KSA Pre Engineered Buildings Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD389

January 2025

97

About the Report

KSA Pre-Engineered Buildings Market Overview

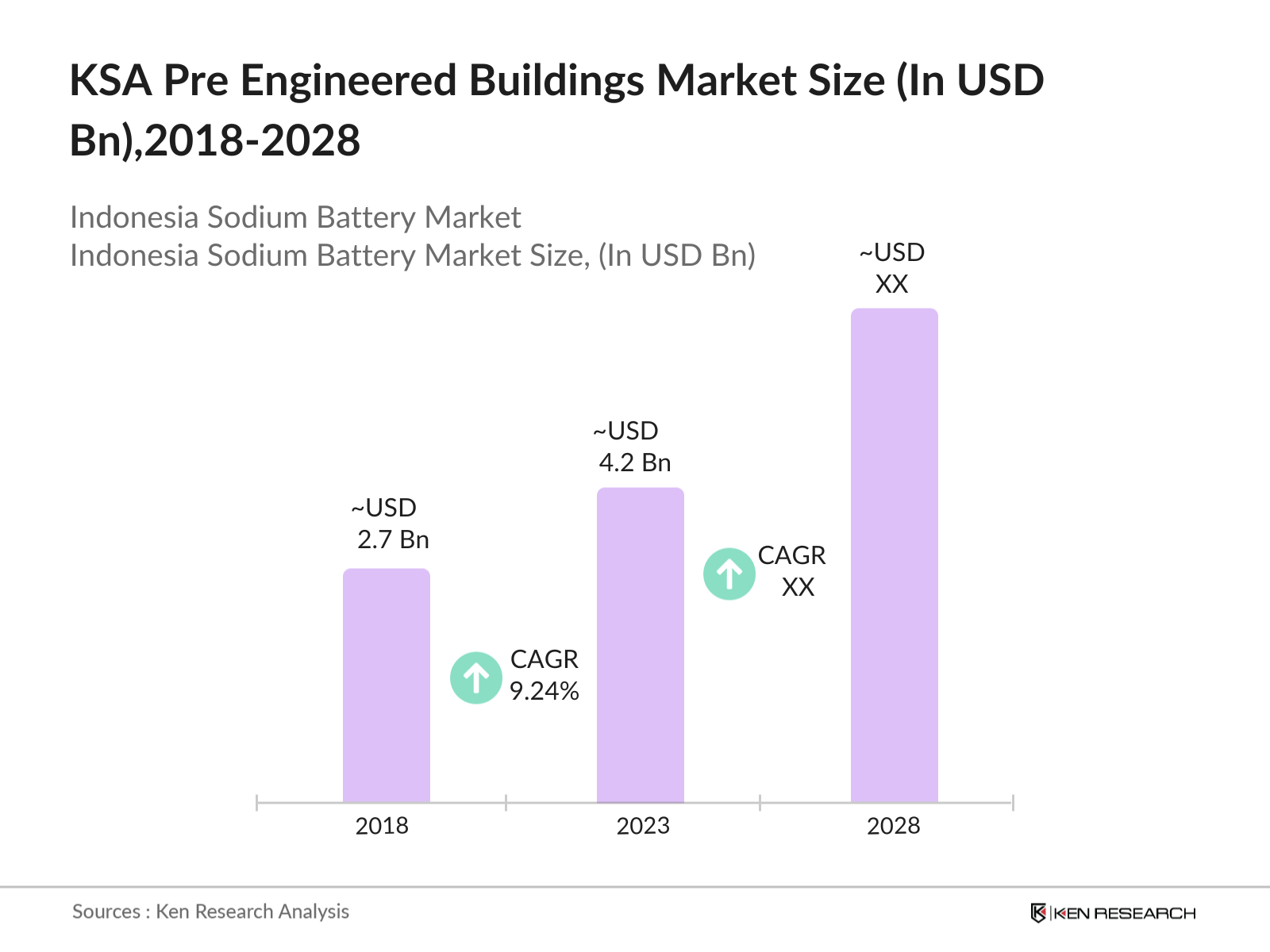

- The KSA Pre-Engineered Buildings (PEB) market was valued at USD 2.7 billion in 2018 and has grown to around USD 4.2 billion by 2023. This growth is driven by increased demand for efficient, cost-effective construction solutions and significant investments in industrial and commercial infrastructure projects.

