KSA POS Payments Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD10855

November 2024

82

About the Report

KSA POS Payments Market Overview

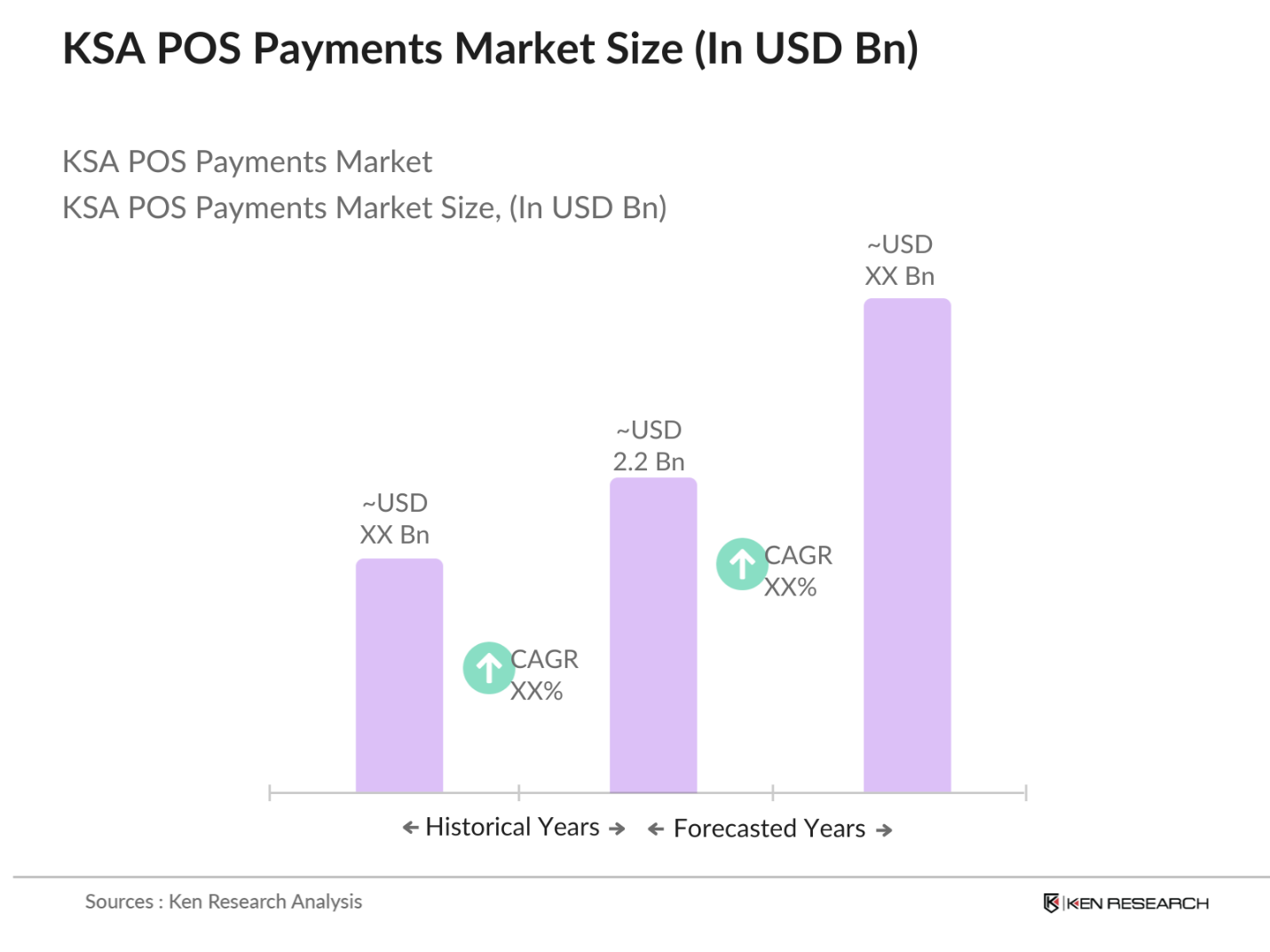

- The KSA POS Payments market, valued at USD 2.2 billion, is driven by government initiatives promoting a cashless economy and increased consumer reliance on digital payment solutions. The adoption of POS systems has been significantly fueled by the government's Vision 2030 program, which seeks to reduce the use of cash and enhance digital financial transactions, supported by favorable regulatory changes and incentives for businesses to adopt POS solutions.

