KSA Rice Bran Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3940

December 2024

91

About the Report

KSA Rice Bran Market Overview

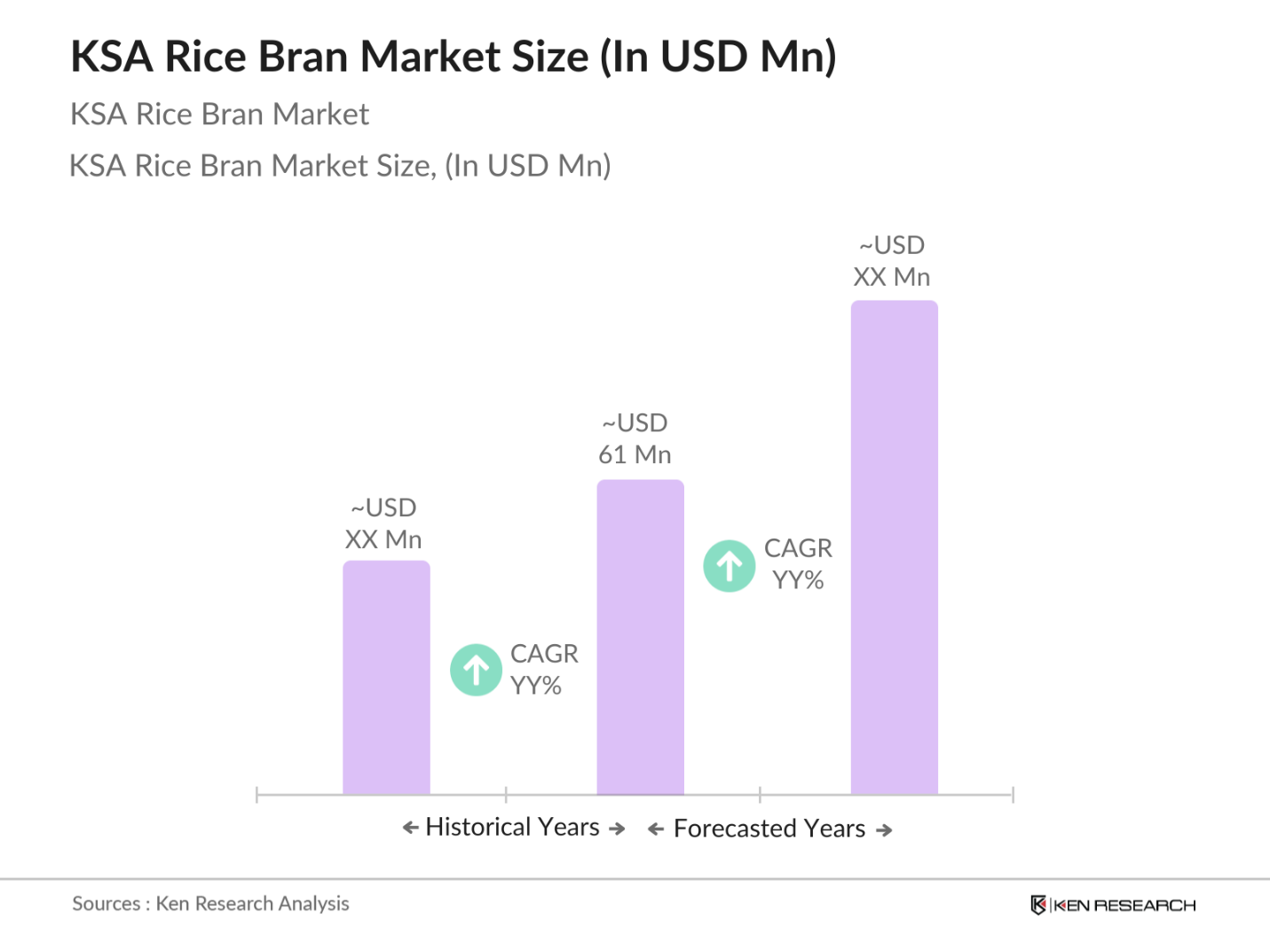

- The KSA Rice Bran Market is valued at approximately USD 61 million, driven by increasing demand for rice bran oil and other by-products in the food and animal feed industries. The market has seen consistent growth due to the rising awareness of the health benefits of rice bran oil, which is rich in antioxidants and vitamins.

