KSA Medical Bandages Market Outlook to 2030

Region:Middle East

Author(s):Naman Rohilla

Product Code:KROD1289

November 2024

97

About the Report

KSA Medical Bandages Market Overview

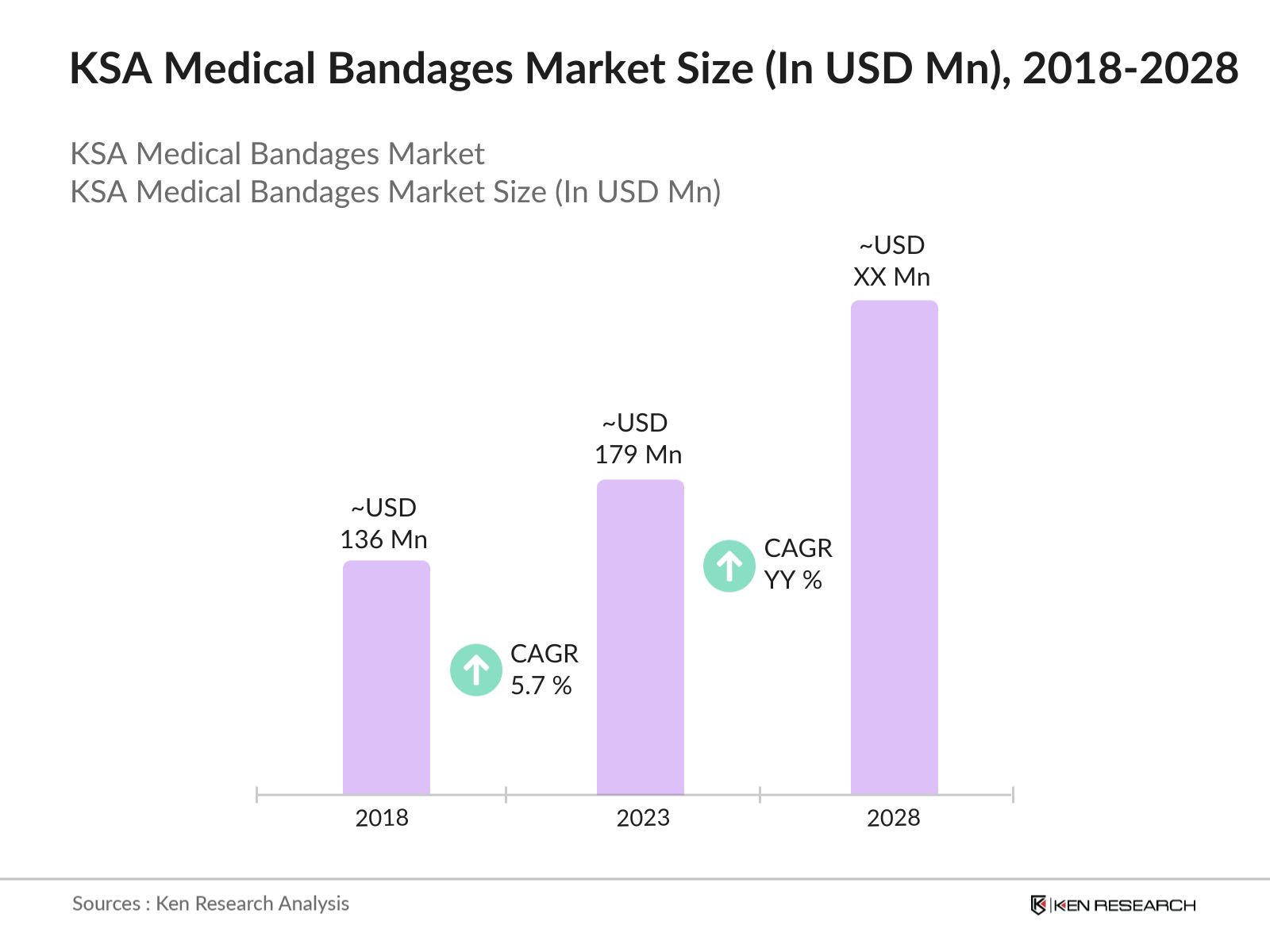

- The KSA Medical Bandages Market size was valued at USD 179 million in 2023. The growing prevalence of chronic wounds, an ageing population, and increased awareness of advanced wound care solutions are key factors driving the demand for medical bandages in Saudi Arabia.

