KSA Property Management Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD3706

December 2024

93

About the Report

KSA Property Management Market Overview

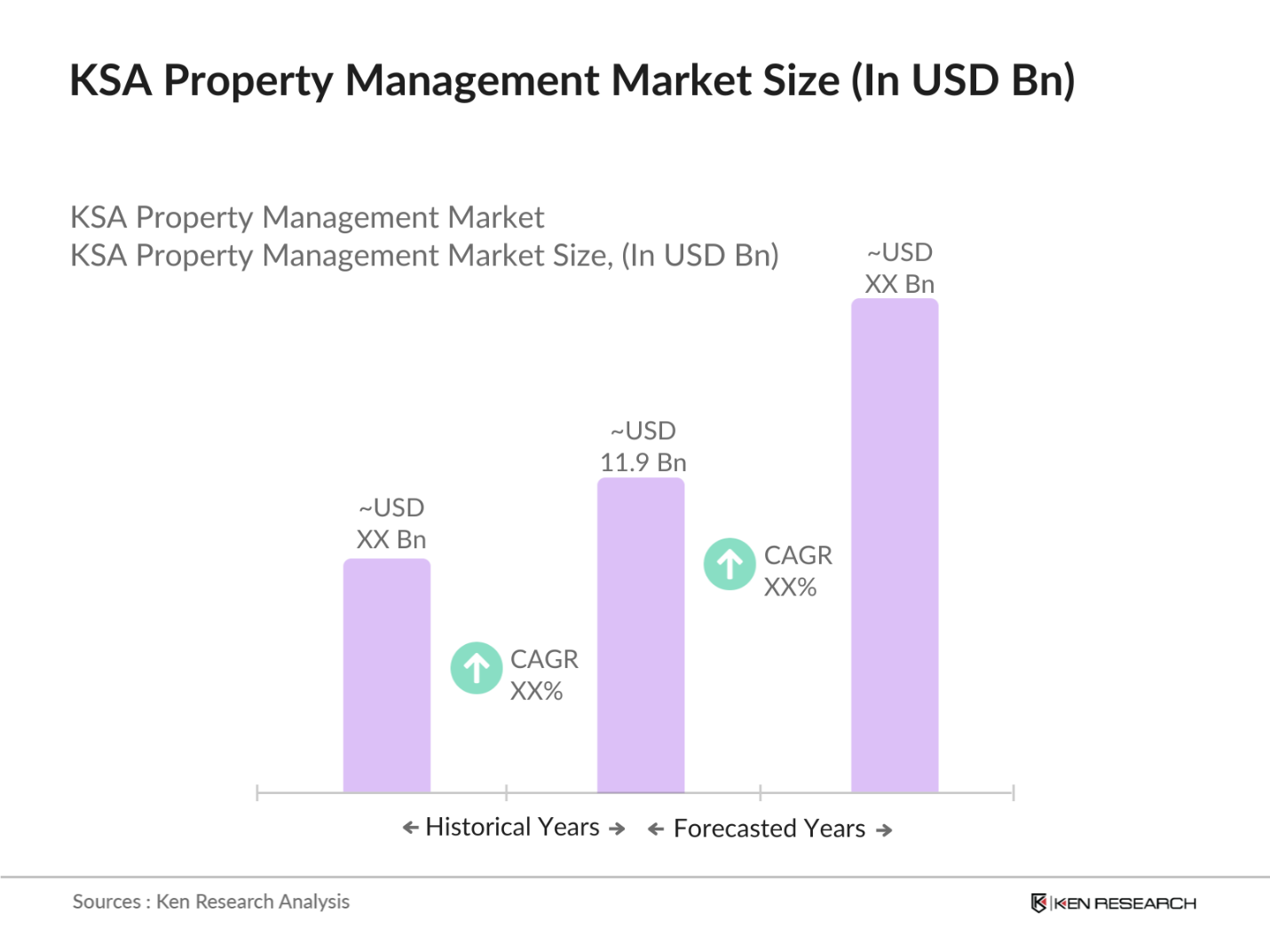

- The KSA property management market is valued at SAR 11.9 billion, based on a detailed five-year historical analysis. The growth is driven by significant infrastructure development under the Vision 2030 initiative, which has attracted domestic and international investments into commercial and residential real estate projects. The growing urban population, coupled with increased demand for organized facility management, has also fueled the expansion of property management services across key urban centers.

