KSA Non-Dispersive Infrared (NDIR) Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD1664

November 2024

94

About the Report

KSA NDIR Market Overview

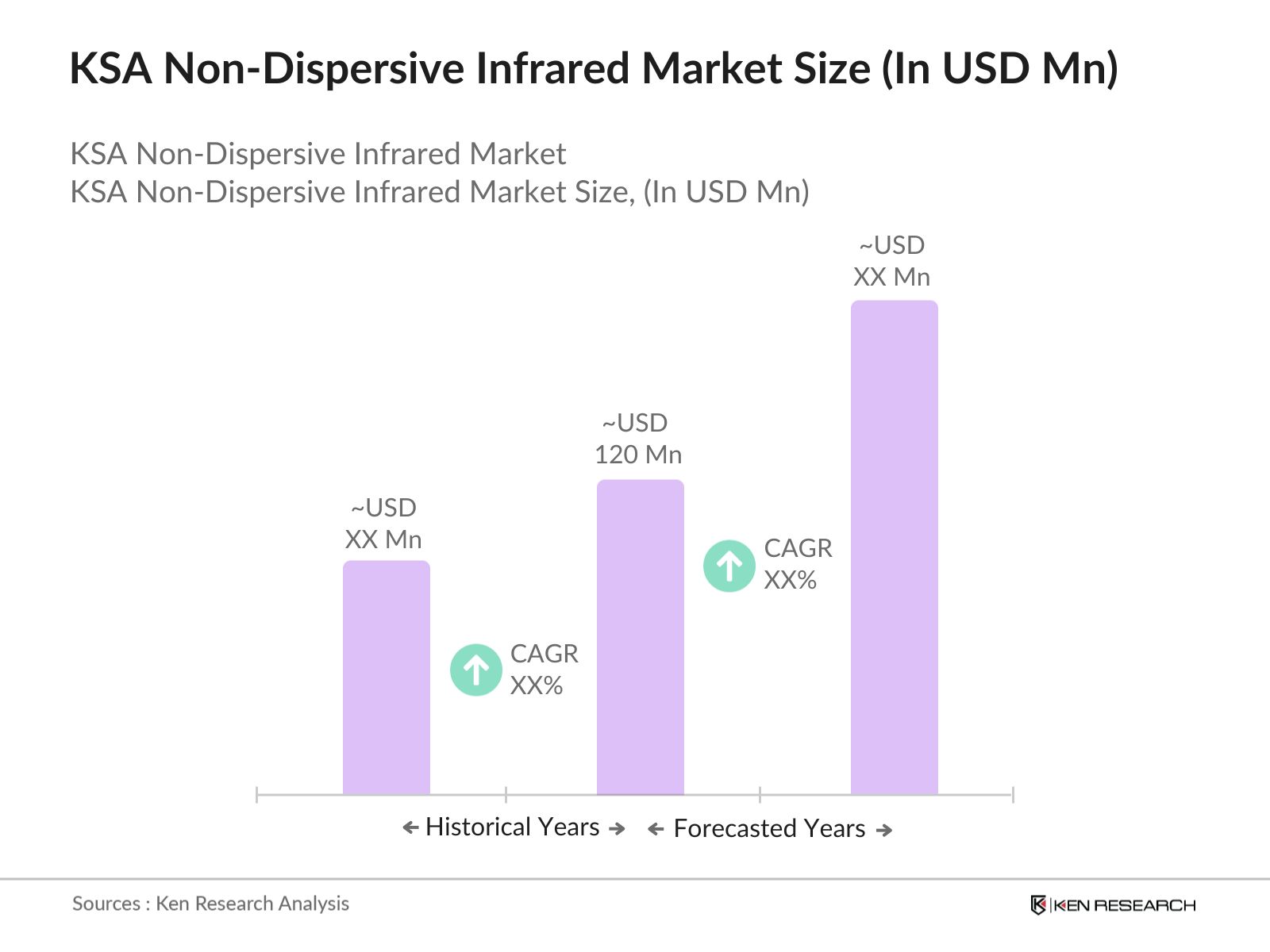

- The KSA Non-Dispersive Infrared (NDIR) market is experiencing remarkable growth, driven by increasing demand for gas detection and analysis in various industries, including oil & gas, automotive, and environmental monitoring. In 2023, the market size reached an estimated valuation of USD 120 million, reflecting the crucial role of NDIR technology in ensuring safety and regulatory compliance.

