KSA Refrigerators Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD2745

November 2024

90

About the Report

KSA Refrigerators Market Overview

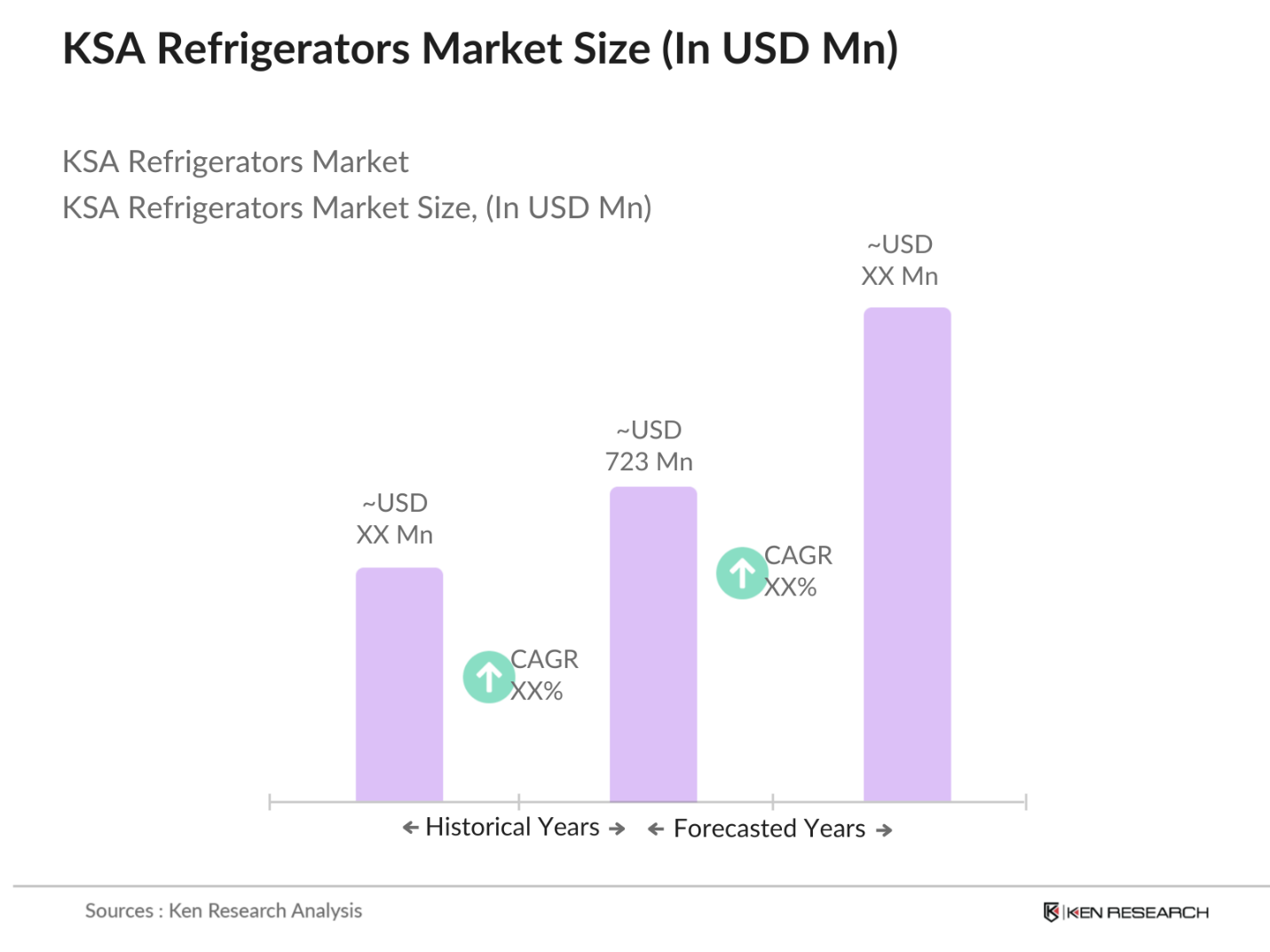

- The KSA Refrigerators market, valued at USD 723 million, has experienced steady growth over the past five years. This expansion is primarily driven by the country's increasing population, rising disposable incomes, and a growing preference for energy-efficient and technologically advanced appliances. The hot and arid climate further necessitates reliable refrigeration solutions, bolstering market demand.

