KSA Packaging Market Outlook to 2030

Region:Middle East

Author(s):Shreya Garg

Product Code:KROD3046

November 2024

92

About the Report

KSA Packaging Market Overview

- The KSA packaging market is valued at USD 17 billion, driven by the rapid industrialization and urbanization across the Kingdom. This surge in demand is particularly attributed to sectors such as food and beverages, personal care, and pharmaceuticals. In addition, the Saudi governments initiatives towards sustainability and Vision 2030 have encouraged the use of eco-friendly and innovative packaging solutions, further fueling growth. The increasing consumer demand for more durable and recyclable packaging options is also pushing the market forward.

- Key cities such as Riyadh, Jeddah, and Dammam are dominant players in the KSA packaging market due to their status as industrial and economic hubs. Riyadh, being the capital, is home to a vast array of businesses that require advanced packaging solutions. Jeddah, with its proximity to the port, plays a critical role in the logistics and export sector, further bolstering the demand for packaging materials. Dammam, due to its oil-driven economy, sees heightened demand for industrial and logistics packaging.

- Saudi Vision 2030 outlines the countrys commitment to sustainability, with specific goals related to reducing waste and promoting green packaging solutions. As part of Vision 2030, the government has allocated SAR 10 billion to projects aimed at reducing the environmental impact of packaging waste. The vision promotes the use of recyclable and biodegradable materials and mandates regulations for packaging waste management. These regulations are expected to influence packaging manufacturers to adopt more sustainable practices and invest in eco-friendly materials.

