KSA Retail Pharmacy Market Outlook to 2028

Region:Middle East

Author(s):Rishabh and Navya

Product Code:KR1446

September 2024

88

About the Report

KSA Retail Pharmacy Market Overview

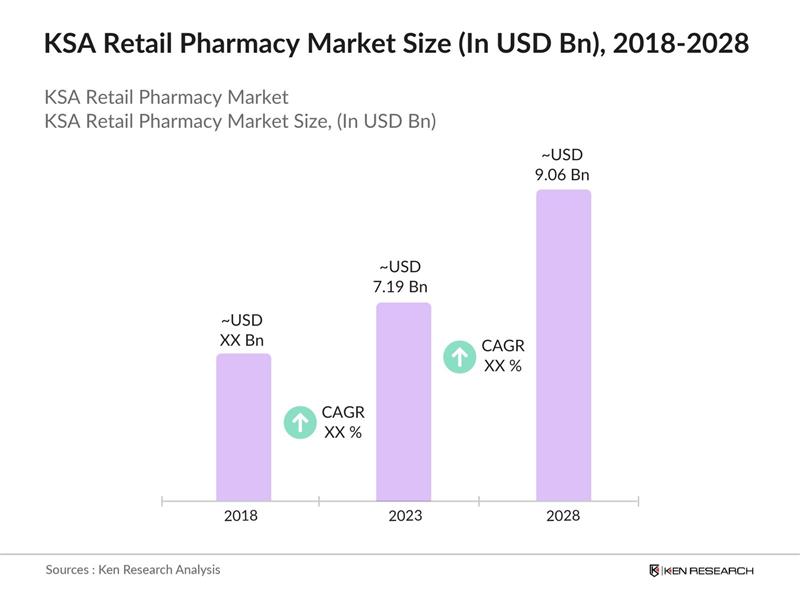

- The KSA retail pharmacy market was valued at 7.19 billion USD in 2023, driven by growing population expanding the customer base, rising chronic diseases leading to increased demand for health & wellness products, introduction of e-prescription platforms resulting in higher volume of prescriptions per pharmacy, and increasing consumer expenditure on healthcare.

- The retail pharmacy market in KSA is dominated by key players such as Nahdi Medical Company, Al-Dawaa Medical Services Co., United Pharmacies, Planet Pharmacy (Acquired by Gulf Pharmaceuticals Industries (Julphar)), and GHC Group (Kunooz Pharmacy and Whites). These players have established a strong presence through extensive networks, customer loyalty programs, and a diverse product range that includes both over-the-counter and prescription medicines.

- In 2022, Nahdi Medical Company launched IMDAD, a state-of-the-art Smart Logistics & Distribution Center, strategically located to serve the entire Kingdom of Saudi Arabia. Spanning an impressive 250,000 square meters, IMDAD is designed to enhance Nahdi's supply chain efficiency and capabilities significantly.

- Riyadh, Jeddah, and Dammam are the dominant cities in the KSA retail pharmacy market, accounting for a significant portion of the market share. Riyadh, the capital city, leads due to its large population and the presence of numerous healthcare facilities, which drive demand for pharmaceutical products.

KSA Retail Pharmacy Market Segmentation

The KSA Retail Pharmacy market is segmented by various factors like product, application, and region.

