KSA Satellite Internet Market Outlook to 2030

Region:Middle East

Author(s):Sanjna Verma

Product Code:KROD1295

December 2024

96

About the Report

KSA Satellite Internet Market Overview

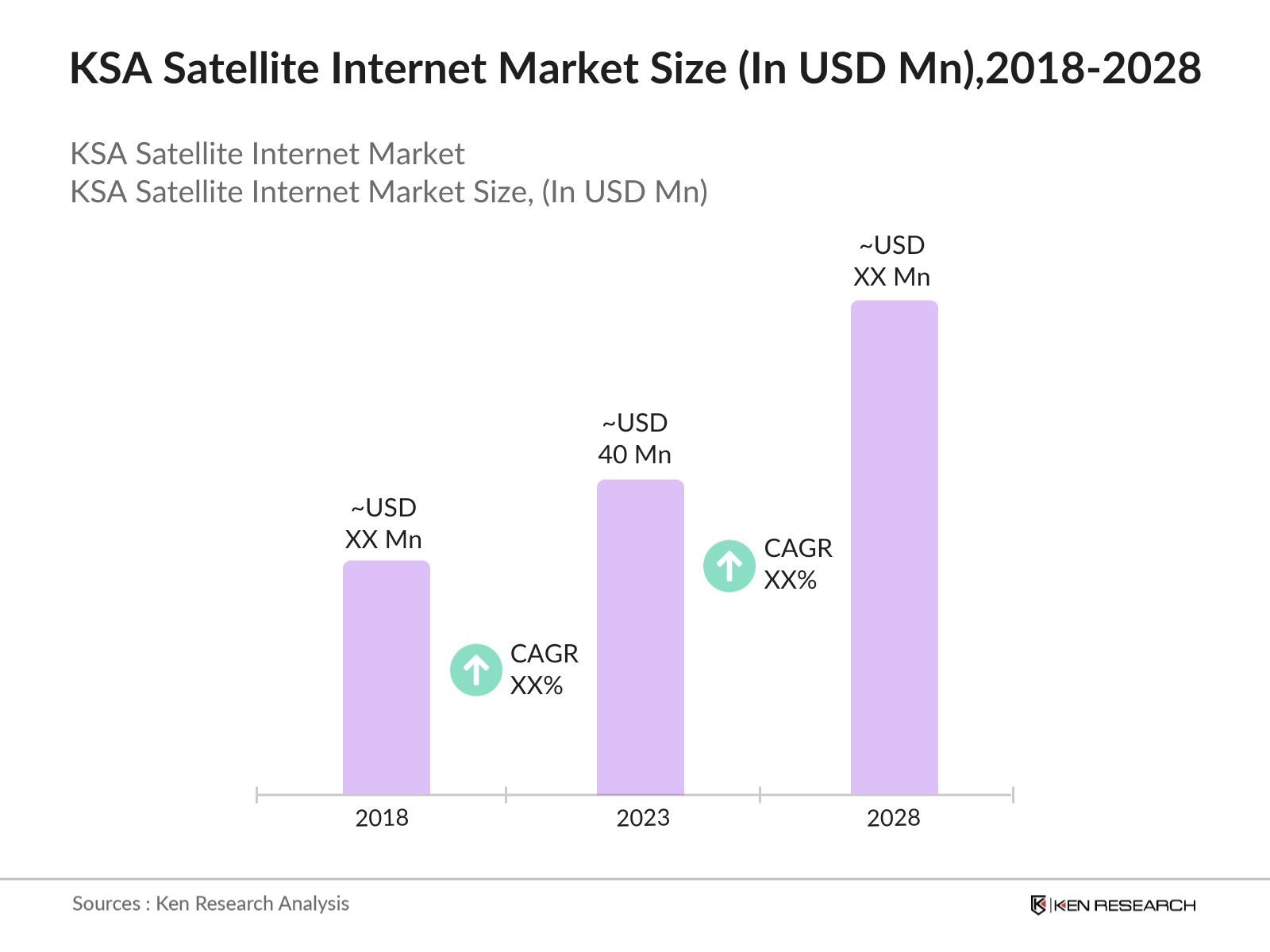

- In 2023, the KSA Satellite Internet Market is valued at USD 40 Million. The growth of satellite internet in Saudi Arabia has been driven by increasing demand for connectivity in remote and rural areas where terrestrial internet infrastructure is limited. The governments Vision 2030 initiative has emphasized digital transformation, further propelling the adoption of satellite internet solutions.

