KSA Quick Service Restaurant Market Outlook to 2030

Region:Middle East

Author(s):Shambhavi Awasthi

Product Code:KROD10382

December 2024

91

About the Report

KSA Quick Service Restaurant Market Overview

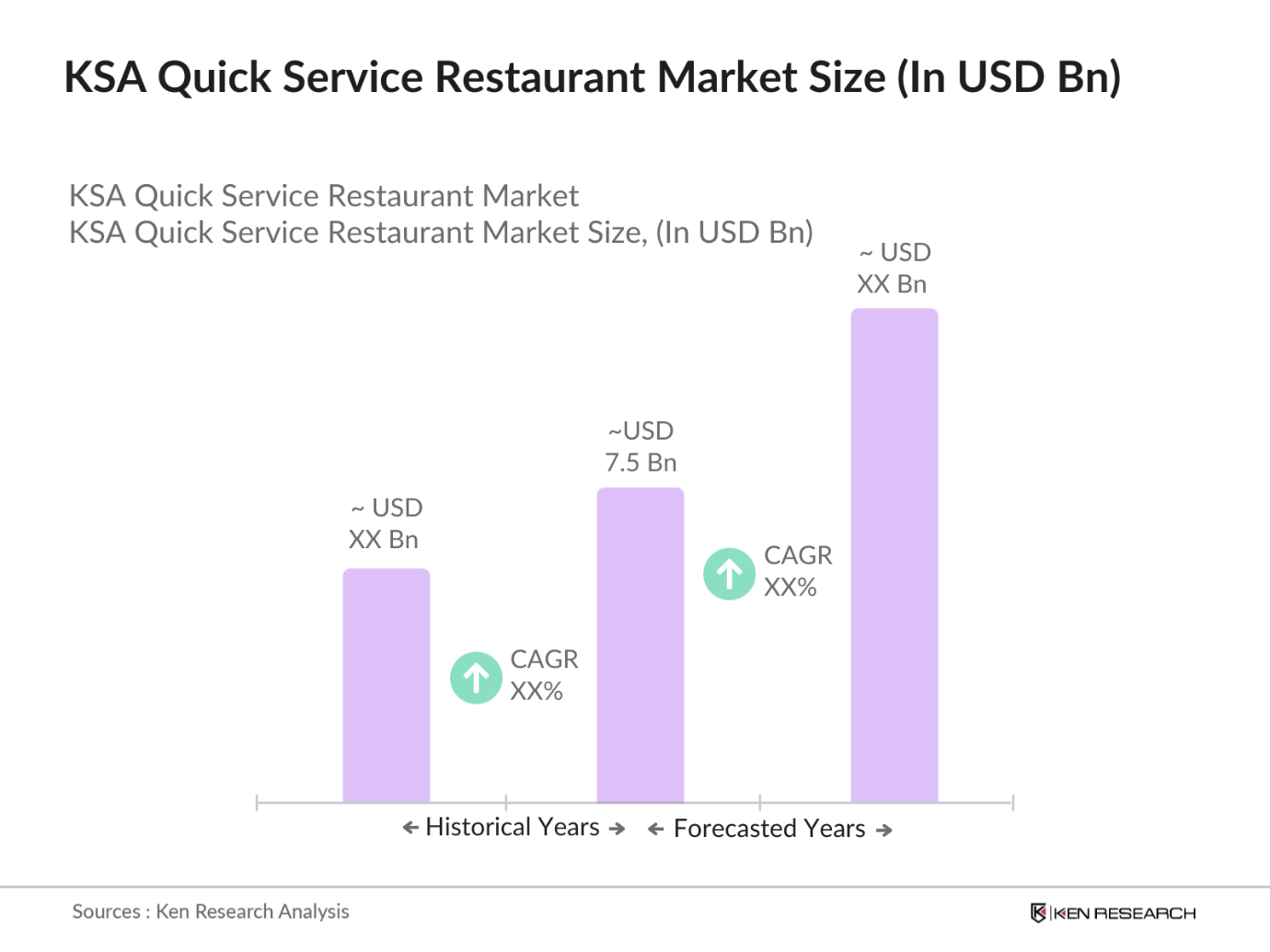

- The KSA Quick Service Restaurant market, currently valued at USD 7.5 billion based on a five-year historical analysis, has witnessed robust growth fueled by a surge in disposable income and rapid urbanization. This growth is supported by Saudi Arabias Vision 2030, which emphasizes enhancing lifestyle quality, further propelling demand for quick, convenient dining options. As consumer preferences shift toward fast-paced dining, the market continues to expand, driven by both local demand and the increasing influx of international tourists looking for familiar QSR brands.

- In Saudi Arabia, Riyadh and Jeddah are key cities driving the QSR market due to their large populations, economic significance, and evolving consumer lifestyles. Riyadh, the capital, has a higher concentration of QSR outlets as it is a central hub for business and tourism, while Jeddahs strong tourism appeal attracts substantial foot traffic to QSR chains. These cities' economic activity and cultural openness support their positions as major contributors to the QSR markets development.

- The SFDA mandates comprehensive food safety standards, requiring all QSRs to comply with regular inspections. These standards involve rigorous food handling, storage, and cleanliness protocols to ensure public safety and reduce contamination risks. Non-compliance leads to heavy fines or operational shutdowns, reinforcing the importance of strict adherence

