KSA Pulp and Paper Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi Bisht

Product Code:KROD5496

December 2024

85

About the Report

KSA Pulp and Paper Market Overview

- The KSA Pulp and Paper Market is valued at USD 3 billion, driven primarily by the increasing demand for packaging materials and the rise of e-commerce in the region. Growth in industrial sectors such as manufacturing and retail has contributed to the higher consumption of corrugated and packaging paper products. Additionally, government initiatives to encourage recycling and reduce waste have spurred demand for paper-based packaging solutions, with a strong focus on sustainability.

- The dominant regions in the KSA Pulp and Paper market include Riyadh and Jeddah, driven by their industrial hubs and proximity to key export ports. Riyadh, being the capital, serves as the center for most manufacturing industries, while Jeddah's strategic coastal location supports strong logistics and distribution networks. These factors ensure that both cities maintain a steady demand for packaging materials, particularly for consumer goods, food, and industrial applications.

- Saudi Arabia's Public Investment Fund (PIF) has invested in the Middle East Paper Company (MEPCO) by acquiring a 23.08% stake through a capital increase and new share subscription, completed in 2024. This initiative aims to enhance MEPCO's production capacity, operational efficiency, and environmental sustainability, aligning with Saudi Arabias Vision 2030 goals. The investment will support MEPCO's expansion into packaging and building materials, bolstering local supply chains and promoting recycling efforts in the region.

