KSA Probiotics Market outlook to 2030

Region:Middle East

Author(s):Dev Chawla

Product Code:KRO011

June 2025

90

About the Report

KSA Probiotics Market Overview

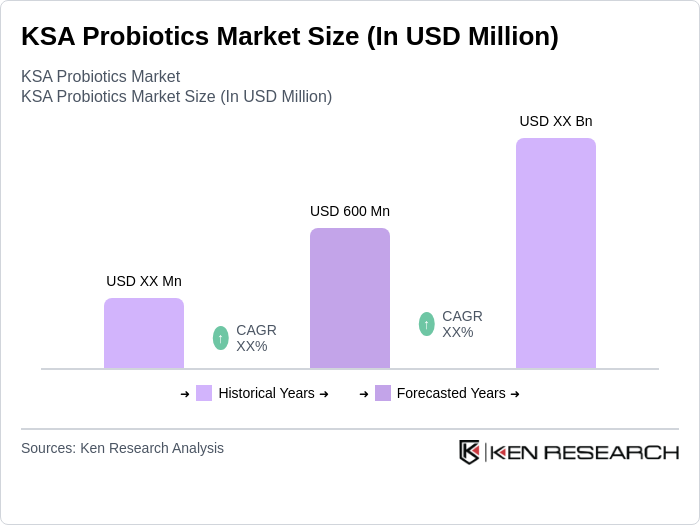

- The KSA Probiotics Market is valued at USD 600 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding gut health, rising demand for functional foods, and the expanding healthcare sector. The market has seen a surge in product innovations and a growing trend towards preventive healthcare, which has significantly contributed to its expansion.

- Key cities dominating the market include Riyadh, Jeddah, and Dammam. These cities are characterized by a high concentration of health-conscious consumers and a robust retail infrastructure. The presence of major healthcare facilities and a growing number of health and wellness stores in these urban areas further enhances their market dominance.

- In 2024, the Saudi Food and Drug Authority (SFDA) implemented new regulations requiring all probiotic products to undergo rigorous safety and efficacy testing before market approval. This regulation aims to ensure consumer safety and enhance the credibility of probiotic products in the market, thereby fostering consumer trust and encouraging market growth.