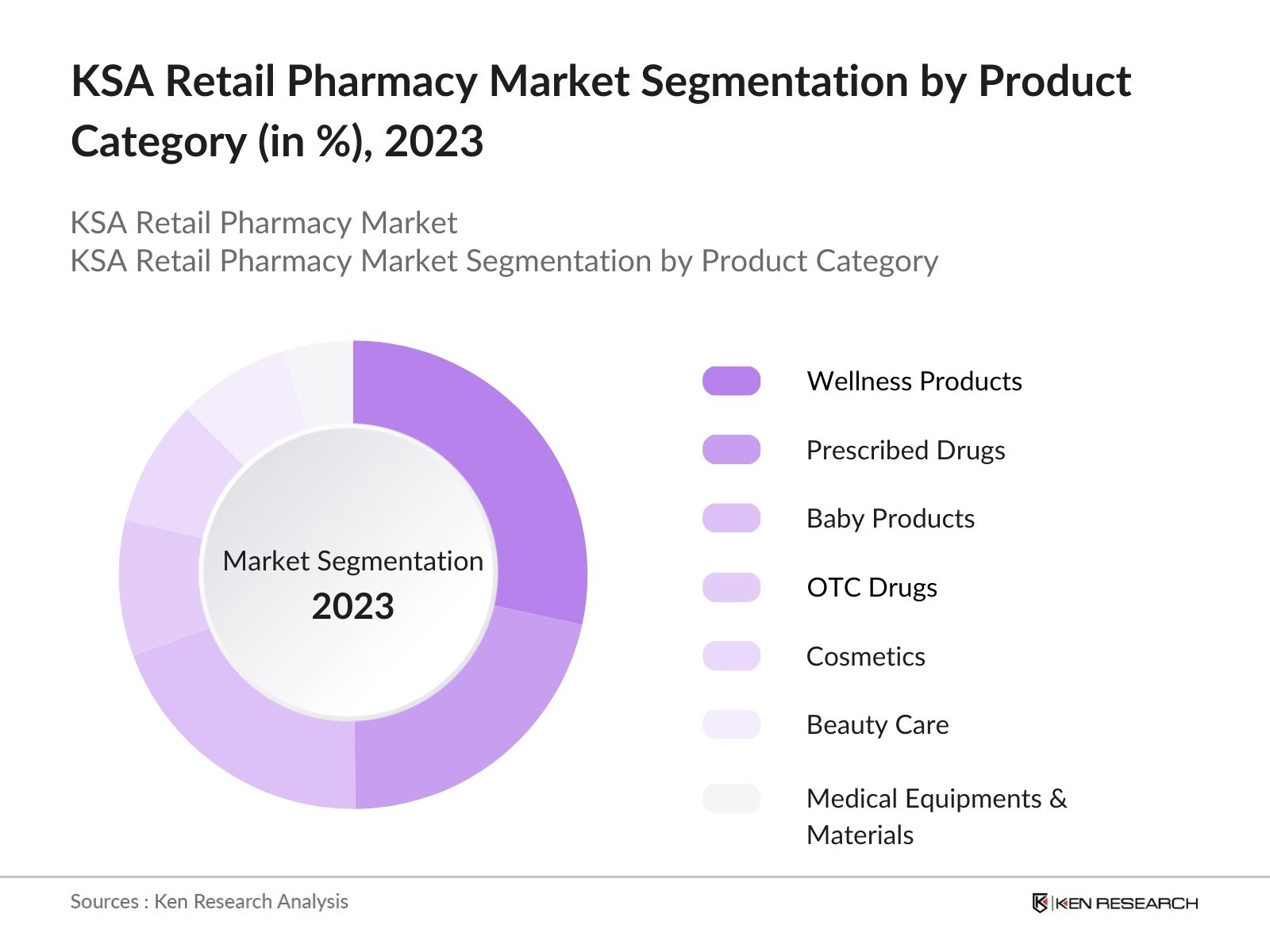

- By Product Category: The KSA retail pharmacy market is segmented by product category into prescribed drugs, OTC (Over-the-Counter) drugs, beauty care, cosmetics, baby products, wellness products, and medical equipment & materials. In 2023, the wellness products segment dominated the market due to a growing consumer focus on health and preventive care. The increasing awareness of fitness and well-being, coupled with the rising demand for supplements, vitamins, and health-related products, has driven the expansion of this segment.

