KSA Perfume Market Outlook to 2030

Region:Middle East

Author(s):Manan Goenka

Product Code:KR1522

October 2024

90

About the Report

KSA Perfume Market Overview

- The KSA Perfume Market is valued at SAR 9 billion based on historic five-year data, following a detailed analysis over the past five years. The market's growth is largely fueled by the increasing disposable income among Saudi nationals, along with a strong cultural affinity towards high-end fragrances and the rising demand for customized perfumes. Saudi Arabia is recognized for its deep-rooted tradition of using perfumes, including attars and oud-based fragrances, driving the consistent expansion of this market.

- Perfume consumption in Saudi Arabia is deeply rooted in tradition but is now evolving with digital trends and changing lifestyles. Consumers exhibit one of the highest global purchase frequencies, averaging one perfume every two months. Annual per capita usage reaches 2.5 liters—over eight times that of Europe. Women, particularly in urban centers like Riyadh and Jeddah, lead demand, with over 85% purchasing more than six perfumes annually, reflecting a shift toward gifting, layering, and luxury brand exploration.

- Government regulations have significantly influenced market entry and timelines. The Saudi Food and Drug Authority (SFDA) mandates registration for all alcohol-based perfumes, with strict disclosure on ingredients, skin safety, and flammability. Halal compliance is essential, particularly for musks and alcohols, requiring certification from recognized global agencies. E-commerce and franchise platforms must comply with Ministry of Commerce licensing, trademark filings with SAIP, and local VAT norms. Non-compliance often results in customs delays or rejections. In 2023, SFDA reviews and labeling norms extended launch timelines by 2–4 months, especially for limited-edition or imported luxury SKUs.

