KSA Refrigerator Market Outlook to 2030

Region:Middle East

Author(s):Shreya

Product Code:KROD5225

November 2024

98

About the Report

KSA Refrigerator Market Overview

- The KSA refrigerator market is valued at USD 670 Million, based on a five-year historical analysis. This market is primarily driven by increasing urbanization and the growing consumer demand for energy-efficient appliances. A rise in disposable incomes across the Kingdom has led to higher consumer spending on premium appliances, while the expansion of retail networks has enabled more widespread availability of refrigerators. Additionally, the government's focus on energy conservation and efficiency under its Vision 2030 has spurred consumer interest in eco-friendly and energy-efficient refrigerators. These factors contribute to the consistent demand growth in the market, with a notable shift towards high-end products.

- Riyadh, Jeddah, and Dammam are dominant cities in the KSA refrigerator market due to their high population density, rapid urbanization, and economic activity. Riyadh, being the capital, attracts a significant portion of the consumer electronics market due to its large urban population. Jeddah's prominence as a commercial hub and Dammam's strategic location near the oil and gas industry also drive significant demand for refrigerators, especially for commercial applications. These cities have higher disposable incomes and infrastructure development, supporting the growth of the refrigerator market.

- Under the Saudi Vision 2030 initiative, the government has implemented stringent energy efficiency standards for appliances, including refrigerators. In 2024, these standards were updated to mandate that all refrigerators sold in the Kingdom must consume no more than 400 kWh annually. The enforcement of these standards is aimed at reducing the country's overall energy consumption, which totaled 330 billion kWh in 2023. Compliance with these regulations is expected to further boost the demand for energy-efficient refrigerators.

