KSA MICE Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD2095

December 2024

90

About the Report

KSA MICE Market Overview

- The KSA Meetings, Incentives, Conferences, and Exhibitions (MICE) market was valued at USD 2.7 billion in 2023. The market is driven by Saudi Arabias Vision 2030 initiative, aimed at diversifying the economy and promoting tourism, alongside significant investments in infrastructure to attract global events and conferences.

- The major players in the KSA MICE market include the Riyadh International Convention & Exhibition Center, King Abdulaziz International Conference Centre, Hilton Riyadh, and Four Seasons Riyadh. These organizations are at the forefront of transforming Saudi Arabia into a global business hub, leveraging state-of-the-art facilities and partnerships with global event organizers.

- In 2023, the Saudi government launched the Saudi Arabia Convention Bureau to promote the Kingdom as a leading MICE destination. The Bureau has been pivotal in attracting international conferences and trade shows, particularly in sectors like energy and technology. As part of this initiative, scale international events are scheduled for 2024.

- In 2023, Riyadh dominated the KSA MICE market, holding the largest share due to its well-developed infrastructure, strategic location, and the presence of high-profile international business events. The citys growing reputation as a regional business hub is expected to continue driving the MICE market in the coming years.

KSA MICE Market Segmentation

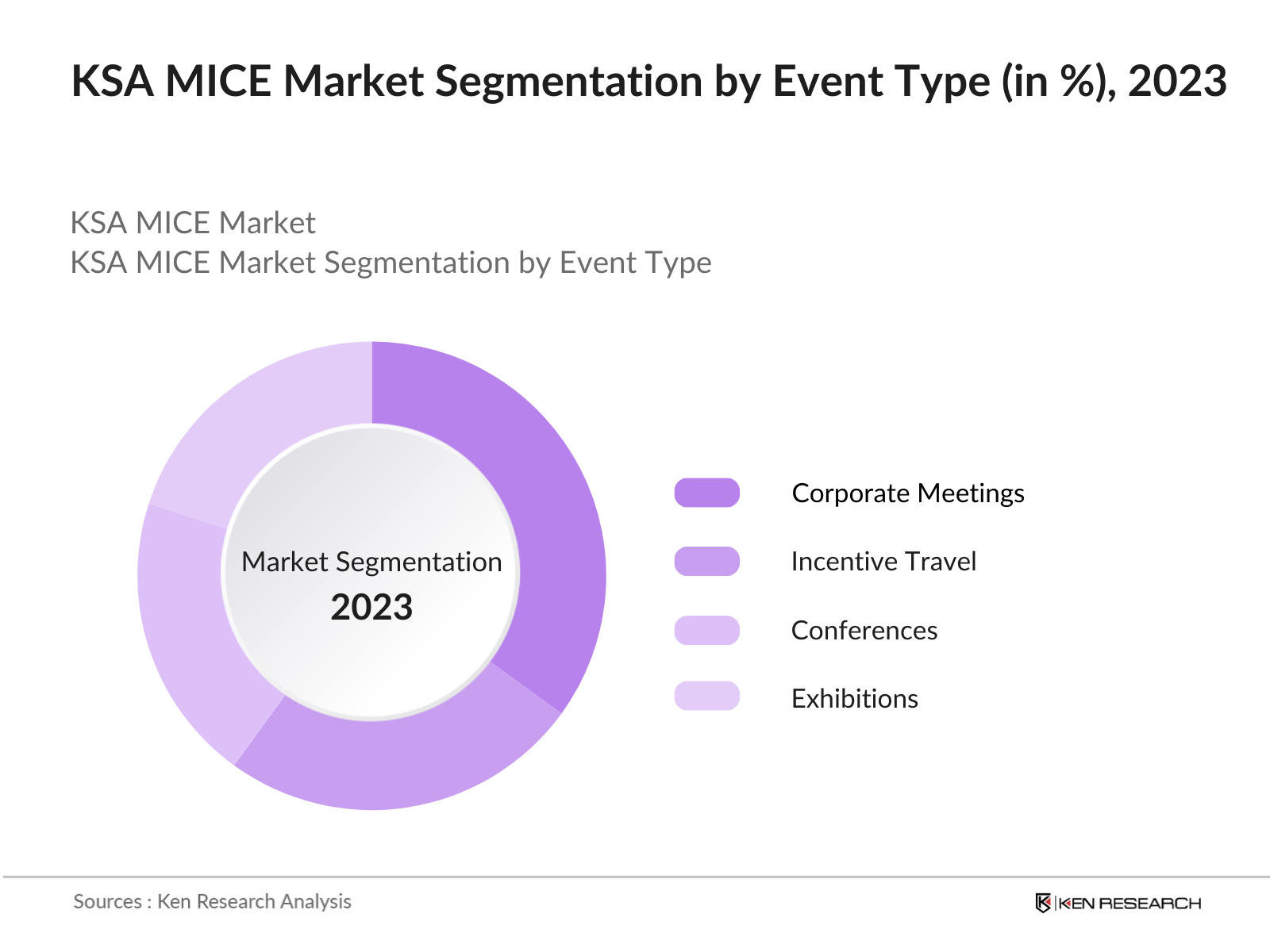

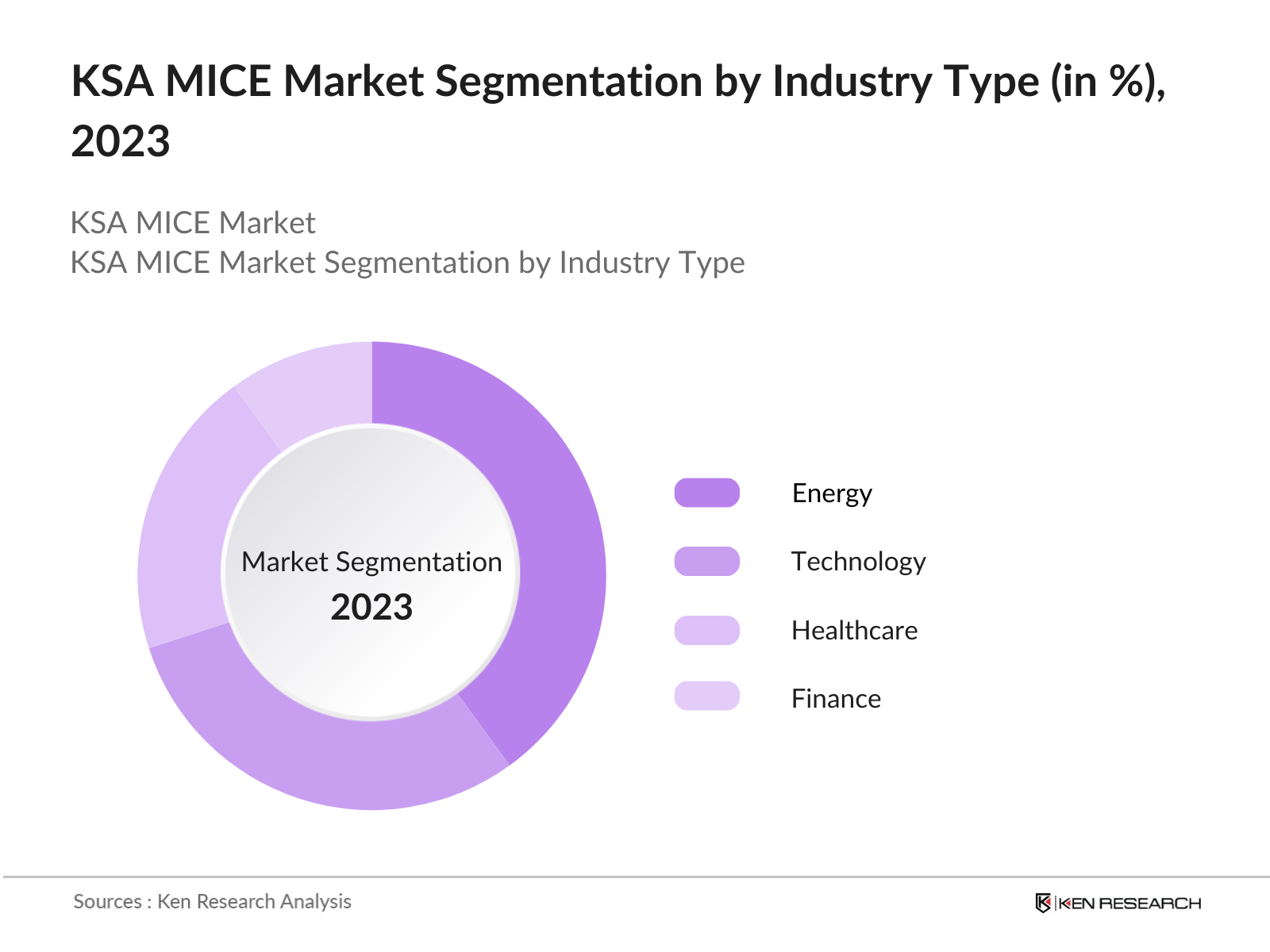

The KSA MICE market is segmented by event type, industry, and region.

By Event Type: The KSA MICE market is segmented into corporate meetings, incentive travel, conferences, and exhibitions. In 2023, corporate meetings hold the largest market share due to increased business activity in the region. The countrys growing status as a business destination, combined with major corporations holding events in Saudi Arabia.