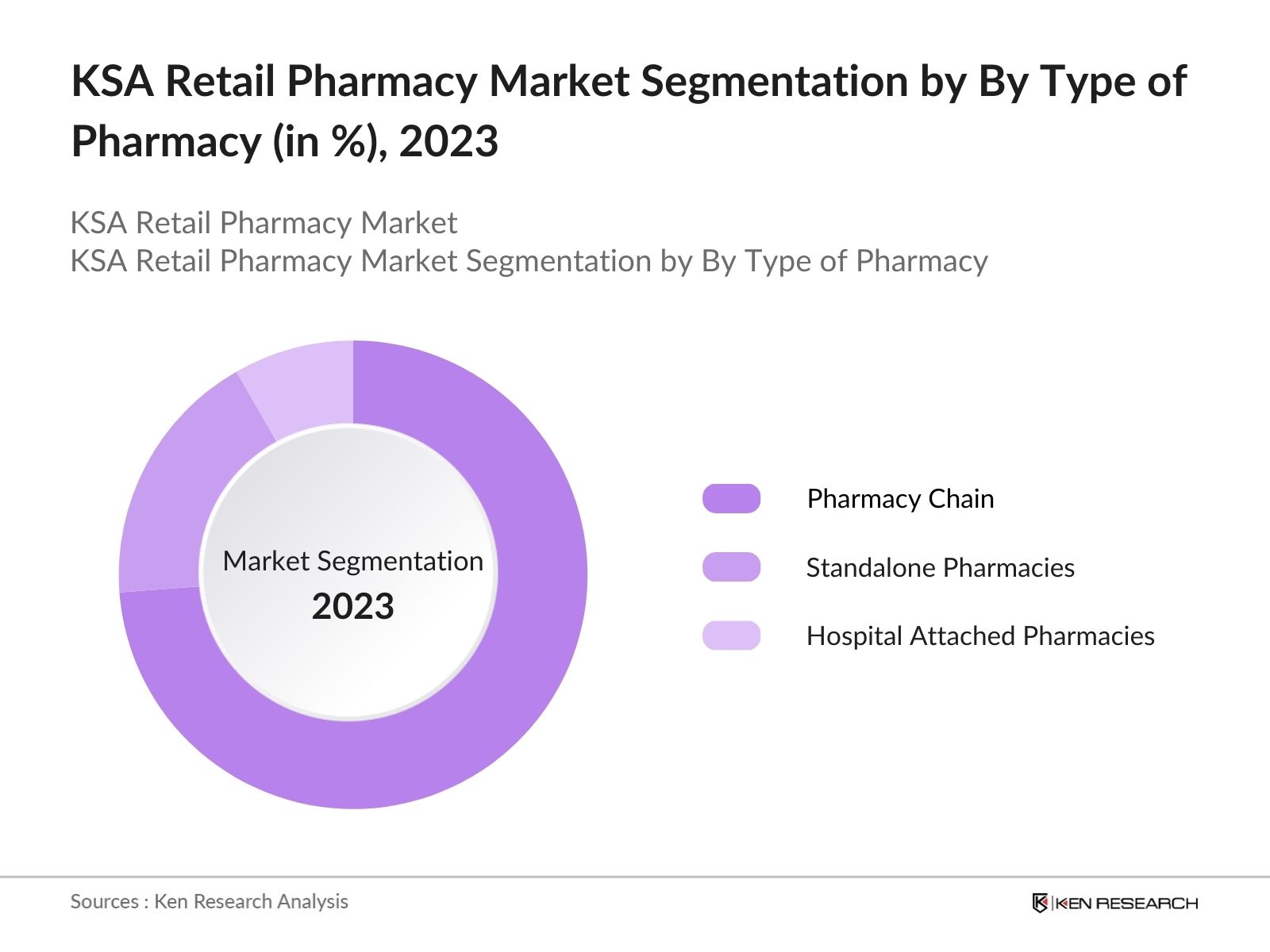

- By Type of Pharmacy: The KSA retail pharmacy market is segmented by the type of pharmacy into pharmacy chains, standalone pharmacies, and hospital-attached pharmacies. In 2023, pharmacy chains held the largest market share, driven by their extensive networks and standardized service offerings across multiple locations. Pharmacy chains like Nahdi and Al-Dawaa have established a strong market presence by providing a consistent customer experience, and offering a wide range of products.

- By Region: The KSA retail pharmacy market is segmented by region into Riyadh, Jeddah, Eastern Region (including Dammam, Al-Ahsa, Hafr-Al Baten, etc.), Makkah, Aseer, Madinah, Jazan, Qaseem, and the rest of KSA (including Taif, Tabouk, Ha`il, Najran, Al-Jouf, Al-Baha, Bishah, Qunfudah, Qurayyat, etc.). Riyadh dominated the market in 2023 due to its status as the capital and largest city in the Kingdom, with a dense population and a high concentration of healthcare facilities.

