KSA POS Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD8414

December 2024

87

About the Report

KSA POS Market Overview

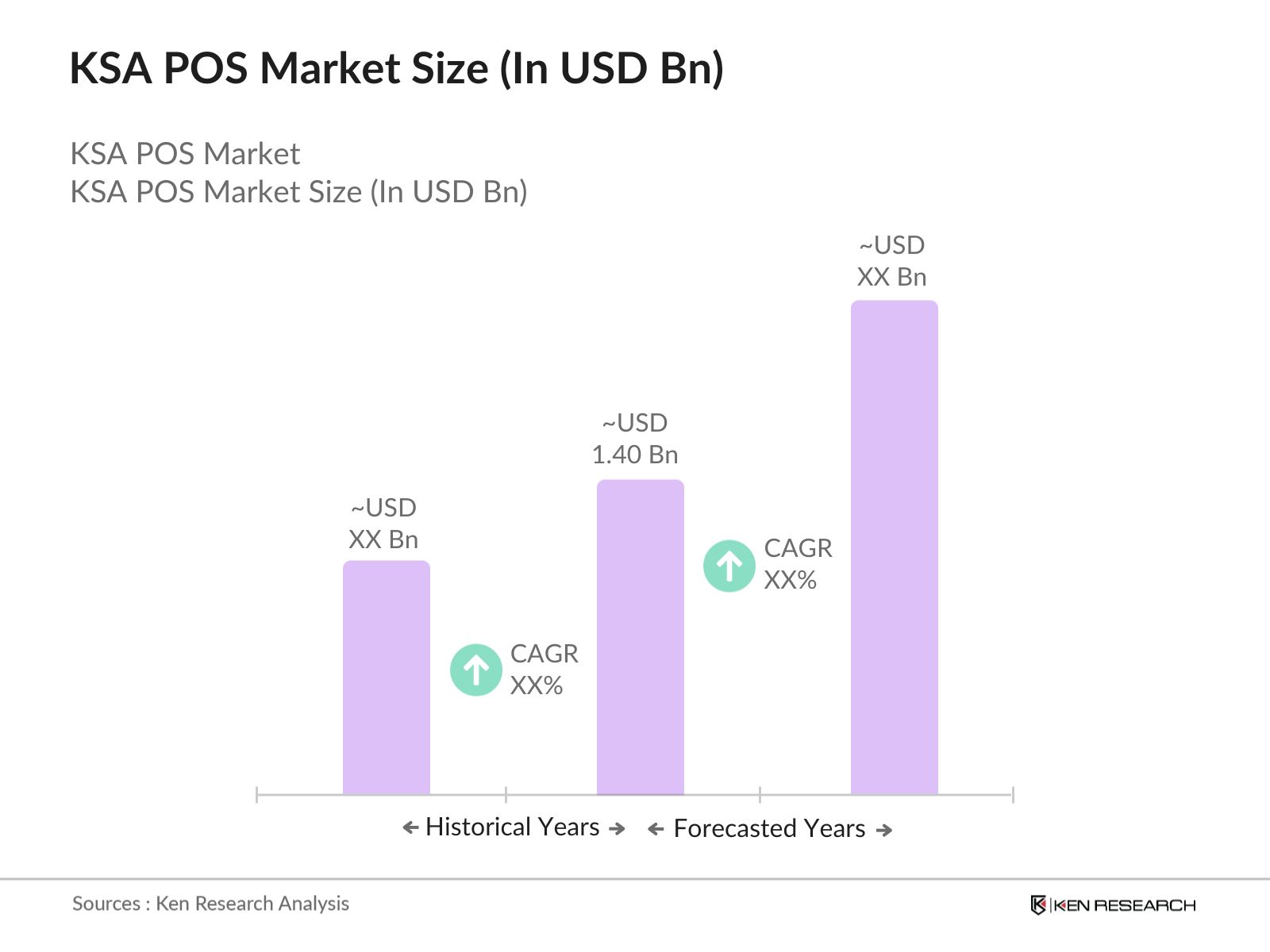

- The KSA Point of Sale (POS) market is valued at USD 1.40 billion, propelled by the country's digital transformation initiatives, increasing retail activity, and the governments commitment to a cashless economy under Vision 2030. Driven by these factors, POS systems are gaining traction across various industries, including retail, hospitality, and healthcare. The market is also influenced by the expansion of e-commerce, leading businesses to adopt advanced POS solutions for better transaction efficiency and customer engagement.

