KSA POS Lending Market Outlook to 2028

Driven by technological advancements, supportive regulatory measures, innovations and a shift in consumer preferences

Region:Middle East

Author(s):Twinkle and Sunaiyna

Product Code:KR1434

April 2024

46

About the Report

Market Overview:

The Point of Sale (POS) lending market in the Kingdom of Saudi Arabia (KSA) is witnessing rapid growth and evolution. With the increasing adoption of digital payment solutions and the proliferation of e-commerce platforms, POS lending has emerged as a convenient and accessible financing option for consumers.

The market is characterized by a diverse range of players, including traditional financial institutions, fintech startups, and e-commerce platforms such as Al Rajhi, Tabby, Tamara and SABB offering various POS lending solutions tailored to meet the needs of different customer segments. Regulatory reforms aimed at promoting financial inclusion and consumer protection are shaping the landscape, encouraging innovation while ensuring responsible lending practices. Despite these developments, the POS lending market in KSA is still in its nascent stages, presenting ample opportunities for growth and expansion in the coming years as consumer awareness and acceptance of POS lending continue to increase.

KSA POS Lending Market Ecosystem

The KSA POS lending market comprises a diverse ecosystem with major players spanning banks like Al Rajhi Bank, SABB, SNB, and Riyadh Bank, non-banking financial companies (NBFCs) such as Tasheel Finance and Tabby, and buy now, pay later (BNPL) providers like Tamara and Postpay. Additionally, card networks such as Visa and Mastercard play a crucial role in facilitating transactions.

Initially, the market might have experienced fragmentation with numerous players catering to different segments. However, over time, consolidation likely occurred as larger entities acquired smaller ones or formed strategic partnerships to expand their reach and services. On the demand side, various industries like fashion (H&M, Max), electronics (Apple, LG), Furniture (IKEA, Home Centre) and other industries contribute to the market's growth by offering products that consumers can purchase through POS lending options, driving further integration within the ecosystem.

KSA POS Lending Market Analysis

- The KSA POS lending market has witnessed robust growth, supported by various initiatives aimed at fostering financial inclusion and stimulating economic activity.

- The government's Vision 2030 initiative, with its focus on diversifying the economy and promoting entrepreneurship, has provided a conducive environment for the expansion of POS lending services.

- COVID-19 has further led to expansion of e-commerce due to which contactless payments increased to 94% from just 4% in 2017.

- As more than 90% of retail trade takes place offline in KSA, the POS Lending market witnessed a strong recovery after lifting of COVID-19 restrictions in 2021.

- Sales also increased due to rise in retail space like outlets, shopping centers and due to a large number of local and foreign tourist visitors.

- Retail in KSA will continue to benefit from a variety of factors like increase in tourism, building of mega projects, rising disposable incomes and increase in women workforce etc.

- BNPL and other technology will also play major role in expansion of retail and e-commerce.

Key Trends by Market Segment:

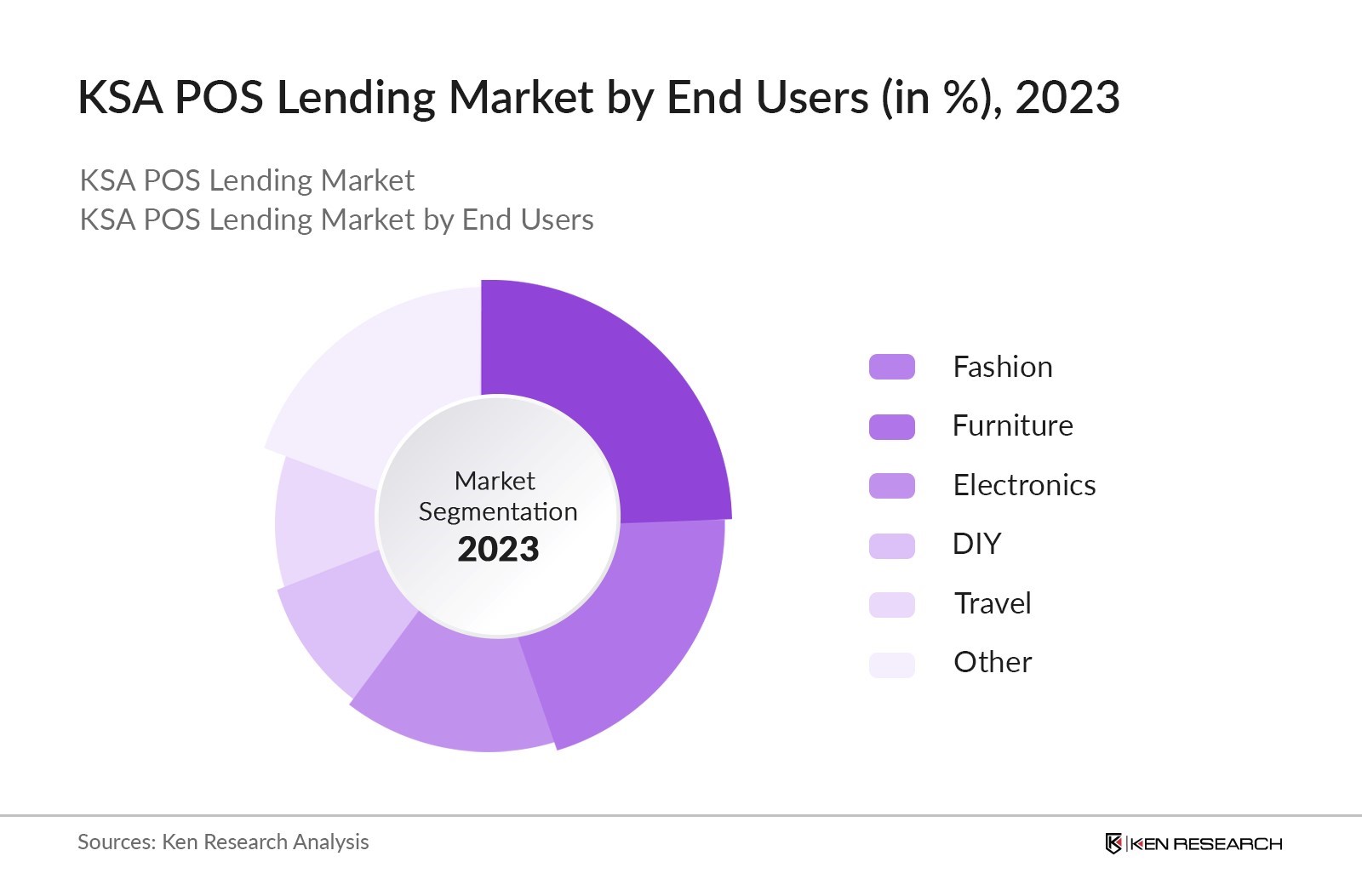

By End-Users: In 2023, the fashion segment emerged as the dominant force in the KSA POS lending market, capturing a substantial 25% market share. This dominance can be attributed to shifting consumer preferences towards fashion retail therapy, coupled with the convenience offered by POS lending options. As consumers increasingly sought trendy clothing and accessories, they opted for flexible payment solutions, driving significant transaction volumes in the fashion segment.

