KSA PVC Pipe market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD1050

April 2025

100

About the Report

KSA PVC Pipe Market Overview

- The KSA PVC pipe market is valued at USD 1.1 billion, based on a five-year historical analysis. This market size is driven by the rapid urbanization and industrialization in the region, which has led to increased demand for infrastructure development. The construction sector, in particular, has been a significant driver, with numerous projects requiring extensive piping systems. Additionally, the government's focus on diversifying the economy and investing in non-oil sectors has further fueled the demand for PVC pipes.

- Riyadh and Jeddah are the dominant cities in the KSA PVC pipe market. Riyadh's dominance is attributed to its status as the capital and its ongoing infrastructure projects, while Jeddah benefits from its strategic location as a major port city, facilitating trade and logistics. These cities have seen substantial investments in residential, commercial, and industrial projects, which have significantly contributed to the demand for PVC pipes.

- The Saudi Arabian government has implemented stringent regulations to ensure the quality and safety of PVC pipes used in construction and infrastructure projects. The Saudi Standards, Metrology and Quality Organization (SASO) mandates compliance with specific standards for manufacturing and installation, ensuring that the pipes meet durability and environmental safety requirements. This regulation aims to enhance the reliability of infrastructure and protect public health by minimizing the risk of contamination and leakage.

KSA PVC Pipe Market Segmentation

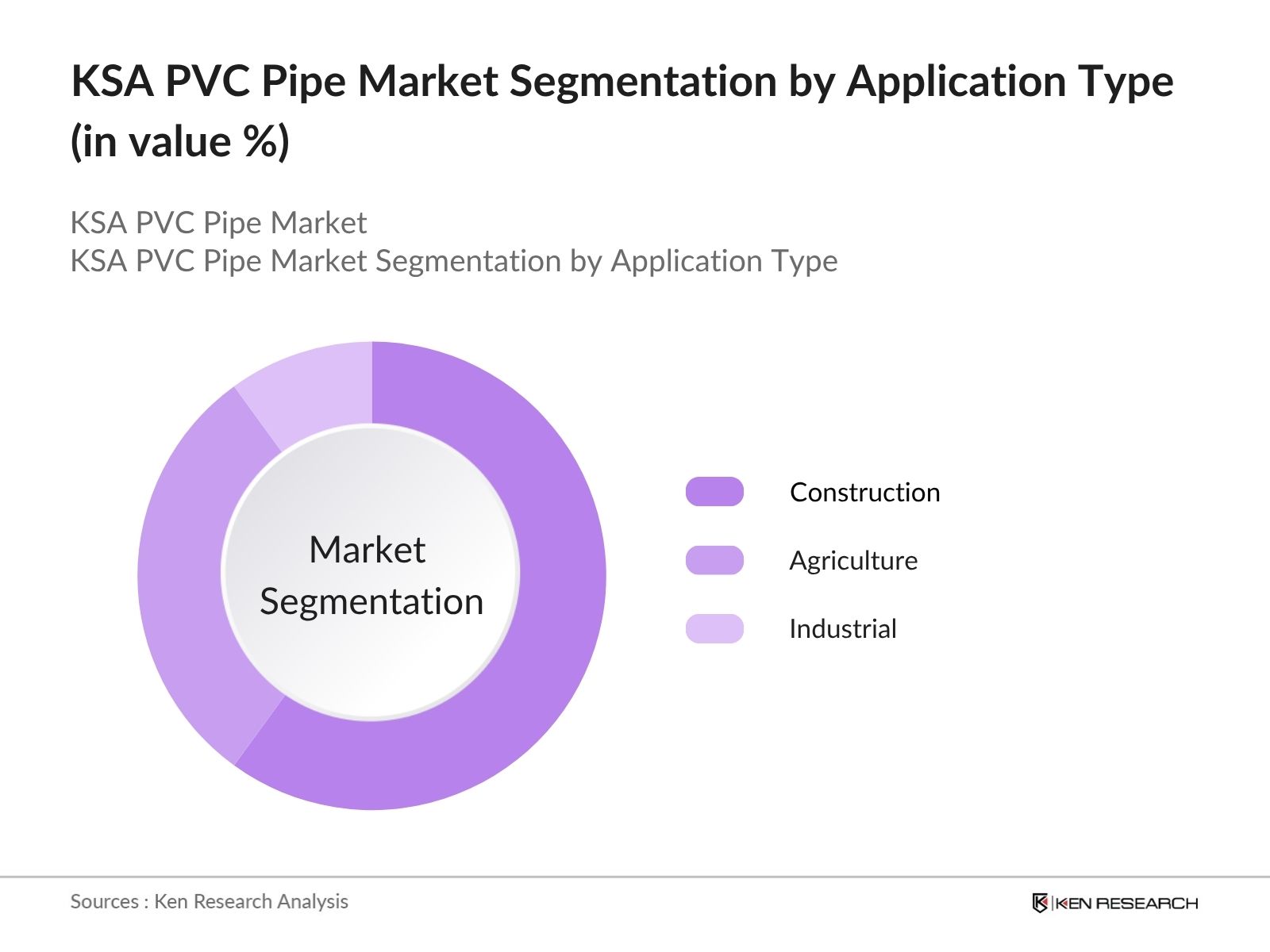

By Application: The market is segmented by application into construction, agriculture, and industrial. The construction segment holds a dominant position, primarily due to the extensive infrastructure development projects across the country. The government's Vision 2030 initiative has led to increased investments in residential and commercial construction, driving the demand for PVC pipes. The durability, cost-effectiveness, and ease of installation of PVC pipes make them a preferred choice for construction projects, further solidifying their dominance in this segment.