- Riyadh and Jeddah dominate the Saudi POS Payments market due to their high population density and concentration of retail and service businesses. The presence of major financial institutions and technology providers in these cities, combined with substantial consumer spending power, has made them primary hubs for POS payment adoption, further supported by an expanding e-commerce sector and a strong urban demand for modern payment solutions.

- The Saudi Central Bank has issued multiple guidelines to govern electronic payments, including POS transactions, with a focus on consumer protection and cybersecurity. These guidelines mandate compliance for all POS operators to ensure secure and reliable transactions, impacting the structure and functionality of POS systems. Compliance with SAMA guidelines is compulsory for all financial

KSA POS Payments Market Segmentation

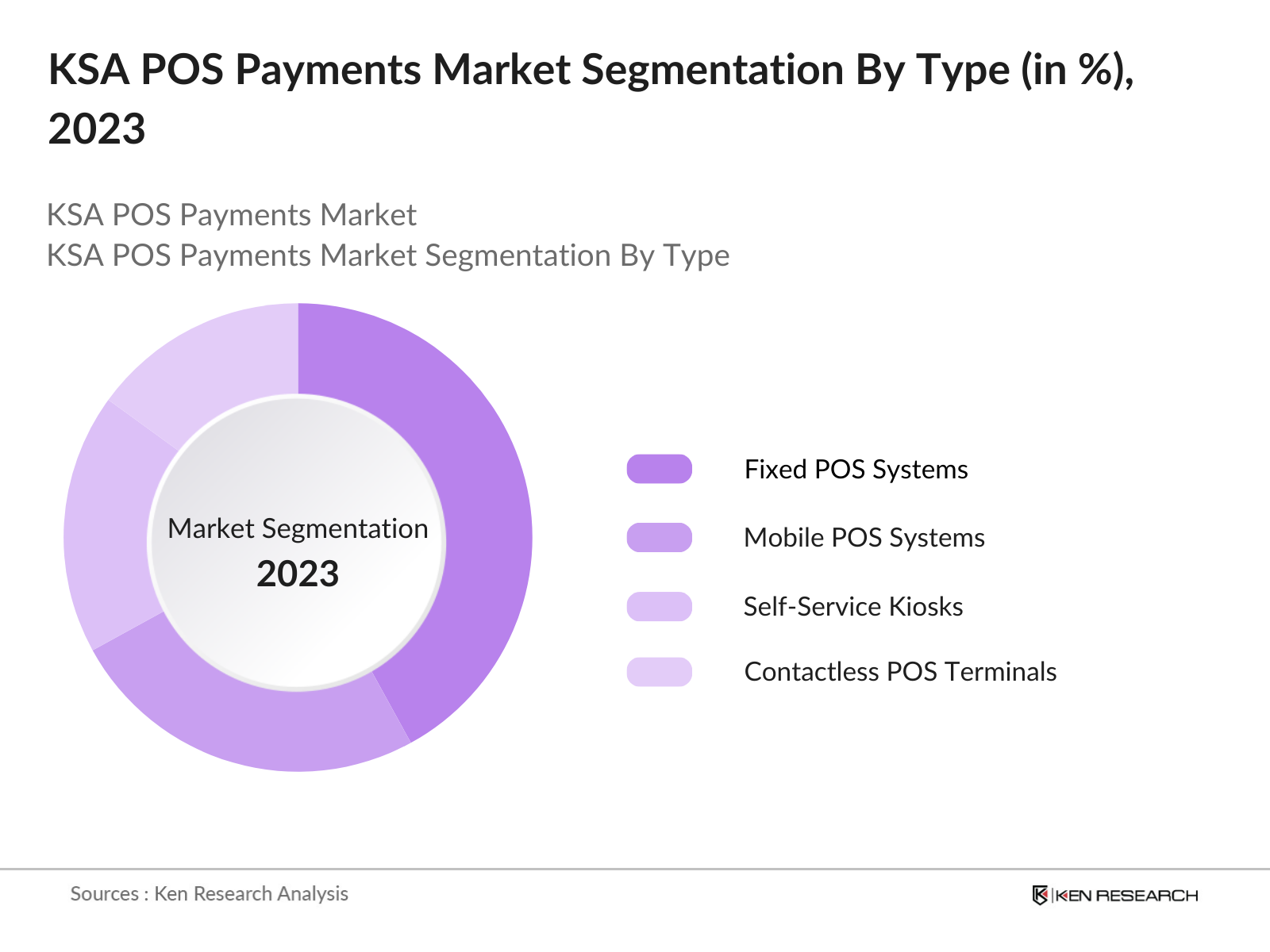

By Type: The KSA POS Payments market is segmented by type into fixed POS systems, mobile POS systems, self-service kiosks, and contactless POS terminals. Recently, fixed POS systems hold a dominant share in the market under this segmentation. This dominance is attributed to their widespread use in high-traffic retail environments where stability and comprehensive functionalities are essential. Fixed systems, integrated with inventory and customer management tools, offer a robust solution for large retailers, restaurants, and grocery chains, driving their preference over mobile and contactless alternatives.