- Riyadh, Jeddah, and Dammam are the primary hubs for POS system adoption in Saudi Arabia. Riyadh, as the capital, is at the forefront due to its dense concentration of retail outlets and commercial establishments. Jeddahs strategic position as a port city facilitates tourism-driven retail activities, while Dammam benefits from large industrial and residential projects, supporting POS demand across these major urban centers.

- POS systems in Saudi Arabia must comply with VAT and invoicing requirements, ensuring transparent and accountable billing. Following the introduction of VAT in 2018, retail compliance has increased, with over majority of businesses now utilizing POS systems that adhere to tax regulations. These requirements facilitate organized financial reporting and accountability within the market.

KSA POS Market Segmentation

- By Component: The market is segmented by component into Hardware, Software, and Services. Hardware, including POS terminals and self-service kiosks, holds a significant share in this segment, primarily due to the necessity of durable, high-performance devices that enhance customer service. Retail and hospitality sectors rely on such robust hardware to ensure seamless and reliable transaction experiences, which is critical for daily business operations.

- By End-User Industry: The market is further segmented by end-user industry into Retail, Hospitality, Healthcare, Transportation, and Entertainment. The retail sector leads within this segmentation, as POS systems are essential for inventory management, real-time analytics, and enhancing customer experience. With high transaction volumes and the need for integrated systems, retail businesses prioritize advanced POS solutions, particularly in urban areas where customer expectations are higher.

KSA POS Market Competitive Landscape

The KSA POS market is highly competitive, featuring both international and local providers such as Verifone, Ingenico, and NCR Corporation. These players leverage extensive distribution networks and innovative product offerings to secure their market positions, focusing on digital and mobile POS solutions to cater to evolving consumer preferences.

KSA POS Market Analysis

Growth Drivers

- Digital Transformation and Cashless Initiatives: The Saudi Arabian governments push for digital transformation has accelerated the adoption of Point of Sale (POS) systems across sectors, with transactions hitting 2.4 billion in the first quarter of 2024, up from 1.8 billion in the same quarter of 2023. This shift is in line with Saudi Vision 2030, which aims to decrease cash transactions to under 70% of total transactions by 2030, making digital payments an integral part of everyday commerce. This government-led drive is expected to continue bolstering POS investments, especially within retail and services sectors.

- Increasing Retail & Hospitality Industry Demand: In 2024, Saudi Arabias retail and hospitality sectors contributed over USD 100 billion to the national GDP, driven by a surge in tourism and domestic spending. The adoption of POS systems within these industries has grown to meet consumer expectations for seamless payment experiences, especially with the influx of over 20 million pilgrims annually. This demand for efficient and modern payment processing solutions has led to increased POS installation across retail and hospitality chains, fostering a competitive environment for vendors.

- Government Vision 2030 Reforms: Vision 2030s economic diversification strategy, focusing on sectors like retail, tourism, and e-commerce, has spurred POS adoption. Government initiatives have led to majority of small businesses integrating digital payment solutions, with plans for further digital payment penetration by 2025. This shift is crucial in reducing cash dependency, modernizing payment infrastructure, and improving transactional transparency within the economy, which supports sustained growth in the POS market.

Challenges

- High Initial Setup and Maintenance Costs: For many small and medium enterprises (SMEs) in Saudi Arabia, the initial cost of POS system installation and the ongoing maintenance fees are significant barriers. Despite subsidies and government-backed programs, the associated expenses remain challenging, limiting POS adoption among smaller businesses. Many SMEs find it difficult to allocate resources for these systems, impacting overall POS penetration in the market.

