KSA Online Meat Delivery Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD1212

June 2025

80

About the Report

KSA Online Meat Delivery Market Overview

- The KSA Online Meat Delivery Market has shown rapid growth over the past five years, supported by the expansion of the overall KSA Meat Market, which has reached a market size of USD 12.1 billion. This growth is primarily driven by the increasing demand for convenience in food purchasing, coupled with a rising trend in online shopping among consumers. The market has seen a significant shift towards digital platforms, with consumers preferring the ease of ordering meat products online, especially during the pandemic.

- Key cities dominating this market include Riyadh, Jeddah, and Dammam. These cities are characterized by a high population density and a growing middle class with increasing disposable income. The urban lifestyle in these areas has led to a greater demand for online services, including meat delivery, as consumers seek convenience and quality in their food choices.

- In 2023, the Saudi government implemented regulations to enhance food safety standards in the online meat delivery sector. This includes mandatory compliance with health and safety protocols for all online meat vendors, ensuring that products meet quality standards and are sourced from licensed suppliers. Such regulations aim to protect consumer health and promote trust in online food services.

KSA Online Meat Delivery Market Segmentation

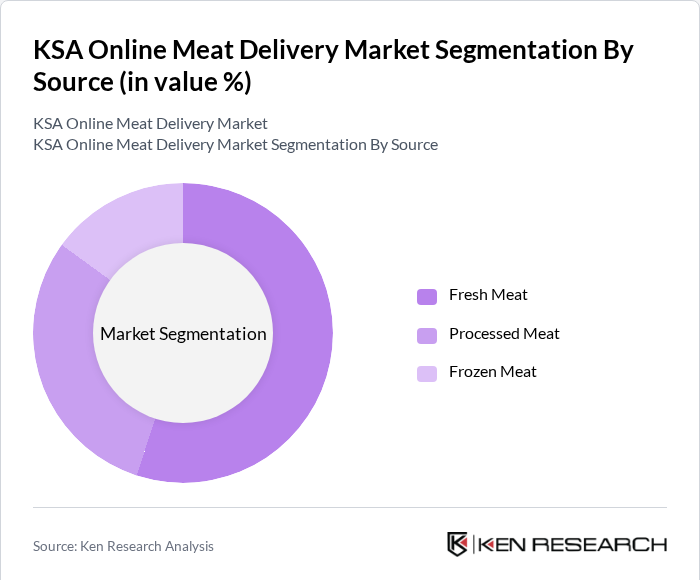

By Source: The online meat delivery market can be segmented based on the source of meat, which includes categories such as beef, poultry, lamb, and processed meats. Among these, beef is the dominant sub-segment, driven by its popularity in traditional Saudi cuisine and the increasing demand for high-quality poultry products. Consumers are increasingly seeking premium cuts and organic options, which has led to a surge in online orders for beef. The convenience of online shopping allows consumers to access a wider variety of beef products than what is typically available in local markets.

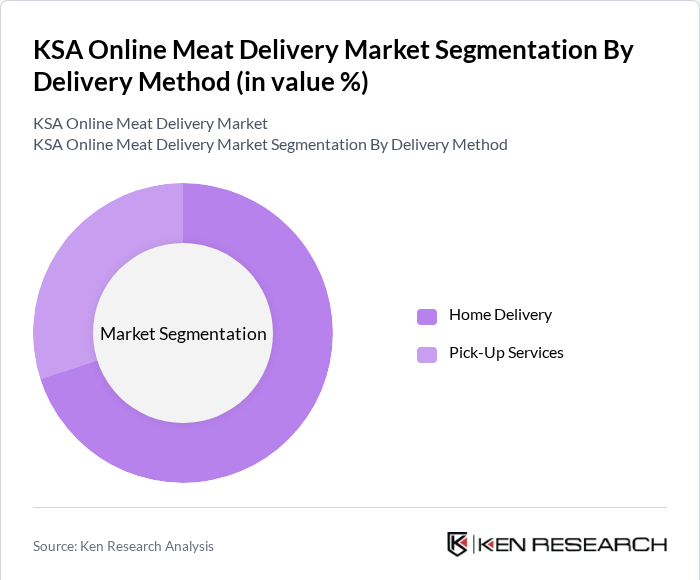

By Delivery Method: The market can also be segmented based on delivery methods, which include home delivery and click-and-collect services. Home delivery is the leading sub-segment, as it offers unparalleled convenience for consumers who prefer to have their meat products delivered directly to their doorstep. The rise of e-commerce and mobile applications has facilitated this trend, allowing consumers to place orders easily and receive their products quickly. Click-and-collect services are also gaining traction, particularly among consumers who prefer to pick up their orders at designated locations for added convenience.