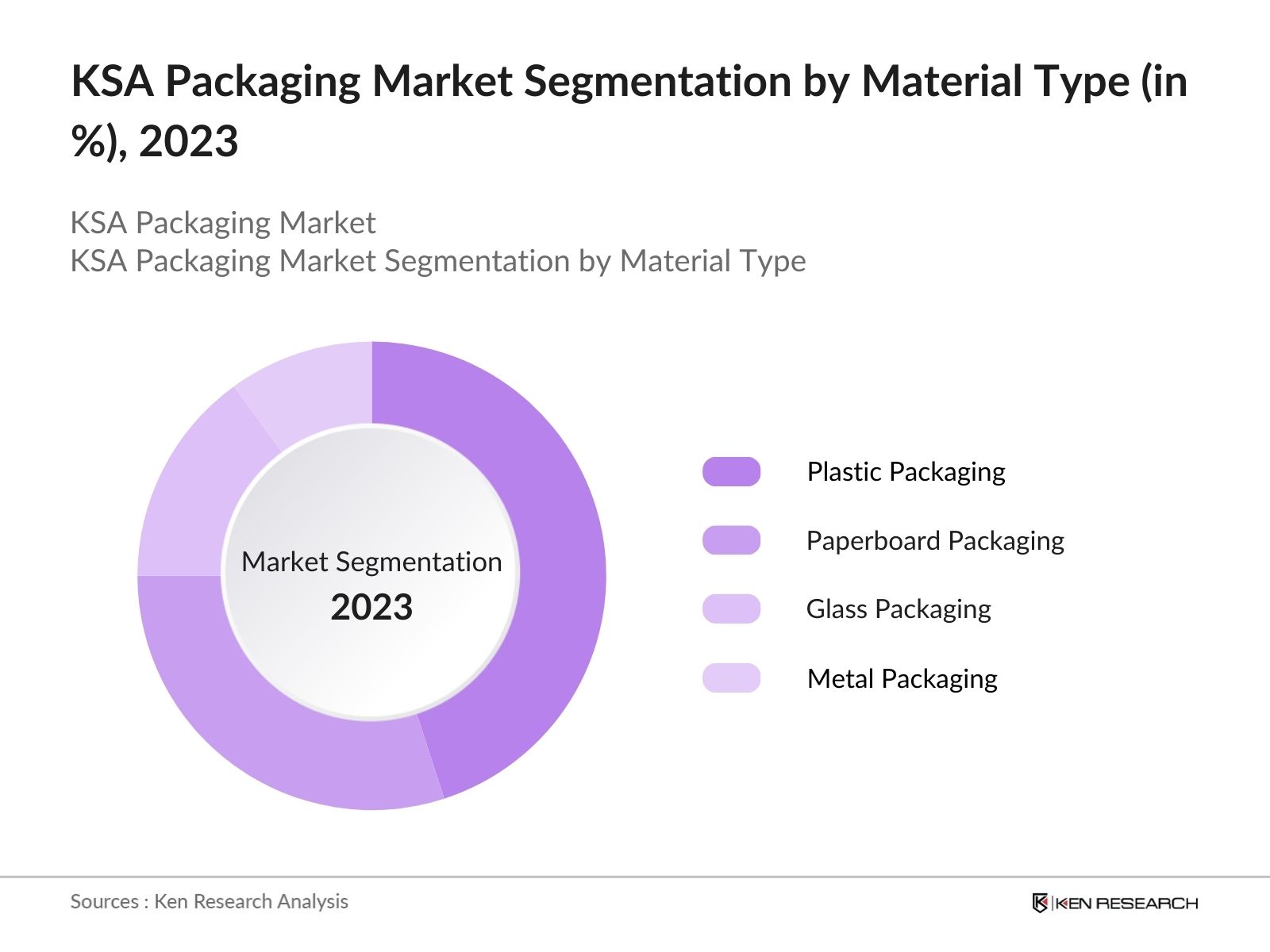

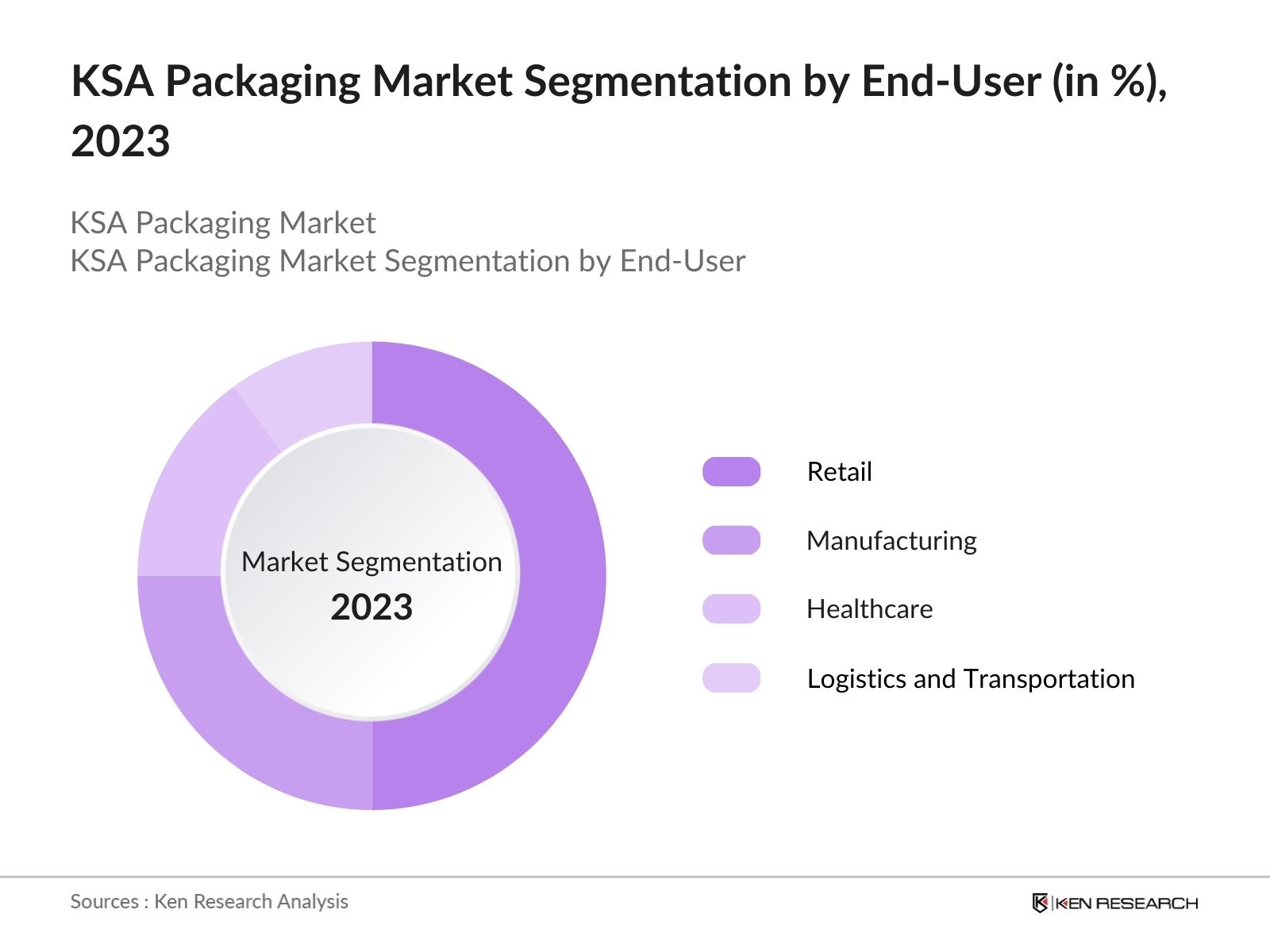

KSA Packaging Market Segmentation

By Material Type: The market is segmented by material type into plastic packaging, paperboard packaging, glass packaging, and metal packaging. Recently, plastic packaging held a dominant market share, due to its wide application in the food and beverage sector. Plastic packaging, particularly flexible packaging, has become the go-to material for its cost-effectiveness, durability, and lightweight properties. Brands in the food, beverage, and consumer goods sectors have widely adopted plastic packaging for convenience in both production and distribution.

By End-User: The market is segmented by end-user into retail, manufacturing, healthcare, and logistics and transportation. The retail sector is dominating the end-user segment, largely due to the rise in e-commerce and consumer goods demand. The rapid shift towards online retail has generated a need for innovative, durable, and visually appealing packaging solutions. With e-commerce expanding across Saudi Arabia, the retail sector has become a major player in driving the demand for various types of packaging materials.

KSA Packaging Market Competitive Landscape

The KSA packaging market is dominated by both local and international players, each focusing on innovation and sustainability to meet the evolving needs of the market. The sector remains highly competitive, with key players investing in new technologies, automation, and environmentally friendly packaging materials. Large firms like Napco National and Middle East Packaging Company are pivotal players, leveraging their well-established supply chains and R&D capabilities to maintain market leadership.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Mn) |

Product Portfolio |

Market Share (2023) |

Sustainability Initiatives |

Production Capacity |

|

Napco National |

1956 |

Riyadh, KSA |

||||||

|

Middle East Packaging Company |

1983 |

Jeddah, KSA |

||||||

|

Zamil Plastics |

1977 |

Dammam, KSA |

||||||

|

Tetra Pak Arabia |

1951 |

Riyadh, KSA |

||||||

|

Sabic Packaging Solutions |

1976 |

Jubail, KSA |

KSA Packaging Industry Analysis

Growth Drivers