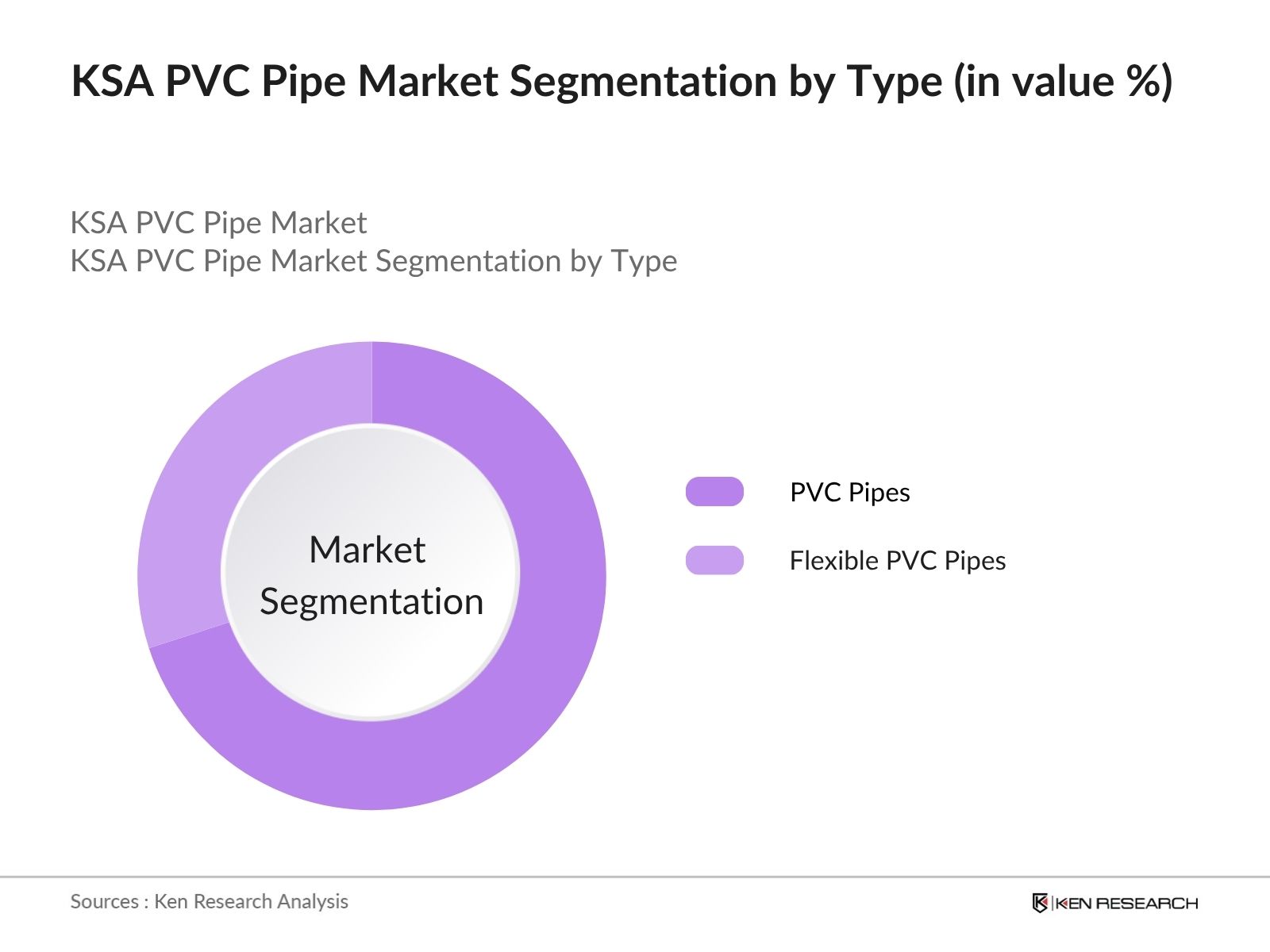

By Type: The market is segmented by type into rigid PVC pipes and flexible PVC pipes. Rigid PVC pipes dominate the market due to their high strength and resistance to pressure, making them ideal for water supply and sewage systems. Their ability to withstand harsh environmental conditions and chemical exposure further enhances their suitability for various applications. The preference for rigid PVC pipes is also driven by their long lifespan and low maintenance requirements, which are crucial factors for infrastructure projects.

