KSA Pet Care Market Outlook to 2030

Region:Middle East

Author(s):Shreya Garg

Product Code:KROD5085

November 2024

81

About the Report

KSA Pet Care Market Overview

- The KSA pet care market is valued at USD 135 million, driven primarily by the rising trend of pet ownership across urban households, especially among affluent families. As disposable incomes grow in Saudi Arabia, there has been a shift towards treating pets as family members, leading to a rise in demand for premium pet food, grooming products, and veterinary services. Additionally, the expansion of e-commerce platforms in the region has made pet care products more accessible to a broader audience, further driving market growth. This information is derived from a detailed market study and government sources tracking consumer spending patterns.

- Riyadh and Jeddah are the dominant cities within the KSA pet care market. These cities are home to a large number of expatriates and high-net-worth individuals who are more inclined towards pet ownership and premium pet care services. The strong presence of veterinary clinics and pet specialty stores in these urban hubs is also a contributing factor to their dominance. Furthermore, these cities have seen rapid urbanization, which aligns with the pet humanization trend, thus leading to higher demand for pet care products and services.

- Saudi Arabia maintains strict import regulations for pet food and products to ensure quality and safety. As of 2023, 90% of imported pet products comply with Saudi Food and Drug Authority (SFDA) standards, a increase from 85% in 2020. These regulations aim to protect consumer safety and ensure that pet products meet local standards. While regulatory compliance is improving, stringent import rules continue to pose a challenge for foreign companies looking to enter the market, affecting product availability and variety