- The Eastern Province and Central Region dominate the KSA rice bran market, primarily due to their favorable climatic conditions for rice cultivation and proximity to industrial processing centers. These regions benefit from significant investment in agro-processing infrastructure and have a high concentration of rice mills, which ensures a steady supply of rice bran for the production of oil and other value-added products. Additionally, the logistical advantages of being close to major transportation hubs make these regions ideal for both domestic consumption and exports.

- In 2022, Saudi Arabia revised its export regulations to ease tariffs on agricultural products, including rice bran oil and animal feed, as part of broader efforts to diversify its economy. The government also signed bilateral trade agreements with key markets in the MENA region to facilitate the export of agricultural products. These regulatory changes are expected to boost the competitiveness of KSAs rice bran industry in international markets.

KSA Rice Bran Market Segmentation

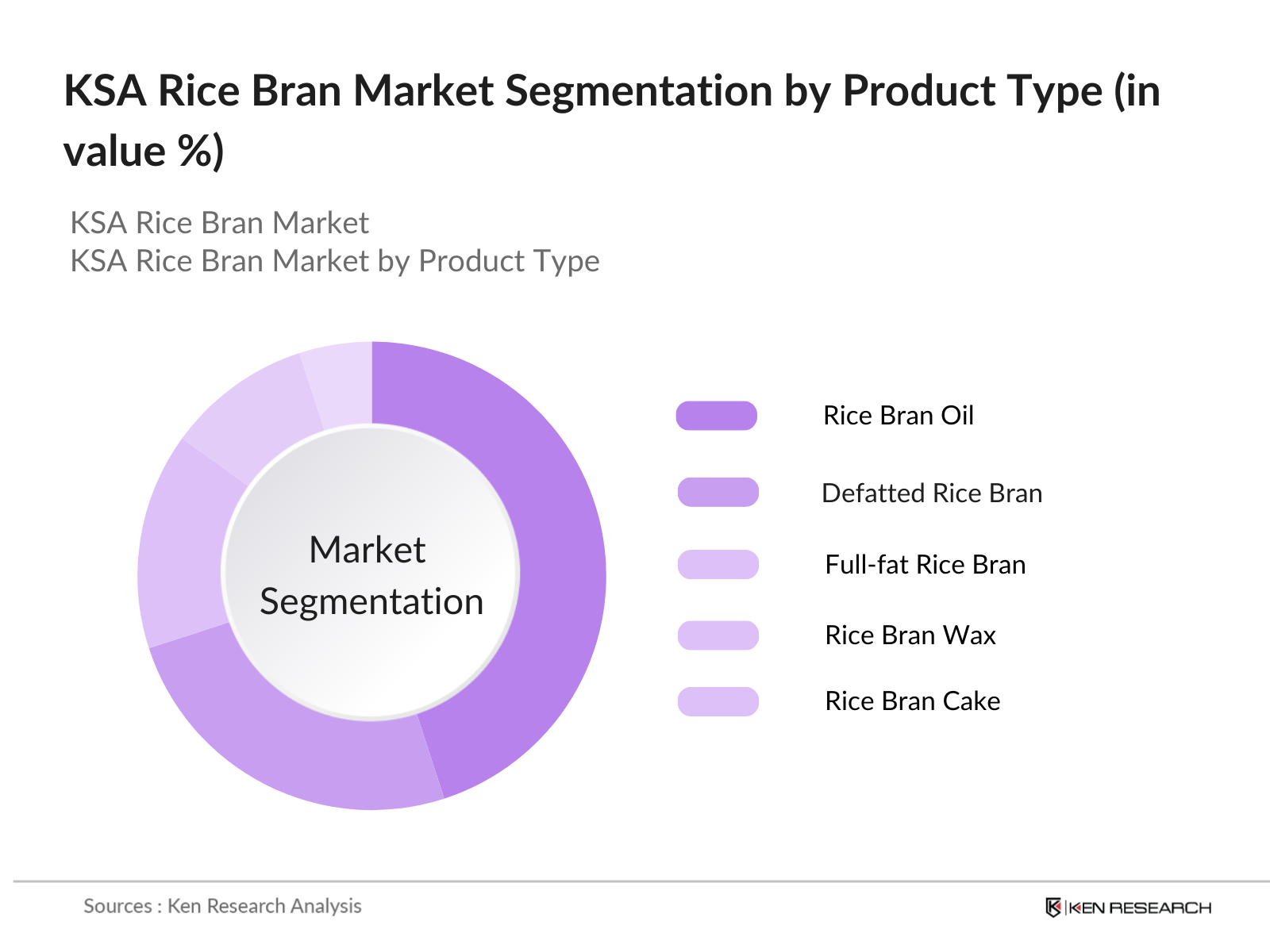

By Product Type: The KSA Rice Bran market is segmented by product type into rice bran oil, defatted rice bran, full-fat rice bran, rice bran wax, and rice bran cake. Rice bran oil holds a dominant share in this segmentation, owing to its increasing use in cooking oils and health supplements. The growing awareness of its health benefits, such as reducing cholesterol and promoting heart health, has led to its widespread adoption among health-conscious consumers. Rice bran oil also sees strong demand in the food and beverage industry for its versatility and nutritional properties.