KSA Retail Pharmacy Market Competitive Landscape

|

Company Name |

Year of Establishment |

Geographical Spread (2023) |

Number of Pharmacy (2023) |

|

Nahdi Medical Company |

1986 |

140+ cities |

1,120 |

|

Al-Dawaa Medical Services Co. |

1991 |

131 Cities |

890 |

|

United Pharmaceuticals Company |

1990 |

44 Cities |

325 |

|

Planet Pharmacy (Acquired by Gulf Pharmaceuticals Industries (Julphar)) |

2007 |

15+ Cities |

~170 |

|

GHC Group (Kunooz Pharmacy and Whites) |

2007 |

22+ Cities |

220+ |

|

Innova Pharmacies |

1994 |

15 Cities |

~178 |

|

Al Mujtama |

2001 |

9 Cities |

125 |

- Al-Dawaa Medical Services Co.: In 2021, Al-Dawaa Medical Services Co. significantly expanded its retail footprint by opening 50 new pharmacies across various regions of Saudi Arabia. This strategic move was part of Nahdi’s broader growth plan to increase its accessibility and service coverage, particularly in underserved areas where the need for quality healthcare services is rapidly growing.

- Planet Pharmacy: In 2021, Gulf Pharmaceuticals Industries, commonly known as Julphar, made a strategic move to strengthen its footprint in the retail pharmacy sector by acquiring a significant stake in Planet Pharmacies. This acquisition was a key component of Julphar's broader strategy to deepen its presence and expand its operations across the Kingdom of Saudi Arabia.

KSA Retail Pharmacy Market Analysis

Growth Drivers

- Expanding Population Enhancing Customer Base: The population of Saudi Arabia is projected to grow from 36 million in 2023 to 40 million by 2030, leading to a broader customer base for pharmacies, encompassing both Saudi nationals and expatriates. Additionally, the increasing participation of women in the workforce is driving up sales of non-pharmaceutical products, such as beauty and mom & baby items, predominantly sold through retail pharmacies. Major pharmacy chains like Nahdi and Al Dawaa are responding to this expanding customer base and changing demands by diversifying their product ranges.

- Rising Chronic Diseases Boosting Demand for Health & Wellness Products: The prevalence of diabetes in Saudi Arabia has increased from 15.8% in 2018 to 20.2% in 2023 and is expected to climb to 26.3% by 2028. Similarly, obesity rates have grown from 37.7% in 2018 to 40.6% in 2023, with projections suggesting a rise to 43.5%. This growing burden of chronic diseases, including diabetes, obesity, and heart disease, is driving consumers to prioritize health and wellness, leading to increased purchases of products like vitamins, protein supplements, and Omega-3 or fish oil tablets from pharmacies.

- Increasing Consumer Spending on Healthcare: Consumer spending on healthcare in Saudi Arabia has risen from SAR 18 billion in 2018 to SAR 21 billion in 2023, marking an approximate 17% increase during this period. This heightened expenditure is boosting the demand for both pharmaceutical and non-pharmaceutical products, as consumers are increasingly willing to invest in healthcare, including wellness products and home-based medical devices like blood sugar monitors and blood pressure equipment.

Challenges

- Regulatory Compliance Pressuring Pharmacy Profit Margins: The Saudi government’s regulation of pharmaceutical product prices limits the profit margins for pharmacies, making it challenging for them to compete based on price alone. Additionally, the government's emphasis on promoting generic drugs further compresses profitability, particularly for smaller independent pharmacies, as these products come with significantly lower prices and margins.

- Intense Competition Leading to Market Saturation: With over 10,000 pharmacies operating across Saudi Arabia, the market is highly competitive, making it difficult for new or smaller players to gain market share. Established pharmacy chains like Al Nahdi and Al Dawaa have created significant entry barriers by leveraging their extensive networks and size to secure lower prices from suppliers, enabling them to offer more competitive pricing to customers. Al Nahdi, with more than 1,200 outlets, also invests heavily in marketing and loyalty programs to attract and retain customers.

Government Initiatives

- Healthcare Transformation Plan: Saudi Arabia has launched an ambitious healthcare transformation plan under Vision 2030, aimed at privatizing 295 hospitals by 2030 to improve quality and efficiency. Key initiatives include establishing health clusters, creating the National Centre for Privatization & PPP, and enacting the Private Sector Participation (PSP) Law to facilitate the privatization process and attract private investment in the healthcare sector.