- Major urban centers such as Riyadh, Jeddah, and Dammam dominate the market due to their high population densities, rapid urbanization, and higher household incomes. These cities have witnessed significant infrastructural development, leading to increased residential and commercial establishments, thereby driving the demand for refrigerators.

- The Saudi Standards, Metrology and Quality Organization (SASO) has established energy efficiency standards for household appliances, including refrigerators. These regulations mandate specific energy consumption limits, promoting the production and use of energy-saving appliances.

KSA Refrigerators Market Segmentation

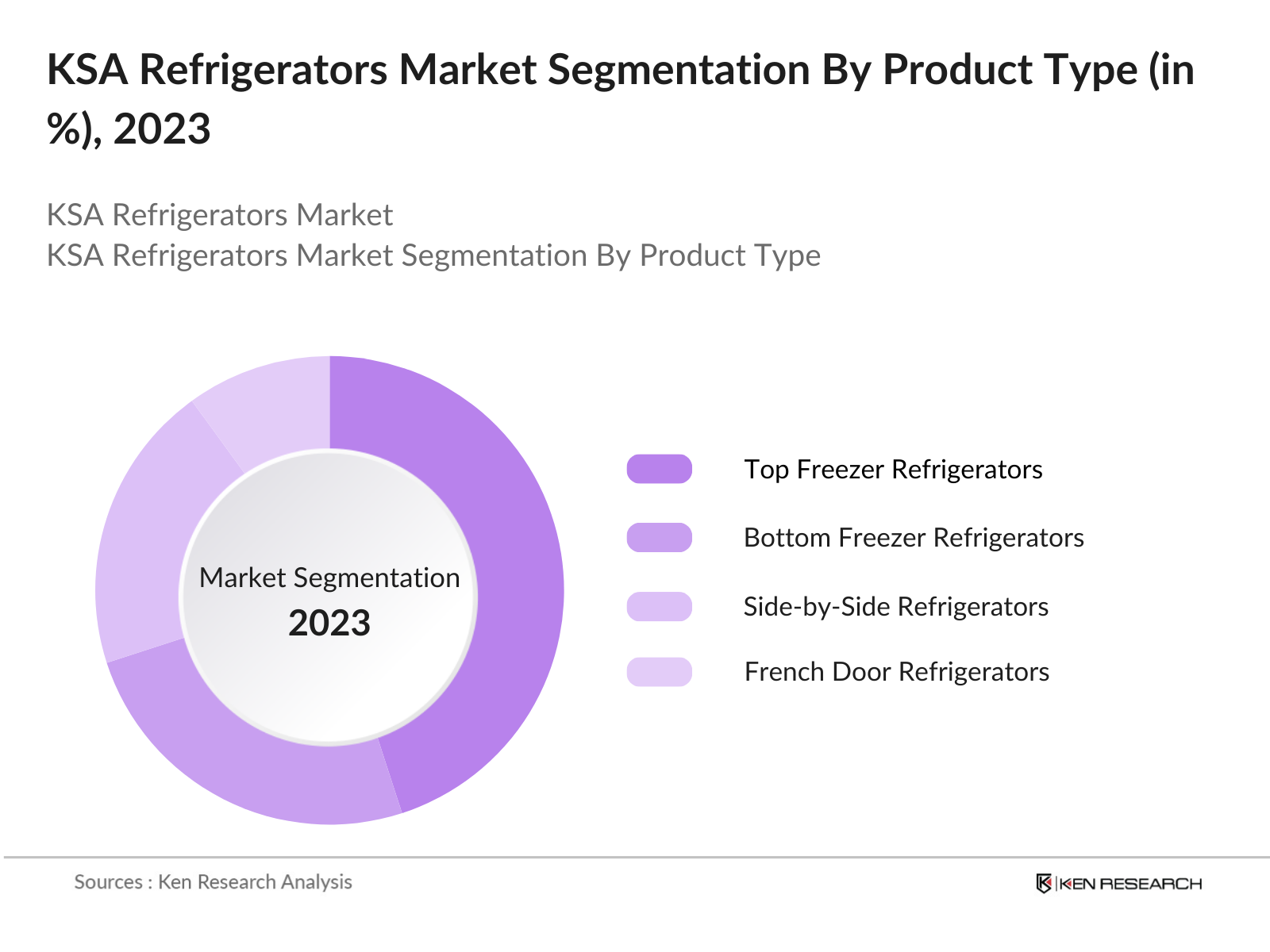

By Product Type: The KSA Refrigerators market is segmented by product type into top freezer refrigerators, bottom freezer refrigerators, side-by-side refrigerators, French door refrigerators, and mini refrigerators. Among these, top freezer refrigerators hold a dominant market share due to their affordability and energy efficiency, making them a popular choice among middle-income households.