- Key players in the KSA PEB market include Zamil Steel, Kirby Building Systems, Mabani Steel, Al Shahin Metal Industries, and Emirates Building Systems. Zamil Steel is the dominant player due to its comprehensive product range and extensive experience.

- The PEB market in KSA faces several challenges, including high initial costs and supply chain disruptions. In 2024, disruptions in the supply of steel and other key materials led to delays in construction projects and increased costs by an average of USD 200,000 per project.

KSA Pre-Engineered Buildings Current Market Analysis

- Urbanization is a major driver in Saudi Arabia’s growth, with the urban population projected to reach 85% by 2030. This has driven significant demand for residential and commercial buildings, requiring efficient and fast construction methods.

- A significant trend in the KSA PEB market is the incorporation of renewable energy solutions, such as solar panels, into building designs. In 2024, new PEB projects included solar energy systems, reflecting a growing focus on sustainability and reducing energy costs.

- Riyadh continues to dominate the KSA PEB market, accounting major of the total market share in 2024. This dominance is driven by extensive infrastructure projects and significant investments in industrial and commercial developments.

KSA Pre Engineered Buildings Market Segmentation

KSA Pre Engineered Buildings Market is majorly segmented into three parts, which are product type, application, and region.

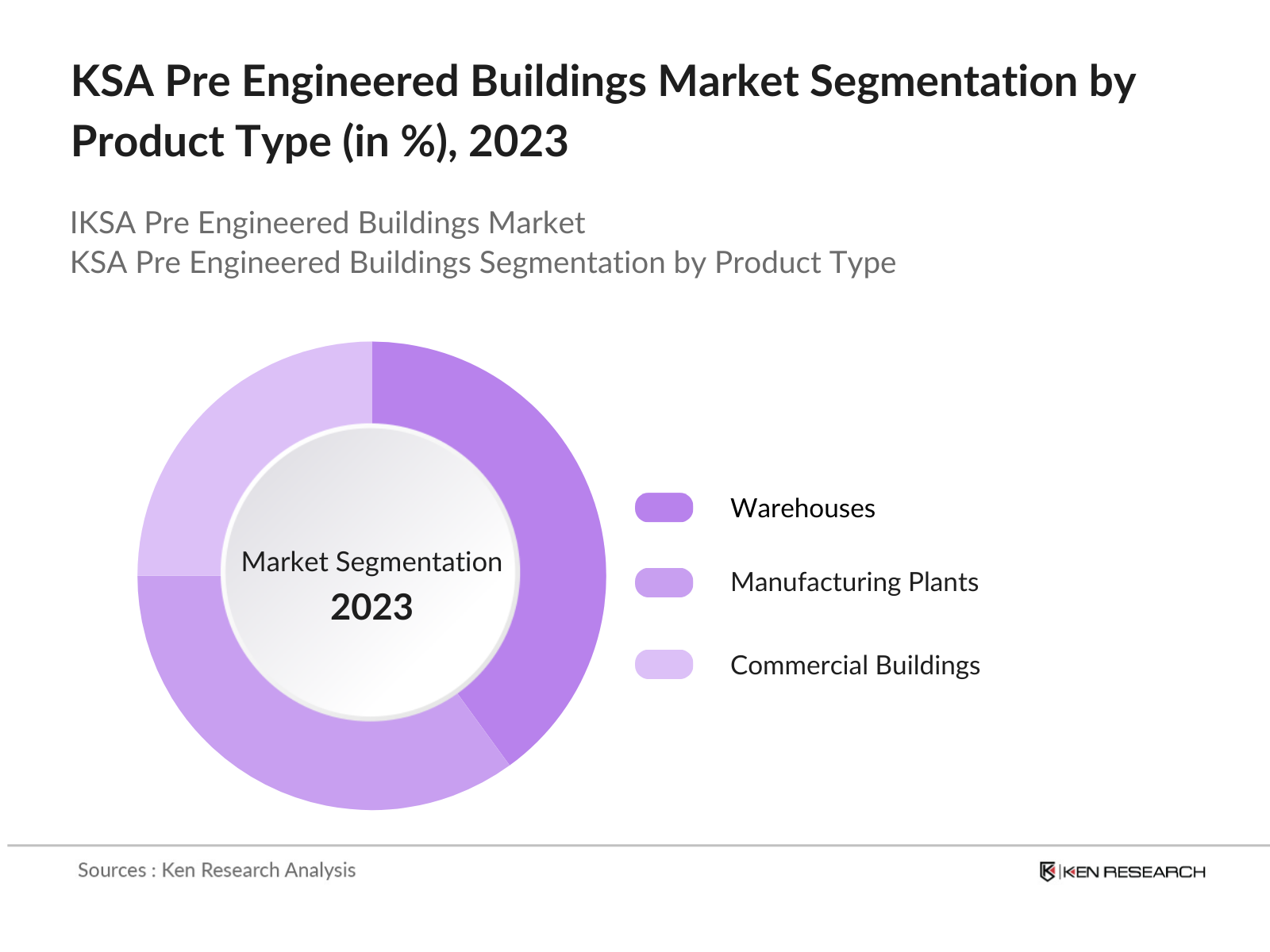

- By Product Type: KSA Pre Engineered Buildings market segmented by product type is divided into warehouses, manufacturing plants, and commercial buildings. In 2023, warehouses dominate due to the booming logistics and e-commerce sectors, which require extensive warehousing facilities.