- Key players in the market include companies such as Siemens AG, Honeywell International Inc., Emerson Electric Co., and Drgerwerk AG & Co. These companies are known for their technological innovations, extensive product ranges, and strong distribution networks.

- In 2023, Siemens AG introduced an advanced NDIR sensor designed for high-precision gas detection in industrial environments, enhancing safety and operational efficiency. This launch is part of Siemens' strategy to expand its market presence in KSA by offering state-of-the-art solutions tailored to local industry needs.

- The East region of KSA dominates the NDIR market, mainly due to the concentration of oil and gas activities, which require stringent environmental monitoring and safety measures. The region has also seen significant investments in industrial infrastructure, supporting market growth.

KSA NDIR Market Segmentation

The KSA NDIR Market can be segmented by various factors like product type, technology, and application.

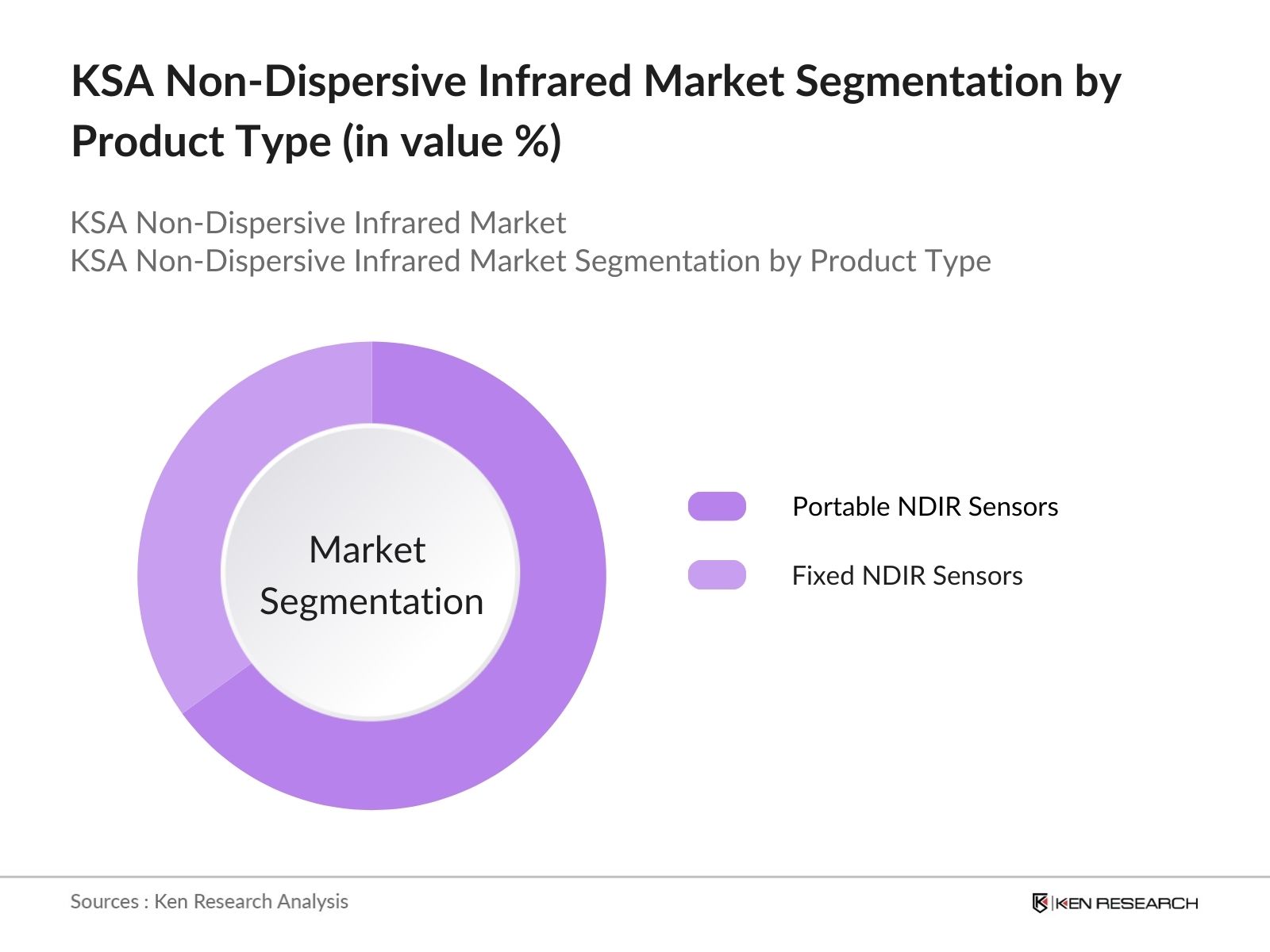

- By Product Type: The KSA NDIR Market is segmented by product type into portable and fixed NDIR sensors. In 2023, fixed NDIR sensors dominate due to their widespread use in industrial monitoring and automotive applications, offering high accuracy and reliability.

