KSA Revenue Cycle Management Market outlook to 2029

Region:Middle East

Author(s):Dev Chawla

Product Code:KRO036

July 2025

90

About the Report

KSA Revenue Cycle Management Market Overview

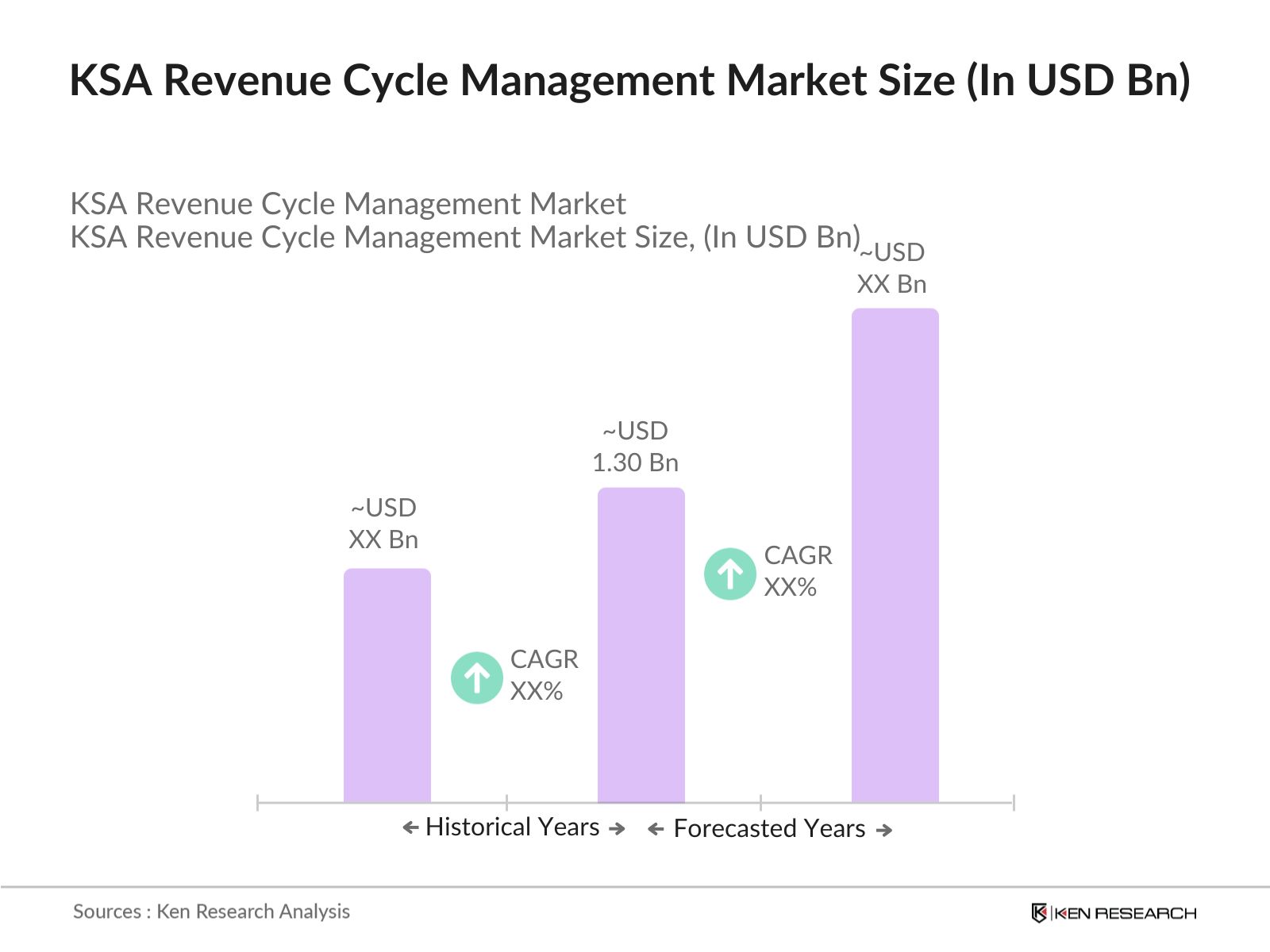

- The KSA Revenue Cycle Management Market is valued at USD 1.30 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital health solutions, the need for efficient billing processes, and the rising demand for healthcare services in the region. The market is also supported by the government's initiatives to enhance healthcare infrastructure and improve patient care.