- Riyadh and Jeddah dominate the KSA property management market due to their position as key economic hubs. Riyadh, as the capital, serves as the center of administrative and financial activities, attracting a large number of residential and commercial developments. Jeddah, being a gateway to Makkah and Medina, witnesses significant real estate growth due to tourism and religious pilgrimages, driving the demand for property management services.

- The Saudi government has implemented stringent building compliance and management standards to enhance property quality and safety. As of 2023, over 80% of new commercial buildings are required to adhere to these standards, which include guidelines on safety, accessibility, and energy efficiency. Compliance with these regulations not only enhances property value but also ensures the safety and satisfaction of tenants. Property management firms must invest in compliance training and resources to meet these evolving standards effectively.

KSA Property Management Market Segmentation

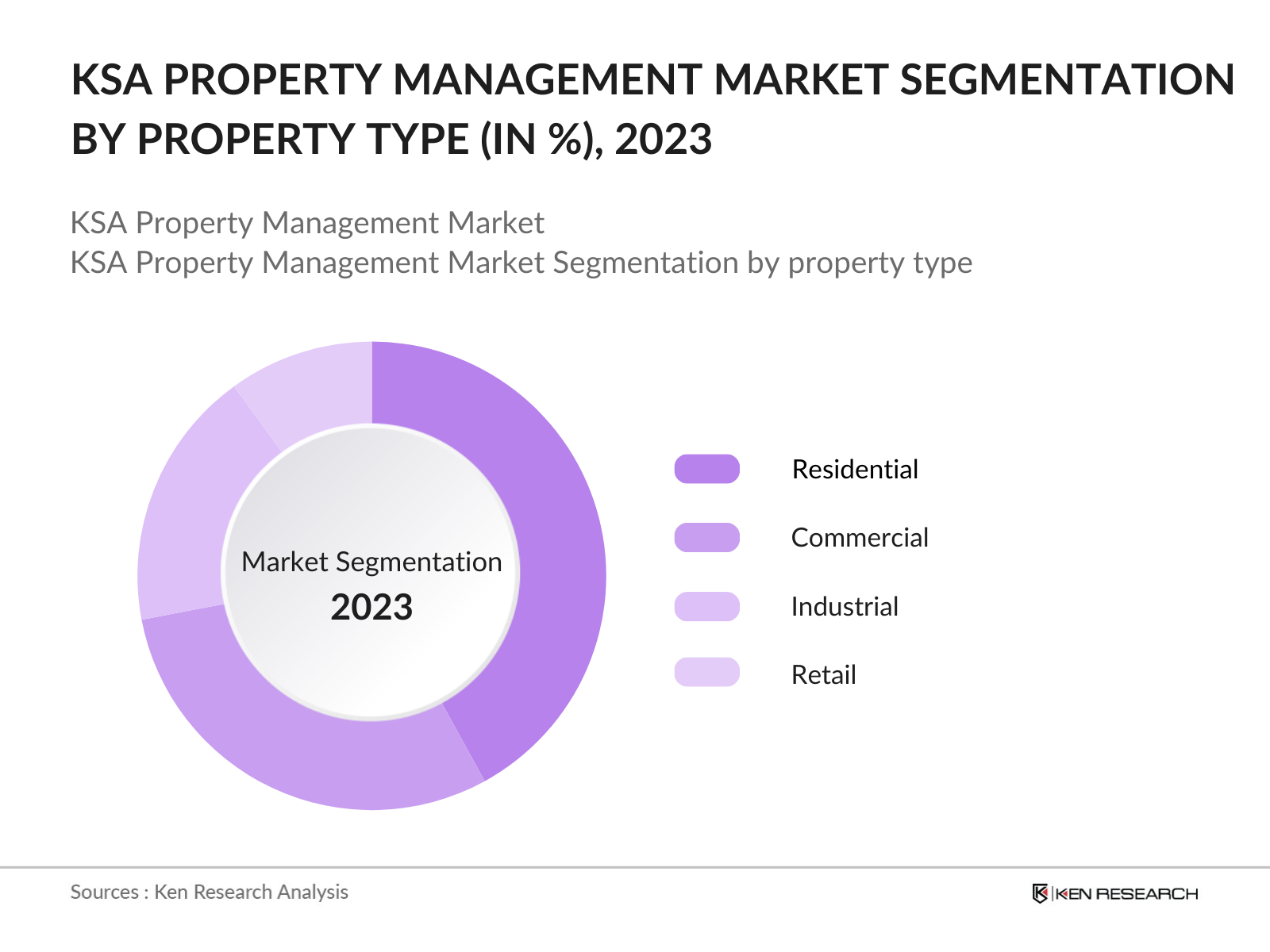

By Property Type: The KSA property management market is segmented by property type into residential, commercial, industrial, and retail. Residential properties currently hold the dominant market share due to the rapid urbanization and increased demand for housing units. Major cities like Riyadh and Jeddah have seen a surge in residential developments driven by population growth and government housing initiatives.