- Data Security Concerns and Compliance Requirements: Data security remains a major concern, with the Saudi Arabian Monetary Authority (SAMA) enforcing strict data protection standards to safeguard customer information. Retailers face the challenge of adhering to advanced security protocols, which increases both costs and complexity in maintaining compliance, especially as cyber threats continue to evolve and demand robust protection measures, impacting operational efficiency and necessitating ongoing updates.

KSA POS Market Future Outlook

The KSA POS market is expected to experience substantial growth through 2028, driven by the Kingdoms ongoing digitalization efforts, particularly in retail and hospitality sectors. Government support for a cashless society aligns with the Vision 2030 strategy, creating ample opportunities for POS system providers to expand their offerings. Additionally, the growth of smart retail solutions and customer-focused innovations will likely enhance the demand for modern POS systems.

Future Market Opportunities

- Integration with Smart Retail Solutions: As the Saudi market moves towards smart retail experiences, there is growing demand for POS systems integrated with advanced features like artificial intelligence (AI) and machine learning (ML). These systems offer retailers insights into consumer preferences, optimize stock levels, and streamline customer interactions, providing a competitive edge in the rapidly evolving retail landscape. This shift reflects the increasing emphasis on personalized, data-driven retail experiences to meet changing consumer expectations.

- Adoption of Cloud-based POS Systems: Businesses in KSA are increasingly transitioning to cloud-based POS systems that provide scalability, real-time data access, and cost-efficiency. This trend is particularly beneficial for retail chains and franchises that require centralized management across multiple outlets, enabling easier expansion and customer data integration across locations. Additionally, cloud-based solutions allow for seamless updates and maintenance, reducing the need for on-site technical support.

Scope of the Report

|

By Component |

POS Terminals Self-Service Kiosks Mobile Devices Inventory Management Billing and Invoicing Customer Management Installation Services Maintenance Services Consulting Services |

|

By Deployment Mode |

Cloud-based On-premises |

|

By End-User |

Retail, Hospitality Healthcare Transportation Entertainment and Leisure |

|

By Organization Size |

SMEs Large Enterprises |

|

By Region |

Riyadh Jeddah Dammam Makkah Eastern Province |

Products

Key Target Audience

Retail Chains and Supermarkets

Hospitality and Tourism Companies

Healthcare Institutions

Transportation and Logistics Firms

Entertainment Venues

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Saudi Arabian Monetary Authority, Ministry of Commerce)

Companies

Players Mentioned in the Report

Verifone

Ingenico

NCR Corporation

Square Inc.

HP Inc.

Oracle Corporation

Diebold Nixdorf

Lightspeed POS

Samsung Electronics

Casio Computer Co., Ltd.

Revel Systems

Newland Payment Technology

Clover Network Inc.

SZZT Electronics

Al Rugaib POS Solutions

Table of Contents

1. KSA POS Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Key Market Segmentation Overview

2. KSA POS Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Milestones and Developments

3. KSA POS Market Analysis

3.1 Growth Drivers

3.1.1 Digital Transformation and Cashless Initiatives

3.1.2 Increasing Retail & Hospitality Industry Demand

3.1.3 Government Vision 2030 Reforms

3.1.4 Technological Advancements in Payment Infrastructure

3.2 Market Challenges

3.2.1 High Initial Setup and Maintenance Costs

3.2.2 Data Security Concerns and Compliance Requirements

3.2.3 Limited Access to Skilled Workforce for POS Solutions

3.2.4 Network and Connectivity Issues in Remote Areas

3.3 Opportunities

3.3.1 Growing E-commerce and Omnichannel Retail Integration

3.3.2 Expansion of Mobile POS Systems

3.3.3 Integration with AI and Machine Learning for Personalized Customer Experience

3.3.4 Collaboration with International POS Providers

3.4 Trends

3.4.1 Adoption of Cloud-based POS Systems

3.4.2 Integration with Customer Relationship Management (CRM)

3.4.3 Rise in Self-Service Kiosks

3.4.4 Increasing Demand for Real-time Analytics

3.5 Government Regulation

3.5.1 Regulatory Compliance for Payment Security Standards

3.5.2 Policies Supporting Digital Payments

3.5.3 Taxation and Billing Requirements

3.5.4 Incentives for Cashless Transactions

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. KSA POS Market Segmentation