- Major players in the KSA Satellite Internet Market include Arabsat, Yahsat, SpaceX (Starlink), and Thuraya. These companies provide a range of satellite internet services tailored to different sectors, including residential, commercial, and government applications. Arabsat and Yahsat have established strong footholds in the region, while Starlink's entry has introduced new competition with its low-latency offerings.

- In 2023, Arabsat announced the launch of a new satellite, Badr-8, aimed at enhancing internet connectivity across Saudi Arabia and the wider MENA region. The satellite is equipped with advanced Ka-band technology, providing higher bandwidth and faster internet speeds.

- Riyadh and Jeddah dominated the KSA Satellite Internet Market in 2023, due to their large populations and the presence of numerous government and business institutions. The demand for reliable and fast internet services in these cities is high, driving the adoption of satellite internet as a complementary solution to fiber and other traditional broadband services.

KSA Satellite Internet Market Segmentation

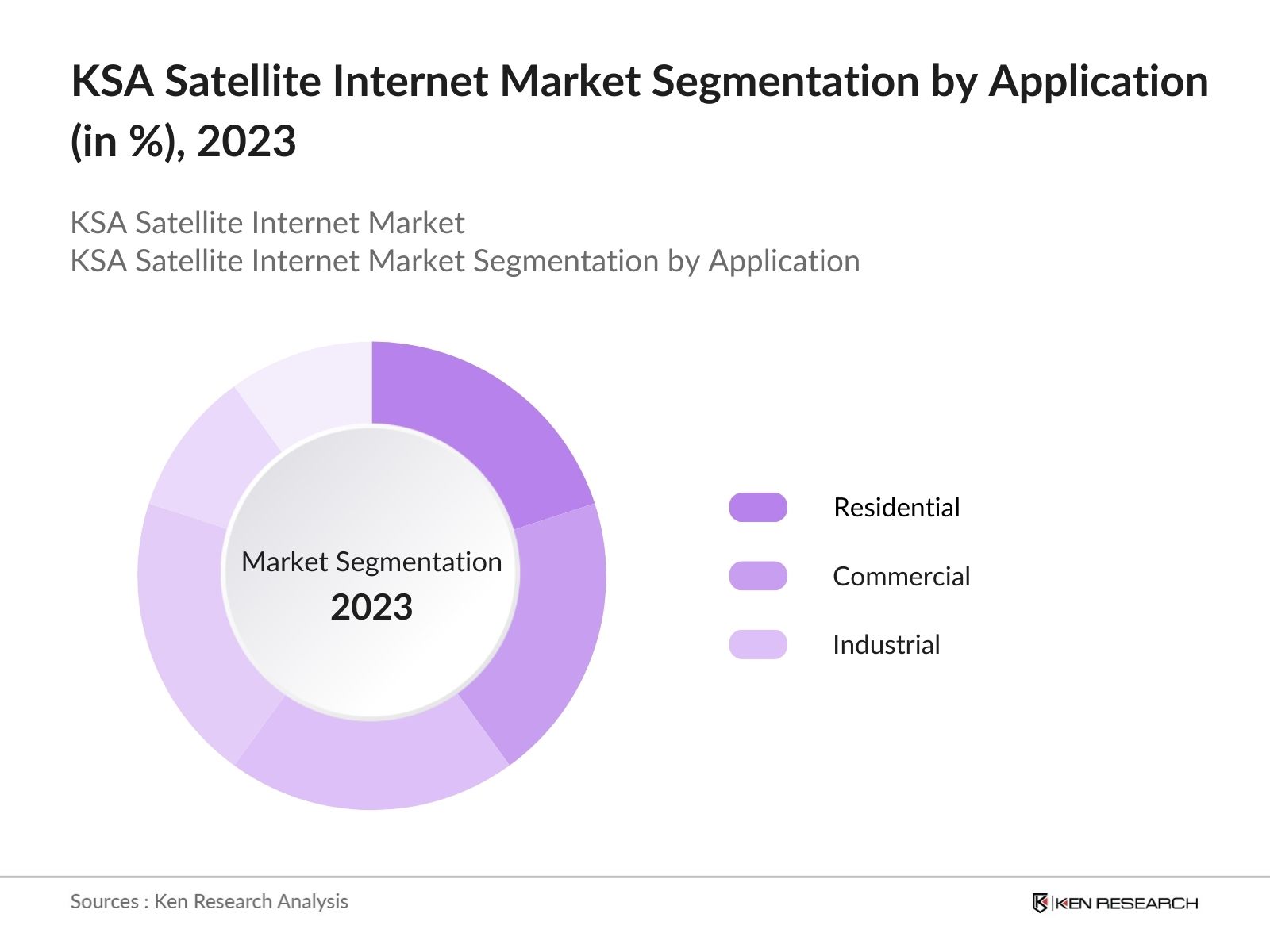

By Application: KSA Satellite Internet Market is segmented by application into residential, commercial, and government sectors. In 2023, the government segment dominated due to its critical need for reliable and secure internet connections across various ministries and agencies. The government's reliance on satellite internet for military and public safety communications has further bolstered this segment.