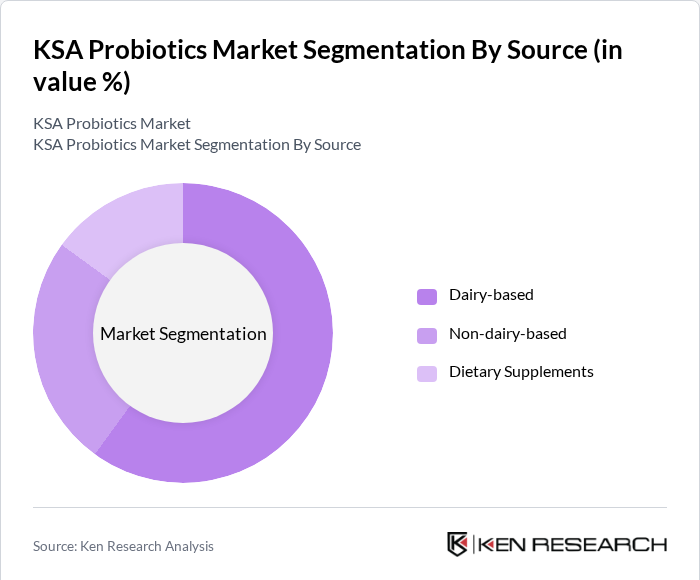

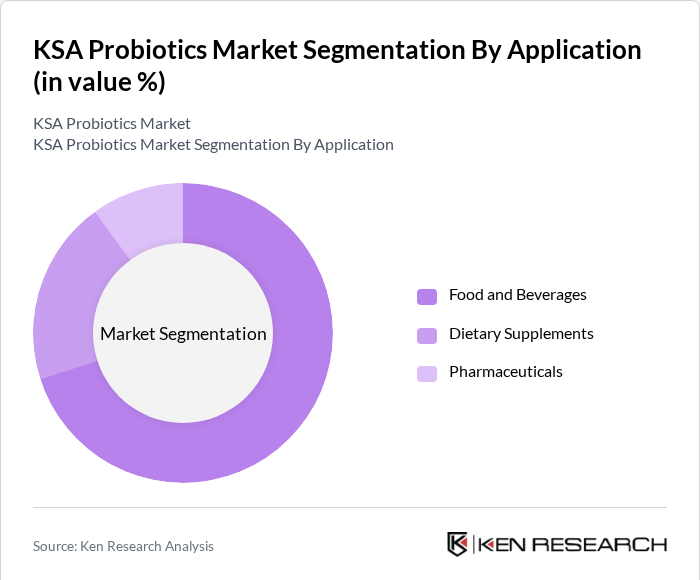

KSA Probiotics Market Segmentation

By Source: The probiotics market is segmented into dairy-based, non-dairy-based, and dietary supplements. Among these, the dairy-based segment is dominating the market due to the traditional consumption of yogurt and fermented milk products in the region. Consumers are increasingly opting for yogurt enriched with probiotics, driven by its perceived health benefits, including improved digestion and enhanced immune function. The familiarity and established presence of dairy products in the Saudi diet contribute significantly to the dominance of this segment.

By Application: The applications of probiotics are primarily categorized into food and beverages, dietary supplements, and pharmaceuticals. The food and beverages segment holds the largest market share, driven by the increasing incorporation of probiotics in functional foods and beverages. Consumers are becoming more health-conscious, leading to a rise in demand for products that promote gut health and overall wellness. This trend is further supported by the growing popularity of health drinks and fortified foods among the Saudi population.