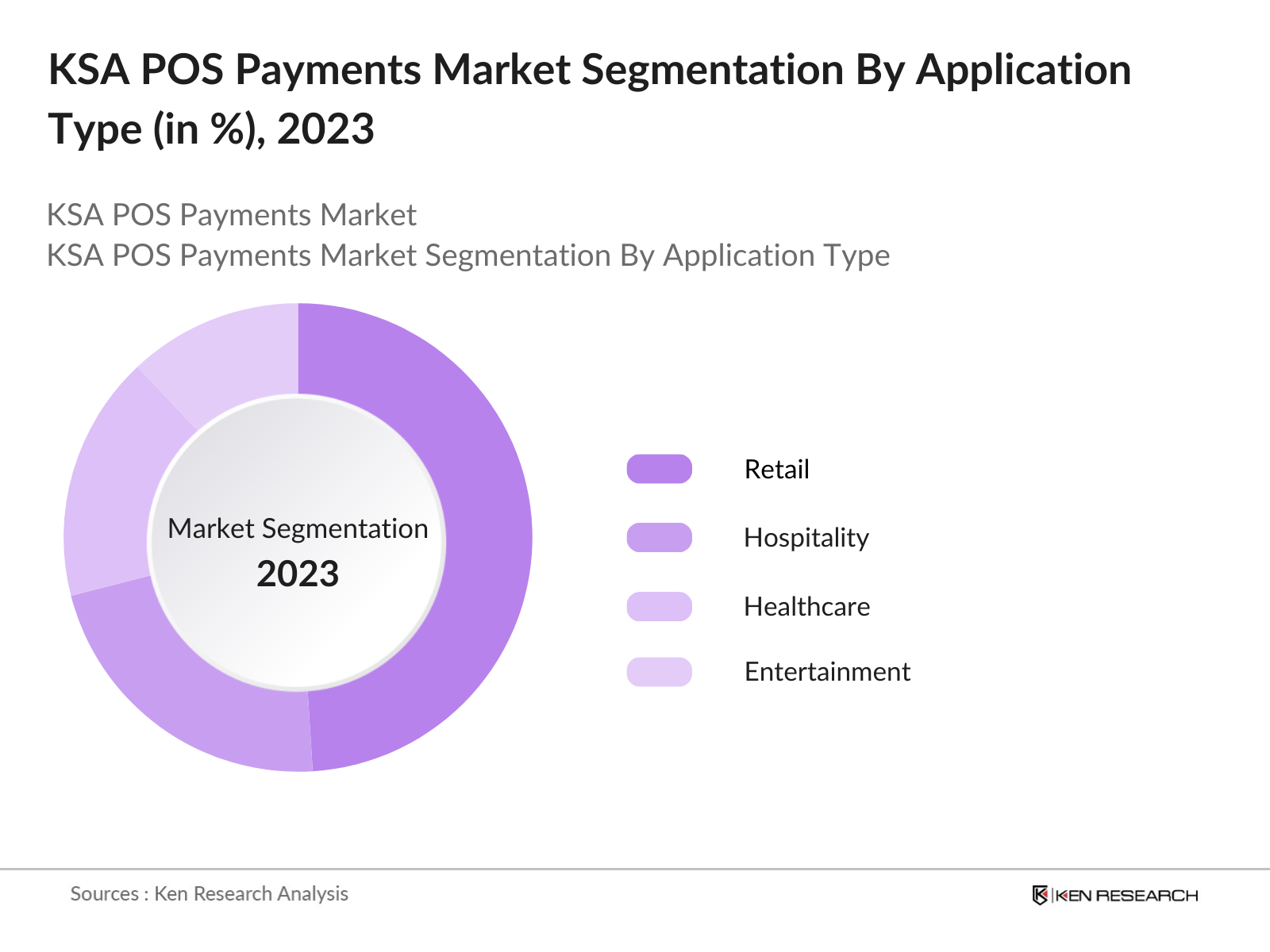

By Application: The KSA POS Payments market is segmented by application into retail, hospitality, healthcare, entertainment, and financial services. The retail segment commands the largest market share due to the sectors extensive requirement for efficient payment processing, enhanced inventory management, and seamless customer service. As retail outlets across KSA expand, especially in high-density urban centers, the demand for POS solutions that streamline transactions and support loyalty programs has fueled the adoption of POS systems within this segment.