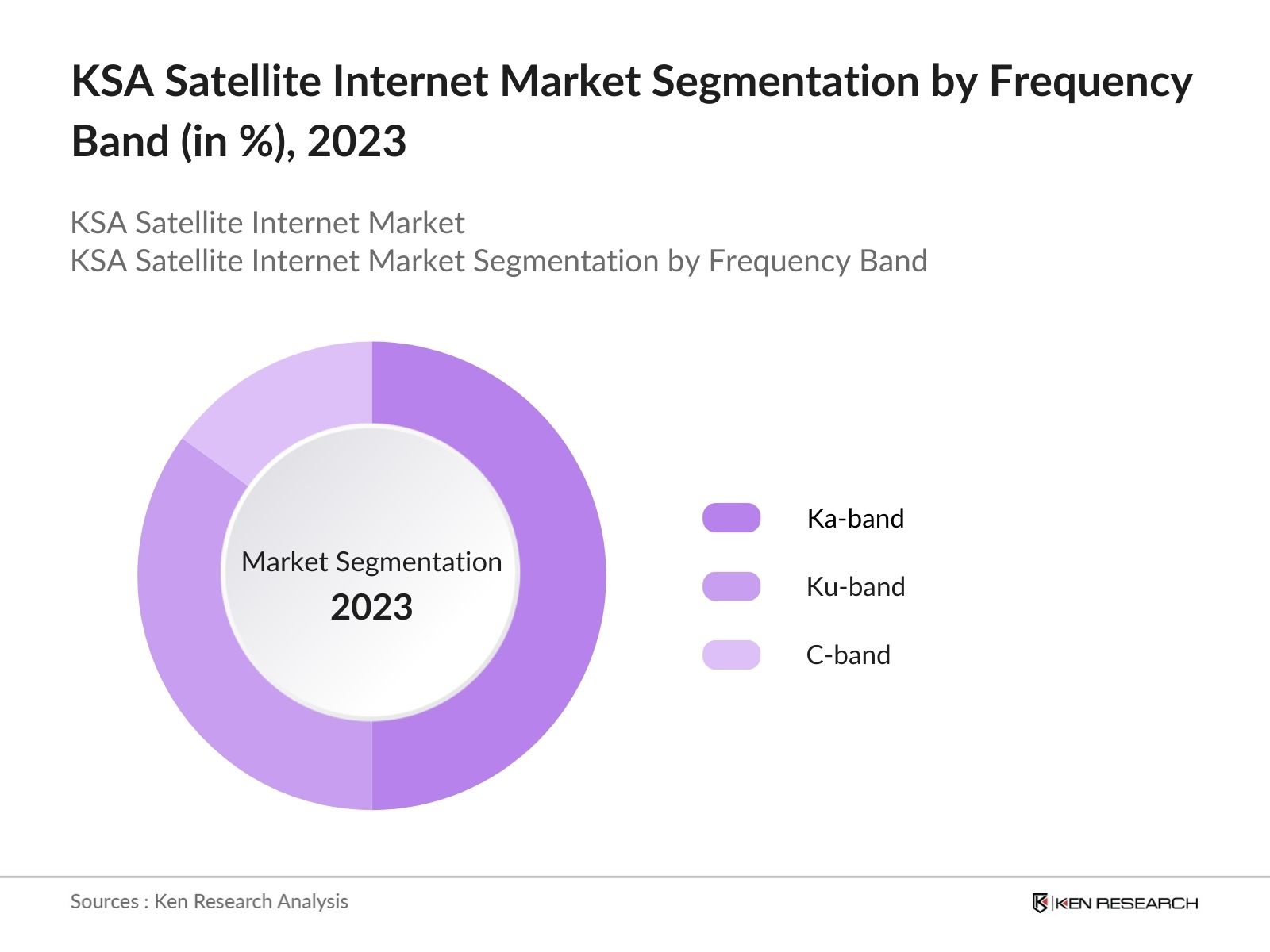

By Frequency Band: KSA Satellite Internet Market is also segmented by frequency band into Ka-band, Ku-band, and C-band. In 2023, Ka-band led the market due to its higher bandwidth and faster data transfer capabilities, making it ideal for both residential and commercial applications. The Ka-band's ability to support high-definition video streaming and other data-intensive services has solidified its dominance.