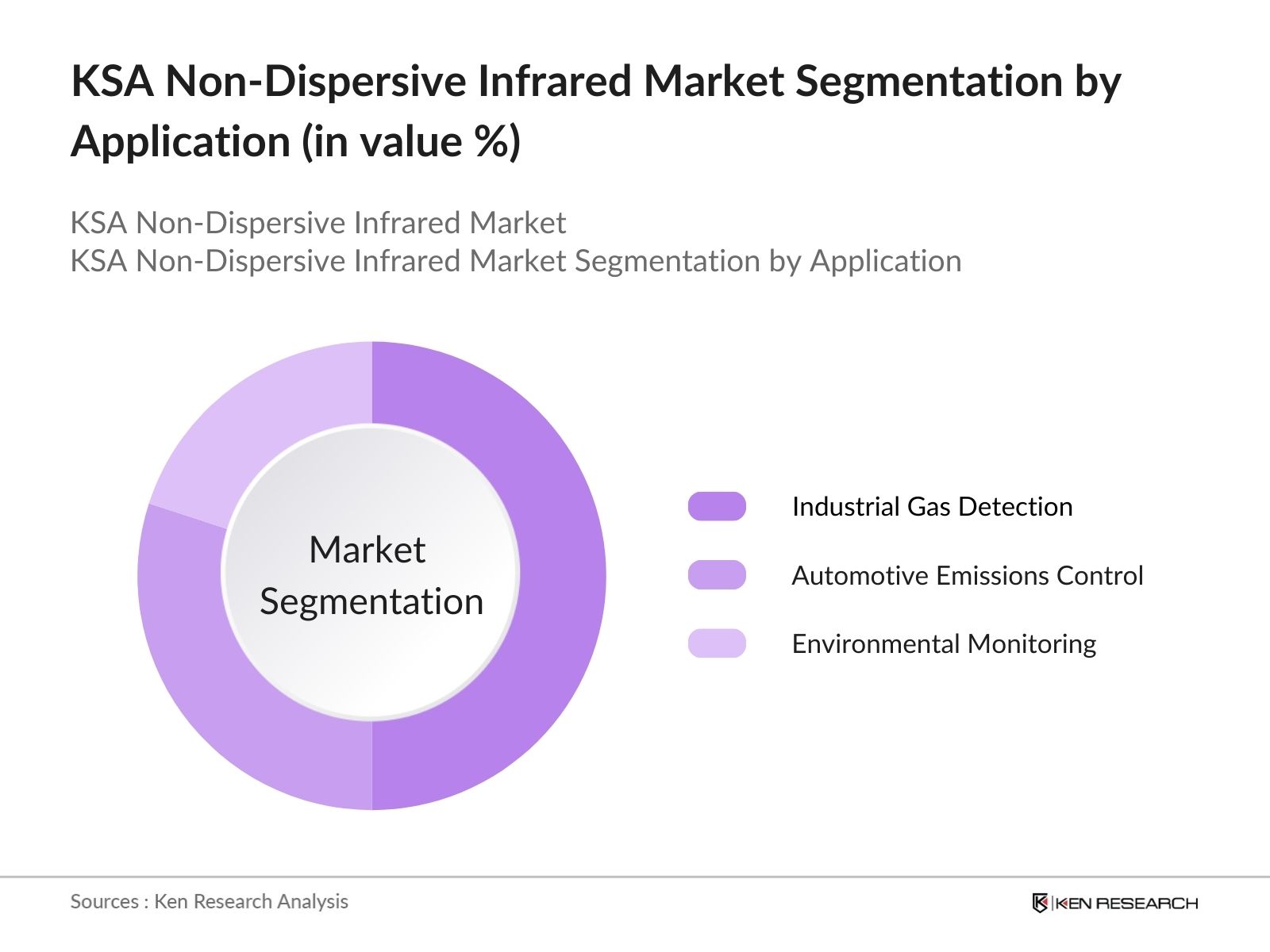

- By Application: The market is further segmented by application into industrial gas detection, automotive emissions control, environmental monitoring. In 2023, industrial gas detection is the leading segment, driven by stringent regulations on emissions and workplace safety.