KSA Perfume Market Segmentation

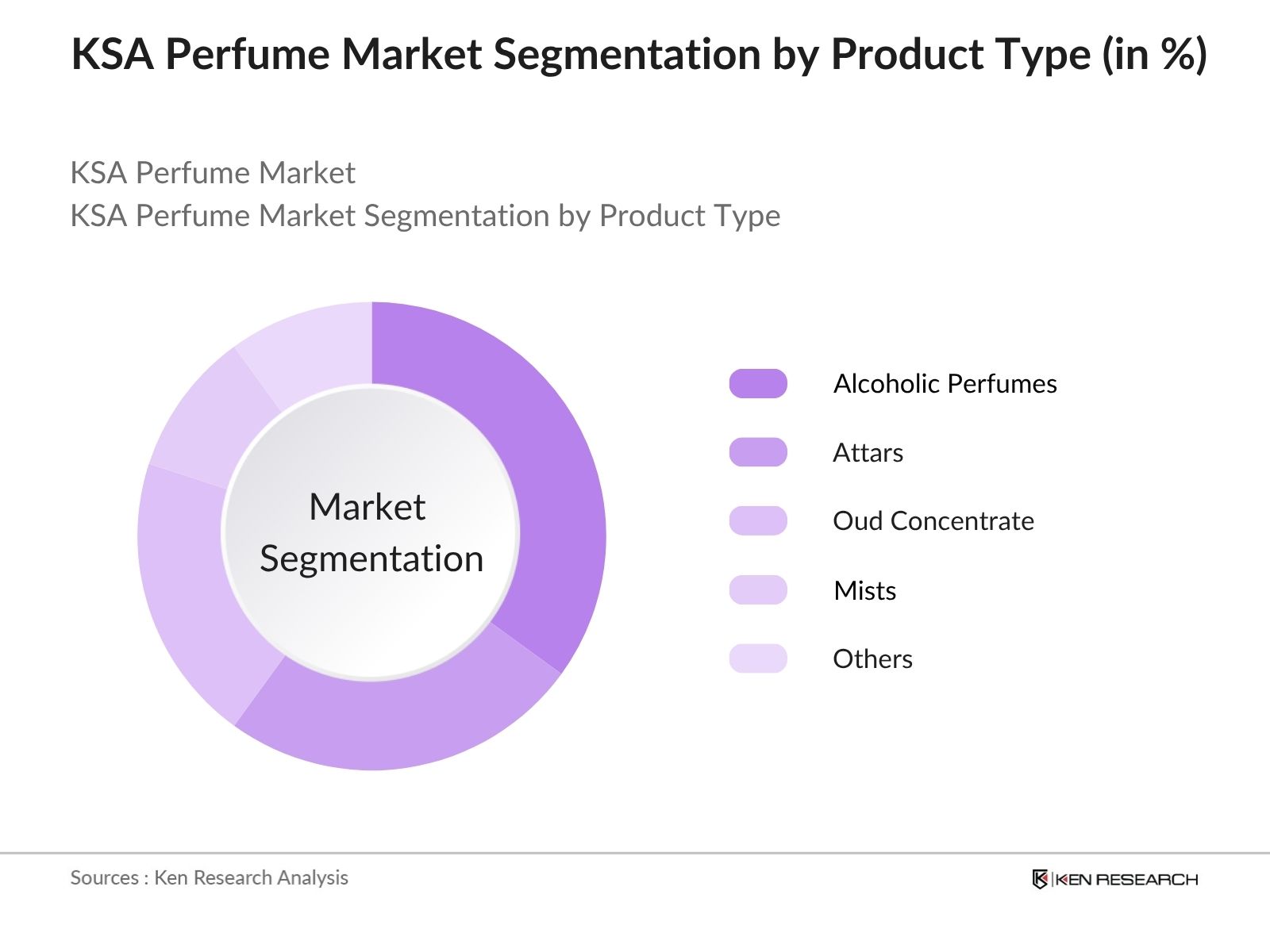

By Product Type: The market is segmented into Alcoholic Perfumes, Attars, Oud Concentrate, Mists, and Others. Alcoholic Perfumes dominate the category, supported by high consumer familiarity, broad retail presence, and long-lasting scent performance across both mass and premium segments. Attars are witnessing growing demand, especially among religious and younger consumers seeking alcohol-free, natural fragrance alternatives. Oud Concentrate is positioned as a luxury segment, favored for its rich, intense aroma and use in gifting. Mists appeal to consumers looking for light, everyday fragrance options. Others include solid, gel-based, and hybrid formats catering to niche preferences.