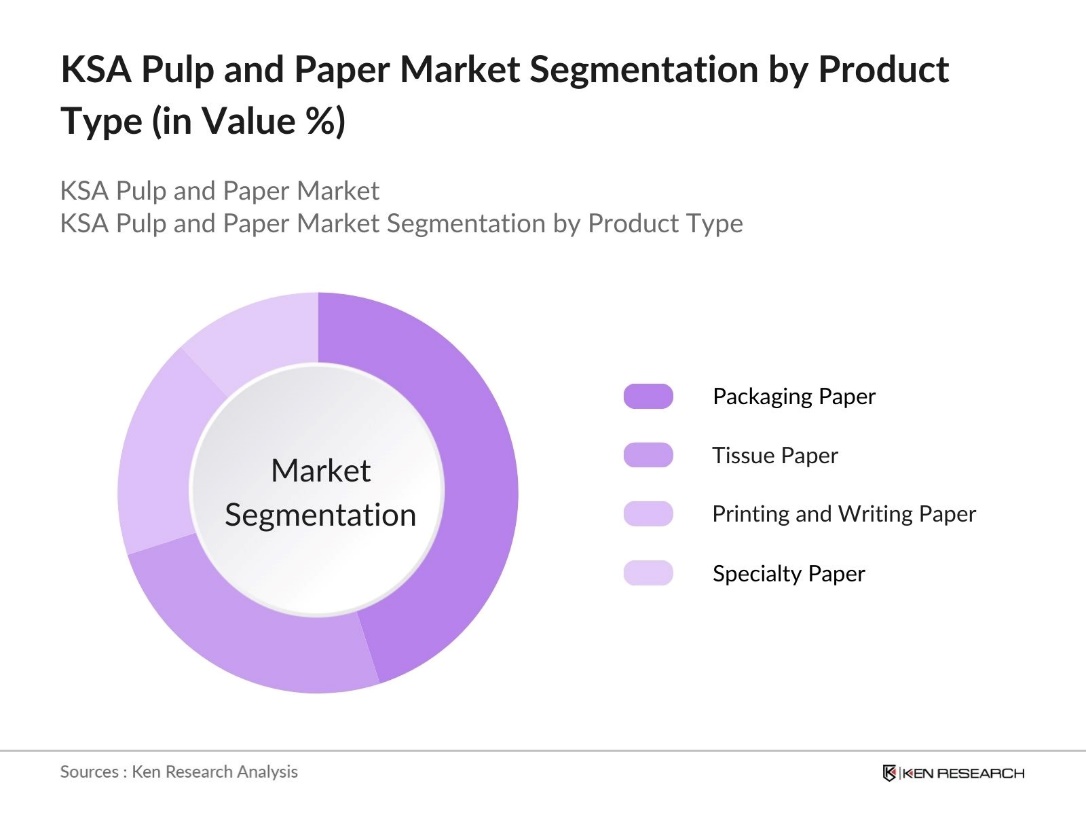

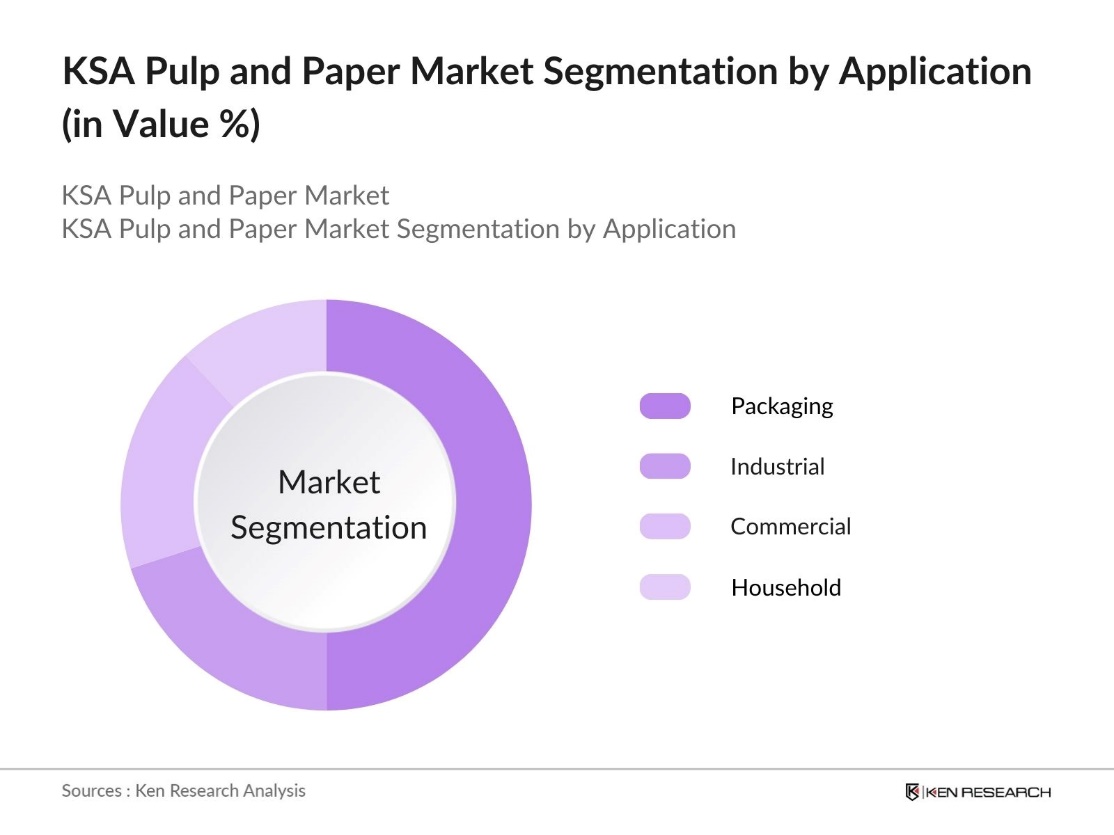

KSA Pulp and Paper Market Segmentation

By Product Type: The KSA Pulp and Paper market is segmented by product type into packaging paper, tissue paper, printing and writing paper, and specialty paper. Among these, packaging paper holds the largest market share in the product type segment due to the growing demand for corrugated boxes, cartons, and flexible packaging. This demand is largely attributed to the expanding e-commerce sector, industrial growth, and food packaging needs in Saudi Arabia. Sustainable packaging has further enhanced the dominance of this sub-segment, as industries shift towards eco-friendly solutions.

By Application: The KSA Pulp and Paper market is also segmented by application into industrial, commercial, household, and packaging. The packaging segment is dominant due to the increased focus on both consumer and industrial packaging, driven by the food and beverage industry, logistics, and retail sectors. Packaging applications are gaining traction due to sustainability efforts, particularly in single-use and recyclable packaging, which are supported by government policies promoting environmental protection.