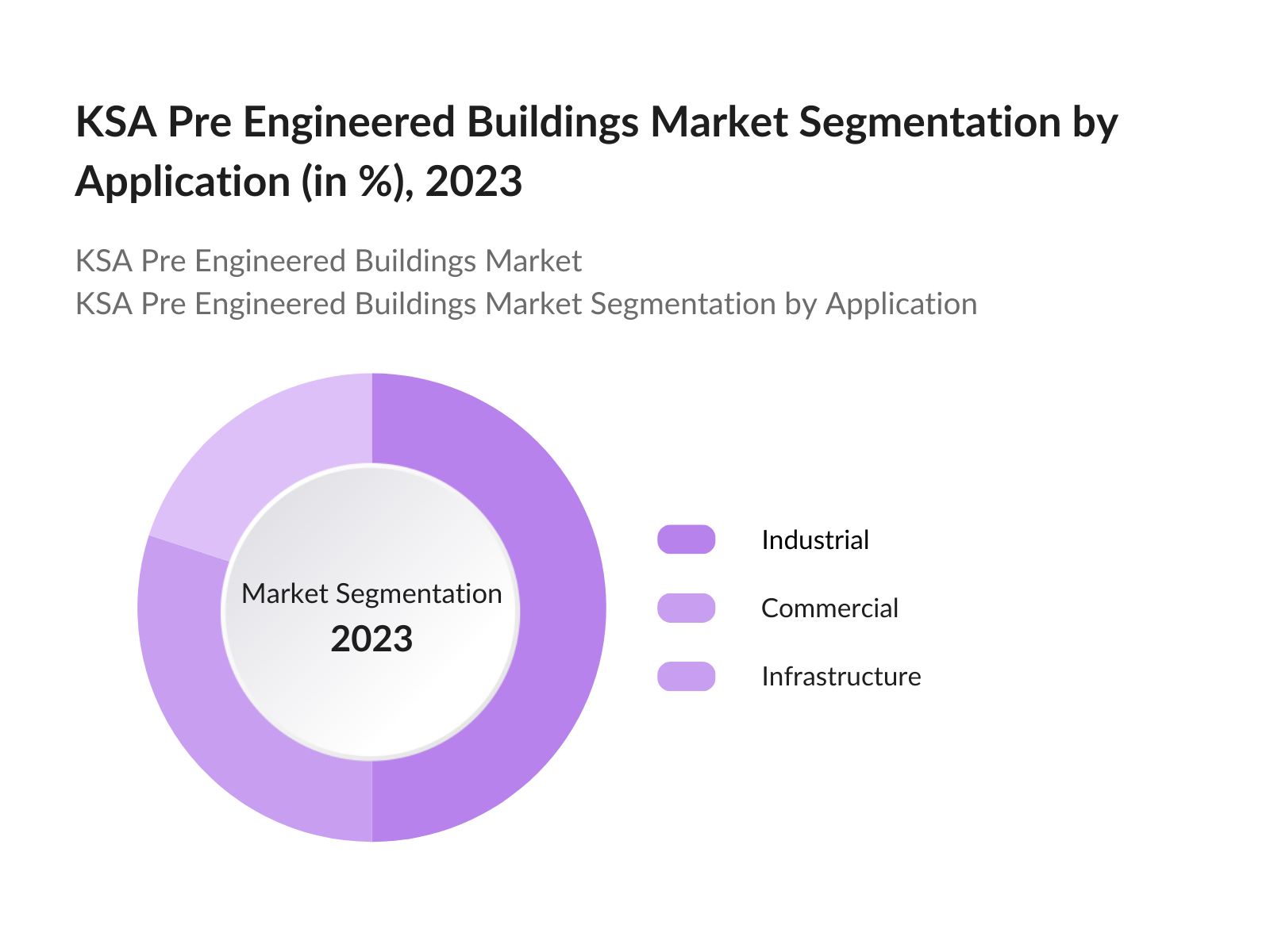

- By Application: KSA Pre Engineered Buildings market segmented by application is divided into industrial, commercial, and infrastructure. In 2023, the industrial segment leads due to the significant investment in new manufacturing facilities and warehouses.

- By Region: KSA Pre Engineered Buildings market segmented by region is divided into Riyadh, Eastern Province, and Western Province. In 2023, riyadh's economic growth and major construction projects make it the leading region.

KSA Pre Engineered Buildings Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Zamil Steel |

1977 |

Dammam, Saudi Arabia |

|

Kirby Building Systems |

1976 |

Kuwait City, Kuwait |

|

Mabani Steel |

1997 |

Ras Al Khaimah, UAE |

|

Al Shahin Metal Industries |

1978 |

Riyadh, Saudi Arabia |

|

Emirates Building Systems |

1976 |

Dubai, UAE |

- Zamil Steel: In 2022, Zamil Steel acquired a local steel fabrication company to expand its production capacity and market reach. This strategic acquisition is expected to boost their market share and strengthen their competitive position in the KSA PEB market. Zamil Steel reported revenues exceeding USD 1 billion in 2023, reflecting robust demand for their PEB solutions across various sectors.

