KSA New Car Market Outlook to 2029

Region:Middle East

Author(s):Harsh Saxena

Product Code:KR1524

August 2025

90

About the Report

KSA New Car Market Overview

- The KSA New Car Market is valued at approximately USD 56 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand, rapid urbanization, and government initiatives such as Vision 2030 aimed at economic diversification and automotive sector expansion. Rising disposable income, a growing population, and increasing participation of women drivers have also contributed notably to the market's expansion.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the Saudi Arabian automotive market due to their large populations and strong economic activities. Riyadh, as the capital, functions as the central hub for vehicle sales and services, while Jeddah’s strategic port location enhances its role in imports and distribution. Dammam and the Eastern Province also contribute significantly to market demand due to their industrial and economic significance.

- In 2024, the Saudi government introduced regulations requiring all new vehicles sold in the country to comply with updated emissions standards, mandating Euro 4 for gasoline vehicles and Euro 5 for diesel vehicles. These measures aim to reduce carbon emissions and promote electric vehicle adoption, aligned with Vision 2030’s sustainability objectives. The government has also announced investments in charging infrastructure and incentives to support EV uptake.

KSA New Car Market Segmentation

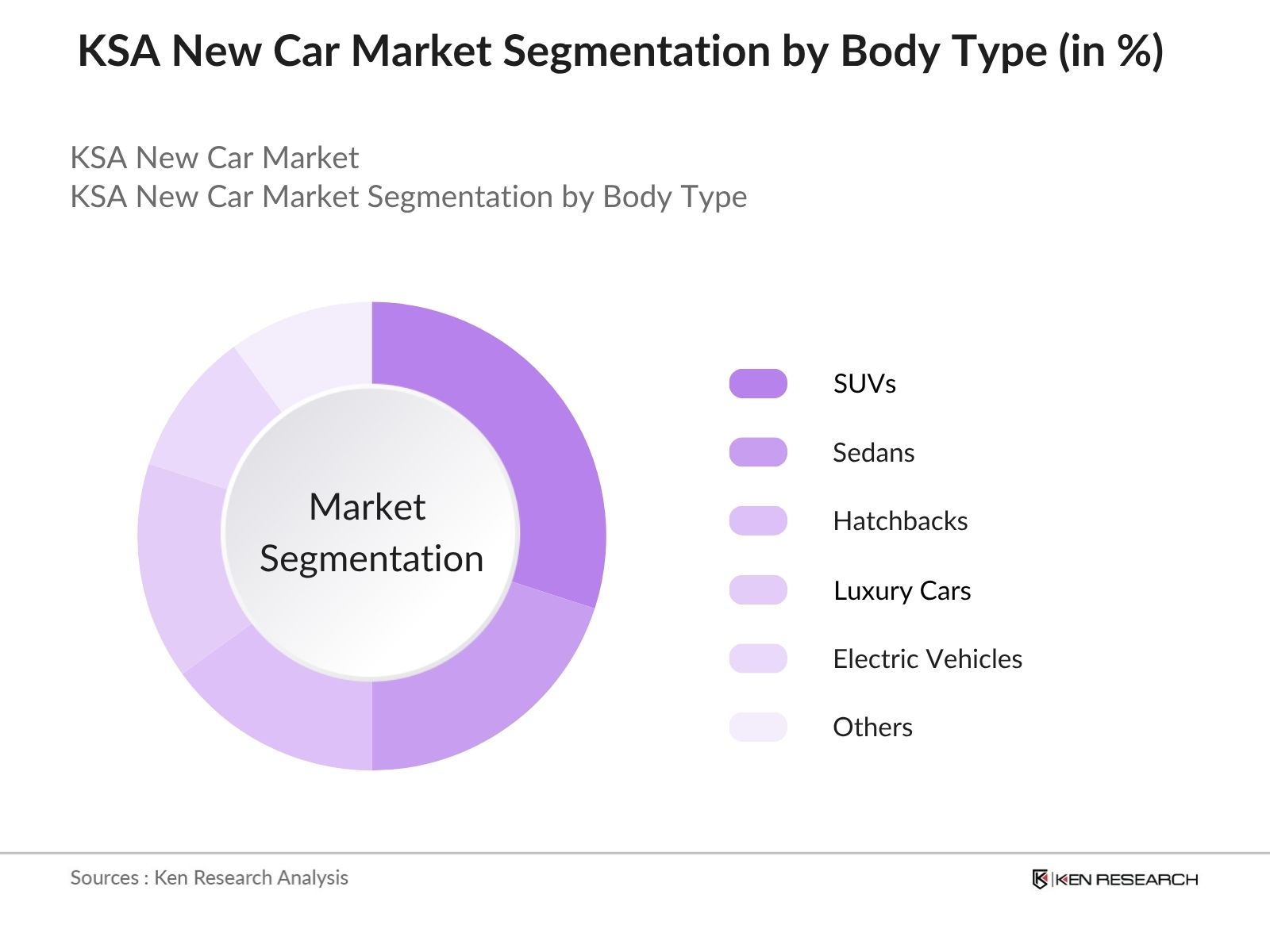

By Body Type: The vehicle body type segmentation includes SUVs, Sedans, Pickup Trucks, Hatchbacks, Luxury Cars, Electric Vehicles, and Others. Each of these subsegments addresses distinct consumer preferences and mobility needs, reflecting the evolving automotive landscape in Saudi Arabia. SUVs are increasingly favored for their versatility and suitability for family and off-road use, while sedans remain popular for urban commuting. Electric vehicles, though still a small segment, are growing rapidly due to government incentives and infrastructure investments.