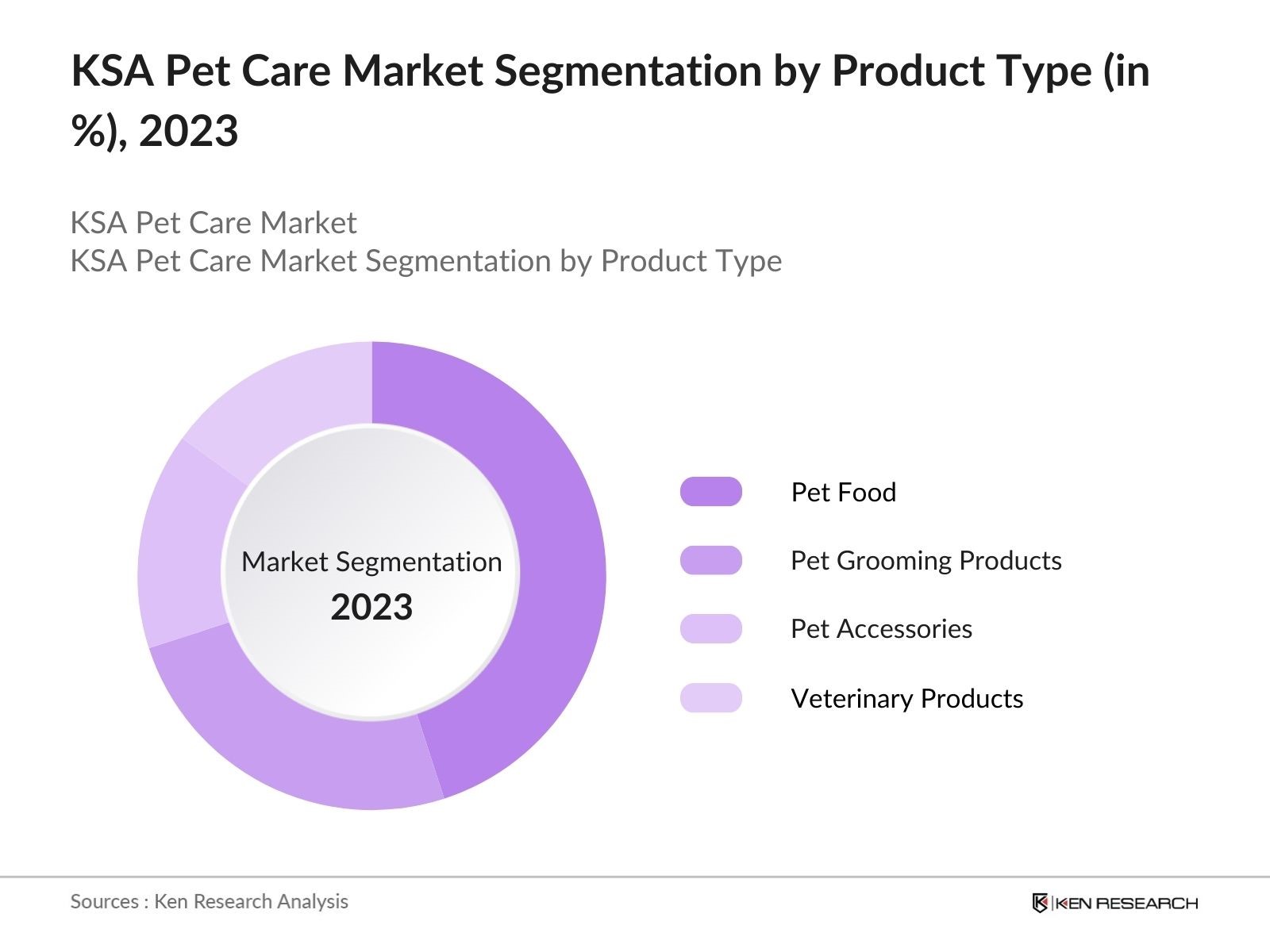

KSA Pet Care Market Segmentation

By Product Type: The market is segmented by product type into pet food, pet grooming products, pet accessories, and veterinary products. Pet food holds the largest market share due to the increased awareness among pet owners regarding the importance of nutrition for their pets. Premium pet food, in particular, dominates this segment as more consumers are opting for organic and grain-free products to ensure better health and longevity for their pets. The growing availability of specialized diets tailored to specific breeds and pet health conditions further enhances the growth of this sub-segment.

