KSA Smart Home Market Outlook to 2030

Region:Middle East

Author(s):Shambhavi

Product Code:KROD2865

November 2024

95

About the Report

KSA Smart Home Market Overview

- The KSA smart home market is valued at USD 480 million, reflecting significant growth driven by the increasing adoption of Internet of Things (IoT) devices, rising disposable income, and government initiatives like Saudi Vision 2030, which encourages the adoption of smart technologies to promote sustainability. Additionally, the market is benefitting from growing awareness of energy efficiency and security, further fueling demand for smart appliances and systems in both residential and commercial sectors.

- The market is largely dominated by major cities like Riyadh, Jeddah, and Dammam, which lead due to rapid urbanization, high-income levels, and the presence of large-scale real estate development projects such as NEOM and Qiddiya. These regions have also witnessed higher demand for luxury homes equipped with smart home solutions, supported by a tech-savvy population and strong infrastructure for IoT deployment.

- Saudi Arabias efforts toward energy efficiency are supported by green building codes introduced under the Saudi Energy Efficiency Center (SEEC). By 2024, new residential buildings must comply with energy conservation standards, including the integration of smart meters and automated energy management systems. Approximately 200,000 homes in the Kingdom have already installed these technologies. The government targets saving 5,000 GWh annually through smart energy solutions in residential buildings by 2030, with SAR 150 billion invested in energy-efficient initiatives.