By Industry: The market is also segmented by industries including finance, technology, healthcare, and energy. In 2023, the energy sector, owing to Saudi Arabias global leadership in oil and gas, accounts for the highest market share. Energy-related conferences and exhibitions draw global attendance, contributing to the sectors prominence.

By Region: The KSA MICE market is regionally divided into Riyadh, Jeddah, Eastern Province (Dammam, Dhahran), and Mecca & Medina. In 2023, Riyadh dominated the MICE market due to its well-developed infrastructure and status as the business hub of Saudi Arabia.

KSA MICE Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Riyadh International Convention Center |

1999 |

Riyadh, KSA |

|

King Abdulaziz International Conference Centre |

2005 |

Riyadh, KSA |

|

Hilton Riyadh |

2017 |

Riyadh, KSA |

|

Four Seasons Riyadh |

2003 |

Riyadh, KSA |

|

Reed Exhibitions |

1960 |

London, UK |

- Riyadh International Convention Center (2023 Data): In 2023, the Riyadh International Convention Center hosted over 50 international conferences, focusing on sectors such as energy, healthcare, and technology. The expansion of its venue space by 15% has allowed it to accommodate larger-scale events, increasing the centers appeal to global organizers.

- Four Seasons Riyadh (2023 Data): In 2023, four Seasons Riyadh expanded its MICE offerings by launching an exclusive business event package aimed at multinational corporations. The hotels business center reported a 20% growth in bookings for international corporate meetings, reflecting the rising demand for premium business event venues in Saudi Arabia.

KSA MICE Market Analysis

KSA MICE Market Growth Drivers