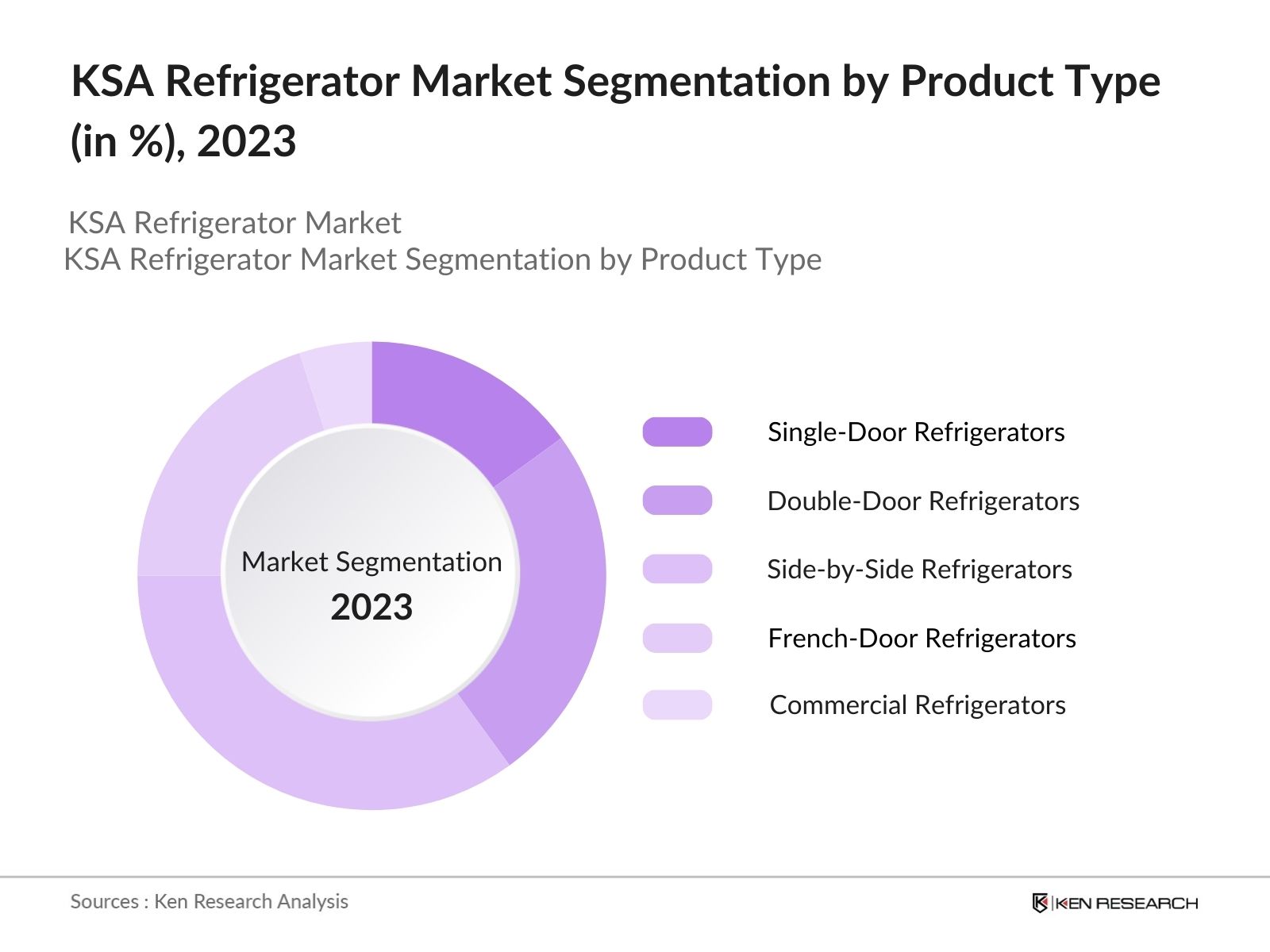

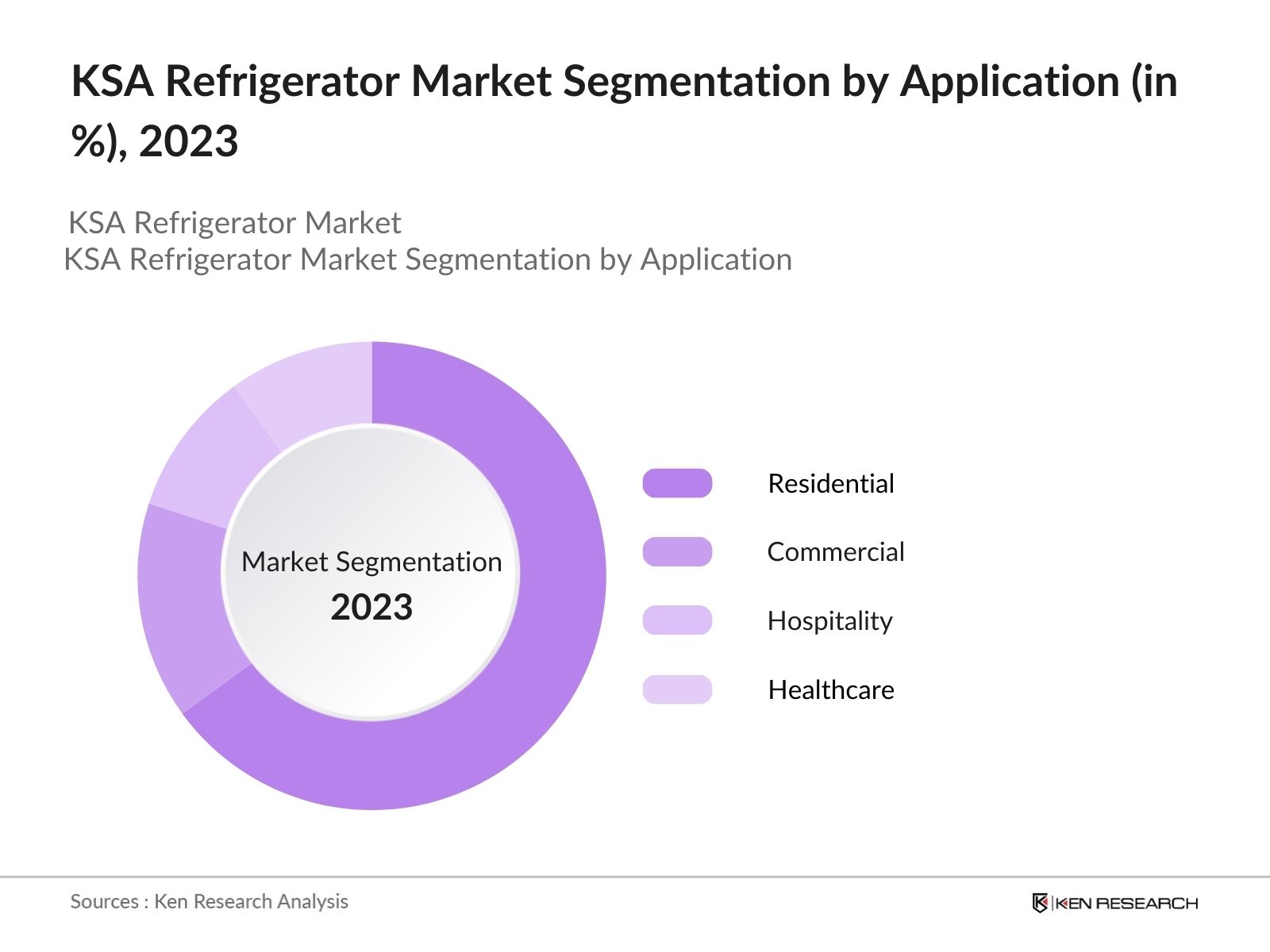

KSA Refrigerator Market Segmentation

- By Product Type: The market is segmented by product type into single-door refrigerators, double-door refrigerators, side-by-side refrigerators, French-door refrigerators, and commercial refrigerators. Recently, side-by-side refrigerators have dominated the market, owing to the increasing preference for spacious and premium appliances in high-income households. The growing trend toward smart home appliances and the need for energy-efficient cooling solutions in residential spaces have bolstered this segments popularity. Additionally, brands like LG and Samsung, known for their advanced technology and innovation, are heavily marketing side-by-side refrigerators, making them the preferred choice in urban areas.

- By Application: The market is segmented by application into residential, commercial, hospitality, and healthcare. Residential refrigerators dominate this segment due to the increasing number of households and the growing trend toward nuclear families, which has raised the demand for home appliances, particularly in urban centers like Riyadh and Jeddah. In commercial spaces, the hospitality sector, driven by Saudi Arabia's tourism boom and development in the entertainment industry, is seeing significant growth in the demand for commercial refrigeration, with hotels and restaurants seeking energy-efficient and high-capacity refrigerators.

KSA Refrigerator Market Competitive Landscape

The KSA refrigerator market is dominated by several global and regional players, with international brands like Samsung, LG, and Panasonic having a strong presence. These companies leverage their extensive product portfolios, technological innovations, and strategic marketing to maintain a competitive edge. The increasing demand for energy-efficient and smart refrigerators has intensified competition in this market, leading companies to invest in research and development, product customization, and improved distribution channels. Local manufacturers are also stepping up their game by offering more affordable options and aligning with the Kingdoms regulatory standards.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investment |