4.1 By Component (In Value %)

Hardware

POS Terminals

Self-Service Kiosks

Mobile Devices

Software

Inventory Management

Billing and Invoicing

Customer Management

Services

Installation Services

Maintenance Services

Consulting Services

4.2 By Deployment Mode (In Value %)

Cloud-based

On-premises

4.3 By End-User Industry (In Value %)

Retail

Hospitality

Healthcare

Transportation

Entertainment and Leisure

4.4 By Organization Size (In Value %)

SMEs

Large Enterprises

4.5 By Region (In Value %)

Riyadh

Jeddah

Dammam

Others

5. KSA POS Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

Verifone

Ingenico

Square Inc.

NCR Corporation

Oracle Corporation

Shopify

HP Inc.

Diebold Nixdorf

Lightspeed POS

Revel Systems

Samsung Electronics

Casio Computer Co., Ltd.

SZZT Electronics

Newland Payment Technology

Clover Network Inc.

5.2 Cross Comparison Parameters (Headquarters, Market Share, Revenue, Installed Base, Technology Portfolio, Product Innovations, Partnerships, After-Sales Support)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Partnerships and Collaborations

5.6 Mergers and Acquisitions

5.7 Investment Analysis

5.8 Funding and Venture Capital Investments

6. KSA POS Market Regulatory Framework

6.1 Compliance Requirements for POS Security

6.2 Regulations on Customer Data Privacy

6.3 Guidelines for POS Device Certification

6.4 Government Initiatives for Cashless Payments

7. KSA POS Future Market Size (In USD Mn)

7.1 Forecasted Market Size and Growth Rate

7.2 Key Factors Driving Future Growth

8. KSA POS Future Market Segmentation

8.1 By Component (In Value %)

8.2 By Deployment Mode (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Organization Size (In Value %)

8.5 By Region (In Value %)

9. KSA POS Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Serviceable Addressable Market (SAM) Analysis

9.3 Market Entry Strategies

9.4 Customer Segmentation and Targeting

9.5 White Space and Emerging Opportunities

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, a comprehensive market ecosystem map is developed to identify all major stakeholders within the KSA POS Market. This involves extensive secondary research to gather foundational data on market drivers and consumer trends.

Step 2: Market Analysis and Data Collection

In this phase, historical data on POS system adoption is analyzed, encompassing different segments such as retail and hospitality. Key trends in technology and consumer behavior are evaluated to establish a solid foundation for forecasting.

Step 3: Validation with Industry Experts

A series of interviews with industry experts and business stakeholders are conducted to validate findings. These discussions offer insights into operational challenges and advancements, ensuring that the data accurately reflects market dynamics.

Step 4: Final Synthesis and Reporting

The last step involves synthesizing primary and secondary research findings into a comprehensive market report. This report includes qualitative and quantitative analyses to provide stakeholders with actionable insights on market growth and strategic opportunities in the KSA POS sector.

Frequently Asked Questions

How big is the KSA POS Market?

The KSA POS market is valued at USD 1.40 billion, driven by rising demand in retail and hospitality sectors, as well as government support for digital payment systems.

What are the challenges in the KSA POS Market?

Challenges in the KSA POS market include high initial setup costs for small businesses and data security compliance requirements, which add to the operational costs for POS solution providers.

Who are the major players in the KSA POS Market?

Key players in the KSA POS market include Verifone, Ingenico, NCR Corporation, Square Inc., and HP Inc., known for their extensive product portfolios and digital retail solutions.

What are the growth drivers of the KSA POS Market?

Growth drivers in the KSA POS market include the countrys digital transformation efforts, e-commerce expansion, and increasing retail demand for efficient, secure payment systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.