- Investment in Infrastructure Development (2023 Data): Saudi Arabias Vision 2030 has prioritized significant investments in infrastructure to support the MICE sector. In 2023, the government allocated USD 1.3 billion for the development of new business event venues, particularly in Riyadh and Jeddah, to position the Kingdom as a global hub for international conferences.

- Business Tourism Expansion: In 2023, Business tourism has grown significantly in Saudi Arabia, with over 100 million tourists business travelers visiting the Kingdom. The increase in international conferences and exhibitions has driven demand for MICE services, particularly in key cities like Riyadh, where top-tier hotels and venues cater to high-profile events.

- Government Support for MICE Sector: The Saudi government has provided substantial support to the MICE sector by funding major events and facilitating easier entry for international participants. The Business Visitor eVisa, introduced in 2023, streamlined entry processes, resulting in an increase in international business event attendance.

KSA MICE Market Challenges

- High Operating Costs in Prime Locations: Operating costs in key MICE destinations such as Riyadh and Jeddah have surged due to rising real estate and utility prices. For example, in 2023, the cost of organizing an event at top-tier venues increased by 15%, according to the Saudi Convention and Exhibition Bureau. These high costs present a barrier for smaller-scale events, limiting participation by SMEs in the market.

- Visa and Regulatory Issues (2023 Data): Although the Business Visitor eVisa has streamlined processes for international attendees, visa restrictions still pose challenges for certain nationalities. According to the Ministry of Foreign Affairs, there were visa rejections in 2023 for attendees from countries with limited diplomatic relations with Saudi Arabia. These challenges can limit the diversity of participants in MICE events.