Market Share |

Regional Presence |

Technological Innovations |

Sustainability Initiatives |

|---|---|---|---|---|---|---|---|---|

|

Samsung Electronics |

1969 |

Seoul, South Korea |

||||||

|

LG Electronics |

1958 |

Seoul, South Korea |

||||||

|

Panasonic |

1918 |

Osaka, Japan |

||||||

|

Hitachi Ltd. |

1910 |

Tokyo, Japan |

||||||

|

Midea Group |

1968 |

Foshan, China |

KSA Refrigerator Industry Analysis

Growth Drivers

- Increasing Urbanization

Saudi Arabia has experienced rapid urbanization in recent years, with over 84% of its population living in urban areas in 2023, compared to 80% in 2019. This increase in urbanization is leading to higher demand for modern appliances like refrigerators, especially in cities like Riyadh, Jeddah, and Dammam, which are seeing significant population growth. Saudi Arabia's urban population is estimated to have reached 31 million in 2024, contributing to increased demand for household appliances. With new housing developments and modern lifestyle trends, refrigerator sales have been on the rise. - Rising Disposable Income

Saudi Arabias gross national income per capita rose from $22,840 in 2022 to $24,210 in 2024. This rise in disposable income, driven by increased employment opportunities and government initiatives, is pushing consumer spending on high-quality home appliances, including refrigerators. The higher purchasing power allows consumers to opt for advanced models with enhanced features, supporting the refrigerator market's growth. Additionally, household consumption expenditure increased by $210 billion in 2024, reflecting the rising ability of consumers to invest in durable goods like refrigerators. - Shifts Toward Energy-Efficient Products

The demand for energy-efficient refrigerators is growing as Saudi consumers become more aware of energy consumption costs. In 2024, the Kingdom saw a shift towards energy-saving appliances, with over 60% of newly sold refrigerators adhering to Energy Star ratings. This demand aligns with Saudi Arabias goal to reduce electricity consumption, which reached 330 billion kWh in 2023. Energy-efficient refrigerators play a crucial role in helping the government meet its targets for reducing carbon emissions by 2030, under Saudi Vision 2030. - Expanding Retail Networks

Saudi Arabia's retail sector has expanded significantly, with 72 new malls opening between 2022 and 2024. This expansion of retail space, particularly in cities like Riyadh and Jeddah, has increased the accessibility and availability of consumer electronics and home appliances, including refrigerators. Online retail channels have also seen growth, with e-commerce sales in Saudi Arabia reaching $11 billion in 2024. The expanding retail landscape supports the increasing availability of both basic and high-end refrigerator models, contributing to market growth

Market Challenges

- High Energy Costs

Energy costs in Saudi Arabia have been on the rise, with electricity prices reaching $0.18 per kWh in 2024, compared to $0.16 per kWh in 2022. As electricity prices increase, consumers face higher operating costs for appliances like refrigerators. These rising energy costs challenge the refrigerator market, as buyers may delay or avoid purchasing new models, particularly high-energy-consuming ones. Households are becoming more cautious about the energy efficiency of new appliances, which affects the demand for less efficient refrigerator models. - Import Regulations

Saudi Arabia has strict import regulations for household appliances, including refrigerators. In 2024, import duties on consumer goods were raised to 10%, making imported refrigerators more expensive. These regulations create challenges for international brands, which account for 55% of the refrigerator market. Moreover, compliance with local standards set by SASO (Saudi Standards, Metrology, and Quality Organization) adds additional costs for manufacturers, further limiting competition and driving up prices.

KSA Refrigerator Market Future Outlook

Over the next five years, the KSA refrigerator market is expected to see significant growth driven by increasing demand for energy-efficient appliances, smart home technologies, and premium products. As Saudi Arabia continues to urbanize and the population grows, particularly in metropolitan regions, consumer preferences will shift toward high-tech and environmentally friendly refrigerators. Government initiatives aimed at reducing energy consumption and promoting green technologies will further encourage the adoption of energy-efficient refrigerators. Additionally, the rise in disposable incomes, fueled by the Kingdom's diversification of its economy, will allow consumers to opt for more expensive, technologically advanced appliances.

