KSA Meat Substitutes Market Outlook to 2030

Region:Middle East

Author(s):Shambhavi Awasthi

Product Code:KROD9550

December 2024

82

About the Report

KSA Meat Substitutes Market Overview

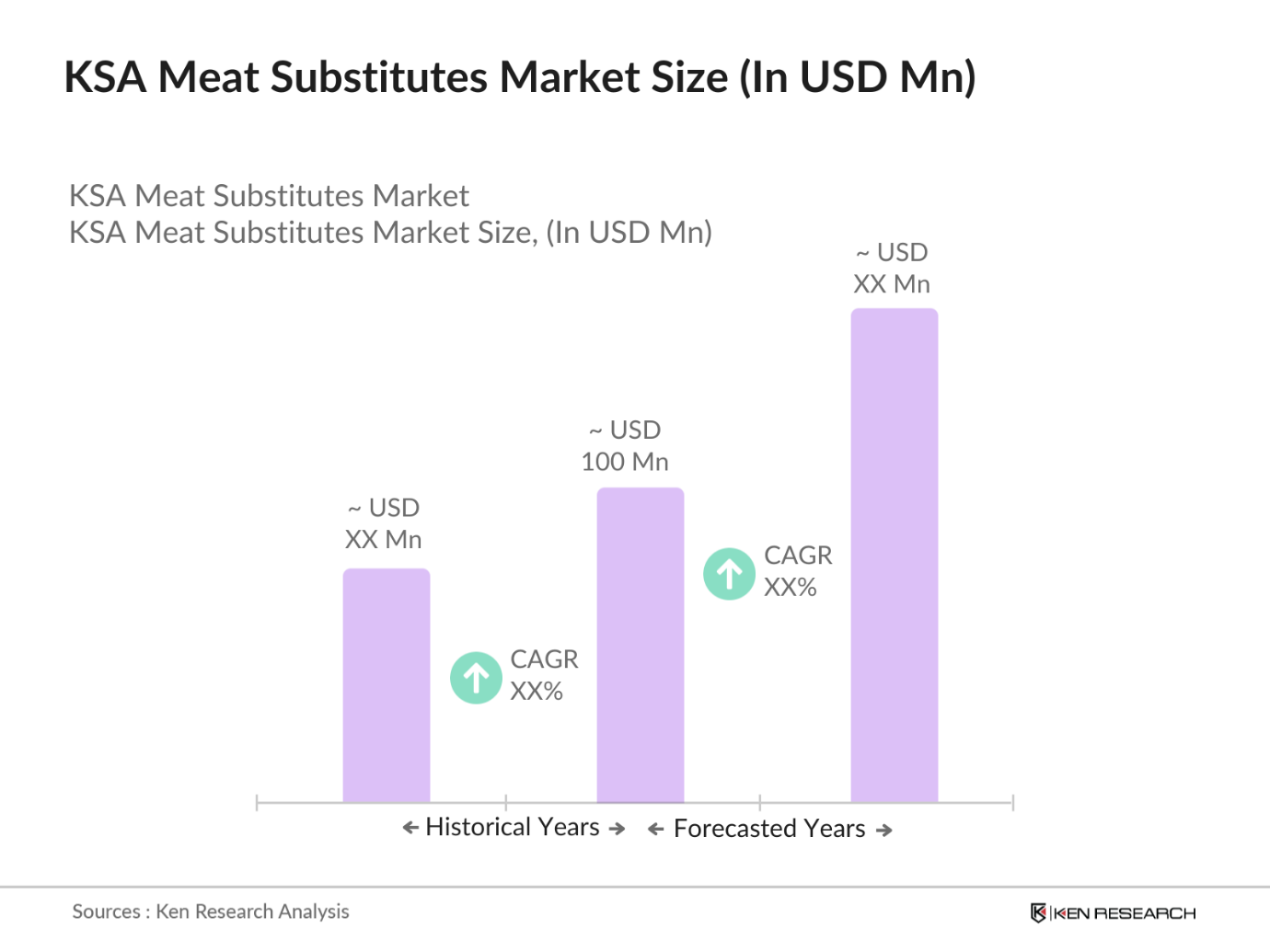

- The Kingdom of Saudi Arabia (KSA) Meat Substitutes Market has grown considerably in recent years, driven by increasing health consciousness and environmental awareness among consumers. According to available data, the market valuation reached USD 100 million in 2023. Growth is fueled by a combination of factors, including rising demand for plant-based alternatives, advancements in food technology, and greater accessibility of meat substitutes across urban centers. Major consumer demographics include health-conscious millennials and Generation Z, who prioritize sustainable food choices.

