KSA Printer Market Outlook to 2030

Region:Middle East

Author(s):Sanjna

Product Code:KROD7453

December 2024

85

About the Report

KSA Printer Market Overview

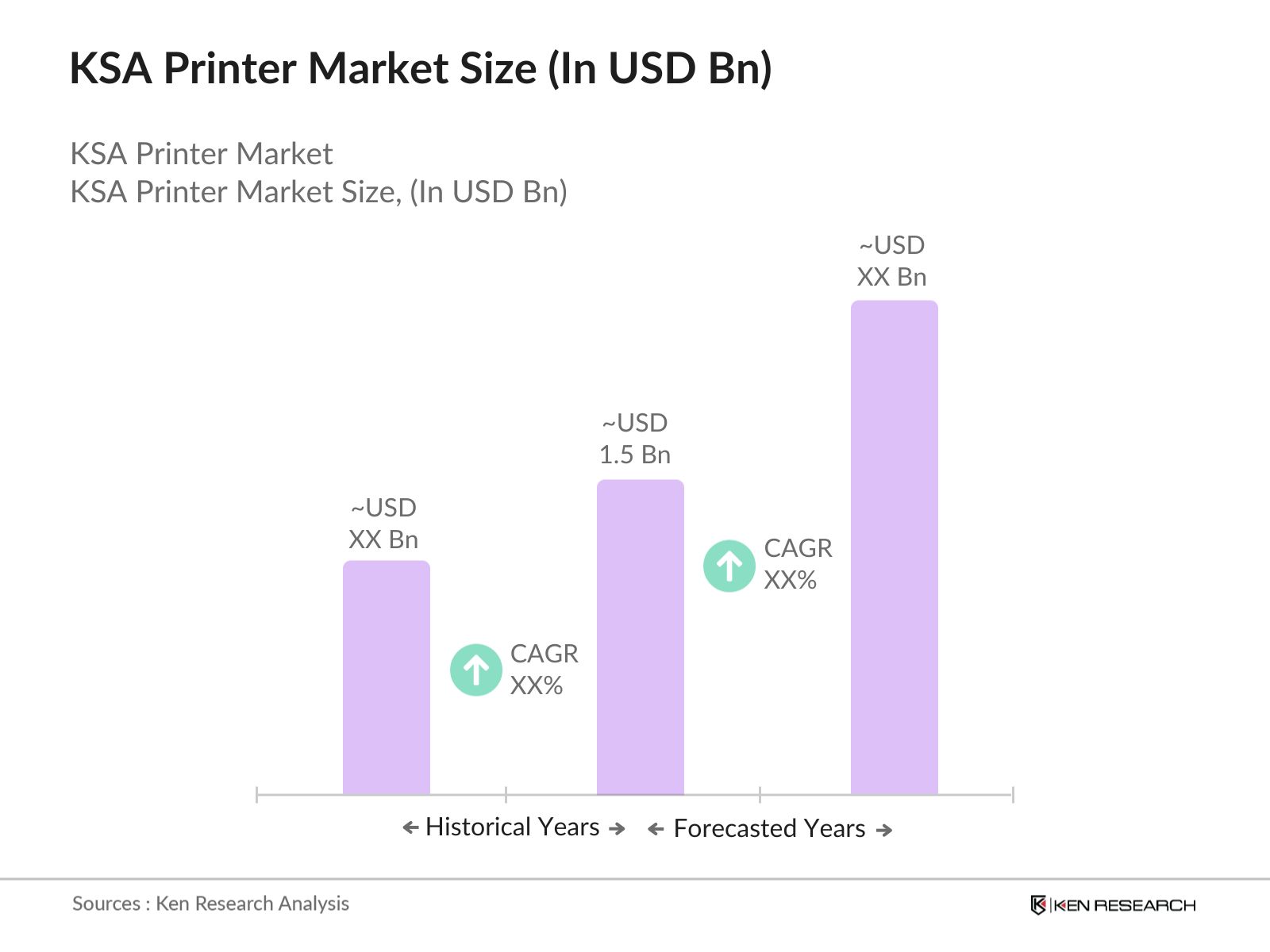

- The KSA Printer Market, valued at USD 1.5 billion, is driven by increasing demand from various sectors including corporate offices, education, healthcare, and government institutions. The adoption of digital solutions and the rise of small and medium enterprises (SMEs) in the region have significantly boosted the demand for advanced printing technologies. Growing e-commerce activities, along with corporate digitization, are further fueling the demand for printers, especially wireless and cloud-based solutions.

