KSA Smart Card Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD5436

November 2024

92

About the Report

KSA Smart Card Market Overview

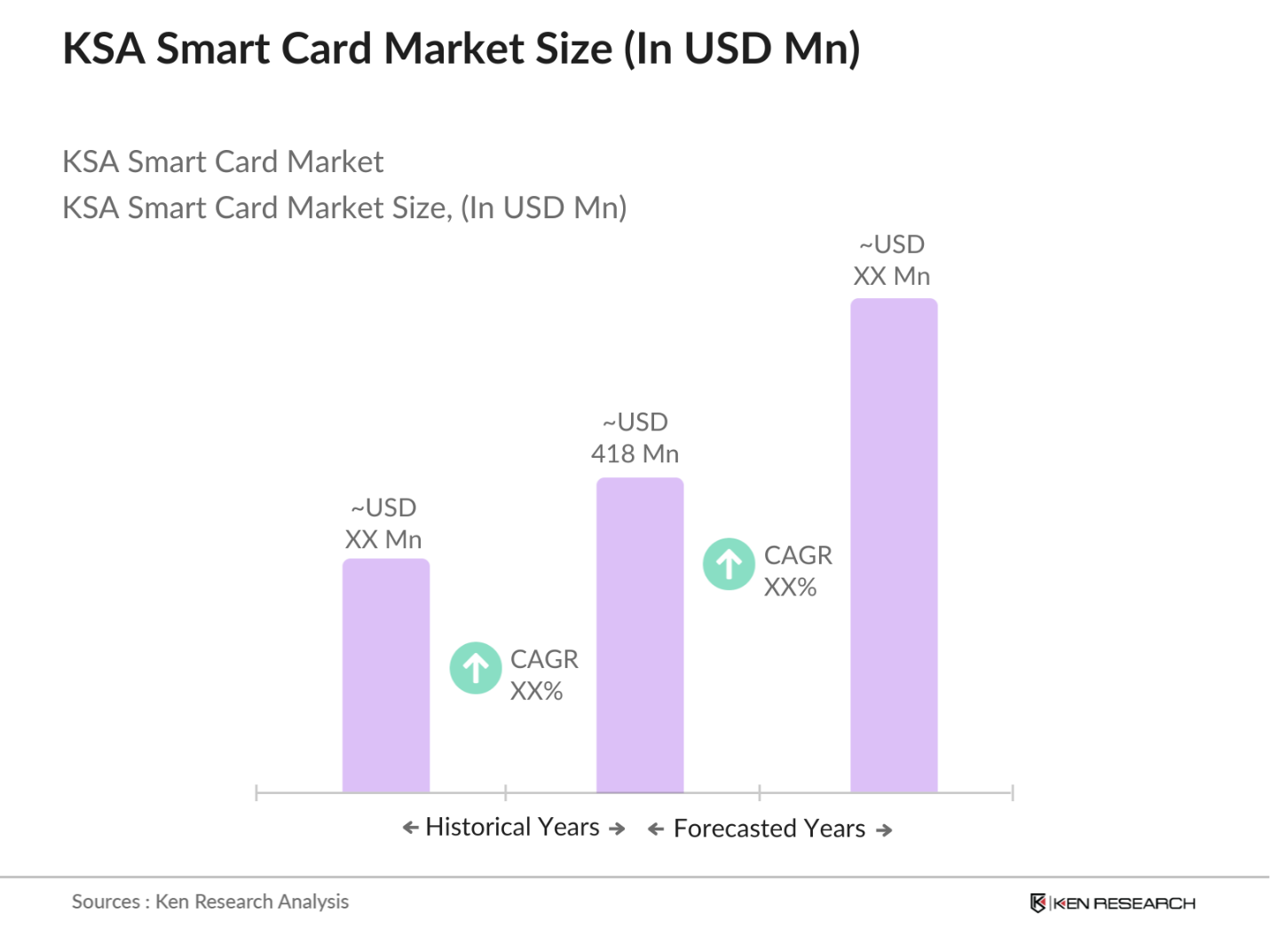

- The KSA Smart Card market is valued at USD 418 million, based on a five-year historical analysis. The market is driven by the increasing adoption of smart card technology across various sectors such as banking, telecommunications, healthcare, and government services. The demand for secure, reliable, and efficient payment methods has led to widespread usage of smart cards in financial transactions and public identification. Additionally, government initiatives, including Vision 2030 and digital transformation efforts, further boost the market, especially with the push towards cashless transactions.