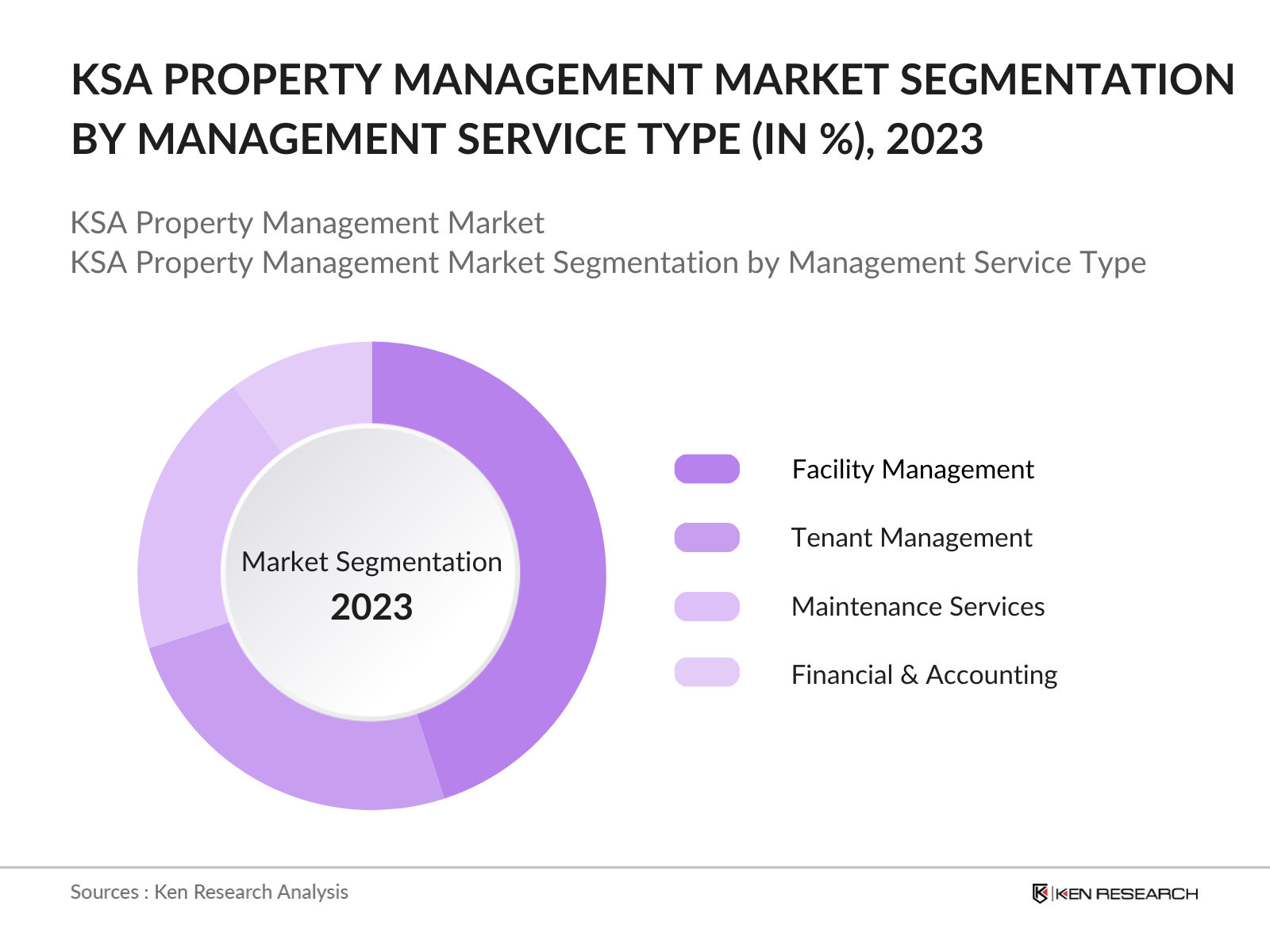

By Management Services: Property management services are segmented into tenant management, facility management, maintenance services, and financial and accounting services. Facility management holds the largest market share due to the rising demand for organized management of large commercial complexes and residential communities. This segment is also bolstered by the integration of smart building technologies that require professional management for maintenance and operational efficiency.

KSA Property Management Market Competitive Landscape

The KSA property management market is dominated by several key players that provide integrated property management solutions across residential, commercial, and industrial sectors. The market is highly competitive, with local and international firms striving to offer innovative services, including the adoption of PropTech solutions. The integration of smart property management tools and energy-efficient systems has also emerged as a significant differentiator in the market.

|

Company Name |

Established |

Headquarters |

Service Portfolio |

Regional Presence |

PropTech Integration |

Sustainability Initiatives |

Major Clients |

No. of Employees |

Annual Revenue (SAR Billion) |

|

EFS Facilities Services |

2006 |

Riyadh |

- |

- |

- |

- |

- |

- |

- |

|

Adeeb Group |

1994 |

Jeddah |

- |

- |

- |

- |

- |

- |

- |

|

EMCO |

1962 |

Dammam |

- |

- |

- |

- |

- |

- |

- |

|

Nesma Trading |

1981 |

Jeddah |

- |

- |

- |

- |

- |

- |

- |

|

Khidmah LLC |

2009 |

Riyadh |

- |

- |

- |

- |

- |

- |

- |

KSA Property Management Industry Analysis

Market Growth Drivers