KSA MICE Market Government Initiatives

- Vision 2030 National Tourism Strategy: In 2023, the Saudi government allocated a budget under its National Tourism Strategy, a core part of Vision 2030. The strategy aims to attract 150 million visits by 2030 and create 1.6 million jobs, contributing significantly to the economy and diversifying income sources. The strategy also involves the expansion of key venues and the promotion of Saudi Arabia as a top MICE destination.

- Launch of the Saudi Arabia Convention Bureau: In 2023, the Saudi Arabia Convention Bureau was launched to coordinate efforts in promoting the Kingdom as a major hub for international business events. With an initial funding, the bureau has partnered with international event organizers to attract global conferences, boosting the visibility of Saudi Arabia in the global MICE landscape.

KSA MICE Market Future Market Outlook

The KSA MICE market is expected to witness significant growth over the next five years, driven by government initiatives, infrastructure development, and the increasing demand for international business events.

Future Trends

- Technological Integration in MICE Management: By 2028, advanced technologies such as AI and VR will play a critical role in event management. AI-powered solutions for personalized event experiences and virtual participation are expected to enhance attendee engagement, with major investments planned for integrating these technologies into Saudi Arabia's business event venues.

- Sustainable Event Practices: By 2028, sustainability will become a key trend in the KSA MICE market, with the Saudi government investing in green infrastructure for business event venues. A growing number of international conferences are expected to adopt carbon-neutral practices, in line with global sustainability goals.

Scope of the Report

|

By Event Type |

Corporate Meetings Incentive Travel Conferences Exhibitions |

|

By Industry |

Energy Technology Healthcare Finance |

|

By Venue Size |

Large Venues Medium Venues Small Venues |

|

By Service Type |

Event Planning Venue Management Equipment Rentals |

|

By Region |

Riyadh Jeddah Eastern Province (Dammam, Dhahran) Mecca & Medina |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (e.g., Saudi Arabia Convention Bureau)

International Event Companies

Corporate Event Planning Companies

Hospitality and Venue Operation Companies

Business Tourism Boards

Technology Providers for Event Management Companies

Investments and Venture Capital Firms

Advertising and Media Agencies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Riyadh International Convention & Exhibition Center

King Abdulaziz International Conference Centre

Hilton Riyadh

Four Seasons Hotel Riyadh

Marriott International Saudi Arabia

Jeddah Center for Forums and Events

InterContinental Riyadh

Madinah International Convention Center

Al Harithy Company for Exhibitions Ltd.