- Riyadh and Jeddah are dominant cities in the KSA Smart Card market. Riyadhs position as the political and financial capital, hosting major banks and financial institutions, drives demand for smart cards, especially in the banking and telecommunications sectors. Jeddah, a major commercial hub, sees high demand for smart cards due to its international trade links and diverse business landscape. Both cities are pivotal in advancing smart card adoption, influenced by their modern infrastructure and government digitization policies.

- SAMA plays a pivotal role in regulating smart card usage in Saudi Arabias financial sector. Its 2024 guidelines mandate secure authentication protocols for all digital payment systems, including smart cards. As of 2023, SAMA required all banks to implement EMV-compliant smart cards, ensuring secure transactions and reducing fraud. These regulations have boosted consumer confidence in using smart cards for daily transactions, leading to increased adoption across various sectors.

KSA Smart Card Market Segmentation

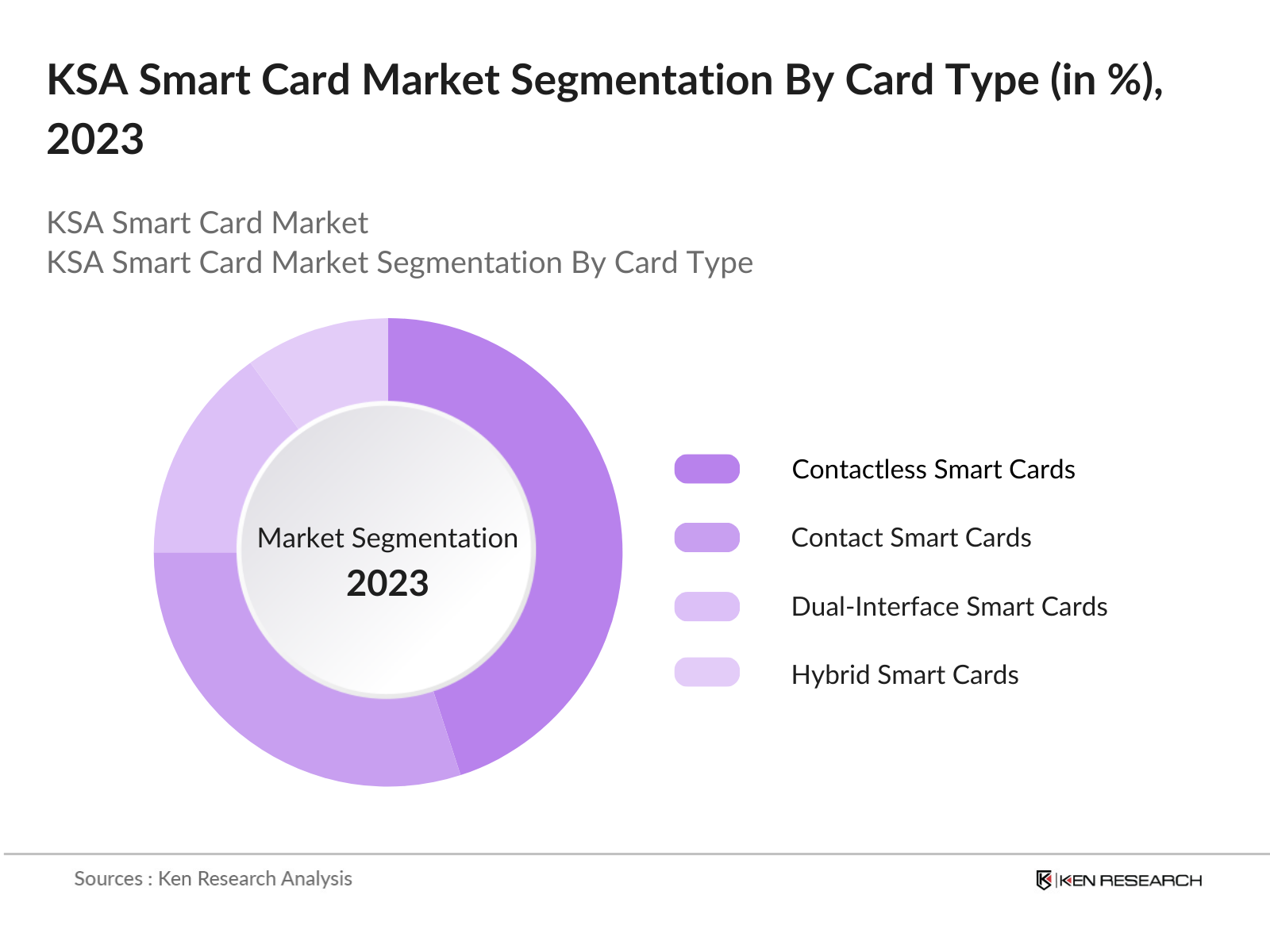

By Card Type: The KSA Smart Card market is segmented by card type into contact smart cards, contactless smart cards, dual-interface smart cards, and hybrid smart cards. Recently, contactless smart cards have a dominant market share in KSA under the segmentation by card type. This is driven by the convenience and security of contactless payments, which have gained traction among consumers, especially in urban areas. Major adoption by banks and retail sectors has fueled the demand for contactless smart cards, particularly in response to the COVID-19 pandemic and the increased use of touchless technology for transactions.