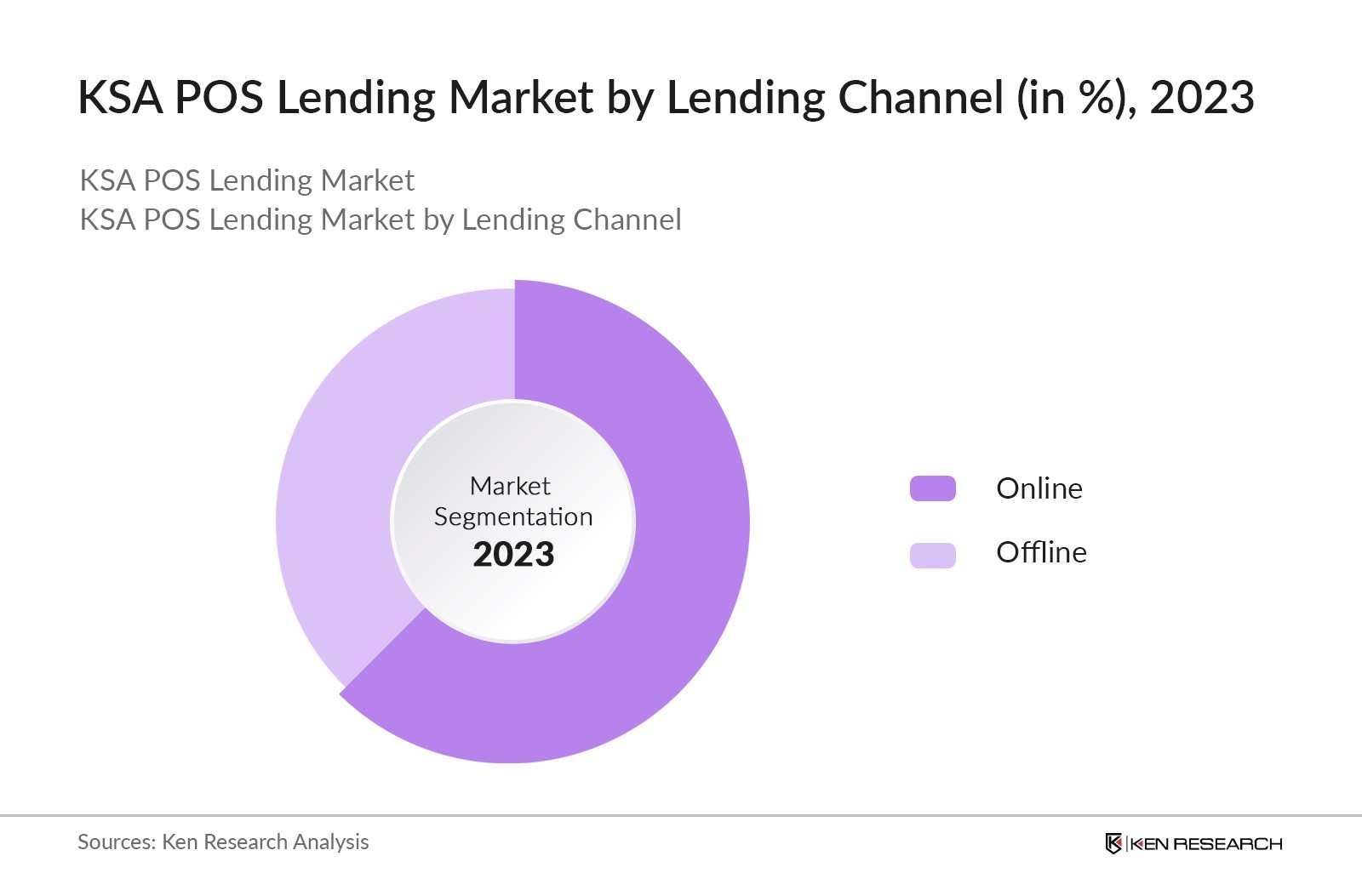

By Lending Channel: In 2023, the KSA POS lending market witnessed the online channel as the dominant force, capturing a significant share of around 60%. The online segment stands dominant due to changing consumer’s ideology towards online shopping and the convenience of accessing POS lending services through digital platforms. Additionally, advancements in e-commerce technology and improved internet infrastructure have facilitated seamless transactions, driving the substantial uptake of POS lending solutions in the online space.