- Regulation of Pharmaceutical Prices and Promotion of Generic Drugs: The Saudi Food and Drug Authority (SFDA) has implemented stringent regulations on pharmaceutical pricing to ensure affordability and accessibility of medications for the population. Alongside this, the government has been actively promoting the use of generic drugs as a cost-effective alternative to branded medications.

KSA Retail Pharmacy Future Market Outlook

The KSA retail pharmacy market is poised for remarkable growth reaching a market size of 9.06 billion USD driven by transition to integrated stores from smaller stores, emphasis on generic drugs, and growing sales from ecommerce.

Future Market Trends

- Transition to Integrated Stores from Smaller Stores: The retail pharmacy market in Saudi Arabia is expected to witness a shift from smaller, standalone stores to larger, integrated pharmacy outlets. These integrated stores will combine a wide range of services and products under one roof, offering not only pharmaceuticals but also health and wellness products, beauty care, and even on-site medical consultations.

- Emphasis on Generic Drugs: The Saudi government and healthcare providers will increasingly promote the use of generic drugs as a cost-effective alternative to branded medications. This trend will be driven by the need to reduce healthcare costs while maintaining access to essential medicines for the population. As a result, pharmacies are expected to place greater emphasis on stocking and selling generic drugs, which are chemically equivalent to their branded counterparts but will be offered at significantly lower prices.

Scope of the Report

|

By Product |

Prescribed Drugs OTC Drugs Beauty Care Cosmetics Baby Products Wellness Products Medical Equipment & Materials |

|

By Type of Pharmacy |

Pharmacy Chain Standalone Pharmacies Hospital Attached Pharmacies |

|

By Region |

Riyadh Jeddah Eastern (Including Dammam, Al-Ahsa, Hafr-Al Baten, etc.) Makkah Aseer Madinah Jazan Qaseem Rest of KSA (Taif, Tabouk, Ha`il, Najran, Al-Jouf, Al-Baha, Bishah, Qunfudah, Qurayyat, etc.) |

Products

Key Target Audience

- Pharmaceutical Manufacturers

- Retail Pharmacy Chains

- E-Pharmacy Platforms

- Healthcare Providers

- Medical Device Manufacturers

- Healthcare Distributors and Wholesalers

- Insurance Companies

- Banks and Financial Institutions

- Investors Venture Capitalist

- Government Agencies and Regulatory Bodies (SFDA)

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

- Nahdi Medical Company

- Al-Dawaa Medical Services Co.

- United Pharmaceuticals Company

- Planet Pharmacy (Acquired by Gulf Pharmaceuticals Industries (Julphar))

- GHC Group (Kunooz Pharmacy and Whites)

- Innova Pharmacies

- Al Mujtama

- Seha Pharmacies

- Tadawi Pharmacy

- Al Nahdi Al Arabia

- Dawaee Pharmacies

- Al Mutlaq Pharmacy

- Madinah Pharmacies

- Tamkeen Pharmacies

- Al Manar Pharmacy

Table of Contents

1. KSA Retail Pharmacy Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Valuation and Historical Performance

1.4 Key Market Trends and Developments

1.5 Market Segmentation Overview

2. KSA Retail Pharmacy Market Size (in USD Bn), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Retail Pharmacy Market Analysis

3.1 Growth Drivers

3.1.1 Expanding Population Enhancing Customer Base

3.1.2 Rising Chronic Diseases Boosting Demand for Health & Wellness Products

3.1.3 Increasing Consumer Spending on Healthcare

3.2 Challenges

3.2.1 Regulatory Compliance Pressuring Pharmacy Profit Margins

3.2.2 Intense Competition Leading to Market Saturation

3.3 Opportunities

3.3.1 Expansion of E-commerce in Pharmacy Sales

3.3.2 Growth of Wellness and Preventive Care Products

3.3.3 Increasing Integration of Digital Health Platforms

3.4 Trends

3.4.1 Transition to Integrated Stores from Smaller Stores

3.4.2 Emphasis on Generic Drugs

3.5 Government Initiatives

3.5.1 Vision 2030 Healthcare Reforms

3.5.2 Regulation of Pharmaceutical Prices and Promotion of Generic Drugs

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. KSA Retail Pharmacy Market Segmentation, 2023