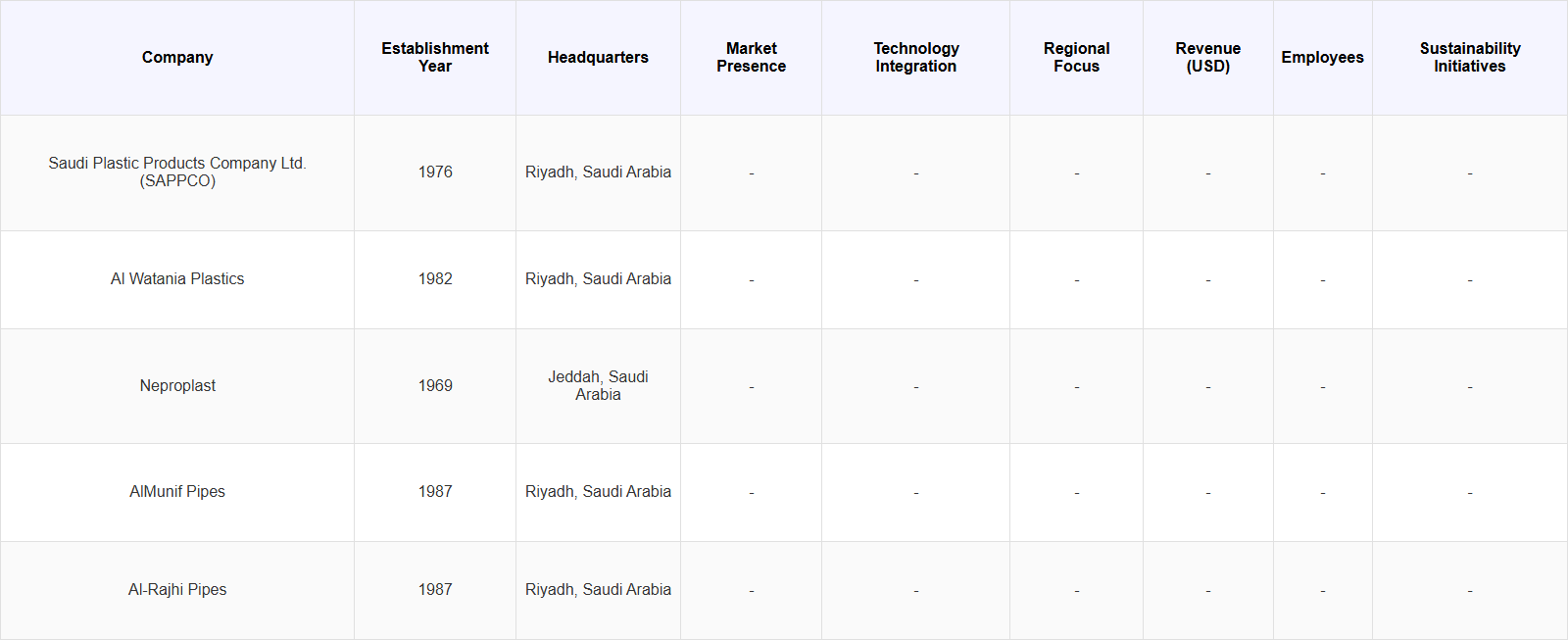

KSA PVC Pipe Market Competitive Landscape

The KSA PVC pipe market is dominated by a few major players, including local manufacturers and international companies. This consolidation highlights the significant influence of these key companies in shaping the market dynamics. The presence of established players ensures a steady supply of high-quality products, meeting the growing demand from various sectors.

