KSA Pharmaceuticals Packaging Market outlook to 2030

Region:Middle East

Author(s):Dev Chawla

Product Code:KRO018

June 2025

90

About the Report

KSA Pharmaceuticals Packaging Market Overview

- The KSA Pharmaceuticals Packaging Market was valued at USD 1 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for pharmaceutical products, along with a growing focus on patient safety and regulatory compliance. Advancements also influence the market in packaging technologies that enhance product shelf life and efficacy.

- Key players in this market include Riyadh Pharma, Al Nahdi Medical Company, and Gulf Pharmaceutical Industries. These companies dominate the market due to their extensive distribution networks, strong brand recognition, and commitment to quality, which are essential in meeting the stringent regulatory requirements of the pharmaceutical industry.

- In 2023, the Saudi Food and Drug Authority (SFDA) implemented new regulations mandating child-resistant packaging for all pharmaceutical products. This regulation aims to enhance safety and prevent accidental ingestion by children, reflecting the government's commitment to public health and safety standards in the pharmaceutical sector.

KSA Pharmaceuticals Packaging Market Segmentation

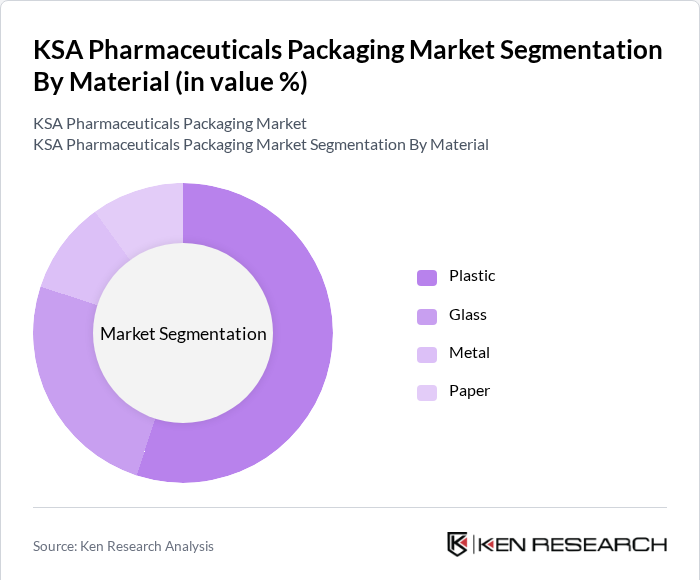

By Material: The KSA Pharmaceuticals Packaging Market is segmented into plastic, glass, metal, and paper. Among these, plastic packaging dominates the market due to its lightweight, cost-effectiveness, and versatility. The increasing use of plastic in various pharmaceutical applications, such as bottles, blisters, and pouches, is driven by consumer preferences for convenience and the need for tamper-evident packaging. Additionally, advancements in biodegradable plastics are further enhancing the appeal of plastic packaging in the pharmaceutical sector.

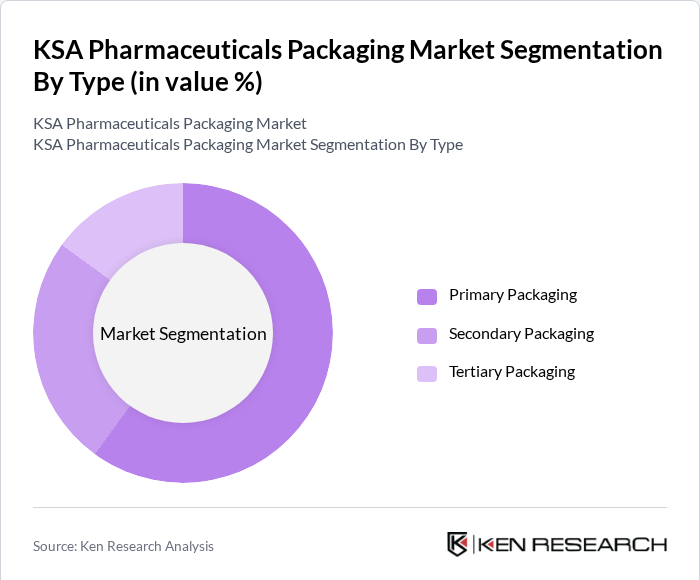

By Type: The market is further segmented into primary, secondary, and tertiary packaging. Primary packaging holds the pharmaceutical product directly and is crucial for maintaining product integrity. This segment is currently leading the market due to the increasing focus on product safety and the need for effective barrier properties to protect against environmental factors. The rise in chronic diseases and the demand for innovative drug delivery systems are also contributing to the growth of primary packaging solutions.