- Increasing Demand from the Food & Beverage Sector: The food and beverage industry in KSA has experienced significant growth, with the sector contributing over SAR 280 billion to the economy in 2023, primarily driven by increased urbanization and rising disposable incomes. This surge in production has driven the demand for packaging solutions, particularly flexible packaging, for preserving and transporting perishable goods. The governments push to localize food production as part of Vision 2030 has further increased the need for innovative packaging, with Saudi Arabia planning to produce over 60% of its food locally by 2025.

- Government Initiatives for Sustainability and Eco-friendly Packaging Solutions: Saudi Arabias Vision 2030 emphasizes sustainability, prompting the government to implement stricter guidelines on packaging waste. The Saudi government has committed SAR 500 million to sustainable packaging initiatives as part of its environmental protection policies. Efforts include banning single-use plastic packaging and promoting biodegradable alternatives. The Ministry of Environment, Water, and Agriculture aims to reduce 25% of packaging waste by 2025. These initiatives have spurred investments in green packaging technologies, driving innovation in eco-friendly materials like plant-based plastics and recycled paper.

- Rapid Industrialization and Urbanization in KSA: KSAs industrial sector grew by 7% in 2023, contributing SAR 1.1 trillion to the GDP. This industrial boom has necessitated advanced packaging solutions, particularly for sectors like electronics, chemicals, and construction, which rely on specialized, durable packaging. Additionally, urbanization in cities like Riyadh, Jeddah, and Dammam is expected to add 2 million more residents by 2025, further boosting the demand for consumer goods and, consequently, the packaging industry. Urbanization is driving retail expansion, fueling the need for high-quality packaging to support product logistics and distribution.

Market Challenges

- High Raw Material Costs: Packaging materials such as plastics, paper, and metal have seen cost fluctuations. In 2023, global oil price hikes pushed up the cost of plastic resins to SAR 5,000 per ton, affecting plastic packaging production. Similarly, paper prices rose due to increased demand and supply chain disruptions, with costs averaging SAR 3,200 per ton. The volatility in raw material costs has increased production expenses for packaging manufacturers, creating challenges in maintaining profit margins and meeting the growing demand for cost-effective packaging.