- The key players in the KSA Medical Bandages market include 3M, Smith & Nephew, Mlnlycke Health Care, and local players like Al Maarefa Medical Supplies and Saudi Mais Co. for Medical Products. These companies offer a wide range of medical bandages, including traditional gauze bandages, elastic bandages, and advanced wound care dressings, catering to hospitals, clinics, and home care settings across the Kingdom.

- In 2023, Mlnlycke Health Care expanded its joint venture with Tamer Group in Saudi Arabia, called Tamer Mlnlycke Care, to enhance its production capacity for advanced wound care solutions. This initiative aims to meet the rising healthcare demands in the region, with the first production of customized surgical procedure trays expected in late 2024. The partnership strengthens Mlnlycke's commitment to supporting healthcare professionals and patients in Saudi Arabia.

- The Riyadh region dominated the KSA Medical Bandages Market in 2023. Riyadh's dominance can be attributed to its status as the healthcare hub of Saudi Arabia, with a high concentration of hospitals, clinics, and healthcare providers.

KSA Medical Bandages Market Segmentation

The KSA Medical Bandages Market is segmented into Bandage Type, End-User Industry, and Region.

- By Bandage Type: The KSA Medical Bandages Market is segmented by bandage type into gauze bandages, elastic bandages, adhesive bandages, and advanced wound care dressings. Gauze bandages hold the dominant market share in 2023, driven by their wide usage in hospitals and clinics for dressing various types of wounds.

- By End-User Industry: The market is also segmented by end-user industry into hospitals, clinics, home care settings, and others (pharmacies, retail). The hospital segment holds the largest market share in 2023, driven by the increasing number of surgeries and the need for effective wound care management in postoperative care.

- By Region: The KSA Medical Bandages Market is segmented by region into North, West, East, and South. The north region, with Riyadh as its core, dominated the market in 2023 due to its well-established healthcare infrastructure and high patient inflow.

KSA Medical Bandages Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

3M |

1902 |

St. Paul, Minnesota, USA |

|

Smith & Nephew |

1856 |

London, UK |

|

Mlnlycke Health Care |

1849 |

Gothenburg, Sweden |

|

Al Maarefa Medical Supplies |

1995 |

Riyadh, Saudi Arabia |

|

Saudi Mais Co. for Medical Products |

1994 |

Riyadh, Saudi Arabia |

- 3M: In 2023, 3M announced the construction of its largest manufacturing facility in the Middle East, located in Dammam, Saudi Arabia. This facility will be built in three phases over five years and aims to enhance local production capabilities for various products, including healthcare solutions. The facility is designed to cater to both local and regional markets, supporting the Kingdom's economic diversification efforts.

- Tamer Group: In 2023, Tamer Group expanded its collaboration with international healthcare providers to distribute advanced wound care solutions in Saudi Arabia. This partnership aims to enhance the availability and adoption of innovative medical bandages in hospitals and clinics across the country, addressing the growing demand for high-quality healthcare products.

KSA Medical Bandages Market Analysis

KSA Medical Bandages Market Growth Drivers:

- Rising Incidence of Chronic Wounds: The increasing prevalence of chronic conditions such as diabetes and obesity is contributing to the rise in chronic wounds. Both conditions are risk factors for developing non-healing wounds, with diabetes leading to complications like diabetic foot ulcers. Around 15% of individuals with diabetes will experience a non-healing ulcer during their lifetime, which underscores the urgent need for effective wound care management.

- Advancements in Wound Care Technologies: The introduction of advanced wound care products, including antimicrobial dressings and hydrocolloid bandages, is expected to drive market growth. These innovative products enhance healing outcomes and are increasingly utilized in clinical settings, improving the management of chronic wounds and reducing complications associated with traditional treatments.