KSA Smart Home Market Segmentation

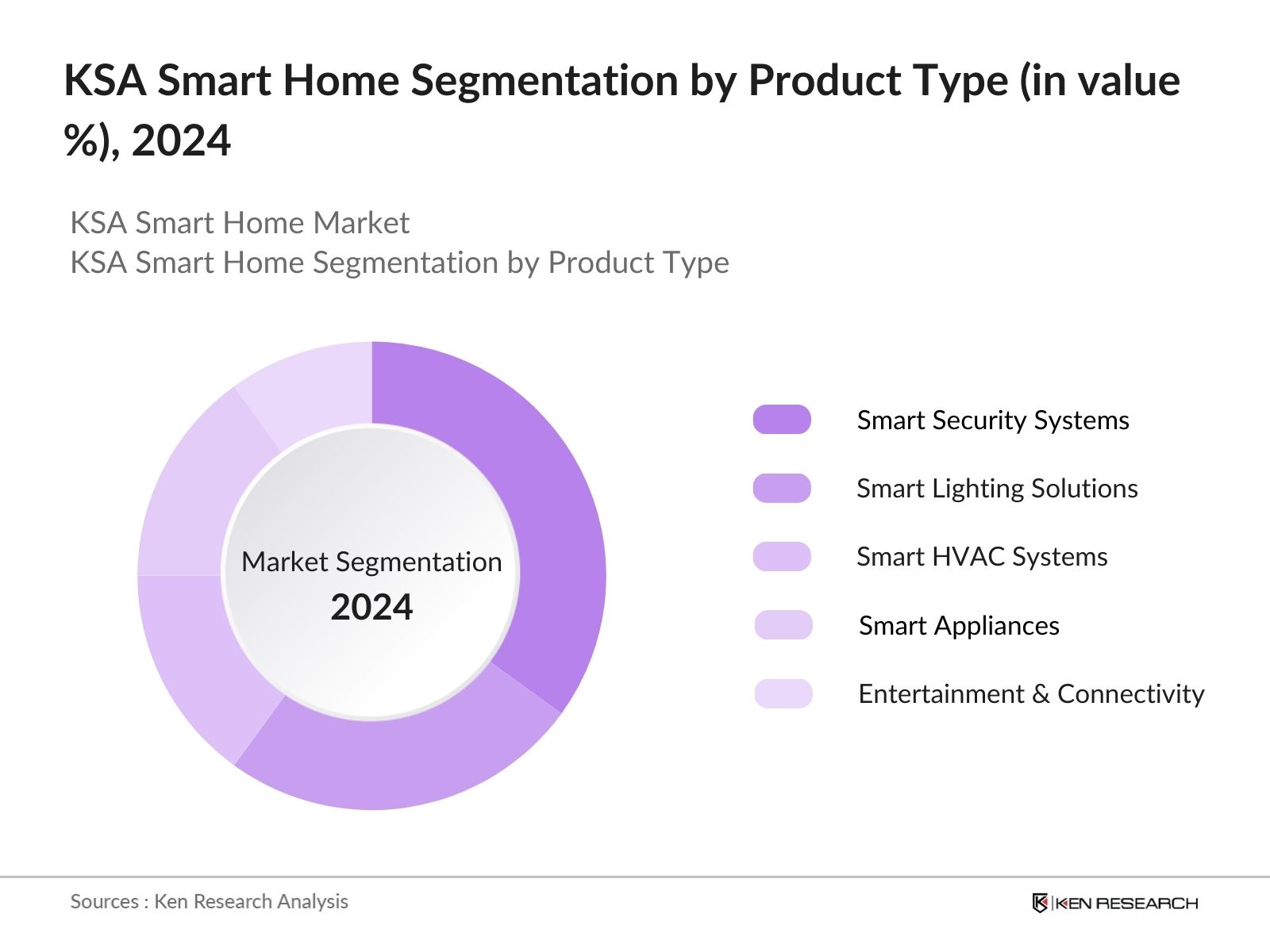

By Product Type: The KSA smart home market is segmented by product type into smart security systems, smart lighting, smart HVAC systems, smart appliances, and entertainment and connectivity solutions. Smart security systems have a dominant market share due to increasing concerns over home security and the need for advanced surveillance systems. With a growing population of high-net-worth individuals, luxury homes are driving demand for sophisticated security setups that include smart cameras, motion sensors, and access control systems.

