KSA Mattress Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD7283

December 2024

86

About the Report

KSA Mattress Market Overview

- The KSA mattress market, based on a comprehensive five-year historical analysis, is valued at approximately USD 1.12 billion. This market growth is primarily driven by increasing urbanization, rising disposable income, and expansion in the residential and hospitality sectors. The governments investments in large-scale real estate projects, such as NEOM and various housing initiatives under Vision 2030, are major catalysts for demand, especially in high-quality, durable mattresses.

- The market is dominated by key cities like Riyadh, Jeddah, and the Eastern Province due to their high concentration of population and economic activities. Riyadh, as the capital and business hub, experiences substantial demand from both residential and hospitality sectors. Additionally, the flourishing tourism sector in Jeddah and the Eastern Province drives the commercial mattress market. These cities also benefit from a higher average income, contributing to greater consumer spending on premium mattresses.

- All mattress imports and locally manufactured products must comply with SASO's stringent quality standards, ensuring consumer safety and product durability. In 2024, SASO introduced updated guidelines for flame retardancy, material safety, and ergonomic design, which all manufacturers and importers must adhere to. Compliance with these standards is mandatory, and failure to meet them can result in hefty fines or product recalls, making regulatory adherence critical for market participants.

KSA Mattress Market Segmentation

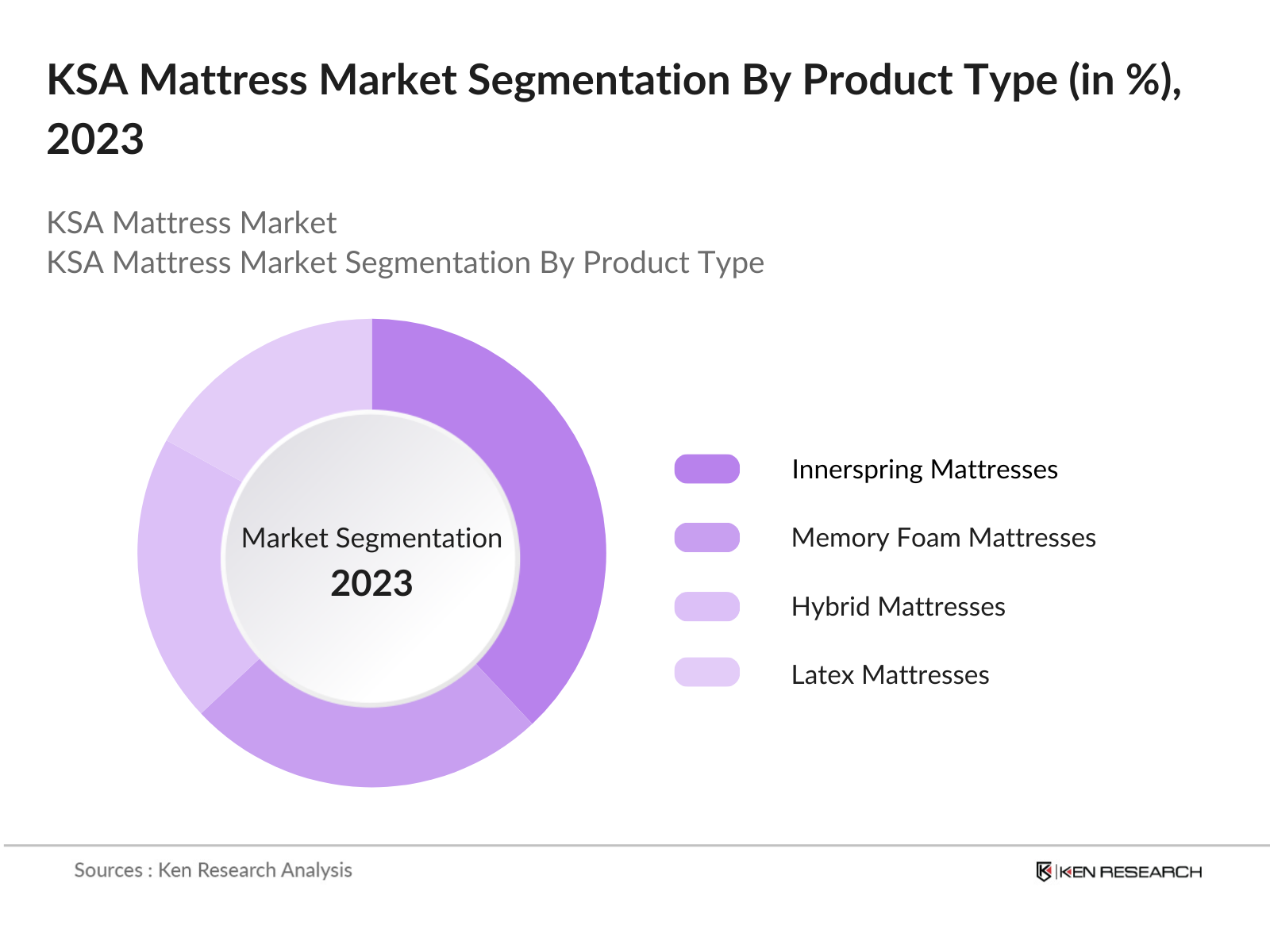

By Product Type: The KSA mattress market is segmented by product type into innerspring mattresses, memory foam mattresses, latex mattresses, hybrid mattresses, and smart mattresses. Among these, innerspring mattresses have a dominant market share due to their long-standing presence in the market, affordability, and general consumer familiarity with the product. Innerspring mattresses are also preferred in the hospitality sector due to their durability and ease of maintenance, making them the go-to option for hotels and furnished apartments.