KSA Online Meat Delivery Market Competitive Landscape

The KSA Online Meat Delivery Market is characterized by a competitive landscape with several key players, including local and international companies. Prominent players such as Almarai, Al-Faisal Meat, and Carrefour have established a strong presence in the market, leveraging their extensive distribution networks and brand recognition. The competition is intensifying as new entrants seek to capture market share by offering innovative services and high-quality products.

KSA Online Meat Delivery Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Convenience: The KSA online meat delivery market is experiencing significant growth driven by a marked increase in consumer demand for convenience. In 2024, the Saudi population is projected to reach approximately 36 million, with a substantial portion of this demographic, particularly millennials and Gen Z, favoring online shopping for its ease and efficiency. According to a report by the Saudi Arabian Monetary Authority (SAMA), e-commerce sales in the Kingdom are expected to exceed USD 52 billion in 2024, reflecting a 25% increase from 2023.

- Rise in E-commerce Adoption: The rise in e-commerce adoption in Saudi Arabia is a pivotal growth driver for the online meat delivery market. The Kingdom's Vision 2030 initiative aims to diversify the economy and enhance the digital landscape, leading to a surge in online shopping activities. In 2024, the e-commerce penetration rate in KSA is expected to reach 25%, up from 20% in 2023, according to the Ministry of Communications and Information Technology (MCIT). This increase is supported by improved internet infrastructure, with broadband penetration exceeding 90%, and the proliferation of digital payment solutions, which have made online transactions more secure and convenient.

- Growing Health Consciousness and Preference for Fresh Products: The increasing health consciousness among Saudi consumers is another critical driver of the online meat delivery market. In 2024, the health and wellness food market in KSA is growing remarkably, reflecting a growing trend towards healthier eating habits. Consumers are becoming more aware of the nutritional value of their food, leading to a heightened demand for fresh, high-quality meat products. This shift is evident in the rising popularity of organic and locally sourced meats, which are perceived as healthier options.

Market Challenges

- Supply Chain Disruptions: One of the significant challenges facing the KSA online meat delivery market is supply chain disruptions. The meat supply chain is complex, involving multiple stakeholders from producers to distributors and retailers. In 2024, the global supply chain is still recovering from the impacts of the COVID-19 pandemic, which has led to increased transportation costs and delays.

- Regulatory Compliance Issues: Regulatory compliance presents another challenge for the online meat delivery market in KSA. The meat industry is subject to stringent food safety standards and regulations enforced by the SFDA. In 2024, compliance with these regulations is more critical than ever, as the government intensifies its focus on food safety and quality assurance. Online meat retailers must navigate complex licensing requirements, import/export regulations, and health certifications to operate legally.

KSA Online Meat Delivery Market Future Outlook

The future of the KSA online meat delivery market appears promising, driven by ongoing trends in consumer behavior and technological advancements. As more consumers embrace online shopping for its convenience and variety, the market is expected to evolve with innovative delivery solutions and enhanced customer experiences.

Market Opportunities

- Expansion of Delivery Services: The expansion of delivery services presents a significant opportunity for growth in the KSA online meat delivery market. With the increasing demand for convenience, online meat retailers can enhance their service offerings by implementing faster and more efficient delivery options. In 2024, the average delivery time for online grocery orders in KSA is expected to decrease to under 30 minutes, driven by advancements in logistics technology and the establishment of localized distribution centers.

- Introduction of Subscription Models: The introduction of subscription models offers a lucrative opportunity for online meat delivery services in KSA. As consumers increasingly seek convenience and predictability in their shopping habits, subscription services can provide a steady revenue stream for retailers. In 2024, it is estimated that subscription-based services will account for 15% of the total online grocery market in KSA.

Scope of the Report

| By Source |

Beef Poultry Lamb Processed Meats |

| By Delivery Method |

Home Delivery Click-and-Collect Services |

| By Customer Type |

Residential Commercial |

| By Payment Method |

Online Payment Cash on Delivery |

| By Region |

Riyadh Jeddah Dhahran Other Regions |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority, Ministry of Environment, Water and Agriculture)

Meat Producers and Suppliers

Logistics and Delivery Service Providers

Online Retail Platforms

Food Safety and Quality Assurance Organizations

Industry Associations (e.g., Saudi Meat and Livestock Association)

Financial Institutions and Banks

Companies

Players Mentioned in the Report:

Almarai

Al-Faisal Meat

Carrefour

Meat & Co.