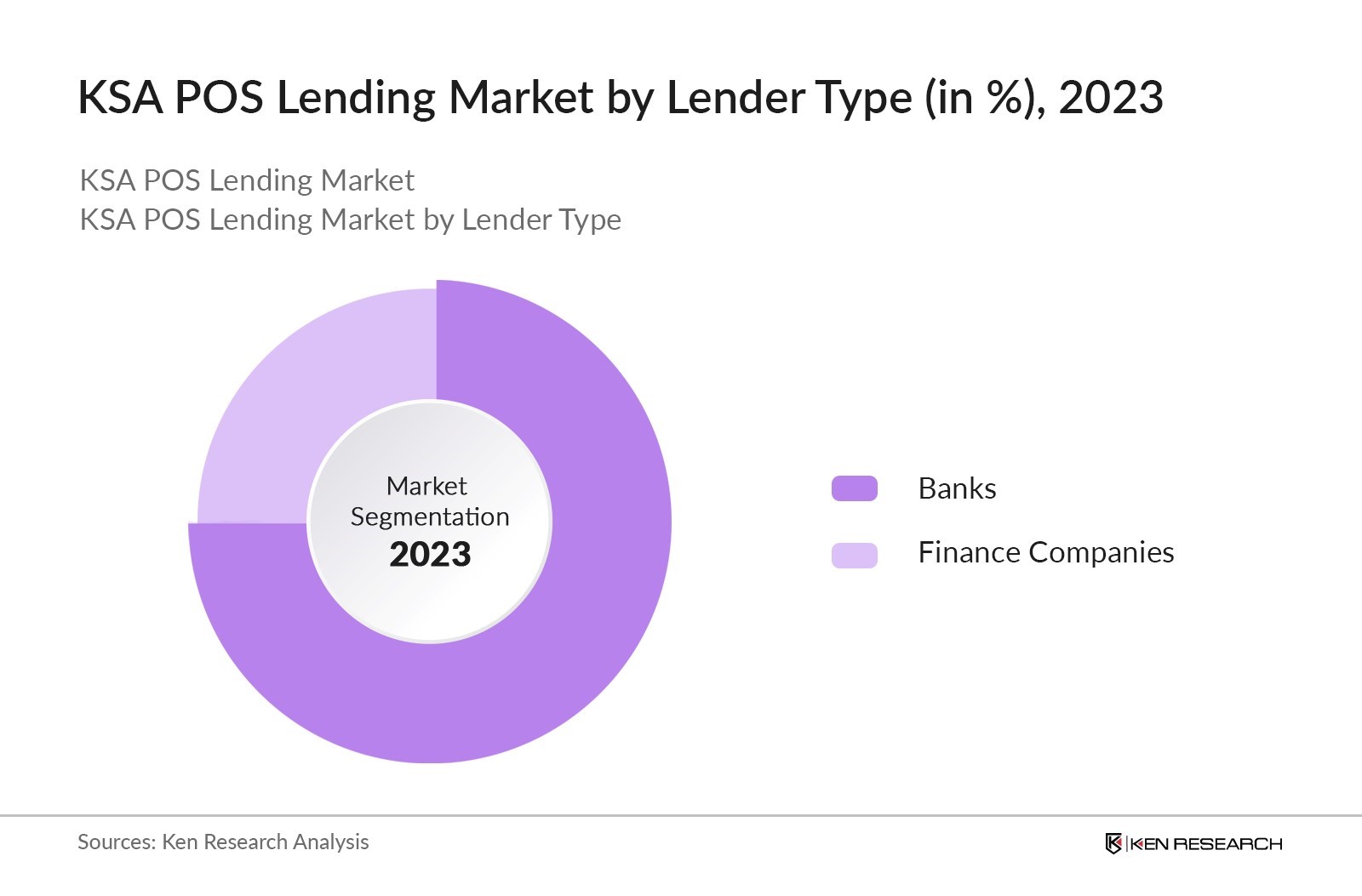

By Lender Type: In 2023, banks held a dominant position in the KSA POS lending market, commanding a substantial 75% market share. This dominance is due to their well-established infrastructure, extensive customer base, and trustworthiness. With established brand recognition and robust risk management systems, banks are preferred by consumers and merchants alike, solidifying their stronghold in the market and limiting the entry of smaller players.