4.1 By Product Category (in Value %)

4.1.1 Prescribed Drugs

4.1.2 OTC Drugs

4.1.3 Beauty Care

4.1.4 Cosmetics

4.1.5 Baby Products

4.1.6 Wellness Products

4.1.7 Medical Equipment & Materials

4.2 By Type of Pharmacy (in Value %)

4.2.1 Pharmacy Chain

4.2.2 Standalone Pharmacies

4.2.3 Hospital Attached Pharmacies

4.3 By Region (in Value %)

4.3.1 Riyadh

4.3.2 Jeddah

4.3.3 Eastern Region (Including Dammam, Al-Ahsa, Hafr-Al Baten, etc.)

4.3.4 Makkah

4.3.5 Aseer

4.3.6 Madinah

4.3.7 Jazan

4.3.8 Qaseem

4.3.9 Rest of KSA (Taif, Tabouk, Ha`il, Najran, Al-Jouf, Al-Baha, Bishah, Qunfudah, Qurayyat, etc.)

5. KSA Retail Pharmacy Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 Nahdi Medical Company

5.1.2 Al-Dawaa Medical Services Co.

5.1.3 United Pharmaceuticals Company

5.1.4 Planet Pharmacy (Acquired by Gulf Pharmaceuticals Industries (Julphar))

5.1.5 GHC Group (Kunooz Pharmacy and Whites)

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Number of Pharmacies)

6. KSA Retail Pharmacy Market Competitive Landscape Analysis

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

6.4.1 Venture Capital Funding

6.4.2 Government Grants

6.4.3 Private Equity Investments

7. KSA Retail Pharmacy Market Regulatory Framework

7.1 Vision 2030 Healthcare Reforms

7.2 Regulation of Pharmaceutical Prices and Promotion of Generic Drugs

7.3 Compliance Requirements and Certification Processes

8. KSA Retail Pharmacy Market Future Outlook (in USD Bn), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

8.3 Future Market Segmentation

8.3.1 By Product Category (in Value %)

8.3.2 By Type of Pharmacy (in Value %)

8.3.3 By Region (in Value %)

9. KSA Retail Pharmacy Market Analysts’ Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Market Player Identification and Product Mapping

Identification of major players operating in KSA Retail Pharmacy market and mapping their product offerings, including prescription drugs, over-the-counter medications, medical supplies, and other healthcare products. Then, aggregating the revenues of all the major players and arriving at an estimated market size figures using Bottom-Up approach.

Step 2: Primary Research via Stakeholder CATIs:

CATIs with the key stakeholders, such as pharmacy owners, managers, and executives, to understand their operating and financial indicators including key product categories, business and revenue model, geographical reach, revenues, future strategies and other value-adding information, including demand trends, competitive landscape, and regulatory environment.

Step 3: Bottom-Up Market Estimation and Segmentation:

Our team adopted Bottom-Up approach in order to evaluate the segmentation shares, including product categories, type of pharmacy, and regional shares. Market size was calculated on the basis of revenues of major players and their prevailing share in the KSA market.

Step 4: Sanity Check and Validation:

Conducted sanity checking from industry veterans, healthcare professionals (i.e. pharmacists), distributors, and proxy variables, such as population size, per capita healthcare expenditure, rate of prevelance of chronic diseases, and other demographic and economic indicators.

Frequently Asked Questions

01 How big is the KSA Retail Pharmacy market?

The KSA retail pharmacy market was valued at USD 7.19 billion in 2023, driven by a growing population, rising chronic diseases, and increasing consumer expenditure on healthcare.

02 What are the challenges in the KSA Retail Pharmacy market?

Challenges in the KSA retail pharmacy market include regulatory pressures on profit margins, intense competition leading to market saturation, and the increasing emphasis on generic drugs, which lowers profitability for pharmacies.

03 Who are the major players in the KSA Retail Pharmacy market?

Major players in the KSA retail pharmacy market include Nahdi Medical Company, Al-Dawaa Medical Services Co., United Pharmaceuticals Company, and GHC Group (Kunooz Pharmacy and Whites), all of which have established strong market presence through extensive networks and diverse product offerings.

04 What are the growth drivers of the KSA Retail Pharmacy market?

The KSA retail pharmacy market is driven by factors such as a growing population, rising prevalence of chronic diseases, increasing consumer spending on healthcare, and the introduction of e-prescription platforms, which boost prescription volumes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.