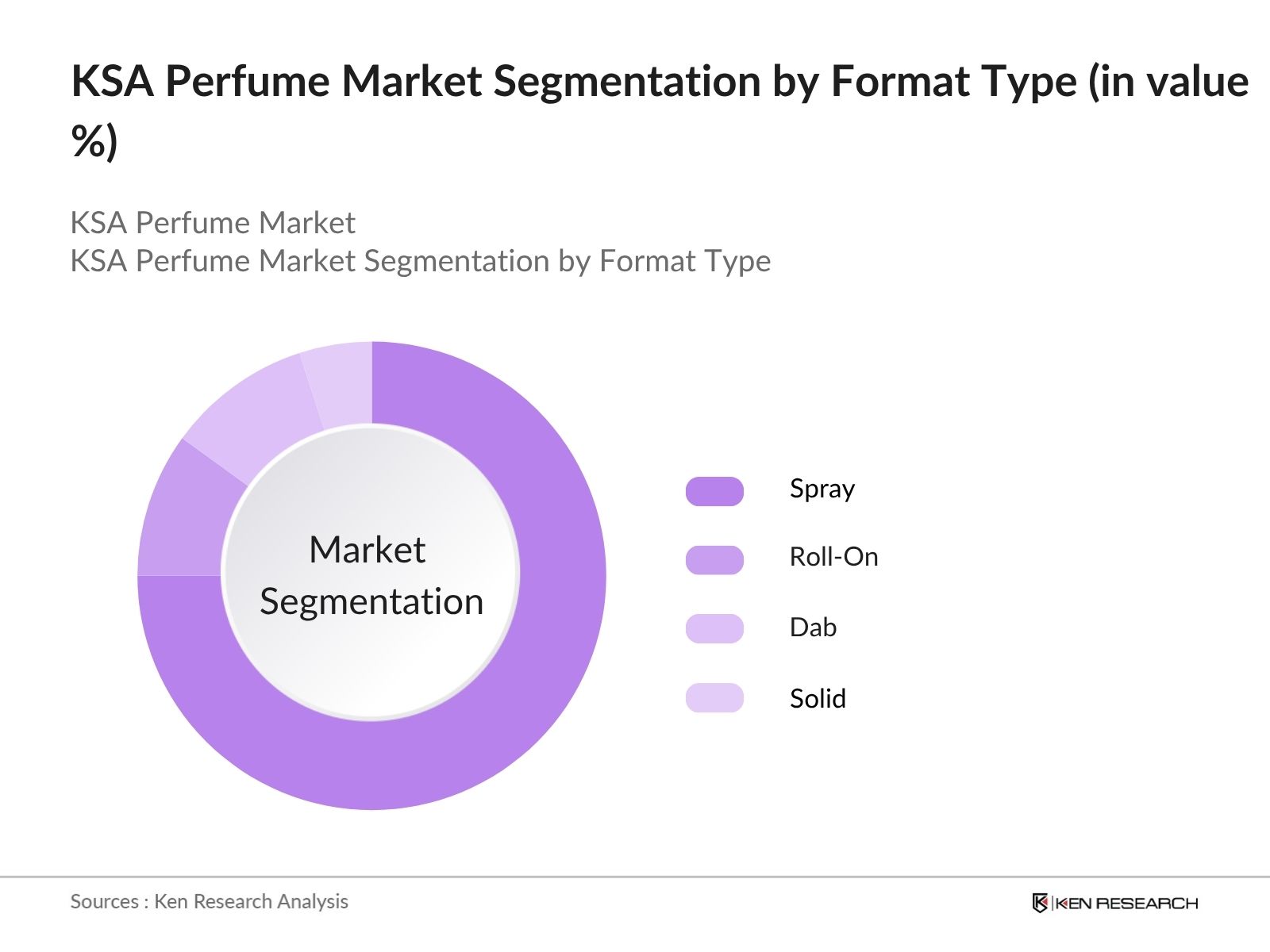

By Format Type: The market is segmented into Spray, Roll-On, Dab, and Solid formats. Spray formats dominate the market, owing to their convenience, hygienic usage, and widespread availability across both mass and premium product lines. Roll-On formats are gaining share, particularly in attars and concentrated oils, due to their portability and alignment with traditional application methods. Dab formats appeal to users preferring controlled, minimal applications, while Solid formats cater to niche segments seeking compact, travel-friendly, or alternative fragrance options.

KSA Perfume Market Competitive Landscape

The market is dominated by a mix of international and regional players, many of whom are known for offering luxury fragrances that cater to the tastes of Saudi consumers. Regional brands like Arabian Oud and Abdul Samad Al Qurashi are leaders in the market, known for their expertise in oud and attar production, while international players such as Chanel, Dior, and Tom Ford have a strong presence in the premium segment.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Key Clients |

Partnerships |

| Arabian Oud | 1982 |

Saudi Arabia |

||||||

| Abdul Samad Al Qurashi |

1852 |

Saudi Arabia |

||||||

| Amouage | 1983 | Oman | ||||||

| Swiss Arabian | 1974 |

UAE |

||||||

| Ajmal |

1951 |

UAE |

KSA Perfume Industry Analysis

Growth Drivers

- Increasing Affluence and Youth-Driven Premiumization: Saudi Arabia’s rising disposable income and digitally active youth population are transforming fragrance consumption trends. Over 60% of the population is under 35, fueling demand for premium and niche perfume brands such as Byredo and Le Labo. Social media and influencer-led discovery have made aspirational, high-end fragrance products more accessible, promoting higher per capita spend. Consumers now prioritize personal expression and layering trends, reflecting a shift toward customized, luxury scent experiences.

- Cultural Integration of Fragrances in Daily Life: Perfume use is deeply embedded in Saudi traditions, with scents playing a role in daily wear, religious rituals, and gifting during cultural events like Eid and weddings. This deep-rooted cultural relevance has ensured sustained demand across generations. Heritage brands such as Abdul Samad Al Qurashi and Arabian Oud dominate due to long-standing emotional and familial attachment to signature scents, reinforcing the continued prominence of fragrance supplements in the Saudi household.