Fresh Meat Delivery

Riyadh Meats Online

Halal Harvest Delivery

Savory Cuts Express

Desert Delicacies Delivery

Gourmet Butcher KSA

Table of Contents

1. KSA Online Meat Delivery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Online Meat Delivery Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Online Meat Delivery Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Demand for Convenience

3.1.2. Rise in E-commerce Adoption

3.1.3. Growing Health Consciousness and Preference for Fresh Products

3.2. Market Challenges

3.2.1. Supply Chain Disruptions

3.2.2. Regulatory Compliance Issues

3.2.3. Competition from Traditional Meat Retailers

3.3. Opportunities

3.3.1. Expansion of Delivery Services

3.3.2. Introduction of Subscription Models

3.3.3. Technological Advancements in Logistics and Tracking

3.4. Trends

3.4.1. Increasing Popularity of Organic and Halal Meat Products

3.4.2. Growth of Mobile Applications for Ordering

3.4.3. Enhanced Focus on Sustainable Practices

3.5. Government Regulation

3.5.1. Food Safety Standards and Regulations

3.5.2. Import and Export Regulations for Meat Products

3.5.3. Licensing Requirements for Online Meat Retailers

3.5.4. Consumer Protection Laws Related to Online Purchases

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. KSA Online Meat Delivery Market Segmentation

4.1. By Source

4.1.1. Beef

4.1.2. Poultry

4.1.3. Lamb

4.1.4. Processed Meats

4.2. By Delivery Method

4.2.1. Home Delivery

4.2.2. Click-and-Collect Services

4.3. By Customer Type

4.3.1. Residential

4.3.2. Commercial

4.4. By Payment Method

4.4.1. Online Payment

4.4.2. Cash on Delivery

4.5. By Region

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dhahran

4.5.4. Other Regions

5. KSA Online Meat Delivery Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Almarai

5.1.2. Al-Faisal Meat

5.1.3. Carrefour

5.1.4. Meat & Co.

5.1.5. Fresh Meat Delivery

5.1.6. Riyadh Meats Online

5.1.7. Halal Harvest Delivery

5.1.8. Savory Cuts Express

5.1.9. Desert Delicacies Delivery

5.1.10. Gourmet Butcher KSA

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Customer Satisfaction Ratings

5.2.3. Delivery Speed

5.2.4. Product Variety

5.2.5. Pricing Strategies

5.2.6. Marketing Reach

5.2.7. Technology Utilization

5.2.8. Sustainability Practices

6. KSA Online Meat Delivery Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Online Meat Delivery Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Online Meat Delivery Market Future Market Segmentation

8.1. By Source

8.1.1. Beef

8.1.2. Poultry

8.1.3. Lamb

8.1.4. Processed Meats

8.2. By Delivery Method

8.2.1. Home Delivery

8.2.2. Click-and-Collect Services

8.3. By Customer Type

8.3.1. Residential

8.3.2. Commercial

8.4. By Payment Method

8.4.1. Online Payment

8.4.2. Cash on Delivery

8.5. By Region

8.5.1. Riyadh

8.5.2. Jeddah

8.5.3. Dhahran

8.5.4. Other Regions

9. KSA Online Meat Delivery Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key stakeholders in the KSA Online Meat Delivery Market. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather relevant industry information. The primary goal is to identify and define the essential variables that impact market trends and consumer behavior.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical data related to the KSA Online Meat Delivery Market. This includes evaluating market growth rates, consumer demographics, and purchasing patterns. Additionally, we will assess the competitive landscape to understand the positioning of various players within the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts and stakeholders. These consultations will provide insights into market trends, challenges, and opportunities, helping to refine our understanding of the market dynamics and validate the data collected.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and insights to produce a comprehensive report on the KSA Online Meat Delivery Market. This will include detailed analyses of market segments, consumer preferences, and growth forecasts, ensuring that the final output is both accurate and actionable for stakeholders.

Frequently Asked Questions

01. How big is the KSA Online Meat Delivery Market?

The KSA Online Meat Delivery Market is valued at USD XX billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the KSA Online Meat Delivery Market?

Key challenges in the KSA Online Meat Delivery Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the KSA Online Meat Delivery Market?

Major players in the KSA Online Meat Delivery Market include Almarai, Al-Faisal Meat, Carrefour, Meat & Co., Fresh Meat Delivery, among others.

04. What are the growth drivers for the KSA Online Meat Delivery Market?

The primary growth drivers for the KSA Online Meat Delivery Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.