KSA Pulp and Paper Market Competitive Landscape

The market is dominated by several major companies that have established strong local manufacturing capabilities and distribution networks. The competitive landscape reflects a blend of local manufacturers and international players, highlighting significant investments in technology and sustainable production.

|

Company |

Establishment Year |

Headquarters |

Production Capacity (tons) |

No. of Employees |

Export Capability |

Technological Integration |

Sustainability Certifications |

|

Saudi Paper Manufacturing Co. |

1989 |

Dammam |

|||||

|

Al-Jazira Paper Factory |

1986 |

Riyadh |

|||||

|

United Carton Industries Co. |

1990 |

Jeddah |

|||||

|

Waraq Paper Manufacturing Co. |

1979 |

Riyadh |

|||||

|

Napco National |

1956 |

Al Khobar |

KSA Pulp and Paper Industry Analysis

Growth Drivers

- Demand for Sustainable Packaging: The growing demand for sustainable packaging solutions in Saudi Arabia is driving the growth of the pulp and paper market. With a rising awareness of environmental sustainability, companies across various sectors are increasingly adopting eco-friendly packaging alternatives. For instance, Almarai has committed to preventing 9,000 metric tons of plastic waste from entering landfills by 2025 and is exploring the incorporation of recycled and biodegradable materials into their packaging solutions. Government regulations pushing for reduced plastic use are further accelerating the demand for paper-based packaging.

- Government Initiatives for Environmental Sustainability: The Saudi government has been taking multiple initiatives aimed at environmental sustainability, which has significantly bolstered the pulp and paper market. In 2021, the government launched its "Saudi Green Initiative," which aims to raise the countrys commitment to sustainability by promoting industries that support environmental health, including paper recycling and reduced deforestation. The governments target to plant 10 billion trees across the kingdom also supports the sustainability of wood-based industries like pulp and paper, making it easier for local manufacturers to source raw materials.

- Rising Paper Recycling Efforts: Paper recycling in Saudi Arabia has been gaining traction, influenced by government policies and private sector participation. There has been a significant rise in the number of recycling facilities across the country, focusing on reprocessing paper products for industrial purposes. These efforts aim to reduce the reliance on virgin pulp imports and promote a more sustainable approach within the market. By encouraging the recycling of paper and cardboard waste, Saudi Arabia is contributing to global sustainability goals and fostering a circular economy in this industry.

Market Challenges

- High Raw Material Costs (Wood Pulp, Recycled Paper): The cost of raw materials, particularly wood pulp and recycled paper, remains a significant challenge for the Saudi pulp and paper market. Global supply chain disruptions and price fluctuations further compound these difficulties, making it challenging for local manufacturers to manage costs effectively. The limited availability of domestically sourced raw materials forces the industry to rely heavily on imports, increasing operational expenses. As a result, the high cost of importing wood pulp places considerable financial pressure on companies, impacting profitability and competitiveness in the market.

- Water Usage Regulations: Water usage regulations pose another major challenge for the pulp and paper industry in Saudi Arabia, as the country faces significant water scarcity issues. The production of paper is a highly water-intensive process, and stringent regulations require manufacturers to adopt more water-efficient technologies. Compliance with these regulations can be costly for companies, as those that exceed allowed water usage limits face fines. This creates an additional financial burden on manufacturers, who must balance regulatory compliance with maintaining operational efficiency and productivity in their production processes.

KSA Pulp and Paper Market Future Outlook

The KSA Pulp and Paper market is expected to experience significant growth over the next five years, driven by the expanding industrial base, rapid urbanization, and a growing focus on sustainable packaging solutions. Government regulations aimed at promoting environmental sustainability and the increased adoption of recycling technologies will further contribute to the industry's upward trajectory. Additionally, technological advancements such as digital printing and automation in paper production processes are likely to enhance operational efficiencies and reduce costs.

Market Opportunities

- Expansion of Corrugated Packaging in E-commerce: The growth of e-commerce in Saudi Arabia presents a significant opportunity for the corrugated packaging market. With an increasing number of online purchases, the demand for durable and sustainable packaging materials is on the rise. Corrugated packaging, known for its strength and recyclability, has become the preferred choice for many e-commerce companies to ensure safe product delivery. As e-commerce continues to expand, especially with major players relying on paper-based solutions for shipments, the pulp and paper industry is well-positioned to benefit from the growing need for corrugated packaging in this sector.