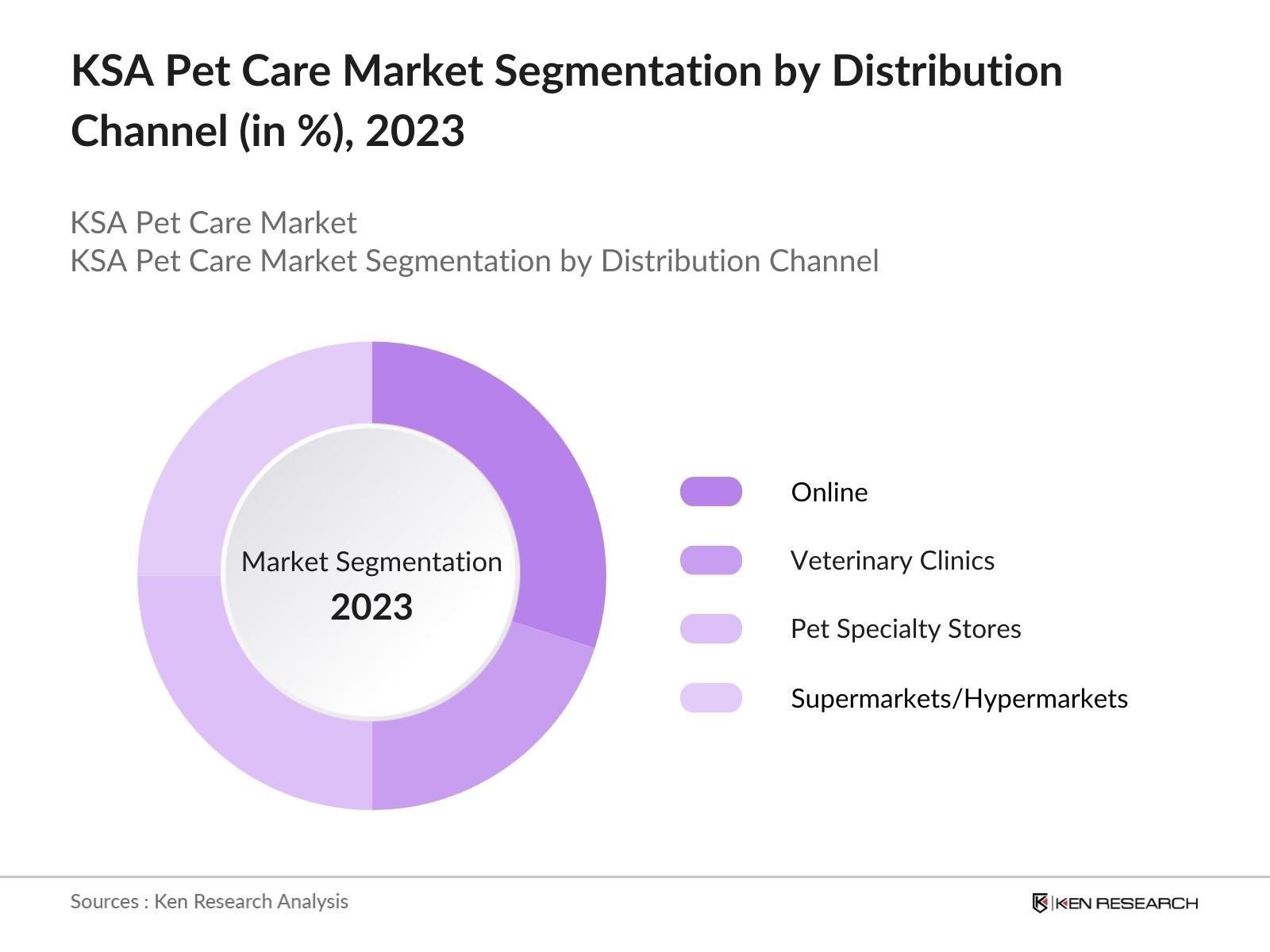

By Distribution Channel: The market is also segmented by distribution channel into online, veterinary clinics, pet specialty stores, and supermarkets/hypermarkets. Online sales channels are experiencing the fastest growth due to the convenience and variety they offer to pet owners. E-commerce platforms like Amazon and local platforms are providing competitive pricing and home delivery services, making it easier for pet owners to access pet care products. This trend has been accelerated by the ongoing digital transformation in the region, along with increasing internet penetration.

KSA Pet Care Market Competitive Landscape

The KSA pet care market is dominated by both global and local players, with companies such as Mars Petcare and Nestl Purina Petcare holding market shares. These players leverage their extensive distribution networks, strong brand presence, and product innovation to maintain a competitive edge. The local market also sees the presence of regional players like Petzone KSA, which cater specifically to the needs of Saudi consumers. The competition in this market is primarily driven by brand loyalty, product quality, and the availability of a wide range of products across various price segments.

|

Company Name |

Establishment Year |

Headquarters |

Number of Employees |

Revenue (USD) |

E-commerce Presence |

Veterinary Products |

Product Portfolio |

Brand Loyalty |

|

Mars Petcare |

1911 |

McLean, Virginia, USA |

||||||

|

Nestl Purina Petcare |

1894 |

St. Louis, Missouri, USA |

||||||

|

Royal Canin |

1968 |

Aimargues, France |

||||||

|

Petzone KSA |

2010 |

Riyadh, Saudi Arabia |

||||||

|

Hill's Pet Nutrition |

1907 |

Topeka, Kansas, USA |

KSA Pet Care Industry Analysis

Growth Drivers

- Rising Pet Ownership: Pet ownership in Saudi Arabia has seen a notable increase, with urban households increasingly adopting pets. According to a 2023 government report, the average number of pets per household in urban areas has risen to 1.8, compared to 1.4 in 2020. This surge is attributed to changing lifestyles and cultural openness toward pets. The rise in pet ownership, particularly among young families and expatriates, is driving the demand for pet care products and services, including veterinary care and specialized nutrition. This trend is creating a solid foundation for the expansion of the pet care industry in KSA.

- Increased Disposable Income: Saudi Arabias per capita income has grown steadily due to economic diversification efforts and the government's Vision 2030 reforms. In 2023, per capita income reached SAR 93,000, up from SAR 88,000 in 2021, as reported by the Saudi General Authority for Statistics. The rise in disposable income has positively impacted consumer spending on non-essential goods, including premium pet care products. Households with higher incomes are more likely to invest in high-quality pet food, grooming services, and veterinary care, fueling growth in the pet care sector.

- Expansion of Veterinary Services: The number of veterinary clinics in Saudi Arabia has grown , with 1,200 clinics reported in 2023 compared to 950 in 2020, according to the Ministry of Environment, Water, and Agriculture. This 26% growth in veterinary infrastructure highlights the expanding access to professional care for pets. The growth in clinics is driven by increased pet ownership and government efforts to improve animal health services. This expansion is essential for ensuring the well-being of pets and is directly linked to the growing demand for veterinary products and treatments.

Market Challenges

- High Cost of Pet Products: The cost of pet care products in Saudi Arabia remains a challenge for many pet owners. In 2023, the average annual spending per pet was SAR 5,200, an increase from SAR 4,700 in 2020, according to the General Authority for Statistics. Rising costs for pet food, grooming, and veterinary care, especially for premium products, strain household budgets. These high costs may deter potential pet owners or limit the ability of existing owners to provide comprehensive care, posing a challenge for market growth.