- Key players in this market include Riyadh, Jeddah, and Dammam, which dominate due to their advanced healthcare facilities and concentration of healthcare providers. These cities are pivotal in the implementation of innovative revenue cycle management solutions, driven by a growing population and increasing healthcare expenditures, making them attractive for investment and development in the healthcare sector.

- The Saudi Health Insurance Law, enacted between 2016 and 2018, mandates health coverage for citizens and residents, improving healthcare access and streamlining revenue cycle management. Ongoing enforcement through 2023 includes digital platforms like NPHIES, enhancing payment efficiency. These initiatives remain vital, supporting Saudi Arabia’s healthcare financial modernization and Vision 2030 goals.

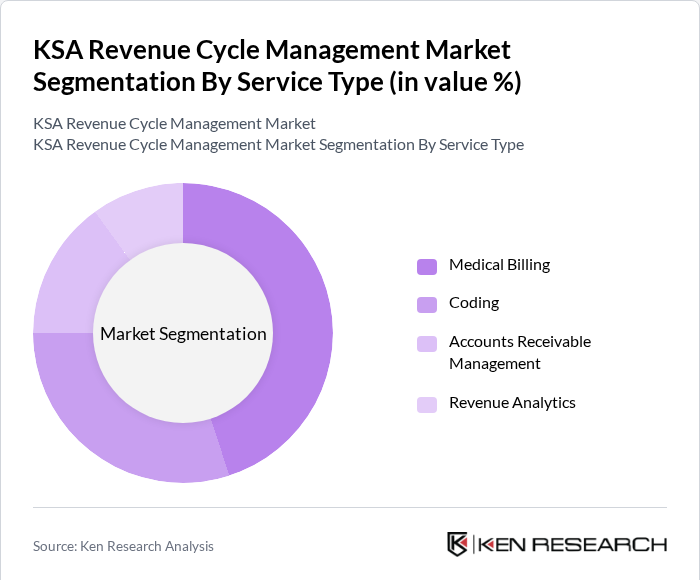

KSA Revenue Cycle Management Market Segmentation

By Service Type: The service type segmentation includes various offerings such as medical billing, coding, accounts receivable management, and revenue analytics. Among these, medical billing is the dominant sub-segment, driven by the increasing complexity of billing processes and the need for accurate claims submissions. Healthcare providers are increasingly outsourcing their billing functions to specialized firms to enhance efficiency and reduce errors, leading to a significant rise in demand for medical billing services.

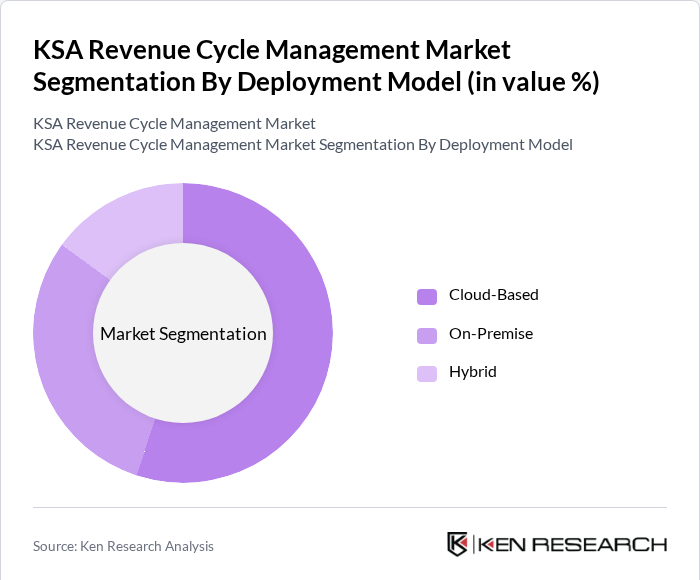

By Deployment Model: The deployment model segmentation includes cloud-based, on-premise, and hybrid solutions. The cloud-based sub-segment is currently leading the market due to its flexibility, scalability, and cost-effectiveness. Healthcare organizations are increasingly adopting cloud-based revenue cycle management solutions to streamline operations, enhance data security, and facilitate remote access to critical information, which is particularly important in the current digital landscape.

