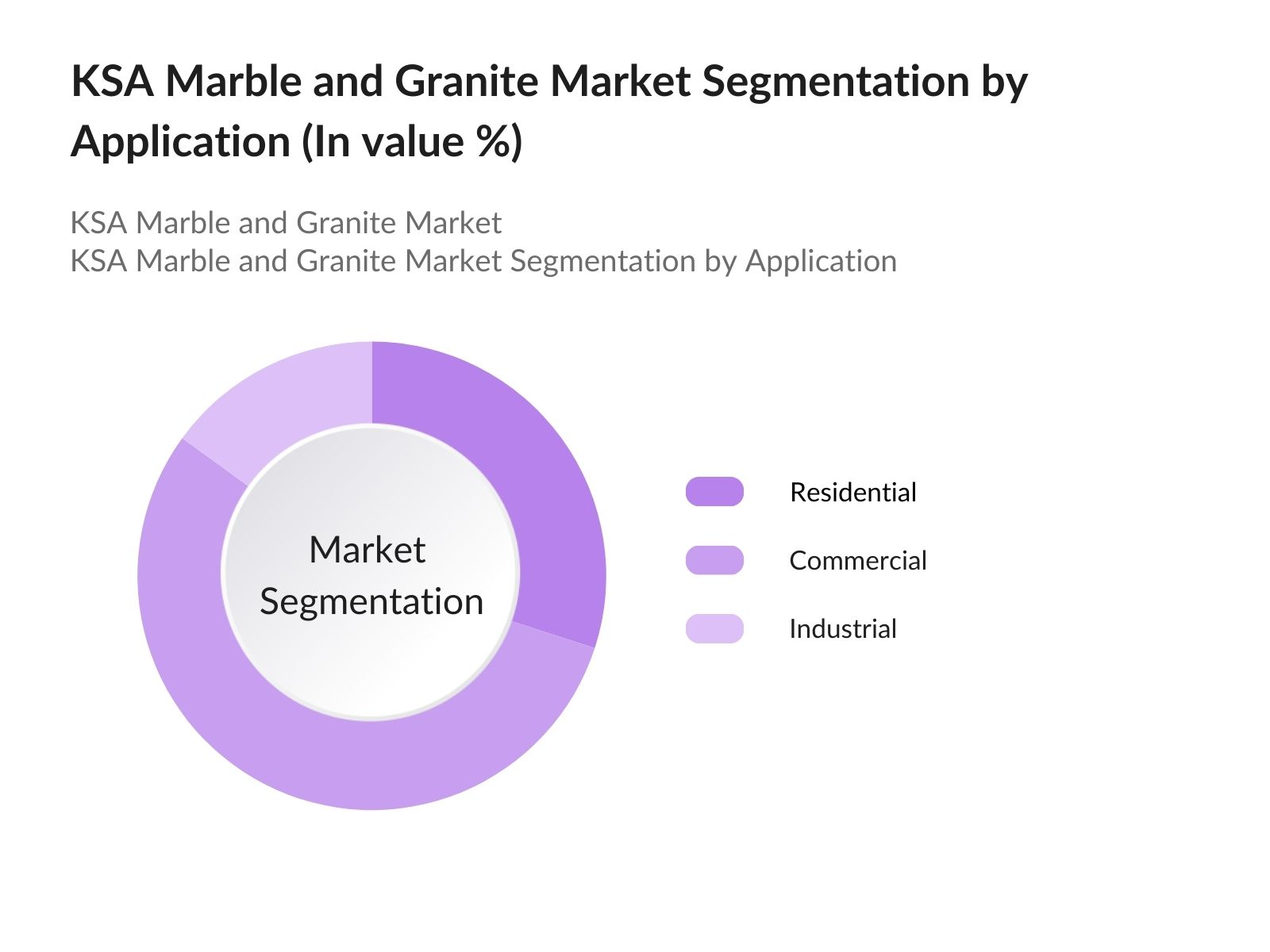

- By Application: The market is segmented by application into residential, commercial, and industrial construction. The commercial sector leads the market, driven by large-scale projects such as shopping malls, hotels, and office buildings. The residential sector, particularly high-end luxury apartments and villas, is also a major contributor, with affluent consumers favoring marble and granite for interior dcor and landscaping. Industrial construction is a smaller segment but is expected to grow as more industrial facilities and infrastructure projects are initiated under Vision 2030.