- In the KSA, dominant cities like Riyadh and Jeddah drive a significant portion of the meat substitutes market. These cities host diverse populations, including a large expatriate community with dietary preferences aligned with plant-based or meat-free options. Additionally, urban centers with high-income residents who are more likely to adopt lifestyle trends focusing on wellness and sustainability contribute to the prominence of these regions in the market.

- The Saudi government is actively promoting sustainable food production practices as part of its Vision 2030 plan. Initiatives aimed at diversifying the economy and reducing dependency on meat consumption are leading to increased investments in alternative protein sources. The government is providing funding and support for research and development in plant-based food technologies, which is expected to foster growth in the meat substitutes market. This proactive approach aims to ensure food security while addressing environmental concerns associated with traditional meat production.

KSA Meat Substitutes Market Segmentation

- By Product Type: The KSA Meat Substitutes Market is segmented by product type into tofu, tempeh, seitan, plant-based patties, and protein-based products. Plant-based patties are a dominant segment in this category, with a considerable market share of around 30% in 2023. This dominance is due to the convenience and familiarity of patties as a food product, making them a popular choice for consumers transitioning to meat alternatives. Companies like Beyond Meat and Impossible Foods have successfully introduced patties that cater to traditional Middle Eastern dishes, appealing to local tastes and cultural preferences.