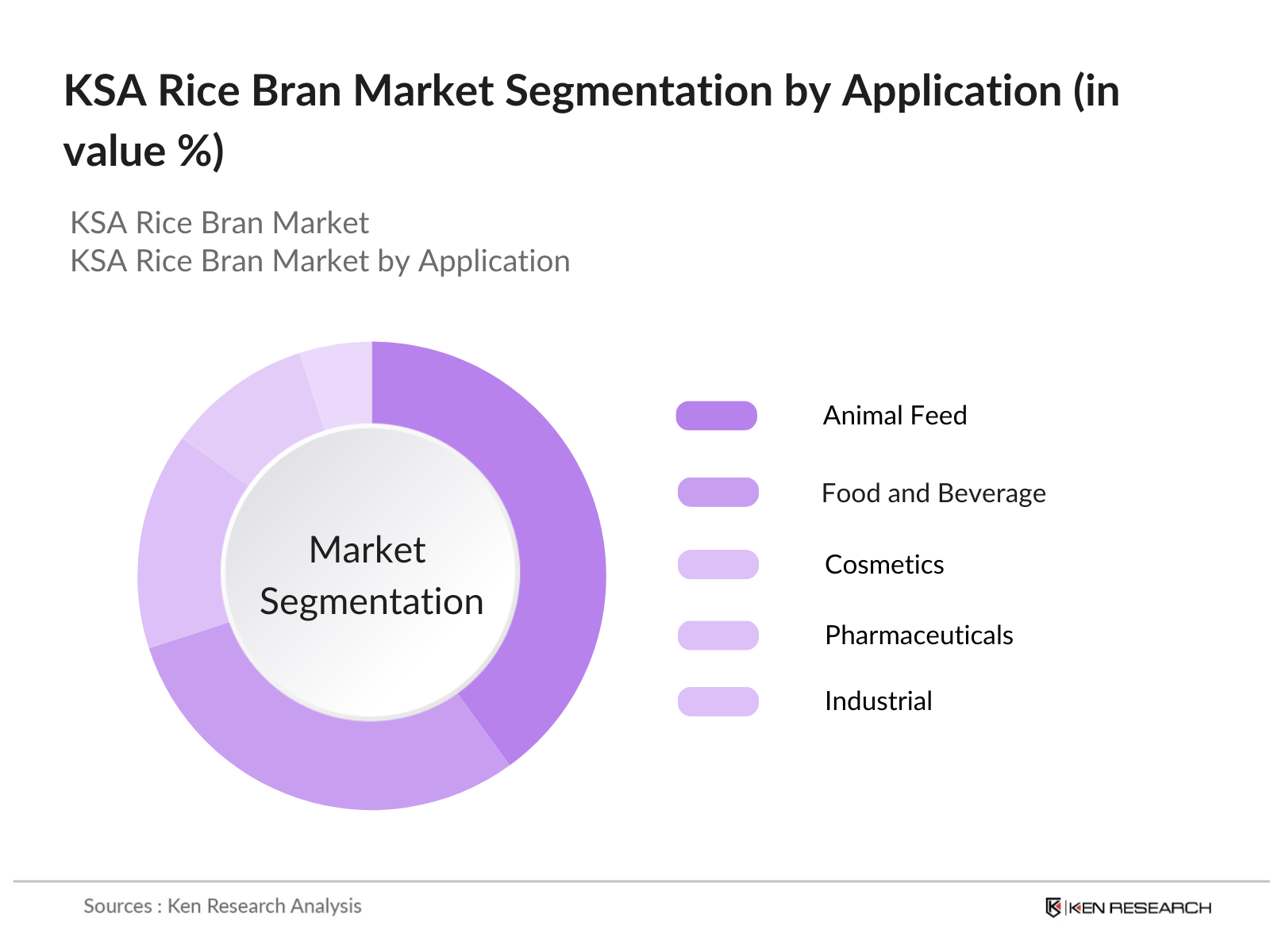

By Application: The KSA Rice Bran market is segmented by application into food and beverage, animal feed, cosmetics, pharmaceuticals, and industrial uses. The animal feed segment holds a dominant market share, primarily due to the high nutritional value of rice bran, which is rich in proteins and essential nutrients, making it an ideal ingredient for livestock and poultry feed. The government's focus on advancing the domestic animal husbandry industry has further driven the adoption of rice bran in feed formulations. Additionally, the trend toward fortified animal feed has amplified the demand for defatted rice bran, given its role in enhancing the nutritional profile of feed products.

KSA Rice Bran Market Competitive Landscape

The KSA Rice Bran market is dominated by a combination of local and global players who benefit from strong distribution networks and established production facilities. Companies in this market are focusing on expanding their product portfolios to meet the rising demand for rice bran by-products across industries like food, cosmetics, and pharmaceuticals. The market also witnesses partnerships between local processors and international firms, strengthening both production capacity and technological advancements.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity (MT) |

Revenue (SAR Mn) |

Product Lines |

Certifications |

Geographical Reach |

|

Savola Group |

1979 |

Riyadh |

|||||

|

Al-Jazira Foods |

1992 |

Jeddah |

|||||

|

Olam Agri |

1989 |

Singapore |

|||||

|

Cargill |

1865 |

Minnesota, USA |

|||||

|

Gulf Rice Bran Oil Co. |

2001 |

Dammam |

KSA Rice Bran Market Analysis

Market Growth Drivers