KSA Pharmaceuticals Packaging Market Competitive Landscape

The KSA Pharmaceuticals Packaging Market is characterized by a competitive landscape with several key players, including Riyadh Pharma, Al Nahdi Medical Company, and Gulf Pharmaceutical Industries. These companies are known for their strong market presence and commitment to innovation, which helps them maintain a competitive edge. The market is moderately concentrated, with a mix of local and international players striving to meet the growing demand for pharmaceutical packaging solutions.

KSA Pharmaceuticals Packaging Market Industry Analysis

Growth Drivers

- Increasing Demand for Biopharmaceuticals: The biopharmaceutical sector in KSA is driven by a growing prevalence of chronic diseases. This surge in demand necessitates advanced packaging solutions that ensure product integrity and safety. The World Health Organization reported that 60% of the population suffers from at least one chronic condition, highlighting the urgent need for effective pharmaceutical packaging to maintain drug efficacy and patient safety.

- Rising Health Awareness and Preventive Healthcare: Health awareness campaigns in KSA have led to a 30% increase in preventive healthcare measures among the population. The Ministry of Health's initiatives have resulted in a significant rise in health check-ups and vaccinations, which in turn drives the demand for pharmaceutical packaging. As more consumers prioritize health, the need for reliable and informative packaging becomes critical to convey essential product information and usage instructions.

- Technological Advancements in Packaging Solutions: The adoption of smart packaging technologies is expected to grow by 20% annually, enhancing the KSA pharmaceuticals packaging market. Innovations such as temperature-sensitive materials and RFID tracking systems improve product safety and traceability. According to industry reports, these advancements not only reduce waste but also enhance user experience, making packaging a vital component in the pharmaceutical supply chain.

Market Challenges

- Stringent Regulatory Compliance: The KSA pharmaceutical packaging sector faces rigorous regulatory standards, which can delay product launches. Compliance with the Saudi Food and Drug Authority (SFDA) regulations requires extensive documentation and testing, increasing operational costs. The packaging companies reported challenges in meeting these compliance requirements, which can hinder market entry for new products and innovations.

- High Cost of Advanced Packaging Materials: The rising costs of advanced packaging materials, such as biodegradable plastics and glass, pose a significant challenge. Prices for these materials have increased in the last year due to supply chain disruptions and increased demand. This escalation in costs can limit the ability of smaller companies to invest in high-quality packaging solutions, potentially impacting their market competitiveness.

KSA Pharmaceuticals Packaging Market Future Outlook

The KSA pharmaceuticals packaging market is poised for significant growth, driven by increasing health awareness and technological advancements. As the population ages and chronic diseases become more prevalent, the demand for innovative packaging solutions will rise. Additionally, the shift towards eco-friendly materials and smart packaging technologies will shape the future landscape. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge in this evolving market.

Market Opportunities

- Expansion of E-commerce in Pharmaceuticals: The e-commerce sector for pharmaceuticals in KSA is expected to grow by 25% annually, creating opportunities for innovative packaging solutions that enhance product delivery. Companies can leverage this trend by developing packaging that ensures product safety during transit and provides a seamless unboxing experience for consumers.

- Growth in the Aging Population: With the aging population projected to reach 8 million by 2024, there is a growing need for specialized packaging that caters to elderly consumers. This demographic shift presents opportunities for companies to design user-friendly packaging that addresses the unique needs of older adults, such as easy-to-open features and clear labeling.

Scope of the Report

| By Material |

Plastic Glass Metal Paper |

| By Type |

Primary Packaging Secondary Packaging Tertiary Packaging |

| By Application |

Pharmaceuticals Biotechnology Healthcare |

| By End-User |

Hospitals Pharmacies Clinics |

| By Region |

Riyadh Jeddah Dammam Makkah |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority, Ministry of Health)

Pharmaceutical Manufacturers

Packaging Material Suppliers

Logistics and Supply Chain Companies

Pharmaceutical Distributors

Healthcare Providers and Institutions

Pharmaceutical Industry Associations

Companies

Players Mentioned in the Report:

Riyadh Pharma

Al Nahdi Medical Company

Gulf Pharmaceutical Industries

Saudi Pharmaceutical Industries and Medical Appliances Corporation

Novartis Pharmaceuticals

MedPack Solutions KSA

PharmaWrap Innovations

KSA MedPackaging Group

Desert Pharma Packaging

Oasis Pharma Solutions

Table of Contents

1. KSA Pharmaceuticals Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Pharmaceuticals Packaging Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Pharmaceuticals Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Biopharmaceuticals