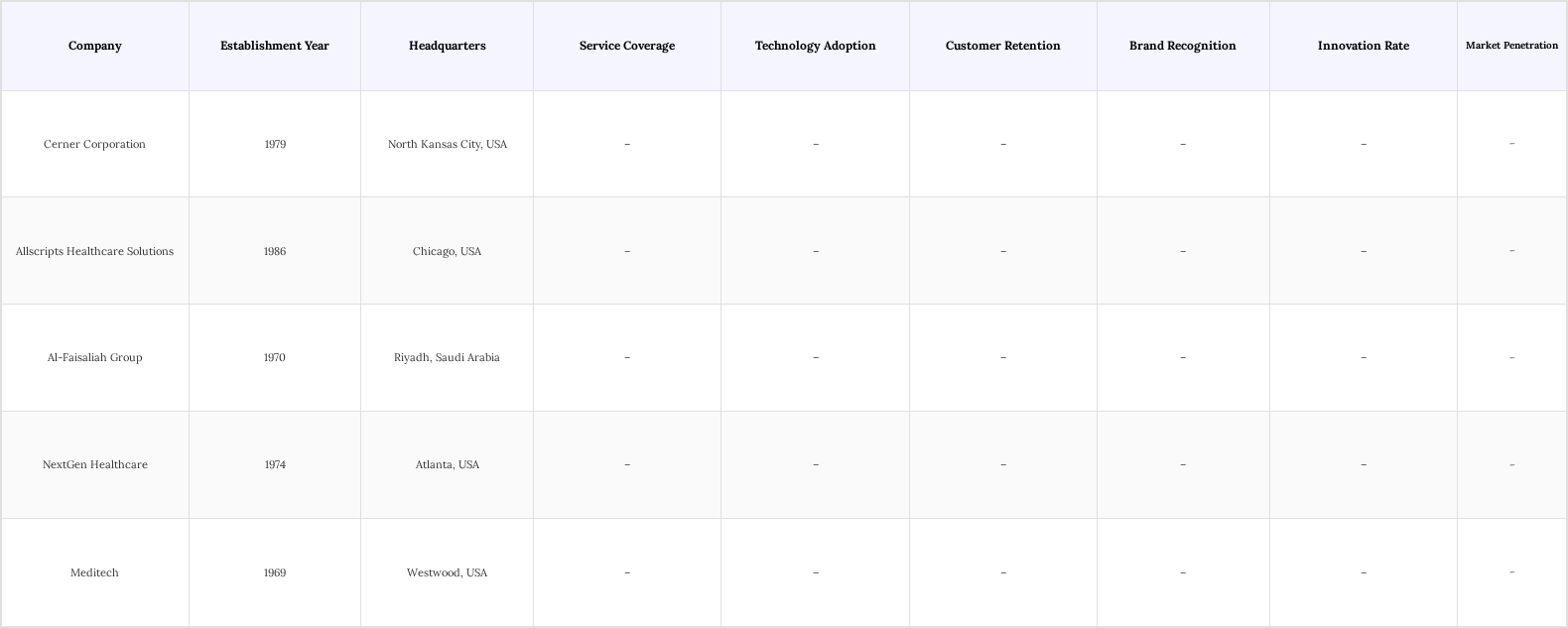

KSA Revenue Cycle Management Market Competitive Landscape

The KSA Revenue Cycle Management Market is characterized by a competitive landscape featuring both local and international players. Companies such as Cerner Corporation, Allscripts Healthcare Solutions, and local firms like Al-Faisaliah Group are key contributors to the market. The competition is driven by the need for innovative solutions, technological advancements, and the increasing demand for efficient revenue cycle management processes among healthcare providers.