- Rising Demand for Edible Oils: The KSA rice bran market is experiencing a surge in demand due to the increasing popularity of rice bran oil, known for its health benefits like high Vitamin E content. In 2023, Saudi Arabia imported over 750,000 metric tons of rice annually to meet domestic needs, increasing the availability of rice bran for oil extraction. The global trend towards healthier oils is further amplified by rising disposable incomes in KSA, contributing to demand for alternatives such as rice bran oil. Government-backed projects in rice farming are playing a critical role in bolstering production.

- Government Programs for Rice Agriculture (Agricultural Investments): The Kingdom of Saudi Arabia has been actively investing in modernizing its agricultural sector, particularly in rice production, to enhance food security and reduce import reliance. In 2022, the government allocated $2 billion for the development of agricultural technologies and the construction of advanced irrigation systems to boost rice yields. These initiatives have led to an increased availability of rice by-products, including rice bran, which is vital for the production of rice bran oil and animal feed.

- Expansion of the Animal Feed Sector: Rice bran is widely used in animal feed due to its high nutritional content, and KSAs animal feed sector has grown significantly, driven by increasing livestock numbers. By 2023, the livestock population in the Kingdom had exceeded 20 million, increasing demand for high-quality feed. The Ministry of Environment, Water, and Agriculture has supported initiatives to incorporate more rice bran into animal feed, thus contributing to the demand for this by-product.

Market Challenges

- Lack of Processing Facilities: KSA currently faces a shortage of advanced rice milling and bran processing facilities. As of 2022, only a few large-scale mills in the country were equipped to process rice bran into oil and other products. This has led to a reliance on imports for value-added products like rice bran oil. The limited infrastructure hampers the growth of local rice bran-based industries, necessitating investments in processing technologies.