- Growing Healthcare Infrastructure: The expansion of healthcare facilities across Saudi Arabia is indeed driving the demand for medical bandages. The country has seen some increase in hospitals and clinics, particularly in major cities like Riyadh, Jeddah, and Dammam. This growth in healthcare infrastructure is essential for addressing the rising healthcare needs and improving access to advanced wound care solutions.

KSA Medical Bandages Market Challenges:

- High Competition from Imported Products: The KSA Medical Bandages Market is impacted by competition from imported products, which often feature advanced technologies or lower prices. About 60% of medical devices in Saudi Arabia are imported, primarily from countries like the US, Germany, and Japan. This reliance on imports puts pressure on local manufacturers to innovate and differentiate their products in a highly competitive landscape, affecting their market share and profitability.

- Fluctuating Raw Material Prices: The profitability of manufacturers in the KSA Medical Bandages Market is challenged by fluctuating raw material prices, such as cotton and synthetic fibres. For instance, the price of cotton has seen fluctuations of up to 50% over the past few years due to global supply chain disruptions and climate impacts. These price variations can affect production costs, making it difficult for manufacturers to maintain competitive pricing while ensuring product quality.

KSA Medical Bandages Market Government Initiatives:

- Investment in Healthcare Infrastructure: The Saudi government is investing $66 billion in healthcare infrastructure as part of its Vision 2030 initiative, aiming to enhance access and quality of care. This investment includes the construction of new hospitals and clinics, with around 80% of healthcare facilities financed through government initiatives. By increasing private sector participation from 40% to 65%, the government seeks to meet the growing demand for medical supplies, including bandages.

- Promotion of Local Manufacturing: The Saudi government is actively promoting local manufacturing of medical products through various incentives, including public-private partnerships and investment in healthcare infrastructure. Plans to privatize 290 hospitals and 2,300 primary health centers aim to increase private sector participation in healthcare from 40% to 65% by 2030. These initiatives are expected to boost domestic production of medical bandages, reduce reliance on imports, and enhance the overall sustainability of the healthcare system in Saudi Arabia.

KSA Medical Bandages Market Future Market Outlook

The KSA Medical Bandages Market is expected to grow steadily over the forecast period, driven by the rising demand for effective wound care solutions and the ongoing healthcare reforms under the Vision 2030 initiative.

KSA Medical Bandages Market Future Market Trends:

- Increased Adoption of Advanced Wound Care Products: The adoption of advanced wound care bandages is indeed expected to increase, driven by better patient outcomes and faster healing times. The global advanced wound care market is projected to grow substantially, with reports indicating that advanced wound dressings account for over 45% of the market share due to their effectiveness in managing chronic wounds such as diabetic foot ulcers and pressure ulcers. Additionally, advancements in technologies, such as smart dressings that provide real-time monitoring and enhanced healing, are contributing to this trend, as they improve patient outcomes and encourage healthcare professionals to adopt these products more widely.

- Growing Demand for Home Care Solutions: As the elderly population in Saudi Arabia continues to grow, there is indeed an increasing demand for home care solutions, including medical bandages, which facilitate easier wound care management at home. The ageing population is expected to rise substantially, with estimates suggesting that by 2030, around 20% of Saudi Arabia's population will be over the age of 60. This demographic shift is driving the demand for home care products, as families seek effective solutions for managing chronic wounds and ensuring proper care for elderly individuals at home.

Scope of the Report

|

By Bandage Type |

Gauze Bandages Elastic Bandages Adhesive Bandages Advanced Wound Care Dressings |

|

By End-User Industry |

Hospitals Clinics Home Care Settings Others (Pharmacies, Retail) |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Medical Supplies Manufacturers

Bandage Manufacturers

Healthcare companies

Pharmaceutical Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

3M

Smith & Nephew

Mlnlycke Health Care

Johnson & Johnson

Hartmann Group

Beiersdorf AG

BSN Medical

Cardinal Health

Medline Industries, Inc.