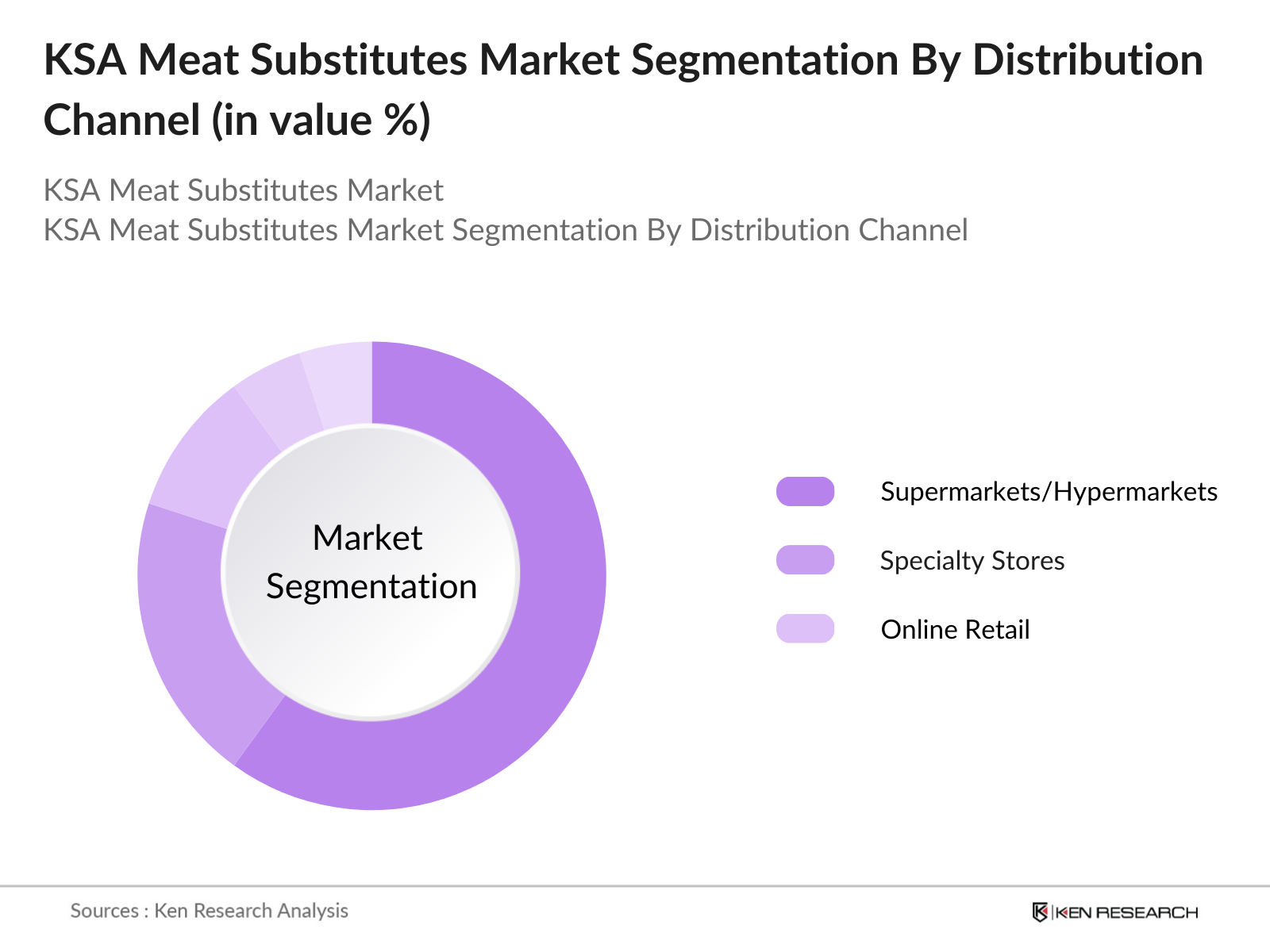

- By Distribution Channel: Distribution channels in the KSA Meat Substitutes Market include supermarkets/hypermarkets, specialty stores, and online retail. Supermarkets and hypermarkets dominate this segment with a market share of 50% in 2023, primarily due to their extensive presence in urban areas, where they cater to the everyday shopping needs of consumers. Leading supermarkets such as Carrefour and Danube offer dedicated sections for meat substitute products, making them accessible and convenient for a growing consumer base.

KSA Meat Substitutes Market Competitive Landscape

The KSA Meat Substitutes Market is consolidated among a few major players, both local and international, who dominate due to brand recognition, quality, and distribution networks. Key players include well-known brands in the global meat substitutes market, which have tailored their offerings to align with local dietary requirements and preferences.

|

Company |

Year Established |

Headquarters |

Product Line Focus |

Market Presence (Cities) |

Local Partnerships |

Innovation in R&D |

Certifications |

Halal Compliance |

|

Beyond Meat |

2009 |

El Segundo, USA |

~ |

~ |

~ |

~ |

~ |

~ |

|

Impossible Foods |

2011 |

Redwood City, USA |

~ |

~ |

~ |

~ |

~ |

~ |

|

Al Islami Foods |

1981 |

Dubai, UAE |

~ |

~ |

~ |

~ |

~ |

~ |

|

Veggie Foods |

2010 |

Riyadh, KSA |

~ |

~ |

~ |

~ |

~ |

~ |

|

Green Evolve |

2016 |

Jeddah, KSA |

~ |

~ |

~ |

~ |

~ |

~ |

KSA Meat Substitutes Marke|t Analysis

Growth Drivers

- Changing Dietary Preferences: In Saudi Arabia, a significant shift in dietary preferences has been observed as consumers are increasingly leaning towards plant-based diets. The World Health Organization has highlighted that about 34% of the Saudi population is now reducing meat consumption in favor of healthier, sustainable options. This is partly driven by rising health concerns related to red meat consumption, including heart disease and obesity, with obesity rates in the country reaching approximately 35%. Such changing preferences are expected to further boost the demand for meat substitutes in the market.

- Health Consciousness: The growing awareness of health and wellness among the Saudi population is significantly contributing to the rise in demand for meat substitutes. The Ministry of Health has reported that non-communicable diseases, including diabetes and hypertension, have seen an alarming rise, affecting more than 60% of adults. As a response, consumers are actively seeking healthier protein alternatives that offer lower fat and cholesterol content. This health-conscious trend is anticipated to drive a greater adoption of meat substitutes as part of a balanced diet.