- Volatility in Rice Production: Rice production in Saudi Arabia is highly dependent on favorable weather conditions and water availability, both of which can be unpredictable. The Kingdom produced around 340,000 metric tons of rice in 2022, but climate-related issues such as drought have sometimes reduced yields, impacting the availability of rice bran. Additionally, Saudi Arabia's heavy reliance on water-intensive crops like rice poses long-term sustainability challenges.

KSA Rice Bran Market Future Outlook

Over the next five years, the KSA Rice Bran market is expected to witness steady growth, driven by a surge in demand for healthier cooking oils and the expansion of the animal feed industry. Government initiatives aimed at boosting local agriculture and food processing industries, combined with technological advancements in rice milling, are set to enhance production efficiency and product quality. The increasing awareness of rice brans health benefits will further propel its adoption across various sectors, including food, cosmetics, and pharmaceuticals.

Market Opportunities:

- Adoption of Advanced Rice Milling Technologies: Saudi Arabia has started to invest in more efficient rice milling technologies, improving the extraction rate of rice bran. As of 2023, the number of modern milling facilities in the Kingdom increased by 15%, reducing waste in rice production and improving the quality of by-products like bran. This shift towards technological advancement in the agro-processing sector aligns with Saudi Vision 2030 and is expected to create more efficient supply chains for rice bran-based products.

- Growing Interest in Plant-based Ingredients: Driven by global health trends, there is growing interest in plant-based ingredients like rice bran in the Saudi market. By 2023, the plant-based food market in the GCC, including KSA, was worth $100 million, and rice bran has become an increasingly popular choice for producing plant-based oils and supplements. This trend is expected to support the growth of rice bran-based products in both the food and cosmetic sectors.

Scope of the Report

|

By Product Type |

Rice Bran Oil Defatted Rice Bran Full-fat Rice Bran Rice Bran Wax Rice Bran Cake |

|

By Display Technology |

Food and Beverage Animal Feed Cosmetics Pharmaceuticals Industrial |

|

By Application |

Solvent Extraction Physical Extraction Expeller Pressing |

|

By End-User |

Direct Sales Online Retail Distributors |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Rice Bran Processors

Food and Beverage Manufacturers

Animal Feed Producers

Cosmetics Manufacturers

Pharmaceutical Companies

Agricultural Investment Firms

Government and Regulatory Bodies (KSA Ministry of Environment, Water, and Agriculture)

Venture Capital and Investment Firms

Companies

Players Mention in the Report

Savola Group

Al-Jazira Foods

Olam Agri

Cargill

Gulf Rice Bran Oil Co.

Archer Daniels Midland (ADM)