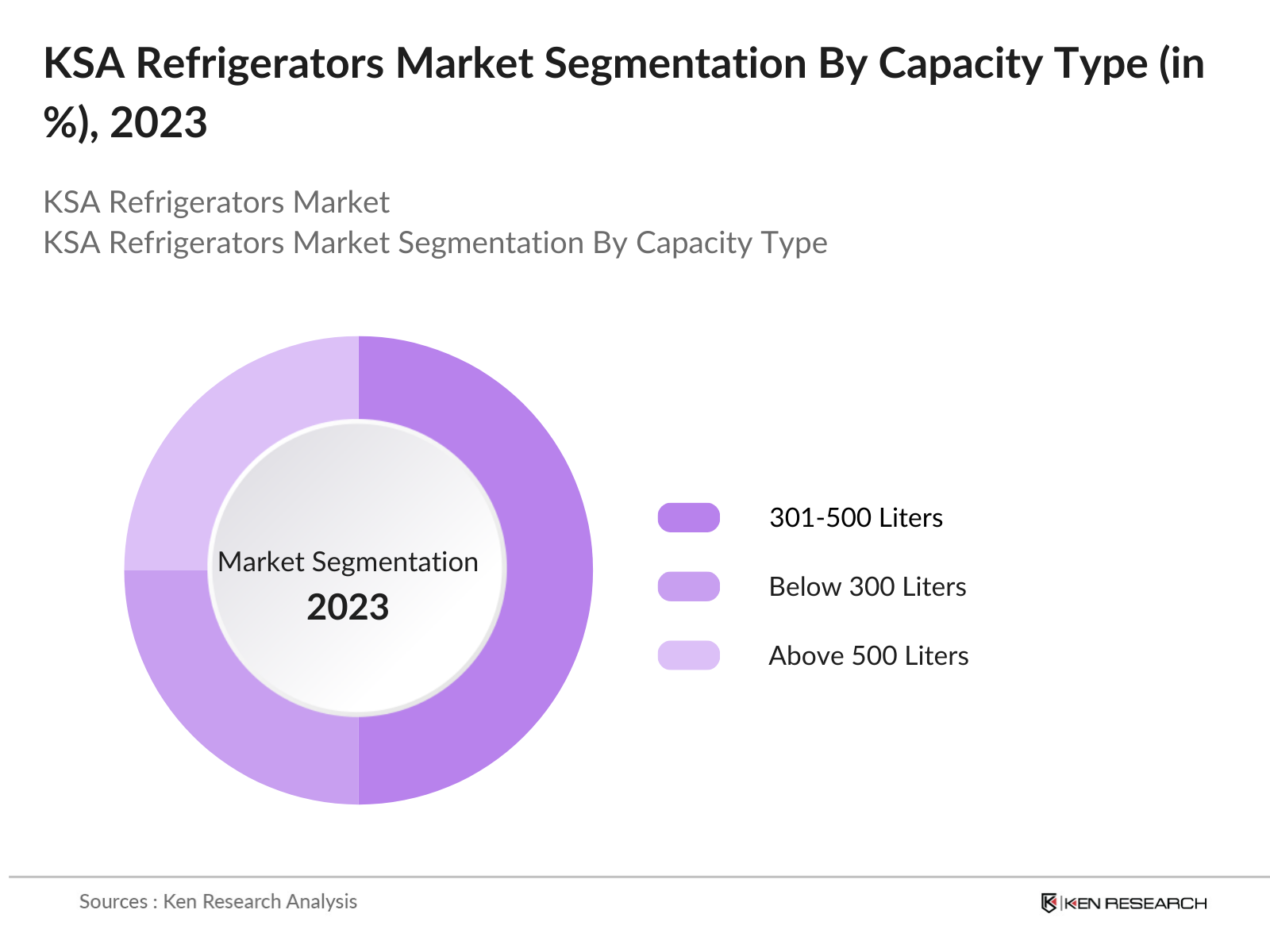

By Capacity: The market is also segmented by capacity into below 300 liters, 301-500 liters, and above 500 liters. Refrigerators with a capacity of 301-500 liters dominate the market, catering to the average household size in Saudi Arabia, which typically requires moderate storage space.

KSA Refrigerators Market Competitive Landscape

The KSA Refrigerators market is characterized by the presence of both international and local players, leading to a competitive environment. Major companies focus on product innovation, energy efficiency, and after-sales services to maintain their market positions.

KSA Refrigerators Market Industry Analysis

Growth Drivers

- Population Growth and Urbanization: As of 2023, Saudi Arabia's total population reached approximately 36 million, with an urbanization rate of 83%. This urban population, totaling around 30 million individuals, has been steadily increasing, driving demand for household appliances, including refrigerators.

- Rising Disposable Income: In 2023, Saudi Arabia's Gross Domestic Product (GDP) per capita was estimated at $23,000, reflecting an increase in disposable income among citizens. This economic growth has enabled more households to invest in modern appliances, such as energy-efficient refrigerators, enhancing their quality of life.

- Technological Advancements: The adoption of smart home technologies has been on the rise in Saudi Arabia, with a significant portion of households integrating smart appliances. This trend has led to increased demand for advanced refrigerators equipped with features like Wi-Fi connectivity and energy management systems, aligning with consumers' preferences for convenience and efficiency.

Market Challenges

- High Competition Among Manufacturers: The Saudi refrigerator market is characterized by intense competition, with numerous domestic and international brands vying for market share. This competitive landscape poses challenges for manufacturers to differentiate their products and maintain profitability.