- The market is primarily dominated by Riyadh, Jeddah, and Dammam, driven by their advanced infrastructure, high concentration of corporate offices, and government institutions. Riyadh stands out as the most influential city due to its role as the commercial hub of the Kingdom, attracting numerous businesses and governmental agencies, leading to higher demand for both commercial and industrial printers. These cities are crucial for the growth of the KSA Printer Market due to their robust technological adoption and growing economic activities.

- Saudi Arabia imposes specific import regulations on printing equipment, which affect the overall cost and availability of printers in the local market. As of 2023, the Saudi Customs Authority imposed a 5% tariff on imported printers, with additional duties based on the type and functionality of the equipment. These regulations, coupled with Value Added Tax (VAT) at 15%, increase the cost burden for businesses looking to purchase new printers. Compliance with import regulations is essential for suppliers and distributors to ensure smooth market entry.

KSA Printer Market Segmentation

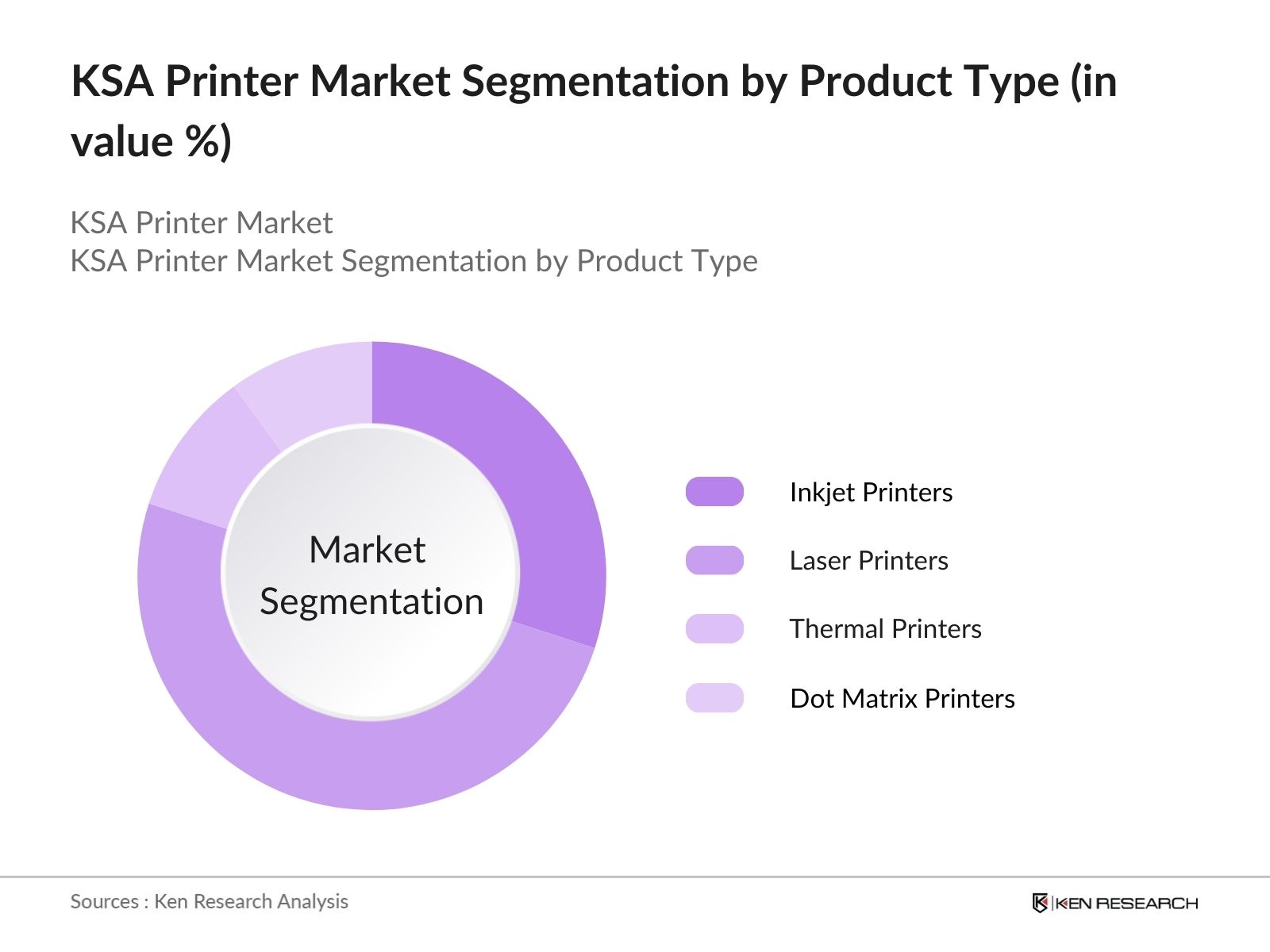

- By Product Type: The KSA Printer market is segmented by product type into inkjet printers, laser printers, thermal printers, and dot matrix printers. Laser printers dominate this segment due to their widespread use in corporate and government offices. Their efficiency, speed, and durability make them highly preferred for high-volume printing tasks. Moreover, the growing trend towards digital documentation in sectors such as banking and healthcare contributes to the dominance of this sub-segment.