Crowne Plaza Riyadh

Table of Contents

1. KSA MICE Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Metrics (Event Type, Venue Size, and Services Offered)

1.4. Market Growth Rate Analysis

1.5. Key Market Developments and Milestones (Infrastructure Investments, Key Venue Expansions)

2. KSA MICE Market Size

2.1. Historical Market Size (in USD)

2.2. Year-on-Year Growth Analysis

2.3. Key Market Drivers and Growth Factors (Vision 2030, International Partnerships)

3. KSA MICE Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Infrastructure under Vision 2030

3.1.2. Rising Business Tourism

3.1.3. Government Support (e.g., Business Visitor eVisa)

3.2. Restraints

3.2.1. High Operating Costs in Prime Cities (Riyadh, Jeddah)

3.2.2. Shortage of Skilled Event Professionals

3.2.3. Visa and Regulatory Issues

3.3. Opportunities

3.3.1. Increasing Focus on International Business Events

3.3.2. Expansion of Event Infrastructure in Secondary Cities (e.g., Dammam, Mecca)

3.3.3. Adoption of Digital and Hybrid Event Solutions

3.4. Market Trends

3.4.1. Growth of Sustainable Event Practices

3.4.2. Adoption of AI and Virtual Event Solutions

3.4.3. Growth of Multinational Corporate Meetings

4. KSA MICE Market Segmentation

4.1. By Event Type

4.1.1. Corporate Meetings

4.1.2. Incentive Travel

4.1.3. Conferences

4.1.4. Exhibitions

4.2. By Industry

4.2.1. Energy

4.2.2. Technology

4.2.3. Healthcare

4.2.4. Finance

4.3. By Region

4.3.1. Riyadh

4.3.2. Jeddah

4.3.3. Eastern Province (Dammam, Dhahran)

4.3.4. Mecca & Medina

4.4. By Venue Size

4.4.1. Large Venues

4.4.2. Medium Venues

4.4.3. Small Venues

4.5. By Service Type

4.5.1. Event Planning

4.5.2. Venue Management

4.5.3. Equipment Rentals

5. KSA MICE Market Competitive Landscape

5.1. Major Market Players

5.1.1. Riyadh International Convention & Exhibition Center

5.1.2. King Abdulaziz International Conference Centre

5.1.3. Hilton Riyadh

5.1.4. Four Seasons Hotel Riyadh

5.1.5. Marriott International Saudi Arabia

5.1.6. Jeddah Center for Forums and Events

5.1.7. InterContinental Riyadh

5.1.8. Madinah International Convention Center

5.1.9. Al Harithy Company for Exhibitions Ltd.

5.1.10. Crowne Plaza Riyadh

5.1.11. Le Mridien Al Khobar

5.1.12. Radisson Blu Hotel, Riyadh

5.1.13. Sheraton Riyadh Hotel & Towers

5.1.14. Holiday Inn Riyadh

5.1.15. Saudi Exhibition and Convention Bureau

5.2. Cross-Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue)

6. KSA MICE Market Competitive Analysis

6.1. Market Share Analysis

6.2. Strategic Initiatives (Partnerships, Mergers & Acquisitions)

6.3. Investment Analysis

6.3.1. Venture Capital Funding

6.3.2. Government Grants

6.3.3. Private Equity Investments

7. KSA MICE Market Regulatory Framework

7.1. Vision 2030 National Tourism Strategy

7.2. Compliance Requirements for International Events

7.3. Saudi Arabia Convention Bureau Policies

7.4. Business Visitor eVisa Regulations

7.5. Public-Private Partnerships in the MICE Industry

8. KSA MICE Market Future Outlook (2023-2028)

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth (Technology Integration, Global Partnerships)

8.3. Expansion of Sustainable Event Practices

9. KSA MICE Market Future Market Segmentation

9.1. By Event Type (2028 Projections)

9.2. By Industry (2028 Projections)

9.3. By Region (2028 Projections)

9.4. By Venue Size (2028 Projections)

9.5. By Service Type (2028 Projections)

10. Analyst Recommendations for KSA MICE Market

10.1. Target Market Opportunities (Corporate Meetings, Hybrid Events)

10.2. Customer Cohort Analysis (Multinational Companies, Government Entities)

10.3. Strategic Marketing Initiatives

10.4. White Space Opportunity Analysis (Secondary Cities, Event Technology Solutions)

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the Market to collate Market-level information.

Step: 2 Market Building

Collating statistics on the KSA MICE market over the years, and analyzing the penetration of Marketplaces as well as the ratio of service providers to compute the revenue generated for the market. We will also review service quality statistics to understand the revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building Market hypotheses and conducting CATIs with Market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple MICE companies to understand the nature of service segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these MICE companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01 How big is the KSA MICE market?

The KSA MICE market was valued at USD 2.7 billion in 2023, driven by the countrys Vision 2030 agenda, which focuses on boosting business tourism and expanding event infrastructure to attract international conferences and exhibitions.

02 What are the challenges in the KSA MICE market?

Challenges in the KSA MICE market include a shortage of skilled professionals, high operational costs in prime locations like Riyadh and Jeddah, and visa restrictions for certain nationalities, which limit international participation in business events.

03 Who are the major players in the KSA MICE market?

Key players in the market include Riyadh International Convention Center, King Abdulaziz International Conference Centre, Hilton Riyadh, and Reed Exhibitions. These organizations dominate the market due to their extensive venues and partnerships with global event organizers.

04 What are the growth drivers of the KSA MICE market?

The KSA MICE market is driven by the government's significant investment in infrastructure, the rise in business tourism, and government initiatives such as Vision 2030, which aims to increase international events and promote Saudi Arabia as a global business hub.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.