- Rising Vegetarian and Vegan Population: The vegetarian and vegan community in Saudi Arabia is witnessing substantial growth, reflecting global trends towards more plant-based diets. According to recent surveys, around 15% of the Saudi population identifies as vegetarian or vegan, driven by ethical concerns about animal welfare and environmental sustainability. This demographic shift is expected to create a robust demand for diverse and innovative meat substitutes, presenting opportunities for manufacturers to cater to these consumers with tailored products.

Market Challenges

- Taste and Texture Limitations: Despite the growth in the meat substitutes market, challenges remain regarding the taste and texture of plant-based products compared to traditional meat. Consumer taste preferences remain a critical barrier, with many still associating meat with better flavor and satisfaction. A study indicated that around 40% of consumers cite taste as a major factor preventing them from switching to meat alternatives. Manufacturers must focus on improving the sensory qualities of meat substitutes to address these concerns effectively.

- High Production Costs: The production of meat substitutes often incurs higher costs than traditional meat, largely due to the technology and ingredients required for manufacturing. Reports show that plant-based proteins can be 20-30% more expensive than their meat counterparts, posing a challenge for widespread adoption, especially in price-sensitive markets like Saudi Arabia. The higher costs associated with advanced processing technologies and sourcing premium ingredients can limit market penetration and accessibility. To overcome this challenge, companies may need to explore cost-reduction strategies, such as optimizing production processes or sourcing alternative raw materials that maintain quality while reducing costs.

KSA Meat Substitutes Market Future Outlook

Over the next five years, the KSA Meat Substitutes Market is anticipated to experience substantial growth, driven by an increasing shift toward healthier lifestyles and sustainable eating habits. Growing awareness about environmental impacts, coupled with innovative product development by global and local brands, is expected to further expand market penetration. Government initiatives supporting food security and diversification of dietary sources will also contribute to the growth of the market. Additionally, advancements in production technologies are likely to reduce costs, making meat substitutes more affordable to a broader demographic in KSA.

Opportunities

- Innovations in Food Technology: The meat substitutes market is ripe for innovations in food technology, including advancements in plant-based protein extraction and processing techniques. Companies investing in research and development to create more appealing and nutritious products are likely to gain a competitive edge. The current trend of using fermentation and cell-based technologies is paving the way for new product formulations that can closely mimic the taste and texture of meat, capturing the attention of a broader consumer base. This innovation can be a game-changer for manufacturers looking to differentiate their offerings.

- Increasing Distribution Channels: The expansion of distribution channels for meat substitutes presents a significant opportunity for growth. The rise of e-commerce and health-focused retail outlets is facilitating greater access to plant-based products. Recent statistics indicate that online grocery shopping has surged, with a reported increase of 50% in the online food retail sector during the past year. By enhancing availability through diverse retail formats, companies can cater to a wider audience, encouraging trial and adoption of meat substitutes.

Scope of the Report

|

Segment |

Sub-segment |

|---|---|

|

By Product Type |

Tofu and Soy Products |

|

Seitan |

|

|

Legume-Based Products |

|

|

Mycelium-Based Products |

|

|

By Source |

Plant-Based |

|

Lab-Grown |

|

|

By Distribution Channel |

Supermarkets and Hypermarkets |

|

Health Food Stores |

|

|

Online Retail |

|

|

By Region |

Riyadh |

|

Jeddah |

|

|

Dammam |

|

|

Other Regions |

|

|

By Consumer Type |

Vegetarians |

|

Flexitarians |

|

|

Meat Lovers |

Products

Key Target Audience

Health-Conscious Consumers

Supermarkets and Hypermarkets

Specialty Vegan and Health Food Stores

Online Grocery Retailers

Investor and Venture Capitalist Firms

Food and Beverage Distributors

Restaurants and Food Service Chains

Government and Regulatory Bodies (Saudi Food and Drug Authority - SFDA)

Companies

Players mentioned in the report

Beyond Meat

Impossible Foods

Al Islami Foods

Green Evolve

Veggie Foods

Nestle (Garden Gourmet)

Kelloggs (MorningStar Farms)

Tyson Foods (Raised & Rooted)

Quorn Foods

Meatless Farm

Gardein (Conagra)

Tofurky

Dr. Praegers

LikeMeat

Vivera

Table of Contents

1. KSA Meat Substitutes Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Meat Substitutes Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Meat Substitutes Market Analysis