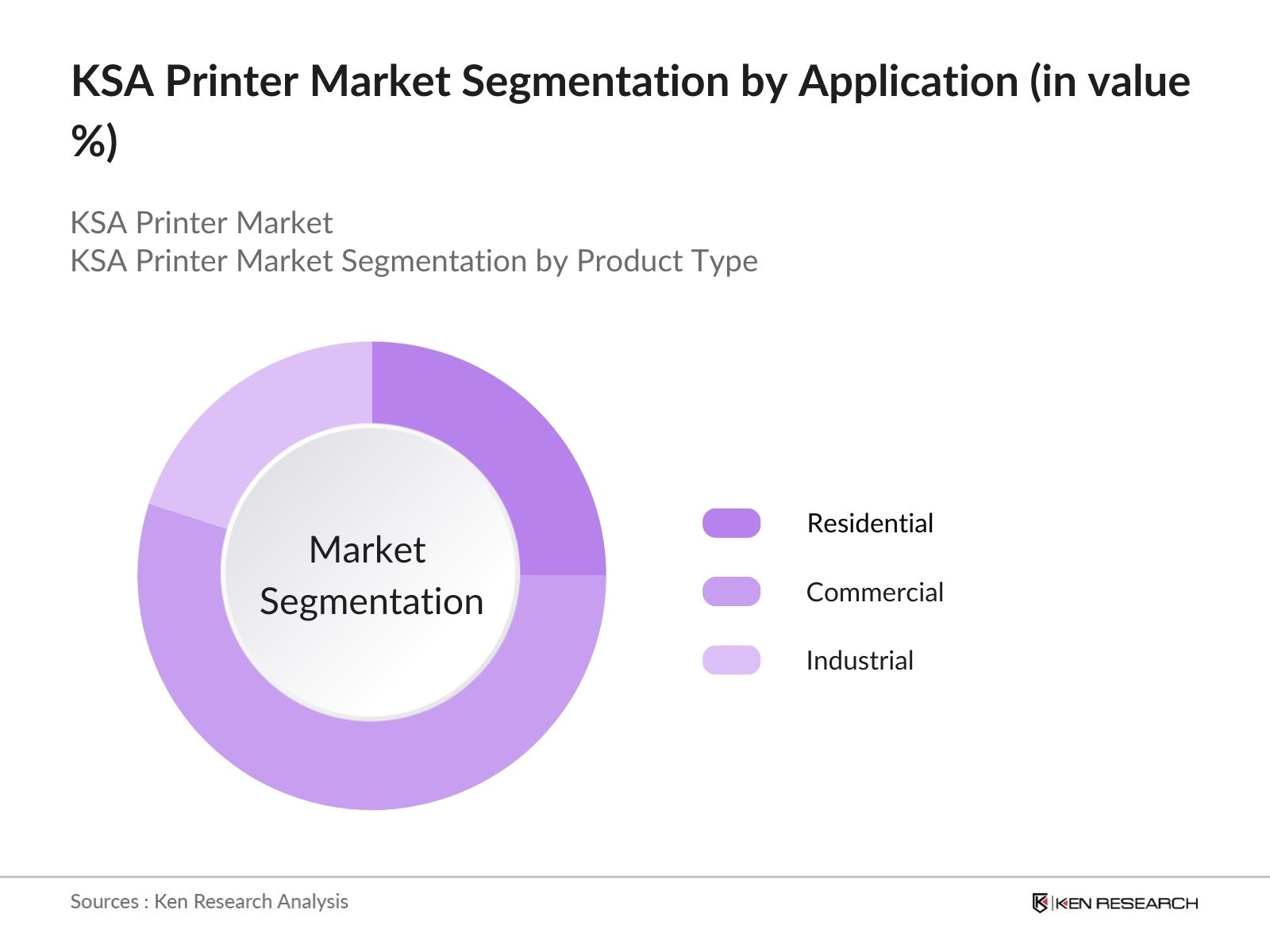

- By Application: The market is further segmented by application into residential, commercial, and industrial sectors. The commercial sector leads the market, driven by the growing number of SMEs and multinational corporations operating in Saudi Arabia. The need for efficient, high-quality printing solutions is critical in industries like education, government, and healthcare, making commercial printers the most sought-after.

KSA Printer Market Competitive Landscape

The KSA Printer market is dominated by global players, alongside strong local distributors. The market is characterized by partnerships between international brands and local distributors to cater to the specific needs of Saudi consumers. Key players focus on expanding their product portfolios to include multifunctional printers, wireless printing solutions, and eco-friendly models. The competitive landscape shows the dominance of global leaders such as HP, Epson, and Canon, primarily due to their technological advancements, strong product portfolios, and effective local partnerships.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

Local Distribution Partners |

Service Network |

Sustainability Initiatives |

Market Penetration |

Customer Support |

|

HP Inc. |

1939 |

USA |

- |

- |

- |

- |

- |

- |

|

Epson |

1942 |

Japan |

- |

- |

- |

- |

- |

- |

|

Canon |

1937 |

Japan |

- |

- |

- |

- |

- |

- |

|

Brother Industries |

1908 |

Japan |

- |

- |

- |

- |

- |

- |

|

Ricoh |

1936 |

Japan |

- |

- |

- |

- |

- |

- |

KSA Printer Market Analysis

Growth Drivers

- Demand for Smart Office Solutions: The demand for multifunctional printers (MFPs) in Saudi Arabia is driven by the increasing adoption of smart office solutions. With the surge in digital transformation initiatives, businesses seek devices that can integrate with their existing IT infrastructure while offering functionalities like printing, scanning, copying, and faxing in a single device. This growing demand for smart office solutions has prompted a rise in the adoption of MFPs, offering enhanced productivity and cost-efficiency.