By Region: KSA Satellite Internet Market is segmented into North, South, East, and West. In 2023, the Northern region dominated due to its vast rural areas and the government's focus on connecting remote communities. The Northern region's extensive infrastructure projects under Vision 2030 have increased demand for satellite internet, as traditional broadband services are often unfeasible in these areas.

KSA Satellite Internet Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Arabsat |

1976 |

Riyadh, Saudi Arabia |

|

Yahsat |

2007 |

Abu Dhabi, UAE |

|

SpaceX (Starlink) |

2002 |

Hawthorne, USA |

|

Thuraya |

1997 |

Abu Dhabi, UAE |

|

Inmarsat |

1979 |

London, UK |

- Thuraya-4: In 2023, Thuraya, a subsidiary of Yahsat, successfully launched its next-generation satellite, Thuraya-4 NGS. The satellites launch, part of USD 550 million investment in the region, is aimed at addressing the increasing demand for satellite internet services in both commercial and government.

- Inmarsat: In 2021, Inmarsat announces extension of GX network on fifth anniversary of launch. They claim that GX is the worlds first and only globally available, high-speed broadband network, owned and managed by a single operator and is already driving the digital transformation of major industries across the world.

KSA Satellite Internet Industry Analysis

KSA Satellite Internet Growth Drivers:

- Expansion of Connectivity: There were 36.84 million internet users in Saudi Arabia till January 2024. Saudi Arabia's internet penetration rate stood at 99.0 percent of the total population. This expansion has been fueled by public-private partnerships, where companies like Arabsat have deployed satellites specifically to improve connectivity in underserved regions.

- Government Contracts and Military Applications: The satellite internet market in Saudi Arabia has seen significant growth, largely driven by the increasing demand for secure and reliable communication channels for government and military applications. Over the past six years, the Kingdom has invested heavily in digital infrastructure, with total capital investments exceeding $24.8 billion. This strategic focus underscores the nation's commitment to enhancing its digital capabilities and maintaining robust, secure communications networks.

- Increased Adoption by Energy Sector: Saudi Arabias energy sector, particularly in remote oil and gas exploration sites, has become a significant user of satellite internet services. Saudi Arabia produces around 8 million barrels of oil per day, with plans to increase this to 12 million barrels per day. This scale of production necessitates robust communication infrastructure, especially in remote areas where traditional internet services may not be available.

KSA Satellite Internet Market Challenges:

- Regulatory and Spectrum Allocation Issues: The satellite internet market in Saudi Arabia faces regulatory challenges, particularly in spectrum allocation. The Communications and Information Technology Commission (CITC) has been slow in allocating additional frequency bands required for the expansion of satellite services. The regulatory environment, while improving, remains a hurdle for companies looking to expand their services rapidly.

- Competition from Terrestrial Internet Services: As fiber optic infrastructure continues to expand across Saudi Arabia, satellite internet providers face increasing competition from terrestrial broadband services. Large population had access to high-speed fiber internet. The availability of cheaper and faster terrestrial internet options in urban and semi-urban areas is reducing the demand for satellite services.

KSA Satellite Internet Government Initiatives:

- Digital Economy Strategy: In 2023, the digital economy makes up 14% of Saudi Arabia's GDP, driven by foreign investments and partnerships. The strategy allocates SAR 3 billion for new satellites and ground infrastructure to reduce the digital divide. Emphasizing digital technologies, this vision aims to boost economic growth and financial inclusion, focusing on building a strong digital finance infrastructure.

- Neo Space Group: In 2024, Saudi Arabia's Public Investment Fund (PIF) launched the Neo Space Group (NSG), a wholly-owned company that will serve as a national champion for the satellite and space sector. NSG aims to develop and enhance commercial space operations in Saudi Arabia, providing innovative satellite and space solutions locally and globally. NSG will invest in localization, technology, startups, and knowledge in the space and satellite sector.

KSA Satellite Internet Future Market Outlook

KSA Satellite Internet Market is poised for significant growth exponentially by 2028, driven by government initiatives aimed at expanding digital infrastructure, increasing demand for connectivity in remote areas, and advancements in satellite technology.