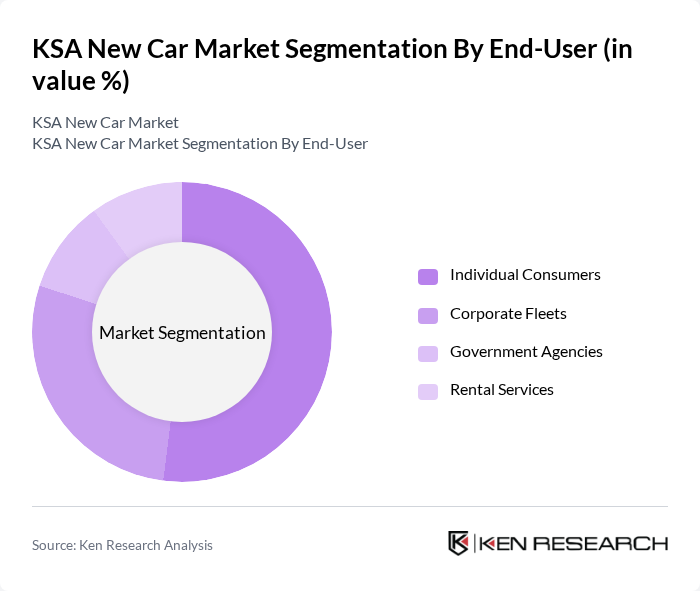

By End-User: The end-user segmentation includes Individual Consumers, Corporate Fleets, Government Agencies, and Rental Services. Individual consumers represent the largest segment, driven by rising middle-class purchasing power, increased vehicle financing options, and a growing preference for personal mobility. Corporate fleets and rental services are also expanding, supported by business growth and tourism sector development.

KSA New Car Market Competitive Landscape

The KSA New Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota (Abdul Latif Jameel Motors), Hyundai (Wallan Trading Company), Nissan (Petromin Nissan), Ford (Al Jazirah Vehicles Agencies Co.), and Chevrolet (Aljomaih Automotive Company) contribute to innovation, geographic expansion, and service delivery in this space.

| Toyota (Abdul Latif Jameel Motors) | 1955 | Jeddah, Saudi Arabia | – | – | – | – | – | – |

| Hyundai (Wallan Trading Company) | 1998 | Riyadh, Saudi Arabia | – | – | – | – | – | – |

| Nissan (Petromin Nissan) | 2016 | Jeddah, Saudi Arabia | – | – | – | – | – | – |

| Ford (Al Jazirah Vehicles Agencies Co.) | 1987 | Riyadh, Saudi Arabia | – | – | – | – | – | – |

| Chevrolet (Aljomaih Automotive Company) | 1967 | Riyadh, Saudi Arabia | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Group Size (Large, Medium, or Small as per industry convention) | Annual New Car Sales Volume (Units) | Market Share (%) | Revenue from New Car Sales (SAR) | Average Selling Price (SAR) | Distribution Network Coverage (Number of Dealerships/Outlets) |

|---|

KSA New Car Market Industry Analysis

Growth Drivers

- Increasing Disposable Income: The average disposable income in Saudi Arabia is projected to grow steadily, with recent figures indicating an annual per capita disposable income of around SAR 38,000. This rise in income enables consumers to allocate more funds towards purchasing new vehicles. As the economy diversifies beyond oil, increased employment opportunities in sectors like tourism and entertainment further bolster consumer spending power, driving demand for new cars significantly.