- Expansion of Omnichannel Retail and Digital Platforms: KSA’s 100% internet penetration and high smartphone usage have catalyzed online fragrance sales through virtual try-ons, sampling kits, and subscription models. Platforms like Amazon.sa, Golden Scent, and Nice One are amplifying brand visibility, while global luxury brands are expanding via Sephora and Faces. The growth of D2C brands leveraging Instagram shops and marketplaces further enables consumers to access exclusive, artisanal, and clean-label perfume supplements, driving the segment’s overall expansion.

Market Challenges

- Brand Saturation and Consumer Loyalty Lock-In: Intense brand saturation in the mid-tier segment presents a formidable challenge in the KSA perfume market. Legacy players with deep-rooted consumer loyalty dominate shelves, making it difficult for emerging brands to gain traction. This entrenched loyalty is culturally reinforced, further limiting preference shifts. Additionally, both offline and online retail spaces are crowded with similar-looking products, eroding brand differentiation and forcing new entrants to invest heavily in marketing to stand out.

- Regulatory and Import Barriers for Ingredients and Packaging: KSA’s perfume market faces complex regulatory hurdles and a high dependency on imported ingredients and packaging materials. Strict SFDA guidelines demand detailed testing and documentation, especially for alcohol-based formulations, while halal certification adds another layer of compliance. Lengthy customs processes and variable import tariffs further delay time-to-market and inflate costs. These barriers constrain innovation, increase production overheads, and create uncertainty for global and domestic brands entering or operating in the market.

KSA Perfume Market Future Outlook

The KSA perfume market is poised for steady growth, fueled by rising demand for clean-label, vegan, and ethically sourced fragrance supplements. As consumers prioritize wellness and ingredient transparency, brands embracing these trends will gain traction. Additionally, Saudi-made perfumes are set to expand across GCC and African markets, supported by cultural relevance and export-friendly positioning, reinforcing the Kingdom’s role as a regional fragrance manufacturing hub.

Future Market Opportunities

- Rising Demand for Clean-Label and Vegan Perfume Supplements: The growing consumer shift in Saudi Arabia toward clean-label, alcohol-free, and vegan fragrance supplements presents a compelling opportunity. Inspired by global niche brands like Jo Malone and Byredo, affluent buyers increasingly seek ethical, story-driven products. This trend aligns with evolving preferences for safer, ingredient-transparent formulations, especially among wellness-conscious and younger demographics in the Kingdom.

- Regional Export Expansion Across GCC and African Markets: Saudi-made perfume supplements are gaining momentum beyond domestic borders, with rising demand in countries like Kuwait, Bahrain, Egypt, and Nigeria. This export potential is fueled by the Kingdom’s manufacturing credibility and cultural affinity across these regions. Brands focusing on GCC-specific preferences and African market entry strategies can tap into lucrative growth through regional distribution and storytelling-based positioning.

Scope of the Report

|

By Product Type |

Alcoholic Perfumes Attars Oud Concentrate Mists Others |

| By Format Type |

Spray Roll-On Dab Solid |

|

By Gender |

Unisex Men Women |

|

By Application |

Daily Wear Religious/Festive Occasions Gifting Luxury/Personal Collection |

|

By Price Distribution |

Premium Mass Luxury |

| By Sales Channel |

Offline Online |

|

By Region |

Riyadh Jeddah Makkah Dammam Others |

Products

Key Target Audience

Luxury Retailers

Perfume Manufacturers

High-Net-Worth Individuals (HNWI)

Online Retail Platforms

Specialty Perfume Boutiques

Fragrance Ingredient Suppliers

Government and Regulatory Bodies (SFDA)