KSA Quick Service Restaurant Market Segmentation

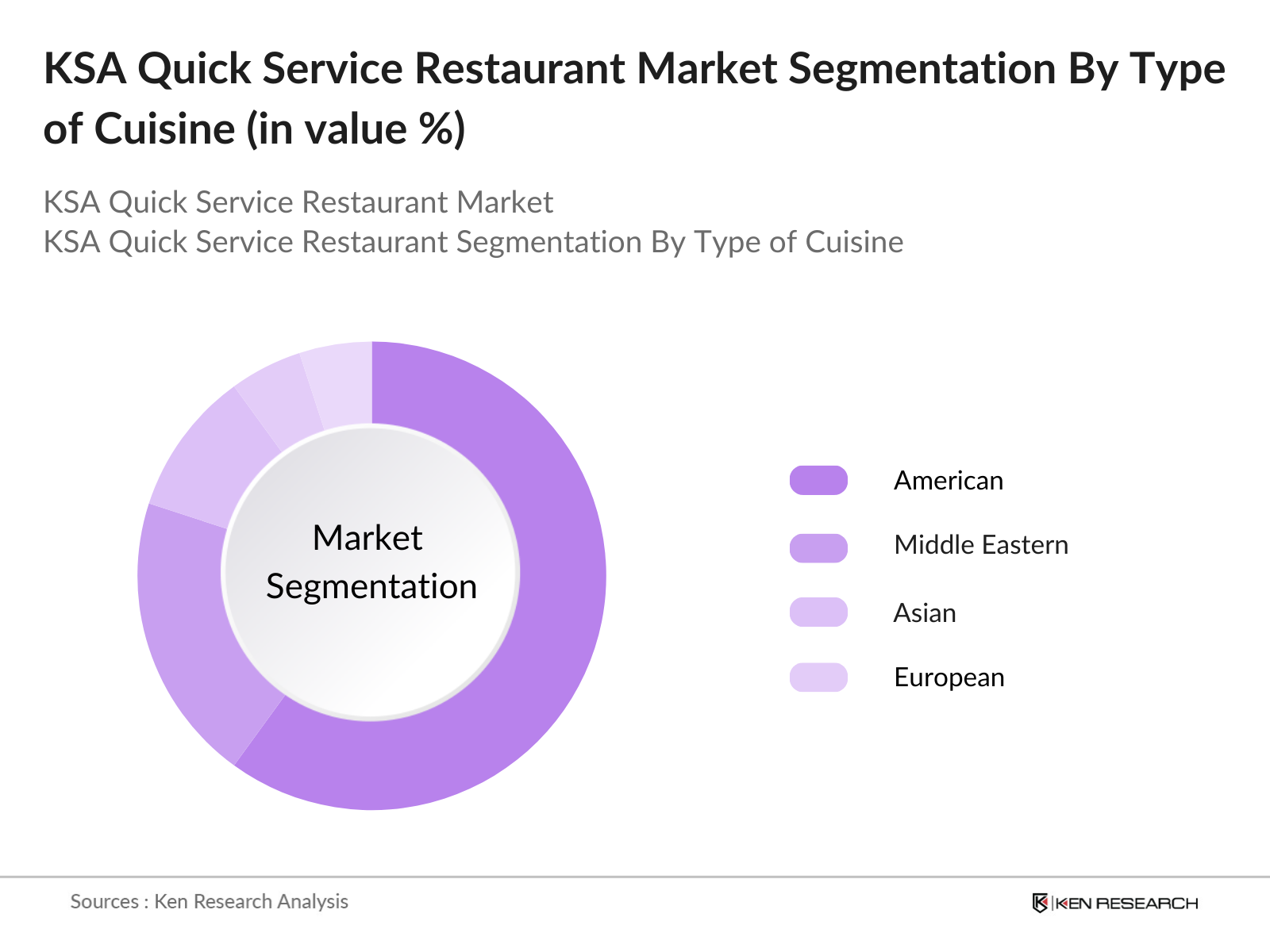

- By Type of Cuisine: The KSA QSR market is segmented by cuisine type, including American, Middle Eastern, Asian, and European cuisines. Currently, American cuisine holds a dominant share, attributed to its broad appeal and established brand presence. Brands like McDonalds, KFC, and Burger King enjoy significant loyalty due to their established reputation, ensuring that American cuisine remains a consumer favorite. The popularity of these brands is largely due to consistent quality, diverse menu options, and active marketing strategies tailored to the Saudi market.