- Government Initiatives for Local Manufacturing: The Saudi government aims to produce over 400,000 vehicles annually by 2030, backed by investments exceeding SAR 12 billion. Programs like NIDLP support domestic production, reducing import reliance, creating jobs, and boosting the economy. These efforts encourage consumers to buy locally made vehicles and align with Vision 2030 goals.

- Rising Urbanization and Population Growth: Saudi Arabia's urban population is expected to reach around 32 million, accounting for approximately 85% of the total population. This rapid urbanization drives demand for personal vehicles as residents seek convenient transportation options. Additionally, the population is projected to grow to about 37 million, further increasing the number of potential car buyers. Urban infrastructure development, including new roads and public transport systems, also supports this growth in vehicle ownership.

Market Challenges

- High Competition Among Automotive Brands: The Saudi new car market is highly competitive, with many brands vying for market share. This leads to aggressive pricing and marketing strategies, making it challenging for new entrants. Established brands must continuously innovate to retain their position amid shifting consumer preferences and strong rivalry.

- Fluctuating Oil Prices Affecting Consumer Spending: Oil prices, a key economic driver in Saudi Arabia, are projected to fluctuate between approximately $65 and $80 per barrel soon. This volatility impacts consumer confidence and spending power, particularly where disposable income is linked to oil revenues. As prices rise, consumers may prioritize essential expenses over new vehicle purchases, creating uncertainty in the automotive market.

KSA New Car Market Future Outlook

The KSA new car market is poised for significant transformation driven by technological advancements and changing consumer preferences. The shift towards electric vehicles is expected to accelerate, supported by government incentives and a growing charging infrastructure. Additionally, the rise of online car sales platforms will reshape the purchasing process, making it more accessible. As urbanization continues, the demand for smart transportation solutions will also increase, fostering innovation and enhancing the overall customer experience in the automotive sector.

Market Opportunities

- Growth in Electric Vehicle Adoption: Saudi Arabia targets 30% of new vehicle sales to be electric by 2030, supported by incentives such as tax exemptions and subsidies. Significant investments are driving the rapid expansion of charging infrastructure, attracting consumers and manufacturers alike. This commitment fosters a robust ecosystem for electric vehicles, aligned with Vision 2030 sustainability goals.

- Expansion of Online Car Sales Platforms: The online car sales market in Saudi Arabia is projected to grow significantly, with a compound annual growth rate of around 9% driven by increasing internet penetration and evolving consumer behaviors. This trend presents a notable opportunity for dealerships to reach a broader audience, streamline the purchasing process, and enhance customer engagement through digital platforms, ultimately boosting sales.

Scope of the Report

| By Body Type |

SUVs Sedans Hatchbacks Luxury Cars Electric Vehicles Others |

| By End-User |

Individual Consumers Corporate Fleets Government Agencies Rental Services |

| By Price Range |

Budget Cars Mid-Range Cars Premium Cars Luxury Cars |

| By Sales Channel |

Dealerships Online Platforms Direct Sales (OEM/Corporate) |

| By Distribution Mode |

Urban Distribution Rural Distribution Export Distribution |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Arabian Standards Organization, Ministry of Commerce and Investment)

Automobile Manufacturers and Producers

Distributors and Retailers

Automotive Aftermarket Suppliers

Technology Providers (e.g., Electric Vehicle Technology Firms)

Industry Associations (e.g., Saudi Automobile Association)

Financial Institutions (e.g., Banks and Financing Companies)

Companies

Players Mentioned in the Report:

Toyota (Abdul Latif Jameel Motors)

Hyundai (Wallan Trading Company)

Nissan (Petromin Nissan)

Ford (Al Jazirah Vehicles Agencies Co.)