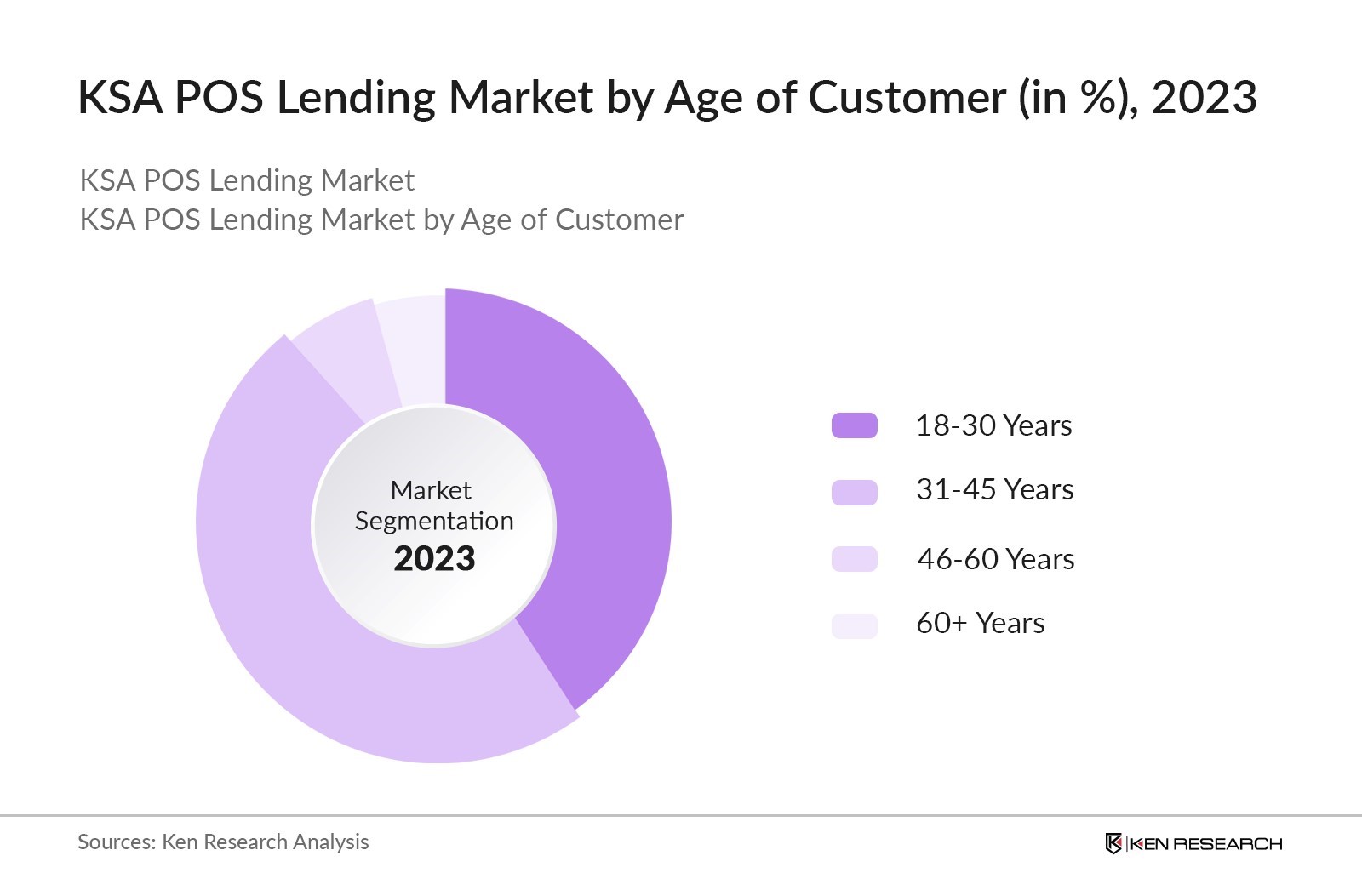

By Age of Customer: In 2023, the KSA POS lending market was notably dominated by the 18-30 age group, capturing a substantial 40% market share. This dominance can be attributed to the tech-savvy nature of younger consumers, who are more inclined to embrace digital payment solutions for their convenience and flexibility. Additionally, this demographic segment often has higher purchasing power and a greater willingness to experiment with new financial products, further solidifying their dominance in the POS lending market.

Competitive Landscape:

Major Players in KSA POS Lending Market

- In KSA POS lending market, traditional banks like Al Rajhi Bank, SNB, SABB, and Riyadh Bank dominate, collectively holding significant amount of the market share.

- However, non-banking financial institutions (NBFCs) and buy now, pay later (BNPL) providers are rapidly gaining ground. NBFCs such as Tasheel Finance contribute significantly to the competition.

- Meanwhile, BNPL players like Tabby, Atamra, Tamara, and Cashew collectively showcase their growing influence and are challenging the market leaders with their innovations and technological advancements.

- This competitive landscape fosters innovation and drives the adoption of advanced technologies to improve customer experiences. As a result, consumers benefit from a diverse array of payment options, competitive interest rates, and flexible repayment terms.

- To maintain their competitive edge, banks and NBFCs are actively forming strategic partnerships and investing in digital infrastructure.

Recent Developments:

- The Saudi Arabian retail market is experiencing significant growth and transformation, with notable developments particularly in the food and beverage (F&B) sector. The easing of COVID-19 restrictions and changes to visa rules have played a crucial role in this growth, as they have led to an increase in the number of pilgrims and tourists visiting the kingdom, especially during religious seasons like Hajj and Umrah.