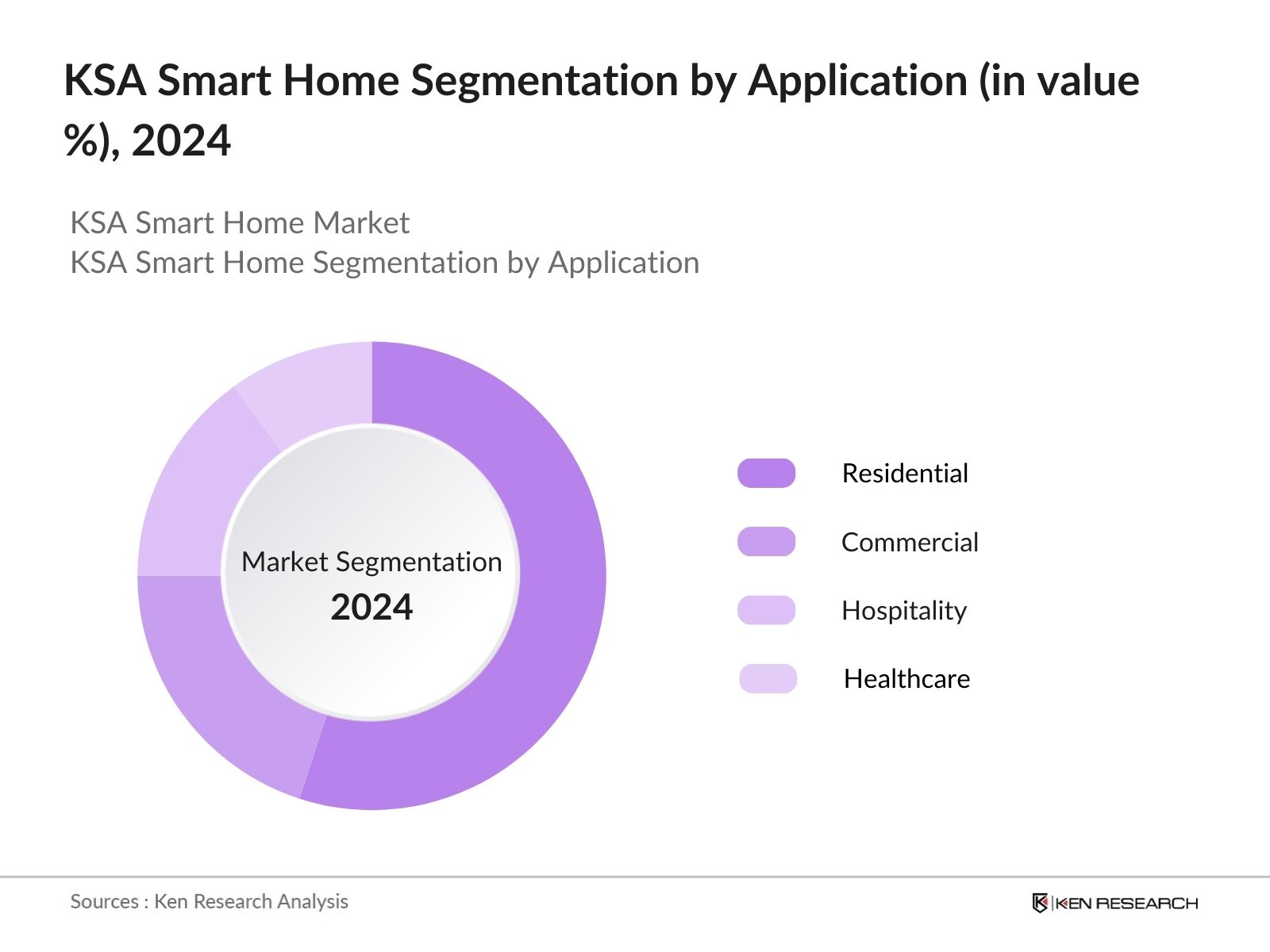

By Application: The market is also segmented by application into residential, commercial, hospitality, and healthcare sectors. The residential segment has a dominant market share, driven by the increasing number of smart homes in urban areas and the rising demand for integrated solutions that offer both comfort and security. High-income households are more inclined to adopt full-home automation systems that include lighting, security, and entertainment features, particularly in metropolitan areas.

KSA Smart Home Market Competitive Landscape

The KSA smart home market is dominated by both local and international players. Companies such as Samsung Electronics, ABB, and Honeywell are leaders due to their innovative product offerings and strong distribution networks. These players have established a firm presence by forming partnerships with local real estate developers and offering tailored smart home solutions for residential and commercial projects.

|

Company |

Establishment Year |

Headquarters |

Market Focus |

Revenue (USD Mn) |

Smart Home Offering |

Local Partnerships |

R&D Investments |

Regional Presence |

Growth Strategy |

|

Samsung Electronics |

1969 |

South Korea |

|||||||

|

Honeywell International Inc. |

1906 |

USA |

|||||||

|

ABB Group |

1988 |

Switzerland |

|||||||

|

Schneider Electric |

1836 |

France |

|||||||

|

Google Nest |

2010 |

USA |

KSA Smart Home Market Analysis

Growth Drivers

- Government Initiatives (Saudi Vision 2030, National Transformation Program): The Saudi government's Vision 2030 aims to diversify the economy and reduce oil dependence, directly impacting sectors like smart homes. The National Transformation Program supports smart cities like NEOM and Qiddiya, enhancing infrastructure for smart home solutions. In 2024, the government allocated SAR 1.5 trillion for infrastructure projects under Vision 2030, facilitating high-speed internet and power grids required for smart home systems. Additionally, the Public Investment Fund (PIF) has set aside SAR 40 billion annually to support housing projects integrating smart technologies. These initiatives aim to modernize over 300,000 homes by 2028.

- Rising Consumer Demand for Home Automation (Smart Security, Smart Lighting): With a population of 36.6 million in 2024, rising urbanization and disposable income are driving the demand for home automation systems. Over 78% of Saudi households have internet access, a significant enabler for smart security and lighting systems. Smart home device shipments surged by 120,000 units in 2023, largely driven by the growing adoption of smart security solutions like cameras and lighting systems. As part of Vision 2030, housing plans estimate 1.5 million new homes by 2030, with smart home integration considered a priority.

- Increased Internet Penetration (IoT Connectivity, Broadband Availability); Saudi Arabias internet penetration reached 98% in 2024, one of the highest globally. The Kingdoms National Broadband Plan aims to provide 100% fiber-optic coverage in urban areas by 2025. Currently, over 12 million homes have access to high-speed internet, which is crucial for IoT-based smart home systems. Moreover, the Saudi government is investing SAR 50 billion in upgrading its broadband infrastructure, facilitating the rapid growth of IoT-enabled devices for homes, including smart appliances and security systems.

Market Challenges

- High Initial Installation Costs: The average installation cost for a fully automated smart home in Saudi Arabia ranges between SAR 30,000 to SAR 80,000, depending on the level of automation and system complexity. These costs can be prohibitive for middle-income households, where the average annual household income is SAR 120,000. The high costs are primarily driven by advanced systems such as smart security, energy management, and voice-activated assistants. Furthermore, maintenance expenses, ranging from SAR 2,500 to SAR 5,000 annually, add to the overall burden, limiting widespread adoption.

- Consumer Awareness and Adaptability (Technology Adoption Barriers): Despite high internet penetration, only 38% of households are fully aware of smart home solutions beyond basic devices such as smart TVs or lighting. This gap in awareness presents a barrier to adoption, especially among older generations. With 70% of Saudi Arabia's population under the age of 40, the younger demographic is more inclined to adopt these technologies, but the overall technology adoption rate remains moderate. Surveys conducted by the Ministry of Communications indicate that around 35% of households find smart technology difficult to integrate into their daily routines.