- Kirby Building Systems: In April 2023, Kirby Building Systems completed major projects including the Al Naqel Express Warehouse and several ARAMCO facilities. These high-profile projects underscore Kirby’s capability to deliver large-scale PEB solutions efficiently. Following the merger and completion of significant projects, Kirby reported a revenue increase of 18% in 2023.

- Mabani Steel: In 2024, Mabani Steel launched a new line of energy-efficient PEBs tailored for commercial applications, addressing the growing demand for sustainable building solutions. Mabani Steel saw a 15% increase in revenue in 2023, driven by the introduction of innovative products and expansion into new markets.

KSA Pre-Engineered Buildings Market Analysis

KSA Pre-Engineered Buildings Market Growth Drivers:

- Infrastructure Development: A significant growth driver for the KSA PEB market is the extensive infrastructure development initiatives. In 2024, the government allocated USD 20 billion for the creation of new industrial cities and economic zones. This allocation is part of a broader effort to diversify the economy and increase non-oil revenues, which included a total infrastructure budget of USD 100 billion for the year

- Adoption of Modern Construction Techniques: The implementation of modern construction techniques, such as Building Information Modeling (BIM) has significantly improved efficiency in the KSA PEB market. The adoption of BIM has been shown to improve project delivery timelines by reducing errors and enhancing collaboration among stakeholders, savings of USD 1 million per large-scale project.