Opportunities

- Growth in Smart Refrigerator Adoption

The adoption of smart refrigerators in Saudi Arabia has increased significantly, with over 110,000 units sold in 2024, compared to 72,000 in 2022. These smart appliances, featuring advanced technologies such as Wi-Fi connectivity and touch-screen interfaces, are particularly popular among younger, tech-savvy consumers in urban areas. The increasing penetration of smart home devices, combined with rising consumer awareness of energy efficiency, creates opportunities for growth in this segment. - Expanding e-Commerce Penetration

Online sales of refrigerators in Saudi Arabia have risen substantially, with e-commerce accounting for 25% of total refrigerator sales in 2024, compared to 18% in 2022. The growth of platforms like Noon and Amazon.sa has made it easier for consumers to purchase refrigerators online, especially in smaller cities where retail stores are less common. The convenience and competitive pricing of online channels continue to drive demand for refrigerators in the Kingdom.

Scope of the Report

|

Segment |

Sub-Segment |

|---|---|

|

By Product Type |

Single Door Refrigerators |

|

Double Door Refrigerators |

|

|

Side-by-Side Refrigerators |

|

|

French Door Refrigerators |

|

|

Commercial Refrigerators |

|

|

By Capacity |

Less than 300L |

|

300L to 500L |

|

|

500L to 700L |

|

|

More than 700L |

|

|

By Application |

Residential |

|

Commercial |

|

|

Hospitality |

|

|

Healthcare |

|

|

By Distribution Channel |

Offline (Retail Stores, Hypermarkets) |

|

Online (e-Commerce Platforms) |

|

|

By Region |

Central Region (Riyadh) |

|

Western Region (Jeddah, Mecca) |

|

|

Eastern Region (Dammam, Khobar) |

|

|

Southern Region |

|

|

Northern Region |

Products

Key Target Audience

Government and Regulatory Bodies (SASO)

Refrigerator Manufacturers

Distributors and Retailers

Hospitality and Commercial Sectors

Energy Efficiency Consultants

Real Estate Developers

Banks and Financial Institutes

Investments and Venture Capitalist Firms

Consumer Electronics Associations

Companies

Major Players in the KSA Refrigerator Market

Samsung Electronics

LG Electronics

Whirlpool Corporation

Panasonic Corporation

Hitachi Ltd.

Midea Group

Bosch (BSH Hausgerte GmbH)

Haier Group

Electrolux AB

Toshiba Corporation

Daewoo Electronics

Gorenje (Hisense)

Arelik A.. (Beko)

Nikai Corporation

Vestel Group

Table of Contents

1. KSA Refrigerator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Refrigerator Market Size (In SAR Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Refrigerator Market Analysis

3.1. Growth Drivers

Increasing Urbanization

Rising Disposable Income

Shifts Toward Energy-Efficient Products

Expanding Retail Networks

3.2. Market Challenges

High Energy Costs

Import Regulations

Competitive Pricing Pressure

Supply Chain Disruptions

3.3. Opportunities

Growth in Smart Refrigerator Adoption

Expanding e-Commerce Penetration

Government Initiatives for Energy Efficiency

Rising Consumer Demand for Premium Products

3.4. Trends

Integration of IoT and Smart Technologies

Growing Demand for Customizable Refrigerators

Increasing Preference for Energy Star Rated Appliances

Expansion in Modular Refrigerator Designs

3.5. Government Regulations

Saudi Vision 2030 and Energy Efficiency Standards

Import Duties and Trade Policies

Incentives for Green Technologies

Compliance with SASO Standards (Saudi Standards, Metrology, and Quality Organization)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape and Market Ecosystem