- Increasing Urbanization: Urbanization in Saudi Arabia is accelerating, with the urban population projected to reach 38 million by 2025, reflecting a significant increase from 32 million in 2020. This growth creates substantial demand for property management services as new urban areas develop. According to the World Bank, urban areas contribute approximately 85% of the country's GDP. Additionally, the influx of residents into urban centers necessitates robust property management systems to handle the increasing number of residential and commercial properties. This trend underscores the need for innovative management solutions to cater to a burgeoning urban population.

- Expansion of Commercial Spaces: The commercial real estate sector is undergoing rapid growth, driven by a surge in retail and office space developments. As of 2022, the total area of commercial buildings in Saudi Arabia was estimated at 340 million square meters, with projections indicating an increase to 400 million square meters by 2025. This expansion is fueled by government initiatives aimed at diversifying the economy beyond oil. The Saudi Arabian General Investment Authority (SAGIA) reports that over 4,500 new commercial projects are in development, presenting significant opportunities for property management services to enhance operational efficiency.

- Vision 2030 and Government Infrastructure Projects: Vision 2030 is a transformative agenda that aims to enhance the Saudi economy through extensive infrastructure projects. The government plans to invest over $1 trillion in various sectors, including housing, transportation, and tourism. As of 2023, more than 1.2 million housing units are scheduled for completion by 2025 under this initiative. The increase in infrastructure projects leads to higher demand for property management services, as new developments require comprehensive management to maintain standards and enhance asset value.