Future Trends

- Expansion of Low-Earth Orbit (LEO) Satellites: The deployment of low-earth orbit (LEO) satellites is expected to revolutionize the KSA Satellite Internet Market. Companies like SpaceX and OneWeb will increase their satellite constellations, offering lower latency and faster internet speeds. This trend will cater to both residential and commercial users.

- Integration of AI and Machine Learning in Satellite Operations: The future of satellite internet in Saudi Arabia will be shaped by the integration of AI and machine learning technologies in satellite operations. These technologies will enhance the efficiency and reliability of satellite services, enabling real-time data analytics, predictive maintenance, and optimized bandwidth allocation.

Scope of the Report

|

By Application |

Residential Commercial Government |

|

By Battery Type |

Ka-band Ku-band C-band |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecommunication Companies

Logistics and Transportation Companies

Oil and Gas Companies

Tourism and Hospitality Companies

Mining and Construction Companies

Investment & Venture Capitalist Firms

Government and Regulatory Bodies (CITC, Ministry of Communications and Information Technology)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Table of Contents

1. KSA Satellite Internet Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. KSA Satellite Internet Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Satellite Internet Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Rural Connectivity

3.1.2. Government Contracts and Military Applications

3.1.3. Increased Adoption by Energy Sector

3.2. Restraints

3.2.1. High Cost of Satellite Internet Services

3.2.2. Regulatory and Spectrum Allocation Issues

3.2.3. Competition from Terrestrial Internet Services

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Partnerships with Government and Private Sectors

3.3.3. Expansion into Underserved Regions

3.4. Trends

3.4.1. Deployment of Low-Earth Orbit (LEO) Satellites

3.4.2. Integration with IoT and Smart Technologies

3.4.3. Growth in Satellite Internet for Maritime and Aviation Sectors

3.5. Government Regulation

3.5.1. Digital Economy Strategy (2023)

3.5.2. Neo Space Group (2024)

3.5.3. Rural Digital Transformation Program (2023)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. KSA Satellite Internet Market Segmentation, 2023

4.1. By Application (in Value %)

4.1.1. Residential

4.1.2. Commercial

4.1.3. Government

4.2. By Frequency Band (in Value %)

4.2.1. Ka-band

4.2.2. Ku-band

4.2.3. C-band

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. KSA Satellite Internet Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Arabsat

5.1.2. Yahsat

5.1.3. SpaceX (Starlink)

5.1.4. Thuraya

5.1.5. Inmarsat

5.1.6. Hughes Network Systems

5.1.7. Viasat

5.1.8. OneWeb

5.1.9. SES Networks

5.1.10. Telesat

5.1.11 Avanti Communications

5.1.12 Iridium Communications

5.1.13 Eutelsat

5.1.14 Blue Origin

5.1.15 Globalstar

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. KSA Satellite Internet Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. KSA Satellite Internet Market Regulatory Framework

7.1. Spectrum Allocation and Licensing

7.2. Compliance Requirements

7.3. Certification Processes

8. KSA Satellite Internet Market Future Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. KSA Satellite Internet Market Future Segmentation, 2028

9.1. By Application (in Value %)

9.2. By Frequency Band (in Value %)

9.3. By Region (in Value %)

10. KSA Satellite Internet Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on KSA Satellite Internet Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA Satellite Internet Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple satellite internet companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from satellite internet companies.

Frequently Asked Questions

01 How big is KSA Satellite Internet Market?

In 2023, the KSA Satellite Internet Market is valued at USD 40 Million. The growth of satellite internet in Saudi Arabia has been driven by increasing demand for connectivity in remote and rural areas where terrestrial internet infrastructure is limited.

02 What are the growth drivers of the KSA Satellite Internet Market?

Growth drivers of KSA Satellite Internet Market include government initiatives, increased adoption of satellite internet by the energy sector, and the expansion of connectivity in rural and remote areas where traditional internet infrastructure is lacking.

03 What are challenges in KSA Satellite Internet Market?

Challenges in the KSA Satellite Internet Market include the high cost of services, regulatory hurdles related to spectrum allocation, and increasing competition from terrestrial internet services, which offer cheaper and faster alternatives.

04 Who are major players in KSA Satellite Internet Market?

Key players in KSA Satellite Internet Market include Arabsat, Yahsat, SpaceX (Starlink), Thuraya, and Inmarsat. These companies dominate the market through their advanced satellite technologies, strategic government partnerships, and extensive service offerings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.