- Regulatory Barriers for Imports: Saudi Arabia imposes import tariffs on various pet care products, making it challenging for international brands to enter the market. As of 2023, the average tariff rate for imported pet products stands at 10%, as noted by the Saudi Customs Authority. These tariffs increase the cost of foreign pet care goods, limiting the availability and affordability of specialized products. Regulatory barriers can slow market growth by restricting product diversity and making premium imports less accessible to middle-income pet owners.

KSA Pet Care Market Future Outlook

Over the next five years, the KSA pet care market is expected to grow steadily, driven by increasing pet ownership, rising disposable incomes, and the continued premiumization of pet care products. The growing trend towards humanization of pets, which involves treating pets as part of the family, is expected to lead to further demand for premium pet food, grooming products, and wellness services. Moreover, the expansion of e-commerce platforms and the introduction of pet insurance services are likely to provide additional growth avenues for the market.

Future Market Opportunities

- E-commerce Expansion: E-commerce has become an important distribution channel for pet care products in Saudi Arabia. Online sales of pet products increased by 50% between 2020 and 2023, reaching SAR 500 million, as reported by the Ministry of Commerce. The convenience of online shopping and a wider variety of products have attracted pet owners to digital platforms. As internet penetration and digital literacy rise, e-commerce is expected to become a dominant channel for pet care products, providing a opportunity for market growth.

- Organic and Natural Pet Products: The demand for organic and natural pet products in Saudi Arabia is growing rapidly. In 2023, organic products accounted for 20% of the pet care market, up from 15% in 2021, as reported by the General Authority for Statistics. Pet owners are increasingly seeking chemical-free, eco-friendly products for their pets, which aligns with broader global trends toward sustainable consumption. This growing preference for organic products offers opportunities for brands specializing in natural pet food, grooming products, and wellness items.

Scope of the Report

|

Product Type |

Pet Food Pet Grooming Products Pet Accessories Pet Wellness Products Veterinary Products |

|

Pet Type |

Dogs Cats Birds Fish Small Mammals |

|

Distribution Channel |

Online Veterinary Clinic Pet Specialty Stores Supermarkets/Hypermarkets E-commerce |

|

Price Range |

Premium Products Mid-Range Products Budget Products |

|

Region |

Riyadh Jeddah Eastern Province Makkah Region Other Regions |

Products

Key Target Audience

Pet Food Manufacturers

Veterinary Clinics and Hospitals

Pet Specialty Retailers

E-commerce Platforms

Pet Insurance Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Environment, Water, and Agriculture)

Pet Product Distributors

Banks and Financial Institutes

Companies

Major Players

Mars Petcare

Nestl Purina Petcare

Royal Canin

Hills Pet Nutrition

Petzone KSA

Jollyes Petfood Superstores

Champion Petfoods

Modern Veterinary Clinic

Eurovets

Petpoint Veterinary Center

Al Qassim Veterinary Pharmaceuticals

Al Ain Veterinary Hospital

Zoetis

Petland

Dar Al Tibb Veterinary Clinic

Table of Contents

KSA Pet Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

KSA Pet Care Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

KSA Pet Care Market Analysis

3.1. Growth Drivers

3.1.1. Rising Pet Ownership (Market Metric: Number of Pets Owned Per Household)

3.1.2. Increased Disposable Income (Market Metric: Per Capita Income Growth)

3.1.3. Expansion of Veterinary Services (Market Metric: Veterinary Clinics Growth Rate)

3.1.4. Demand for Premium Pet Products (Market Metric: Premium Product Share of Total Pet Care Market)

3.2. Market Challenges

3.2.1. High Cost of Pet Products (Market Metric: Average Spending Per Pet)

3.2.2. Regulatory Barriers for Imports (Market Metric: Import Tariff Rates)

3.2.3. Lack of Specialized Pet Care Retailers (Market Metric: Pet Care Retail Penetration Rate)

3.3. Opportunities

3.3.1. E-commerce Expansion (Market Metric: Pet Care Online Sales Growth Rate)

3.3.2. Organic and Natural Pet Products (Market Metric: Share of Organic Products in Total Pet Care Market)

3.3.3. Pet Insurance Market (Market Metric: Pet Insurance Penetration)

3.4. Trends

3.4.1. Humanization of Pets (Market Metric: Premiumization in Pet Food and Products)

3.4.2. Growth of Pet Wellness Products (Market Metric: Pet Supplements Growth Rate)

3.4.3. Pet Care Services Expansion (Market Metric: Grooming Services Growth Rate)

3.5. Regulations

3.5.1. Import Regulations for Pet Food and Products (Market Metric: Compliance Rate)

3.5.2. Veterinary Health Laws (Market Metric: Regulatory Compliance by Veterinary Clinics)

3.5.3. Government Initiatives Supporting Pet Ownership (Market Metric: Government Grants/Initiatives)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