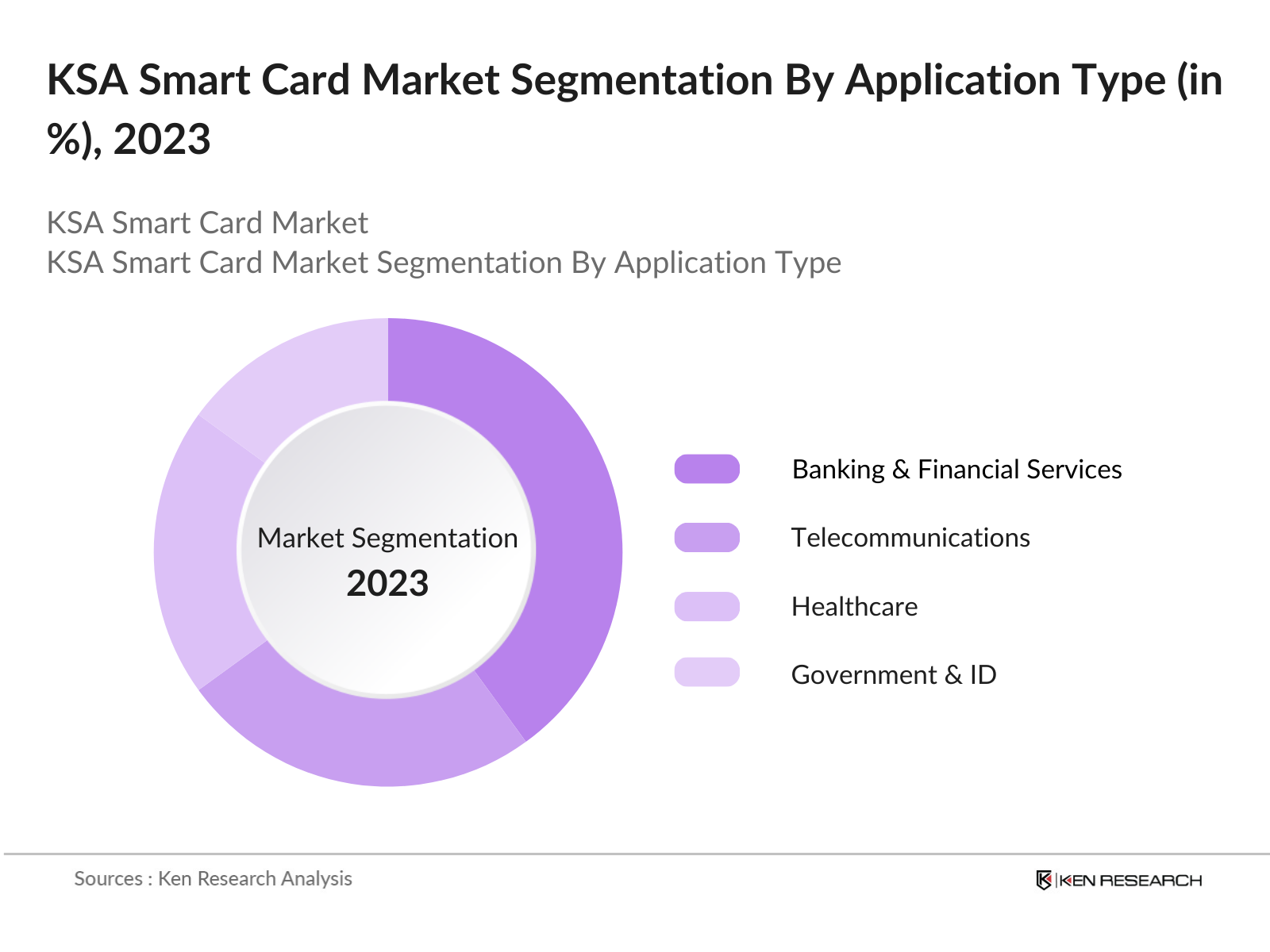

By Application: The KSA Smart Card market is segmented by application into banking & financial services, telecommunications, healthcare, government & ID, and transportation. The banking & financial services segment holds the dominant market share, primarily due to the widespread use of smart cards in debit and credit cards for secure financial transactions. With banks introducing advanced payment solutions and the governments push towards digital payments, the banking sector has witnessed a surge in smart card deployment.

KSA Smart Card Market Competitive Landscape

The KSA Smart Card market is dominated by several key players, with a mix of local and global manufacturers. These companies have a strong presence in various sectors such as telecommunications, banking, and government services. The competitive landscape highlights a mix of innovation, partnerships, and expansions, with companies competing on technological advancements and service diversification. The KSA Smart Card market features a blend of local and international players, including global technology providers and regional banks, with entities like Gemalto (now Thales Group) and Oberthur Technologies leading the market in terms of technological innovation. These companies are known for their broad product portfolios, including chip-based and contactless smart cards, which have set the benchmark in the market.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (2023) |

Product Portfolio |

Global Presence |

Market Share (%) |

Technological Innovation |

Key Clients |

|

Gemalto N.V. (Thales Group) |

1988 |

France |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Oberthur Technologies |

1984 |

France |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Giesecke+Devrient GmbH |

1852 |

Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

NXP Semiconductors N.V. |

1953 |

Netherlands |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Infineon Technologies AG |