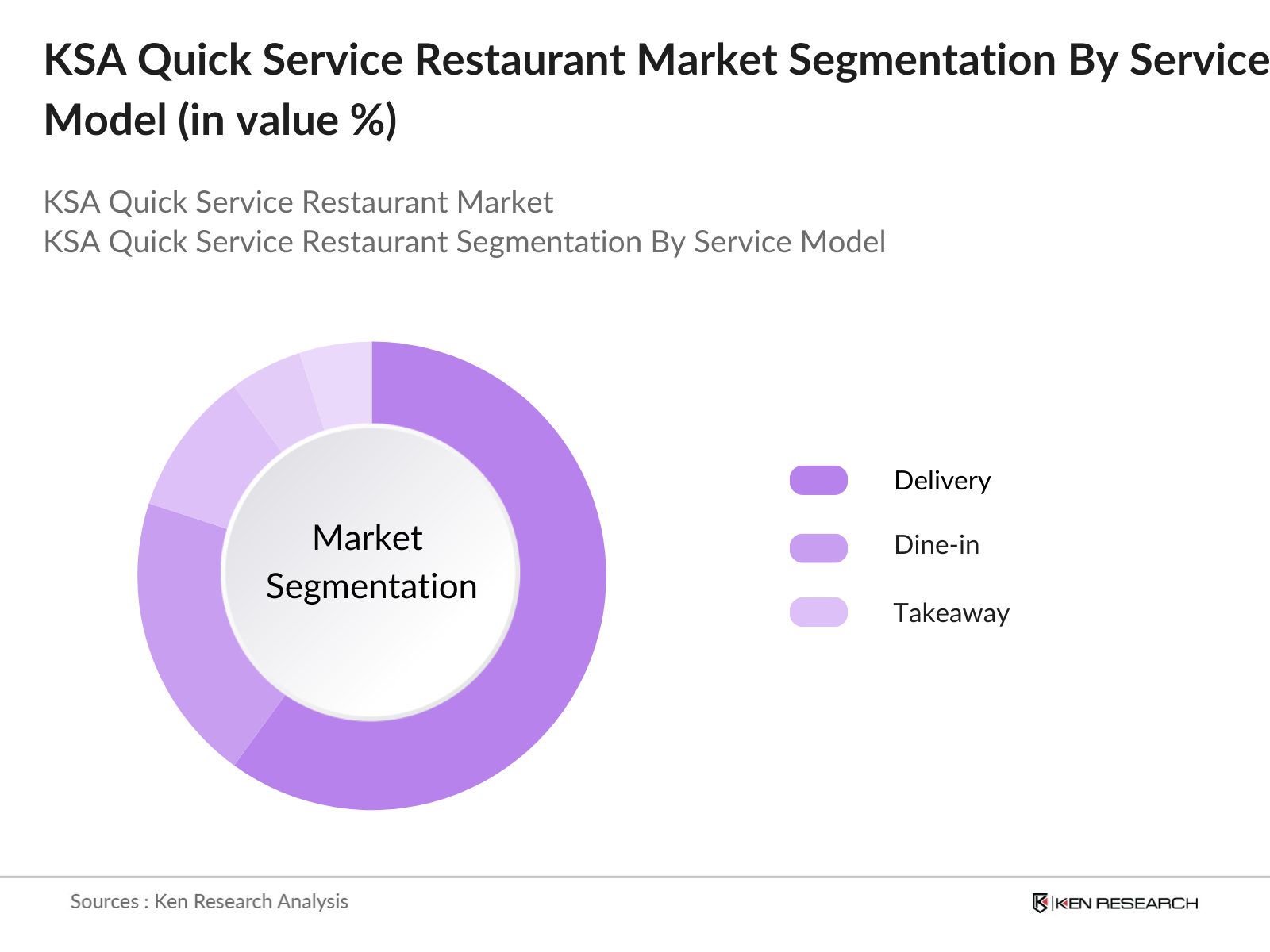

- By Service Model: The KSA QSR market can also be segmented by service model, including dine-in, takeaway, and delivery services. The delivery segment has seen rapid growth, largely due to increased smartphone penetration and the popularity of food delivery platforms like HungerStation and Talabat. With convenience and accessibility being primary concerns, delivery services dominate, especially in metropolitan areas where consumers seek to avoid traffic and wait times, ensuring continued market share growth for this segment.

KSA Quick Service Restaurant Market Competitive Landscape

The KSA QSR market is dominated by major global and local players, each bringing diverse culinary offerings to the Saudi market. Established brands like McDonalds and KFC are central, maintaining significant brand recognition and operational scale. Local players have also emerged, often catering to regional preferences and reinforcing a diverse market presence.

KSA Quick Service Restaurant Market Analysis

Growth Drivers

- Urbanization: Saudi Arabias urban population growth has been significant, with an estimated 38.5 million people now residing in urban areas, supported by government initiatives like Vision 2030. These initiatives aim to increase urban livability and economic growth, thereby increasing the demand for quick service restaurants (QSRs) as disposable income and modern lifestyles rise. Urban regions such as Riyadh and Jeddah are primary growth hubs, where QSRs are becoming central to social culture and eating preferences .

- Economic Growth: Saudi Arabias GDP reached approximately 820 billion USD in 2023, driven by robust growth in non-oil sectors. This economic expansion boosts disposable income and encourages greater spending on convenient food options like QSRs. With new jobs being created, and the increase in per capita income, the QSR industry is anticipated to benefit directly as spending power increases among Saudi citizens and expatriates alike .

- Changing Consumer Lifestyles: Rapidly shifting preferences for convenience, especially among Saudi Arabias youthful demographic (around 60% under age 30), contribute to a strong QSR market. A preference for fast, diverse, and accessible food aligns with the cultural and social shifts toward busier lifestyles and convenience-oriented services. This younger demographic is increasingly seeking fast service and variety in dining, propelling demand for QSR services .