- The Saudi Arabian Monetary Authority reported a 16% year-on-year increase in point-of-sale transactions for April and May, reflecting a healthy growth in the non-oil sector. This aligns with Saudi Arabia's vision to diversify its economy and reduce its dependence on oil.

- The SAR 50 Bn opportunity in Saudi Arabia's e-commerce market is a clear indicator of its potential. The post-pandemic era has seen an unprecedented growth rate in e-commerce, positioning the Kingdom to become a regional e-commerce powerhouse within the GCC region. This growth is fueled by the adoption of digital commerce over traditional brick-and-mortar retail, accelerated by the global COVID-19 pandemic which pushed consumers towards online shopping.

Future Outlook:

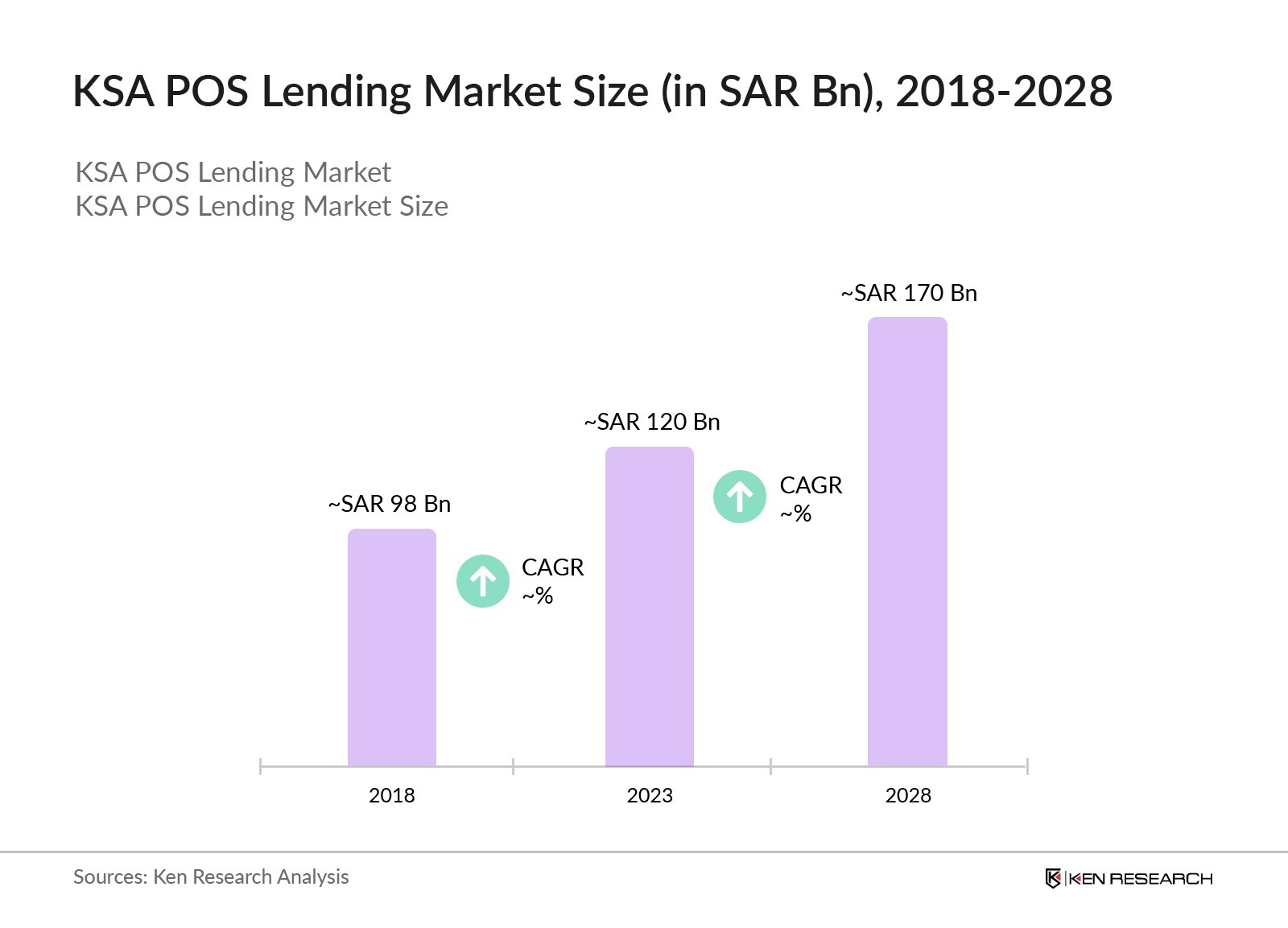

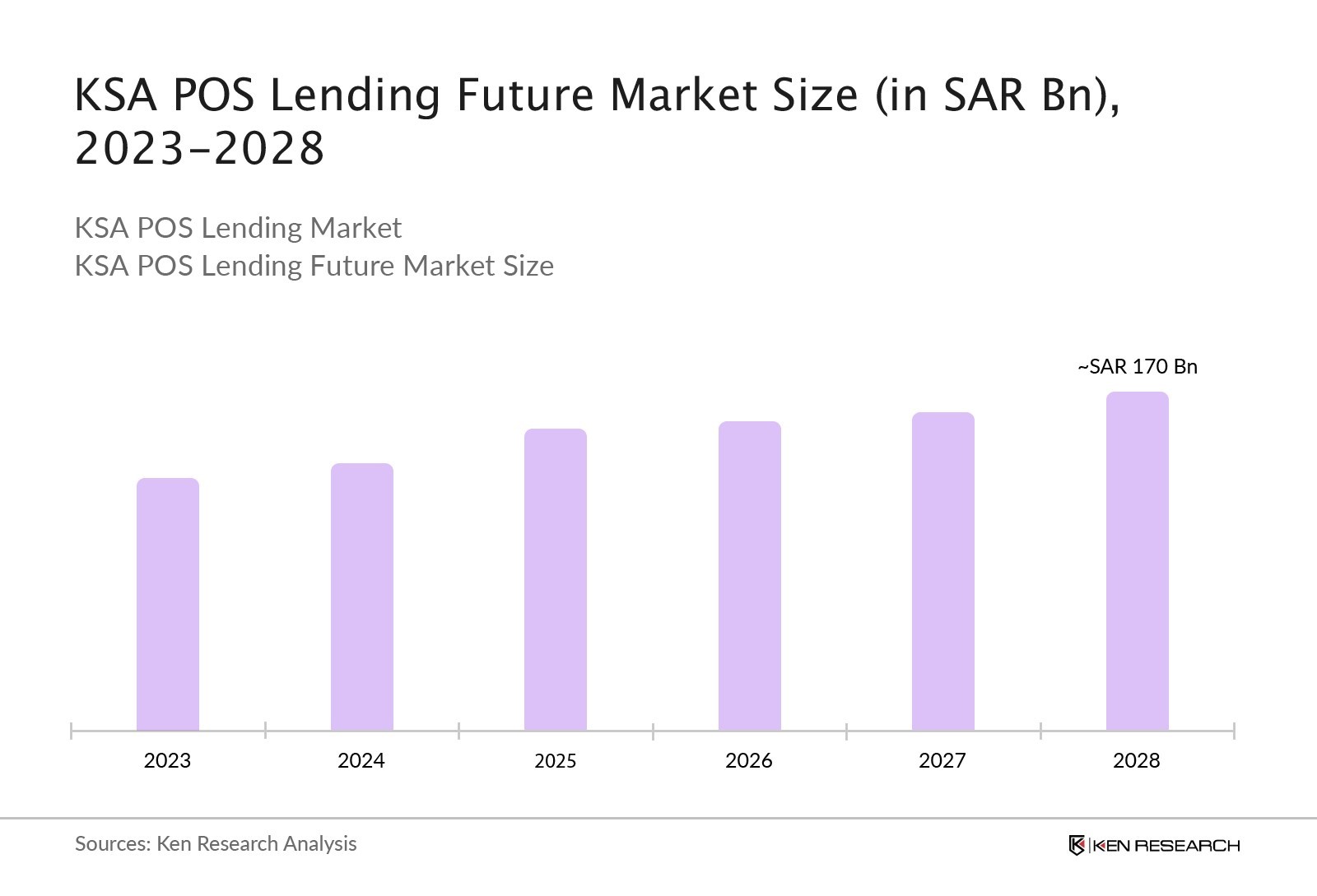

- The future outlook for the KSA POS lending market is indicating a growth to SAR 170 Bn by 2028. Several factors contribute to this positive forecast.