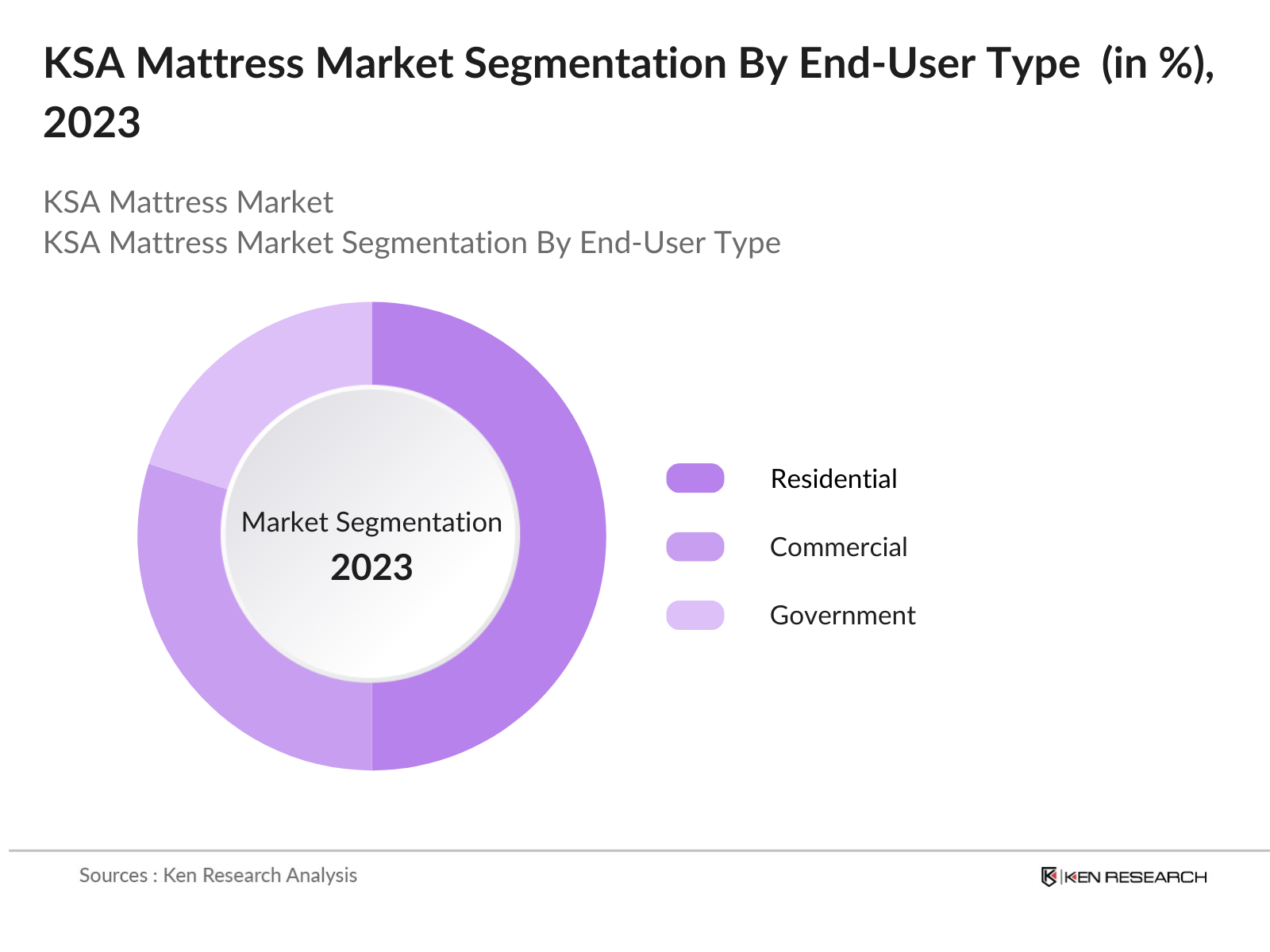

By End-User: The market is segmented by end-user into residential, commercial (hotels, hospitals, educational institutions), and government. Residential dominates the market share due to the increasing number of housing projects initiated under the Vision 2030 agenda. The growing middle class and the expansion of housing programs fuel the demand for high-quality mattresses. The sector also benefits from the rising trend of apartment living, where consumers prioritize comfort and health, driving demand for orthopedic and memory foam mattresses.

KSA Mattress Market Competitive Landscape

The KSAn mattress market is primarily consolidated, with key players holding significant market influence. These companies are known for their established distribution networks, strong brand recognition, and focus on product innovation. Local manufacturers like Sleep High and Raha Mattress have a stronghold in the market, offering affordable, high-quality mattresses tailored to local preferences. International brands like Sealy Middle East and Serta Simmons cater to the premium and luxury segments, contributing to the competitive landscape.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

Technology Integration |

Local Manufacturing |

Market Position |

Sustainability Efforts |

Customer Service Excellence |

Distribution Reach |

|

Sleep High |

1963 |

Riyadh, KSA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Sealy Middle East |

1881 |

Houston, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Serta Simmons |

1931 |

Doraville, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Raha Mattress |

1956 |

Jeddah, KSA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

King Koil |

1898 |

Willowbrook, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