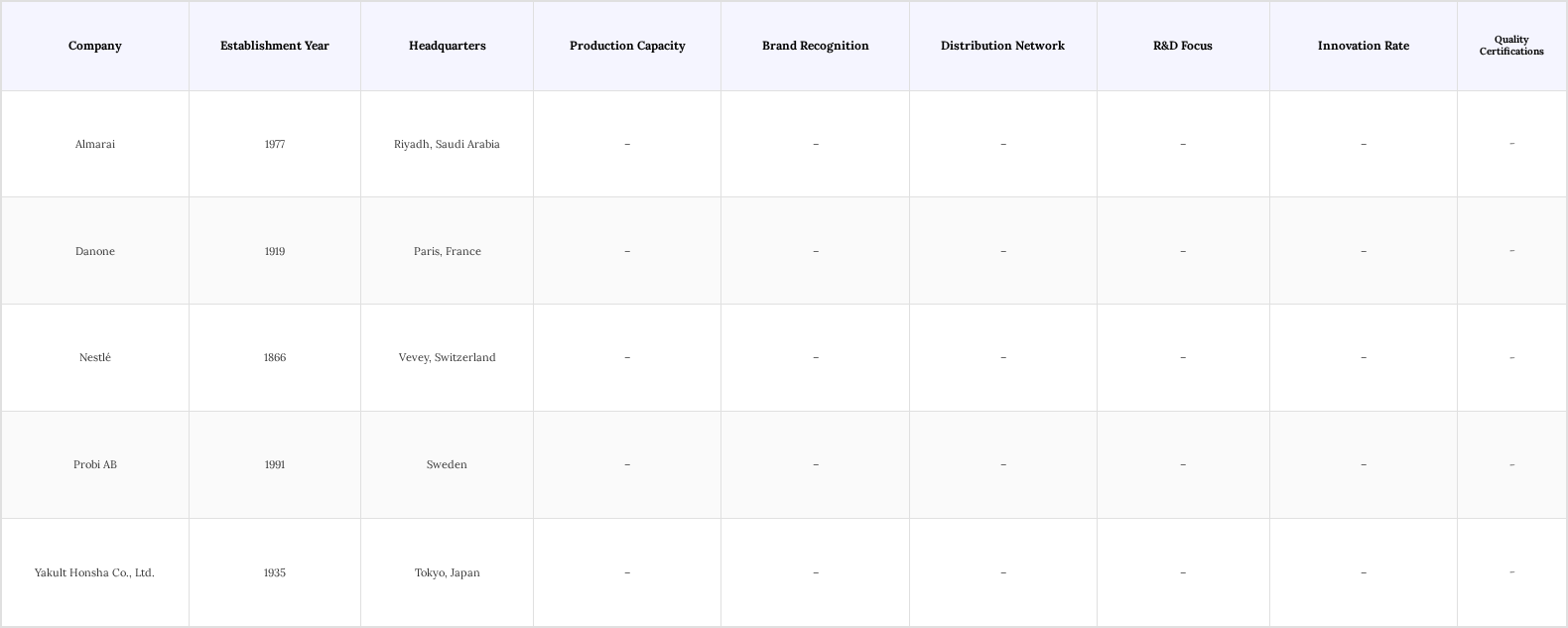

KSA Probiotics Market Competitive Landscape

The KSA Probiotics Market is characterized by a competitive landscape featuring both local and international players. Companies such as Almarai, Danone, and Nestlé are prominent in this market, leveraging their established brand recognition and extensive distribution networks. The market is moderately concentrated, with key players focusing on product innovation and expanding their portfolios to meet the growing consumer demand for health-oriented products.

KSA Probiotics Market Industry Analysis

KSA Probiotics Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness about Gut Health: The KSA probiotics market is experiencing growth due to heightened consumer awareness regarding gut health. This awareness is driving demand for probiotic-rich products, with the functional food sector leading the industry, reflecting a significant shift towards health-conscious purchasing behaviors.

- Rising Demand for Functional Foods and Beverages: The demand for functional foods and beverages in KSA is on the rse. This growth is fueled by a growing population that increasingly seeks health benefits from their diets. The functional beverage segment alone is expected to grow by 12% annually, driven by innovations in probiotic drinks that cater to health-conscious consumers looking for convenient options.

- Growth in the Dietary Supplement Sector: The dietary supplement sector in KSA is projected to grow exponentially by 2025, driven by a growing interest in preventive healthcare. A report from the Ministry of Health indicates that 45% of adults in KSA regularly consume dietary supplements, with probiotics being a key focus. This trend is supported by increasing healthcare costs, prompting consumers to invest in supplements that promote overall wellness and gut health.

Market Challenges

- Limited Consumer Knowledge about Probiotics: Despite the growing market, a significant challenge remains in consumer knowledge regarding probiotics. A study by the KSA Health Ministry found that only 30% of consumers understand the benefits of probiotics. This lack of awareness limits market penetration and hinders the growth potential of probiotic products, as many consumers remain unaware of their health benefits and applications.

- Regulatory Hurdles in Product Approvals: The regulatory landscape for probiotics in KSA poses challenges for manufacturers. The Saudi Food and Drug Authority has stringent guidelines for product approvals, which can delay market entry. In 2023, over 40% of probiotic product applications faced delays due to compliance issues. These regulatory hurdles can stifle innovation and limit the availability of new probiotic products in the market.

KSA Probiotics Market Future Outlook

The KSA probiotics market is poised for significant growth, driven by evolving consumer preferences towards health and wellness. As awareness of gut health continues to rise, innovative product formulations and increased availability through e-commerce platforms are expected to enhance market accessibility. Additionally, collaborations between manufacturers and healthcare professionals will likely foster consumer trust and education, further propelling market expansion. The focus on sustainability in production processes will also play a crucial role in shaping future trends within the industry.

Market Opportunities

- Expansion of E-commerce Platforms: The growth of e-commerce in KSA presents a significant opportunity for probiotic brands. With online sales projected to increase by 20% annually, companies can reach a broader audience. This shift allows for targeted marketing strategies and direct consumer engagement, enhancing brand visibility and sales potential in the competitive probiotic market.

- Development of Innovative Probiotic Formulations: There is a growing opportunity for manufacturers to develop innovative probiotic formulations tailored to specific health needs. With 55% of consumers expressing interest in personalized nutrition, companies can capitalize on this trend by creating targeted products that address digestive health, immunity, and overall wellness, thereby expanding their market share.