- Fluctuating Raw Material Prices: The refrigerator manufacturing industry is susceptible to fluctuations in raw material prices, such as steel and plastics. These price variations can impact production costs and, consequently, the pricing strategies of manufacturers, affecting their profit margins.

KSA Refrigerators Market Future Outlook

Over the next five years, the KSA Refrigerators market is expected to witness significant growth, driven by continuous urbanization, increasing disposable incomes, and a growing inclination towards smart and energy-efficient appliances. Government initiatives promoting energy conservation and the development of smart cities are also anticipated to boost market demand.

Opportunities

- Demand for Smart Refrigerators: The increasing penetration of the Internet of Things (IoT) in Saudi households has led to a growing demand for smart refrigerators. Consumers are seeking appliances that offer advanced features, such as remote monitoring and energy optimization, presenting opportunities for manufacturers to introduce innovative products.

- Expansion in Rural Areas: While urban areas dominate appliance consumption, rural regions in Saudi Arabia represent untapped markets. With ongoing infrastructure development and electrification projects, there is potential for increased refrigerator sales in these areas as households seek to improve their living standards.

Scope of the Report

|

Refrigerator Type |

Single Door |

|

Capacity |

Below 300 Liters |

|

Application |

Residential |

|

Distribution Channel |

Supermarkets and Hypermarkets |

|

Region |

Central |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Refrigerator Manufacturing Companies

Appliance Distributors and Retailer Companies

Hospitality Industries

Real Estate Development Companies

Government and Regulatory Bodies (e.g., Saudi Standards, Metrology and Quality Organization)

Consumer Electronics Companies

Energy Efficiency Advocacy Companies

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Samsung Electronics

LG Electronics

Haier Group Corporation

Whirlpool Corporation

Panasonic Corporation

Hitachi, Ltd.

Bosch Siemens Hausgerte GmbH

Midea Group Co., Ltd.