KSA POS Payments Market Competitive Landscape

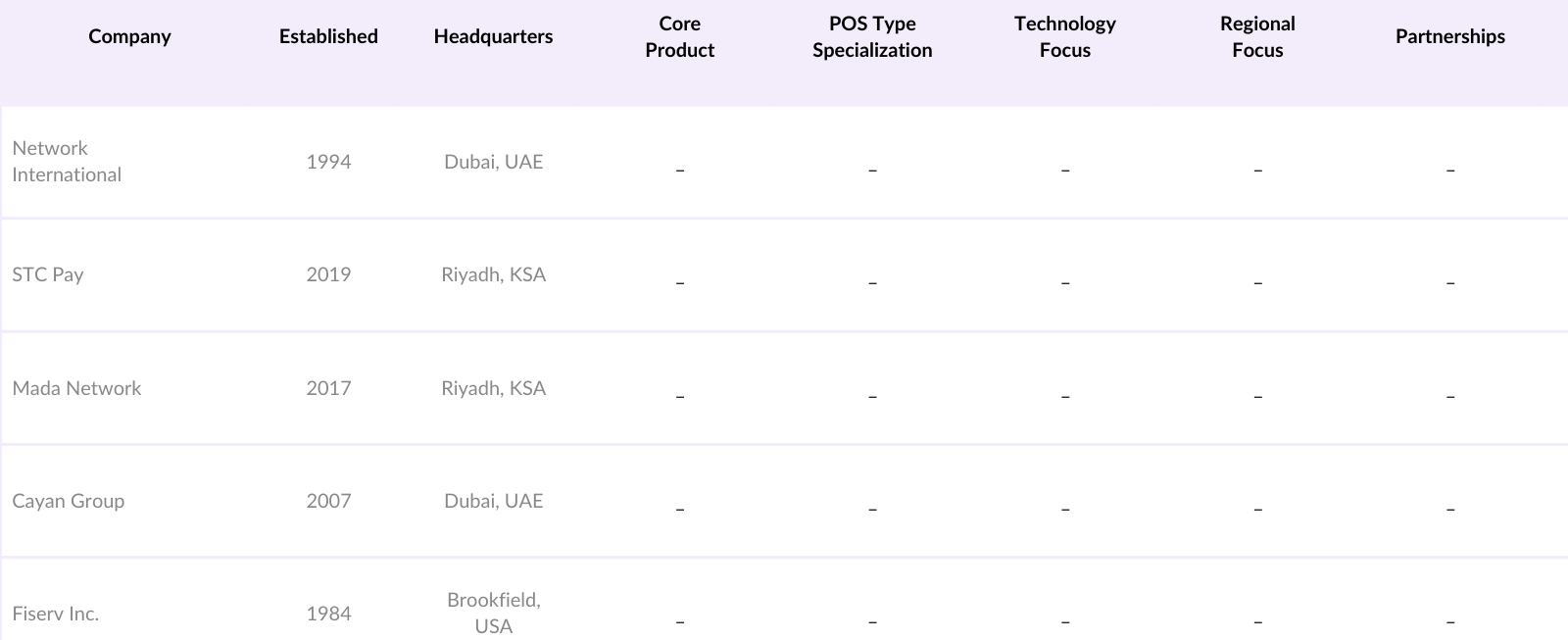

The KSA POS Payments market is dominated by several key players, each bringing unique offerings and specialized payment solutions tailored to local business needs. This competitive landscape showcases major players like Network International and STC Pay, as well as global leaders who have gained a foothold in the region, underscoring the consolidation and specialization within the market.