- Technological Advancements: Technology integration has transformed Saudi Arabia's QSR sector, with mobile apps and online ordering platforms seeing increased use, reportedly growing 20% annually. Government efforts to boost digitalization support this trend, with the Ministry of Communications aiming to increase internet penetration nationwide, enabling QSRs to optimize service efficiency and customer reach through online platforms and delivery partnerships.

Challenges

- Regulatory Compliance: Strict regulatory requirements for food safety, hygiene, and import standards place operational challenges on QSRs. Compliance with the Saudi Food and Drug Authoritys (SFDA) safety and quality standards is mandatory, adding costs for monitoring, training, and equipment, as well as requiring time-intensive processes. Failing to meet these standards can result in penalties, impacting operational continuity and increasing costs.

- Intense Competition: The Saudi QSR market is crowded, with over 40 established international and domestic brands vying for market share. High levels of competition lead to heavy investment in advertising, promotions, and price cuts, which, although beneficial to consumers, add pressure on profit margins and necessitate continuous product and service innovation to stand out .

KSA Quick Service Restaurant Market Future Outlook

Over the next five years, the KSA Quick Service Restaurant market is expected to grow steadily, driven by rising disposable incomes, urbanization, and an influx of international tourists. Government initiatives supporting economic diversification and improvements in infrastructure will facilitate new restaurant openings, while a younger, tech-savvy population will drive demand for digital ordering and delivery services. Additionally, evolving tastes and preferences towards healthier and diverse options are expected to introduce new menu offerings and attract a broader consumer base.

Market Opportunities

- Expansion into Untapped Regions: Saudi Arabias expanding urban landscape beyond major cities presents significant potential for QSR expansion into areas like Dammam and Khobar. As infrastructure investments spread, new opportunities emerge for establishing QSR outlets to cater to rising consumer demand in these growth regions.

- Health-Conscious Menu Innovations: With an increasing focus on health, consumers are actively seeking QSR options with low-calorie, organic, or natural ingredients. This shift aligns with Vision 2030s objectives to promote public health, allowing QSRs that introduce health-conscious menu items to differentiate themselves and capture a broader market share

Scope of the Report

|

Segment |

Sub-segments |

|

Service Type |

Eat-in Takeaway Drive-thru Home Delivery |

|

Cuisine Type |

Meat-based Cuisines Burgers Pizzas Ice Cream Others |

|

Outlet Type |

Independent Outlets Chained Outlets |

|

Region |

Riyadh Jeddah Mecca Medina |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Investment, General Authority for Statistics)

QSR Chain Operators

Food and Beverage Industry Suppliers

Real Estate Developers

Technology Providers (POS and Delivery Platforms)

Marketing and Branding Agencies

Consumer Behavior Analysts

Companies

Players mentioned in the report

McDonalds

Al Baik

KFC

Burger King

Herfy

Dominos Pizza

Subway

Pizza Hut

Shawarmer

Hardees

Dunkin Donuts

Tim Hortons

Starbucks

Texas Chicken

Baskin-Robbins

Table of Contents

1. Saudi Arabia Quick Service Restaurant Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Quick Service Restaurant Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Quick Service Restaurant Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization

3.1.2. Economic Growth

3.1.3. Changing Consumer Lifestyles

3.1.4. Technological Advancements

3.2. Market Challenges

3.2.1. Regulatory Compliance

3.2.2. Intense Competition

3.2.3. Supply Chain Disruptions

3.2.4. Cultural Sensitivities

3.3. Opportunities

3.3.1. Expansion into Untapped Regions

3.3.2. Health-Conscious Menu Innovations

3.3.3. Integration of Digital Ordering Platforms

3.3.4. Strategic Partnerships and Franchising

3.4. Trends

3.4.1. Rise of Delivery and Takeaway Services

3.4.2. Adoption of Contactless Payment Systems

3.4.3. Emphasis on Sustainable Practices

3.4.4. Popularity of International Cuisines

3.5. Government Regulations

3.5.1. Food Safety Standards

3.5.2. Licensing and Permits

3.5.3. Health and Hygiene Protocols

3.5.4. Import and Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Saudi Arabia Quick Service Restaurant Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Eat-in