KSA Marble and Granite Market Competitive Landscape

The KSA marble and granite market is highly competitive, with several local and international players providing a diverse range of products. Key players include Al Harbi Marble, Saudi Marble & Granite Factory Company (SMG), Al Ayuni Group, and Global Stone. These companies are continuously expanding their quarrying and production capabilities to meet the growing demand. They are also investing in advanced machinery and technology to enhance product quality and output. Strategic partnerships with construction firms and government-backed infrastructure projects are common strategies employed by these players to strengthen their market presence.

|

Company |

Establishment Year |

Headquarters |

Key Products |

Production Capacity |

Technology Use |

Local Projects |

International Reach |

Sustainability Initiatives |

Partnerships |

|

Saudi Marble & Granite Co. |

1990 |

Jeddah, KSA |

|||||||

|

Al Harbi Marble |

1991 |

Riyadh, KSA |

|||||||

|

Global Stone |

2005 |

Dammam, KSA |

|||||||

|

Al Ayuni Group |

1960 |

Riyadh, KSA |

|||||||

|

Red Sea Mining |

1985 |

Yanbu, KSA |

KSA Marble and Granite Market Industry Analysis

Growth Drivers

- Government Infrastructure Projects: The Saudi governments Vision 2030 initiative has led to the development of megaprojects like Neom, Red Sea Project, and Qiddiya. These projects require extensive use of high-quality marble and granite for residential, commercial, and public buildings. The Neom project alone has an estimated investment of USD 500 billion, with significant demand for construction materials, including marble and granite. As part of Vision 2030, these infrastructure developments are designed to boost local material consumption, reducing import dependency by utilizing domestically sourced materials.

- Local Production Boost Under Vision 2030: Saudi Arabia is focused on reducing its dependency on imported marble and granite through Vision 2030. The country has an estimated 60 quarries, with ongoing plans to expand domestic stone extraction and processing facilities. As of 2024, around 70% of the marble and granite used in local construction comes from domestic sources, reflecting a significant shift from previous years. This increase is driven by government policies to support local producers and encourage foreign investments in the stone processing sector.

- Rising Demand in High-End Residential and Commercial Real Estate: KSAs real estate market has been experiencing a significant rise in demand for luxury housing and commercial spaces. Projects such as the Riyadh Development Strategy, which aims to double the citys population by 2030, require premium materials, including marble and granite, for building interiors and exteriors. In 2023, the luxury real estate market in Saudi Arabia grew substantially in terms of property development, driving the demand for premium materials like marble and granite in construction.

Market Challenges

- High Production Costs and Energy Consumption: The extraction and processing of marble and granite are energy-intensive processes, leading to high production costs. The price of electricity and fuel for heavy machinery is a significant challenge for manufacturers. As energy prices fluctuate, so do production costs, impacting profitability, particularly for smaller players in the market. These costs are also passed on to consumers, affecting the competitiveness of locally produced marble and granite compared to imports.

- Environmental Concerns: The quarrying process for marble and granite can lead to significant environmental degradation, including deforestation, soil erosion, and water pollution. In response, the government has introduced stricter regulations to minimize environmental damage. However, compliance with these regulations increases production costs, particularly for companies that must invest in sustainable technologies and practices. This challenge is particularly acute for smaller quarry operators, who may struggle to balance profitability with environmental responsibility.

KSA Marble and Granite Market Future Outlook

The KSA marble and granite market is expected to grow steadily over the next five years, driven by government infrastructure initiatives and the rising demand for high-end residential and commercial properties. The increased focus on local production and the use of advanced technologies will further enhance the markets competitiveness. Sustainable quarrying practices and environmental regulations will shape the future of this industry as the Kingdom balances economic growth with ecological preservation.