KSA POS Payments Industry Analysis

Growth Drivers

- Governments Vision 2030 Initiatives: KSAs Vision 2030 aims to diversify the nations economy, reduce dependency on oil, and build a digitally powered ecosystem. The Saudi government is actively fostering a digital economy, allocating $15 billion towards the development of fintech and other digital services to support non-cash transactions. In 2024, the government also expanded digital infrastructure by adding over 100,000 POS devices countrywide, aiding seamless transactions in retail and services sectors.

- Shift Towards Cashless Economy: With the KSAn Monetary Authority (SAMA) reporting a 90% surge in cashless transactions between 2022 and 2024, the nation is rapidly moving toward a cashless economy. SAMAs initiatives led to the installation of more than 60,000 additional POS systems in 2024. By facilitating a modern financial infrastructure, the Kingdom is seeing a tangible reduction in cash-based transactions, particularly in retail and e-commerce sectors.

- Increasing E-commerce Penetration: As e-commerce expands in KSA, the POS payments market has seen a significant boost, with online retail sales valued at $14 billion in 2023. Driven by urbanization and internet penetration rates reaching 97%, the demand for POS systems compatible with e-commerce platforms has risen. This trend aligns with the higher adoption of digital payments by the 35 million-strong population.

Market Challenges

- High Implementation Costs: Despite increased adoption, the high costs associated with implementing POS systems remain a challenge for SMEs in KSA. Initial setup costs for advanced POS systems can reach up to SAR 20,000 ($5,333), which poses a barrier, especially for small-scale enterprises. Financial institutions are actively working to reduce these costs, but SMEs in particular still find this a significant challenge.

- Cybersecurity Concerns: With the digitalization of payments comes a heightened risk of cybersecurity threats. In 2023, KSA reported over 1,000 cybersecurity incidents targeting digital transactions. According to SAMA, strengthening cybersecurity measures remains a priority, as these concerns present obstacles for further POS adoption among cautious businesses.

KSA POS Payments Market Future Outlook

The KSA POS Payments market is expected to experience steady growth in the upcoming years, driven by progressive government policies aimed at increasing digital transactions, advancements in POS technologies, and the rising trend of contactless and mobile payment options. As businesses increasingly adopt POS systems integrated with analytics and customer management tools, the demand for more sophisticated solutions is likely to rise. Furthermore, increased e-commerce and changing consumer behavior toward digital payments will continue to fuel this expansion.

Opportunities

- Expansion of Mobile POS Payments: Mobile POS (mPOS) solutions are expected to drive future growth in KSAs POS market. In 2024, the number of mPOS devices in use rose to 60,000, largely due to the popularity of smartphones and the ease of remote transactions. This expansion particularly benefits the retail and hospitality sectors, which are rapidly adopting mPOS to enhance customer experience.

- Growth of SME Adoption of POS Systems: KSAs SME sector, which comprises over 99% of all private sector establishments, has increasingly adopted POS systems. In 2024, government-led initiatives like the Financial Sector Development Program provided subsidies for SMEs to implement POS solutions, increasing POS penetration in this sector by 35%.

Scope of the Report

|

Type |

Fixed POS Systems Mobile POS Systems Self-Service Kiosks Contactless POS Terminals |

|

Component |

Hardware Software Services |

|

Application |

Retail Hospitality Healthcare Entertainment and Recreation Financial Services |

|

End-User Industry |

Small and Medium Enterprises (SMEs) Large Enterprises |

|

Region |

Riyadh Jeddah Dammam Mecca Al Khobar |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Retail Chain Companies

Hospitality and Entertainment Industries

Healthcare Companies

Payment Solution Provider Companies

E-commerce Platform Companies

Government and Regulatory Bodies (KSAn Monetary Authority - SAMA)

Investor and Venture Capitalist Firms

Financial Service Providers and Banks

Companies

Players Mentioned in the Report

Network International

STC Pay

Al Rajhi Bank

Samba Financial Group

Arab National Bank

Mada Network

Visa KSA

Mastercard Middle East

Amwal

Table of Contents

1. KSA POS Payments Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA POS Payments Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA POS Payments Market Analysis