Market Challenges

- Stringent Regulatory Requirements: The property management sector in Saudi Arabia faces challenges due to stringent regulatory requirements imposed by the government. For instance, compliance with the Real Estate Regulatory Authority (RERA) mandates involves numerous licensing and operational standards. As of 2023, RERA has processed over 10,000 licensing applications, indicating a rigorous regulatory environment. These requirements can increase operational complexity and costs for property management firms, potentially hindering market growth. Adapting to these regulations requires continuous investment in compliance measures and staff training.

- Lack of Skilled Workforce: A significant challenge in the KSA property management market is the shortage of skilled professionals. According to a report by the International Labour Organization (ILO), the construction sector is projected to require an additional 1.5 million skilled workers by 2025 to meet rising demand. This shortage impacts property management services, as firms struggle to find qualified personnel for effective property oversight and maintenance. Addressing this gap requires enhanced training programs and collaboration with educational institutions to develop a skilled workforce tailored to the sector's needs.

KSA Property Management Market Future Outlook

The KSA property management market is expected to witness substantial growth over the next five years, driven by increasing urbanization, ongoing infrastructure projects under Vision 2030, and the growing adoption of smart property solutions. The demand for organized property management services is anticipated to expand further as the country continues to position itself as a regional hub for real estate investment, commercial activities, and tourism. Moreover, government support for sustainable building practices and energy-efficient technologies will play a crucial role in shaping the future of the property management sector in the Kingdom.

Market Opportunities

- Integration of PropTech Solutions: The integration of PropTech solutions presents significant opportunities for enhancing property management services in Saudi Arabia. As of 2022, investments in real estate technology reached $1 billion, with projections indicating a continued increase as firms seek to improve operational efficiency. By implementing technologies such as artificial intelligence and big data analytics, property management companies can streamline operations and enhance tenant experiences. This tech-driven approach will enable firms to respond quickly to market changes and maintain competitiveness.

- Expansion of Public-Private Partnerships (PPP): Public-private partnerships (PPP) are gaining traction in the Saudi property management market, driven by government efforts to boost investment in infrastructure and housing projects. The government has announced over 100 PPP projects valued at approximately $15 billion across various sectors, including real estate. These initiatives provide private firms with opportunities to participate in lucrative projects, fostering collaboration that can enhance property management efficiency and effectiveness. Such partnerships are essential for meeting the ambitious goals outlined in Vision 2030.

Scope of the Report

|

By Property Type |

Residential Commercial Industrial Retail |

|

By Management Services |

Tenant Management Facility Management Maintenance Services Financial and Accounting Services |

|

By End-User |

Real Estate Developers Commercial Property Owners Institutional Investors Individual Property Owners |

|

By Technology Integration |

PropTech Solutions IoT-Based Solutions Energy Management Systems |

|

By Region |

Riyadh Jeddah Makkah Eastern Province |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Real Estate Companies

Commercial Property Industry

Individual Property Owners

Government and Regulatory Bodies (Real Estate Regulatory Authority, Ministry of Housing)

Financial Institutions and Banks

Investments and Venture Capitalist Firms

Property Management Service Companies

Companies

Players Mentioned in the Report:

EFS Facilities Services

Adeeb Group

EMCO

Nesma Trading

Khidmah LLC

Tamimi Group

Rezayat Group

Abdullah H. Al Shuwayer Group

Saudi Oger Ltd.

ARAMARK

Table of Contents

1. KSA Property Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Property Management Market Size (In SAR Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Property Management Market Analysis

3.1 Growth Drivers (Urbanization, Construction Boom, Government Initiatives)

3.1.1. Increasing Urbanization

3.1.2. Expansion of Commercial Spaces

3.1.3. Vision 2030 and Government Infrastructure Projects

3.2 Market Challenges (Regulatory Hurdles, Workforce Shortage, High Operational Costs)

3.2.1. Stringent Regulatory Requirements

3.2.2. Lack of Skilled Workforce

3.2.3. High Maintenance and Operational Costs

3.3 Opportunities (Technology Integration, Public-Private Partnerships, Smart Property Solutions)

3.3.1. Integration of PropTech Solutions

3.3.2. Expansion of Public-Private Partnerships (PPP)

3.3.3. Opportunities in Smart and Green Buildings

3.4 Trends (PropTech, Smart Property Management, Energy-Efficient Buildings)

3.4.1. Increasing Adoption of PropTech

3.4.2. Focus on Sustainable and Energy-Efficient Property Management

3.4.3. Rise in Demand for Cloud-based Solutions

3.5 Government Regulation (Regulatory Reforms, Compliance Standards, Incentives)

3.5.1. Building Compliance and Management Standards

3.5.2. Real Estate Regulatory Authority (RERA) Guidelines

3.5.3. Vision 2030 Incentives for Real Estate Projects

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Property Management Market Segmentation