Future Market Opportunities

- Expansion into International Markets: Saudi Arabias marble and granite industry has significant export potential, especially within the GCC and European markets. In 2022, Saudi Arabia exported approximately USD 619 million worth of stone and glass products, which includes marble and granite, making it the 39th largest exporter in this category globally, mainly to neighbouring GCC countries. With ongoing investments in quarrying and stone processing technologies, the Kingdom is well-positioned to increase exports, tapping into the growing demand for premium construction materials across international markets.

- Investment in Sustainable Quarrying Practices There is increasing interest in sustainable quarrying and stone processing practices in Saudi Arabia. In 2024, the Saudi government allocated millions for sustainable quarrying initiatives, including waste reduction technologies and eco-friendly practices. The demand for green building materials is growing, especially among international buyers, presenting an opportunity for local producers to align with global sustainability standards.

Scope of the Report

|

By Type of Stone |

Marble Granite Limestone Travertine Others (Onyx, Slate) |

|

By Application |

Residential Commercial Industrial |

|

By End User |

Construction Companies Architects & Designers Government Infrastructure Projects Retail & Wholesale Distributors |

|

By Color |

White Marble Black Granite Beige Limestone Multi-Coloured Stones |

|

By Finish |

Polished Honed Flamed Leathered |

Products

Key Target Audience

Construction Companies

Architectural Firms

Real Estate Developers

Banks and Financial Institutes

Government and Regulatory Bodies (Ministry of Industry and Mineral Resources)

Investors and Venture Capitalist Firms

Retailers and Wholesalers in Building Materials

Quarrying and Mining Companies

Infrastructure Project Developers

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Saudi Marble & Granite Factory Co.

Al Harbi Marble

Al Ayuni Group

Global Stone

Red Sea Mining

Universal Building Materials (UBM)

Riyadh Stone Co.

Classic Marble Co.

Tanhat Mining Co. Ltd.

Marble & Granite International Co.

Rakami Stone

Bin Harkil Group

Al Watania for Marble & Granite

Al Rawas Marble & Granite

RAK Ceramics

Table of Contents

1. KSA Marble and Granite Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy (Marble, Granite, Limestone, Travertine)

1.3 Market Growth Rate

1.4 Market Segmentation Overview (By Stone Type, By Application, By End User, By Color, By Finish)

2. KSA Marble and Granite Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Marble and Granite Market Analysis

3.1 Growth Drivers

3.1.1 Government Infrastructure Projects (Neom, Red Sea Project, Qiddiya)

3.1.2 Local Production Boost Under Vision 2030 (Reduction of Import Dependency)

3.1.3 Rising Demand in High-End Residential and Commercial Real Estate

3.1.4 Technological Advancements in Stone Processing (Automated Cutting, Water Jet Technologies)

3.2 Market Challenges

3.2.1 High Production Costs and Energy Consumption

3.2.2 Environmental Regulations and Quarrying Restrictions

3.2.3 Fluctuations in Raw Material Availability (Local vs Imported Materials)

3.3 Opportunities

3.3.1 Expansion into International Markets (GCC, Europe)

3.3.2 Investment in Sustainable Quarrying Practices

3.3.3 Increasing Demand for Luxury Interiors and Landscapes

3.4 Trends

3.4.1 Use of Polished Marble in Premium Architectural Designs

3.4.2 Growing Popularity of Granite in Industrial Infrastructure

3.4.3 Technological Integration in Manufacturing (AI in Precision Cutting)

3.5 Government Regulations

3.5.1 Ministry of Industry and Mineral Resources Regulations (Licensing, Environmental Compliance)

3.5.2 National Policies on Domestic Production Quotas

3.5.3 Standards for Marble and Granite Quality in Public Infrastructure Projects

3.5.4 Export Regulations and Compliance with International Trade Standards

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. KSA Marble and Granite Market Segmentation