4.1.2. Takeaway

4.1.3. Drive-thru

4.1.4. Home Delivery

4.2. By Cuisine Type (In Value %)

4.2.1. Meat-based Cuisines

4.2.2. Burgers

4.2.3. Pizzas

4.2.4. Ice Cream

4.2.5. Others

4.3. By Outlet Type (In Value %)

4.3.1. Independent Outlets

4.3.2. Chained Outlets

4.4. By Region (In Value %)

4.4.1. Riyadh

4.4.2. Jeddah

4.4.3. Mecca

4.4.4. Medina

4.4.5. Eastern Province

4.4.6. Western Province

4.4.7. Southern Province

4.4.8. Northern Province

5. Saudi Arabia Quick Service Restaurant Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ALBAIK Food Systems Company S.A.

5.1.2. Americana Restaurants International PLC

5.1.3. Fawaz Abdulaziz AlHokair Company

5.1.4. Herfy Food Service Company

5.1.5. M.H. Alshaya Co. WLL

5.1.6. AlAmar Foods Company

5.1.7. Apparel Group

5.1.8. Galadari Ice Cream Co Ltd LLC

5.1.9. Kudu Company For Food And Catering

5.1.10. Reza Food Services Company Limited

5.2. Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2. Headquarters Location

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Market Share

5.2.6. Product Portfolio

5.2.7. Geographic Presence

5.2.8. Strategic Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Quick Service Restaurant Market Regulatory Framework

6.1. Food Safety Standards

6.2. Licensing and Permits

6.3. Health and Hygiene Protocols

6.4. Import and Export Regulations

7. Saudi Arabia Quick Service Restaurant Market Future Outlook

7.1. Market Size Projections

7.2. Key Factors Driving Future Growth

8. Saudi Arabia Quick Service Restaurant Market Analysts Recommendations

8.1. Total Addressable Market (TAM) Analysis

8.2. Serviceable Available Market (SAM) Analysis

8.3. Serviceable Obtainable Market (SOM) Analysis

8.4. Customer Cohort Analysis

8.5. Marketing Initiatives

8.6. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping out key industry players and understanding the dynamics of the KSA QSR market. This process involves secondary research, including government reports and industry publications, to define market variables.

Step 2: Market Analysis and Construction

A comprehensive analysis of historical data and current market conditions is conducted to determine the distribution of market shares among segments. Data collection focuses on factors like customer preferences and revenue generation, ensuring data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts are performed through surveys and interviews to validate market assumptions. Insights obtained from these consultations are used to refine the data and identify additional trends influencing the market.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the research findings into a structured report, providing a holistic view of the market. Cross-verification with primary and secondary data ensures that the final analysis is robust and reliable.

Frequently Asked Questions

01. How big is the KSA Quick Service Restaurant Market?

The KSA Quick Service Restaurant Market is valued at USD 7.5 billion, propelled by increased disposable incomes, urban expansion, and rising demand for convenient dining options.

02. What are the challenges in the KSA QSR Market?

Challenges include high competition, fluctuating food costs, and regulatory compliance. The recent emphasis on healthy eating also pressures QSR brands to adapt their menus.

03. Who are the major players in the KSA QSR Market?

Key players include McDonalds, Al Baik, KFC, Burger King, and Herfy, all of which have extensive brand presence and loyal customer bases across the country.

04. What are the growth drivers of the KSA QSR Market?

The market growth is driven by rising urbanization, higher disposable income, government initiatives like Vision 2030, and an expanding youth demographic eager for quick dining options.

05. What is the role of technology in the KSA QSR Market?

Technology plays a significant role in the KSA QSR Market, with digital ordering, delivery apps, and AI-driven customer engagement improving operational efficiency and customer satisfaction.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.