- Growth in Tissue Paper Products (Increased Hygiene Awareness): The heightened awareness of hygiene, particularly following the global pandemic, has driven increased demand for tissue paper products in Saudi Arabia. Tissue products, including facial tissues, paper towels, and sanitary products, are becoming more widely used across various sectors such as healthcare, hospitality, and residential. This growing awareness and demand have led manufacturers to scale up production to meet the needs of consumers, creating a significant growth opportunity for the tissue paper industry. The trend toward higher hygiene standards continues to support the expansion of this market segment.

Scope of the Report

|

Product Type |

Printing and Writing Paper Packaging Paper and Board Specialty Paper Tissue Paper |

|

Application |

Industrial Commercial Household Packaging |

|

Raw Material |

Wood Pulp Recycled Paper Non-Wood Fiber (Bagasse, Bamboo) |

|

Manufacturing Process |

Mechanical Pulping Chemical Pulping Recycled Fiber Pulping |

|

Region |

Riyadh Jeddah Dammam Makkah |

Products

Key Target Audience

Pulp and Paper Manufacturers

Food and Beverage Industry

Retail and E-commerce Platforms

Investments and Venture Capitalist Firms

Waste Management and Recycling Companies

Government and Regulatory Bodies (Ministry of Industry and Mineral Resources)

Investor and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned int he Report

Saudi Paper Manufacturing Co.

Al-Jazira Paper Factory

United Carton Industries Co.

Waraq Paper Manufacturing Co.

Napco National

Fipco

Gulf Packaging Industries

Hotpack Global

Zamil Paper Industries

Green Pulp Paper Industry

Al Suwaidi Paper Co.

Obeikan Paper Industries

Middle East Paper Co. (MEPCO)

Tetra Pak Saudi Arabia

Gulf Carton Factory

Table of Contents

1. KSA Pulp and Paper Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Industry Expansion Rate, Key Market Trends)

1.4. Market Segmentation Overview (by Type, Application, End-Use, and Region)

2. KSA Pulp and Paper Market Size (In USD Bn)

2.1. Historical Market Size (by Volume and Value)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Industry Shifts, Technological Innovations, and Key Stakeholder Initiatives)