- Lack of Recycling Infrastructure: Saudi Arabias recycling rate for packaging materials stands at only 14%, significantly lower than global standards. Despite government initiatives aimed at increasing this rate, the country still faces challenges due to insufficient recycling plants and limited consumer awareness. The lack of a comprehensive recycling infrastructure complicates the packaging industrys ability to meet sustainability goals. Additionally, the high cost of developing these facilities, estimated at SAR 2 billion, has slowed progress in enhancing recycling capacity, which remains a critical obstacle to sustainable packaging growth.

KSA Packaging Market Future Outlook

Over the next five years, the KSA packaging market is expected to show significant growth driven by rapid industrialization, an increase in retail and e-commerce demand, and the government's focus on sustainability. The push towards environmentally friendly packaging materials, coupled with the rising consumer awareness of eco-friendly products, is set to transform the packaging landscape. Furthermore, technological advancements in smart packaging and automation are likely to open up new opportunities in both the industrial and consumer packaging sectors.

Future Market Opportunities

- Shift towards Sustainable Packaging Solutions: The KSA governments focus on sustainability has driven demand for biodegradable and recyclable packaging solutions. The packaging industry has the opportunity to capitalize on this trend, with investments in eco-friendly packaging technologies exceeding SAR 1 billion in 2023. There is significant growth potential in adopting materials such as plant-based plastics, compostable films, and recycled paper. Companies that prioritize these innovations are well-positioned to capture a growing market segment, as consumers and businesses shift towards environmentally responsible packaging solutions.

- Technological Advancements in Smart Packaging: Technological innovations in packaging, such as the integration of RFID and QR codes for product tracking and authentication, have gained traction. KSAs tech investment, amounting to SAR 12 billion in 2023, has boosted the development of smart packaging solutions, particularly in sectors like pharmaceuticals, where track-and-trace technologies are essential. These innovations present an opportunity for the packaging industry to offer value-added services, enabling businesses to enhance supply chain transparency and consumer engagement through interactive packaging designs.

Scope of the Report

|

Material Type |

Plastic Packaging Paperboard Packaging Glass Packaging Metal Packaging Biodegradable Packaging |

|

Packaging Type |

Flexible Packaging Rigid Packaging Semi-rigid Packaging |

|

Application |

Food & Beverage Healthcare & Pharmaceutical Consumer Goods Industrial Packaging Personal Care |

|

End-User |

Retail Manufacturing Healthcare Logistics & Transportation |

|

Region |

Central Region Western Region Eastern Region Southern Region Northern Region |

Products

Key Target Audience

Food and Beverage Companies

Healthcare and Pharmaceutical Firms

Retail and E-Commerce Giants

Industrial Packaging Consumers

Logistics and Supply Chain Operators

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization)

Banks and Financial Institutes

Sustainability and Environmental Agencies

Companies

Major Players

Napco National

Middle East Packaging Company

Zamil Plastics

Tetra Pak Arabia

Sabic Packaging Solutions

Al Obeikan Packaging

Gulf Printing and Packaging Company

FIPCO

Arabian Paper Products Company

Sealed Air Corporation KSA

Greif Saudi Arabia

Al Watania for Industries

Mondi KSA

National Packaging Company

Crown Holdings KSA

Table of Contents

1. KSA Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Compound Annual Growth Rate)

1.4. Market Segmentation Overview

2. KSA Packaging Market Size (In SAR Mn)

2.1. Historical Market Size (In Value)

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand from the Food & Beverage Sector

3.1.2. Rise in E-commerce and Retail Packaging

3.1.3. Government Initiatives for Sustainability and Eco-friendly Packaging Solutions

3.1.4. Rapid Industrialization and Urbanization in KSA

3.2. Market Challenges

3.2.1. High Raw Material Costs (Plastic, Paper, Metal)

3.2.2. Environmental Concerns and Stringent Regulations on Plastic Packaging

3.2.3. Lack of Recycling Infrastructure

3.3. Opportunities

3.3.1. Shift towards Sustainable Packaging Solutions

3.3.2. Technological Advancements in Smart Packaging

3.3.3. Growth in Pharmaceuticals and Healthcare Packaging Demand

3.4. Trends

3.4.1. Adoption of Bio-degradable Packaging Materials

3.4.2. Use of Digital Printing in Packaging

3.4.3. Increasing Customization in Packaging Design for Marketing

3.5. Government Regulations

3.5.1. Saudi Vision 2030 and its Impact on Sustainable Packaging

3.5.2. National Environmental Protection Policies Related to Packaging Waste

3.5.3. Import/Export Guidelines for Packaging Materials

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA Packaging Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Plastic Packaging