Wilmar International

Bunge Limited

Riceland Foods

General Mills

A.P. Organics

Golden Agri-Resources

Solvent Extractors Association

Hindustan Unilever Limited

Almarai

Table of Contents

01. KSA Rice Bran Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Demand for By-products, Government Initiatives)

1.4. Market Segmentation Overview (By Product Type, Application, Region, Processing Method, and Sales Channel)

02. KSA Rice Bran Market Size (In SAR Mn)

2.1. Historical Market Size (Consumption Trends, Rice Bran Oil Demand)

2.2. Year-on-Year Growth Analysis (Rice Bran Exports, Local Production)

2.3. Key Market Developments and Milestones (Rice Milling Developments, Industrial Applications)

03. KSA Rice Bran Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Edible Oils

3.1.2. Increasing Health Awareness

3.1.3. Government Programs for Rice Agriculture (Vision 2030, Agricultural Investments)

3.1.4. Expansion of the Animal Feed Sector

3.2. Market Challenges

3.2.1. Lack of Processing Facilities

3.2.2. Volatility in Rice Production

3.2.3. Quality Control and Standardization Issues

3.3. Opportunities

3.3.1. Value-added Rice Bran Products (Rice Bran Oil, Animal Feed)

3.3.2. Industrial Applications (Cosmetics, Pharmaceuticals)

3.3.3. Export Market Expansion (High-value Nutritional Products)

3.4. Trends

3.4.1. Adoption of Advanced Rice Milling Technologies

3.4.2. Growing Interest in Plant-based Ingredients

3.4.3. Increasing Investment in Agro-processing Industries

3.5. Government Regulation

3.5.1. KSA Agricultural Policy (Subsidies for Rice Milling)

3.5.2. Rice Bran Oil Standards and Certifications (Health and Safety Compliance)

3.5.3. Export Regulations (Trade Agreements and Tariffs)

3.6. SWOT Analysis

3.6.1. Strengths (Growing Rice Cultivation)

3.6.2. Weaknesses (Limited Value Chain Integration)

3.6.3. Opportunities (Potential in Cosmetic Industry)

3.6.4. Threats (Price Volatility in Raw Material Supply)

3.7. Stakeholder Ecosystem (Rice Farmers, Processors, Distributors, Government Agencies)

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. KSA Rice Bran Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Rice Bran Oil

4.1.2. Defatted Rice Bran

4.1.3. Full-fat Rice Bran

4.1.4. Rice Bran Wax

4.1.5. Rice Bran Cake

4.2. By Application (In Value %)

4.2.1. Food and Beverage

4.2.2. Animal Feed

4.2.3. Cosmetics

4.2.4. Pharmaceuticals

4.2.5. Industrial

4.3. By Processing Method (In Value %)

4.3.1. Solvent Extraction

4.3.2. Physical Extraction

4.3.3. Expeller Pressing

4.4. By Sales Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Online Retail

4.4.3. Distributors

4.5. By Region (In Value %)

4.5.1. Eastern Province

4.5.2. Central Region

4.5.3. Western Region

4.5.4. Northern Borders

05. KSA Rice Bran Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Savola Group

5.1.2. Al-Jazira Foods

5.1.3. Olam Agri

5.1.4. Archer Daniels Midland (ADM)

5.1.5. Cargill

5.1.6. Riceland Foods

5.1.7. Bunge Limited

5.1.8. Wilmar International

5.1.9. A.P. Organics

5.1.10. Golden Agri-Resources

5.1.11. General Mills

5.1.12. Solvent Extractors Association

5.1.13. Gulf Rice Bran Oil Co.

5.1.14. Almarai

5.1.15. Hindustan Unilever Limited

5.2. Cross Comparison Parameters (Employee Strength, Headquarters, Production Capacity, Product Lines, Revenue, Strategic Alliances, Certifications, Geographical Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. KSA Rice Bran Market Regulatory Framework

6.1. Agricultural Standards for Rice Production

6.2. Food Safety and Quality Regulations

6.3. Environmental Compliance in Rice Bran Processing

07. KSA Rice Bran Future Market Size (In SAR Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. KSA Rice Bran Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Processing Method (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Region (In Value %)

09. KSA Rice Bran Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase focuses on mapping the KSA Rice Bran market ecosystem by identifying critical stakeholders, including processors, manufacturers, and distributors. Secondary research through verified sources like government reports and industry publications is employed to define key market dynamics.

Step 2: Market Analysis and Construction

This step involves a thorough analysis of historical market data, including the number of rice mills, production trends, and revenue from rice bran by-products. The analysis aims to quantify the market size and assess market penetration rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses, particularly regarding growth drivers and challenges, are validated through interviews with industry experts. The insights obtained from rice bran processors and manufacturers provide valuable input into the accuracy of market data.

Step 4: Research Synthesis and Final Output

The final step synthesizes all gathered data and insights, refining the bottom-up market estimates and aligning them with industry benchmarks. Direct engagement with manufacturers ensures the reliability of the conclusions drawn from the research.

Frequently Asked Questions

01. How big is the KSA Rice Bran Market?

The KSA Rice Bran Market is valued at USD 61 million, driven by increasing demand for rice bran oil and animal feed products.

02. What are the challenges in the KSA Rice Bran Market?

Challenges include the lack of advanced processing facilities, volatility in rice production due to weather conditions, and quality standardization issues across production lines.

03. Who are the major players in the KSA Rice Bran Market?

Key players include Savola Group, Al-Jazira Foods, Olam Agri, Cargill, and Gulf Rice Bran Oil Co., all of which have significant production capacities and market reach.

04. What are the growth drivers of the KSA Rice Bran Market?

The market is driven by increasing awareness of the health benefits of rice bran oil, government support for agricultural processing, and rising demand for fortified animal feed.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.