KSA Smart Home Market Future Outlook

Over the next five years, the KSA smart home market is expected to experience accelerated growth, driven by increased investments in infrastructure, the expansion of smart city initiatives like NEOM, and consumer preference for energy-efficient homes. The rollout of 5G technology is expected to enhance IoT capabilities, allowing for better integration and performance of smart home devices. Additionally, the growing awareness around energy conservation and sustainability will likely fuel demand for smart solutions aimed at reducing energy consumption, particularly in high-demand urban areas.

Market Opportunities

- Increasing Demand for AI and Voice Assistants (Smart Speakers, AI-driven Automation):The smart speaker market in Saudi Arabia is witnessing a surge, with over 2 million units expected to be in use by the end of 2024. AI-driven automation systems such as Amazons Alexa and Google Assistant are gaining traction, particularly in Riyadh and Jeddah, where 80% of high-income households have already adopted voice-activated assistants. Government-backed smart city projects like NEOM are heavily incorporating AI for home automation, providing a substantial market opportunity for technology firms looking to expand in this region.

- Expansion of 5G Networks: Saudi Arabias 5G network, which currently covers over 70% of the population, plays a crucial role in enhancing IoT and smart home functionalities. The Saudi government plans to invest SAR 40 billion in expanding 5G coverage to rural areas, improving connectivity for over 2.5 million households by 2025. This will further enable advanced smart home applications, including real-time monitoring and automation. With 5G, latency issues that have previously hampered the adoption of certain smart home technologies are expected to diminish.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Product Type |

Smart Security Systems Smart Lighting Solutions Smart HVAC Systems Smart Appliances Entertainment and Connectivity |

|

By Application |

Residential Commercial Hospitality Healthcare |

|

By Technology |

Wireless Technology Wired Technology AI and Machine Learning Cloud-based Solutions |

|

By Region |

Central (Riyadh) Western (Jeddah, Mecca) Eastern (Dammam, Al Khobar) Southern (Abha, Jizan) |

|

By Distribution Channel |

Online Retailers Offline Retailers Direct Sales |

Products

Key Target Audience

Real Estate Developers

Smart Home Device Manufacturers

Home Automation Service Providers

Telecommunication Companies

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization - SASO)

Energy and Utility Companies

Investments and Venture Capitalist Firms

Home Security Firms

Companies

List of Major Players

Samsung Electronics

ABB Group

Honeywell International Inc.

Schneider Electric

Google Nest

LG Electronics

Siemens AG

Bosch Smart Home

Huawei Technologies

Legrand SA

Johnson Controls

Amazon (Alexa)

Apple (HomeKit)

Belkin International (WeMo)

Ring

Table of Contents

1. KSA Smart Home Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Smart Home Market Size (In USD Bn)

2.1. Historical Market Size (Revenue, Volume)

2.2. Year-On-Year Growth Analysis (CAGR, Market Share)

2.3. Key Market Developments and Milestones (Partnerships, Product Launches)

3. KSA Smart Home Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives (Saudi Vision 2030, National Transformation Program)

3.1.2. Rising Consumer Demand for Home Automation (Smart Security, Smart Lighting)

3.1.3. Increased Internet Penetration (IoT Connectivity, Broadband Availability)

3.1.4. Energy Efficiency and Sustainability Goals (Green Building Codes)

3.2. Market Challenges

3.2.1. High Initial Installation Costs

3.2.2. Consumer Awareness and Adaptability (Technology Adoption Barriers)

3.2.3. Limited Integration Across Systems (Interoperability Issues)

3.3. Opportunities

3.3.1. Increasing Demand for AI and Voice Assistants (Smart Speakers, AI-driven Automation)

3.3.2. Expansion of 5G Networks

3.3.3. Rising Real Estate Development (Smart Cities, New Housing Projects)

3.3.4. Cross-Industry Collaboration (Partnerships Between Telecom, Utility, and Tech Firms)

3.4. Trends

3.4.1. Integration with Smart City Initiatives (NEOM, Qiddiya)

3.4.2. Growth of Subscription-Based Smart Home Services (Security as a Service, Home Automation Packages)

3.4.3. Adoption of Smart Healthcare Solutions (Health Monitoring, Wellness Devices)

3.4.4. Customizable Smart Solutions for Luxury Homes (High Net-Worth Segment Targeting)

3.5. Government Regulations

3.5.1. Data Privacy and Security Laws (IoT Regulations, Cybersecurity Standards)

3.5.2. National Smart Home Standards (Energy Conservation Guidelines)

3.5.3. Infrastructure Development (Smart Metering, Electric Vehicle Integration)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Porters Five Forces (Supplier Power, Buyer Power, Threat of Substitutes, Threat of New Entrants, Industry Rivalry)