4.1.2. Paperboard Packaging

4.1.3. Glass Packaging

4.1.4. Metal Packaging

4.1.5. Biodegradable Packaging

4.2. By Packaging Type (In Value %)

4.2.1. Flexible Packaging

4.2.2. Rigid Packaging

4.2.3. Semi-rigid Packaging

4.3. By Application (In Value %)

4.3.1. Food & Beverage Packaging

4.3.2. Healthcare & Pharmaceutical Packaging

4.3.3. Consumer Goods Packaging

4.3.4. Industrial Packaging

4.3.5. Personal Care Packaging

4.4. By End-User (In Value %)

4.4.1. Retail

4.4.2. Manufacturing

4.4.3. Healthcare

4.4.4. Logistics & Transportation

4.5. By Region (In Value %)

4.5.1. Central Region

4.5.2. Western Region

4.5.3. Eastern Region

4.5.4. Southern Region

4.5.5. Northern Region

5. KSA Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Middle East Packaging Company

5.1.2. Napco National

5.1.3. Saudi Printing & Packaging Company

5.1.4. Zamil Plastics

5.1.5. Tetra Pak Arabia

5.1.6. Gulf Printing and Packaging Company

5.1.7. Sabic Packaging Solutions

5.1.8. Al Obeikan Packaging

5.1.9. Greif Saudi Arabia

5.1.10. Al Watania for Industries

5.1.11. Mondi KSA

5.1.12. National Packaging Company

5.1.13. FIPCO

5.1.14. Arabian Paper Products Company

5.1.15. Sealed Air Corporation KSA

5.2. Cross Comparison Parameters (Revenue, Production Capacity, No. of Employees, Headquarters Location, Market Share, Product Portfolio, Inception Year, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Packaging Market Regulatory Framework

6.1. Environmental Compliance Standards

6.2. Packaging Waste Regulations

6.3. Certification Processes (ISO, KSA-Specific Certifications)

7. Future Market Size of KSA Packaging Market (In SAR Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Packaging Market Future Segmentation

8.1. By Material Type (In Value %)

8.2. By Packaging Type (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. KSA Packaging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Strategies

9.4. White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

This step involves constructing a comprehensive ecosystem map encompassing all stakeholders within the KSA packaging market. Extensive desk research utilizing secondary databases provides a robust foundation to identify the key variables that influence market dynamics.

Step 2: Market Analysis and Construction

The next step involves compiling historical data on the KSA packaging market, evaluating market penetration, material consumption, and overall revenue generation. Data quality is ensured through cross-validation from proprietary sources.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed from initial research and then validated through interviews with industry professionals. These consultations allow us to gather firsthand insights from industry stakeholders, refining the research data.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all research data into a cohesive output, ensuring that the statistics and market insights are both reliable and validated through industry sources.

Frequently Asked Questions

01 How big is the KSA Packaging Market?

The KSA packaging market is valued at USD 17 billion, driven by factors such as rapid urbanization, increasing demand for sustainable packaging, and rising e-commerce activities.

02 What are the challenges in the KSA Packaging Market?

Challenges in the KSA packaging market include high raw material costs, environmental concerns related to plastic waste, and a lack of recycling infrastructure across the Kingdom.

03 Who are the major players in the KSA Packaging Market?

Key players in the KSA packaging market include Napco National, Sabic Packaging Solutions, Zamil Plastics, and Tetra Pak Arabia, dominating the market due to their extensive production capacities and innovative solutions.

04 What are the growth drivers of the KSA Packaging Market?

The KSA packaging market is driven by government initiatives like Vision 2030, increasing demand from the food and beverage sector, and a rising focus on eco-friendly packaging materials.

05 What are the opportunities in the KSA Packaging Market?

Opportunities in the KSA packaging market include the shift towards biodegradable packaging materials, advancements in smart packaging, and the growing importance of sustainable packaging solutions in the retail sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.