KSA PVC Pipe Industry Analysis

Growth Drivers

- Infrastructure Development: Saudi Arabia's ambitious infrastructure projects, such as the NEOM city and the Red Sea Project, are driving the demand for PVC pipes. These projects require extensive piping systems for water supply, sewage, and other utilities. According to the World Bank, Saudi Arabia's infrastructure investment is projected to reach 1 tUSD rillion by 2030, significantly boosting the PVC pipe market. The Kingdom's Vision 2030 plan further emphasizes infrastructure development, ensuring a steady demand for PVC pipes in the coming years.

- Government Initiatives: The Saudi government is actively promoting the use of sustainable materials, including PVC pipes, in construction and infrastructure projects. The National Industrial Development and Logistics Program (NIDLP) aims to transform Saudi Arabia into a leading industrial powerhouse, with a focus on sustainable development. The IMF reports that government spending on industrial development is expected to increase by 15% in 2024, providing a favorable environment for the PVC pipe industry to thrive.

- Technological Advancements: Innovations in PVC pipe manufacturing, such as the development of eco-friendly and high-performance materials, are enhancing the market's growth prospects. The introduction of smart pipe systems, which enable real-time monitoring and maintenance, is gaining traction in Saudi Arabia. According to the World Bank, the country's investment in research and development is projected to grow remarkably by 2030, fostering technological advancements in the PVC pipe industry and driving market expansion.

Market Challenges

- Environmental Concerns: The production and disposal of PVC pipes raise environmental concerns due to the release of harmful chemicals. Saudi Arabia is increasingly focusing on environmental sustainability, which poses a challenge for the PVC pipe industry. The World Bank reports that the Kingdom's environmental regulations are expected to become more stringent by 2024, requiring manufacturers to adopt eco-friendly practices and materials. This shift may increase production costs and impact the market's growth.

- Fluctuating Raw Material Prices: The PVC pipe industry is heavily reliant on raw materials such as crude oil and natural gas, which are subject to price fluctuations. The IMF projects that global oil prices will remain volatile in 2024, affecting the cost of PVC production. This volatility poses a challenge for manufacturers, as it can lead to increased production costs and reduced profit margins. The industry must find ways to mitigate these risks to maintain competitiveness in the market.

KSA PVC Pipe Market Future Outlook

Over the next five years, the KSA PVC pipe market is expected to experience robust growth, driven by ongoing infrastructure projects, government support for sustainable development, and technological advancements in pipe manufacturing. The increasing demand for efficient water supply and sewage systems will further boost the market. As the Kingdom continues to invest in industrial development and urbanization, the PVC pipe industry is poised for significant expansion, offering numerous opportunities for growth and innovation.

Market Opportunities

- Expansion in Rural Areas: The Saudi government's focus on rural development presents a significant opportunity for the PVC pipe market. As infrastructure projects extend to rural areas, the demand for PVC pipes for water supply and sewage systems is expected to rise. According to the World Bank, rural development spending in Saudi Arabia is projected to increase rapidly in 2025, creating a favorable environment for market expansion. This growth will enable manufacturers to tap into new markets and diversify their customer base.

- Innovations in PVC Pipe Manufacturing: The development of advanced manufacturing techniques and materials offers significant growth potential for the PVC pipe industry. Innovations such as the use of recycled materials and the production of lightweight, durable pipes are gaining traction in Saudi Arabia. The IMF reports that investment in research and development is expected to increase by 10% in 2024, supporting the adoption of innovative manufacturing processes. These advancements will enhance the market's competitiveness and drive future growth.