3.8. Competitive Ecosystem (Market Players, Distribution Channels, Supplier Networks)

4. KSA Smart Home Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Smart Security Systems (Cameras, Alarms, Access Control)

4.1.2. Smart Lighting Solutions (Dimmers, Sensors, Smart Bulbs)

4.1.3. Smart HVAC Systems (Smart Thermostats, Climate Control)

4.1.4. Smart Appliances (Refrigerators, Washing Machines, Kitchen Appliances)

4.1.5. Entertainment and Connectivity (Home Hubs, Streaming Devices)

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Hospitality

4.2.4. Healthcare

4.3. By Technology (In Value %)

4.3.1. Wireless Technology (Wi-Fi, Zigbee, Z-Wave, Bluetooth)

4.3.2. Wired Technology

4.3.3. AI and Machine Learning

4.3.4. Cloud-based Solutions

4.4. By Region (In Value %)

4.4.1. Central (Riyadh)

4.4.2. Western (Jeddah, Mecca)

4.4.3. Eastern (Dammam, Al Khobar)

4.4.4. Southern (Abha, Jizan)

4.5. By Distribution Channel (In Value %)

4.5.1. Online Retailers

4.5.2. Offline Retailers (Showrooms, Hypermarkets)

4.5.3. Direct Sales

5. KSA Smart Home Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Samsung Electronics

5.1.2. Schneider Electric

5.1.3. ABB Group

5.1.4. Legrand SA

5.1.5. Honeywell International Inc.

5.1.6. Siemens AG

5.1.7. LG Electronics

5.1.8. Johnson Controls

5.1.9. Google Nest

5.1.10. Amazon (Alexa)

5.1.11. Bosch Smart Home

5.1.12. Huawei Technologies

5.1.13. Apple (HomeKit)

5.1.14. Belkin International (WeMo)

5.1.15. Ring

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, R&D Expenditure, Market Presence, Headquarters, Inception Year, Regional Focus, Growth Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Collaborations, Partnerships)

5.5. Mergers and Acquisitions (Recent Transactions, Strategic Fit)

5.6. Investment Analysis (Capital Investments, R&D Investments)

5.7. Government Grants and Incentives

5.8. Private Equity Investments

5.9. Venture Capital Funding

6. KSA Smart Home Market Regulatory Framework

6.1. Data Privacy and Security Regulations (GDPR Equivalent, IoT Security)

6.2. Compliance Requirements (Energy Efficiency, Smart Home Standards)

6.3. Certification Processes (Local Certification Bodies, International Standards)

7. KSA Smart Home Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Smart Home Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Region (In Value %)

8.5. By Distribution Channel (In Value %)

9. KSA Smart Home Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map was constructed that encompassed major stakeholders in the KSA smart home market. Extensive desk research using a combination of secondary sources and proprietary databases was conducted to gather market-level data. The objective was to define critical variables such as growth drivers, technology trends, and consumer preferences.

Step 2: Market Analysis and Construction

The next phase involved compiling historical data on market penetration and product offerings in the KSA smart home market. Key metrics like consumer adoption rates, product preferences, and regional performance were analyzed to estimate revenue generation and market demand for each segment.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts via Computer-Assisted Telephone Interviews (CATIs). Experts from various smart home product segments provided operational and financial insights that were crucial for refining market estimates.

Step 4: Research Synthesis and Final Output

In the final phase, data from primary interviews and desk research was synthesized to ensure a comprehensive view of the KSA smart home market. Final revenue figures were corroborated with feedback from major players and real estate developers to provide accurate market estimates.

Frequently Asked Questions

1. How big is the KSA smart home market?

The KSA smart home market is valued at USD 480 million, driven by increased adoption of IoT devices and smart home solutions, as well as government initiatives like Saudi Vision 2030.

2. What are the challenges in the KSA smart home market?

Challenges include high installation costs, low consumer awareness in rural areas, and interoperability issues among different smart devices.

3. Who are the major players in the KSA smart home market?

Major players include Samsung Electronics, ABB Group, Honeywell International Inc., Schneider Electric, and Google Nest, all of which offer comprehensive smart home solutions.

4. What are the growth drivers of the KSA smart home market?

Key drivers include government initiatives promoting smart infrastructure, rising consumer demand for home automation, and the development of new smart city projects like NEOM and Qiddiya.

5. What future trends are expected in the KSA smart home market?

Upcoming trends include the integration of AI and machine learning in home automation, the expansion of 5G networks, and the incre

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.