KSA Mattress Industry Analysis

Growth Drivers

- Rising Disposable Income: KSA has experienced consistent growth in per capita income, driven by the government's Vision 2030 initiative, which focuses on diversifying the economy. In 2024, KSAs GDP per capita is projected to be around $25,000, an increase from $23,586 in 2022, according to the World Bank. This rise in disposable income enhances consumer purchasing power, leading to increased demand for premium mattresses and sleep products. The expanding middle class is further driving consumer spending on quality and luxury mattresses as people prioritize comfort and health.

- Expanding Real Estate & Housing Projects: The Saudi government has launched several large-scale housing projects under the Sakani and Vision 2030 programs. By 2024, the Ministry of Housing aims to deliver over 300,000 new residential units to meet the growing population needs, particularly in urban areas. This expansion in the real estate sector increases the demand for home essentials, including mattresses. The Sakani program alone has helped over 1.2 million families secure housing since its launch in 2017, boosting related industries like mattress production and sales.

- Increase in Hospitality Sector Demand: KSAs growing tourism and hospitality sector, bolstered by the Vision 2030 goal to attract 100 million tourists annually, has led to a rise in demand for mattresses, particularly in the hospitality industry. With 2.5 million visitors during the 2023 Hajj alone, hotel occupancy rates surged, requiring constant upgrades and refurbishments of amenities, including mattresses. The growing number of hotels and resorts, especially in cities like Riyadh, Jeddah, and Mecca, directly impacts mattress demand. Source: Saudi Ministry of Tourism.