- By Region: Regionally, the market is segmented into north, east, west and south KSA. The East region leads due to its industrial base and investments in environmental monitoring technologies.

KSA NDIR Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Siemens AG |

1847 |

Munich, Germany |

|

Honeywell International Inc. |

1906 |

Charlotte, USA |

|

Emerson Electric Co. |

1890 |

Missouri, USA |

|

Drgerwerk AG & Co. |

1889 |

Lbeck, Germany |

|

ABB Ltd. |

1988 |

Zurich, Switzerland |

- Siemens AG: Siemens AG continues to innovate with new NDIR sensors offering enhanced sensitivity and reliability for industrial applications. The company focuses on integrating smart technology for real-time monitoring and data analysis, which has strengthened its market position.

- Honeywell International Inc.: Known for its robust NDIR products, Honeywell has expanded its product line to include portable gas detectors, catering to both industrial and commercial users. The company's emphasis on safety and compliance has bolstered its market share in KSA.

KSA Non-Dispersive Infrared Industry Analysis

Growth Drivers

-

Increasing Demand for Industrial Safety Solutions: The stringent safety regulations in industries such as oil & gas, chemicals, and manufacturing are driving the demand for reliable gas detection systems. In 2023, the industrial safety equipment market in KSA was valued at USD 400 million, with a significant portion attributed to gas detection technologies like NDIR.

- Technological Advancements in NDIR Sensors: Continuous innovations in NDIR technology, including the development of sensors with enhanced sensitivity and reduced response times, are expanding their applications across various industries. Recent advancements have improved the detection capabilities for gases like CO2 and methane by 20%, supporting broader adoption in environmental monitoring and industrial processes.

- Expansion of the Oil & Gas Sector: The growth of the oil & gas sector in KSA, driven by increased exploration and production activities, has amplified the need for effective gas monitoring solutions. The sector's investment in safety technologies is projected to reach USD 500 million by 2025 , underscoring the critical role of NDIR sensors in operational safety and compliance.

Market Challenges

- High Initial Costs: The advanced nature of NDIR technology involves upfront investment, making it a costly option for some industries. This high initial cost can be a barrier, especially for small and medium-sized enterprises (SMEs) in adopting these systems.

- Technical Complexity and Maintenance: The integration and maintenance of NDIR systems require specialized technical expertise. The lack of trained personnel and the complexity of these systems can lead to operational challenges, particularly in remote or less-developed regions.

Government Initiatives

- Environmental Regulations and Compliance: The Saudi government has implemented strict regulations to control industrial emissions and ensure environmental safety. These regulations mandate the use of advanced gas detection systems like NDIR sensors, promoting market growth.

- Support for Technological Innovation: In 2023, the Saudi government announced a funding initiative worth USD 150 million to support research and development in industrial safety technologies, including NDIR sensors. This initiative aims to foster innovation and enhance the local manufacturing capabilities of advanced safety equipment.

KSA Non-Dispersive Infrared Future Market Outlook

The KSA Non-Dispersive Infrared (NDIR) market is expected to experience substantial growth by 2028, driven by advancements in sensor technology and increasing applications in industrial safety and environmental monitoring. The market is projected to register a respectable CAGR during the forecast period of 2023-2028.

Future Trends

- Rising Adoption of Smart and Connected NDIR Sensors: There is a growing trend towards integrating NDIR sensors with IoT and smart technologies, enabling real-time monitoring and data analytics. By 2028, the demand for smart NDIR sensors is expected to increase, driven by the need for more efficient and automated monitoring systems in industrial settings. Companies are likely to focus on developing smart sensor solutions that offer enhanced connectivity and data integration capabilities.

- Increased Use in Environmental Monitoring: With increasing awareness and regulations regarding environmental protection, the use of NDIR sensors for monitoring air quality and emissions is projected to grow. The market for environmental monitoring applications is anticipated to expand by 2028, as industries and regulatory bodies invest in technologies to ensure compliance with environmental standards.

- Expansion in Healthcare and Automotive Sectors: The healthcare sector's demand for NDIR sensors, particularly in applications such as respiratory monitoring and anesthesia gas monitoring, is expected to rise. Additionally, the automotive industry's focus on improving cabin air quality and monitoring vehicle emissions will drive the adoption of NDIR technology. By 2028, these sectors are likely to become key growth drivers for the NDIR market in KSA.