1999 |

Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

KSA Smart Card Market Analysis

Growth Drivers

- Government Digitization Initiatives: The Saudi government's Vision 2030 plan has accelerated digitization efforts across sectors, increasing the demand for smart cards. As part of the National Digital Transformation Program, approximately 90% of government services are now digital, enhancing the need for secure identification and payment systems. Smart cards, integrated with secure national ID solutions, have been vital to these efforts. The Saudi e-Government Program (Yesser) has invested heavily in digital infrastructure to support cashless payments and identification systems. In 2023, government spending on ICT reached $33 billion, further supporting smart card deployment.

- Expansion of Cashless Transactions: In line with Vision 2030, Saudi Arabia aims to reduce cash payments, with over 57% of transactions in 2024 already being cashless. The growth in digital payment systems, particularly mobile and contactless payments, is pushing the adoption of smart cards in retail and banking. Smart cards have become critical for secure digital transactions, supported by the Saudi Central Bank's (SAMA) electronic payment standards. The number of point-of-sale terminals has increased to 1.4 million by 2024, with smart card integration being a mandatory feature.

- Integration with National ID Systems: The Saudi national ID system now incorporates biometric-enabled smart cards, which provide multifactor authentication for services like healthcare, banking, and public transport. By 2023, over 35 million Saudi citizens and residents had been issued national ID cards that function as multipurpose smart cards. These cards are a vital part of the national digital transformation, enabling secure access to government services. The Ministry of Interior's National Information Center has ensured that these cards are compliant with international standards, promoting widespread use across sectors.