4.1 By Type of Stone (In Value %)

4.1.1 Marble

4.1.2 Granite

4.1.3 Limestone

4.1.4 Travertine

4.1.5 Others (Onyx, Slate)

4.2 By Application (In Value %)

4.2.1 Residential

4.2.2 Commercial

4.2.3 Industrial

4.3 By End User (In Value %)

4.3.1 Construction Companies

4.3.2 Architects and Designers

4.3.3 Government Infrastructure Projects

4.3.4 Retail and Wholesale Distributors

4.4 By Color (In Value %)

4.4.1 White Marble

4.4.2 Black Granite

4.4.3 Beige Limestone

4.4.4 Multi-Colored Stones

4.5 By Finish (In Value %)

4.5.1 Polished

4.5.2 Honed

4.5.3 Flamed

4.5.4 Leathered

5. KSA Marble and Granite Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Al Harbi Marble

5.1.2 Saudi Marble & Granite Factory Co.

5.1.3 Al Ayuni Group

5.1.4 Global Stone

5.1.5 Tanhat Mining Co. Ltd.

5.1.6 Marble & Granite International Co. (M&G)

5.1.7 Universal Building Materials (UBM)

5.1.8 Al Watania for Marble & Granite

5.1.9 Red Sea Mining

5.1.10 Classic Marble Co.

5.1.11 Rakami Stone

5.1.12 Riyadh Stone Co.

5.1.13 Bin Harkil Group

5.1.14 Al Jazeera Marble Co.

5.1.15 Al Rawas Marble & Granite

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Specialization, Technology Use, Supply Chain, Export/Import Ratio)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. KSA Marble and Granite Market Regulatory Framework

6.1 Industry Standards (Stone Quality, Finish Grades, Environmental Compliance)

6.2 Quarry Licensing Regulations

6.3 Export Documentation and Certification Processes

6.4 Local Production Quotas

7. KSA Marble and Granite Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Marble and Granite Future Market Segmentation

8.1 By Type of Stone (In Value %)

8.2 By Application (In Value %)

8.3 By End User (In Value %)

8.4 By Color (In Value %)

8.5 By Finish (In Value %)

9. KSA Marble and Granite Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, an in-depth ecosystem analysis was conducted, mapping all key stakeholders involved in the KSA marble and granite market. Extensive desk research was used to gather industry-level data, focusing on supply chain dynamics, production capacities, and market growth drivers.

Step 2: Market Analysis and Construction

Historical data pertaining to marble and granite consumption, domestic production, and import-export ratios were compiled and analyzed. Key data points such as market penetration rates and production outputs were cross-referenced with credible sources, including government reports and industry publications.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with key industry experts, including local producers and international suppliers. This phase involved qualitative interviews to gain insights into production challenges, material preferences, and technological adoption within the market.

Step 4: Research Synthesis and Final Output

In this final stage, the data was synthesized to develop a comprehensive understanding of market trends, competitive dynamics, and future growth opportunities. Direct consultations with quarry operators and construction companies further validated market estimates and projections.

Frequently Asked Questions

01. How big is the KSA Marble and Granite Market?

The KSA marble and granite market was valued at USD 1.80 billion, driven by large-scale infrastructure projects and increased demand in the luxury real estate sector.

02. What are the challenges in the KSA Marble and Granite Market?

Challenges in the KSA marble and granite market include high production costs due to energy-intensive quarrying processes and strict environmental regulations that increase operational costs for local producers.

03. Who are the major players in the KSA Marble and Granite Market?

Key players in the KSA marble and granite market include Saudi Marble & Granite Factory Co., Al Harbi Marble, Al Ayuni Group, Global Stone, and Red Sea Mining. These companies dominate due to their local production capabilities and strategic partnerships with government projects.

04. What are the growth drivers of the KSA Marble and Granite Market?

The KSA marble and granite market is driven by large-scale construction initiatives under Vision 2030, the rising demand for luxury real estate, and government support for boosting local production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.