KSA Revenue Cycle Management Market Industry Analysis

Growth Drivers

- Increasing Demand for Efficient Healthcare Services: The KSA healthcare sector is projected to grow significantly, with government spending expected to reach approximately USD 60 billion by 2024. This surge in investment is driven by a rising population and an increasing prevalence of chronic diseases, necessitating more efficient revenue cycle management (RCM) solutions. Enhanced patient care and operational efficiency are critical, leading healthcare providers to adopt RCM systems that streamline billing and collections, ultimately improving cash flow and service delivery.

- Adoption of Advanced Technologies in Healthcare: The integration of advanced technologies, such as artificial intelligence and machine learning, is transforming the KSA healthcare landscape. By 2024, healthcare facilities will implement AI-driven RCM solutions, enhancing accuracy in billing and coding processes. This technological shift not only reduces errors but also accelerates revenue collection cycles, allowing healthcare providers to focus on patient care while optimizing financial performance through innovative RCM practices.

- Rising Focus on Reducing Operational Costs: With operational costs in the KSA healthcare sector projected to rise by 6% annually, healthcare providers are increasingly seeking ways to enhance efficiency. Implementing RCM solutions can lead to a reduction in administrative costs by up to 25%, as these systems automate billing processes and improve claims management. This focus on cost reduction is driving the adoption of RCM services, enabling healthcare organizations to allocate resources more effectively and improve overall financial health.

Market Challenges

- Complexity of Regulatory Compliance: Navigating the regulatory landscape in KSA poses significant challenges for healthcare providers. Compliance with local and international regulations, such as the Saudi Health Information Exchange (SHIE) standards, requires substantial investment in RCM systems. In 2024, it is estimated that compliance-related costs could account for a good part of total operational expenses, hindering the ability of smaller healthcare facilities to adopt advanced RCM solutions and maintain competitiveness in the market.

- High Initial Investment Costs for RCM Solutions: The upfront costs associated with implementing RCM solutions can be a barrier for many healthcare providers in KSA. This financial burden can deter smaller practices from adopting necessary technologies, limiting their ability to compete effectively and optimize revenue cycles in an increasingly digital healthcare environment.

KSA Revenue Cycle Management Market Future Outlook

The KSA Revenue Cycle Management market is poised for significant transformation as healthcare providers increasingly prioritize efficiency and patient-centric care. The integration of telehealth services and advanced analytics is expected to reshape RCM processes, enhancing revenue optimization. Additionally, the growing emphasis on value-based care models will drive further innovation in RCM solutions, enabling healthcare organizations to adapt to evolving patient needs while ensuring financial sustainability in a competitive landscape.

Market Opportunities

- Expansion of Telehealth Services: The rapid growth of telehealth services presents a significant opportunity for RCM providers. As more healthcare organizations adopt telehealth, the demand for integrated RCM solutions that can handle virtual billing and coding will increase, creating a lucrative market for innovative service providers.

- Integration of Artificial Intelligence in RCM Processes: The incorporation of AI technologies in RCM processes is expected to enhance operational efficiency and accuracy. By 2024, AI-driven RCM solutions could reduce claim denials by up to 35%, presenting a substantial opportunity for companies that develop and implement these advanced systems, ultimately improving financial outcomes for healthcare providers.

Scope of the Report

| By Service Type |

Medical Billing Coding Accounts Receivable Management Revenue Analytics |

| By Deployment Model |

On-Premise Cloud-Based Hybrid Solutions |

| By End-User |

Hospitals Physician Practices Ambulatory Surgical Centers Others |

| By Region |

Riyadh Jeddah Dammam Makkah |

| By Organization Size |

Small and Medium Enterprises (SMEs) Large Enterprises |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health, Saudi Food and Drug Authority)

Healthcare Providers (e.g., Hospitals, Clinics)

Insurance Companies

Healthcare IT Solution Providers

Billing and Coding Service Providers

Healthcare Management Organizations

Financial Institutions

Companies

Players Mentioned in the Report:

Cerner Corporation

Allscripts Healthcare Solutions

Al-Faisaliah Group

NextGen Healthcare

Meditech

HealthRev Solutions

Riyadh Revenue Management

MedCycle Innovations

KSA HealthFlow Systems

RevGenix Healthcare Solutions

Table of Contents

1. KSA Revenue Cycle Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Revenue Cycle Management Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Revenue Cycle Management Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand for efficient healthcare services