Market Challenges

- Cybersecurity Threats: The growing reliance on smart cards in Saudi Arabia has raised concerns over cybersecurity risks, especially as digital payments expand. In 2024, cybersecurity threats related to digital payment systems increased, with over 400 cyber incidents targeting financial institutions and smart card payment systems. Saudi Arabia's National Cybersecurity Authority has implemented stringent security protocols, but smart card systems remain vulnerable to fraud and hacking attempts, particularly in rural areas where security infrastructure is less robust.

- High Initial Investment: Despite the advantages of smart card systems, the initial costs associated with their implementation remain a challenge. In sectors like banking, public transport, and healthcare, deploying secure smart card systems requires significant capital. By 2023, the average cost to implement a smart card system in a medium-sized enterprise exceeded $500,000, including hardware, software, and cybersecurity features. The Ministry of Communications and Information Technology provides limited financial support, but many businesses, particularly SMEs, find the upfront costs prohibitive.

KSA Smart Card Market Future Outlook

Over the next five years, the KSA Smart Card market is expected to show significant growth, driven by increasing government efforts towards a cashless economy, technological advancements in card security, and growing demand for convenient and secure digital payment methods. With the rise of mobile payment solutions, especially in urban centers like Riyadh and Jeddah, the market will continue to expand. Additionally, the introduction of biometric and multi-application smart cards is poised to revolutionize both the banking and healthcare sectors, offering a more personalized and secure experience for users.

Opportunities

- Growth in Mobile Payment Solutions: The rise of mobile payment solutions presents a key growth opportunity for the smart card market. In 2023, the mobile payment transaction volume in Saudi Arabia surpassed 1 billion transactions, largely facilitated by NFC-enabled smart cards. With over 40 million smartphone users in the country, the integration of mobile payments and smart cards offers seamless, secure payment experiences. Financial institutions are increasingly collaborating with telecom providers to expand mobile wallet services, pushing smart card demand even further.

- Partnerships with International Technology Providers: Collaborations between Saudi companies and international technology providers are fostering innovation in smart card solutions. In 2024, partnerships with European and Asian tech firms led to the development of advanced contactless smart cards with biometric verification. These partnerships are supported by government-led initiatives to attract foreign investment under the Vision 2030 framework, with the Ministry of Investment reporting over $2 billion in technology sector investments in 2023. Such collaborations are expected to enhance smart card capabilities across sectors like banking, transport, and healthcare.

Scope of the Report

|

Card Type |

Contact Smart Cards Contactless Smart Cards Dual-Interface Smart Cards Hybrid Smart Cards |

|

Application |

Banking & Financial Services Telecommunications Healthcare Government and ID Transportation |

|

Technology |

Chip-based Smart Cards Magnetic Stripe Smart Cards Optical Cards |

|

Component |

Microprocessor Memory Interface Operating System (JavaCard, MULTOS) |

|

End-User |

Enterprises Government Consumers |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institutions

Telecom Provider Industry

Government and Regulatory Bodies (KSAn Monetary Authority - SAMA)

Healthcare Companies

Transportation Industries

Security Solution Provider Companies

Investor and Venture Capitalist Firms

Retail Companies

Companies

Players Mentioned in the Report

Gemalto N.V. (Thales Group)

Oberthur Technologies

Giesecke+Devrient GmbH

NXP Semiconductors N.V.

Infineon Technologies AG

Atos SE

Verimatrix SA

Samsung SDS Co., Ltd.

Watchdata Technologies

Thales Group

Table of Contents

1. Saudi Arabia Smart Card Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Smart Card Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Smart Card Market Analysis

3.1. Growth Drivers

3.1.1. Government Digitization Initiatives (e.g., Vision 2030)

3.1.2. Expansion of Cashless Transactions (Focus on Digital Payments)

3.1.3. Integration with National ID Systems

3.1.4. Adoption in Public Transport & Health Sectors

3.2. Market Challenges

3.2.1. Cybersecurity Threats

3.2.2. High Initial Investment

3.2.3. Limited Awareness in Rural Areas

3.3. Opportunities

3.3.1. Growth in Mobile Payment Solutions

3.3.2. Partnerships with International Technology Providers

3.3.3. Innovations in Biometric Smart Cards

3.4. Trends

3.4.1. Shift Towards Contactless Smart Cards

3.4.2. Integration with Blockchain for Secure Transactions

3.4.3. Enhanced Multi-Application Cards for Banking & Transport

3.5. Government Regulations

3.5.1. Saudi Arabian Monetary Authority (SAMA) Guidelines

3.5.2. E-Government Regulations (e.g., National Digital Transformation Plan)

3.5.3. National Payment Systems & Security Protocols

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, Manufacturers, End-users)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Saudi Arabia Smart Card Market Segmentation