3.1. Growth Drivers

3.1.1. Governments Vision 2030 Initiatives

3.1.2. Shift Towards Cashless Economy

3.1.3. Increasing E-commerce Penetration

3.1.4. Technological Advancements in POS Solutions

3.2. Market Challenges

3.2.1. High Implementation Costs

3.2.2. Cybersecurity Concerns

3.2.3. Interoperability Issues

3.3. Opportunities

3.3.1. Expansion of Mobile POS Payments

3.3.2. Growth of SME Adoption of POS Systems

3.3.3. Integration with Loyalty Programs

3.4. Trends

3.4.1. Rise of Contactless Payments

3.4.2. Adoption of Cloud-Based POS Systems

3.4.3. Use of Data Analytics in POS Payments

3.5. Regulatory Landscape

3.5.1. Saudi Central Bank (SAMA) Guidelines

3.5.2. Data Protection and Privacy Regulations

3.5.3. Compliance with Anti-Money Laundering (AML) Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA POS Payments Market Segmentation

4.1. By Type (In Value %)

4.1.1. Fixed POS Systems

4.1.2. Mobile POS Systems

4.1.3. Self-Service Kiosks

4.1.4. Contactless POS Terminals

4.2. By Component (In Value %)

4.2.1. Hardware

4.2.2. Software

4.2.3. Services

4.3. By Application (In Value %)

4.3.1. Retail

4.3.2. Hospitality

4.3.3. Healthcare

4.3.4. Entertainment and Recreation

4.3.5. Financial Services

4.4. By End-User Industry (In Value %)

4.4.1. Small and Medium Enterprises (SMEs)

4.4.2. Large Enterprises

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Mecca

4.5.5. Al Khobar

5. KSA POS Payments Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Network International

5.1.2. STC Pay

5.1.3. Al Rajhi Bank

5.1.4. Samba Financial Group

5.1.5. Arab National Bank

5.1.6. Mada Network

5.1.7. Visa KSA

5.1.8. Mastercard Middle East

5.1.9. Amwal

5.1.10. Tap Payments

5.1.11. Cayan Group

5.1.12. Fiserv Inc.

5.1.13. Saudi Payments

5.1.14. HyperPay

5.1.15. Global Payments Inc.

5.2. Cross Comparison Parameters (Employee Count, Revenue, Headquarters, Market Position, Key Offerings, Growth Strategy, Market Penetration, Digital Transformation Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Support and Subsidies

5.9. Private Equity Investments

6. KSA POS Payments Market Regulatory Framework

6.1. Licensing and Compliance Requirements

6.2. Data Protection Standards

6.3. Anti-Fraud and AML Guidelines

7. KSA POS Payments Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA POS Payments Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Component (In Value %)

8.3. By Application (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. KSA POS Payments Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Key Customer Segment Analysis

9.3. Marketing and Go-To-Market Initiatives

9.4. White Space Analysis and Strategic Growth Areas

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive ecosystem map for the KSA POS Payments market, which includes major stakeholders. Extensive desk research combined with secondary databases is used to pinpoint critical variables influencing the markets structure and dynamics.

Step 2: Market Analysis and Data Collection

In this phase, historical data relevant to the POS Payments market in KSA is compiled. This includes analysis of transaction volumes, adoption rates by industry, and usage trends in urban versus rural areas to ensure a reliable projection.

Step 3: Hypothesis Validation and Expert Consultations

Market assumptions are formulated and validated through consultations with industry experts. Interviews with representatives from major POS solution providers ensure an accurate and nuanced understanding of market growth patterns and future demand.

Step 4: Research Synthesis and Final Output

The last stage involves synthesizing research findings, supplemented by insights from primary stakeholders to refine data accuracy. The report output ensures a comprehensive analysis of the KSA POS Payments market, corroborated through a bottom-up approach and thorough industry validation.

Frequently Asked Questions

1. How big is the KSA POS Payments market?

The KSA POS Payments market is valued at USD 2.2 billion, driven by government incentives, the push for a cashless economy, and increased consumer adoption of digital payments.

2. What are the primary challenges in the KSA POS Payments market?

The market faces challenges such as high initial setup costs for advanced POS systems, cybersecurity risks, and limited interoperability among different payment systems.

3. Who are the leading players in the KSA POS Payments market?

Key players include Network International, STC Pay, Al Rajhi Bank, and Mada Network, known for their strong market presence and advanced payment solutions.

4. What are the main drivers of the KSA POS Payments market?

The market is driven by Vision 2030 initiatives, the rise of e-commerce, and increasing demand for efficient transaction solutions among retail and service businesses.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.