4.1 By Property Type (In Value %)

4.1.1. Residential

4.1.2. Commercial

4.1.3. Industrial

4.1.4. Retail

4.2 By Management Services (In Value %)

4.2.1. Tenant Management

4.2.2. Facility Management

4.2.3. Maintenance Services

4.2.4. Financial and Accounting Services

4.3 By End-User (In Value %)

4.3.1. Real Estate Developers

4.3.2. Commercial Property Owners

4.3.3. Institutional Investors

4.3.4. Individual Property Owners

4.4 By Technology Integration (In Value %)

4.4.1. PropTech Solutions

4.4.2. IoT-Based Solutions

4.4.3. Energy Management Systems

4.5 By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Makkah

4.5.4. Eastern Province

5. KSA Property Management Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. EFS Facilities Services Group

5.1.2. Adeeb Group

5.1.3. EMCO

5.1.4. Tamimi Group

5.1.5. Initial Saudi Group

5.1.6. Nesma Trading

5.1.7. Khidmah LLC

5.1.8. Al Kifah Contracting

5.1.9. Rezayat Group

5.1.10. Abdullah H. Al Shuwayer Group

5.1.11. Saudi Oger Ltd.

5.1.12. ARAMARK

5.1.13. Blue Diamond Facilities Management

5.1.14. Edara Property Management

5.1.15. Apleona HSG

5.2 Cross Comparison Parameters (Service Portfolio, Technological Integration, Regional Presence, Client Base, Pricing Model, Employee Strength, Operational Expertise, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Property Management Market Regulatory Framework

6.1. Property Management Standards

6.2. Compliance and Building Regulations

6.3. Property Leasing and Management Certifications

7. KSA Property Management Future Market Size (In SAR Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Property Management Future Market Segmentation

8.1. By Property Type (In Value %)

8.2. By Management Services (In Value %)

8.3. By Technology Integration (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. KSA Property Management Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables through an ecosystem map, detailing the major stakeholders in the KSA Property Management Market. This is achieved through in-depth desk research and data collection from proprietary databases and industry reports.

Step 2: Market Analysis and Construction

In this phase, the gathered historical data is analyzed to construct a comprehensive understanding of the markets past performance. This includes a detailed evaluation of property management services and their revenue-generating capabilities.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the current and future market scenarios are developed and validated through interviews with property management experts. These consultations provide insights into market trends, competitive dynamics, and service innovations.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing research findings to ensure the accuracy of the data and forecasts. Engagement with multiple property management firms provides the necessary inputs to verify projections and validate market trends.

Frequently Asked Questions

01. How big is the KSA Property Management Market?

The KSA property management market is valued at SAR 11.9 billion, with increasing investments in residential and commercial real estate sectors driving growth.

02. What are the challenges in the KSA Property Management Market?

Challenges in the KSA property management market include stringent regulatory requirements, a lack of skilled workforce, and high operational costs associated with managing large-scale properties.

03. Who are the major players in the KSA Property Management Market?

Key players in the KSA property management market include EFS Facilities Services, Adeeb Group, EMCO, Nesma Trading, and Khidmah LLC. These companies lead the market due to their extensive service portfolios, regional presence, and adoption of PropTech solutions.

04. What are the growth drivers of the KSA Property Management Market?

The growth of the KSA property management market is driven by Vision 2030 initiatives, increasing urbanization, and the rise of smart property management solutions that optimize building operations.

05. What trends are shaping the KSA Property Management Market?

Key trends in the market include the adoption of PropTech solutions, the increasing demand for energy-efficient buildings, and the growing focus on sustainable property management practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.