Electrolux AB

Toshiba Corporation

Table of Contents

1. KSA Refrigerators Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. KSA Refrigerators Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Refrigerators Market Analysis

3.1 Growth Drivers

3.1.1 Population Growth and Urbanization

3.1.2 Rising Disposable Income

3.1.3 Technological Advancements

3.1.4 Government Initiatives for Energy Efficiency

3.2 Market Challenges

3.2.1 High Competition Among Manufacturers

3.2.2 Fluctuating Raw Material Prices

3.2.3 Import Dependence

3.3 Opportunities

3.3.1 Demand for Smart Refrigerators

3.3.2 Expansion in Rural Areas

3.3.3 Growth in Hospitality and Tourism Sectors

3.4 Trends

3.4.1 Integration with Smart Home Systems

3.4.2 Preference for Energy-Efficient Models

3.4.3 Customizable and Modular Designs

3.5 Government Regulations

3.5.1 Energy Efficiency Standards

3.5.2 Import Tariffs and Trade Policies

3.5.3 Environmental Compliance

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. KSA Refrigerators Market Segmentation

4.1 By Refrigerator Type (In Value %)

4.1.1 Single Door

4.1.2 Double Door

4.1.3 Side-by-Side

4.1.4 French Door

4.1.5 Mini Refrigerators

4.2 By Capacity (In Value %)

4.2.1 Below 300 Liters

4.2.2 301-500 Liters

4.2.3 Above 500 Liters

4.3 By Application (In Value %)

4.3.1 Residential

4.3.2 Commercial

4.4 By Distribution Channel (In Value %)

4.4.1 Supermarkets and Hypermarkets

4.4.2 Specialty Stores

4.4.3 Online Retail

4.4.4 Other Distribution Channels

4.5 By Region (In Value %)

4.5.1 Central

4.5.2 Western

4.5.3 Eastern

4.5.4 Southern

5. KSA Refrigerators Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Samsung Electronics Co., Ltd.

5.1.2 LG Electronics Inc.

5.1.3 Haier Group Corporation

5.1.4 Whirlpool Corporation

5.1.5 Panasonic Corporation

5.1.6 Hitachi, Ltd.

5.1.7 Bosch Siemens Hausgerte GmbH

5.1.8 Midea Group Co., Ltd.

5.1.9 Electrolux AB

5.1.10 Toshiba Corporation

5.1.11 Hisense Co., Ltd.

5.1.12 Sharp Corporation

5.1.13 Daewoo Electronics Corporation

5.1.14 Gorenje Group

5.1.15 Nikai Group

5.2 Cross Comparison Parameters

5.2.1 Market Share

5.2.2 Product Portfolio

5.2.3 Pricing Strategy

5.2.4 Distribution Network

5.2.5 Technological Innovation

5.2.6 Brand Recognition

5.2.7 Customer Service

5.2.8 Regional Presence

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. KSA Refrigerators Regulatory Framework

6.1 Energy Efficiency Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. KSA Refrigerators Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Refrigerators Future Market Segmentation

8.1 By Refrigerator Type (In Value %)

8.2 By Capacity (In Value %)

8.3 By Application (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. KSA Refrigerators Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Refrigerators market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the KSA Refrigerators market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple refrigerator manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA Refrigerators market.

Frequently Asked Questions

1. How big is the KSA Refrigerators market?

The KSA Refrigerators market is valued at USD 723 million, driven by factors such as increasing population, rising disposable incomes, and a growing preference for energy-efficient appliances.

2. What are the challenges in the KSA Refrigerators market?

Challenges include high competition among manufacturers, fluctuating raw material prices, and dependence on imports for certain components, which can affect pricing and supply chain stability.

3. Who are the major players in the KSA Refrigerators market?

Key players in the market include Samsung Electronics, LG Electronics, Haier Group Corporation, Whirlpool Corporation, and Panasonic Corporation, dominating due to their extensive product portfolios and strong distribution networks.

4. What are the growth drivers of the KSA Refrigerators market?

The market is propelled by factors such as rapid urbanization, increasing disposable incomes, technological advancements in appliances, and government initiatives promoting energy efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.