3.1.2. Adoption of advanced technologies in healthcare

3.1.3. Rising focus on reducing operational costs in healthcare facilities

3.2. Market Challenges

3.2.1. Complexity of regulatory compliance

3.2.2. High initial investment costs for RCM solutions

3.2.3. Resistance to change among healthcare providers

3.3. Opportunities

3.3.1. Expansion of telehealth services

3.3.2. Growing emphasis on patient-centric care

3.3.3. Integration of artificial intelligence in RCM processes

3.4. Trends

3.4.1. Shift towards value-based care models

3.4.2. Increased use of data analytics for revenue optimization

3.4.3. Rise of outsourcing RCM services to specialized firms

3.5. Government Regulation

3.5.1. Overview of healthcare regulations impacting RCM

3.5.2. Data protection and privacy laws affecting RCM practices

3.5.3. Compliance with international healthcare standards

3.5.4. Incentives for adopting electronic health records (EHRs)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. KSA Revenue Cycle Management Market Segmentation

4.1. By Service Type

4.1.1. Medical Billing

4.1.2. Coding

4.1.3. Accounts Receivable Management

4.1.4. Revenue Analytics

4.2. By Deployment Model

4.2.1. On-Premise

4.2.2. Cloud-Based

4.2.3. Hybrid Solutions

4.3. By End-User

4.3.1. Hospitals

4.3.2. Physician Practices

4.3.3. Ambulatory Surgical Centers

4.3.4. Others

4.4. By Region

4.4.1. Riyadh

4.4.2. Jeddah

4.4.3. Dammam

4.4.4. Makkah

4.5. By Organization Size

4.5.1. Small and Medium Enterprises (SMEs)

4.5.2. Large Enterprises

5. KSA Revenue Cycle Management Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cerner Corporation

5.1.2. Allscripts Healthcare Solutions

5.1.3. Al-Faisaliah Group

5.1.4. NextGen Healthcare

5.1.5. Meditech

5.1.6. HealthRev Solutions

5.1.7. Riyadh Revenue Management

5.1.8. MedCycle Innovations

5.1.9. KSA HealthFlow Systems

5.1.10. RevGenix Healthcare Solutions

5.2. Cross-Comparison Parameters

5.2.1. Market Share Analysis

5.2.2. Revenue Growth Rate

5.2.3. Customer Satisfaction Ratings

5.2.4. Product Innovation Index

5.2.5. Geographic Reach

5.2.6. Service Portfolio Diversity

5.2.7. Partnership and Collaboration Strength

5.2.8. Pricing Strategy Effectiveness

6. KSA Revenue Cycle Management Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Revenue Cycle Management Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Revenue Cycle Management Market Future Market Segmentation

8.1. By Service Type

8.1.1. Medical Billing

8.1.2. Coding

8.1.3. Accounts Receivable Management

8.1.4. Revenue Analytics

8.2. By Deployment Model

8.2.1. On-Premise

8.2.2. Cloud-Based

8.2.3. Hybrid Solutions

8.3. By End-User

8.3.1. Hospitals

8.3.2. Physician Practices

8.3.3. Ambulatory Surgical Centers

8.3.4. Others

8.4. By Region

8.4.1. Riyadh

8.4.2. Jeddah

8.4.3. Dammam

8.4.4. Makkah

8.5. By Organization Size

8.5.1. Small and Medium Enterprises (SMEs)

8.5.2. Large Enterprises

9. KSA Revenue Cycle Management Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Revenue Cycle Management Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the KSA Revenue Cycle Management Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA Revenue Cycle Management Market.

Frequently Asked Questions

01. How big is the KSA Revenue Cycle Management Market?

The KSA Revenue Cycle Management Market is valued at USD 1.30 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the KSA Revenue Cycle Management Market?

Key challenges in the KSA Revenue Cycle Management Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the KSA Revenue Cycle Management Market?

Major players in the KSA Revenue Cycle Management Market include Cerner Corporation, Allscripts Healthcare Solutions, Al-Faisaliah Group, NextGen Healthcare, and Meditech, among others.

04. What are the growth drivers for the KSA Revenue Cycle Management Market?

The primary growth drivers for the KSA Revenue Cycle Management Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.