4. KSA Refrigerator Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Single Door Refrigerators

4.1.2. Double Door Refrigerators

4.1.3. Side-by-Side Refrigerators

4.1.4. French Door Refrigerators

4.1.5. Commercial Refrigerators

4.2. By Capacity (In Value %)

4.2.1. Less than 300L

4.2.2. 300L to 500L

4.2.3. 500L to 700L

4.2.4. More than 700L

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Hospitality

4.3.4. Healthcare

4.4. By Distribution Channel (In Value %)

4.4.1. Offline (Retail Stores, Hypermarkets)

4.4.2. Online (e-Commerce Platforms)

4.5. By Region (In Value %)

4.5.1. Central Region (Riyadh)

4.5.2. Western Region (Jeddah, Mecca)

4.5.3. Eastern Region (Dammam, Khobar)

4.5.4. Southern Region

4.5.5. Northern Region

5. KSA Refrigerator Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. LG Electronics

5.1.2. Samsung Electronics

5.1.3. Whirlpool Corporation

5.1.4. Panasonic Corporation

5.1.5. Hitachi Ltd.

5.1.6. Midea Group

5.1.7. Bosch (BSH Hausgerte GmbH)

5.1.8. Haier Group

5.1.9. Electrolux AB

5.1.10. Toshiba Corporation

5.1.11. Daewoo Electronics

5.1.12. Gorenje (Hisense)

5.1.13. Arelik A.. (Beko)

5.1.14. Nikai Corporation

5.1.15. Vestel Group

5.2 Cross Comparison Parameters (Product Portfolio, Market Share, Revenue, R&D Investment, Manufacturing Presence, Marketing Spend, Innovation Index, Customer Satisfaction)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Subsidies

5.9 Private Equity Investments

6. KSA Refrigerator Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Import Tariff Structures

6.3. Labeling Requirements (Energy Star, Eco-Friendly Certifications)

6.4. Safety Regulations and Compliance

7. KSA Refrigerator Market Future Size (In SAR Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. KSA Refrigerator Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Capacity (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. KSA Refrigerator Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Serviceable Addressable Market (SAM) Analysis

9.3. Serviceable Obtainable Market (SOM) Analysis

9.4. Go-to-Market Strategy Recommendations

9.5. White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the key stakeholders in the KSA refrigerator market, including manufacturers, suppliers, and consumers. Data is sourced from secondary databases such as government reports and proprietary databases. The focus is on identifying the variables influencing market dynamics, such as urbanization, disposable income, and energy efficiency trends.

Step 2: Market Analysis and Construction

Historical data on refrigerator sales, penetration rates, and energy consumption patterns are compiled and analyzed. This phase also involves evaluating product segment performance and customer satisfaction rates across various regions in Saudi Arabia, ensuring accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted via telephonic interviews to validate the initial market assumptions. These consultations provide valuable insights into operational challenges, consumer preferences, and product innovations, helping to refine the market data.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the data through a combination of quantitative analysis and expert validation. Detailed insights on product categories, sales performance, and regional demand patterns are collected from manufacturers and industry specialists, ensuring comprehensive market coverage.

Frequently Asked Questions

1. big is the KSA Refrigerator Market?

The KSA refrigerator market is valued at USD 670 Million. This growth is driven by increasing urbanization, rising disposable incomes, and government initiatives focused on energy efficiency in home appliances.

2. What are the challenges in the KSA Refrigerator Market?

Challenges in the KSA refrigerator market include high energy costs, import regulations, and stiff competition from global and regional brands. The market also faces logistical hurdles related to the supply chain, particularly for imported products.

3. Who are the major players in the KSA Refrigerator Market?

Key players in the KSA refrigerator market include Samsung Electronics, LG Electronics, Whirlpool Corporation, Panasonic Corporation, and Hitachi Ltd. These brands dominate due to their technological innovations, extensive distribution networks, and premium product offerings.

4. What are the growth drivers of the KSA Refrigerator Market?

The KSA refrigerator market is primarily driven by rising demand for energy-efficient and smart refrigerators, increasing disposable incomes, and government regulations promoting green technologies. The growing trend toward premium appliances also boosts market growth.

5. What is the role of government regulations in the KSA Refrigerator Market?

Government regulations, particularly SASOs energy efficiency standards, play a critical role in shaping consumer preferences and encouraging the adoption of energy-efficient appliances. The Vision 2030 initiative further supports this trend by promoting sustainable development.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.