- Increasing Urbanization: Rapid urbanization in Saudi Arabia is a key growth driver for the PEB market. In 2024 alone, urban development projects in major cities like Riyadh and Jeddah saw investments exceeding USD 10 billion.

KSA Pre-Engineered Buildings Market Challenges:

- High Initial Costs: One of the primary challenges in the KSA PEB market is the high initial cost associated with pre-engineered buildings. In 2024, the average setup cost for a PEB structure was around USD 500,000. This substantial upfront investment can be prohibitive for small and medium-sized enterprises.

- Supply Chain Disruptions: The PEB market faces significant supply chain challenges, particularly in procuring essential raw materials like steel. These disruptions affect the timely delivery and overall cost-effectiveness of PEB projects.

- Regulatory Hurdles: Navigating the regulatory landscape for PEB projects in KSA can be complex and time-consuming. In 2024, obtaining the necessary permits and approvals for PEB construction took an average of 6-8 months. These delays can deter potential investors and slow market growth, making it a significant challenge for the industry.

KSA Pre-Engineered Buildings Market Government Initiatives:

- Saudi Vision 2030: Launched in 2016, Saudi Vision 2030 remains a cornerstone government initiative driving the PEB market. In 2024, the government allocated USD 20 billion to infrastructure projects under this plan, emphasizing the development of industrial cities and economic zones.

- National Industrial Development and Logistics Program (NIDLP): Introduced in 2019, the NIDLP aims to transform Saudi Arabia into an industrial powerhouse. By 2024, the program had invested USD 12 billion in enhancing industrial infrastructure, increasing the demand for PEBs to support new manufacturing facilities and logistics hubs.

- Incentives for Sustainable Construction: The Saudi government has introduced various incentives to promote sustainable construction practices. In 2024, USD 5 million in grants and subsidies were provided to construction firms adopting green building practices.

KSA Pre-Engineered Buildings Market Outlook

The future of the KSA Pre-Engineered Buildings (PEB) market looks promising, with continued growth driven by technological advancements, sustainable construction practices, and extensive government infrastructure projects.

Future Market Trends

- Development of Green Buildings: There is an increasing trend towards the construction of green buildings, driven by environmental sustainability goals and energy efficiency regulations. By 2028, it is anticipated that 30% of new PEB projects in KSA will incorporate green building practices, contributing to an estimated USD 3 billion in energy savings annually.

- Increasing Integration of Renewable Energy Solutions: The trend of integrating renewable energy solutions, such as solar panels, into PEB designs is set to grow. By 2028, a larger proportion of new PEB projects will include solar energy systems, driven by government incentives for green construction and rising environmental awareness among developers and businesses.

- Expansion of Smart Building Features: The incorporation of smart technologies into PEBs is anticipated to expand significantly. Features such as automated lighting, HVAC systems, and IoT-enabled monitoring will become more prevalent, enhancing building efficiency and user experience. By 2028, these smart features will be a standard in many PEB projects, catering to the evolving needs of modern infrastructure.

Scope of the Report

|

By Product Type |

Warehouses Manufacturing Plants Commercial Buildings |

|

By Application |

Industrial Commercial Infrastructure |

|

By Region |

Riyadh Eastern Province Western Province Other Regions |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Construction Companies

Real Estate Developers

Government Bodies (e.g., Ministry of Housing)