- Economic expansion and increasing disposable incomes are expected to drive consumer spending, thereby increasing demand for POS lending services. Additionally, the widespread adoption of smartphones and internet connectivity will facilitate easier access to digital payment solutions, further stimulating market growth.

- Regulatory efforts such as Vision 2030 aimed at promoting financial inclusion and digital payments are also anticipated to create a conducive environment for market expansion.

- Technological advancements such as artificial intelligence and machine learning will enable providers to deliver tailored and seamless POS lending experiences, enhancing overall customer satisfaction and loyalty.

- With favorable economic conditions, technological innovations, and supportive regulatory measures, the KSA POS lending market is poised for significant growth in the forthcoming years.

Scope of the Report

|

KSA POS Lending Market Segmentation |

|

|

By End-Users |

Fashion Furniture Electronics DIY Travel Others |

|

By Lending Channel |

Online Offline |

|

By Lender Type |

Banks Finance Companies |

|

By Age of Customer |

18-30 years 31-45 years 46-60 Years 60+ Years |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors

Micro Enterprises

Banks

Non-Banking Financial (NBFCs)

Buy Now Pay Later Providers (BNPL)

Financial Institutions

Industry Associations

Government Entities

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Al Rajhi Bank

SNB

SAIB

Jarir

SACO

Al Othaim

Tabby

Tamara

Sabb

Riyadh Bank

Emirates BND

Banque Saudi Fransi

The Saudi Investment Bank

Companies covered from Demand Side

Namshi

H&M

Ounass

RedSea

Extra

Modern Electronics

Suadia

Emirates Airlines

Almosafer

Almanea

IKEA

Amazon

Homecentre

Homebox

Carrefour

Table of Contents

1. Executive Summary

2. Market Overview

2.1 Taxonomy of KSA POS Lending Market

2.2 Industry Value Chain

2.3 Ecosystem

2.4 KSA POS Lending Market Government Regulations

2.5 Growth Drivers of KSA POS Lending Market

2.6 Issues and Challenges of KSA POS Lending Market

2.7 Impact of COVID-19 on KSA POS Lending Market

2.8 SWOT Analysis

3. KSA POS Lending Market Size, 2018 – 2023

4. KSA POS Lending Market Segmentation

4.1 By End-User, 2018 - 2023

4.2 By Lending Channel, 2018 - 2023

4.3 By Lender Type, 2018 – 2023

4.4 By Age of Customer, 2018-2023

5. KSA POS Lending Market Competitive Landscape

5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

5.2 Strategies Adopted by Leading Players

5.3 Company Profiles

5.3.1 Al Rajhi Bank

5.3.2 SNB

5.3.3 SAIB

5.3.4 Tabby

5.3.5 Tamara

5.3.6 SABB

5.3.7 Riyadh Bank

6. KSA POS Lending Future Market Size, 2023– 2028

7. KSA POS Lending Future Market Segmentation

7.1 By End-User, 2023 - 2028

7.2 By Lending Channel, 2023 - 2028

7.3 By Lender Type, 2023 – 2028

7.4 By Age of Customer, 2023-2028

8. Analyst Recommendations

9. Research Methodology

10. Disclaimer

11. Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on POS lending market over the years, penetration of marketplaces and service providers ratio to compute finance disbursed for KSA POS Lending market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Our team will approach multiple POS lenders and understand nature of services segments and product, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from POS lenders.

Frequently Asked Questions

01 How big is KSA POS Lending Market?

The KSA POS Lending Market was valued at ~SAR 120 Bn in 2023.

02 What are the Key Factors Driving the KSA POS Lending Market?

Favorable economic conditions, technological innovations, supportive regulatory measures, shift in consumer preferences are some of the major drivers of the KSA POS Lending Market.

03 Who are the Major Players in the KSA POS Lending Market?

Al Rajhi, SNB, SAIB, Tabby, Tamara, Sabb, Riyadh Bank are some of the key players in KSA POS Lending Market.

04 What is the Future of KSA POS Lending Market?

The KSA POS Lending Market is expected to reach ~SAR 170 Bn by 2028.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.