Chevrolet (Aljomaih Automotive Company)

Kia (Aljabr Automotive)

Mitsubishi (Al Bahar United Company)

Honda (Abdullah Hashim Company Ltd.)

Volkswagen (SAMACO Automotive)

BMW (Mohamed Yousuf Naghi Motors)

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. KSA New Car Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 KSA New Car Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. KSA New Car Market Analysis

3.1 Growth Drivers

3.1.1 Increasing disposable income

3.1.2 Government initiatives for local manufacturing

3.1.3 Rising urbanization and population growth

3.1.4 Expansion of financing options for consumers

3.2 Market Challenges

3.2.1 High competition among automotive brands

3.2.2 Fluctuating oil prices affecting consumer spending

3.2.3 Regulatory compliance costs

3.2.4 Limited infrastructure in rural areas

3.3 Market Opportunities

3.3.1 Growth in electric vehicle adoption

3.3.2 Expansion of online car sales platforms

3.3.3 Increasing demand for luxury vehicles

3.3.4 Development of smart transportation solutions

3.4 Market Trends

3.4.1 Shift towards sustainable and eco-friendly vehicles

3.4.2 Integration of advanced technology in vehicles

3.4.3 Rise of car-sharing and ride-hailing services

3.4.4 Increasing focus on customer experience and service

3.5 Government Regulation

3.5.1 Emission standards for new vehicles

3.5.2 Incentives for electric vehicle purchases

3.5.3 Import tariffs on foreign vehicles

3.5.4 Safety regulations for automotive manufacturing

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. KSA New Car Market Market Size, 2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. KSA New Car Market Segmentation

8.1 By Vehicle Body Type

8.1.1 SUVs

8.1.2 Sedans

8.1.3 Hatchbacks

8.1.4 Luxury Cars

8.1.5 Electric Vehicles

8.1.6 Others

8.2 By End-User

8.2.1 Individual Consumers

8.2.2 Corporate Fleets

8.2.3 Government Agencies

8.2.4 Rental Services

8.3 By Price Range

8.3.1 Budget Cars

8.3.2 Mid-Range Cars

8.3.3 Premium Cars

8.3.4 Luxury Cars

8.4 By Sales Channel

8.4.1 Dealerships

8.4.2 Online Platforms

8.4.3 Direct Sales (OEM/Corporate)

8.5 By Distribution Mode

8.5.1 Urban Distribution

8.5.2 Rural Distribution

8.5.3 Export Distribution

9. KSA New Car Market Competitive Analysis

9.1 Market Share of Key Players

9.2 KPIs for Cross Comparison of Key Players

9.2.1 Company Name

9.2.2 Group Size (Large, Medium, or Small as per industry convention)

9.2.3 Annual New Car Sales Volume (Units)

9.2.4 Market Share (%)

9.2.5 Revenue from New Car Sales (SAR)

9.2.6 Average Selling Price (SAR)

9.2.7 Distribution Network Coverage (Number of Dealerships/Outlets)

9.2.8 Customer Satisfaction Index (CSI Score)

9.2.9 After-Sales Service Network (Number of Service Centers)

9.2.10 Digital Sales Penetration (%)

9.2.11 Brand Recognition Score

9.2.12 Innovation Index (e.g., EV/Hybrid Models Offered)

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 List of Major Companies

9.5.1 Toyota (Abdul Latif Jameel Motors)

9.5.2 Hyundai (Wallan Trading Company)

9.5.3 Nissan (Petromin Nissan)

9.5.4 Ford (Al Jazirah Vehicles Agencies Co.)

9.5.5 Chevrolet (Aljomaih Automotive Company)

9.5.6 Kia (Aljabr Automotive)

9.5.7 Mitsubishi (Al Bahar United Company)

9.5.8 Honda (Abdullah Hashim Company Ltd.)

9.5.9 Volkswagen (SAMACO Automotive)

9.5.10 BMW (Mohamed Yousuf Naghi Motors)

10. KSA New Car Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Vehicle procurement policies

10.1.2 Budget allocation for vehicle purchases

10.1.3 Preferred vehicle types

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Investment in fleet upgrades