3. KSA Pulp and Paper Market Analysis

3.1. Growth Drivers

3.1.1. Demand for Sustainable Packaging

3.1.2. Government Initiatives for Environmental Sustainability

3.1.3. Rising Paper Recycling Efforts

3.1.4. Expanding Industrial Applications (Construction, Printing, Packaging)

3.2. Market Challenges

3.2.1. High Raw Material Costs (Wood Pulp, Recycled Paper)

3.2.2. Water Usage Regulations

3.2.3. Competition from Digital Media (Reduced Paper Demand in Publishing)

3.2.4. Supply Chain Bottlenecks

3.3. Opportunities

3.3.1. Expansion of Corrugated Packaging in E-commerce

3.3.2. Growth in Tissue Paper Products (Increased Hygiene Awareness)

3.3.3. Increased Export Opportunities (Rising Global Demand for Packaging Materials)

3.4. Trends

3.4.1. Adoption of Digital Printing Technologies

3.4.2. Growing Use of Biodegradable and Recycled Paper Products

3.4.3. Automation in Manufacturing Processes (Reducing Production Costs)

3.4.4. Shift Towards Lightweight Paper Grades (Energy Conservation)

3.5. Government Regulation

3.5.1. Environmental Protection Laws (Water Usage, Emission Standards)

3.5.2. National Recycling Programs

3.5.3. Import Tariffs on Pulp and Paper Materials

3.5.4. Support for Local Manufacturers (Subsidies, Tax Incentives)

3.6. SWOT Analysis

3.6.1. Strengths (Local Production Capacity, Government Support)

3.6.2. Weaknesses (Dependence on Imported Raw Materials)

3.6.3. Opportunities (Regional Trade Agreements, Technological Advancements)

3.6.4. Threats (Global Market Volatility, Environmental Pressures)

3.7. Stakeholder Ecosystem (Suppliers, Manufacturers, Distributors, End-users)

3.8. Porters Five Forces Analysis (Bargaining Power of Suppliers, Buyers, Competitive Rivalry, etc.)

3.9. Competition Ecosystem (Market Share Distribution, Key Players Positioning)

4. KSA Pulp and Paper Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Printing and Writing Paper

4.1.2. Packaging Paper and Board

4.1.3. Specialty Paper

4.1.4. Tissue Paper

4.2. By Application (In Value %)

4.2.1. Industrial

4.2.2. Commercial

4.2.3. Household

4.2.4. Packaging

4.3. By Raw Material (In Value %)

4.3.1. Wood Pulp

4.3.2. Recycled Paper

4.3.3. Non-Wood Fiber (Bagasse, Bamboo)

4.4. By Manufacturing Process (In Value %)

4.4.1. Mechanical Pulping

4.4.2. Chemical Pulping

4.4.3. Recycled Fiber Pulping

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Makkah

5. KSA Pulp and Paper Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Saudi Paper Manufacturing Co.

5.1.2. Al-Jazira Paper Factory

5.1.3. United Carton Industries Co.

5.1.4. Waraq Paper Manufacturing Co.

5.1.5. Middle East Paper Co. (MEPCO)

5.1.6. Obeikan Paper Industries

5.1.7. Fipco

5.1.8. Napco National

5.1.9. Gulf Carton Factory

5.1.10. Green Pulp Paper Industry

5.1.11. Gulf Packaging Industries

5.1.12. GPC Group

5.1.13. Zamil Paper Industries

5.1.14. Hotpack Global

5.1.15. Al Suwaidi Paper Co.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Revenue, Production Capacity, Raw Material Usage, Market Penetration, Technological Integration, Environmental Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Sustainability Initiatives, R&D Investments, Digitalization Strategies)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Local and International Investments in the Industry)

5.7. Venture Capital and Private Equity Investments

5.8. Government Grants and Subsidies

6. KSA Pulp and Paper Market Regulatory Framework

6.1. Environmental Standards (Water Usage, Emissions)

6.2. Compliance Requirements (Sustainability Certifications, Safety Protocols)

6.3. Certification Processes (ISO Certifications, Environmental Management Standards)

7. KSA Pulp and Paper Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Urbanization, Export Demand, and Technological Advancements)

8. KSA Pulp and Paper Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Raw Material (In Value %)

8.4. By Manufacturing Process (In Value %)

8.5. By Region (In Value %)

9. KSA Pulp and Paper Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves defining key factors influencing the KSA Pulp and Paper market. Extensive research, utilizing industry reports, government publications, and proprietary data sources, is used to identify market drivers, challenges, and emerging trends. The objective is to map the entire market ecosystem comprehensively.

Step 2: Market Analysis and Construction

In this phase, historical market data is compiled and analyzed to assess the market's current state. This includes understanding key demand factors, price fluctuations, and technological adoption trends, ensuring a precise view of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends, pricing, and consumption are validated through expert interviews and consultations. These interviews with industry professionals provide critical insights into operational practices, market challenges, and technological innovations, reinforcing the market analysis.

Step 4: Research Synthesis and Final Output

In the final stage, all findings are synthesized into a cohesive report, covering market size, growth projections, segmentation, and competitive analysis. A combination of top-down and bottom-up approaches ensures that the data is accurate and reflective of real-world market dynamics.

Frequently Asked Questions

01. How big is the KSA Pulp and Paper Market?

The KSA Pulp and Paper Market is valued at USD 3 billion, driven by rising demand in industrial packaging, consumer goods, and growing e-commerce activities.

02. What are the challenges in the KSA Pulp and Paper Market?

Challenges in KSA Pulp and Paper Market include the rising cost of raw materials such as wood pulp, compliance with environmental regulations, and competition from alternative packaging materials like plastics and metals.

03. Who are the major players in the KSA Pulp and Paper Market?

Key players in KSA Pulp and Paper Market include Saudi Paper Manufacturing Co., Al-Jazira Paper Factory, United Carton Industries Co., Waraq Paper Manufacturing Co., and Napco National, each contributing significantly to local and export markets.

04. What are the growth drivers of the KSA Pulp and Paper Market?

The KSA Pulp and Paper Market is driven by factors such as increased industrialization, government support for sustainable packaging, and the growing use of recycled materials in the packaging industry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.