Market Challenges

- Price Sensitivity Among Consumers: Despite rising incomes, a significant portion of Saudi consumers remains price-sensitive, especially in rural and lower-income areas. Around 17% of the population lives in rural regions where spending on luxury items like high-end mattresses is lower compared to urban areas. Consumers in these areas often prioritize affordability over quality, presenting a challenge for manufacturers and retailers targeting premium segments. The government's ongoing economic diversification plan aims to bridge this income gap, but it remains a barrier for now.

- Limited Penetration in Rural Areas: While urban areas such as Riyadh and Jeddah experience strong demand for mattresses, rural regions, home to approximately 5.6 million people, see lower market penetration. Poor infrastructure and a lower concentration of retail outlets hinder the distribution of mattresses in these areas. The Ministry of Economy has highlighted that rural regions account for just 12% of total retail sales in the country, making it difficult for mattress companies to expand their reach without significant investments in logistics and marketing.

KSA Mattress Market Future Outlook

Over the next few years, the KSAn mattress market is expected to experience significant growth driven by several key factors. The governments continued investment in housing projects under Vision 2030, along with a growing middle-class population, will drive demand in the residential sector. Additionally, the expansion of the tourism and hospitality industries, coupled with increasing consumer awareness of the health benefits of quality sleep, will fuel demand for premium and specialty mattresses, such as orthopedic and smart mattresses. The rise of e-commerce platforms and the increasing penetration of online retail will also create new avenues for market growth.

Opportunities

Growth in E-Commerce Sales Channels: The e-commerce sector in KSA is rapidly growing, with online sales projected to exceed $10 billion in 2024. This surge presents significant opportunities for mattress companies to tap into the growing online consumer base. Platforms like Amazon.sa and Noon are witnessing increased demand for home essentials, including mattresses, as consumers increasingly prefer online shopping due to convenience and a wider selection of products. This trend is especially pronounced in urban centers, where internet penetration rates are over 95%.

Rising Demand for Smart Mattresses: Smart mattresses, equipped with sleep-tracking and temperature-regulation features, are gaining popularity in KSA. With the countrys high smartphone penetration rate of 98% in 2024, tech-savvy consumers are increasingly adopting smart home devices, including smart mattresses. These mattresses cater to a growing demand for health-related and high-tech home products, with sales in this segment seeing substantial growth, especially in urban areas where consumers are more inclined to spend on innovative products.

Scope of the Report

|

By Product Type |

Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Smart Mattresses |

|

By End-User |

Residential Commercial Government |

|

By Distribution Channel |

Offline Online |

|

By Size |

Single Double King Queen |

|

By Region |

Riyadh Jeddah Eastern Province Mecca Province Rest of KSA |

Products

Key Target Audience

Mattress Companies

Raw Material Companies

Government and Regulatory Bodies (Saudi Standards, Metrology, and Quality Organization - SASO)

Hospitality Industry

Residential Real Estate Developers

Investors and Venture Capitalist Firms

Healthcare Sector (Hospitals and Clinics)

Companies

Major Players

Sleep High

Sealy Middle East

Serta Simmons

Tempur Sealy

King Koil

IKEA

Al Rajhi Group

Raha Mattress

Al Mutlaq Furniture

Hilsonic International

Hayat Holding

Arabian Furniture and Mattresses

Sleepmed

Dunlopillo

La-Z-Boy

Table of Contents

1. KSA Mattress Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Mattress Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Mattress Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income (Per Capita Income Trends)