Scope of the Report

| By Product Type |

Rigid PVC Pipes Flexible PVC Pipes |

| By Application |

Construction Agriculture Industrial |

| By End-User |

Residential Commercial Industrial |

| By Diameter Size |

Small Diameter Medium Diameter Large Diameter |

| By Distribution Channel |

Direct Sales Distributors Online Retail |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Standards, Metrology and Quality Organization)

Manufacturers and Producers

Construction and Infrastructure Companies

Water and Sewage Management Authorities

Oil and Gas Industry Stakeholders

Distributors and Retailers

Industry Associations

Companies

Players Mentioned in the Report:

Saudi Plastic Products Company Ltd. (SAPPCO)

Al Watania Plastics

Neproplast

Almunif Pipes

Al-Rajhi Industrial Group

Al-Bilad Concrete Pipe Co., Ltd.

Alkhorayef Group

Alwasail Industrial Company

Al Jubail Sanitary Pipe Factory

Al Yamamah Plastic Factory

Table of Contents

1. KSA PVC Pipe Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA PVC Pipe Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA PVC Pipe Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development

3.1.2. Government Initiatives

3.1.3. Technological Advancements

3.1.4. Increasing Urbanization

3.2. Restraints

3.2.1. Environmental Concerns

3.2.2. Fluctuating Raw Material Prices

3.3. Opportunities

3.3.1. Expansion in Rural Areas

3.3.2. Innovations in PVC Pipe Manufacturing

3.4. Trends

3.4.1. Adoption of Eco-Friendly Materials

3.4.2. Smart Pipe Systems

3.5. SWOT Analysis

3.6. Porters Five Forces

3.7. Competition Ecosystem

4. KSA PVC Pipe Market Segmentation

4.1. By Application

4.1.1. Construction

4.1.2. Agriculture

4.1.3. Industrial

4.2. By Type

4.2.1. Rigid PVC Pipes

4.2.2. Flexible PVC Pipes

4.3. By Diameter

4.3.1. Small Diameter

4.3.2. Medium Diameter

4.3.3. Large Diameter

4.4. By End-User

4.4.1. Residential

4.4.2. Commercial

4.4.3. Industrial

4.5. By Distribution Channel

4.5.1. Direct Sales

4.5.2. Distributors

4.5.3. Online Retail

5. KSA PVC Pipe Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Saudi Plastic Products Company Ltd. (SAPPCO)

5.1.2. Al Watania Plastics

5.1.3. Neproplast

5.1.4. Almunif Pipes

5.1.5. Al-Rajhi Industrial Group

5.1.6. Al-Bilad Concrete Pipe Co., Ltd.

5.1.7. Alkhorayef Group

5.1.8. Alwasail Industrial Company

5.1.9. Al Jubail Sanitary Pipe Factory

5.1.10. Al Yamamah Plastic Factory

5.2. Cross Comparison Parameters

5.2.1. Revenue

5.2.2. Market Share

5.2.3. Product Portfolio

5.2.4. Distribution Network

5.2.5. Brand Recognition

5.2.6. Sustainability Initiatives

5.2.7. Technological Innovation

5.2.8. Customer Base

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investors Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA PVC Pipe Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA PVC Pipe Market Future Segmentation

7.1. By Application

7.1.1. Construction

7.1.2. Agriculture

7.1.3. Industrial

7.2. By Type

7.2.1. Rigid PVC Pipes

7.2.2. Flexible PVC Pipes

7.3. By Diameter

7.3.1. Small Diameter

7.3.2. Medium Diameter

7.3.3. Large Diameter

7.4. By End-User

7.4.1. Residential

7.4.2. Commercial

7.4.3. Industrial

7.5. By Distribution Channel

7.5.1. Direct Sales

7.5.2. Distributors

7.5.3. Online Retail

8. Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA PVC Pipe market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the KSA PVC Pipe market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA PVC Pipe market.

Frequently Asked Questions

01. How big is the KSA PVC Pipe market?

The KSA PVC Pipe market is valued at USD 1.1 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the KSA PVC Pipe market?

Key challenges in the KSA PVC Pipe market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the KSA PVC Pipe market?

Major players in the KSA PVC Pipe market include Saudi Plastic Products Company Ltd. (SAPPCO), Al Watania Plastics, Al-Bilad Concrete Pipe Co., Ltd., Almunif Pipes, Neproplast, among others.

04. What are the growth drivers for the KSA PVC Pipe market?

The primary growth drivers for the KSA PVC Pipe market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.