- Expansion in the SME Sector: The expansion of the SME sector has generated increased demand for cost-efficient printing solutions, particularly MFPs, which are preferred for their affordability and multifunctionality. According to the General Authority for Statistics of Saudi Arabia, the countrys SMEs contribute nearly USD 222 billion annually to the economy. The need for cost-effective printing solutions is pivotal for SMEs to optimize operational efficiency without incurring high capital expenditures.

- Government Digitization Efforts: Saudi Arabia's Vision 2030 initiative has placed significant emphasis on digitization across all sectors, boosting the demand for digital printing and related technologies. In 2023, the Saudi government invested USD 6.4 billion in various digitization efforts, leading to higher demand for printers integrated with cloud and digital services. This strategic shift aligns with the Kingdoms long-term goal of becoming a digitally connected economy.

Challenges

- High Initial Capital Investment: The high initial capital investment required for advanced printers, especially multifunctional models, poses a significant challenge for smaller businesses in Saudi Arabia. The average cost of an MFP ranges between USD 399 to USD 1596, depending on the specifications. While larger corporations can absorb these costs, SMEs and home office users often struggle to justify the expense. Despite financing options provided by local banks, many businesses face difficulties in securing funds due to stringent loan requirements.

- Technological Obsolescence: The rapid pace of technological advancements in the printer market results in frequent product obsolescence, which is a challenge for businesses aiming to invest in long-term equipment. On average, new printer models with enhanced features, such as AI integration and cloud-based solutions, are introduced every 18-24 months. In 2023, the Saudi Ministry of Investment highlighted that businesses are increasingly reluctant to invest in new printing technologies, fearing rapid obsolescence and diminishing returns on investment.