Investment and Venture Capital Firms

Banks and Financial Institutions

Companies

Major Players in the KSA Perfume Supplements Market

-

Arabian Oud

Abdul Samad Al Qurashi

Amouage

Ajmal Perfumes

Swiss Arabian

Rasasi

Dior

Tom Ford

Al Haramain

Le Labo

Table of Contents

1. Executive Summary

1.1 Executive Summary – KSA Perfume Market

2. KSA Country Overview

2.1 Demographics Overview of KSA

2.2 Population Overview of KSA

2.3 KSA Grooming Market Overview

3. KSA Perfume Market Overview

3.1 KSA Perfume Market Ecosystem

3.2 Business Cycle of KSA Perfume Market

3.3 Perfume Consumption Trends in KSA

3.4 KSA Perfume Market Size, 2019 – 2024 – 2032F

4. KSA Perfume Market Segmentations

4.1 Segmentation by Product and Format Types, 2024 & 2032F

4.2 Segmentation by Gender and Usage Patterns, 2024 & 2032F

4.3 Segmentation by Price Bands, 2024 & 2032F

4.4 Segmentation by Sales Channel, 2024 & 2032F

4.5 Segmentation by Regions, 2024 & 2032F

5. Competitive Landscape of KSA Perfume Market

5.1 Competition Landscape Overview

5.2 Market Share Analysis of Key Players

5.3 Cross Comparison of Key Players

5.4 Company Profile: Arabian Oud

5.5 Company Profile: Abdul Samad Al Qurashi

5.6 Company Profile: Amouge

5.7 Company Profile: Swiss Arabian

5.8 Company Profile: Ajmal Saudi Arabia

5.9 Company Profile: Rasasi

5.10 Company Profile: Al Majed Oud

6. Industry Analysis of KSA Perfume Market

6.1 Growth Drivers

6.2 Key Challenges

6.3 Emerging Trends

6.4 SWOT Analysis

6.5 Regulatory Landscape in KSA

7. Supply-Side Analysis of KSA Perfume Market

7.1 Manufacturing-Side Supply Chain Analysis

7.2 Cost Economics for Perfume Manufacturers

7.3 Cost Comparison: Local Manufacturing vs. Importing Finished Perfumes

8. End User Analysis of KSA Perfume Market

8.1 Demand Side Analysis: End User Survey

9. Analyst Recommendations

9.1 TAM, SAM & SOM Analysis

9.2 Strategic Recommendations for a New Entrant

10. Research Methodology

10.1 Market Definitions and Assumptions

10.2 Abbreviations Used

10.3 Market Sizing Approach

10.4 Industry Experts Interviewed – Supply Side Players

10.5 Methodology for Consumer Behavior Study

11. Disclaimer

12. Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the entire KSA perfume supplements ecosystem, identifying key stakeholders such as manufacturers, retailers, and distributors. Extensive desk research is conducted using secondary and proprietary databases to gather detailed market information and define critical variables influencing market trends.

Step 2: Market Analysis and Construction

This phase focuses on analyzing historical market data, including product penetration, sales channels, and the revenue contribution from different product segments. Detailed assessments of supplier and retailer performance are conducted to validate revenue estimates and market size.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on primary data and validated through consultations with key industry experts, including perfume manufacturers and distributors. These interviews provide operational insights and help corroborate market trends and growth drivers.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with major perfume supplement manufacturers to gain insights into consumer preferences, product development, and distribution strategies. This data is synthesized to produce an accurate and validated analysis of the KSA perfume supplements market.

Frequently Asked Questions

01. How big is the KSA Perfume Market?

The KSA perfume supplements market is valued at SAR 9 billion, driven by increasing disposable income and cultural importance of perfumes among Saudi consumers.

02. What are the challenges in the KSA Perfume Market?

Challenges in the market include the prevalence of counterfeit products, strict regulatory requirements for halal certification, and the high cost of premium perfume supplements that limits access to middle-income consumers.

03. Who are the major players in the KSA Perfume Market?

Key players in the market include Arabian Oud, Abdul Samad Al Qurashi, Ajmal Perfumes, Dior, and Jo Malone. These companies dominate the market due to their strong brand presence, extensive product portfolios, and customer loyalty.

04. What are the growth drivers of the KSA Perfume Market?

The market is propelled by increasing demand for personalized and customized perfume supplements, rising disposable income, and the growing popularity of e-commerce platforms, which make it easier for consumers to access luxury products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.