4.1. By Card Type (In Value %)

4.1.1. Contact Smart Cards

4.1.2. Contactless Smart Cards

4.1.3. Dual-Interface Smart Cards

4.1.4. Hybrid Smart Cards

4.2. By Application (In Value %)

4.2.1. Banking & Financial Services

4.2.2. Telecommunications

4.2.3. Healthcare

4.2.4. Government and ID

4.2.5. Transportation

4.3. By Technology (In Value %)

4.3.1. Chip-based Smart Cards

4.3.2. Magnetic Stripe Smart Cards

4.3.3. Optical Cards

4.4. By Component (In Value %)

4.4.1. Microprocessor

4.4.2. Memory

4.4.3. Interface

4.4.4. Operating System (JavaCard, MULTOS)

4.5. By End-User (In Value %)

4.5.1. Enterprises

4.5.2. Government

4.5.3. Consumers

5. Saudi Arabia Smart Card Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Gemalto N.V.

5.1.2. Oberthur Technologies (Idemia)

5.1.3. Giesecke+Devrient GmbH

5.1.4. Infineon Technologies AG

5.1.5. NXP Semiconductors N.V.

5.1.6. Atos SE

5.1.7. Verimatrix SA

5.1.8. Samsung SDS Co., Ltd.

5.1.9. Watchdata Technologies

5.1.10. Thales Group

5.1.11. American Express

5.1.12. CardLogix Corporation

5.1.13. HID Global Corporation

5.1.14. Datacard Group

5.1.15. Ingenico Group

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Global Presence, Technological Innovation, Partnerships, Key Clients, Number of Patents)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

5.8. Government Grants and Incentives

6. Saudi Arabia Smart Card Market Regulatory Framework

6.1. Saudi Communications and Information Technology Commission Regulations

6.2. Digital Identification Policies

6.3. Data Protection Laws

6.4. Certification and Compliance Requirements

7. Saudi Arabia Smart Card Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Smart Card Future Market Segmentation

8.1. By Card Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Component (In Value %)

8.5. By End-User (In Value %)

9. Saudi Arabia Smart Card Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves defining the market ecosystem for the KSA Smart Card Market. This is achieved through extensive desk research using trusted industry databases and reports to gather a detailed understanding of key stakeholders and market dynamics. Key variables such as adoption rates, regulatory environment, and technological advancements are identified.

Step 2: Market Analysis and Construction

In this step, historical data from trusted sources like government reports and proprietary research databases is analyzed to assess the growth of the smart card market. The focus is on market penetration in key sectors such as banking, telecommunications, and government services, and estimating the revenue generation in each.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are carried out via interviews with industry professionals. Insights from these discussions help validate the market hypotheses, ensuring that projections and analyses are grounded in real-world dynamics.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the data collected from primary and secondary sources to create a comprehensive report. This includes validating all information through triangulation with industry experts and market participants, ensuring accuracy and completeness of the market estimates.

Frequently Asked Questions

01 How big is the KSA Smart Card Market?

The KSA Smart Card Market is valued at USD 418 million, based on a five-year historical analysis. The market is driven by increasing demand for secure payment methods and government digitization efforts.

02 What are the challenges in the KSA Smart Card Market?

Challenges include cybersecurity threats, high initial investment costs, and limited awareness in rural areas, which slow down the adoption of smart cards across various sectors.

03 Who are the major players in the KSA Smart Card Market?

Key players in the market include Gemalto (Thales Group), Oberthur Technologies, Giesecke+Devrient, NXP Semiconductors, and Infineon Technologies. These companies dominate due to their technological innovations and strong presence in both global and regional markets.

04 What are the growth drivers of the KSA Smart Card Market?

The market is propelled by government initiatives like Vision 2030, digitization across banking and telecommunications, and growing adoption of cashless payment methods, especially through contactless smart cards.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.