KSA Printer Market Future Outlook

KSA Printer market is expected to experience robust growth, driven by continuous technological advancements, increased adoption of cloud-based printing solutions, and the growing focus on sustainability. The market is likely to witness increased demand from SMEs and government initiatives aimed at digitization. Moreover, the rise of e-commerce and the growth in the education sector are anticipated to play key roles in driving the market forward.

Market Opportunities

- Growth in Managed Print Services: Managed Print Services (MPS) have gained traction in Saudi Arabia, providing businesses with a comprehensive solution for their printing needs while optimizing costs. In 2023, the adoption of MPS grew by 12%, according to the Saudi Ministry of Industry and Mineral Resources, as businesses seek ways to improve efficiency and reduce printing costs. MPS offers a scalable solution for both SMEs and large corporations, helping them manage printer fleets, reduce paper waste, and automate printing workflows, creating significant growth opportunities in the market.

- Demand for Eco-Friendly Printers: As sustainability initiatives gain momentum in Saudi Arabia, there is a rising demand for eco-friendly printers that align with the Kingdoms environmental goals. In 2023, the Ministry of Environment, Water, and Agriculture highlighted that 15% of businesses have adopted sustainable printing practices, leading to a surge in demand for printers that use less energy, recycled materials, and eco-friendly inks. The market is ripe for growth in eco-friendly printing technologies, as businesses look to align with both regulatory requirements and consumer preferences for sustainability.

Scope of the Report

|

Segment |

Sub-Segments |

|

Printer Type |

Inkjet Printers Laser Printers Thermal Printers Dot Matrix Printers |

|

Application |

Residential Commercial Industrial |

|

Technology |

Wireless Printing Cloud Printing Multi-Function Printers |

|

Distribution Channel |

Online Offline (Retail Stores, Corporate Deals) |

|

Region |

Riyadh Jeddah Dammam Makkah |

Products

Key Target Audience

Corporate Offices and SMEs

Retail and E-commerce Companies

Education Sector (Universities, Colleges, Schools)

Healthcare Institutions

Office Equipment Distributors and Retailers

Local Distributors and Service Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization - SASO)

Companies

Players Mentioned in the Report

HP Inc.