Paul Hartmann AG

ConvaTec Group

Coloplast

Derma Sciences

Baxter International

Saudi Mais Co. for Medical Products

Table of Contents

1. KSA Medical Bandages Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Medical Bandages Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Medical Bandages Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population

3.1.2. Rising Incidence of Chronic Wounds

3.1.3. Government Healthcare Initiatives

3.1.4. Increasing Healthcare Awareness

3.2. Restraints

3.2.1. High Cost of Advanced Bandages

3.2.2. Limited Awareness in Rural Areas

3.2.3. Stringent Regulatory Requirements

3.3. Opportunities

3.3.1. Expansion of Home Healthcare

3.3.2. Technological Advancements in Wound Care

3.3.3. Rising Demand for Advanced Wound Care Products

3.4. Trends

3.4.1. Increasing Adoption of Antimicrobial Bandages

3.4.2. Growth of E-commerce in Medical Supplies

3.4.3. Integration of Nanotechnology in Bandages

3.5. Government Regulation

3.5.1. Vision 2030 Healthcare Reforms

3.5.2. National Health Regulations and Standards

3.5.3. Local Manufacturing Incentives

3.5.4. Public-Private Partnerships in Healthcare

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. KSA Medical Bandages Market Segmentation, 2023

4.1. By Bandage Type (in Value %)

4.1.1. Gauze Bandages

4.1.2. Elastic Bandages

4.1.3. Adhesive Bandages

4.1.4. Advanced Wound Care Dressings

4.2. By End-User Industry (in Value %)

4.2.1. Hospitals

4.2.2. Clinics

4.2.3. Home Care Settings

4.2.4. Others (Pharmacies, Retail)

4.3. By Region (in Value %)

4.3.1. North Region

4.3.2. West Region

4.3.3. East Region

4.3.4. South Region

5. KSA Medical Bandages Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. 3M

5.1.2. Smith & Nephew

5.1.3. Mlnlycke Health Care

5.1.4. Johnson & Johnson

5.1.5. Hartmann Group

5.1.6. Beiersdorf AG

5.1.7. BSN Medical

5.1.8. Cardinal Health

5.1.9. Medline Industries, Inc.

5.1.10. Paul Hartmann AG

5.1.11. ConvaTec Group

5.1.12. Coloplast

5.1.13. Saudi Mais Co. for Medical Products

5.1.14. Al Maarefa Medical Supplies

5.1.15. Baxter International

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. KSA Medical Bandages Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. KSA Medical Bandages Market Regulatory Framework

7.1. Healthcare Regulations and Compliance

7.2. Certification Processes for Medical Products

7.3. Quality Assurance Standards

8. KSA Medical Bandages Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. KSA Medical Bandages Future Market Segmentation, 2028

9.1. By Bandage Type (in Value %)

9.2. By End-User Industry (in Value %)

9.3. By Region (in Value %)

10. KSA Medical Bandages Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

11. Disclaimer

12. Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the KSA Medical Bandages market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple medical bandage manufacturers and distributors to understand the nature of product segments and sales, consumer preference, and other parameters, which will support us in validating statistics derived through the bottom-to-top approach from these medical bandage manufacturers and distributors.

Frequently Asked Questions

01. How big is the KSA Medical Bandages Market?

The KSA Medical Bandages Market was valued at USD 179 million in 2023. The growing prevalence of chronic wounds, an ageing population, and increased awareness of advanced wound care solutions are key factors driving the demand for medical bandages in Saudi Arabia.

02. Who are the major players in the KSA Medical Bandages market?

The major players in the KSA Medical Bandages market include 3M, Smith & Nephew, Mlnlycke Health Care, Al Maarefa Medical Supplies, and Saudi Mais Co. for Medical Products. These companies have established themselves as leaders in the market by offering comprehensive wound care solutions that cater to a wide range of healthcare settings.

03. What are the growth drivers of the KSA Medical Bandages market?

The growth drivers of the KSA Medical Bandages market include the rising incidence of chronic wounds, advancements in wound care technologies, and government initiatives to improve healthcare infrastructure.

04. What are the challenges in the KSA Medical Bandages market?

The KSA Medical Bandages market faces challenges like the high cost of advanced wound care products, limited awareness in rural areas, and competition from traditional bandages. These factors impact the market's growth and adoption of advanced solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.