10.2.2 Budget for sustainable vehicles

10.2.3 Spending on maintenance and service

10.3 Pain Point Analysis by End-User Category

10.3.1 Cost of ownership

10.3.2 Availability of service centers

10.3.3 Vehicle reliability

10.4 User Readiness for Adoption

10.4.1 Awareness of new technologies

10.4.2 Acceptance of electric vehicles

10.4.3 Financial readiness for new purchases

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Evaluation of vehicle performance

10.5.2 Cost savings analysis

10.5.3 Expansion of vehicle usage scenarios

11. KSA New Car Market Future Size, 2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market gaps identification

1.2 Value proposition development

1.3 Revenue model exploration

1.4 Customer segmentation analysis

1.5 Competitive landscape overview

1.6 Key partnerships identification

1.7 Risk assessment

2. Marketing and Positioning Recommendations

2.1 Branding strategies

2.2 Product USPs

2.3 Target audience definition

2.4 Communication strategy

2.5 Digital marketing approach

2.6 Event marketing initiatives

3. Distribution Plan

3.1 Urban retail strategy

3.2 Rural NGO tie-ups

3.3 Online sales channels

3.4 Partnerships with local dealers

3.5 Logistics and supply chain management

4. Channel & Pricing Gaps

4.1 Underserved routes

4.2 Pricing bands analysis

4.3 Competitor pricing comparison

4.4 Customer willingness to pay

4.5 Discount strategies

5. Unmet Demand & Latent Needs

5.1 Category gaps identification

5.2 Consumer segments analysis

5.3 Emerging trends exploration

5.4 Feedback collection mechanisms

6. Customer Relationship

6.1 Loyalty programs

6.2 After-sales service enhancements

6.3 Customer feedback loops

6.4 Community engagement initiatives

7. Value Proposition

7.1 Sustainability initiatives

7.2 Integrated supply chains

7.3 Customer-centric product development

7.4 Competitive differentiation

8. Key Activities

8.1 Regulatory compliance

8.2 Branding efforts

8.3 Distribution setup

8.4 Training and development

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product mix considerations

9.1.2 Pricing band strategy

9.1.3 Packaging options

9.2 Export Entry Strategy

9.2.1 Target countries analysis

9.2.2 Compliance roadmap

10. Entry Mode Assessment

10.1 Joint Ventures

10.2 Greenfield investments

10.3 Mergers & Acquisitions

10.4 Distributor Model

11. Capital and Timeline Estimation

11.1 Capital requirements

11.2 Timelines for market entry

12. Control vs Risk Trade-Off

12.1 Ownership considerations

12.2 Partnerships evaluation

13. Profitability Outlook

13.1 Breakeven analysis

13.2 Long-term sustainability strategies

14. Potential Partner List

14.1 Distributors

14.2 Joint Ventures

14.3 Acquisition targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Activity timelines

15.2.2 Milestone tracking

Disclaimer Contact UsResearch Methodology

Phase 1: Approach

Desk Research

- Analysis of automotive sales data from the Saudi Arabian Ministry of Commerce and Investment

- Review of industry reports from the Saudi Automotive Association and relevant trade publications

- Examination of consumer behavior studies and market trends published by local research firms

Primary Research

- Interviews with dealership owners and managers across major cities in Saudi Arabia

- Surveys conducted with potential car buyers to understand preferences and purchasing behavior

- Focus groups with automotive industry experts and analysts to gather insights on market dynamics

Validation & Triangulation

- Cross-validation of findings through comparison with historical sales data and market forecasts

- Triangulation of insights from primary interviews with secondary data sources

- Sanity checks through expert panel reviews to ensure data reliability and accuracy

Phase 2: Market Size Estimation

Top-down Assessment

- Estimation of total addressable market based on national vehicle registration statistics

- Segmentation of market size by vehicle type (sedans, SUVs, trucks) and fuel type (petrol, diesel, electric)

- Incorporation of government initiatives promoting electric vehicles and sustainability

Bottom-up Modeling

- Collection of sales data from major automotive dealerships and manufacturers operating in KSA

- Analysis of average transaction prices and sales volumes to derive revenue estimates

- Estimation of market growth rates based on historical trends and economic indicators

Forecasting & Scenario Analysis

- Multi-factor regression analysis incorporating GDP growth, consumer confidence, and oil prices

- Scenario modeling based on potential regulatory changes and shifts in consumer preferences

- Development of baseline, optimistic, and pessimistic forecasts through 2030

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| New Car Buyers | 120 | Individuals aged 25-55, Middle to Upper Income |

| Automotive Dealerships | 60 | Dealership Owners, Sales Managers |

| Fleet Management Companies | 40 | Fleet Managers, Procurement Officers |

| Automotive Industry Experts | 40 | Market Analysts, Industry Consultants |

| Government Regulatory Bodies | 20 | Policy Makers, Regulatory Officials |

Frequently Asked Questions

What is the current value of the KSA New Car Market?