3.1. Growth Drivers

3.1.1. Changing Dietary Preferences

3.1.2. Health Consciousness

3.1.3. Rising Vegetarian and Vegan Population

3.1.4. Government Initiatives for Sustainable Food Sources

3.2. Market Challenges

3.2.1. Taste and Texture Limitations

3.2.2. High Production Costs

3.2.3. Limited Awareness of Plant-Based Options

3.3. Opportunities

3.3.1. Innovations in Food Technology

3.3.2. Increasing Distribution Channels

3.3.3. Expansion of Retail Formats

3.4. Trends

3.4.1. Emergence of Hybrid Meat Products

3.4.2. Growth of E-Commerce for Meat Substitutes

3.4.3. Social Media Influence on Food Choices

3.5. Government Regulation

3.5.1. Food Safety Standards

3.5.2. Labeling and Nutritional Information Requirements

3.5.3. Subsidies for Plant-Based Product Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Meat Substitutes Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Tofu and Soy Products

4.1.2. Seitan

4.1.3. Legume-Based Products

4.1.4. Mycelium-Based Products

4.2. By Source (In Value %)

4.2.1. Plant-Based

4.2.2. Lab-Grown

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Health Food Stores

4.3.3. Online Retail

4.4. By Region (In Value %)

4.4.1. Riyadh

4.4.2. Jeddah

4.4.3. Dammam

4.4.4. Other Regions

4.5. By Consumer Type (In Value %)

4.5.1. Vegetarians

4.5.2. Flexitarians

4.5.3. Meat Lovers

5. KSA Meat Substitutes Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Beyond Meat

5.1.2. Impossible Foods

5.1.3. Tofurky

5.1.4. Quorn Foods

5.1.5. Gardein

5.1.6. MorningStar Farms

5.1.7. Field Roast

5.1.8. Lightlife

5.1.9. Oatly

5.1.10. A&W Food Services

5.1.11. Mosa Meat

5.1.12. Eat Just

5.1.13. Meati Foods

5.1.14. Hungry Planet

5.1.15. Perfect Day

5.2 Cross Comparison Parameters (Market Share, Product Range, Geographical Reach, Sustainability Practices, Pricing Strategies, Innovation Rate, Brand Recognition, Customer Loyalty)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Meat Substitutes Market Regulatory Framework

6.1. Food Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Meat Substitutes Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Meat Substitutes Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Source (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Region (In Value %)

8.5. By Consumer Type (In Value %)

9. KSA Meat Substitutes Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase included mapping the key stakeholders in the KSA Meat Substitutes Market, utilizing extensive desk research and secondary databases. The aim was to establish a foundation of variables that influence market trends, such as consumer preferences, distribution channels, and demographic data.

Step 2: Market Analysis and Construction

Historical data on the KSA Meat Substitutes Market was compiled and analyzed, focusing on revenue generation, consumer demographics, and regional distribution. This data informed the market size, segmentation, and trends, ensuring accuracy in projected growth rates and market value.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with industry experts via telephone and online surveys, gaining insights into consumer trends, distribution channels, and emerging market dynamics. These discussions helped refine data accuracy and relevance.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing all gathered data, including direct interactions with meat substitute manufacturers and distributors. These interactions helped verify statistics and added depth to the qualitative aspects of the report, supporting a comprehensive analysis of the KSA Meat Substitutes Market.

Frequently Asked Questions

01. How big is the KSA Meat Substitutes Market?

The KSA Meat Substitutes Market reached a valuation of approximately USD 100 million, driven by increased awareness of health benefits and sustainability.

02. What are the main challenges in the KSA Meat Substitutes Market?

Key challenges include cultural preferences for traditional meat, high prices of meat substitutes, and limited consumer awareness, which affects broader adoption.

03. Who are the dominant players in the KSA Meat Substitutes Market?

Major players include Beyond Meat, Impossible Foods, Al Islami Foods, Green Evolve, and Veggie Foods, owing to their strong distribution networks and brand recognition.

04. What drives growth in the KSA Meat Substitutes Market?

Growth is propelled by increasing health consciousness, environmental awareness, and government support for dietary diversification.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.