Scope of the Report

| By Source |

Dairy-based Non-dairy-based Dietary supplements |

| By Application |

Food and beverages Dietary supplements Pharmaceuticals |

| By Distribution Channel |

Online Offline |

| By End User |

Adults Children Infants |

| By Region |

Central Region Western Region Eastern Region Southern Region |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority, Ministry of Health)

Manufacturers and Producers

Distributors and Retailers

Health and Wellness Organizations

Pharmaceutical Companies

Food and Beverage Companies

Market Analysts and Industry Experts

Companies

Players Mentioned in the Report:

Almarai

Danone

Nestlé

Probi AB

Yakult Honsha Co., Ltd.

BioBalance KSA

PureGut Solutions

ProBio Saudi

GutHarmony Innovations

ThriveProbiotics KSA

Table of Contents

1. KSA Probiotics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Probiotics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Probiotics Market Analysis

3.1. Growth Drivers

3.1.1. Increasing consumer awareness about gut health

3.1.2. Rising demand for functional foods and beverages

3.1.3. Growth in the dietary supplement sector

3.2. Market Challenges

3.2.1. Limited consumer knowledge about probiotics

3.2.2. Regulatory hurdles in product approvals

3.2.3. Competition from alternative health products

3.3. Opportunities

3.3.1. Expansion of e-commerce platforms for probiotic products

3.3.2. Development of innovative probiotic formulations

3.3.3. Increasing collaborations between manufacturers and health professionals

3.4. Trends

3.4.1. Growing popularity of plant-based probiotics

3.4.2. Rising interest in personalized nutrition

3.4.3. Increased focus on sustainability in production processes

3.5. Government Regulation

3.5.1. Overview of food safety regulations impacting probiotics

3.5.2. Labeling requirements for probiotic products

3.5.3. Guidelines for health claims on probiotic products

3.5.4. Monitoring and enforcement of compliance standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. KSA Probiotics Market Segmentation

4.1. By Source

4.1.1. Dairy-based

4.1.2. Non-dairy-based

4.1.3. Dietary supplements

4.2. By Application

4.2.1. Food and beverages

4.2.2. Dietary supplements

4.2.3. Pharmaceuticals

4.3. By Distribution Channel

4.3.1. Online

4.3.2. Offline

4.4. By End User

4.4.1. Adults

4.4.2. Children

4.4.3. Infants

4.5. By Region

4.5.1. Central Region

4.5.2. Western Region

4.5.3. Eastern Region

4.5.4. Southern Region

5. KSA Probiotics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Almarai

5.1.2. Danone

5.1.3. Nestlé

5.1.4. Probi AB

5.1.5. Yakult Honsha Co., Ltd.

5.1.6. BioBalance KSA

5.1.7. PureGut Solutions

5.1.8. ProBio Saudi

5.1.9. GutHarmony Innovations

5.1.10. ThriveProbiotics KSA

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Range

5.2.3. Pricing Strategies

5.2.4. Distribution Networks

5.2.5. Brand Reputation

5.2.6. Innovation and R&D Investment

5.2.7. Customer Engagement Strategies

5.2.8. Sustainability Practices

6. KSA Probiotics Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Probiotics Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Probiotics Market Future Market Segmentation

8.1. By Source

8.1.1. Dairy-based

8.1.2. Non-dairy-based

8.1.3. Dietary supplements

8.2. By Application

8.2.1. Food and beverages

8.2.2. Dietary supplements

8.2.3. Pharmaceuticals

8.3. By Distribution Channel

8.3.1. Online

8.3.2. Offline

8.4. By End User

8.4.1. Adults

8.4.2. Children

8.4.3. Infants

8.5. By Region

8.5.1. Central Region

8.5.2. Western Region

8.5.3. Eastern Region

8.5.4. Southern Region

9. KSA Probiotics Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Probiotics Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the KSA Probiotics Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA Probiotics Market.

Frequently Asked Questions

01. How big is the KSA Probiotics Market?

The KSA Probiotics Market is valued at USD 600 million, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the KSA Probiotics Market?

Key challenges in the KSA Probiotics Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the KSA Probiotics Market?

Major players in the KSA Probiotics Market include Almarai, Danone, Nestlé, Probi AB, Yakult Honsha Co., Ltd., among others.

04. What are the growth drivers for the KSA Probiotics Market?

The primary growth drivers for the KSA Probiotics Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.