Epson

Canon

Brother Industries

Ricoh

Samsung

Xerox

Sharp

Kyocera

Lexmark

Table of Contents

1. KSA Printer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Drivers

1.4. Key Market Developments and Milestones

1.5. Market Segmentation Overview

2. KSA Printer Market Size (In USD Bn)

2.1. Current Market Size

2.2. Growth Analysis

2.3. Key Market Developments

2.4. Competitive Landscape Overview

3. KSA Printer Market Analysis

3.1. Growth Drivers

3.1.1. Demand for Smart Office Solutions (Growing Adoption of MFPs)

3.1.2. Expansion in the SME Sector (Increased Demand for Cost-Efficient Printing)

3.1.3. Government Digitization Efforts (Vision 2030 Initiatives)

3.1.4. Increased Home Office Use (Rise of Remote Working)

3.2. Market Challenges

3.2.1. High Initial Capital Investment

3.2.2. Technological Obsolescence (Rapid Technology Upgradation)

3.2.3. Environmental Regulations (E-Waste and Sustainability)

3.3. Opportunities

3.3.1. Growth in Managed Print Services (MPS Adoption)

3.3.2. Demand for Eco-Friendly Printers (Sustainability in Printing)

3.3.3. Potential in 3D Printing Technology (Expansion of Use Cases)

3.4. Trends

3.4.1. Integration with Cloud Solutions (Cloud-Based Printing)

3.4.2. Wireless and Mobile Printing (Increase in Mobile Device Integration)

3.4.3. Customizable and On-Demand Printing Solutions

3.5. Government Regulation

3.5.1. Import Regulations for Printing Equipment (Taxation, Duties)

3.5.2. Environmental Compliance (E-Waste Management)

3.5.3. Standardization of Printing Equipment (Industry Norms and Certifications)

3.6. Porters Five Forces Analysis

3.7. SWOT Analysis

3.8. Competitive Ecosystem Overview

4. KSA Printer Market Segmentation

4.1. By Printer Type (In Value %)

4.1.1. Inkjet Printers

4.1.2. Laser Printers

4.1.3. Multifunction Printers (MFP)

4.1.4. 3D Printers

4.2. By End-User Industry (In Value %)

4.2.1. Commercial

4.2.2. Residential

4.2.3. Government

4.2.4. Educational Institutions

4.3. By Functionality (In Value %)

4.3.1. Single-Function Printers

4.3.2. Multifunction Printers (Printing, Scanning, Copying, Faxing)

4.4. By Technology (In Value %)

4.4.1. Inkjet Technology

4.4.2. Laser Technology

4.4.3. Thermal Technology

4.4.4. 3D Printing Technology

4.5. By Distribution Channel (In Value %)

4.5.1. Direct Sales

4.5.2. Retail Sales

4.5.3. Online Sales

4.5.4. OEM Partners

5. KSA Printer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. HP Inc.

5.1.2. Canon Inc.

5.1.3. Epson Corporation

5.1.4. Brother Industries Ltd.

5.1.5. Samsung Electronics

5.1.6. Ricoh Company Ltd.

5.1.7. Xerox Corporation

5.1.8. Kyocera Document Solutions

5.1.9. Konica Minolta Inc.

5.1.10. Lexmark International Inc.

5.2. Cross Comparison Parameters (Headquarters, Revenue, Market Share, Product Offerings, R&D Investment, Regional Presence, Partnership Ecosystem, Competitive Strategies)

5.3. Market Share Analysis (By Printer Type and End-User Industry)

5.4. Strategic Initiatives (Mergers & Acquisitions, Joint Ventures, Partnerships)

5.5. Key Innovations in the Market (Patents, New Product Launches)

5.6. Investment Analysis

5.7. Venture Capital Funding in Printing Technology

5.8. Government Support and Subsidies for Printer Technology

5.9. Future Market Developments and Innovations

6. KSA Printer Market Regulatory Framework

6.1. Import and Export Policies (Relevant to Printing Equipment)

6.2. Licensing and Certification Requirements (ISO Standards for Printers)

6.3. E-Waste Regulations (Compliance and Waste Management)

7. KSA Printer Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Factors Influencing Future Market Growth

8. KSA Printer Market Future Segmentation

8.1. By Printer Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Technology (In Value %)

8.4. By Functionality (In Value %)

8.5. By Distribution Channel (In Value %)

9. KSA Printer Market Analysts' Recommendations

9.1. Strategic Recommendations for Key Stakeholders

9.2. White Space Opportunities for Market Expansion

9.3. Investment Areas for Future Growth

Research Methodology

Step 1: Identification of Key Variables

In this phase, a detailed map of the printer market in KSA is constructed. This involves identifying all major stakeholders, including manufacturers, distributors, and key end-users in corporate and government sectors. Extensive desk research and proprietary databases are used to gather industry-level information.

Step 2: Market Analysis and Construction

Historical data is compiled to analyze the penetration of different types of printers. The revenue generated by the top market players is evaluated, along with an assessment of local distribution networks and service quality statistics.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated by interviewing industry experts and corporate users across various sectors, providing a clear understanding of operational dynamics and financial insights.

Step 4: Research Synthesis and Final Output

Engagements with manufacturers and distributors are utilized to obtain deep insights into product offerings and consumer preferences. This, combined with bottom-up analysis, ensures accurate and comprehensive market data.

Frequently Asked Questions

01. How big is the KSA Printer Market?

The KSA Printer market is valued at USD 1.5 billion, driven by high demand from the corporate and government sectors, and supported by increasing digitalization and e-commerce growth.

02. What are the challenges in the KSA Printer Market?

Challenges in KSA Printer market include the high cost of advanced printers, counterfeit products, and competition from digital document management systems, which reduce the need for traditional printing.

03. Who are the major players in the KSA Printer Market?

Key players in KSA Printer market include HP Inc., Epson, Canon, Brother Industries, and Ricoh. These companies dominate due to their wide range of products, strong local partnerships, and advanced technologies.

04. What are the growth drivers of the KSA Printer Market?

Growth in KSA Printer market is driven by the demand for multifunctional printers, increased adoption of wireless and cloud printing, and the government's push towards digital infrastructure development.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.