3.1.2. Rising Health Awareness and Preventive Healthcare

3.1.3. Technological Advancements in Packaging Solutions

3.2. Market Challenges

3.2.1. Stringent Regulatory Compliance

3.2.2. High Cost of Advanced Packaging Materials

3.2.3. Environmental Concerns and Sustainability Issues

3.3. Opportunities

3.3.1. Expansion of E-commerce in Pharmaceuticals

3.3.2. Growth in the Aging Population

3.3.3. Innovations in Smart Packaging Technologies

3.4. Trends

3.4.1. Shift Towards Eco-friendly Packaging Solutions

3.4.2. Increasing Use of Serialization and Track-and-Trace Technologies

3.4.3. Customization and Personalization in Packaging Designs

3.5. Government Regulation

3.5.1. Overview of Regulatory Bodies in KSA

3.5.2. Key Regulations Impacting Packaging Standards

3.5.3. Compliance with International Packaging Standards

3.5.4. Impact of Regulatory Changes on Market Dynamics

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. KSA Pharmaceuticals Packaging Market Segmentation

4.1. By Material

4.1.1. Plastic

4.1.2. Glass

4.1.3. Metal

4.1.4. Paper

4.2. By Type

4.2.1. Primary Packaging

4.2.2. Secondary Packaging

4.2.3. Tertiary Packaging

4.3. By Application

4.3.1. Pharmaceuticals

4.3.2. Biotechnology

4.3.3. Healthcare

4.4. By End-User

4.4.1. Hospitals

4.4.2. Pharmacies

4.4.3. Clinics

4.5. By Region

4.4.1. Riyadh

4.4.2. Jeddah

4.4.3. Dammam

4.4.4. Makkah

5. KSA Pharmaceuticals Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Riyadh Pharma

5.1.2. Al Nahdi Medical Company

5.1.3. Gulf Pharmaceutical Industries

5.1.4. Saudi Pharmaceutical Industries and Medical Appliances Corporation

5.1.5. Novartis Pharmaceuticals

5.1.6. MedPack Solutions KSA

5.1.7. PharmaWrap Innovations

5.1.8. KSA MedPackaging Group

5.1.9. Desert Pharma Packaging

5.1.10. Oasis Pharma Solutions

5.2. Cross Comparison Parameters

5.2.1. Market Share Analysis

5.2.2. Revenue Growth Rate

5.2.3. Product Portfolio Diversity

5.2.4. Geographic Presence

5.2.5. Innovation and R&D Investment

5.2.6. Customer Satisfaction Ratings

5.2.7. Supply Chain Efficiency

5.2.8. Sustainability Initiatives

6. KSA Pharmaceuticals Packaging Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Pharmaceuticals Packaging Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Pharmaceuticals Packaging Market Future Market Segmentation

8.1. By Material

8.1.1. Plastic

8.1.2. Glass

8.1.3. Metal

8.1.4. Paper

8.2. By Type

8.2.1. Primary Packaging

8.2.2. Secondary Packaging

8.2.3. Tertiary Packaging

8.3. By Application

8.3.1. Pharmaceuticals

8.3.2. Biotechnology

8.3.3. Healthcare

8.4. By End-User

8.4.1. Hospitals

8.4.2. Pharmacies

8.4.3. Clinics

8.5. By Region

8.4.1. Riyadh

8.4.2. Jeddah

8.4.3. Dammam

8.4.4. Makkah

9. KSA Pharmaceuticals Packaging Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Pharmaceuticals Packaging Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the KSA Pharmaceuticals Packaging Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA Pharmaceuticals Packaging Market.

Frequently Asked Questions

01. How big is the KSA Pharmaceuticals Packaging Market?

The KSA Pharmaceuticals Packaging Market is valued at USD 1 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the KSA Pharmaceuticals Packaging Market?

Key challenges in the KSA Pharmaceuticals Packaging Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the KSA Pharmaceuticals Packaging Market?

Major players in the KSA Pharmaceuticals Packaging Market include Riyadh Pharma, Al Nahdi Medical Company, Gulf Pharmaceutical Industries, Saudi Pharmaceutical Industries and Medical Appliances Corporation, and Novartis Pharmaceuticals, among others.

04. What are the growth drivers for the KSA Pharmaceuticals Packaging Market?

The primary growth drivers for the KSA Pharmaceuticals Packaging Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.