The KSA New Car Market is valued at approximately USD 56 billion, driven by increasing consumer demand, urbanization, and government initiatives like Vision 2030, which aims to diversify the economy and enhance the automotive sector.

Which cities dominate the KSA New Car Market?

Key cities such as Riyadh, Jeddah, and Dammam dominate the KSA New Car Market due to their large populations and robust economic activities, with Riyadh serving as the central hub for automotive sales and services.

What are the new environmental regulations for vehicles in Saudi Arabia?

In 2023, the Saudi government introduced regulations requiring all new vehicles to comply with updated environmental standards aimed at reducing carbon emissions and promoting electric vehicle adoption, aligning with the sustainability objectives of Vision 2030.

What types of vehicles are most popular in the KSA New Car Market?

The KSA New Car Market is segmented by vehicle body type, with SUVs currently dominating due to their versatility and appeal for family and off-road use, followed by sedans, pickup trucks, and an emerging interest in electric vehicles.

Who are the primary end-users in the KSA New Car Market?

The primary end-users in the KSA New Car Market include individual consumers, corporate fleets, government agencies, and rental services, with individual consumers representing the largest segment driven by rising middle-class purchasing power and vehicle financing options.

What are the growth drivers for the KSA New Car Market?

Key growth drivers include increasing disposable income, government initiatives for local manufacturing, and rising urbanization and population growth, which collectively enhance consumer spending power and demand for new vehicles in Saudi Arabia.

What challenges does the KSA New Car Market face?

The KSA New Car Market faces challenges such as high competition among automotive brands, fluctuating oil prices affecting consumer spending, and regulatory compliance costs, which can impact market dynamics and consumer purchasing behavior.

How is the electric vehicle market expected to grow in Saudi Arabia?

The electric vehicle market in Saudi Arabia is expected to grow significantly, with government targets aiming for 35% of new vehicle sales to be electric, supported by incentives like tax exemptions and subsidies to attract consumers and manufacturers.

What role does online sales play in the KSA New Car Market?

Online sales platforms are projected to grow by 30% in the KSA New Car Market, driven by increased internet penetration and changing consumer behaviors, providing dealerships with opportunities to reach a broader audience and streamline the purchasing process.

What is the impact of urbanization on vehicle ownership in Saudi Arabia?

Rapid urbanization in Saudi Arabia, with the urban population expected to reach 38 million, drives demand for personal vehicles as residents seek convenient transportation options, further supported by infrastructure development and population growth.

Which automotive brands are leading in the KSA New Car Market?

Leading automotive brands in the KSA New Car Market include Toyota, Hyundai, Nissan, Ford, and Chevrolet, among others, contributing to innovation, geographic expansion, and service delivery within the competitive landscape.

What financing options are available for new car buyers in Saudi Arabia?

New car buyers in Saudi Arabia have various financing options, including cash purchases, loans, leases, and installment plans, which enhance accessibility and affordability for consumers looking to purchase vehicles.

How does the KSA government support local vehicle manufacturing?

The Saudi government supports local vehicle manufacturing through initiatives like the National Industrial Development and Logistics Program (NIDLP), aiming to produce 350,000 vehicles annually and investing over SAR 12 billion to enhance local production capabilities.

What trends are shaping the future of the KSA New Car Market?

Trends shaping the future of the KSA New Car Market include a shift towards sustainable and eco-friendly vehicles, integration of advanced technology, and the rise of online sales platforms, enhancing customer experience and accessibility.

What is the expected market size for new cars in Saudi Arabia by 2024?

The KSA New Car Market is expected to see approximately 650,000 new vehicle registrations by 2024, reflecting ongoing growth driven by consumer demand, urbanization, and government initiatives aimed at boosting the automotive sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.