Industrial Manufacturers

Commercial Property Developers

Architects and Engineers

Investors and Financial Institutions

PEB Manufacturers and Suppliers

Healthcare Facilities

Hospitality Industry

Infrastructure Developers

Urban Planning Agencies

Modular Construction Companies

Construction Technology Firms

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Zamil Steel

Kirby Building Systems

Mabani Steel

Al Shahin Metal Industries

Emirates Building Systems

Saudi Building Systems Manufacturing Company

Gulf Modular Industry

Tiger Steel Engineering

Al Zamil Heavy Industries

Al-Rashed Steel

Assent Steel Industries

Red Sea Housing Services

Alghanim Industries

PEB Steel Buildings

Mammut Building Systems

Al Rashed Building Materials

Al Kifah Holding Company

Al Hamdan Consulting Office

Al Bayan Metal Industries

Pan Gulf Industrial Investment

Table of Contents

1. KSA Pre-Engineered Buildings Market Overview

1.1 KSA Pre-Engineered Buildings Market Taxonomy

2. KSA Pre-Engineered Buildings Market Size (in USD Bn), 2018-2023

3. KSA Pre-Engineered Buildings Market Analysis

3.1 KSA Pre-Engineered Buildings Market Growth Drivers

3.2 KSA Pre-Engineered Buildings Market Challenges and Issues

3.3 KSA Pre-Engineered Buildings Market Trends and Development

3.4 KSA Pre-Engineered Buildings Market Government Regulation

3.5 KSA Pre-Engineered Buildings Market SWOT Analysis

3.6 KSA Pre-Engineered Buildings Market Stake Ecosystem

3.7 KSA Pre-Engineered Buildings Market Competition Ecosystem

4. KSA Pre-Engineered Buildings Market Segmentation, 2023

4.1 KSA Pre-Engineered Buildings Market Segmentation by Product Type (in value %), 2023

4.2 KSA Pre-Engineered Buildings Market Segmentation by Application Type (in value %), 2023

4.3 KSA Pre-Engineered Buildings Market Segmentation by Region (in value %), 2023

5. KSA Pre-Engineered Buildings Market Competition Benchmarking

5.1 KSA Pre-Engineered Buildings Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. KSA Pre-Engineered Buildings Future Market Size (in USD Bn), 2023-2028

7. KSA Pre-Engineered Buildings Future Market Segmentation, 2028

7.1 KSA Pre-Engineered Buildings Market Segmentation by Product Type (in value %), 2028

7.2 KSA Pre-Engineered Buildings Market Segmentation by Application (in value %), 2028

7.3 KSA Pre-Engineered Buildings Market Segmentation by Region (in value %), 2028

8. KSA Pre-Engineered Buildings Market Analysts’ Recommendations

8.1 KSA Pre-Engineered Buildings Market TAM/SAM/SOM Analysis

8.2 KSA Pre-Engineered Buildings Market Customer Cohort Analysis

8.3 KSA Pre-Engineered Buildings Market Marketing Initiatives

8.4 KSA Pre-Engineered Buildings Market White Space Opportunity Analysis

Disclamier

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on KSA pre-engineered buildings market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA pre-engineered buildings market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step: 3 Validating and Finalizing:

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple pre-engineered building companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from pre-engineered building companies.

Frequently Asked Questions

How big is the KSA pre-engineered buildings Market?

The KSA Pre-Engineered Buildings (PEB) market was valued at approximately USD 13 billion in 2018. By 2023, the market size has grown to around USD 25 billion, driven by the increasing demand for efficient and cost-effective construction solutions.

Who are the major players in the KSA pre-engineered buildings Market?

The major players in the KSA PEB market include Zamil Steel, Kirby Building Systems, Mabani Steel, Al Shahin Metal Industries, and Emirates Building Systems. Zamil Steel leads the market with significant production capacity and extensive market reach, while Kirby Building Systems and Mabani Steel are known for their innovative and energy-efficient PEB solutions.

What are the growth drivers of KSA pre-engineered buildings Market?

Key growth drivers for the KSA PEB market include extensive infrastructure development, with the government allocating USD 20 billion in 2024 for new industrial cities and economic zones.

What are the challenges in KSA pre-engineered buildings Market?

The KSA PEB market faces several challenges, including high initial costs, with setup costs for PEB structures averaging around USD 500,000, which can be prohibitive for SMEs. Supply chain disruptions, particularly in procuring essential raw materials like steel, have led to construction delays and increased project costs by an average of USD 200,000 per project.

Which segment dominates the KSA pre-engineered buildings Market?

The industrial segment dominates the KSA PEB market, driven by significant investments in new manufacturing facilities and logistics centers. This segment benefits from the efficiency and cost-effectiveness of PEB solutions, which are ideal for large-scale industrial applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.