3.1.2. Expanding Real Estate & Housing Projects (Government Housing Programs)

3.1.3. Increase in Hospitality Sector Demand (Tourism & Hospitality Metrics)

3.1.4. Increasing Health Awareness (Orthopedic Mattress Demand)

3.2. Market Challenges

3.2.1. Price Sensitivity Among Consumers

3.2.2. Limited Penetration in Rural Areas

3.2.3. High Import Dependency (Import Tariffs and Trade Barriers)

3.3. Opportunities

3.3.1. Growth in E-Commerce Sales Channels

3.3.2. Rising Demand for Smart Mattresses (Technology Adoption Rates)

3.3.3. Expansion of Luxury Mattress Segment

3.4. Trends

3.4.1. Customization in Mattress Products (Consumer Preferences)

3.4.2. Sustainable Materials & Eco-Friendly Products

3.4.3. Increased Focus on Ergonomics and Sleep Science

3.5. Government Regulation

3.5.1. Quality Standards (Saudi Standards, Metrology, and Quality Organization - SASO)

3.5.2. Tariff Structures on Imports

3.5.3. Local Content Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. KSA Mattress Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Innerspring Mattresses

4.1.2. Memory Foam Mattresses

4.1.3. Latex Mattresses

4.1.4. Hybrid Mattresses

4.1.5. Smart Mattresses

4.2. By End-User (In Value %)

4.2.1. Residential

4.2.2. Commercial (Hotels, Hospitals, Educational Institutions)

4.2.3. Government

4.3. By Distribution Channel (In Value %)

4.3.1. Offline (Retail Stores, Specialty Stores)

4.3.2. Online (E-commerce Platforms, Direct-to-Consumer)

4.4. By Size (In Value %)

4.4.1. Single

4.4.2. Double

4.4.3. King

4.4.4. Queen

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

4.5.4. Mecca Province

4.5.5. Rest of KSA

5. KSA Mattress Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sleep High

5.1.2. Sealy Middle East

5.1.3. Serta Simmons

5.1.4. Tempur Sealy

5.1.5. King Koil

5.1.6. IKEA

5.1.7. Al Rajhi Group

5.1.8. Raha Mattress

5.1.9. Al Mutlaq Furniture

5.1.10. Hilsonic International

5.1.11. Hayat Holding

5.1.12. Arabian Furniture and Mattresses

5.1.13. Sleepmed

5.1.14. Dunlopillo

5.1.15. La-Z-Boy

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Technological Integration, Sustainability Initiatives, Local Manufacturing Capabilities, Customer Service Excellence, Distribution Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Joint Ventures, Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Mattress Market Regulatory Framework

6.1. SASO Compliance Standards

6.2. Import Tariffs & Duties

6.3. Local Manufacturing Incentives

7. KSA Mattress Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Mattress Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Size (In Value %)

8.5. By Region (In Value %)

9. KSA Mattress Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first stage involved mapping out all major stakeholders within the KSAn mattress market. Extensive desk research was conducted using secondary sources such as company reports, government publications, and proprietary databases. Key variables such as product types, consumer preferences, and distribution channels were identified to provide an in-depth understanding of market dynamics.

Step 2: Market Analysis and Construction

This phase included compiling and analyzing historical data on market penetration, product sales, and revenue generation. We also evaluated the ratio of offline to online sales, the emergence of e-commerce, and the impact on retail dynamics. Historical data on product preferences by region was cross-checked for reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and tested through expert interviews with industry professionals from leading mattress companies. These consultations provided insights into product trends, manufacturing challenges, and opportunities for expansion within the KSAn market.

Step 4: Research Synthesis and Final Output

The final stage synthesized data from various sources, validated through industry experts, to provide a robust analysis of the KSAn mattress market. This ensured that the final report was comprehensive and accurately reflected current market conditions.

Frequently Asked Questions

1. How big is the KSA Mattress Market?

The KSA mattress market is valued at USD 1.12 billion in 2023, driven by factors such as urbanization, rising disposable incomes, and increased demand from the residential and hospitality sectors.

2. What are the challenges in the KSA Mattress Market?

Challenges include the high price sensitivity among consumers, import dependency for premium mattresses, and logistical issues related to distribution in rural areas.

3. Who are the major players in the KSA Mattress Market?

Key players include Sleep High, Sealy Middle East, Serta Simmons, Raha Mattress, and King Koil. These companies dominate due to their product innovation, strong brand presence, and extensive distribution networks.

4. What are the growth drivers of the KSA Mattress Market?

Growth is driven by government investments in housing projects, the expansion of the tourism and hospitality sectors, and increased consumer awareness of health and well-being benefits related to high-quality mattresses.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.