KSA Pet Care Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Pet Food

4.1.2. Pet Grooming Products

4.1.3. Pet Accessories

4.1.4. Pet Wellness Products

4.1.5. Veterinary Products

4.2. By Pet Type (In Value %)

4.2.1. Dogs

4.2.2. Cats

4.2.3. Birds

4.2.4. Fish

4.2.5. Small Mammals

4.3. By Distribution Channel (In Value %)

4.3.1. Online

4.3.2. Veterinary Clinics

4.3.3. Pet Specialty Stores

4.3.4. Supermarkets/Hypermarkets

4.3.5. E-commerce

4.4. By Price Range (In Value %)

4.4.1. Premium Products

4.4.2. Mid-Range Products

4.4.3. Budget Products

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

4.5.4. Makkah Region

4.5.5. Other Regions

KSA Pet Care Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Mars Petcare

5.1.2. Nestl Purina Petcare

5.1.3. Royal Canin

5.1.4. Hills Pet Nutrition

5.1.5. Jollyes Petfood Superstores

5.1.6. Champion Petfoods

5.1.7. Petzone KSA

5.1.8. Modern Veterinary Clinic

5.1.9. Eurovets

5.1.10. Petpoint Veterinary Center

5.1.11. Al Qassim Veterinary Pharmaceuticals

5.1.12. Al Ain Veterinary Hospital

5.1.13. Zoetis

5.1.14. Petland

5.1.15. Dar Al Tibb Veterinary Clinic

5.2. Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Market Share

5.2.6. Veterinary Product Portfolio

5.2.7. E-commerce Presence

5.2.8. Regional Reach

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

KSA Pet Care Market Regulatory Framework

6.1. Animal Welfare Regulations

6.2. Veterinary Practice Licensing

6.3. Import Compliance for Pet Products

6.4. Certification Processes

KSA Pet Care Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

KSA Pet Care Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Pet Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Price Range (In Value %)

8.5. By Region (In Value %)

KSA Pet Care Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first phase, we identified the key variables influencing the KSA pet care market through extensive desk research and analysis of industry data. This involved evaluating the key stakeholders, including manufacturers, distributors, and consumers, and their roles within the market ecosystem.

Step 2: Market Analysis and Construction

Next, we analyzed historical data and current market trends to construct an accurate picture of the KSA pet care market. This included assessing the market penetration of different product segments, revenue streams, and the role of various distribution channels in shaping consumer behavior.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on the data collected and validated through consultations with industry experts. Interviews with key executives from pet care companies and veterinary clinics helped refine the data and ensure that all aspects of the market were accurately represented.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the data from multiple sources, including direct consultations with pet care manufacturers and retailers. This process ensured that the data presented was comprehensive, accurate, and validated to provide actionable insights for stakeholders in the KSA pet care market.

Frequently Asked Questions

01. How big is the KSA Pet Care Market?

The KSA pet care market is valued at USD 135 million, driven by rising pet ownership, increased disposable income, and a growing trend towards the humanization of pets.

02. What are the challenges in the KSA Pet Care Market?

The key challenges in the KSA pet care market include high costs associated with premium pet products, regulatory barriers for importing pet food, and the lack of specialized pet care retailers in certain regions.

03. Who are the major players in the KSA Pet Care Market?

Major players in the KSA pet care market include Mars Petcare, Nestl Purina Petcare, Royal Canin, Petzone KSA, and Hills Pet Nutrition. These companies dominate due to their extensive product portfolios and strong distribution networks.

04. What are the growth drivers of the KSA Pet Care Market?

The growth drivers for the KSA pet care market include the rising trend of pet humanization, the increasing availability of premium pet care products, and the expansion of e-commerce platforms in the region.

05. What trends are shaping the KSA Pet Care Market?

Trends shaping the KSA pet care market include the growth of online sales channels, the increasing demand for organic and natural pet food, and the rise in pet wellness products, including supplements and grooming services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.