Scope of the Report

|

By Product Type |

NDIR Gas Analyzers NDIR Gas Detectors |

|

By Application |

Oil & Gas Automotive Environmental Monitoring |

|

By Region |

North East West South |

Products

Key Target Audience

Industrial Safety Equipment Manufacturers

Automotive Manufacturers

Environmental Monitoring Agencies

Bank s and Financial Institutes

Government and Regulatory Bodies (GAMEP, RCJY, MODON, SASO)

Research and Development Institutions

Venture Capital Firms

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Siemens AG

Honeywell International Inc.

Emerson Electric Co.

Drgerwerk AG & Co.

ABB Ltd.

MKS Instruments, Inc.

Fuji Electric Co., Ltd.

Nova Analytical Systems Inc.

Teledyne Technologies Inc.

Gasmet Technologies Oy

Thermo Fisher Scientific Inc.

GE Measurement & Control Solutions

SICK AG

Endress+Hauser Group

HORIBA, Ltd.

Table of Contents

KSA Non-Dispersive Infrared Market Overview

1.1 KSA Non-Dispersive Infrared Market Taxonomy

KSA Non-Dispersive Infrared Market Size (in USD Mn), 2018-2023

KSA Non-Dispersive Infrared Market Analysis

3.1 KSA Non-Dispersive Infrared Market Growth Drivers

3.2 KSA Non-Dispersive Infrared Market Challenges and Issues

3.3 KSA Non-Dispersive Infrared Market Trends and Development

3.4 KSA Non-Dispersive Infrared Market Government Regulation

3.5 KSA Non-Dispersive Infrared Market SWOT Analysis

3.6 KSA Non-Dispersive Infrared Market Stake Ecosystem

3.7 KSA Non-Dispersive Infrared Market Competition Ecosystem

KSA Non-Dispersive Infrared Market Segmentation, 2023

4.1 KSA Non-Dispersive Infrared Market Segmentation by Product Type (in value %), 2023

4.2 KSA Non-Dispersive Infrared Market Segmentation by Application (in value %), 2023

4.3 KSA Non-Dispersive Infrared Market Segmentation by Region (in value %), 2023

KSA Non-Dispersive Infrared Market Competition Benchmarking

5.1 KSA Non-Dispersive Infrared Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

KSA Non-Dispersive Infrared Future Market Size (in USD Mn), 2023-2028

KSA Non-Dispersive Infrared Future Market Segmentation, 2028

7.1 KSA Non-Dispersive Infrared Market Segmentation by Product Type (in value %), 2028

7.2 KSA Non-Dispersive Infrared Market Segmentation by Application (in value %), 2028

7.3 KSA Non-Dispersive Infrared Market Segmentation by Region (in value %), 2028

KSA Non-Dispersive Infrared Market Analysts Recommendations

8.1 KSA Non-Dispersive Infrared Market TAM/SAM/SOM Analysis

8.2 KSA Non-Dispersive Infrared Market Customer Cohort Analysis

8.3 KSA Non-Dispersive Infrared Market Marketing Initiatives

8.4 KSA Non-Dispersive Infrared Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

- Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Market Building

- Collating statistics on the KSA Non-Dispersive Infrared Market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated for the KSA Non-Dispersive Infrared Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

- Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

- Approaching multiple NDIR equipment suppliers and distributors to understand product segments, sales, consumer preferences, and other parameters to validate statistics derived through a bottom-to-top approach from NDIR equipment suppliers and distributors.

Frequently Asked Questions

01 How big is the KSA Non-Dispersive Infrared Market?

The KSA Non-Dispersive Infrared (NDIR) market has seen significant growth, reaching a market size of USD 120 million in 2023. This growth is driven by increasing demand for industrial safety solutions and advancements in gas detection technologies.

02 What are the growth drivers of the KSA Non-Dispersive Infrared Market?

The KSA Non-Dispersive Infrared (NDIR) market is propelled by stringent industrial safety regulations, advancements in NDIR sensor technology, the expansion of the oil & gas sector, and a growing emphasis on environmental monitoring and compliance.

03 What challenges are faced by the KSA Non-Dispersive Infrared Market?

Challenges in the KSA Non-Dispersive Infrared (NDIR) market include high initial costs of NDIR systems, technical complexity in integration and maintenance, a need for skilled personnel, and regulatory compliance pressures.

04 Who are the major players in the KSA Non-Dispersive Infrared Market?

Key players in the KSA Non-Dispersive Infrared (NDIR) market include Siemens AG, Honeywell International Inc., Emerson Electric Co., Drgerwerk AG & Co., and ABB Ltd. These companies are leaders due to their technological innovations and extensive product offerings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.